Ultrasound Probe Disinfection Market by Product (Instrument, Services, Consumables (Disinfectants & Detergents)), Probe Type (Linear, Convex, & TEE Transducers),Process (High-Level & Low-Level Disinfection), End User (Hospitals) - Global Forecast to 2027

Updated on : March 17, 2023

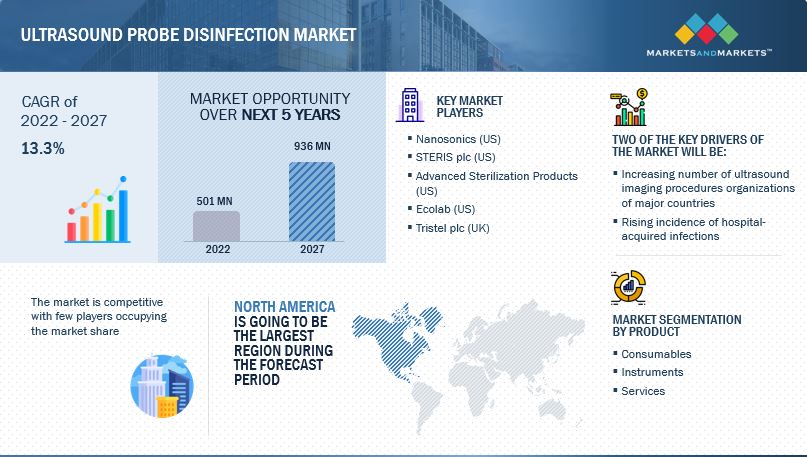

The global ultrasound probe disinfection market in terms of revenue was estimated to be worth $501 million in 2022 and is poised to reach $936 million by 2027, growing at a CAGR of 13.3% from 2022 to 2027. The updated version of the report covers the historical market for the ultrasound probe disinfection market for the years 2020 and 2021, the estimated market for 2022, and the forecast for 2027, along with the CAGR from 2022 to 2027. The market's growth is largely driven by increasing awareness regarding high-level disinfection of semi-critical probes and growing demand for low-cost ultrasonography procedures. Infectious diseases acquired due to improper reprocessing of ultrasound probes demand high-level disinfection of endocavitary probes after use or during surgery. Many leading players are focusing on enhancing their installed bases of automated high-level disinfection systems across the globe. The high degree of compliance with high-level disinfection guidelines in developed markets is a major factor driving the adoption of automated high-level disinfection systems for critical and semi-critical ultrasound probes.

To know about the assumptions considered for the study, Request for Free Sample Report

Ultrasound Probe Disinfection Market Dynamics

Driver: Increasing number of ultrasound imaging procedures

Advancements in diagnostic ultrasound imaging procedures have helped improve diagnosis by offering urgent clinical information. The ease of use of rapid diagnostic data has consequently helped decrease overall healthcare costs by changing more expensive diagnostic exams. A wide variety of ultrasound imaging procedures offers important growth opportunities for the growth of the ultrasound probe disinfection market. Also, the increasing geriatric population across the globe is another major factor resulting in the increasing volume of ultrasound imaging procedures performed. Since the elderly (65 years and above) are more prone to hospital-acquired infections and chronic diseases, such as cardiovascular diseases (CVD) and various cancers, the requirement for disease diagnosis and therapies is expected to rise steadily. According to Diagnostic Imaging Dataset Statistical Release, the number of ultrasound imaging procedures performed in NHS patients increased from 9,446,855 in 2021 to 9,927,335 in 2022.

Restraint: High cost of automated prbe reprocessors

Due to the high price, majority hospitals in developing countries cannot provide automated probe reprocessors for high-level disinfection (HLD). The cost of UV-C disinfector is around USD 15,000 to USD 35,000 and average cost of automated reprocessors is near USD 10,000-USD 15,000. The usage of automated reprocessors and consumables including wipes and liquids are not in use at a higher scale because of the extreme price in developing countries. In developing countries, radiologists are of the belief that the usage of these consumables adds to the price of imaging centers, and hence they prefer using lower alternatives like probe covers. Shortage of strict regulations for the minimal awareness of infections caused by infected probes among radiologists and patients and use of disinfectants before procedures are also limiting the adoption of correct disinfection process in developed countries including China, Brazil, Mexico and India. Maintenance and additional cost of storage cabinets is other factor restraining the implementation of automated probe reprocessors among end users with restricted budgets.

Opportunity: Increasing birth rates/ number of pregnancies

The increasing number of childbirths and pregnancies across the world is expected to enhance the implementation of ultrasound technology for OB/GYN imaging and neonatal care. As per the American College of Obstetricians and Gynecologists (ACOG), the demand for obstetrics and gynecology professionals is expected to increase from 50,850 to 52,660 (4%) by 2030.According to the WHO, an estimated 15 million babies are born prematurely every year. India and China, in particular, witnessed a considerable increase in the number of childbirths. According to the March of Dimes 2022 Report Card, the preterm birth rate in the US increased to 10.5% in 2021, which is a significant 4% increase in just one year and the highest recorded rate since 2007. The WHO estimates that preterm birth rates range from 5% to 18% of the total number of births across 184 countries. More than 60% of preterm births occur in Africa and South Asia. In the UK, around 60,000 babies are born each year prematurely. In 2019, preterm births affected 1 in every 10 infants born in the US (Source: CDC).Additionally, increasing number of births (pregnancies) and newer applications of ultrasound in obstetrics (such as detection of pulsations in different fetal blood vessels and fetal cardiac pulsations) are projected to provider significant development opportunities for ultrasound probe disinfection product manufacturers across the globe.

