Structural Health Monitoring Market Size, Share, Industry Growth, Trends & Analysis by Offering (Hardware, Software & Services), Technology (Wired, Wireless), Vertical (Civil Infrastructure, Aerospace & Defense, Energy, Mining), Implementation, Application and Region - Global Forecast to 2029

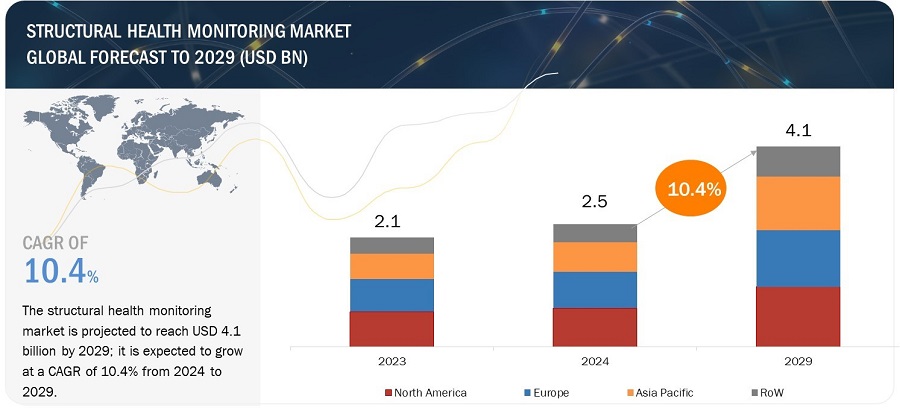

[254 Pages Report] The global structural health monitoring market Size, Share, Industry Growth, Trends & Analysis was valued at USD 2.5 billion in 2024 and is projected to reach USD 4.1 billion by 2029; it is expected to register a CAGR of 10.4% during the forecast period. Aging infrastructure, increased infrastructure investment, and stringent safety regulations are among the major factors driving the growth of the Structural health monitoring for preventive maintenance and risk mitigation. Advancements in sensor technology, data analytics, and machine learning enhance monitoring capabilities, enabling real-time anomaly detection and predictive maintenance. Integration with building information modeling (BIM) further enhances monitoring, analysis, and decision-making throughout a structure's lifecycle.

Structural Health Monitoring Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Government regulations pertaining to sustainable structures

Catastrophic failure of structures not only poses a risk to public safety but also leads to heavy monetary losses. For instance, the failure of dams can lead to the impairment of other structures such as bridges, roads, and water systems, resulting in risk to life as well as monetary losses. To improve public safety, such risks related to structures must be reduced. Hence, most governments around the world are focused on improving communication and coordination across governing agencies, developing tools based on advanced technology, promoting emergency action plans (EAP), and modifying regulatory policies to ensure the safety of infrastructure. Regulations, such as those outlined in the Guiding Principles for Sustainable Federal Buildings, emphasize the importance of energy efficiency, water conservation, indoor environmental quality, materials sustainability, and resilience in building design, construction, and operation. In US, building energy codes are established by the US Department of Energy, often based on ASHRAE standards, with many states and municipalities adopting these codes or implementing even stricter energy efficiency requirements. In the European Union, ambitious energy performance regulations target near-zero energy buildings by 2050, while regulations promote sustainable materials through recycled content and forestry practices. In India, the government promotes green building practices through the Energy Conservation Building Code (ECBC) and incentivizes LEED certification, alongside public procurement policies encouraging sustainable construction in government buildings.

By mandating sustainable practices, government regulations ensure that structures are built and maintained to high-performance standards, reducing environmental impact, conserving resources, and promoting occupant health and safety. Compliance with these regulations often necessitates the implementation of SHM strategies to monitor the structural health, performance, and sustainability of buildings over time. Therefore, government regulations play a crucial role in driving the adoption of SHM practices to meet sustainability requirements, enhance building performance, and ensure the long-term viability of structures in alignment with regulatory mandates.

