Urology Devices Market by Product (Dialysis, Laser, Lithotripsy, Robotic, Insufflators, Guidewires, Catheters, Stents, Implants), Application (Kidney Diseases, Cancer, Pelvic Organ Prolapse, BPH, Stones), End User, and Region - Global Forecast to 2028

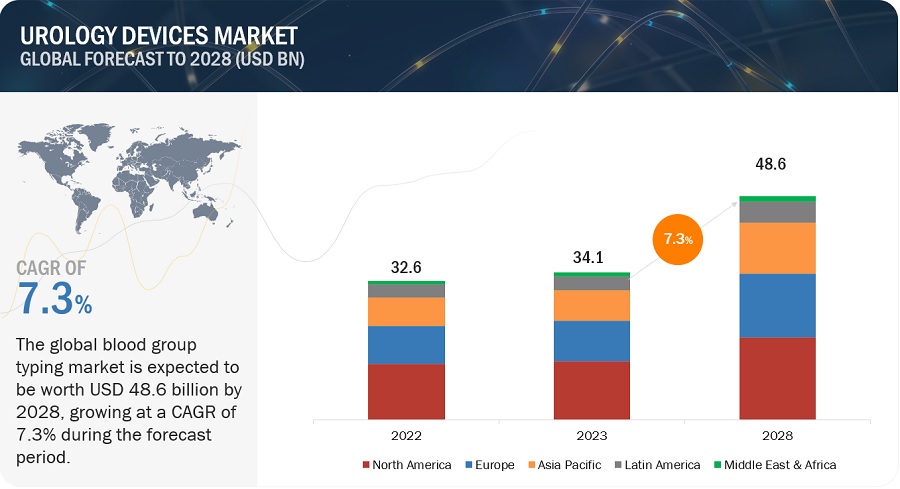

The global urology devices market in terms of revenue was estimated to be worth $34.1 billion in 2023 and is poised to reach $48.6 billion by 2028, growing at a CAGR of 7.3% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Investments by hospitals in procuring advanced instruments, expanding units, and establishing new centers are expected to boost the market for urology devices. Moreover, increased demand for MIS robotic systems is expected to increase in the coming years, which is expected to propel the market growth.

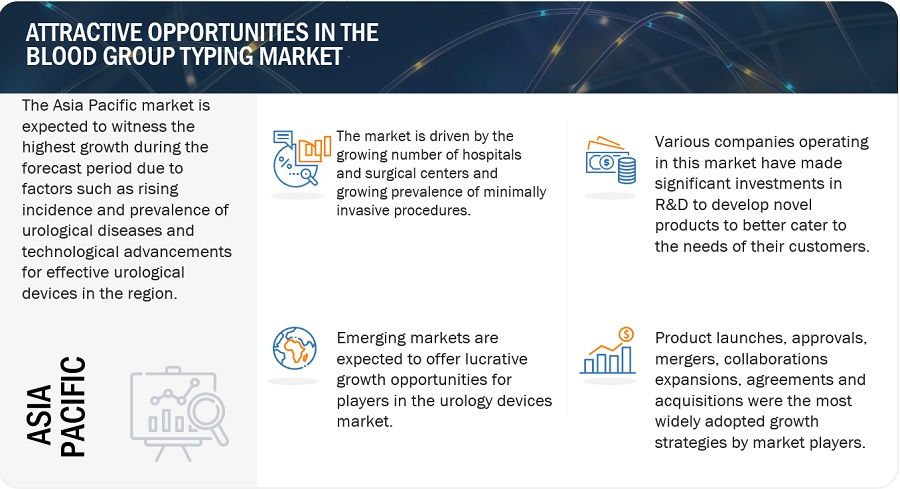

Attractive Opportunities in the Urology Devices Market

To know about the assumptions considered for the study, Request for Free Sample Report

Urology Devices Market Dynamics

DRIVER: Rising incidence of urological diseases

With the rising incidence of urological diseases and surgical procedures for their treatment, the demand for urology devices has increased. The prevalence of urological conditions, such as chronic kidney diseases (CKD), end-stage renal diseases (ESRD), urinary incontinence, kidney and ureteral stones, and bladder and prostate cancer, have increased significantly globally. Patients with chronic conditions often require regular procedures to manage their conditions, while surgical procedures, especially major surgeries, necessitate significant technologically advanced devices for safe and successful outcomes. This is expected to positively impact the market. According to the American Kidney Fund (AKF), in 2022, kidney diseases affected 37 million Americans, with 807,000 living with kidney failure, over 562,000 undergoing dialysis, and more than 245,000 receiving kidney transplants.