Challenge: Dearth of knowledge about probe reprocessing

Disinfection of ultrasound probes is a crucial stage in reprocessing, as the usage of infected probes can lead to fatal patient diseases or instrument failures. According to the Joint Commission’s survey report, hospital-acquired infections (HAIs) caused due to bacterial agents or blood-borne pathogens in patients are rising due to a lack of experience among healthcare providers about probe reprocessing. High-level disinfection (HLD) after every usage and reprocessing of ultrasound probe is a complicated job, requires trained personnel. Hence, many hospitals hire certified sterile processing team. Written and up-to-date guidelines and procedures must be presented on site for training/checking the staff accountable for device reprocessing. Dearth of knowledge in probe reprocessing and minimal awareness about the significance of thorough cleaning of all transducers affects market growth.

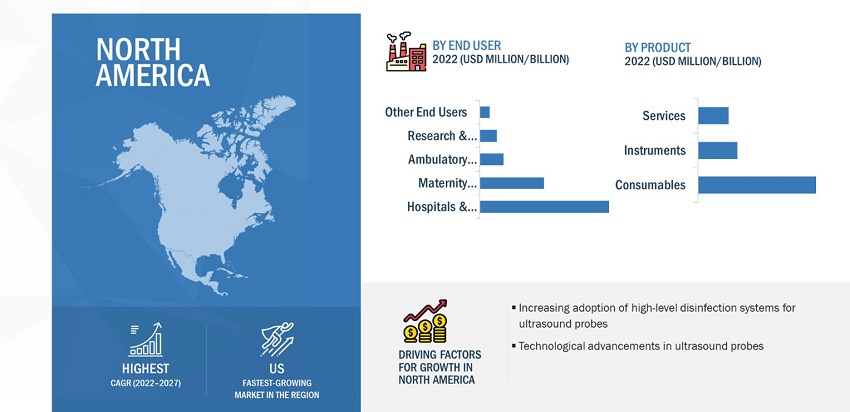

North America is projected to contribute the largest share of the ultrasound probe disinfection market in 2022

On the basis of region, the ultrasound probe disinfection market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. In 2022, North America projected to lead market share of the ultrasound probe disinfection market. This can be attributed to the increasing incidence of hospital-acquired infections (HAIs) and the growing volume of ultrasound imaging procedures performed in the region.

By type of probe, the linear transducers segment is projected to lead the market of the Ultrasound Probe Disinfection Market in 2022

By type of probe/transducer, the ultrasound probe disinfection market is divided into phased array transducers, convex transducers, linear transducers,endocavitary transducers, transesophageal echocardiography (TEE) transducers, and other transducers. In 2022,the linear transducers segment is projected to lead the market of the global ultrasound probe disinfection market. This is due to the higher adoption of linear probes in vascular examinations, breast and thyroid imaging, and intraoperative and laparoscopy procedures.

The hospitals & diagnostic imaging centers segment, is projected to grow at a highest CAGR during the forecast period, by end user

By end user, the ultrasound probe disinfection market is divided into, maternity centers, hospitals & diagnostic imaging centers, ambulatory care centers, research & academic institutes, and other end users. During 2022-2027, the hospitals & diagnostic imaging centers segment is projected to grow at a highest CAGR Growing requirement for the high-level disinfection (HLD) of semi-critical and critical ultrasound probes due to the risk of HAIs and rising number of ultrasound imaging procedures are driving the growth of this segment.

Major players in this market in the ultrasound probe disinfection market include Nanosonics (Australia), Tristel plc (UK), STERIS plc (US), Ecolab (US), Advanced Sterilization Products (US), Metrex Research, LLC. (US), CIVCO Medical Solutions (US), CS Medical LLC (US), Virox (Canada), Germitec (France), Schülke & Mayr GmbH (Germany), Parker Laboratories, Inc. (US).

Ultrasound Probe Disinfection Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$501 million |

|

Estimated Value by 2027 |

$936 million |

|

Growth Rate |

Poised to grow at a CAGR of 13.3% |

|

Market Driver |

Increasing number of ultrasound imaging procedures |

|

Market Opportunity |

Increasing birth rates/ number of pregnancies |

|

Segments covered |

By Product type, process, type of probe and end user |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa |

The study categorizes the Ultrasound Probe Disinfection Market to forecast revenue and analyze trends in each of the following submarkets

By Product Type

-

Instruments

- Automated Reprocessors

- Manual Reprocessors/ Soaking Stations

- Ultrasound Transducer Storage Cabinets

-

Consumables

-

Disinfectants

-

By Formulation

- Disinfectant Wipes

- Disinfectant Liquid

- Disinfectant Sprays

-

By Type

- High-Level Disinfectants

- Low-Level Disinfectants

-

By Formulation

-

Detergents

- Enzymatic

- Non-Enzymatic

-

Disinfectants

- Services

By process

- High-Level Disinfection

- Low-Level Disinfection

By Type of Probe

- Linear Transducers

- Convex Transducers

- Phased Array Transducers

- Endocavitary Transducers

- TEE Transducers

- Other Transducers

By End User

- Hospitals & Diagnostic Imaging Centers

- Ambulatory Care centers

- Maternity Centers

- Academic & Research Institutes

- Others

By Mode of Purchase

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments

- In September 2022, Tristel Plc collaborated with Parker Laboratories. Under this collaboration, Parker will manufacture and distribute Tristel DUO, a disinfecting foam approved for the cleaning and disinfection of general medical surfaces, including ultrasound transducers, in the US markets.