Restraint: High Implementation Costs

Installing and maintaining Structural Health Monitoring (SHM) systems can be a costly endeavor, with expenses varying based on several factors. The cost is influenced by the size and complexity of the structure being monitored, as larger or more intricate buildings may require a greater number of sensors and more sophisticated monitoring systems. Additionally, the type and quantity of sensors needed, along with the chosen data acquisition and analysis platform, contribute to the overall cost of implementing an SHM system. This variability in costs can pose a significant barrier for smaller structures or projects with limited budgets, potentially limiting their ability to invest in comprehensive SHM solutions. The financial implications associated with SHM highlight the importance of considering budget constraints and cost-effectiveness when planning for the installation and maintenance of monitoring systems, especially for smaller structures or projects with restricted financial resources.

Opportunity: Increasing investments in oil & gas and energy projects

Many governments and other organizations have started investing in new oil & gas infrastructure and major energy projects. The dam is one of the most advanced smart mega hydropower stations globally due to its usage of low-heat cement and built-in monitoring systems. The growing need for sustainable power generation and the reduction of the carbon footprint has led to an increased focus on developing wind farms, hydropower stations, and other renewable energy projects. The growing focus on energy mega-projects is expected to increase the demand for structural health monitoring systems.

Similarly, in the oil & gas industry, pipelines need to be monitored regularly to ensure structural safety and prevent metal loss due to corrosion, erosion, and cracks. The monitoring of pipelines is majorly restricted to flow measurement and visual inspection, which have very limited potential to detect leakages. Hence, pipeline failures are generally identified only when the output flow is affected or the surrounding environment is affected, leading to increased costs. Hence, several stakeholders involved in oil & gas projects are increasingly using structural health monitoring solutions to monitor pipelines effectively. Some of the major oil & gas projects in recent years include Alaska’s LNG Mega-Project and the Al Zour Refinery in Kuwait.

Challenge: Processing and management of large volumes of data

Data processing and management is a major challenge in structural health monitoring. Sensors are strategically installed at various places on the structure to record data related to several critical parameters. Hence, any decision related to the maintenance of the structure is based on the data acquired by the sensor. Sensors, such as strain gauge sensors, accelerometer sensors, and displacement sensors, capture essential data related to the structure and transfer it to the base center for further analysis. These sensors generate large volumes of data daily, which is difficult to maintain and analyze. However, advanced computing solutions and technologies can be deployed for such large volume data management and processing. Various research institutes are working on different methods to overcome this challenge while maintaining data reliability. It is expected that this challenge could be overcome by adopting new approaches toward identifying and extracting useful information from a large database and using certain data analytics tools.

