Threat Modeling Tools Market by Component (Solutions, Services), Platform (Web-based, Desktop-based, Cloud-based), Organization Size (Large Enterprises, Small and Medium Sized Enterprises), Vertical and Region - Global Forecast to 2027

Updated on : Jan 5, 2024

Threat Modelling Tools Market Size 2027

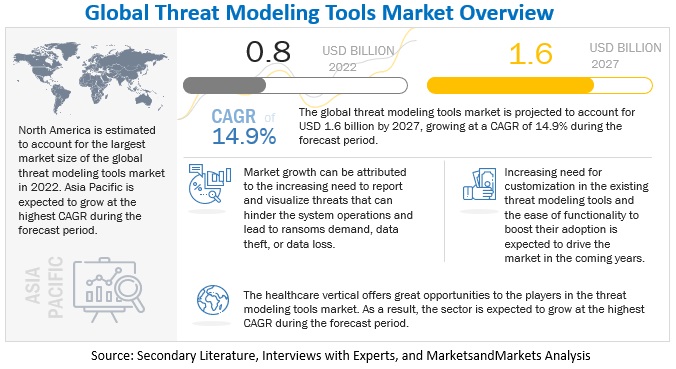

The Global Threat Modelling Tools Market is projected to reach USD 1.6 billion by 2027 from an estimated USD 0.8 billion in 2022. At a compound annual growth rate (CAGR) of 14.9%. Factors driving market growth include the growing adoption of threat modeling tools due to the rising number of cyber-attacks, the growing need for visualization and reporting of the threat landscape, and the growing demand for customizable threat modeling tools. However, integration with existing infrastructure, low-security budget, and spending is expected to hinder the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Threat Modeling Tools Market Dynamics

Driver: Growing demand for user-friendly threat modeling tools

Threat modeling tools are user-friendly and straightforward to navigate and use. They have a clear and intuitive user interface, offer step-by-step guidance for creating and analyzing threat models, and can easily import and export data. Threat modeling tools include built-in templates for common threat modeling scenarios, can collaborate and share threat models with other team members, and facilitate integration with other security tools or systems. This can help streamline the threat modeling process and make it more efficient for the users. Some tools also automatically identify and prioritize potential threats based on the system's architecture or configuration, which can save time and improve the overall effectiveness of the threat modeling process. Overall, ease of use is an important feature in threat modeling tools, as it can increase the adoption and effectiveness of the tool within an organization.

Restraint: Rising complexities

Complexity in threat modeling tools refers to the difficulty experienced in using and understanding the tool and the complexity of the systems and applications the tool is designed to analyze. Some tools may have a steep learning curve and require a high level of technical expertise. Others may have a user-friendly interface but require significant time and effort to set up and configure. Complexity can also be seen in the breadth and depth of the analysis performed by the tool. Some tools may only focus on a limited set of assets and threats, while others may be able to analyze a wide range of assets and threats, including those that are hidden or hard to detect.

Complexity in the systems and applications the tool is designed to analyze is also important. Some tools may be designed to analyze simple, single-purpose systems, while others may be designed to analyze complex, multi-tier applications. The complexity of the system or application being analyzed can affect the accuracy and completeness of the threat modeling analysis. In conclusion, choosing a tool appropriate for the complexity of the system or application being analyzed is important. Therefore, complexity is acting as an obstruction in the wide adoption of threat modeling tools.

Opportunity: Widespread adoption of cloud and IoT

The adoption of cloud and IoT (Internet of Things) technologies can be seen as an opportunity for the adoption of threat modeling tools. As more and more organizations move their systems and applications to the cloud and deploy IoT devices, the need for effective threat modeling tools that can analyze and protect these systems and devices increases. One way that the adoption of cloud and IoT can drive the adoption of threat modeling tools is by increasing the complexity of the systems and applications that need to be protected. As organizations move to cloud and deploy IoT devices, the systems and applications that need to be protected become more complex and diverse. Threat modeling tools that can handle this complexity and provide a comprehensive analysis of these systems and devices can be more effective in identifying and assessing potential threats. Another way that the adoption of cloud and IoT can drive the adoption of threat modeling tools is by increasing the need for integration and compatibility. As more and more systems and devices are connected to the internet, the need for security tools that can integrate and work seamlessly with other systems and devices increases. Threat modeling tools that are compatible with the cloud and IoT devices and can integrate with other security tools can be more effective in protecting these systems and devices. Finally, the adoption of cloud and IoT also increases the need for automation, as the number of systems and devices to be protected increases. Threat modeling tools that can automate the threat modeling process can help organizations to scale their security efforts and respond quickly to identified threats.