- In March 2021, Metrex Research, LLC announced a strategic partnership with the Association for Professionals in Infection Control and Epidemiology (APIC) to reduce the risk of infection.

- In June 2021, STERIS plc. acquired Cantel Medical Corporation, a leading player in the infection control market for endoscopy, dental, dialysis, and life sciences services. This acquisition increased the share of STERIS in the infection control and ultrasound probe disinfection markets.

- In February 2020, GAMA Healthcare Ltd. partnered with Cardiff University. The partnership helped GAMA Healthcare in the R&D of innovative disinfection solutions. GAMA Healthcare provided funding of USD 687,827.50 (GBP 500,000) to the University for procuring innovative solutions.

Frequently Asked Questions (FAQs):

What is the projected market value of the global Ultrasound Probe Disinfection Market?

The global market of Ultrasound Probe Disinfection is projected to reach USD 936 million.

What is the estimated growth rate (CAGR) of the global Ultrasound Probe Disinfection Market for the next five years?

The global Ultrasound Probe Disinfection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of CAGR of 13.3% from 2022 to 2027.

What are the major revenue pockets in the Ultrasound Probe Disinfection Market currently?

The new edition of the report provides updated financial information in the context of the ultrasound probe disinfection market until 2022 for each listed company in a graphical representation in a single diagram (instead of multiple tables). This will easily help analyze the present status of profiled companies in terms of their financial strength, key revenue-generating country/region, business segment focus in terms of the highest revenue-generating segment, and investments in R&D activities.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.3.1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 7 REVENUE ANALYSIS OF THE TOP FIVE COMPANIES: ULTRASOUND PROBE DISINFECTION MARKET (2020)

FIGURE 8 DEMAND-SIDE ANALYSIS: INSTRUMENTS MARKET

FIGURE 9 DEMAND-SIDE ANALYSIS: CONSUMABLES MARKET

FIGURE 10 DEMAND-SIDE ANALYSIS: TOTAL GLOBAL MARKET

FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 12 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MARKET (2021–2026)

FIGURE 13 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 14 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: GLOBAL MARKET

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 59)

FIGURE 15 ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 16 GLOBAL MARKET, BY PROCESS, 2021 VS. 2026 (USD MILLION)

FIGURE 17 GLOBAL MARKET, BY TYPE OF PROBE, 2021 VS. 2026 (USD MILLION)

FIGURE 18 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 19 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 20 RISING INCIDENCE OF HOSPITAL-ACQUIRED INFECTIONS IS DRIVING MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY TYPE OF PROBE AND COUNTRY

FIGURE 21 LINEAR TRANSDUCERS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 22 CHINA & INDIA TO WITNESS THE HIGHEST GROWTH IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.4 GLOBAL MARKET: DEVELOPED VS DEVELOPING MARKETS

5 MARKET OVERVIEW (Page No. - 67)

5.1 MARKET DYNAMICS

FIGURE 23 ULTRASOUND PROBE DISINFECTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 MARKET DRIVERS

5.1.1.1 Increasing number of ultrasound imaging procedures

5.1.1.2 Rising incidence of hospital-acquired infections due to the improper reprocessing of ultrasound probes

TABLE 2 CERVICAL CANCER DATA, BY REGION, 2020-2050 (THOUSAND)

5.1.1.3 Increasing adoption of automated high-level disinfection systems for critical and semi-critical ultrasound probes

5.1.1.4 Government regulations and guidelines in developed markets

5.1.1.5 Technological advancements in ultrasound probes

TABLE 3 DRIVERS: IMPACT ANALYSIS

5.1.2 MARKET RESTRAINTS

5.1.2.1 High cost of automated probe reprocessors

5.1.2.2 Reluctance to shift from manual disinfection methods to automated probe reprocessors

TABLE 4 RESTRAINTS: IMPACT ANALYSIS

5.1.3 MARKET OPPORTUNITIES

5.1.3.1 Increasing birth rates/number of pregnancies

5.1.3.2 High growth opportunities in emerging countries

TABLE 5 RISING INCOME LEVELS IN EMERGING COUNTRIES

TABLE 6 OPPORTUNITIES: IMPACT ANALYSIS

5.1.4 MARKET CHALLENGES

5.1.4.1 Lack of knowledge about probe reprocessing

5.1.4.2 Inadequate cleaning and disinfection of probes

TABLE 7 CHALLENGES: IMPACT ANALYSIS

5.2 INDUSTRY TRENDS

5.2.1 UPGRADATION IN TECHNOLOGY FOR THE DISINFECTION OF ULTRASOUND TRANSDUCERS

TABLE 8 UV-C VS. HIGH-LEVEL DISINFECTION TECHNOLOGIES

5.2.2 INCREASING NUMBER OF PARTNERSHIPS, ACQUISITIONS, AND AGREEMENTS IN THE MARKET

TABLE 9 RECENT PARTNERSHIPS, ACQUISITIONS, AND AGREEMENTS FOR THE DEVELOPMENT AND EXPANSION OF ULTRASOUND PROBE DISINFECTION PRODUCTS

5.3 PRICING ANALYSIS

TABLE 10 COMPARATIVE PRICING ANALYSIS OF ASTRA VR AND TROPHON

5.4 VALUE CHAIN ANALYSIS

FIGURE 24 GLOBAL MARKET: VALUE CHAIN ANALYSIS

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 25 GLOBAL MARKET: SUPPLY CHAIN ANALYSIS