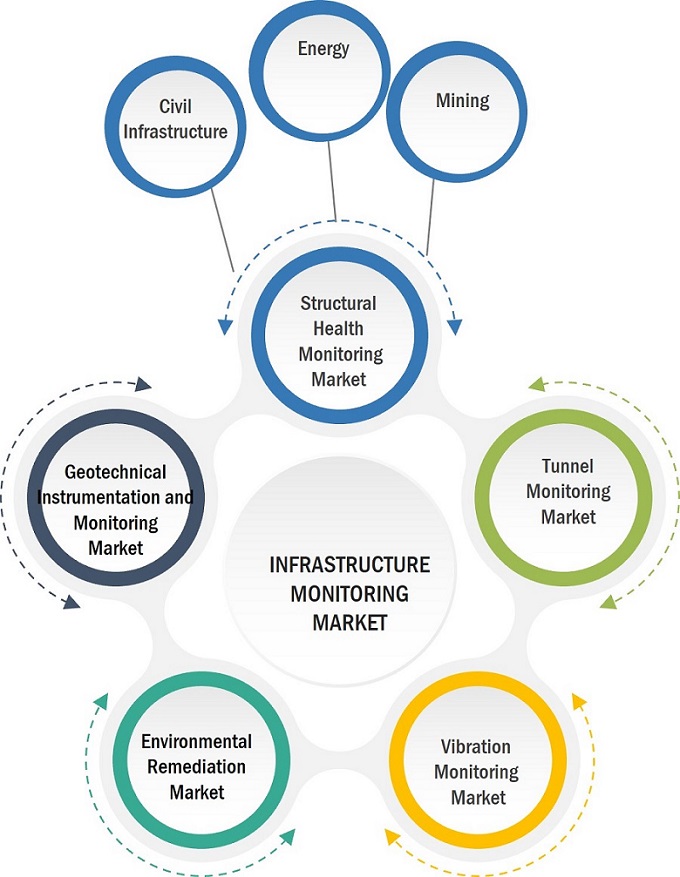

Structural Health Monitoring Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of structural health monitoring services. These companies have been operating in the market for several years and possess a diversified product and software & service portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include COWI A/S (Denmark), Campbell Scientific (US), Geokon (US), Nova Metrix LLC (US), SGS SA (Switzerland), Trimble Inc. (US), Structural Monitoring Systems PLC (Australia), Sixense (France), Digitexx Data Systems, Inc. (US), and Acellent Technologies, Inc. (US)

By offering, the software & services segment is expected to grow with the highest rate during the forecast period.

The increased complexity of data collected by modern structural health monitoring (SHM) systems necessitates specialized software for efficient data acquisition, management, visualization, analysis, and predictive maintenance. Also, organizations often lack in-house expertise in data analysis, structural engineering, and SHM principles, relying on specialized software and service providers. The evolving SHM technologies demand cutting-edge solutions that software and service providers can offer, staying ahead of developments. Moreover, seamless integration with existing systems, cost-effectiveness, vendor expertise, and ongoing support are crucial considerations. Additionally, the growing demand for cloud-based solutions, driven by remote access, centralized management, and scalability, presents opportunities for software and service providers to cater to evolving needs. The regulatory requirements mandating specific data collection and reporting practices further drive demand for compliant solutions offered by software and service providers.

By vertical, the energy sector for the structural health monitoring market is experiencing notable growth.

The structural health monitoring (SHM) market is poised for significant growth within the energy sector due to various compelling factors. Aging infrastructure, such as power plants, pipelines, wind turbines, and transmission lines nearing the end of their design life, underscores the importance of SHM in detecting issues early to prevent failures and ensure reliable energy production. Safety concerns drive the need for proactive identification and resolution of potential problems to mitigate risks of accidents and supply disruptions. Stricter regulatory scrutiny mandates safety inspections and maintenance practices, with SHM providing vital monitoring data for compliance. The integration of renewable energy sources necessitates ensuring the structural integrity of new infrastructure like wind turbine towers and solar arrays. Remote monitoring capabilities reduce operational costs by enabling continuous monitoring in remote locations. Predictive maintenance facilitated by SHM leads to cost savings through early issue identification and intervention. SHM data enhances asset management by optimizing maintenance schedules, extending asset lifespans, and informing investment decisions. Integration with digital twins offers a comprehensive view of asset health for improved planning and decision-making. Applications in the energy sector include monitoring wind turbine blades, pipelines for corrosion, power plant structures, transmission lines, and hydroelectric dams to ensure stability and prevent outages, highlighting the diverse benefits and applications of SHM in enhancing energy infrastructure performance and reliability.