Challenge: Data privacy concerns

Data privacy is a significant challenge for threat modeling tools, as these tools are designed to analyze and assess the security of systems and applications that may contain sensitive or confidential information. Privacy constraints can limit the types of data that can be analyzed, the types of analysis that can be performed, and the storage and sharing of the data and results of the analysis. This can lead to incomplete or inaccurate results, limit the ability of the tool to identify, assess potential threats and vulnerabilities, and hinder collaboration and teamwork. Data privacy can also be a challenge in terms of storage and sharing of the data and results of the analysis. For example, organizations may have concerns about who has access to the data and results of the analysis, as well as how it's stored and shared. This can make it difficult for organizations to share the results of the analysis with the relevant stakeholders, which can hinder collaboration and teamwork.

Threat Modeling Tools Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By platform, the cloud-based segment to grow at the highest CAGR during the forecast period

Cloud-based threat modeling tools are hosted on the cloud and accessible through a web browser or API, allowing organizations to conduct threat modeling remotely and from multiple locations. These tools offer scalability, reliability, and security benefits of cloud-based infrastructure and are usually subscription-based. They can be integrated with other security tools and services to provide a comprehensive view of an organization's security posture. IriusRisk is a platform that allows users to create threat models, categorize threats, and evaluate their likelihood and impact via a web-based interface. Additionally, it comes with a collection of pre-made threat models that can be customized to suit specific organizations or systems.

By vertical, the healthcare segment is expected to grow at the highest CAGR during the forecast period

The healthcare industry deals with sensitive information, such as patient medical records, personal identification information, and financial data, which makes it a prime target for cyber-attacks. To address these risks, healthcare organizations use threat modeling tools to identify potential threats to their systems and networks and evaluate the level of risk they pose. One widely used tool in the healthcare sector is Anomali ThreatStream, which aggregates and analyzes threat data from multiple sources, including open-source intelligence, commercial threat intelligence, and internal systems, to enable organizations to detect and respond to cyber threats in real time. This tool can be integrated with other security tools, such as SIEM and vulnerability management software, to provide a more comprehensive view of an organization's security posture. Anomali ThreatStream also helps organizations prioritize their security efforts by identifying the most critical assets and the most likely attack scenarios and provides recommendations for mitigating potential threats, such as implementing specific security controls. Additionally, the tool can be used to perform incident response and forensic investigations and track the activities of APT groups, criminal organizations, and state-sponsored actors.

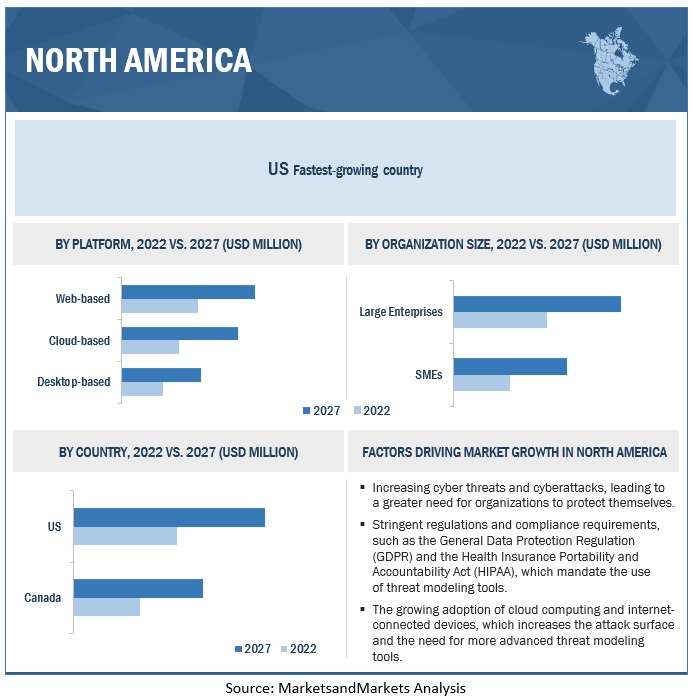

By region, North America to hold largest highest market size during the forecast period

North America is the most-affected region in terms of data security breaches and, as a result, has the largest number of threat modeling tool providers. Hence, the global threat modeling tools market is expected to be dominated by North America. Data security is recognized as the most serious economic and national security challenge by organizations and governments in the region. The growing concern about the security of critical infrastructure and sensitive data has increased the government's intervention in threat modeling tools in recent years. Specific budget allocations, support from the government, and mandated data protection policies are expected to make North America the most profitable region for the growth of threat modeling tool providers.