5.6 ECOSYSTEM MARKET MAP

FIGURE 26 GLOBAL MARKET: ECOSYSTEM MARKET MAP

5.7 PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 REGULATORY ANALYSIS

TABLE 11 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING MEDICAL DEVICES

TABLE 12 STRINGENCY OF REGULATIONS FOR ULTRASOUND PROBE DISINFECTION PRODUCTS, BY COUNTRY

5.8.1 NORTH AMERICA

5.8.1.1 US

FIGURE 27 US PREMARKET NOTIFICATION: 510(K) APPROVAL FOR MEDICAL DEVICES

5.8.1.2 Canada

FIGURE 28 CANADA: APPROVAL PROCESS FOR CLASS II MEDICAL DEVICES

5.8.2 EUROPE

FIGURE 29 EUROPE: CE MARK APPROVAL PROCESS FOR ULTRASOUND PROBE DISINFECTION PRODUCTS

5.8.3 APAC

5.8.3.1 Australia

5.8.3.2 Japan

5.8.3.3 China

5.8.3.4 India

5.9 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.10 PATENT ANALYSIS

5.10.1 PATENT PUBLICATION TRENDS FOR ULTRASOUND PROBE DISINFECTION

FIGURE 30 PATENT PUBLICATION TRENDS (JANUARY 2011–JULY 2021)

5.10.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 31 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTES) FOR ULTRASOUND PROBE DISINFECTION PATENTS (JANUARY 2011–JUNE 2021)

FIGURE 32 TOP APPLICANT COUNTRIES/REGIONS FOR ULTRASOUND PROBE DISINFECTION PATENTS (JANUARY 2011–JUNE 2021)

5.11 TECHNOLOGY ANALYSIS

TABLE 13 SPAULDING CLASSIFICATION OF MEDICAL DEVICES BASED ON THE LEVEL OF PATIENT CONTACT

5.11.1 KEY TECHNOLOGIES

5.11.1.1 Manual disinfection

5.11.1.2 Automated disinfection

5.11.2 COMPLEMENTARY TECHNOLOGIES

5.11.2.1 Reporting compliance and traceability

5.11.2.2 Staff and patient safety

5.11.2.3 Post disinfection storage

5.11.3 ADJACENT TECHNOLOGIES

5.11.3.1 UV-C HLD

6 ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT (Page No. - 94)

6.1 INTRODUCTION

TABLE 14 GLOBAL MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 IMPACT OF COVID-19 ON ULTRASOUND PROBE DISINFECTION PRODUCTS

6.3 CONSUMABLES

FIGURE 33 DISINFECTANTS SEGMENT TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 15 ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 16 ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.1 DISINFECTANTS

6.3.1.1 Disinfectants, by formulation

TABLE 17 ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 18 ULTRASOUND PROBE DISINFECTANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.1.1.1 Disinfectant wipes

6.3.1.1.1.1 Ease of use for the disinfection of ultrasound transducers to support market growth

TABLE 19 KEY ULTRASOUND PROBE DISINFECTANT WIPES AVAILABLE IN THE MARKET

TABLE 20 DISINFECTANT WIPES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.1.1.2 Disinfectant liquids

6.3.1.1.2.1 Low cost of liquid disinfectants is a key factor driving their adoption in the market

TABLE 21 KEY ULTRASOUND PROBE DISINFECTANT LIQUIDS AVAILABLE IN THE MARKET

TABLE 22 DISINFECTANT LIQUIDS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.1.1.3 Disinfectant sprays

6.3.1.1.3.1 The use of sprays for disinfecting ultrasound probes has increased due to COVID-19

TABLE 23 KEY ULTRASOUND PROBE DISINFECTANT SPRAYS AVAILABLE IN THE MARKET

TABLE 24 DISINFECTANT SPRAYS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.1.2 Disinfectants, by type

TABLE 25 ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 26 ULTRASOUND PROBE DISINFECTANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.1.2.1 High-level disinfectants

6.3.1.2.1.1 Increasing prevalence of healthcare-acquired infections has increased the demand for high-level disinfectants

TABLE 27 KEY HIGH-LEVEL DISINFECTANTS AVAILABLE IN THE MARKET

TABLE 28 HIGH-LEVEL DISINFECTANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.1.2.2 Intermediate/low-level disinfectants

6.3.1.2.2.1 Widespread application of low-level disinfectants to aid market growth

TABLE 29 KEY LOW-LEVEL DISINFECTANTS AVAILABLE IN THE MARKET

TABLE 30 LOW-LEVEL DISINFECTANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.2 DETERGENTS

TABLE 31 MAJOR ULTRASOUND PROBE DISINFECTION DETERGENTS AVAILABLE IN THE MARKET

TABLE 32 ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 33 ULTRASOUND PROBE DETERGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.2.1 Enzymatic detergents

6.3.2.1.1 These detergents offer quick and effective cleaning and on-site disinfection

TABLE 34 ENZYMATIC DETERGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3.2.2 Non-enzymatic detergents

6.3.2.2.1 Non-enzymatic detergents offer high detergency

TABLE 35 NON-ENZYMATIC DETERGENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.4 INSTRUMENTS

TABLE 36 COMPARATIVE PARAMETERS BETWEEN ULTRASOUND PROBE DISINFECTION SYSTEMS

FIGURE 34 AUTOMATED PROBE REPROCESSORS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 37 ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.4.1 AUTOMATED PROBE REPROCESSORS