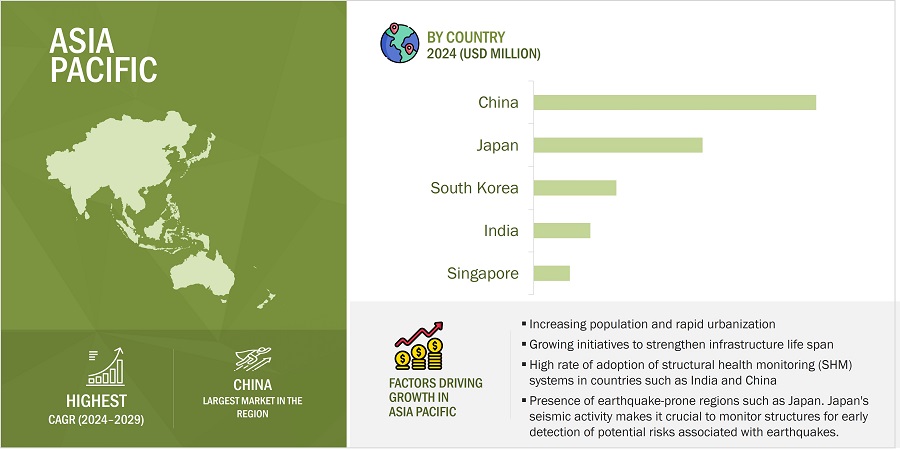

During the forecast period Asia Pacific is projected to record highest growth rate of the overall Structural health monitoring market.

Structural Health Monitoring Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific region is witnessing a rapid urbanization trend, driving a surge in construction activities for new buildings, bridges, and transportation networks. This growth spurt necessitates robust monitoring solutions to uphold the safety and durability of these structures. With aging infrastructure nearing the end of its design life, Structural Health Monitoring (SHM) offers a proactive approach to managing these assets by enabling early issue detection and averting costly repairs or catastrophic incidents. Increased government investments in infrastructure development further fuel the demand for SHM systems, ensuring their incorporation in both new and existing projects. The region's heightened focus on safety, sustainability, and public awareness underscores the pivotal role of SHM in accident prevention and structural integrity maintenance. Technological advancements have led to more efficient and cost-effective SHM solutions, making them more accessible across a broader spectrum of structures. The growing availability of skilled SHM professionals in the region enhances the effective implementation and maintenance of monitoring systems.

Key Market Players

COWI A/S (Denmark), Campbell Scientific (US), Geokon (US), Nova Metrix LLC (US), SGS SA (Switzerland), Trimble Inc. (US), Structural Monitoring Systems plc (Australia), Sixense (France), Digitexx Data Systems, Inc. (US), and Acellent Technologies, Inc. (US) are some of the key players in the structural health monitoring companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By offering, technology, vertical, implementation, application, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

COWI A/S (Denmark), Campbell Scientific (US), Geokon (US), Nova Metrix LLC (US), SGS SA (Switzerland), Trimble Inc. (US), Structural Monitoring Systems PLC (Australia), Sixense (France), Digitexx Data Systems, Inc. (US), and Acellent Technologies, Inc. (US) are some of the key players in the structural health monitoring market. |

Structural Health Monitoring Market Highlights

This research report categorizes the structural health monitoring market based on offering, technology, vertical, implementation, application, and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Technology |

|

|

By Vertical |

|

|

By Implementation |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In December 2023, Campbell Scientific has launched the Aspen 10 Internet of Things (IoT) Edge Device, a cutting-edge instrument that seamlessly connects Aspen 10-compatible sensors to CampbellCloud. This robust device is specifically engineered for outdoor installation, eliminating the necessity for an extra enclosure. It boasts an integrated solar panel and internal rechargeable battery, ensuring self-sustainability and reliable operation in outdoor environments.

- In September 2023, Trimble and Kyivstar collaborated to establish a Continuously Operating Reference Station (CORS) network in Ukraine, offering GNSS correction services through Trimble's hardware and software technology.

- In May 2023, COWI A/S completed the acquisition of Mannvit. With this acquisition COWI focus on expanding its business within key sectors like infrastructure, industry, environment, and renewable energy in Iceland. Mannvit is a global consulting company that focuses on engineering, renewable energy, scientific services, and project management.

