Ventilators Market by Mobility (ICU, Portable), Type (Adult/Paediatric, Neonatal), Mode, Interface (Invasive, Non-invasive), End User (Hospital,Clinic, ACC, Homecare), Key Stakeholder & Buying Criteria, Unmet Need, Reimbursement - Global Forecast to 2028

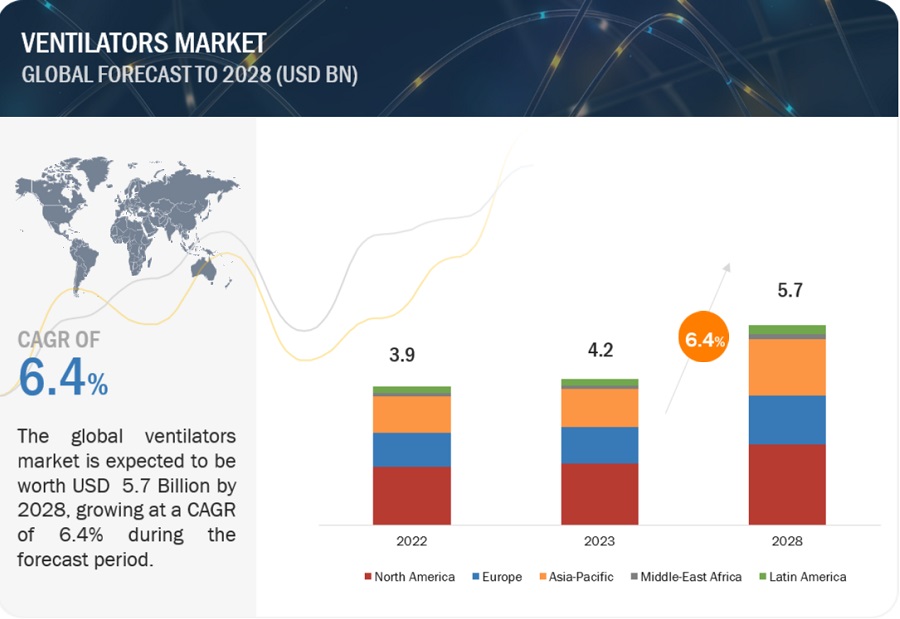

The global ventilators market in terms of revenue was estimated to be worth $4.2 billion in 2023 and is poised to reach $5.7 billion in 2028, growing at a CAGR of 6.4% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

In recent years, the the global market has evolved significantly due to technological advancements, such as the development of advanced portable ventilators and improvements in the sensor technologies used in ventilators. The demand for multimodal ventilators has been on the rise due to their versatility and ability to cater to a wide range of patients’ needs within a single device. These ventilators offer various ventilation modes and settings, making them suitable for treating patients with diverse respiratory conditions, from mild to severe. Particularly, during the COVID-19 pandemic, the flexibility of multimodal ventilators became essential in adapting to rapidly changing patient requirements, allowing healthcare providers to transition between modes seamlessly as patient conditions evolved. This adaptability, combined with features such as advanced monitoring capabilities and user-friendly interfaces, has made multimodal ventilators a preferred choice in modern healthcare settings, where they optimize patient care while streamlining equipment management and reducing the need for multiple specialized devices.

Attractive Opportunities in Ventilators Market

To know about the assumptions considered for the study, Request for Free Sample Report

Ventilators Market Dynamics

Driver: Rising obesity cases due to sedentary lifestyles

An unhealthy diet, obesity, and physical inactivity are some of the leading risk factors contributing to the burden of respiratory diseases. Weight gain is related to an increase in the incidence or severity of conditions such as asthma, COPD, obstructive sleep apnea (OSA), pulmonary embolism, exertional dyspnea, aspiration pneumonia, and obesity-hypoventilation syndrome. State of Obesity 2022: Better Policies for a Healthier America report found that four in ten American adults have obesity, and obesity rates continue to rise. Addressing obesity is critical because it is associated with various diseases, including type 2 diabetes, heart disease, stroke, arthritis, sleep apnea, and some cancers. According to Medical Expenditure Panel Survey (MEPS), obesity is estimated to increase US healthcare spending by USD 170 billion annually (including billions by Medicare and Medicaid). This figure rises to over $200 billion if excess costs from overweight (over $600 per person) are included, highlighting the large economic impact of overweight and obesity in the US.

Restraint: Reimbursement Concerns

Many patients rely on reimbursements to receive treatment. In the US, Medicare Part B covers medically necessary durable medical equipment, including ventilators. Medicare has categorized devices with exhalation valves, adjustable ventilator rates, and alarms as mechanical ventilators. It covers ventilators to treat restrictive thoracic diseases, neuromuscular diseases, chronic respiratory failure, and COPD. Ventilators are considered under the “Frequently & Substantially Serviced” payment category of Medicare. Accordingly, the payment in this category is paid on a monthly rental basis by Medicare, and patients medically require the equipment for a long time. However, Medicare does not make any payment for the purchase and does not cover any other accessories required for ventilators, such as humidifiers.

