Sterilization Services Market by Method (Electron beam, EtO, Steam, X-ray), Type (Contract Sterilization, Validation Services), Mode of Delivery (Off-site, On-site), End User (Medical Device, Pharmaceuticals, Hospitals, Clinics) & Region - Global Forecasts to 2027

The sterilization services market is projected to reach USD 5.9 billion by 2027, at a CAGR of 5.5% during the forecast period. Strict mandates introduced by governments and regulatory bodies in the healthcare industry to maintain compliance with Good Manufacturing Practices (GMP), a surge in number of surgical procedures; and the increasing outsourcing of sterilization services among pharmaceutical companies, hospitals, and medical device manufacturers are the factors attributing to the growth of this market.

Global Sterilization Services Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Sterilization Services Market Dynamics

Growth Drivers: Growing prevalence of hospital acquired infections (HAIs)

According to the World Health Organization (WHO) report on Infection Prevention and Control in 2022, out of every 100 patients in acute care hospitals, seven patients in high-income countries and about 15 patients in low- and middle-income countries will acquire at least one healthcare-associated infection (HAI) during their hospital stay. They are nosocomial infections that occur during a patient’s stay in hospitals and related facilities and are not observed at the time of admission. These infections include central line-associated bloodstream infections, surgical-site infections, catheter-associated urinary tract infections, hospital-acquired pneumonia, ventilator-associated pneumonia, and Clostridium difficile infections. The most common bacteria associated with HAIs include C. difficile, MRSA, Klebsiella, E. coli, Enterococcus, and the Pseudomonas species. Using infected medical devices during diagnostic and therapeutic procedures is a major cause of HAIs.

Growth Opportunities: Growing medical device and pharmaceutical companies in emerging economies

Emerging economies such as India, China, Brazil, Russia, and countries in Latin America and Southeast Asia are expected to provide significant growth opportunities to players operating in this market. Over half the world’s population resides in India and China, making these markets home to a large patient population. Public pressure to improve the quality of hospital care, the increased cost of HAIs in healthcare systems, the emergence of multi-drug-resistant microorganisms, and the initiatives of government authorities play an important role in the growth of the global market in these countries. In the past few years, medical device manufacturing has witnessed significant growth in the Asia Pacific region. The current development trends among players indicate even greater potential in the coming years. This can be attributed to technological advancements, the growing disease burden, and the increasing number of surgeries performed in this region.

Restraints: Concerns regarding the safety of reprocessed instruments

Some reusable medical devices include surgical forceps, endoscopes, and stethoscopes. But, there are concerns about the safety and performance of reprocessed devices. There has been a paradigm shift in the reprocessing of medical devices, with increased emphasis on the quality management systems approach that requires validated sterilization instructions from manufacturers and ongoing monitoring by reprocessing personnel to ensure the adequacy of sterilization. The FDA is taking steps to reduce the risk of infection from reprocessed reusable devices by conducting reviews of premarket and post-market information from all manufacturers and reprocessed device types.

Challenges: Sterilization of advanced medical instruments

Certain concerns are related to the cleaning, disinfection, and sterilization of advanced medical devices. Inadequate sterilization of these devices might expose patients to the risk of acquiring HAIs. Moreover, with the introduction of technologically advanced instruments such as endoscopes and analyzers in the market, there is a growing need for advanced sterilizers compatible with the automated endoscope reprocessors (AER) used for cleaning and disinfecting flexible endoscopes after each procedure. Failure to properly sterilize critical medical devices for various endoscopy procedures such as bronchoscopy, cystoscopy, and duodenoscopy has led to numerous outbreaks of multi-drug resistance (MDR) pathogens with serious consequences to patients. Currently, reprocessing these instruments after every use is a major challenge faced by healthcare providers in complying with sterilization standards.

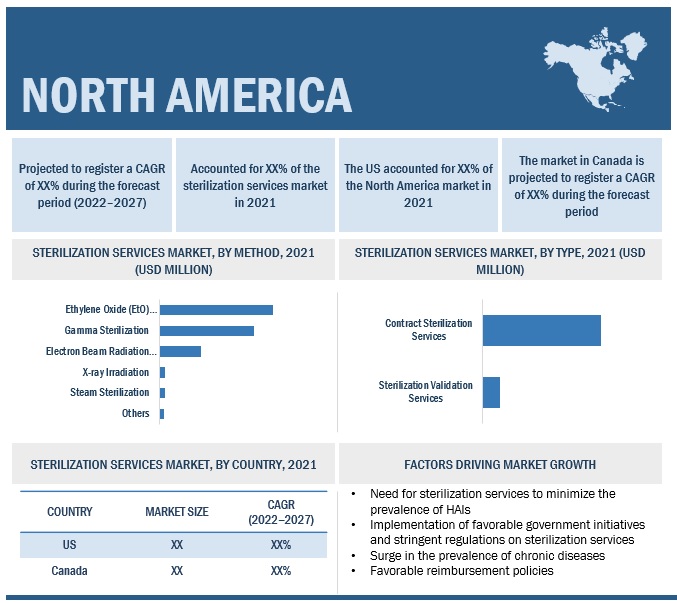

The ethylene oxide (EtO) sterilization segment accounted for the largest share of the sterilization services market