RESTRAINT: High degree of consolidation among key players

Intense competition characterizes this market, which is heavily dominated by major players. Significant capital investments, elevated R&D and manufacturing costs make entry difficult for newcomers. Moreover, the established top-tier companies benefit from brand loyalty, further solidifying their market position. The considerable consolidation within the industry serves as a formidable barrier for potential entrants. For instance, according to a 2020 article in Investigative and Clinical Urology, many companies have expressed keen interest in entering this global market and developing their own surgical robotic systems.

OPPORTUNITY: Potential growth opportunities in emerging economies

The market's growth is significantly driven by the private healthcare sector's expansion, aimed at meeting the increasing demands of the expanding middle-class population. The middle-class population in the Asia Pacific is expected to increase to 66% by 2030 from 28% in 2009 (Source: OECD). According to the same source, the purchasing power of the growing middle-class population is expected to increase to 59% by 2020 from 23% in 2009. As disposable incomes increase and the middle class requires more medical attention, manufacturers of urology devices must devise new strategies to address this demand. Emerging markets, yet to be fully explored by major players, represent significant untapped market potential.

CHALLENGE: Product recalls witnessed by major market players

Product recalls in the medical device industry occur when a product is found to be defective, potentially harmful, or not in compliance with regulatory standards. Recalls can be initiated voluntarily by the manufacturer or mandated by regulatory agencies. The market growth is significantly affected by the product recalls due to the significant financial and reputational impacts on manufacturers. Regulatory bodies like the FDA in the United States or the CE Marking system in Europe oversee these recalls to ensure patient safety and compliance with regulations. Frequent product recalls during 2020–2021 witnessed by giant companies, such as Fresenius Medical Care, Olympus Corporation, Karl Storz, and Cook Medical, pose a major challenge to the growth of the urology device market.

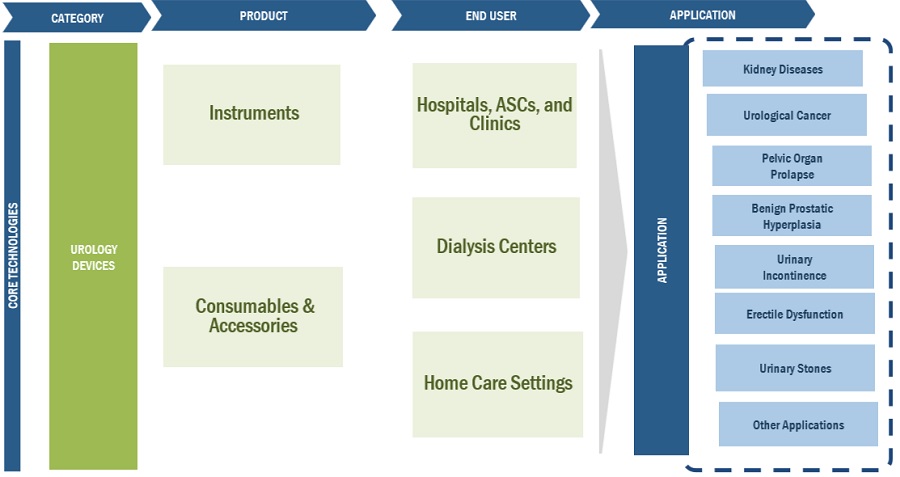

Urology Devices Ecosystem/Market Map

Instruments segment accounted for the largest share of the urology devices industry in 2022, by product.