Opportunity: Cost efficiency of home care services

Patients with COPD, cystic fibrosis, and paralytic syndromes have significant respiratory care requirements. Due to the rising inclination towards home care therapies, companies are up with specialized home care services, such as resupply systems and rental services. CHI Health (US) provides lower-cost devices that enable patients to receive care and treatment in a safe and comfortable home environment. Similarly, sleep apnea therapy equipment needs regular maintenance and replacement to maintain comfortable and effective therapy. In home care services, self-medicated devices, such as oxygen concentrators, inhalers, and nebulizers, are used. But in a few cases wherein the patient is critical, some hospitals provide respiratory therapists and nurses who serve patients, which includes oxygen therapy and airway management/tracheostomy care. Such circumstances help increase patient outcomes and will encourage companies to develop homecare respiratory care devices in the near future.

Challenge: Supply chain disruptions in Ventilators Market

The market experienced significant supply chain disruptions in the wake of the COVID-19 pandemic. The surge in global demand for ventilators, driven by the immediate need to treat critically ill COVID-19 patients, exposed vulnerabilities in the supply chain for these life-saving devices. Manufacturers faced challenges in sourcing critical components and materials, including valves, sensors, and electronic components, due to disruptions in the global supply chain. Many of these components were sourced from regions heavily impacted by the pandemic, leading to delays and shortages in production. Additionally, the increased competition for resources and materials further strained supply chains, making it difficult for some manufacturers to meet the soaring demand.

Reimbursement Scenario

|

Ventilator Type |

Ventilator Example |

Reimbursement Scenario |

|

ICU Ventilators |

Hamilton C1 Ventilator, Dräger Evita V300 Ventilator |

This ventilator is designed for use in intensive care units (ICUs) and can be used to treat a variety of respiratory conditions, including ARDS, COPD, and asthma. Medicare will reimburse hospitals for the cost of ventilators, but the amount of reimbursement will vary depending on the patient's diagnosis and the length of time they are on the ventilator. For example, Medicare may reimburse a hospital USD 1,500 per day for a patient who is on a ventilator for pneumonia. Medicaid and commercial insurance companies will also reimburse hospitals for the cost of ventilators, but the amount of reimbursement will vary depending on the patient's insurance plan. |

|

Portable Ventilators |

Medtronic Puritan Bennett 560, ResMed Astral 150 |

This portable ventilator is designed for use in a variety of settings, including hospitals, homes, and ambulances. It can be used to treat a variety of respiratory conditions, including COPD, asthma, and sleep apnea. Medicare, Medicaid, and commercial insurance companies will generally reimburse hospitals and other healthcare providers for the cost of portable ventilators, but the amount of reimbursement will vary depending on the patient's insurance plan. |

Ventilators Market Ecosystem

Leading players in this market include well-established and financially stable service providers of ventilators. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in this market include Koninklijke Philips N.V. (Netherlands), ResMed (US), Drägerwerk AG & CO. KGAA (Germany), Medtronic (Ireland), Getinge AB (Sweden).

Based on type, the high-end ICU ventilators segment accounted of the intensive care ventilators industry

In 2022, the high-end ICU ventilators segment accounted of the intensive care ventilators market. The demand for high-end ICU ventilators largely comes from large hospitals in developed countries. The combination of modularity, ease of use, mobility, and advanced features allows healthcare providers to individualize the patient’s ventilation therapy, such as using graphics to differentiate spontaneous and machine breaths and waveform representations.

Based on mode, the combined-mode ventilators segment of the ventilators industry will grow at the highest CAGR during the forecast period

The combined-mode ventilators segment will continue to dominate the ventilators market in 2027, growing at the highest CAGR during the forecast period. These ventilators offer hybrid modes combining the features of volume-targeted and pressure-targeted ventilation, intending to avoid the high peak airway pressure that can occur during volume-mode ventilation and varying pressure that may occur during pressure-mode ventilation.

Based on end user, home care settings segment of the ventilators industry will grow at the highest CAGR during the forecast period

In 2022, home care settings segment will grow at the highest CAGR during the forecast period. Growth in this segment is mainly due to the emergence of remote health monitoring devices. These devices can be used at home to analyze health parameters, reduce hospital visits, and minimize the risk of hospital-acquired infections. There is no need for mechanical ventilators, and simple Noninvasive oxygen supplements can manage these patients. The high influx of critically ill patients in hospitals drives more patients to be managed in home care settings.

