Traffic Management Market by Component (Hardware, Solutions (Route guidance & optimization, Smart Signaling, Traffic Analytics), Services), System (UTMC, ATCS, JTMS, DTMS), Areas of Application and Region - Global Forecast to 2028

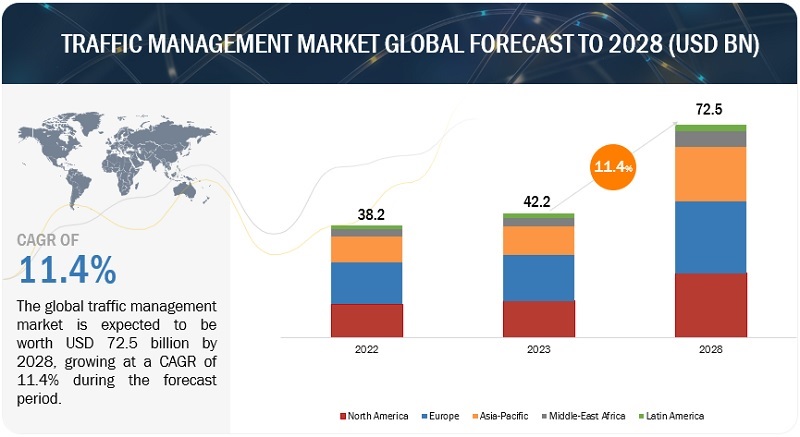

[294 Pages Report] The global Traffic Management Market size is projected to grow from USD 42.3 billion in 2023 to USD 72.5 billion by 2028 at a CAGR of 11.4% during the forecast period. Growing concerns about public safety, particularly related to traffic congestion and accidents, drive the adoption of traffic management technologies. Governments and organizations are focusing on improving road safety through the development of advanced traffic signal control systems, intelligent speed adaptation technologies, and systems that detect pedestrians and cyclists.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Global Traffic Management Market Dynamics

Driver: Connected Cars and Data Revolutionizing Traffic Management Systems

Traffic management poses a significant challenge for municipalities, but the advent of connected cars is poised to transform the landscape. In the realm of the IoT, connected cars have emerged as one of the fastest-growing technologies, capable of transmitting and receiving real-time data. In the UK, where over 30% of inner-city traffic stems from drivers hunting for parking spaces, the impact of connected vehicles is particularly promising. They can guide drivers to available parking spots, identify cost-effective pricing, and, in the future, even facilitate payments through the vehicle's dashboard. Furthermore, the integration of connected digital parking and permitting services can generate valuable big-data insights, addressing mobility challenges. Connected cars deliver both overt and covert data, ranging from adjusting fuel mix during adverse weather conditions to steering clear of pollution-heavy areas due to localized factors. Local authorities can leverage this wealth of data, combining it with analyses of traffic flows and real-time on-street parking demand. This synergy empowers the establishment of demand-driven parking tariffs, informs traffic management policies, guides the construction of new parking facilities, and fuels the development of resident parking schemes.

Restraint: Shortage Limiting New Projects

The labor market has impacted businesses in various industries, including the traffic management services sector. However, the effects of the labor shortage are particularly pronounced in this field due to the crucial emphasis on safety and the specialized training required for the job. Despite the expectation that the labor supply would improve as government programs such as the American Rescue Plan concluded, the recovery has been slower than anticipated. With discussions about a potential recession, there is hope that job seekers may turn to recession-resilient sectors such as traffic management. To navigate the tight labor market, companies have had to reduce the number of projects they undertake, extend project lead times, and become more competitive in their bidding strategies. Businesses with strong corporate cultures that can attract and retain talent are well-positioned to capitalize on the current situation. They can outperform their competitors by taking on projects that others cannot due to the labor shortage and delivering higher-quality work with a more stable workforce.

