Track Etched Membrane Market by Product (Membrane Filter, Capsule & Cartridge Filter, Cell Culture Insert), Material (Polycarbonate, Polyimide), Application (Cell Biology, Microbiology, Analytical testing, Automotive), End User - Global Forecasts to 2023

The track etched membrane market is projected to reach USD 813.1 million by 2023, growing at a CAGR of 11.3%.

Objectives of the study

- To define, describe, segment, and forecast the global track etched membrane market by product, material, application, end user, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the track etched membrane market in North America, Europe, Asia Pacific, and the Rest of the World

- To profile key players in the track etched membrane market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; expansions; mergers & acquisitions; and product developments and launches undertaken by key players in the track etched membrane market

Research Methodology

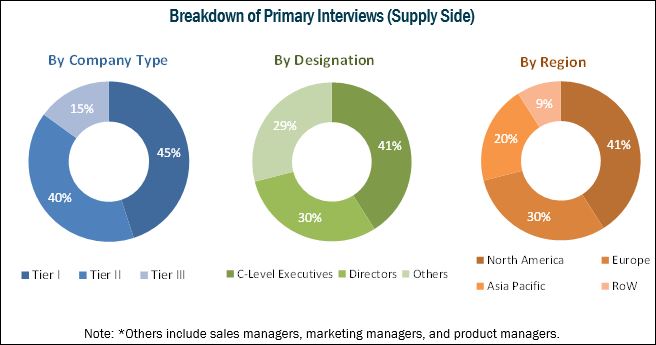

Top-down and bottom-up approaches were used to validate the size of the track etched membrane market and to estimate the size of other dependent submarkets. Various secondary sources such as associations (World Health Organization (WHO), American Membrane Technology Associations, American Filtration and Separations Society, American Chemical Society, European Membrane Society, Russian Membrane Society, Institute of Nuclear Chemistry and Technology (Poland), Membrane Industry Association of China), directories, industry journals, databases, and annual reports of the companies were used to identify and collect information useful for the study of this market. Primary sources such as experts from both supply- and demand-sides were interviewed to obtain and validate information as well as to assess the dynamics of this market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key players operating in the global track etched membrane are GE Healthcare (US), Danaher (US), Corning (US), Merck (Germany), it4ip (Belgium), Sterlitech (US), Oxyphen (Switzerland), Sarstedt (US), BRAND GMBH (Germany), Sartorius (Germany), SABEU (Germany), Zefon International (US), GVS (Italy), Thermo Fisher Scientific (US), Eaton (Ireland), Greiner Bio-One (Austria), MACHEREY-NAGEL (Germany), Avanti Lipids Polar (US), SKC (US), Advantec (Canada), Avestin (Canada), CHMLAB (Spain), Scaffdex (Finland), and Graver Technologies (US).

Target Audience:

- Manufacturers of Track Etched Membranes, Laboratory Filtration Equipment and Accessories

- Distributors of Laboratory Filtration Equipment and Accessories

- Pharmaceutical, Biotechnology, and Food & Beverage Companies

- Hospitals and Clinical Laboratories

- Academic and Research Institutes

- R&D Laboratories

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Track Etched Membrane Market Scope

The research report categorizes the track etched membrane market into the following segments and subsegments:

By Product

- Membrane Filters

- Capsule & Cartridge Filters

- Other Track Etched Membrane Products

By Material

- Polycarbonate

- Polyethylene Terephthalate

- Polyimide

By Application

- Cell Biology

- Microbiology

- Analytical Testing

- Other Applications

By End User

- Pharmaceutical and Biopharmaceutical Companies

- Academic and Research Institutes

- Food and Beverage Companies

- Hospital and Diagnostic Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

- Asia Pacific

- Rest of the World

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Asia Pacific track etched membrane market into the Japan, China, India, and others

- Further breakdown of the Rest of the World track etched membrane market into Latin America and Middle East & Africa

Key factors driving the growth of this market include increasing R&D spending in the pharmaceutical and biopharmaceutical industries and increasing purity requirements among end users of track etched membranes. However, the high cost of production and the limited supply of track etched Membranes are major factors that are expected to restrain the growth of this market during the forecast period.

The report analyzes the global track etched membrane market, by product, material, application, end user, and region. By product, the membrane filters segment is expected to lead the track etched membrane market by 2023. The large share of this segment can be attributed to the increasing applicability of membrane filters in sterilizing, final filtration, sample preparation, filtration of aqueous and organic solutions, fluid monitoring, and venting and gas filtration.