6.4.1.1 Growing demand for automated disinfection of ultrasound probes to drive market growth

TABLE 39 AUTOMATED REPROCESSORS OFFERED BY KEY PLAYERS

TABLE 40 AUTOMATED PROBE REPROCESSORS MARKET, BY REGION, 2019–2026 (UNITS)

TABLE 41 AUTOMATED PROBE REPROCESSORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.4.2 ULTRASOUND TRANSDUCER STORAGE CABINETS

6.4.2.1 These storage cabinets are majorly used for the post-disinfection storage of ultrasound probes

TABLE 42 MAJOR ULTRASOUND TRANSDUCER STORAGE CABINETS OFFERED BY KEY PLAYERS

TABLE 43 ULTRASOUND TRANSDUCER STORAGE CABINETS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.4.3 MANUAL REPROCESSORS/SOAKING STATIONS

6.4.3.1 Increased adoption of manual reprocessors in developing countries to support market growth

TABLE 44 MANUAL REPROCESSORS/SOAKING STATIONS OFFERED BY KEY PLAYERS

TABLE 45 MANUAL REPROCESSORS/SOAKING STATIONS MARKET, BY COUNTRY, 2019–2026 (USD THOUSAND)

6.5 SERVICES

6.5.1 SERVICES ENSURE ALL DISINFECTION INSTRUMENTS ARE SAFE TO USE

TABLE 46 ULTRASOUND PROBE DISINFECTION SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7 ULTRASOUND PROBE DISINFECTION MARKET, BY PROCESS (Page No. - 124)

7.1 INTRODUCTION

TABLE 47 CLASSIFICATION OF THE ULTRASOUND PROBE DISINFECTION PROCESS

TABLE 48 GLOBAL MARKET, BY PROCESS, 2019–2026 (USD MILLION)

7.2 HIGH-LEVEL DISINFECTION

7.2.1 INCREASING INCIDENCE OF HAIS TO DRIVE MARKET GROWTH

TABLE 49 HIGH-LEVEL DISINFECTANTS OFFERED BY KEY PLAYERS

TABLE 50 HIGH-LEVEL DISINFECTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 INTERMEDIATE/LOW-LEVEL DISINFECTION

7.3.1 THESE DISINFECTANTS ARE USED COMMONLY IN IMAGING CENTERS & MATERNITY CENTERS

TABLE 51 LOW-LEVEL DISINFECTANTS OFFERED BY KEY PLAYERS

TABLE 52 INTERMEDIATE/LOW-LEVEL DISINFECTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 ULTRASOUND PROBE DISINFECTION MARKET, BY TYPE OF PROBE (Page No. - 129)

8.1 INTRODUCTION

TABLE 53 GLOBAL MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

8.2 LINEAR TRANSDUCERS

8.2.1 LINEAR TRANSDUCERS ARE DISINFECTED USING INTERMEDIATE/LOW-LEVEL DISINFECTION TECHNIQUES

TABLE 54 DISINFECTANTS FOR LINEAR TRANSDUCERS OFFERED BY KEY PLAYERS

TABLE 55 LINEAR ULTRASOUND TRANSDUCERS DISINFECTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 CONVEX TRANSDUCERS

8.3.1 CONVEX ULTRASOUND TRANSDUCERS ARE USED FOR DEEP STRUCTURES

TABLE 56 DISINFECTANTS FOR CONVEX TRANSDUCERS OFFERED BY KEY PLAYERS

TABLE 57 CONVEX ULTRASOUND TRANSDUCERS DISINFECTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 PHASED ARRAY TRANSDUCERS

8.4.1 INCREASING NUMBER OF ECHOCARDIOGRAPHY AND ABDOMINAL ULTRASOUND PROCEDURES TO DRIVE MARKET GROWTH

TABLE 58 DISINFECTANTS FOR PHASED ARRAY TRANSDUCERS OFFERED BY KEY PLAYERS

TABLE 59 PHASED ARRAY ULTRASOUND TRANSDUCERS DISINFECTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 ENDOCAVITARY TRANSDUCERS

8.5.1 ENDOCAVITARY PROBES ARE KNOWN TO BE A CONCERN IN ULTRASOUND DEPARTMENTS DUE TO THEIR RISK OF TRANSMITTING STIS

TABLE 60 DISINFECTANTS FOR ENDOCAVITARY TRANSDUCERS OFFERED BY KEY PLAYERS

TABLE 61 ENDOCAVITARY ULTRASOUND TRANSDUCERS DISINFECTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.6 TRANSESOPHAGEAL ECHOCARDIOGRAPHY (TEE) TRANSDUCERS

8.6.1 TEE TRANSDUCERS ARE FLEXIBLE, REUSABLE, AND HEAT-SENSITIVE

TABLE 62 DISINFECTANTS FOR TEE TRANSDUCERS OFFERED BY KEY PLAYERS

TABLE 63 TRANSESOPHAGEAL ECHOCARDIOGRAPHY ULTRASOUND TRANSDUCERS DISINFECTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.7 OTHER TRANSDUCERS

TABLE 64 DISINFECTANTS FOR OTHER TRANSDUCERS OFFERED BY KEY PLAYERS

TABLE 65 OTHER ULTRASOUND TRANSDUCERS DISINFECTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9 ULTRASOUND PROBE DISINFECTION MARKET, BY END USER (Page No. - 140)