Opportunity: Changing Pricing Dynamics in the Traffic Management Industry

The current market climate has brought about a notable shift in pricing dynamics for traffic management service providers. In the past, these providers faced challenges in raising their prices, especially with long-term clients, as prices remained relatively stable. However, the prevailing inflationary environment has altered this landscape, allowing many providers to implement price increases successfully. The widespread experience of rising operational costs has made clients more receptive to these price adjustments. Furthermore, the critical nature of traffic management work has prompted clients to prioritize quality and reputation over lower prices, making them more willing to invest in reputable, skilled companies. It's worth noting that the total cost of traffic management typically represents a relatively small portion, approximately 2-3%, of the total project costs. Consequently, even a modest increase in traffic management costs has a minimal impact on the overall project budget.

This changing pricing dynamic can be viewed as an opportunity for the traffic management industry. Providers who can offer high-quality services and build strong reputations are well-positioned to leverage the willingness of clients to accept increased pricing. As long as the price increases are reasonable and commensurate with the value and expertise provided, this shift in client mindset can be advantageous for the growth and sustainability of traffic management businesses.

Challenge: sensors and touchpoints pose data fusion challenges

Data fusion is used to synthesize the data generated from various touchpoints and sensors. It helps reduce blind spots and complexities in measuring systems. Traffic management systems comprise many sensors, such as loop detectors, ultrasonic wave detectors, pedestrian sensors, and cameras. All these generate huge amounts of data. Synthesizing and integrating all the raw data generated from these touchpoints to gain valuable traffic information, such as speed, travel times, and congestion, is a difficult task and sometimes leads to the failure of these systems. Thus, deploying a multi-sensor data fusion technology that collates all the recorded signals to create a more informed environment for traffic control poses a major challenge.

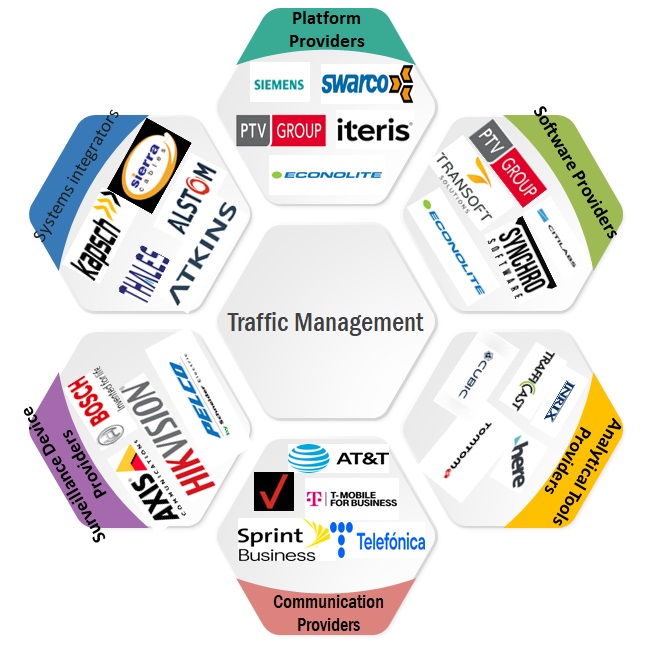

Ecosystem of Global Traffic Management Market

The traffic analytics solution to register the highest CAGR in the traffic management market during the forecast period.

Traffic analytics is a pivotal component of modern traffic management systems, providing a systematic approach to analyzing data sourced from diverse elements within a transportation network. By collecting and interpreting information from sensors, cameras, and other data-capturing devices on roadways, traffic analytics offers real-time insights into traffic patterns, behaviors, and conditions. This data-driven methodology is essential for informed decision-making by traffic management authorities. Leveraging advanced analytics techniques, traffic analytics provides a comprehensive understanding of vehicle volumes, congestion levels, and peak traffic times. This enables authorities to optimize signal timings, implement effective rerouting strategies, and formulate policies that enhance overall traffic flow and safety. Additionally, predictive traffic analytics, utilizing historical data and advanced algorithms, contributes to forecasting future traffic levels in cities. The adoption of sensors and cameras further drives the growth of traffic analytics, allowing authorities to make informed decisions based on real-time and historical data for effective road network management. In essence, the integration of traffic analytics into traffic management systems facilitates the development of intelligent transportation strategies, addressing the dynamic challenges of urban mobility.

By hardware, the surveillance camera segment is expected to hold the largest market size during the forecast.