By application, the track etched membrane market is segmented into cell biology, microbiology, analytical testing, and other applications. The cell biology segment is estimated to hold the largest share of the track etched membrane market in 2018. The growing adoption of cell culture-based vaccines, increasing demand for monoclonal antibodies, rising funding for cell-based research, and the launch of advanced cell culture products are factors expected to drive the cell biology segment.

Based on material, the track etched membrane market is segmented into polycarbonate, polyethylene terephthalate, and polyimide membranes. The polycarbonate track etched membranes segment is expected to lead the track etched membrane market during the forecast period. The large share of this segment can be attributed to the growing adoption of these membranes in cell biology and analytical testing and their increasing applications in academic and research institutes and in pharmaceutical and food industries.

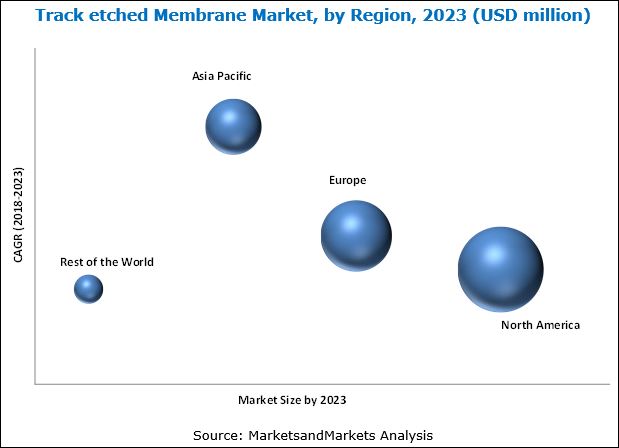

Geographically, the global track etched membrane market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America is expected to continue to dominate the track etched membrane market till 2023, followed by Europe and Asia Pacific. The large share of the North American market can be attributed to the presence of global pharmaceutical manufacturers, a large number of quality control laboratories for the food & beverage industry, and growing concern towards improving the quality of food products and the medical devices that utilize track etched membranes.

The commercial production of track etched membranes is almost always a secondary operation, and the production time is dependent on the time consumed by the primary operation of the facility. Facilities for beaming or irradiation are limited and in most cases are operated by government agencies, universities, or research laboratories. Although track etched membranes can be produced with a precisely determined pore size, shape, and distribution, their conventional production is very expensive for large-scale separation processes. Heavy ion irradiation of thin polymer films at a nuclear reactor or large accelerator facilities, which involves large capital costs, is generally the key initial manufacturing stage for track etched membranes. This cost is prohibitive or unaffordable for most consumers of Industrial Filtration systems. Moreover, considering the high costs, end users such as diagnostic laboratories and research institutes prefer the use of low-cost alternatives such as depth filters. This is one of the major factors restraining the growth of the track etched membrane market.

Key players in the global track etched membrane are GE Healthcare (US), Danaher (US), Corning (US), Merck (Germany), it4ip (Belgium), Sterlitech (US), Oxyphen (Switzerland), Sarstedt (US), BRAND GMBH (Germany), Sartorius (Germany), SABEU (Germany), Zefon International (US), GVS (Italy), Thermo Fisher Scientific (US), Eaton (Ireland), Greiner Bio-One (Austria), MACHEREY-NAGEL (Germany), Avanti Lipids Polar (US), SKC (US), Advantec (Canada), Avestin (Canada), CHMLAB (Spain), Scaffdex (Finland), and Graver Technologies (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions for the Study

2.6 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Track etched Membrane Market: Overview

4.2 Europe: Track etched Membrane Market, By End User and Country, 2017

4.3 Track etched Membrane Market: Geographical Snapshot

4.4 Track etched Membrane Market, By Region, 2018 vs 2023

4.5 Track etched Membrane Market: Developing vs Developed Markets, 2018 vs 2023

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing R&D Spending in Pharmaceutical and Biopharmaceutical Industries