9.1 INTRODUCTION

TABLE 66 GLOBAL MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 HOSPITALS & DIAGNOSTIC IMAGING CENTERS

9.2.1 HOSPITALS & DIAGNOSTIC IMAGING CENTERS ARE THE LARGEST END USERS OF ULTRASOUND TRANSDUCERS

TABLE 67 GLOBAL MARKET FOR HOSPITALS & DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 MATERNITY CENTERS

9.3.1 RISE IN PRENATAL TESTING TO SUPPORT MARKET GROWTH

TABLE 68 GLOBAL MARKET FOR MATERNITY CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 AMBULATORY CARE CENTERS

9.4.1 RISING DEMAND FOR PORTABLE AND COMPACT ULTRASOUND DEVICES TO DRIVE MARKET GROWTH

TABLE 69 GLOBAL MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

9.5 RESEARCH & ACADEMIC INSTITUTES

9.5.1 GROWING USE OF ULTRASOUND IMAGING IN CLINICAL RESEARCH APPLICATIONS TO SUPPORT MARKET GROWTH

TABLE 70 GLOBAL MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

9.6 OTHER END USERS

TABLE 71 GLOBAL MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

10 ULTRASOUND PROBE DISINFECTION MARKET, BY REGION (Page No. - 147)

10.1 INTRODUCTION

FIGURE 35 EMERGING COUNTRIES ARE EXPECTED TO WITNESS HIGHER GROWTH IN THE FORECAST PERIOD

TABLE 72 GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The US dominates the global ultrasound probe disinfection market

FIGURE 37 US: TOTAL FERTILITY RATE (1990-2020)

TABLE 83 US: KEY MACROINDICATORS

TABLE 84 US: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 85 US: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 US: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 US: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 US: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 89 US: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 US: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 91 US: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 92 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Slower adoption of high-level disinfectants in Canada to restrain the market growth

TABLE 93 CANADA: KEY MACROINDICATORS

TABLE 94 CANADA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 95 CANADA: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 CANADA: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 CANADA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 CANADA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 99 CANADA: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 CANADA: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 101 CANADA: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 102 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 103 EUROPE: ULTRASOUND PROBE DISINFECTION MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 105 EUROPE: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 EUROPE: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 EUROPE: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 EUROPE: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 109 EUROPE: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing healthcare expenditure to support market growth

TABLE 113 GERMANY: KEY MACROINDICATORS

TABLE 114 GERMANY: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 115 GERMANY: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 GERMANY: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 GERMANY: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 GERMANY: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 119 GERMANY: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 GERMANY: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 121 GERMANY: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 122 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Favorable health insurance system to drive the ultrasound probe disinfection market in France

TABLE 123 FRANCE: KEY MACROINDICATORS

TABLE 124 FRANCE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 125 FRANCE: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 FRANCE: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 FRANCE: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 FRANCE: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 129 FRANCE: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 FRANCE: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 131 FRANCE: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 132 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 Increased demand for ultrasound procedures will drive the ultrasound probe disinfection market in the UK

FIGURE 38 UK: NUMBER OF ULTRASOUND IMAGING PROCEDURES, 2014-2018

TABLE 133 UK: KEY MACROINDICATORS

TABLE 134 UK: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 135 UK: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 UK: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 UK: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 UK: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 139 UK: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 140 UK: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 141 UK: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 142 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Market growth is augmented by the growing prevalence of HAIs

TABLE 143 ITALY: KEY MACROINDICATORS

TABLE 144 ITALY: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 145 ITALY: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 146 ITALY: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 ITALY: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 ITALY: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 149 ITALY: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 ITALY: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 151 ITALY: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 152 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 High burden of HAIs in Spain to drive the ultrasound probe disinfection market

TABLE 153 SPAIN: KEY MACROINDICATORS

TABLE 154 SPAIN: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 155 SPAIN: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 SPAIN: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 157 SPAIN: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 SPAIN: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 159 SPAIN: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 SPAIN: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 161 SPAIN: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 162 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 163 REST OF EUROPE: ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 164 REST OF EUROPE: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 REST OF EUROPE: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 166 REST OF EUROPE: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 167 REST OF EUROPE: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 168 REST OF EUROPE: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 169 REST OF EUROPE: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 170 REST OF EUROPE: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 171 REST OF EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 39 APAC: ULTRASOUND PROBE DISINFECTION MARKET SNAPSHOT

TABLE 172 APAC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 173 APAC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 174 APAC: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 175 APAC: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 176 APAC: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 APAC: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 178 APAC: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 179 APAC: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 180 APAC: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 181 APAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Large geriatric population in the country is driving the demand for ultrasound probe disinfection

TABLE 182 JAPAN: KEY MACROINDICATORS

TABLE 183 JAPAN: ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 184 JAPAN: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 185 JAPAN: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 186 JAPAN: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 187 JAPAN: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 188 JAPAN: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 189 JAPAN: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 190 JAPAN: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 191 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Large patient population and healthcare infrastructure improvements to drive the market in China

TABLE 192 CHINA: KEY MACROINDICATORS

TABLE 193 CHINA: ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 194 CHINA: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 195 CHINA: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 196 CHINA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 197 CHINA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 198 CHINA: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 199 CHINA: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 200 CHINA: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 201 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.3 AUSTRALIA