Key Market Players

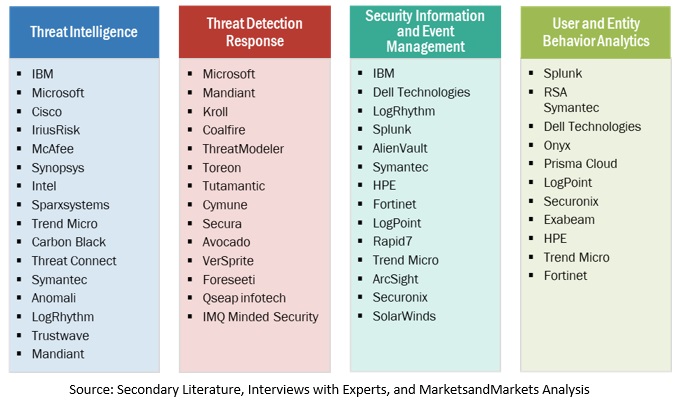

Key players in the global threat modeling tools market include Cisco (US), IBM (US), Synopsys (US), Intel (US), Microsoft (US), Varonis Systems (US), Sparx Systems (Australia), Kroll (US), Mandiant (US), Coalfire (US), Securonix (US), Security Compass (Canada), IriusRisk (Spain), Kenna Security (US), ThreatModeler (US), Toreon (Belgium), Foreseeti (Sweden), Tutamantic (UK), Cymune (India), Avocado Systems (US), Secura (Netherlands), qSEAp (India), VerSprite (Georgia) and IMQ Minded Security (Italy).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

|

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Major companies covered |

Cisco (US), IBM (US), Synopsys (US), Intel (US), Microsoft (US), Varonis Systems (US), Sparx Systems (Australia), Kroll (US), Mandiant (US), Coalfire (US), Securonix (US), Security Compass (Canada), IriusRisk (Spain), Kenna Security (US), ThreatModeler (US), Toreon (Belgium), Foreseeti (Sweden), Tutamantic (UK), Cymune (India), Avocado Systems (US), Secura (Netherlands), qSEAp (India), VerSprite (Georgia) and IMQ Minded Security (Italy). |

Market Segmentation

Recent Developments

- In November 2022, Kroll expanded its partnership with CrowdStrike to offer joint customers worldwide advanced incident response (IR) and remediation capabilities through the Kroll Responder managed detection and response service. This expansion allows customers to take advantage of the CrowdStrike Falcon platform and Kroll's advanced Security Operations Center (SOC) capabilities for enhanced situational awareness, proactive threat hunting, and integrated digital forensics and incident response, resulting in faster threat detection and resolution.

- In September 2022, by merging forces, Google Cloud and Mandiant provided a complete security operations solution that offers even more robust capabilities to help customers protect both their cloud and on-premises environments. The acquisition enabled the companies to deliver an end-to-end security operations suite that covered all the necessary aspects of security for the customers.

- In July 2021, Microsoft acquired CloudKnox Security to strengthen its security portfolio to reduce risk and prevent security breaches. Microsoft aims at gaining granular visibility, enabling them to monitor and automate remediation for hybrid and multi-cloud permissions.

Frequently Asked Questions (FAQ):

What is the definition of Threat Modeling Tools?

MarketsandMarkets defines threat modeling tools as a process of identifying and evaluating potential security threats to a system or application to identify vulnerabilities and determine appropriate remediations. Threat modeling tools are software tools that automate or facilitate this process. They are used to identify and assess the potential risks to a system, application, or organization and help determine appropriate security controls to mitigate or prevent them.

What is the projected value of the global threat modeling tools market?