Based on method, the market has been classified into ethylene oxide (EtO) sterilization, gamma sterilization, electron beam (e-beam) radiation sterilization, steam sterilization, x-ray irradiation, and other sterilization methods. The ethylene oxide (EtO) sterilization segment accounted for the largest share of the global market. High material compatibility when compared with radiation sterilization methods, and cost efficiency associated with the use of EtO sterilization methods are attributable to the large share of this segment.

The sterilization validation services segment accounted for the second largest share of the sterilization services market

Based on type, the global market has been segmented into contract sterilization services and sterilization validation services. The sterilization validation services segment accounted for the second largest share of this market, in 2021. Increasing preference for biological indicators by the central sterile services departments (CSSDs), stringent regulatory standards for validation of sterilization processes, and the launch of advanced biological indicators are the key factors supporting the growth of sterilization validation services.

The off-site sterilization services segment accounted for the largest share of the sterilization services market

By mode of delivery, the market has been segmented into off-site sterilization services and on-site sterilization services. The off-site sterilization services segment accounted for a largest share of the global market. The limited availability of space in in-house sterile processing departments and the cost reduction benefits are the key factors supporting the segment’s largest share.

The hospitals and clinics segment accounted for the second largest share of the sterilization services market

Based on end user, the global market has been segmented into hospitals & clinics, medical device companies, pharmaceutical & biotechnology companies, and others (food & beverage industry, cosmetic industry, dietary supplement manufacturers, veterinary industry, and other healthcare providers, such as long-term care facilities and diagnostic & imaging centers). The hospitals and clinics segment accounted for the second largest share of the market in 2021. Growth in this segment is majorly attributed to the increasing government initiatives to reduce HAIs in hospitals, the growing hospital sector in emerging countries such as China, India, and Brazil due to growing awareness, and rising medical tourism.

North America accounted for the largest share of the sterilization services market in 2021

In 2021, North America accounted for the largest share of the global market. The region's large share can be attributed to the surge in the geriatric population in the coming years, subsequent increase in the prevalence of chronic diseases, and adoption of sterilization services due to the rising focus on healthy lifestyles and disease prevention among consumers.

To know about the assumptions considered for the study, download the pdf brochure

Sterilization Services Market Key Players

The prominent players in This market are STERIS plc (US) Sotera Health Company (US) Stryker Corporation (US) Advanced Sterilization Products (ASP, US) E-BEAM Services, Inc. (US), MMM Group (Germany), Belimed AG (Switzerland), BGS Beta-Gamma-Service GmbH & Co. KG (Germany), Medistri SA (Switzerland), and Noxilizer, Inc. (US).

Sterilization Services Market Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Method, Type, Mode of Delivery, End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, the Middle East and Africa |

|

Companies covered |

STERIS plc (US), Sotera Health Company (US), Stryker Corporation (US), Advanced Sterilization Products (ASP, US), E-BEAM Services, Inc. (US), MMM Group (Germany), Belimed AG (Switzerland), BGS Beta-Gamma-Service GmbH & Co. KG (Germany), Medistri SA (Switzerland), Noxilizer, Inc. (US), H.W.Andersen Products Ltd. (US), Cosmed Group (US), Cretex Companies, Inc. (US), Life Science Outsourcing, Inc. (US), MICROTROL Sterilisation Services Pvt. Ltd. (India), Medline Industries, Inc. (US), Avantti Medi Clear (Mexico), Steripure SAS (France), Europlaz Technologies Limited (UK), Centerpiece (US), Midwest Sterilization Corporation (US), Blue Line Sterilization Services LLC (US), SteriPack Group (Ireland), Steri-Tek (US), and Sterilization Services (US) |

The study categorizes the Sterilization Services Market based on method, type, mode of delivery, end user, and regional and global level.

By Method

- X-ray Irradiation

- EtO Sterilization

- Gamma Sterilization

- Other Methods

- E-beam Sterilization

- Steam Sterilization

By Type

- Sterilization Validation Services

- Contract Sterilization Services

By Mode of Delivery

- On-Site Sterilization Services

- Off-Site Sterilization Services

By End User

- Medical Device Companies

- Hospitals & Clinics

- Other End Users

- Pharmaceutical & Biotechnology Companies

By Region

-

North America

- Canada

- US

-

Europe

- UK

- Germany

- Italy

- France

- Switzerland

- Rest of Europe

- Spain

-

Asia Pacific

- India

- China

- Southeast Asia

- Rest of APAC

- Japan

-

Latin America

- Mexico

- Rest of Latin America

- Brazil

- Middle East & Africa

Recent Developments:

- In 2022, BGS Beta-Gamma-Service GmbH & Co. KG expanded its laboratory in Wiehl to meet the increased need for sterilization services in the sectors of biotechnology, medicine, and diagnostics for radiation cross-linking.

