Stucco Market by Material (Cement, Aggregates, Admixture, Plasticizers, Bonding Agent), Type (Traditional, Insulated), Base (Concrete, Masonry, Tile), End-use (Residential & Non-residential), and Region- Global forecast to 2024

Updated on : March 31, 2023

Stucco Market

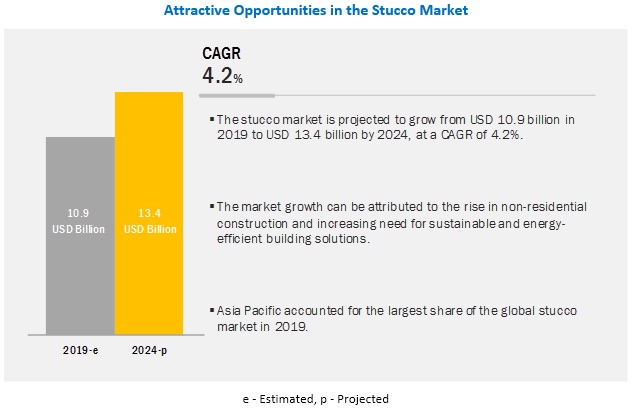

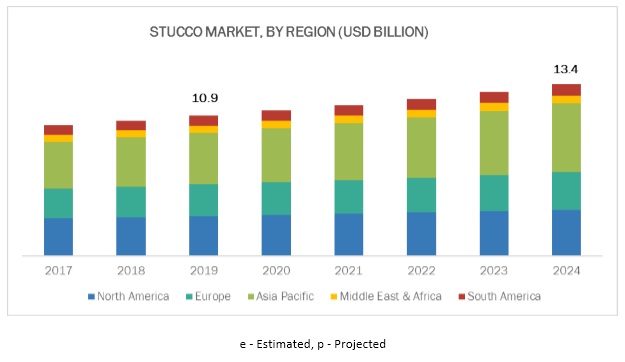

The stucco market was valued at USD 10.9 billion in 2019 and is projected to reach USD 13.4 billion by 2024, growing at a cagr 4.2% from 2019 to 2024. The demand for stucco can be attributed to the high growth of residential and non-residential construction industries across the globe. Other factors driving the market include rapid industrialization and the growing non-residential sector across the globe.

In terms of value and volume, the insulated segment is projected to lead the stucco market from 2019 to 2024.

Based on type, the insulated segment is projected to be a faster-growing market during the forecast period. On the other hand, the traditional segment dominated the stucco market in 2018. The strong market position of the traditional segment can be attributed to its superior properties, such as high strength, prolonged durability, fire-resistance, and ability to fight moisture.

In terms of value and volume, the residential segment of the stucco market is projected to grow at a higher CAGR during the forecast period.

The residential segment is a faster-growing segment in the stucco market. Factors such as the comparatively lower cost of stucco than other plasters used for residential construction, as a result of its superior durability and high tensile strength, make stucco the widely used material for the residential construction.

In terms of both value as well as volume, the Asia Pacific region is dominated to account for the largest share in the global stucco market during the forecast period.

The Asia Pacific region, which is witnessing a rebound in its residential and non-residential construction sector, is estimated to account for the largest market share in 2019. This market in this region is driven by the need for new construction and retrofitting or rehabilitation of older construction. Also, the increasing number of new housing units and huge investments in the non-residential sector are driving the demand for stucco in this region. Besides, the less stringent norms and standards for safety and environmental compliance, along with the easy availability of cheap labor, are attracting the major players across diverse industries to set up production facilities in this region. These factors help to accelerate the demand for stucco in the region further.

Stucco Market Players

Key players such as Sika AG (Switzerland) and The Quikrete Companies (US) adopted acquisitions and new product developments to strengthen their product portfolios, expand their market presence, and enhance their growth prospects in the stucco market.

Cemex is a key global building material company manufacturing and supplying construction and solutions worldwide. The company aims at creating sustainable value by providing quality products and solutions to satisfy the construction needs of its customers worldwide. Along with a geographically diversified portfolio of products, it also has a balanced, sustainable & profitable growth in the market. The company undertakes a number of initiatives to streamline and reposition its portfolio to enhance their product portfolios and achieve higher profitable growth. The company is financially and strategically well placed and has a strong customer base. It gives high importance to research and developmental activities. It aims to expand its existing distribution network to serve the customers better. Further, it also aims to innovate and expand its existing product portfolio for the stucco.