The urology devices market is categorized into instruments and consumables & accessories based on product. The instruments segment emerged as the dominant force in the market in 2022. The market is being driven by technological advancements coupled with launch of new urology devices and increasing incidence of kidney diseases. Nevertheless, the risk of infections from the repeated utilization of surgical instruments poses a significant hurdle to the market's expansion.

Kidney diseases segment accounted for the largest share in the urology devices industry in 2022, by application.

The global urology devices market is categorized into kidney diseases, urological cancer, pelvic organ prolapse, benign prostatic hyperplasia, urinary incontinence, erectile dysfunction, urinary stones and other applications based on application. In 2022, the kidney diseases segment held the largest share in the market, categorized by application. Throughout the world, kidney disease stands as a prominent cause of mortality. Early identification and treatment play a crucial role in minimizing additional kidney harm. Without proper intervention, it can progress to end-stage renal failure. Therefore, the growing incidence of kidney diseases coupled with the health complications associated with them is driving the demand for urological interventions to manage them, which, in turn, is propelling the market for urology devices.

Hospitals, ASCS & clinics segment accounted for the largest share in the urology devices industry in 2022, by end user.

Based on end users, the urology devices market has been segmented into hospitals, ASCS & clinics, dialysis centers and home care settings. In 2022, the hospitals, ASCS & clinics segment accounted for the largest share of the market. Urology diagnostic services and treatments are available across hospitals, ASCs and clinics, each possessing substantial infrastructure for both invasive and non-invasive procedures. These facilities boast advantages such as enhanced and specialized testing options, streamlined billing systems, and cost-effectiveness. Additionally, the growth in the number of ASCs, coupled with the growing number of surgical procedures performed in ASCs, is expected to drive the demand for urology devices in this end-user segment.

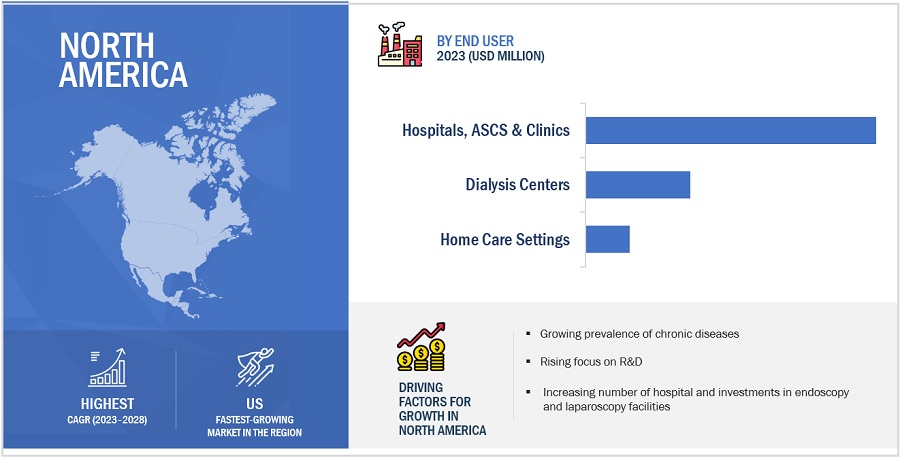

North America accounted for the largest share of the urology devices industry in 2022.

The urology devices market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America emerged as the leading contributor, claiming the largest portion of the market share in the urology devices industry. The region has a robust infrastructure for R&D, which has led to the rapid adoption of innovative techniques and platforms. Also, North America houses several major companies operating in the urology devices sector. These companies have significant expertise, resources, and established distribution networks, which contribute to the region's market dominance. Also, the high burden of chronic conditions on regional healthcare systems is another major driver for market growth.

To know about the assumptions considered for the study, download the pdf brochure

The major players in urology devices market are Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International, Inc. (US), Boston Scientific Corporation (US), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany). The market leadership of these players stems from their comprehensive product portfolios and expansive global footprint. These dominant market players possess several advantages, including strong marketing and distribution networks, substantial research and development budgets, and well-established brand recognition.