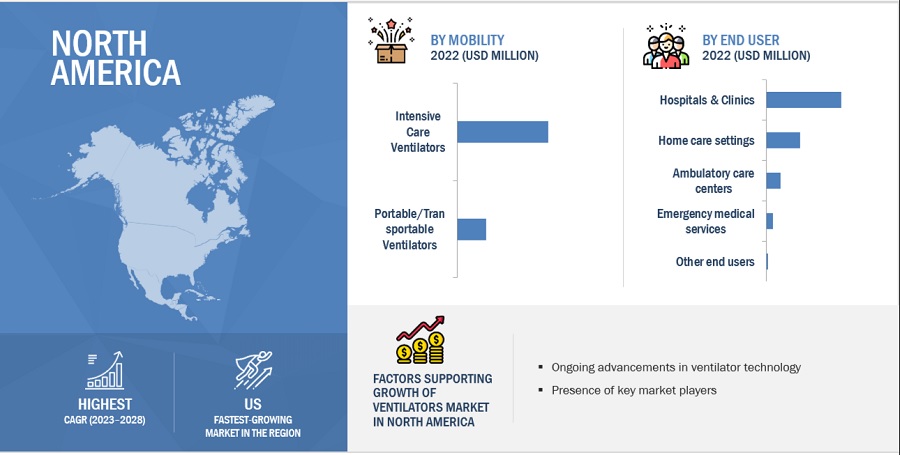

North America is expected to account for the largest share of the ventilator industry in 2022

To know about the assumptions considered for the study, download the pdf brochure

North America is expected to account for the largest share of the ventilator market in 2022.The ongoing advancements in ventilator technology, such as the development of more sophisticated and portable devices, have increased the appeal of these machines for healthcare providers. Additionally, the aging US population, with a higher prevalence of respiratory diseases among the elderly, has created a sustained demand for ventilators. As healthcare facilities continue to prioritize respiratory care and emergency preparedness, the North America ventilator market is expected to maintain its growth trajectory, offering a range of opportunities for manufacturers, suppliers, and healthcare providers alike.

The prominent players in the ventilator market are Koninklijke Philips N.V. (Netherlands), ResMed (US), Medtronic (Ireland), Vyaire Medical, Inc. (US), Getinge AB (Sweden), Drägerwerk AG & CO. KGAA (Germany), ICU Medical, Inc. (US), Hamilton Medical (Switzerland), GE Healthcare (US), Air Liquide (France), Asahi Kasei Corporation (Japan), Allied Healthcare Products, Inc. (US), Nihon Kohden Corporation (Japan), Shenzhen Mindray Bio-Medical Electronics Co., Ltd, (China), Skanray Technologies (India), Baxter International Inc, (US), aXcent Medical GmbH (Germany), Metran Co., Ltd (Japan), MAGNAMED (Brazil), Leistung Ingeniería SRL(Argentina), Avasarala Technologies Limited (India), Airon Corporation (Florida), TRITON Electronic Systems Ltd. (Russia), Bio-Med Devices, Inc. (US), and HEYER Medical AG (Germany).

Scope of the Ventilators Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$4.2 billion |

|

Estimated Value by 2028 |

$5.7 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.4% |

|

Market Driver |

Rising obesity cases due to sedentary lifestyles |

|

Market Opportunity |

Cost efficiency of home care services |

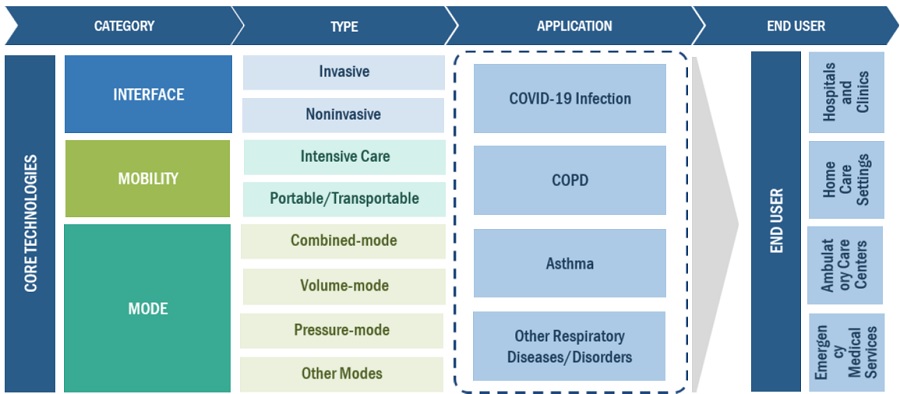

The study categorizes the ventilator market to forecast revenue and analyze trends in each of the following submarkets:

By Mobility

-

Intensive Care Ventilators

- High-end ICU ventilators

- Mid-end ICU ventilators

- Basic ICU Ventilators

- Portable/transportable ventilators

By Type

- Adult/pediatric Ventilators

- Neonatal/infant ventilators

By Interface

- Invasive Ventilators

- Non-invasive Ventilators

By Mode

- Combined Mode Ventilators

- Volume Mode Ventilators

- Pressure Mode Ventilators

- Other modes of ventilators

By End User

- Hospitals & Clinics

- Ambulatory care centers

- Emergency medical services

- Home care settings

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

Recent Developments of Ventilators Industry

- In January 2022, ICU Medical acquired Smiths Group plc, aims to support the expansion of ICU Medical’s product line, including infusion therapy and ventilators, thus expanding ICU Medical’s presence in critical care markets.