The global threat modeling tools market is expected to grow from an estimated USD 0.8 billion in 2022 to 1.6 billion USD by 2027, at a Compound Annual Growth Rate (CAGR) of 14.9% from 2022 to 2027.

Which are the key companies influencing the growth of the threat modeling tools market?

Cisco (US), IBM (US), Synopsys (US), Varonis Systems(US), Intel (US), and Microsoft (US). Some key companies in the threat modeling tools market are recognized as star players. These companies account for a significant share of the threat modeling tools market. They offer comprehensive solutions related to threat modeling tools and services. These vendors offer customized solutions as per user requirements and adopt growth strategies to consistently achieve the desired growth and mark their presence in the market.

Which vertical segment is expected to grow at the highest CAGR during the forecast period?

The healthcare vertical is expected to grow at the highest CAGR during the forecast period.

Which country in the Asia Pacific region is expected to hold the largest market size during the forecast period?

China is expected to hold the largest market size during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

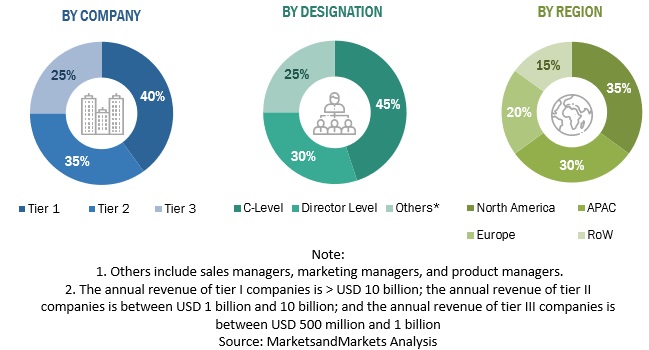

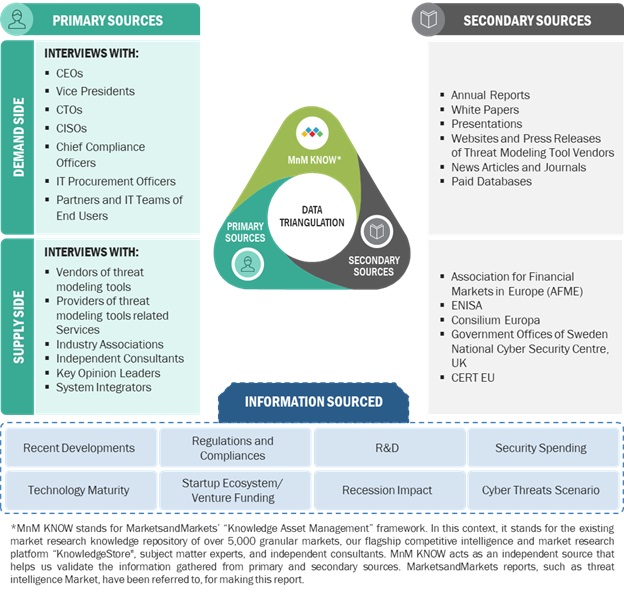

This study involved multiple steps in estimating the current size of the threat modeling tools market. Exhaustive secondary research was carried out to collect information on the threat modeling tools industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. The top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the threat modeling tools market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of threat modeling tools vendors, forums, certified publications, and whitepapers. This research was used to obtain key information related to the industry's value chain, the total pool of key players, market classification, and segmentation from the market- and technology-oriented perspectives.

Factors Considered To Estimate Regional-Level Market Size:

- Gross Domestic Product (GDP) Growth

- Information and Communication Technology (ICT) Security Spending

- Recent Market Developments

- Market Ranking Analysis of Major Threat Modeling Tools Providers

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. These sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the threat modeling tools market.

Following is the breakup of the primary interviews:

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

To know about the assumptions considered for the study, Request for Free Sample Report

Report Objectives

- To define, describe, and forecast the threat modeling tools market based on component, platform, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the threat modeling tools market

- To forecast the threat modeling tools market size across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To analyze the sub-segments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To map the companies to get competitive intelligence based on their profiles, key player strategies, and game-changing developments, such as product launches, collaborations, and acquisitions

- To track and analyze competitive developments, such as product launches and enhancements, acquisitions, partnerships, and collaborations in the threat modeling tools market

Available Customization

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Threat Modeling Tools Market