Stucco Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD Billion) and Volume (Million Square Feet) |

|

Segments covered |

Type, Base, Material, End-use, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

|

Companies covered |

Sika AG (Switzerland), Cemex (Mexico), BASF SE (Germany), Omega Products International (US), Dryvit Systems Inc. (US), The Quikrete Companies (US), Sto Group (Germany), E. I DuPont DE Nemours (US), California Stucco Products Corp. (US), and Western Blended Products (US) |

This research report categorizes the stucco market based on type, base, material, end-use, and region.

On the basis of type:

- Traditional

- Insulated

On the basis of base

- Concrete

- Masonry

- Tile

- Other bases (gypsum board, cement boards, OSB board, and plywood)

On the basis of material:

- Cement

- Aggregates

- Admixture

- Plasticizers

- Reinforcement

- Bonding agent

- Other materials (building paper and fiber)

On the basis of end-use

- Residential

- Non-residential

On the basis of region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In May 2019, Sika AG acquired Parex Group (US), one of the leading manufacturers in the construction industry. The key markets of the Parex Group include China, the US, France, Argentina, Brazil, Singapore, the UK, and Australia. The acquisition is expected to expand Sika’s presence across the globe and will use Parex’s technologies and its distribution channels for business growth.

- In March 2019, Quikrete launched its new FastSet Stucco Patch, which makes stucco repair easier, faster, and more effective. Designed for full-depth and thin repairs, Quikrete FastSet Stucco Patch is a Portland cement-based material formulated to restore damaged stucco surfaces.

- In January 2018, Quikrete launched its Lightweight Fiberglass Reinforced Stucco (FRS), which is the industry’s lightest, most sustainable stucco. It helps maximize jobsite productivity and profitability. It is 35% lighter than traditional pre-blended stucco, making it faster and easier to transport, stage, mix, pump, place, and finish.

Key Questions Addressed by the Report:

- What are the global trends in the stucco market? Would the market witness an increase or decline in the demand in the coming years?

- What is the estimated demand for different resin types of stucco?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for stucco?

- Who are the major players in the stucco market globally?

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the stucco market?

What are the factors contributing to the final price of stucco?

Which are the exterior wall surfaces suitable for the stucco?

What are the types of stucco?

What are the different building structures where stucco is applied?

What is the most significant restraint for stucco market growth?

How can regulations affect the growth of stucco globally?

How is the stucco market aligned?

Who are the major manufacturers?

How is stucco different from EIFS?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Scope

1.3.2 Periodization Considered for the Study

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Market Size Estimation

2.2.1 Approach (Based on Type, By Country)

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Emerging Economies to Witness A Relatively Higher Demand for Stucco

4.2 Asia Pacific: Stucco Market, By Type & Country

4.3 Stucco Market, By Type

4.4 Stucco Market, By End Use

4.5 Stucco Market, By Key Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Regulations to Reduce Greenhouse Gas Emission