Surveillance cameras provide real-time visual data to monitor and control vehicular movement on roadways. These cameras, strategically deployed at key points within transportation networks, capture live footage of traffic conditions and enable authorities to closely observe various aspects, including vehicle flow, congestion levels, and compliance with traffic regulations. The role of surveillance cameras in traffic management is multifaceted. Firstly, they serve as essential tools for traffic monitoring, allowing authorities to assess current conditions and respond promptly to incidents or congestion. Additionally, surveillance cameras contribute to enhancing road safety by facilitating the enforcement of traffic rules and regulations through visual evidence. The data collected by these cameras is often integrated into larger traffic analytics systems, aiding in the formulation of informed strategies for optimizing signal timings, implementing effective rerouting measures, and improving overall traffic flow. In essence, surveillance cameras are indispensable components of intelligent transportation systems, offering a visual window into traffic dynamics and supporting data-driven decision-making processes for efficient and responsive traffic management.

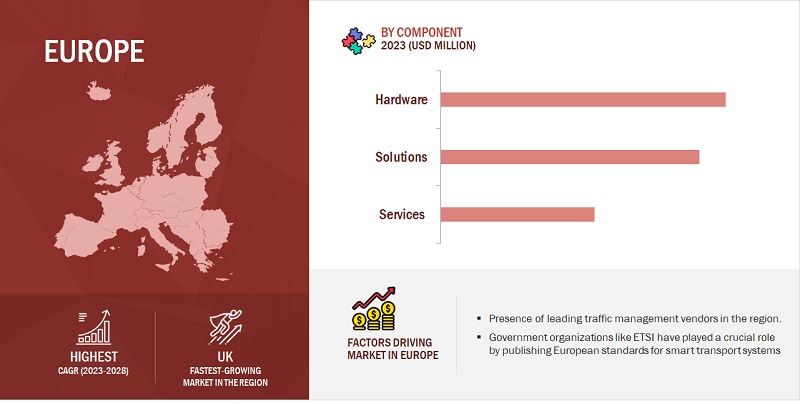

Based on region, Europe is expected to hold the largest market size during the forecast.

In Europe, businesses have diverse needs, as in North America. Enterprises in this region boast strong technical expertise and larger IT budgets. With numerous traffic management vendors, Europe stands as the largest regional market, with the UK, the most developed economy, playing a significant role in market growth. The European government's investments in improving public transportation create an ideal environment for implementing traffic management systems. The European Commission has allocated a substantial budget of USD 6,684 million for the smart, green, and integrated transport challenge, focusing on enhancing mobility, reducing congestion, and improving safety and security. Ongoing traffic management projects, including Amsterdam Smart City in the Netherlands, Vilnius Traffic Management System in Lithuania, and Athens Traffic Management System in Greece, highlight the region's commitment to efficient traffic solutions.

Market Players:

The major vendors in traffic management market include Cisco (US), Mundys SpA (Italy), SWARCO (Austria), Siemens (Germany), IBM (US), Kapsch TrafficCom (Austria), Thales Group (France), Q-Free (Norway), PTV Group (Germany), Teledyne FLIR Systems Inc. (US), Cubic Corporation (US), TOMTOM (Netherlands), Huawei (China), ST Engineering (Singapore), ChevronTM (England), Indra Sistemas (Spain), and Econolite (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the traffic management market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By component (hardware, solutions, and services), System, Areas of Application, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

The major players in the traffic management market are Cisco (US), Mundys SpA (Italy), SWARCO (Austria), Siemens (Germany), IBM (US), Kapsch TrafficCom (Austria), Thales Group (France), Q-Free (Norway), PTV Group (Germany), Teledyne FLIR Systems Inc. (US), Cubic Corporation (US), TOMTOM (Netherlands), Huawei (China), ST Engineering (Singapore), ChevronTM (England), Indra Sistemas (Spain), and Econolite (US). |

This research report categorizes the global traffic management market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component:

-

Hardware

- Display Boards

-

Sensors

- Vehicle Detection Sensors

- Pedestrian Presence Sensors

- Speed Sensors

- Other Sensors (Air Quality Sensors, Ground Sensors)