- In 2022, Sterigenics expanded its electron beam facility located in Columbia city, Indiana. This facility provides mission-critical E-beam sterilization services to help ensure the safety of medical devices and drug products.

- In 2021, STERIS acquired Cantel, which is a provider of infection prevention services, and this acquisition will strengthen the STERIS leadership in infection prevention by bringing together two complementary businesses.

- In 2020, STERIS added X-rays to its product portfolio in the existing gamma irradiation by an expansion of its facility in Thailand.

Frequently Asked Questions (FAQ):

Which are the top industry players in the global sterilization services market?

The top market players in the global sterilization services market include Steripure SAS (France), Europlaz Technologies Limited (UK), Centerpiece (US), Midwest Sterilization Corporation (US)Belimed AG (Switzerland), BGS Beta-Gamma-Service GmbH & Co. KG (Germany), Medistri SA (Switzerland), Noxilizer, Inc. (US), H.W.Andersen Products Ltd. (US), Cosmed Group (US), STERIS plc (US), Sotera Health Company (US), Stryker Corporation (US), Advanced Sterilization Products (ASP, US), E-BEAM Services, Inc. (US), Blue Line Sterilization Services LLC (US), SteriPack Group (Ireland), Steri-Tek (US), and Sterilization Services (US), MMM Group (Germany), Cretex Companies, Inc. (US), Life Science Outsourcing, Inc. (US), MICROTROL Sterilisation Services Pvt. Ltd. (India), Medline Industries, Inc. (US), and Avantti Medi Clear (Mexico).

Which global sterilization methods have been included in this report?

This report contains the following method segments:

- Ethylene Oxide (EtO) Sterilization

- Gamma Sterilization

- Electron Beam Radiation Sterilization

- Steam Sterilization

- X-ray Irradiation

- Other Methods

Which geographical region is the second largest market in the global sterilization services market?

The global sterilization services market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. Europe is the second largest market for sterilization services. The large share of the region can be attributed to the large pharmaceutical industry, increasing cosmetic surgeries in the region, and the growing number of surgeries performed annually, primarily due to the rising geriatric population and the growing prevalence of lifestyle diseases such as obesity and CVD (cardiovascular disease).

Which is the leading global sterilization services market, by type?

The contract sterilization services segment accounted for the largest market share. The large share of the segment can be attributed to the large share can be attributed to the growing preference for contract sterilization by medical device companies, growing incidence of chronic diseases, and the increasing need to reduce surgical-site infections (SSIs). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the sterilization services market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

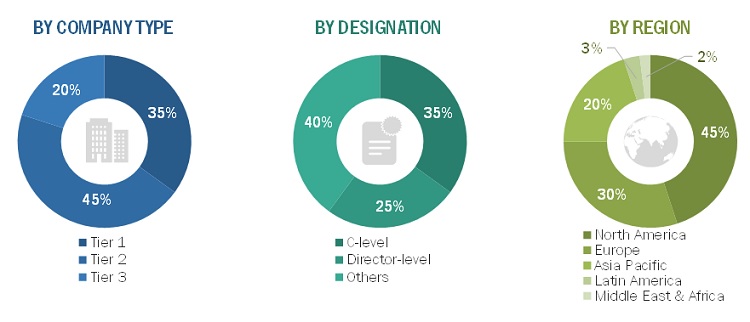

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the sterilization services market. The primary sources from the demand side include key executives from hospitals, pharmaceutical and medical device companies, and research institutes.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Sterilization Services Market Size Estimation

The total size of the sterilization services market was arrived at after data triangulation from different approaches. After each approach, the weighted average of the approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the sterilization services market by method, type, mode of delivery, end user, and region

- To provide detailed information about factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in five main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions, and expansions, of the leading market players

- To benchmark players within the sterilization services market using the “Company Evaluation Quadrant” framework, which analyzes market players on various

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe sterilization services market into Russia, the Netherlands, and Poland

- Further breakdown of the Rest of Asia Pacific sterilization services market into Australia, Taiwan, and South Korea

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sterilization Services Market

What are the Key Opportunities on Offer for Sterilization Service Providers in Sterilization Services Market ?

What are the Factors Restraining Demand for Sterilization Services Market in 2028 and 2030 ?

Which is the base year calculated in the sterilization services market report?

I would like to know what are the applications of sterilization services.

How, the key players, are dominating the Sterilization Services Market?