5.2.1.2 Lower Energy Consumption and Operating Costs

5.2.1.3 Low Maintenance and Easy Installation

5.2.2 Restraints

5.2.2.1 Preference for New Finished Systems

5.2.2.2 Extreme Cold Temperatures Not Optimal for Stucco Application

5.2.3 Opportunities

5.2.3.1 Rise in New Construction Projects in Emerging Economies

5.2.3.2 Product Advancement With the Use of Insulation Foam

5.2.4 Challenges

5.2.4.1 Lack of Awareness and Deficit in Skilled Labors

6 Stucco Market, By Material (Page No. - 35)

6.1 Introduction

6.2 Cement

6.3 Aggregates

6.4 Admixtures

6.5 Plasticizers

6.6 Reinforcements

6.7 Bonding Agents

6.8 Other Materials

7 Stucco Market, By Base (Page No. - 37)

7.1 Introduction

7.2 Concrete

7.3 Masonry

7.4 Tile

7.5 Other Bases

8 Stucco Market, By Type (Page No. - 38)

8.1 Introduction

8.2 Traditional

8.3 Insulated

9 Stucco Market, By End Use (Page No. - 41)

9.1 Introduction

9.2 Residential

9.3 Non-Residential

9.3.1 Industrial Building

9.3.2 Commercial Building

9.3.3 Other Non-Residential Buildings

10 Regional Analysis (Page No. - 45)

10.1 Introduction

10.2 Asia Pacific

10.2.1 China

10.2.1.1 The Chinese Stucco Market is Projected to Grow at the Highest Rate in Asia Pacific

10.2.2 India

10.2.2.1 India is the Thirst-Largest Market in the Asia Pacific Region

10.2.3 Japan

10.2.3.1 Japan is Projected to Grow at the Second-Highest CAGR in the Asia Pacific Stucco Market

10.2.4 Australia

10.2.4.1 The Traditional Segment Accounted for the Larger Share in the Australian Stucco Market

10.2.5 South Korea

10.2.5.1 The Non-Residential Sector is Projected to Lead the South Korean Stucco Market

10.2.6 Rest of Asia Pacific

10.3 North America

10.3.1 US

10.3.1.1 The US is Projected to Be the Largest Market for Stucco in the North American Region

10.3.2 Canada

10.3.2.1 The Insulated Segment to Grow at A Higher CAGR, in Terms of Both Volume and Value, in Canada

10.3.3 Mexico

10.3.3.1 Mexico to Be the Fastest-Growing Country in the North American Region By 2024

10.4 Europe

10.4.1 France

10.4.1.1 France Was Ranked the Fourth-Largest Market for Stucco in Europe in 2018

10.4.2 Germany

10.4.2.1 Germany to Be the Largest Market for Stucco in Europe

10.4.3 UK

10.4.3.1 The Residential Segment to Be the Faster-Growing Segment in the UK By 2024

10.4.4 Poland

10.4.4.1 Traditional Stucco to Be the Larger Segment in the Polish Market

10.4.5 Russia

10.4.5.1 Russia to Be the Second-Fastest-Growing Country in the European Stucco Market

10.4.6 Spain

10.4.6.1 Spain to Be the Fastest-Growing Country in the Stucco Market in Europe

10.4.7 Rest of Europe

10.4.7.1 The Non-Residential Segment to Be the Larger Segment in the Rest of Europe Market By 2024

10.5 Middle East & Africa

10.5.1 Turkey

10.5.1.1 Turkey to Be the Second-Largest Market in the Middle East & Africa for Stucco

10.5.2 UAE

10.5.2.1 UAE to Lead the Middle East & African Stucco Market

10.5.3 Saudi Arabia

10.5.3.1 Non-Residential to Be the Leading Segment in the Saudi Arabian Stucco Market

10.5.4 South Africa

10.5.4.1 The Traditional Segment to Dominate the South African Stucco Market

10.5.5 Rest of the Middle East & Africa

10.5.5.1 Rise in Infrastructure Spending and Energy-Efficient Building Norms to Boost the Demand for Stucco in the Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.1.1 Brazil to Dominate the South American Stucco Market

10.6.2 Argentina

10.6.2.1 Argentina to Be the Fastest-Growing Country in South America for Stucco

10.6.3 Rest of South America

10.6.3.1 Significant Opportunities for Investment to Boost the Stucco Market in Rest of South America

11 Competitive Landscape (Page No. - 90)

11.1 Overview

11.2 Microquadrants for Stucco Manufacturers

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic Differentiators

11.2.4 Emerging Companies

11.2.5 Strength of Product Portfolio

11.2.6 Business Strategy Excellence

11.3 Competitive Scenario

11.3.1 Acquisitions

11.3.2 New Product Developments

12 Company Profiles (Page No. - 95)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Financial Assessment, Operational Assessment, Winning Imperatives, Current Focus and Strategies, Threat From Competition & Right to Win)*

12.1 Cemex

12.2 BASF SE

12.3 Sika AG

12.4 Omega Products International

12.5 Dryvit Systems Inc.

12.6 The Quikrete Companies

12.7 STO Group

12.8 California Stucco Products Corp.

12.9 Dupont

12.10 Western Blended Products

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Financial Assessment, Operational Assessment, Winning Imperatives, Current Focus and Strategies, Threat From Competition & Right to Win Might Not Be Captured in Case of Unlisted Companies.