- Surveillance Cameras

- Other Hardware (Traffic Controllers, Road Radio Frequency Products)

-

Solutions

- Smart Signaling

- Route Guidance & Route Optimization

- Traffic Analytics

- Other Solutions (Smart Surveillance, Tolling Solutions)

-

Services

- Consulting

- Implementation

- Support and Maintenance

Based on System:

- Urban Traffic Management & Control System

- Adaptive Traffic Control System

- Journey Time Management System

- Dynamic Traffic Management

- Other Systems (Predictive Traffic Modelling System, Incident Detection and Location System)

Based on Areas of Application

- Urban

- Inter-Urban

- Rural

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East and Africa

-

- GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2022, HDtraffic and Siemens, signed a strategic cooperation agreement with Yutraffic Technologies to jointly develop and create systemic product-based solutions with Yutraffic and collaborated with Yutraffic on commercial projects and demonstration projects in the fields of transportation digitalization, Internet of Vehicles (IoV), and autonomous driving.

- In July 2022, TomTom partnered with the Dutch Ministry of Infrastructure and Water Management to increase road safety. Through three-year-long cooperation with the Dutch Ministry and ANWB, Be-Mobile, Inrix, Hyundai, and Kia, Dutch drivers rely on TomTom traffic services.

- In April 2021, Q-Free and the Georgia transport department signed a 10-year agreement where Q-Free will provide central traffic management software, Intelight MAXTIME, an intersection control software, and all associated intersection traffic controller hardware services throughout the state. This deal completely upgrades the State’s current central traffic signal management system to Kinetic Signals.

- In February 2021, Huawei and Tumeng Technology partnered to release a joint solution for holographic intersections. This would strengthen the urban traffic movement in the Suzhou research center.

Frequently Asked Questions (FAQ):

What is traffic management?

Traffic management refers to the systematic planning, monitoring, and control of vehicular and pedestrian movement on roads and transportation networks to ensure efficient and safe flow of traffic. It encompasses a range of strategies, technologies, and measures aimed at optimizing the use of transportation infrastructure, minimizing congestion, enhancing road safety, and improving overall mobility.

What is the market size of the traffic management market?

The traffic management market size is projected to grow from USD 42.3 billion in 2023 to USD 72.5 billion by 2028 at a CAGR of 11.4% during the forecast period.

What are the major drivers in the traffic management market?

The major drivers in the traffic management market include connected cars and data revolutionizing traffic management systems, rising demand for real-time traffic information to drivers and passengers, an increasing urban population, a rising number of vehicles, and inadequate infrastructure. These factors have led to a rising demand for traffic management hardware, solutions, and services.

Who are the key players operating in the traffic management market?

The key vendors operating in the traffic management market include Cisco (US), Mundys SpA (Italy), SWARCO (Austria), Siemens (Germany), IBM (US), Kapsch TrafficCom (Austria), Thales Group (France), Q-Free (Norway), PTV Group (Germany), Teledyne FLIR Systems Inc. (US), Cubic Corporation (US), TOMTOM (Netherlands), Huawei (China), ST Engineering (Singapore), ChevronTM (England), Indra Sistemas (Spain), and Econolite (US).

What are the opportunities for new market entrants in the traffic management market?

New entrants entering the traffic management market can seize opportunities by leveraging the rising demand for cutting-edge solutions amid urbanization and increased traffic congestion. Smart city initiatives create a favorable environment for innovative technologies like real-time analytics and Intelligent Transportation Systems. Exploring areas such as adaptive signal control and safety-enhancing solutions, along with forming strategic collaborations, positions new entrants to make a meaningful impact in this dynamic market. By active ingredient, the Amino acids segment dominated the market for biostimulants and was valued the largest at USD 1. 4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