- In December 2022, The new Model 8940 Series GeoNet Dataloggers provide a valuable data collection solution for all GEOKON vibrating wire instruments and digital sensor strings, including MEMS IPI and VW sensors

- In June 2023, Campbell Scientific and the Royal Netherlands Meteorological Institute (KNMI) have partnered to enhance the surface observation systems in the Netherlands. This collaboration focuses on modernizing the observation network through software tools and solutions, aiming to improve responses to weather impacts and climate changes. The project involves deploying new software developed in partnership with KNMI, introducing Edge devices, and implementing a new software platform to remotely manage the observation network.

Frequently Asked Questions(FAQs):

Which are the major companies in the testing, inspec tion, and certification market? What are their major strategies to strengthen their market presence?

The major companies in the Structural health monitoring market are – COWI A/S (Denmark), Campbell Scientific (US), Geokon (US), Nova Metrix LLC (US), SGS SA (Switzerland), Trimble Inc. (US), Structural Monitoring Systems PLC (Australia), Sixense (France), Digitexx Data Systems, Inc. (US), and Acellent Technologies, Inc. (US). These players are strengthening their positions through strategies such as continuous innovation and product development, strategic partnerships and collaborations, market expansion, customer-centric approaches, research and development investments, acquisitions and mergers, effective marketing and branding, regulatory compliance, sustainability initiatives, and talent development.

Which vertical of structural health monitoring market is likely to have greatest impact in coming years?

The civil infrastructure vertical for structural health monitoring has the greatest impact on the market. This sector's significance lies in the increasing number of civil infrastructure projects, the urgent need for high-quality infrastructure, and the rising public awareness of preventing damage to critical structures like bridges, dams, and buildings. The demand for structural health monitoring systems in civil infrastructure projects is expected to be high, driving market growth and positioning this vertical as a key driver in the structural health monitoring market.

How software & services related to structural health monitoring is likely to drive market growth in coming years?

The growth of software and services in the structural health monitoring (SHM) market is highest in offering segment. The demand for software and services is being propelled by the increasing need for advanced monitoring solutions, data analytics, and cloud computing in the SHM industry. Software plays a vital role in processing data collected by monitoring systems, providing real-time insights, and facilitating predictive maintenance. On the other hand, services encompass installation, maintenance, and support, ensuring the effective operation of SHM systems. The growth of software and services in the SHM market is driven by the industry's focus on accuracy, efficiency, and cost-effectiveness, reflecting the market's evolution towards more sophisticated and comprehensive monitoring solutions.

What are the drivers and opportunities for the structural health monitoring market?

The global structural health monitoring (SHM) market is witnessing substantial growth, driven by several intersecting factors, which present promising opportunities for stakeholders. Key drivers include aging infrastructure, escalating infrastructure investments, stringent safety regulations, advancements in sensor technology, data analytics, cost benefits, sustainability demands, and integration with Building Information Modeling (BIM). These drivers pave the way for various opportunities such as expanding into new applications, focusing on cloud-based solutions, establishing standardized protocols, prioritizing user-friendliness and affordability, specializing in infrastructure types, integrating with Building Management Systems (BMS) and Computerized Maintenance Management Systems (CMMS), and emphasizing cybersecurity measures. These opportunities enable stakeholders to capitalize on the growing demand for SHM solutions and address evolving market needs effectively.

What are the restraints and challenges for the structural health monitoring market?

Despite its growth potential, the structural health monitoring (SHM) market encounters challenges hindering broader adoption. High implementation costs, scarcity of skilled professionals, and data management complexities pose hurdles. Cybersecurity risks, interoperability issues, and standardization challenges further impede progress. Additionally, limited long-term data availability and difficulty in demonstrating clear return on investment complicate adoption efforts. Overcoming these obstacles requires innovative solutions, robust cybersecurity measures, and industry-wide collaboration to establish standards and facilitate cost-effective implementation of SHM systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of the structural health monitoring market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering structural health monitoring systems have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the structural health monitoring market. Secondary sources considered for this research study include government sources, corporate filings, and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of Structural health monitoring systems to identify key players based on their products and prevailing industry trends in the Structural health monitoring market by offering, type, panel size, location, vertical, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