Scope of the Urology Devices Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$34.1 billion |

|

Projected Revenue by 2028 |

$48.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 7.3% |

|

Market Driver |

Rising incidence of urological diseases |

|

Market Opportunity |

Potential growth opportunities in emerging economies |

This report categorizes the urology devices market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Instruments

-

Dialysis Devices

- Hemodialysis Devices

- Peritoneal Dialysis Devices

-

Endoscopes

- Laparoscopes

- Ureteroscopes

- Nephroscopes

- Resectoscopes

- Cystoscopes

- Laser & Lithotripsy Devices

- Endovision & Imaging Devices

- Robotic Systems

- Insufflators

- Endoscopy Fluid Management Systems

- Urodynamic Systems

- Other Instruments

- Consumables & Accessories

- Dialysis Consumables

- Catheters

- Guidewires

- Retrieval Devices & Extractors

- Surgical Dissectors, Forceps, & Needle Holders

- Dilator Sets & Urethral Access Sheaths

- Stents and Implants

- Biopsy Devices

- Tubes & Distal Attachments

- Drainage Bags

- Other Consumables & Accessories

By Application

- Kidney Diseases

- Urological Cancer

- Pelvic Organ Prolapse

- Benign Prostatic Hyperplasia

- Urinary Incontinence

- Erectile Dysfunction

- Urinary Stones

- Other Applications

By End User

- Hospitals, ASCS & Clinics

- Dialysis Centers

- Home Care Settings

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Urology Devices Industry

- In August 2023, Fresenius Medical Care AG & Co. KGaA (Germany), announced FDA Clearance for the product Versi HD with GuideMe Software.

- In December 2022, Boston Scientific Corporation (US) and Acotec Scientific Holdings Limited (China) announced today that Boston Scientific will make a partial offer to acquire a majority stake, up to a maximum of 65%, of shares of Acotec, a Chinese medical technology company that offers solutions designed for a variety of interventional procedures.

- In May 2022, B. Braun SE (Germany) entered into a distribution agreement, and B. Braun surgery division Aesculap has strengthened its long-term partnership with True Digital Surgery, a Californian company that is an expert in robotically controlled 3D digital visualization.

- In April 2022, Baxter International, Inc. (US) Announces U.S. FDA Clearance of ST Set used for renal replacement therapy (CRRT)

- In April 2021, Becton, Dickinson and Company (US) announced an investment of USD 65 million for the construction of a state-of-the-art medical facility in Tucson, Arizona (US), which will serve as a final stage manufacturing and sterilization center to improve overall efficiency, customer service, and supply chain in the US.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global urology devices market?

The global urology devices market boasts a total revenue value of $48.6 billion by 2028.

What is the estimated growth rate (CAGR) of the global urology devices market?

The global urology devices market has an estimated compound annual growth rate (CAGR) of 7.3% and a revenue size in the region of $34.1 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, restraints, and key player strategies. To track company developments such as product launches, agreements, collaborations, partnerships, expansions, and acquisitions of the leading players, the competitive landscape of the urology devices market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

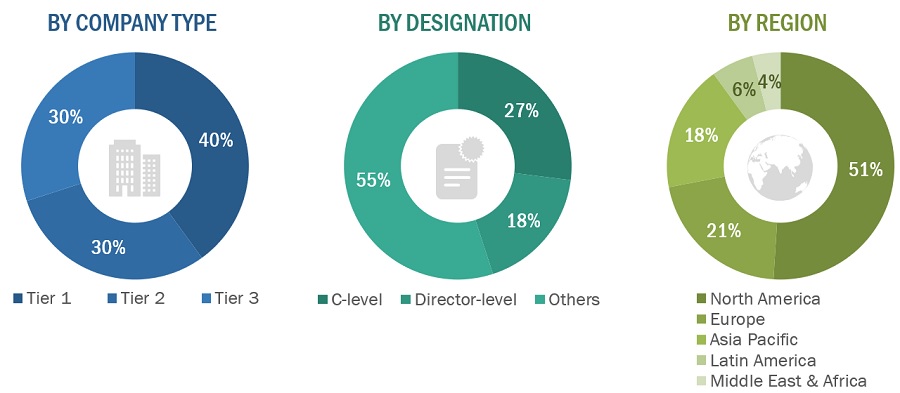

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Baxter International, Inc. |

