Ultrasound Probe Covers Market by Type (Disposable, Reusable), Material (Latex, Latex-free), Application (Endocavitary), End User (Hospitals, Diagnostic Imaging Centers, Maternity Centers, Ambulatory Surgical Centers) & Region - Global Forecast to 2027

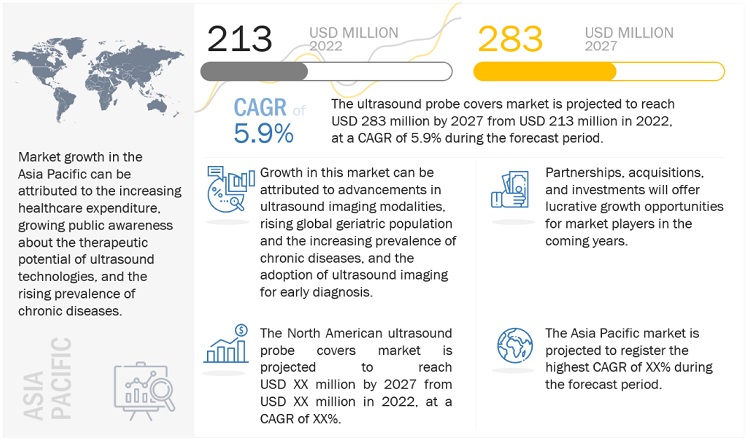

The global ultrasound probe covers market in terms of revenue was estimated to be worth $213 million in 2022 and is poised to reach $283 million in 2027, growing at a CAGR of 5.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The incidence of hospital-acquired infections due to improper probe reprocessing has been drastically increasing in the recent past. This has led to an emerging awareness about infection control, especially with regards to ultrasound probes, which is one of the major drivers of the global market. Simultaneously, the rising prevalence of chronic diseases also leads to more ultrasound imaging procedures being performed, which in turn increases the market for ultrasound probe covers.

Ultrasound Probe Covers Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Ultrasound Probe Covers Market Dynamics

Driver: Advancements in ultrasound imaging modalities

The availability of instant diagnostic data has helped reduce overall healthcare costs by replacing more expensive diagnostic exams. This has led to a wide range of ultrasound imaging procedures, most of which require ultrasound probe covers for infection prevention. In the past decade, the medical devices sector has witnessed significant transformations and technological advancements in ultrasound imaging, including the emergence of portable, handheld, and smartphone-based ultrasound imaging devices and the evolution of ultrasound probes and transducers. The advancing technologies in ultrasound imaging and probes, and subsequently the growing application of ultrasound imaging in various modalities, will also lead to an increased use of ultrasound probe covers for the control of potential infections through ultrasound probes.

Restraint: Lack of awareness about probe reprocessing and infection control

According to the Joint Commission's survey, hospital-acquired infections caused by blood-borne pathogens or bacterial agents in patients are increasing due to a lack of knowledge among healthcare providers about probe reprocessing and infection control. Non-compliance with evidence-based guidelines and manufacturers' instructions for use (IFU) has resulted in an increased risk of infections and outbreaks. This lack of awareness and knowledge about infection control is one of the major factors restraining market growth in the forecast period.

Opportunity: High growth opportunities in emerging countries

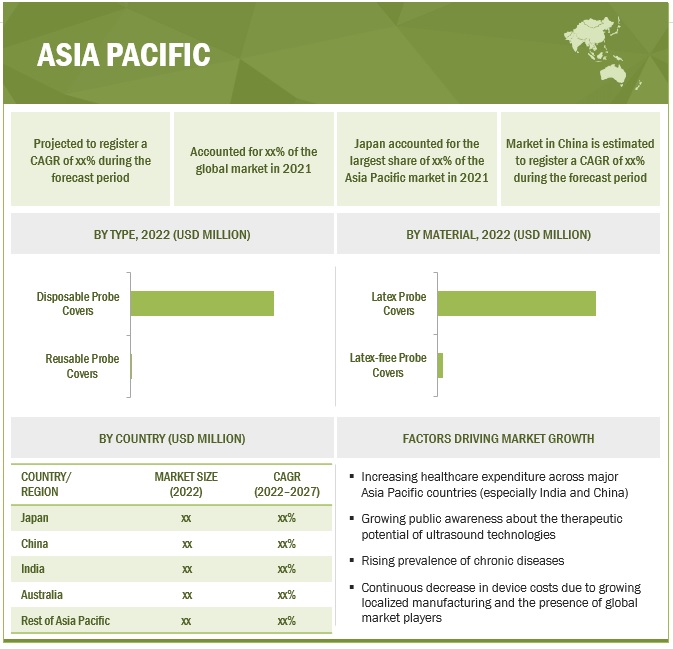

Diversified healthcare markets in the APAC region, rising infectious and chronic disease incidence, and increased R&D initiatives to raise awareness about safe practises in medicine and healthcare are just a few of the reasons why China, India, and other emerging economies offer significant growth opportunities for ultrasound probe covers companies.

In addition, infrastructural developments in healthcare facilities, increasing healthcare expenditure, and the low-cost manufacturing advantage offered by emerging countries in the Asia Pacific are expected to encourage market players to invest in this region in the coming years.