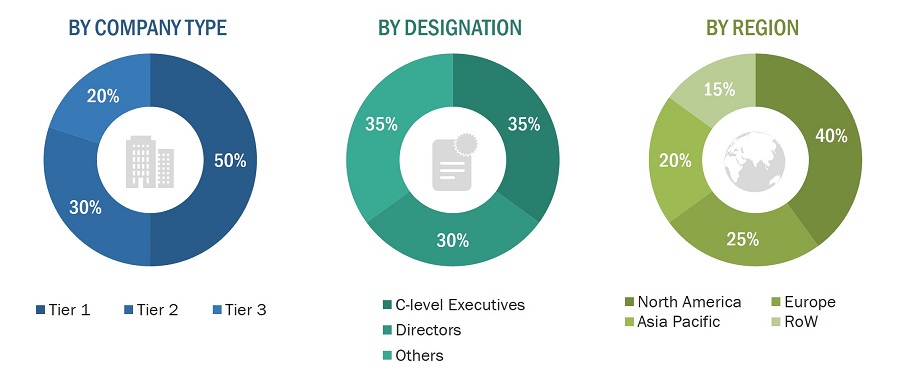

Extensive primary research has been conducted after understanding and analyzing the current scenario of the Structural health monitoring market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions-North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

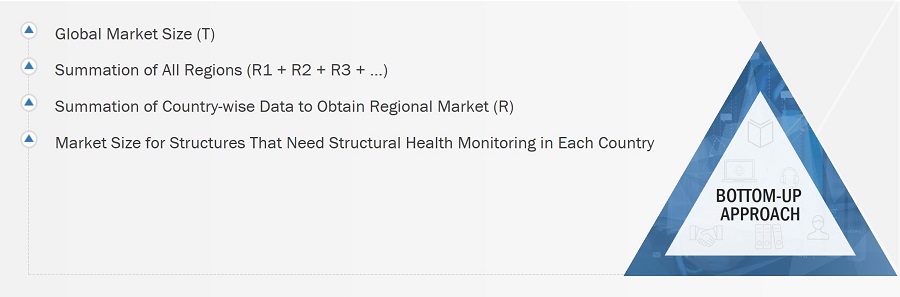

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the structural health monitoring market.

- Analyzing the size of the structural health monitoring market in each country by identifying segmental revenues of players in this market

- Identifying the total number of structures in the country that require structural health monitoring

- Estimating the prices of hardware and software solutions needed for the project

- Estimating the size of the structural health monitoring market in each country (total number of structures that require monitoring in the country * total cost of hardware, software, and services)

- Estimating the market size in each region by the summation of the country-wise market data

- Identifying the upcoming structural health monitoring projects by various companies in different regions and forecasting the market size based on these development and other important parameters

- Estimating the global market by the summation of region-wise data

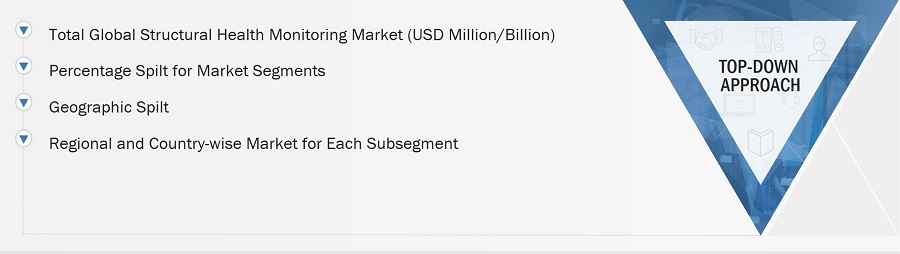

The top-down approach has been used to estimate and validate the total size of the Structural health monitoring market.

- Initially, the focus was on top-line investments and spending in the ecosystems. Further, the segment level splits and major developments in the market have been considered.