5.2.1.2 Rising Application of Nanotechnology

5.2.1.3 Increasing Purity Requirements in End-Use Industries

5.2.2 Restraints

5.2.2.1 Limited Supply of Track etched Membranes Due to High Production Cost

5.2.3 Opportunities

5.2.3.1 Ultrafiltration Track etched Polymer Membranes

6 Industry Insights (Page No. - 41)

6.1 Distribution Channel Analysis

6.2 Pricing Analysis: Membrane Material

6.3 Pricing Analysis: Finished Products

6.4 Parent Market Analysis

7 Track etched Membrane Market, By Product (Page No. - 46)

7.1 Introduction

7.2 Membrane Filters

7.3 Cartridge & Capsule Filters

7.4 Other Track etched Membrane Products

8 Track etched Membrane Market, By Material (Page No. - 54)

8.1 Introduction

8.2 Polycarbonate

8.3 Polyethylene Terephthalate

8.4 Polyimide

9 Track etched Membrane Market, By Application (Page No. - 61)

9.1 Introduction

9.2 Cell Biology

9.3 Microbiology

9.4 Analytical Testing

9.5 Other Applications

10 Track etched Membrane Market, By End User (Page No. - 67)

10.1 Introduction

10.2 Pharmaceutical and Biopharmaceutical Companies

10.3 Academic and Research Institutes

10.4 Food and Beverage Companies

10.5 Hospital and Diagnostic Laboratories

10.6 Other End Users

11 Track etched Membrane Market, By Region (Page No. - 74)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 UK

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia Pacific

11.5 Rest of the World

12 Competitive Landscape (Page No. - 107)

12.1 Introduction

12.2 Product Portfolio Matrix

12.3 Geographical Assessment of Public Players in the Track etched Membrane Market (2017)

12.4 Competitive Situations and Trends

13 Company Profiles (Page No. - 112)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

13.1 GE Healthcare

13.2 Danaher Corporation

13.3 Corning, Inc.

13.4 Merck KGaA

13.5 Thermo Fisher Scientific

13.6 Sabeu GmbH & Co. Kg

13.7 It4ip S.A.

13.8 Sarstedt

13.9 GVS Filter Technology

13.10 Oxyphen AG

13.11 Brand GmbH + Co Kg

13.12 Sterlitech Corporation

13.13 Chmlab Group

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 133)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (85 Tables)

Table 1 Standard Currency Conversion Rates

Table 2 Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 3 Track etched Membrane Market, By Country, 2016–2023 (USD Million)

Table 4 Track etched Membrane Filters Available in the Market

Table 5 Membrane Filters Market, By Country, 2016–2023 (USD Million)

Table 6 Cartridge & Capsule Filters Available in the Market

Table 7 Cartridge & Capsule Filters Market, By Country, 2016–2023 (USD Million)

Table 8 Other Track etched Membrane Products Available in the Market

Table 9 Other Track etched Membrane Products Market, By Country, 2016–2023 (USD Million)

Table 10 Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 11 Polycarbonate Track etched Membrane Products

Table 12 Polycarbonate Track etched Membrane Market, By Country, 2016–2023 (USD Million)

Table 13 Polyethylene Terephthalate Track etched Membrane Products

Table 14 Polyethylene Terephthalate Track etched Membrane Market, By Country, 2016–2023 (USD Million)

Table 15 Polyimide Track etched Membrane Products

Table 16 Polyimide Track etched Membrane Market, By Country, 2016–2023 (USD Million)

Table 17 Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 18 Track etched Membrane Market for Cell Biology, By Country, 2016–2023 (USD Million)

Table 19 Track etched Membrane Market for Microbiology, By Country, 2016–2023 (USD Million)

Table 20 Track etched Membrane Market for Analytical Testing, By Country, 2016–2023 (USD Million)

Table 21 Track etched Membrane Market for Other Applications, By Country, 2016–2023 (USD Million)

Table 22 Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 23 Track etched Membrane Market for Pharmaceutical and Biopharmaceutical Companies, By Country, 2016–2023 (USD Million)

Table 24 Ongoing and Competed Research Projects

Table 25 Track etched Membrane Market for Academic and Research Institutes, By Country, 2016–2023 (USD Million)

Table 26 Track etched Membrane Market for Food and Beverage Companies, By Country, 2016–2023 (USD Million)

Table 27 Track etched Membrane Market for Hospitals and Diagnostic Laboratories, By Country, 2016–2023 (USD Million)

Table 28 Track etched Membrane Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 29 Track etched Membrane Market, By Region, 2016–2023 (USD Million)

Table 30 North America: Track etched Membrane Market, By Country, 2016–2023 (USD Million)

Table 31 North America: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 32 North America: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 33 North America: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 34 North America: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 35 US Medical and Health Research Expenditures for Academic and Research Institutions, 2013–2016 (USD Million)