12.11 Other Players

12.11.1 Silpro

12.11.2 Guangdong Yunyan Special Cement Building Materials Ltd.

12.11.3 Total Wall Inc.

12.11.4 Vasari Plaster and Stucco LLC

12.11.5 Mission Stucco Co.

12.11.6 Spec Mix LLC

12.11.7 Gomix Co. Ltd.

12.11.8 JBR Coatings and Insulations

12.11.9 Eagle Building Materials

12.11.10 Isomat S.A.

13 Appendix (Page No. - 126)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (135 Tables)

Table 1 Region-Wise Regulations to Reduce Ghg Emissions

Table 2 Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 3 Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 4 Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 5 Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 6 Stucco Market Size, By Region, 2017–2024 (USD Million)

Table 7 Stucco Market Size, By Region, 2017–2024 (Million Square Feet)

Table 8 Asia Pacific: Stucco Market Size, By Country, 2017–2024 (USD Million)

Table 9 Asia Pacific: Stucco Market Size, By Country, 2017–2024 (Million Square Feet)

Table 10 Asia Pacific: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 11 Asia Pacific: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 12 Asia Pacific: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 13 Asia Pacific: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 14 China: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 15 China: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 16 China: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 17 China: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 18 India: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 19 India: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 20 India: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 21 India: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 22 Japan: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 23 Japan: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 24 Japan: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 25 Japan: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 26 Australia: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 27 Australia: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 28 Australia: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 29 Australia: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 30 South Korea: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 31 South Korea: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 32 South Korea: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 33 South Korea: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 34 Rest of Asia Pacific: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 35 Rest of Asia Pacific: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 36 Rest of Asia Pacific: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 37 Rest of Asia Pacific: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 38 North America: Stucco Market Size, By Country, 2017–2024 (USD Million)

Table 39 North America: Stucco Market Size, By Country, 2017–2024 (Million Square Feet)

Table 40 North America: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 41 North America: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 42 North America: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 43 North America: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 44 US: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 45 US: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 46 US: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 47 US: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 48 Canada: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 49 Canada: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 50 Canada: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 51 Canada: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 52 Mexico: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 53 Mexico: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 54 Mexico: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 55 Mexico: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 56 Europe: Stucco Market Size, By Country, 2017–2024 (USD Million)

Table 57 Europe: Stucco Market Size, By Country, 2017–2024 (Million Square Feet)

Table 58 Europe: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 59 Europe: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 60 Europe: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 61 Europe: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 62 France: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 63 France: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 64 France: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 65 France: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 66 Germany: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 67 Germany: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 68 Germany: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 69 Germany: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 70 UK: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 71 UK: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 72 UK: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 73 UK: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 74 Poland: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 75 Poland: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 76 Poland: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 77 Poland: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 78 Russia: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 79 Russia: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 80 Russia: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 81 Russia: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 82 Spain: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 83 Spain: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 84 Spain: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 85 Spain: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 86 Rest of Europe: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 87 Rest of Europe: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 88 Rest of Europe: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 89 Rest of Europe: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 90 Middle East & Africa: Stucco Market Size, By Country, 2017–2024 (USD Million)

Table 91 Middle East & Africa: Stucco Market Size, By Country, 2017–2024 (Million Square Feet)

Table 92 Middle East & Africa: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 93 Middle East & Africa: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 94 Middle East & Africa: Stucco Market Size, By End Use, 2017–2024(USD Million)

Table 95 Middle East & Africa: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 96 Turkey: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 97 Turkey: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 98 Turkey: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 99 Turkey: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 100 UAE: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 101 UAE: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 102 UAE: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 103 UAE: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 104 Saudi Arabia: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 105 Saudi Arabia: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 106 Saudi Arabia: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 107 Saudi Arabia: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 108 South Africa: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 109 South Africa: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 110 South Africa: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 111 South Africa: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 112 Rest of the Middle East & Africa: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 113 Rest of the Middle East & Africa: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 114 Rest of the Middle East & Africa: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 115 Rest of the Middle East & Africa: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 116 South America: Stucco Market Size, By Country, 2017–2024 (USD Million)

Table 117 South America: Stucco Market Size, By Country, 2017–2024 (Million Square Feet)