Challenge: Lack of trained professionals

There are a number of inherent risks arising from sonographers' practice, including misdiagnosis and misuse of ultrasound equipment, as well as the risks associated with carrying out intimate examinations. Worldwide, there is a stark shortage of skilled healthcare workers, including sonographers. This has a direct impact on the usage of ultrasound machines and probes, which includes following their proper disinfection protocol. This will hamper the adoption of ultrasound probe covers.

Among end users, maternity centers occupied the second-largest share of the ultrasound probe covers industry.

After hospitals and diagnostic imaging centers, maternity centers occupied the largest share of the ultrasound probe covers market. The continuous rise in prenatal testing across major markets and the increasing number of awareness programs to sensitise healthcare professionals about the infections transmitted through endocavitary probes to the mother and foetus are expected to drive the market for ultrasound probe covers.

The United States had the world's largest region for the ultrasound probe covers industry.

In 2021, the US occupied the largest share in North America and globally, in the global ultrasound probe covers market. This can mainly be attributed to the growing availability of medical reimbursements for ultrasound procedures, and the growing number of diagnostic centers and hospitals in the country. Along with this, increasing awareness of infection control and ultrasound disinfection is also expected to support market growth during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Among the key emerging players in the ultrasound probe covers market are CIVCO Medical Solutions (US), Ecolab, Inc. (US), GE Healthcare (US), CS Medical LLC (US), Parker Laboratories, Inc. (US), Sheathing Technologies, Inc. (US), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Advance Medical Designs, Inc. (US), Nanosonics Ltd. (Australia), and Aspen Surgical (US).

These companies adopted strategies such as partnerships, acquisitions, and investments to strengthen their presence, globally.

Scope of the Ultrasound Probe Covers Industry:

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$213 million |

|

Estimated Value by 2027 |

$283 million |

|

Revenue Rate |

Poised to grow at a CAGR of 5.9% |

|

Market Driver |

Advancements in ultrasound imaging modalities |

|

Market Opportunity |

High growth opportunities in emerging countries |

The research report categorizes the ultrasound probe covers market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Disposable probe covers

- Reusable probe covers

By Material

- Latex Probe Covers

- Latex-free probe covers

By Application

- Endocavitary probe covers

- External cavitary probe covers

By End User

- Hospitals and Diagnostic Imaging Centers

- Maternity Centers

- Ambulatory Care Centers

- Research and Academic Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of Ultrasound Probe Covers Industry

- In April 2022, Audax Private Equity (US) invested in Aspen Surgical (US), which will allow Audax to continue to support Aspen as it pursues imminent organic growth and larger-scale acquisition opportunities to expand globally.

- In December 2021, GE Healthcare (US) acquired BK Medical (US) to add the field of real-time surgical visualization to its pre- and post-operative ultrasound capabilities

- In March 2021, Aspen Surgical (US) acquired BlueMed Medical Supplies (Canada) to strengthen its broad portfolio of surgical disposables and patient and staff safety products

- In February 2021, CS Medical LLC (US) renewed its partnership with Association for Professionals in Infection Control and Epidemiology (APIC, US) for the prevention of healthcare-associated infections (HAIs).

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global ultrasound probe covers market?

The global ultrasound probe covers market boasts a total revenue value of $283 million in 2027.

What is the estimated growth rate (CAGR) of the global ultrasound probe covers market?

The global ultrasound probe covers market has an estimated compound annual growth rate (CAGR) of 5.9% and a revenue size in the region of $213 million in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

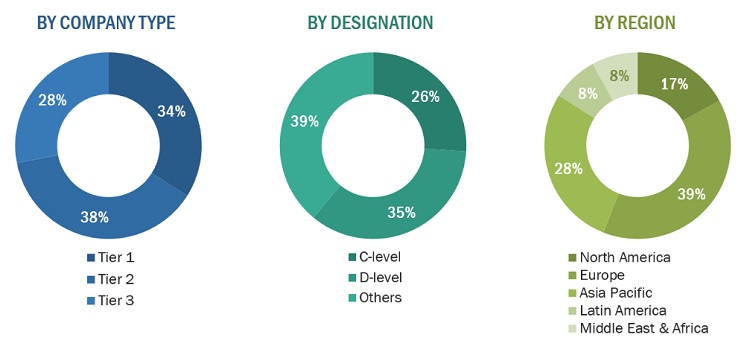

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the ultrasound probe covers market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the global market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the ultrasound probe covers market is provided below:

Tiers are defined based on a company’s total revenue. As of 2021: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the ultrasound probe covers market was arrived at after data triangulation as mentioned below.

Approach to calculating the revenue of different players in the global market

The size of the global ultrasound probe covers market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the ultrasound probe covers market by application, type, end user, material, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the global market with respect to five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players in the global market as well as comprehensively analyze their core competencies

- To track and analyze competitive developments such as investments, partnerships, and acquisitions of the leading players in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific market into New Zealand, South Korea, Malaysia, Singapore, Indonesia, and other countries

- Further breakdown of the Rest of Europe market into Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Rest of Latin America market into Argentina, Peru, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ultrasound Probe Covers Market