10.4.3.1 Increasing adoption of advanced instruments for disinfection to drive market growth

TABLE 202 AUSTRALIA: KEY MACROINDICATORS

TABLE 203 AUSTRALIA: ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 204 AUSTRALIA: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 205 AUSTRALIA: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 206 AUSTRALIA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 207 AUSTRALIA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 208 AUSTRALIA: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 209 AUSTRALIA: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 210 AUSTRALIA: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 211 AUSTRALIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Healthcare infrastructural improvements to support market growth in India

TABLE 212 INDIA: KEY MACROINDICATORS

TABLE 213 INDIA: ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 214 INDIA: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 215 INDIA: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 216 INDIA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 217 INDIA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 218 INDIA: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 219 INDIA: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 220 INDIA: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 221 INDIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.5 REST OF APAC

TABLE 222 REST OF APAC: ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 223 REST OF APAC: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 224 REST OF APAC: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 225 REST OF APAC: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 226 REST OF APAC: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 227 REST OF APAC: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 228 REST OF APAC: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 229 REST OF APAC: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 230 REST OF APAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 RISING HEALTHCARE EXPENDITURE TO SUPPORT MARKET GROWTH

TABLE 231 LATIN AMERICA: ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 232 LATIN AMERICA: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 233 LATIN AMERICA: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 234 LATIN AMERICA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 235 LATIN AMERICA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 236 LATIN AMERICA: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 237 LATIN AMERICA: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 238 LATIN AMERICA: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 239 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 INITIATIVES TO ENHANCE HEALTHCARE ACCESSIBILITY TO SUPPORT MARKET GROWTH

TABLE 240 MEA: ULTRASOUND PROBE DISINFECTION MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 241 MEA: ULTRASOUND PROBE DISINFECTION INSTRUMENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 242 MEA: ULTRASOUND PROBE DISINFECTION CONSUMABLES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 243 MEA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 244 MEA: ULTRASOUND PROBE DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 245 MEA: ULTRASOUND PROBE DETERGENTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 246 MEA: MARKET, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 247 MEA: MARKET, BY TYPE OF PROBE, 2019–2026 (USD MILLION)

TABLE 248 MEA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 223)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 40 REVENUE ANALYSIS OF THE TOP PLAYERS IN THE ULTRASOUND PROBE DISINFECTION MARKET

11.4 MARKET SHARE ANALYSIS

FIGURE 41 GLOBAL MARKET SHARE, BY KEY PLAYER, 2020

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 42 GLOBAL MARKET: COMPANY EVALUATION QUADRANT (2020)

11.6 COMPANY EVALUATION QUADRANT FOR START-UPS

11.6.1 PROGRESSIVE COMPANIES

11.6.2 DYNAMIC COMPANIES

11.6.3 STARTING BLOCKS

11.6.4 RESPONSIVE COMPANIES

FIGURE 43 GLOBAL MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS (2020)

11.7 COMPANY PRODUCT FOOTPRINT

TABLE 249 PRODUCT PORTFOLIO ANALYSIS: GLOBAL MARKET, BY PROCESS

TABLE 250 PRODUCT PORTFOLIO ANALYSIS: GLOBAL MARKET, BY PRODUCT

TABLE 251 PRODUCT PORTFOLIO ANALYSIS: GLOBAL MARKET, BY TYPE OF PROBE

11.8 GEOGRAPHIC FOOTPRINT OF MAJOR PLAYERS IN THE GLOBAL MARKET

TABLE 252 GEOGRAPHIC REVENUE MIX: GLOBAL MARKET

11.9 COMPETITIVE SCENARIO

11.9.1 PRODUCT LAUNCHES

TABLE 253 PRODUCT LAUNCHES (JANUARY 2018–JUNE 2021)

11.9.2 DEALS

TABLE 254 DEALS (JANUARY 2018–JUNE 2021)

11.9.3 OTHER DEVELOPMENTS

TABLE 255 OTHER DEVELOPMENTS (JANUARY 2018–JUNE 2021)

12 COMPANY PROFILES (Page No. - 238)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, MNM view)*

12.1.1 NANOSONICS LTD.

TABLE 256 NANOSONICS LTD.: BUSINESS OVERVIEW

FIGURE 44 NANOSONICS LTD.: COMPANY SNAPSHOT (2020)

12.1.2 TRISTEL PLC

TABLE 257 TRISTEL PLC: BUSINESS OVERVIEW

FIGURE 45 TRISTEL PLC: COMPANY SNAPSHOT (2020)

12.1.3 STERIS PLC

TABLE 258 STERIS PLC: BUSINESS OVERVIEW

FIGURE 46 STERIS PLC: COMPANY SNAPSHOT (2020)

12.1.4 ECOLAB, INC.

TABLE 259 ECOLAB, INC.: BUSINESS OVERVIEW

FIGURE 47 ECOLAB, INC.: COMPANY SNAPSHOT (2020)

12.1.5 ADVANCED STERILIZATION PRODUCTS

TABLE 260 ADVANCED STERILIZATION PRODUCTS: BUSINESS OVERVIEW

FIGURE 48 FORTIVE CORPORATION: COMPANY SNAPSHOT (2020)

12.1.6 METREX RESEARCH, LLC (A PART OF DANAHER CORPORATION)

TABLE 261 METREX RESEARCH, LLC: BUSINESS OVERVIEW

FIGURE 49 DANAHER CORPORATION: COMPANY SNAPSHOT (2020)

12.1.7 BODE CHEMIE GMBH

TABLE 262 BODE CHEMIE GMBH: BUSINESS OVERVIEW

FIGURE 50 HARTMANN GROUP: COMPANY SNAPSHOT (2020)