Senior Product Manager |

|

Cardinal Health |

Quality Control Manager |

|

Becton, Dickinson and Company |

Marketing Manager |

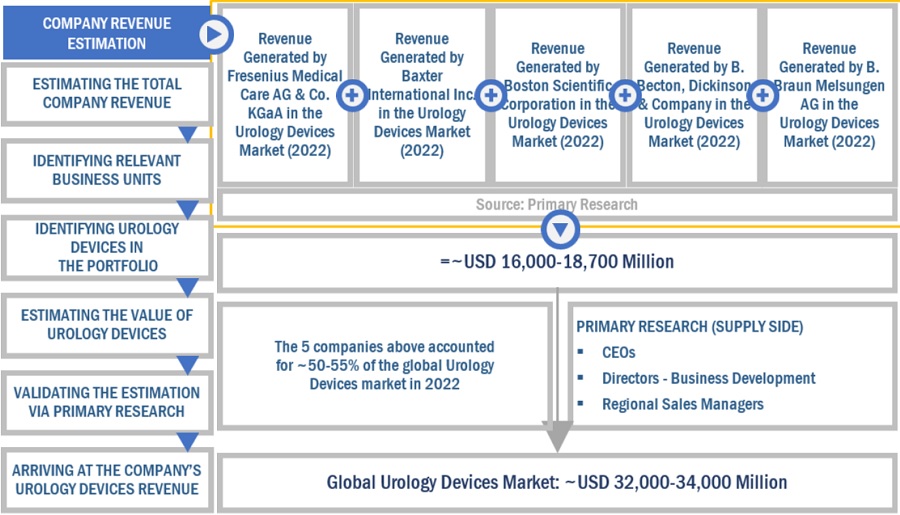

Market Size Estimation

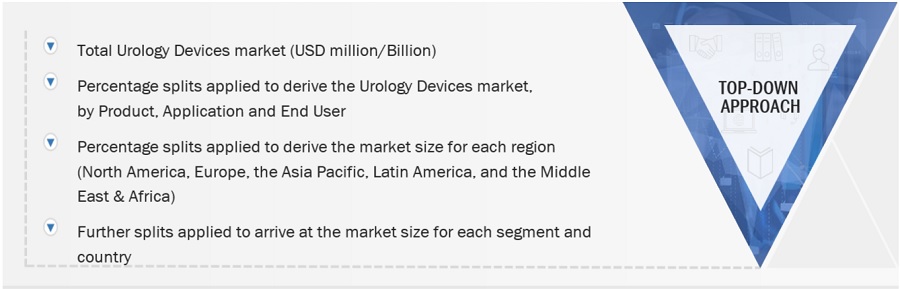

Both top-down and bottom-up approaches were used to estimate and validate the urology devices market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the urology devices market have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Urology Devices Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Urology Devices Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Urology is a medical specialty that deals with the physiology, diseases, and disorders of the human urinary tract and male reproductive organs. Urology devices consist of various types of equipment used during the diagnosis, surgery, and treatment of urological diseases, such as chronic kidney diseases, renal failure, urinary stones, benign prostate hyperplasia (BPH), pelvic organ prolapse (POP), prostate cancer, kidney cancer, bladder cancer, and erectile dysfunction.

Key Stakeholders

- Manufacturers and distributors of urology devices

- Hospitals and ASCs

- Academic research institutes

- Urology clinics

- Urology device service providers

- Venture capitalists and investors

- Clinical research organizations (CROs)

Report Objectives

- To define, describe, and forecast the urology devices market by product, application, end user, and region

- To forecast the size of the urology devices market with respect to five regional segments, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall urology devices market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the urology devices market and comprehensively analyze their market shares and core competencies2 in terms of market developments and growth strategies

- To track and analyze competitive developments such as product launches, agreements, collaborations, partnerships, expansions, and acquisitions in the urology devices market

- To benchmark players within the urology devices market using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Available Customizations

MarketsandMarkets offers the following customizations for this market report.

Country Information

- Additional country-level analysis of the urology devices market

Company profiles

- Additional five company profiles of players operating in the urology devices market.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the urology devices market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Urology Devices Market