Table 36 US: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 37 US: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 38 US: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 39 US: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 40 Canada: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 41 Canada: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 42 Canada: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 43 Canada: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 44 Europe: Track etched Membrane Market, By Country, 2016–2023 (USD Million)

Table 45 Europe: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 46 Europe: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 47 Europe: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 48 Europe: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 49 Germany: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 50 Germany: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 51 Germany: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 52 Germany: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 53 UK: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 54 UK: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 55 UK: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 56 UK: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 57 France: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 58 France: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 59 France: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 60 France: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 61 Italy: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 62 Italy: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 63 Italy: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 64 Italy: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 65 Spain: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 66 Spain: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 67 Spain: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 68 Spain: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 69 Rest of Europe: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 70 Rest of Europe: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 71 Rest of Europe: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 72 Rest of Europe: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 73 Asia Pacific: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 74 Asia Pacific: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 75 Asia Pacific: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 76 Asia Pacific: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 77 Rest of the World: Track etched Membrane Market, By Product, 2016–2023 (USD Million)

Table 78 Rest of the World: Track etched Membrane Market, By Material, 2016–2023 (USD Million)

Table 79 Rest of the World: Track etched Membrane Market, By Application, 2016–2023 (USD Million)

Table 80 RoW: Track etched Membrane Market, By End User, 2016–2023 (USD Million)

Table 81 Track etched Membranes Portfolio Matrix

Table 82 Track etched Membranes Portfolio Matrix

Table 83 Product Launches (2017–2018)

Table 84 Acquisitions (2015–2017)

Table 85 Expansions (2015–2018)

List of Figures (37 Figures)

Figure 1 Research Design

Figure 2 Primary Sources

Figure 3 Breakdown of Primary Interviews (Supply Side): By Company Type, Designation, and Region

Figure 4 Breakdown of Primary Interviews (Demand Side): By End User, Designation, and Region

Figure 5 Data Triangulation Methodology

Figure 6 Track etched Membranes Market, By Product, 2018 vs 2023 (USD Million)

Figure 7 Track etched Membrane Market, By Material, 2018 vs 2023 (USD Million)

Figure 8 Track etched Membrane Market, By Application, 2018 vs 2023 (USD Million)

Figure 9 Track etched Membrane Market, By End User, 2018 vs 2023 (USD Million)

Figure 10 Geographic Analysis: Track etched Membrane Market, 2017

Figure 11 Increasing R&D Spending in Pharmaceutical and Biopharmaceutical Industries is Driving Market Growth During the Forecast Period

Figure 12 Pharmaceutical & Biopharmaceutical Companies Accounted for the Largest Share of the Track etched Membrane Market

Figure 13 US Accounted for the Largest Share of the Track etched Membrane Market in 2017

Figure 14 North America is Projected to Dominate the Track etched Membrane Market During the Forecast Period

Figure 15 Asia Pacific to Register the Highest Growth Rate During the Forecast Period

Figure 16 Track etched Membrane Market: Drivers, Restraints, and Opportunities

Figure 17 Global Pharmaceutical R&D Spending (2012–2022)

Figure 18 US: Biopharmaceutical R&D Spending (USD Billion)

Figure 19 Distribution Channel

Figure 20 Distribution Channel Analysis

Figure 21 Laboratory Filtration Market

Figure 22 Pharmaceutical Filtration Market

Figure 23 Membrane Filters to Dominate the Track etched Membrane Market During the Forecast Period (2018–2023)

Figure 24 Polyimide Track etched Membranes to Register the Highest Growth Rate During the Forecast Period

Figure 25 Common Causes of Food Product Recalls

Figure 26 Pharmaceutical and Biopharmaceutical Companies Estimated to Be the Largest End Users of Track etched Membranes in 2018

Figure 27 Track etched Membrane Market: Geographic Snapshot

Figure 28 North America: Track etched Membrane Market Snapshot

Figure 29 Medical and Health R&D, By Funding Sector (2016)

Figure 30 Europe: Track etched Membrane Market Snapshot

Figure 31 Biotechnology Companies Overview: Germany

Figure 32 Key Developments of Major Players Between 2014 and 2017

Figure 33 Company Snapshot: GE Healthcare (2017)

Figure 34 Company Snapshot: Danaher Corporation (2017)

Figure 35 Company Snapshot: Corning (2017)

Figure 36 Company Snapshot: Merck KGaA (2017)

Figure 37 Company Snapshot: Thermo Fisher Scientific (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Track Etched Membrane Market