12.1.8 DIVERSEY HOLDINGS, LTD.

TABLE 263 DIVERSEY HOLDINGS, LTD.: BUSINESS OVERVIEW

FIGURE 51 DIVERSEY HOLDINGS, LTD.: COMPANY SNAPSHOT (2020)

12.1.9 RUHOF CORPORATION

TABLE 264 RUHOF CORPORATION: BUSINESS OVERVIEW

12.1.10 CIVCO MEDICAL SOLUTIONS

TABLE 265 CIVCO MEDICAL SOLUTIONS: BUSINESS OVERVIEW

12.1.11 CS MEDICAL LLC

TABLE 266 CS MEDICAL LLC: BUSINESS OVERVIEW

12.1.12 VIROX TECHNOLOGIES INC.

TABLE 267 VIROX TECHNOLOGIES INC.: BUSINESS OVERVIEW

12.1.13 GERMITEC S.A.

TABLE 268 GERMITEC S.A.: BUSINESS OVERVIEW

12.1.14 SCHÜLKE & MAYR GMBH

TABLE 269 SCHÜLKE & MAYR GMBH: BUSINESS OVERVIEW

12.1.15 PARKER LABORATORIES INC.

TABLE 270 PARKER LABORATORIES, INC.: BUSINESS OVERVIEW

12.1.16 SOLUSCOPE SAS

TABLE 271 SOLUSCOPE SAS: BUSINESS OVERVIEW

12.1.17 DR. SCHUMACHER GMBH

TABLE 272 DR. SCHUMACHER GMBH: BUSINESS OVERVIEW

12.1.18 WHITELEY MEDICAL

TABLE 273 WHITELEY MEDICAL: BUSINESS OVERVIEW

12.1.19 MÜNCHENER MEDIZIN MECHANIK GMBH (MMM GROUP)

TABLE 274 MMM GROUP: BUSINESS OVERVIEW

12.1.20 GAMA HEALTHCARE LTD.

TABLE 275 GAMA HEALTHCARE LTD.: BUSINESS OVERVIEW

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 ADVANCED ULTRASOUND SOLUTIONS, INC.

TABLE 276 ADVANCED ULTRASOUND SOLUTIONS, INC.: COMPANY OVERVIEW

12.2.2 IMA-X

TABLE 277 IMA-X: COMPANY OVERVIEW

12.2.3 PDI, INC.

TABLE 278 PDI, INC.: COMPANY OVERVIEW

12.2.4 BORER CHEMIE AG

TABLE 279 BORER CHEMIE AG: COMPANY OVERVIEW

12.2.5 MEDEVICE HEALTHTECH PVT. LTD.

TABLE 280 MEDEVICE HEALTHTECH PVT. LTD.: COMPANY OVERVIEW

13 APPENDIX (Page No. - 278)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

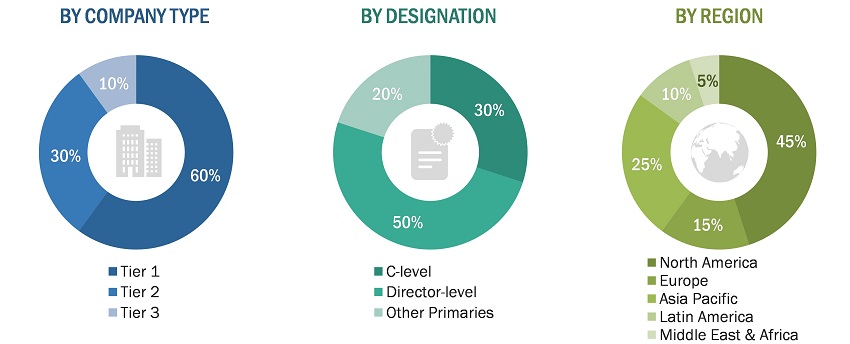

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the ultrasound probe disinfection market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side and demand side are detailed below.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the ultrasound probe disinfection market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Market Definition

An ultrasound probe is a very important and expensive component of ultrasound scanners. Ultrasound probes require thorough care, cleaning, and proper disinfection, as the performance and imaging quality of ultrasound scanners are affected by the improper maintenance of probes. These are disinfected using automated probe disinfectors, detergents, disinfectant liquids, disinfectant sprays, and disinfectant wipes, among other products.

Key Stakeholders

- Manufacturers of Ultrasound Probe Disinfectants

- End User

- R&D Department

Objectives of the Study

- To validate the segmentation defined through the assessment of the product portfolios of the leading players in the market

- To understand key industry trends and issues defining the growth objectives of market players

- To gather both demand- and supply-side validation of the key factors affecting market growth, including market drivers, restraints, opportunities, and challenges

- To validate assumptions for the market sizing and forecasting model used for this market study

- To understand the market positions of the leading players in the ultrasound probe disinfection market and their shares/rankings

- To understand the ongoing pricing trends in the market and future expectations

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the RoE ultrasound probe disinfection market into Belgium, Russia, the Netherlands, Switzerland, and others.

- Further breakdown of the RoAPAC ultrasound probe disinfection market into South Korea, Southeast Asia, and others.

Competitive Landscape Assessment

- Market share analysis, by region (North America and Europe), which provides market shares of the top 3-5 key players in the ultrasound probe disinfection market.

- Competitive leadership mapping for established players for the US.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ultrasound Probe Disinfection Market