- Information related to the market revenue generated by key players in the structural health monitoring market has been obtained.

- Multiple discussions have been conducted with key opinion leaders from major companies that develop structural health monitoring instruments and software and provide monitoring and supply-related services.

- Geographic splits have been estimated using secondary sources based on factors such as the number of players in a specific region, types of services or the instruments manufactured, and various end users related to the market.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the structural health monitoring market.

Market Definition

Structural health monitoring is the process of implementing a damage detection strategy for any civil and mechanical engineering structures or components. Its goal is to identify structural changes and damages at the earliest so that corrective actions can be taken to reduce the risk of catastrophic failure, injury, or even loss of life, as well as minimize downtime and operational and maintenance costs. Structural health monitoring is required not only in pre-construction, under-construction, post-construction phases but also in the dilapidation stage. Structural health monitoring systems are crucial for the successful completion of infrastructural projects. Applications of structural health monitoring systems and services vary according to the complexity of the structure.

At present, structural health monitoring systems are adopted globally to monitor civil infrastructures such as dams, tunnels, bridges, buildings and stadiums. They find applications in aerospace & defense, energy, mining, industrial machinery, automotive & transportation, and marine markets. Structural health monitoring combines advanced sensor technologies with intelligent algorithms to infer the health condition of structures, enabling improved reliability and safety and enhanced structural performance.

Key Stakeholders

- Semiconductor and electronic component manufacturers and distributors

- Sensor manufacturers and distributors

- Raw material and manufacturing equipment suppliers

- Original equipment manufacturers (OEMs)

- ODM and OEM technology solution providers

- Technology standards organizations, forums, alliances, and associations

- Government bodies, venture capitalists, and private equity firms

- System integrators

- Construction and infrastructure service providers

- Green-field and brown-field project development companies

- Research organizations

- Technology investors

Report Objectives

- To define, describe, segment, and forecast the structural health monitoring market, by offering, technology, and vertical, in terms of value

- To forecast the market for sensors, which is the subsegment of hardware offerings, in terms of volume

- To describe and forecast the market for various segments, with respect to four main regions, namely, the North America, Europe, Asia Pacific, and the RoW(South America, and MEA), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the structural health monitoring market

- To define and describe implementation methods and applications of structural health monitoring systems

- To understand and analyze the impact of evolving technologies on the overall value chain of the structural health monitoring market and upcoming trends in the ecosystem

- To forecast and compare the market size of pre-recession with that of the post-recession at the regional level

- To provide a detailed overview of the structural health monitoring market’s value chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis for the market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) related to the structural health monitoring systems

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To analyze competitive developments such as product launches/developments, contracts, collaborations, partnerships, agreements, acquisitions, expansions, and research and development (R&D) activities carried out by players in the structural health monitoring market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Structural Health Monitoring Market

I've seen that catastrophic failures of the civil structures led to severe losses. SHM is best solution to overcome it. I am researching various aspects of structural health monitoring and this document looks to be of interest. It is possible that extracts from this may be quoted and the reference cited in a forthcoming publication by Construction Industry Research and Information Association (CIRIA).

Because of my new role, I would like to read your analysis and adapt to German and scandinavian markets. It could be useful to find out new market segment to develop in the next years. Can you share sectional infromation? What is the price for that?

I am writing my Master's Thesis on business model innovation through Industry 4.0. The proposed new business models are especially for Structural Health Monitoring divisions. Does the report provide any specific information about how infrastructural developments and investments could create oppportunities for SHM?

I am currently doing research on the sensors and data analytics for structural health monitoring. Does your report include information about recent launcches in the sensors and software for SHM? I am interested in understanding the current and upcoming market potential for the sensors in SHM? Can you provide such information?

We have a structural monitoring project in Istanbul, turkey, and we want to learn global market details to improve our systems. Does the report include all the emerging trends, technological changes, projects in the SHM space?