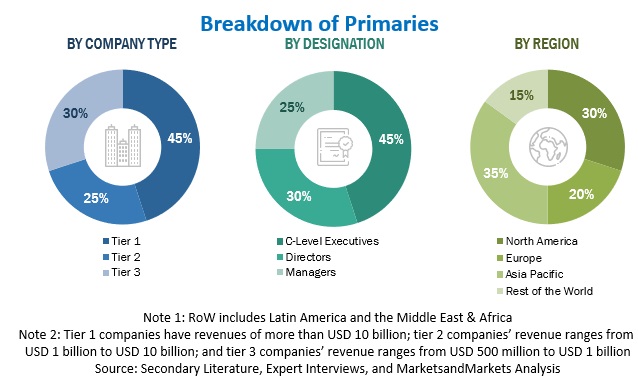

The research study involved four major activities in estimating the traffic management market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations, such as the International Road Federation (IRF), International Traffic Safety Data and Analysis Group (IRTAD), The World Road Association (PIARC), the American Traffic Safety Services Association (ATSSA), and the Traffic Management Association of Australia (TMAA) were also referred to. Secondary research was mainly done to obtain essential information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various sources from both the supply and demand sides were interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the traffic management market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

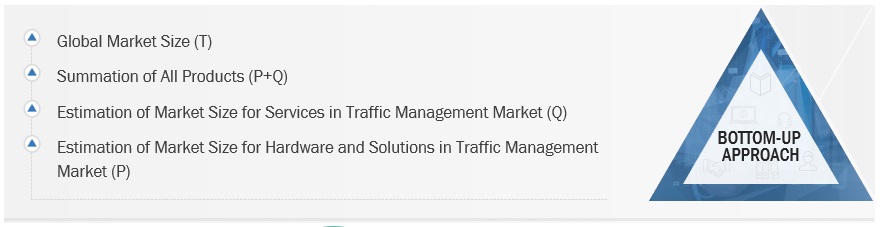

Market Size Estimation

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the traffic management market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Further, major developments in the key market area have been considered.

- Analyzing major original equipment manufacturers (OEMs), studying their product portfolios, and understanding different applications of their solutions.

- Analyzing the trends related to adopting different types of authentications and brand protection equipment.

- Tracking the recent and upcoming developments in the traffic management market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters.

- Conduct multiple discussions with key opinion leaders to know about different types of authentications and brand protection offerings used and the applications for which they are used to analyze the breakup of the scope of work carried out by major companies.

- Segmenting the market based on technology types concerning applications wherein the types are to be used and deriving the size of the global application market.

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The traffic management market has been split into several segments and sub-segments after arriving at the overall market size from the estimation process explained above. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The traffic management market size has been validated using top-down and bottom-up approaches.

Market Definition

According to PIARC (World Road Association), traffic management refers to the combination of measures that serve to preserve traffic capacity and improve the security, safety, and reliability of the overall road transport system. These measures use intelligent transportation systems (ITS), services, and projects in day-to-day operations that impact road network performance.

Stakeholders

- Original Equipment Manufacturers (OEMs)

- Internet of Things (IoT) Technology Vendors

- Technology Vendors

- Managed Service Providers (MSPs)

- Networking and Communications Service Providers (CSPs)

- Consulting and Advisory Firms

- Regional Department of Public Transport Authorities

- Governments and Urban Planning Agencies

- Regional Associations

- Investors and Venture Capitalists

- Independent Software Vendors

- Value-Added Resellers (VARs) and Distributors

Report Objectives

- To determine and forecast the global traffic management market by component (hardware, solutions, and services), system, areas of application, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments concerning five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East & African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Traffic Management Market

Interested in LiDAR (Lighting Detection And Ranging) in the traffic

Understanding the market segments of Traffic Management Market

Intersted in Traffic management market

Interseted in Traffic management market

Interested in sensor technology in traffic management market

Interested in traffic management market in south africa

Understanding the market size and growth in traffic management system and itelligent transport systems.

Interseted in Traffic management market

Interested in Trafiic control market

Interested in Traffic management market in south africa

Understanding the market segments of Traffic Management Market

Interested in Traffic Management Market

Understanding the close-loop traffic light control system market

Understanding the market segments of Traffic Management Market

Market prediction and future scope of traffic management system

Segments and players in the solution segments

Interested in Traffic management market in south africa

Interested in Traffic management market in south africa

Interested in data on toll management solutions

Interseted in Traffic management market

Interested in Traffic Survey Market

Interested in market size and forecast of traffic management market