Table 118 South America: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 119 South America: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 120 South America: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 121 South America: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 122 Brazil: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 123 Brazil: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 124 Brazil: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 125 Brazil: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 126 Argentina: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 127 Argentina: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 128 Argentina: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 129 Argentina: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 130 Rest of South America: Stucco Market Size, By Type, 2017–2024 (USD Million)

Table 131 Rest of South America: Stucco Market Size, By Type, 2017–2024 (Million Square Feet)

Table 132 Rest of South America: Stucco Market Size, By End Use, 2017–2024 (USD Million)

Table 133 Rest of South America: Stucco Market Size, By End Use, 2017–2024 (Million Square Feet)

Table 134 Acquisitions, 2019

Table 135 New Product Developments, 2018–2019

List of Figures (34 Figures)

Figure 1 Stucco Market Segmentation

Figure 2 Stucco Market, By Region

Figure 3 Approach (Primary and Secondary Research)

Figure 4 Stucco Market: Data Triangulation

Figure 5 Key Market Insights

Figure 6 List of Stakeholders Involved and Breakdown of Primary Interviews

Figure 7 Traditional Stucco, By Type, Estimated to Account for the Larger Share in 2019

Figure 8 The Residential Segment to Be the Faster-Growing End Use During the Forecast Period

Figure 9 Asia Pacific Dominated the Stucco Market in 2018

Figure 10 Emerging Economies Offer Attractive Opportunities in the Stucco Market During the Forecast Period

Figure 11 China Accounted for the Largest Market for Stucco in Asia Pacific in 2018

Figure 12 The Traditional Segment is Projected to Lead the Stucco Market During the Forecast Period

Figure 13 The Non-Residential Segment to Lead the Stucco Market in 2019

Figure 14 China is Projected to Grow at the Highest CAGR in the Global Market From 2019 to 2024

Figure 15 Overview of Factors Governing Stucco Market

Figure 16 Stucco Market Size, By Type, 2019 vs. 2024 (USD Million)

Figure 17 Stucco Market Size, By End Use, 2019 vs. 2024 (USD Million)

Figure 18 Regional Stucco Market Snapshot: China to Dominate the Stucco Market

Figure 19 Asia Pacific Stucco Market Snapshot: China is Projected to Be the Fastest-Growing Market Between 2019 and 2024

Figure 20 Stucco Market (Global): Competitive Leadership Mapping, 2019

Figure 21 Cemex: Company Snapshot

Figure 22 Cemex: SWOT Analysis

Figure 23 Winning Imperatives: Cemex

Figure 24 BASF SE: Company Snapshot

Figure 25 BASF SE: SWOT Analysis

Figure 26 Winning Imperatives: BASF SE

Figure 27 Sika AG: Company Snapshot

Figure 28 Sika AG: SWOT Analysis

Figure 29 Winning Imperatives: Sika AG

Figure 30 Omega Products International: SWOT Analysis

Figure 31 Winning Imperatives: Omega Products International

Figure 32 Dryvit Systems Inc.: SWOT Analysis

Figure 33 Winning Imperatives: Dryvit Systems Inc.

Figure 34 STO Group: Company Snapshot

The study involved four major activities for estimating the current global size of the stucco market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of stucco through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the stucco market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the stucco market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

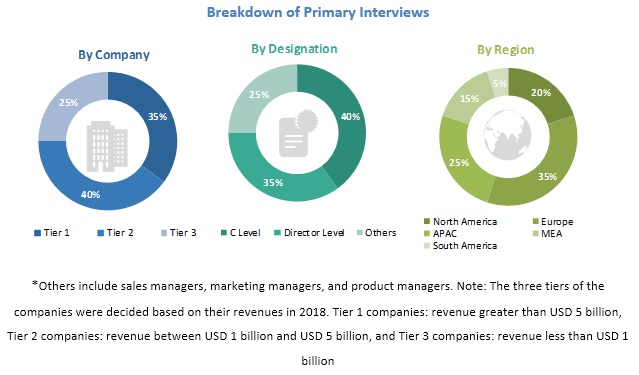

Primary Research

Various primary sources from both the supply and demand sides of the stucco market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the stucco industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions.

The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the stucco market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the stucco market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Research Objectives

- To define, analyze, and project the size of the stucco market in terms of value and volume based on type, base, material, end-use, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches and acquisitions in the stucco market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the stucco report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the stucco market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Stucco Market