- In October 2021, GE Healthcare partnered with Apprise Health Insights. The companies together launched Oregon’s Statewide Capacity System to track 7,368 beds and approximately 800 ventilators across 60 hospitals.

- In June 2021, Vyaire Medical, Inc. partnered with GenWorks Healthcare Limited. The partnership in India expands the company's footprint and provides greater accessibility to high-quality pulmonary screening, testing, and treatment.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global ventilators market?

The global ventilators market boasts a total revenue value of $5.7 billion in 2028.

What is the estimated growth rate (CAGR) of the global ventilators market?

The global ventilators market has an estimated compound annual growth rate (CAGR) of 6.4% and a revenue size in the region of $4.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

13 COMPANY PROFILES (Page No. - 230)

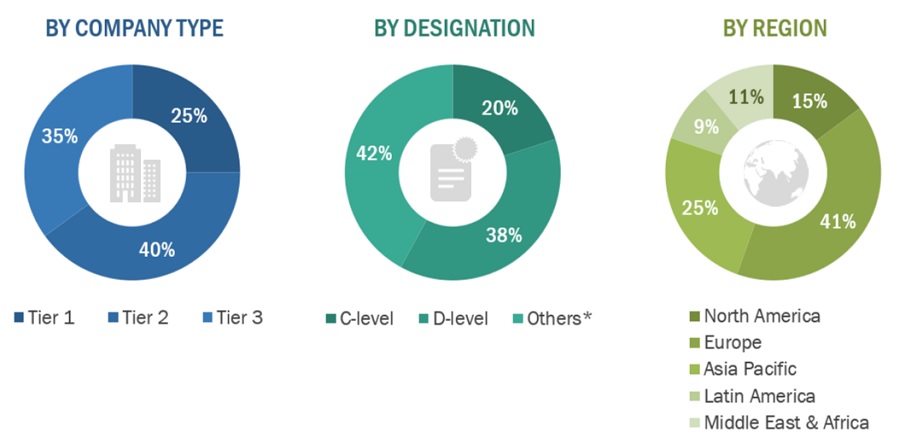

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the ventilator market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side and demand side are detailed below.

A breakdown of the primary respondents is provided below:

Breakdown Of Primary Interviews: Supply-Side Participants, By Company Type, Designation, And Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

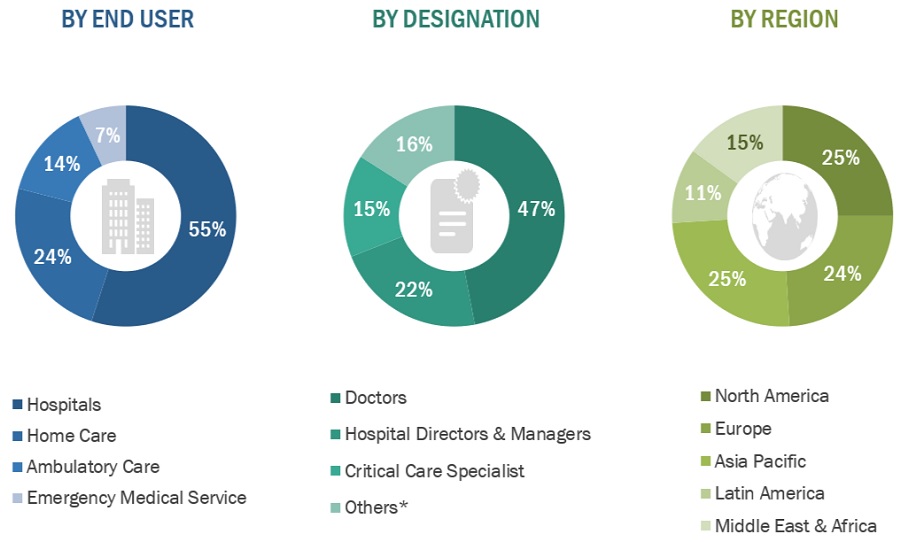

Breakdown Of Primary Interviews: Demand-Side Participants By End User, Designation, And Region

Note: Others include department heads, research scientists, and professors.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation

The total size of the ventilators market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Global Ventilators Market Size: Top-Down Approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Market Definition

A ventilator is a machine that assists patients in breathing by blowing or pushing air/oxygen into the lungs. Usually, patients can breathe independently, but a ventilator can assist with that function. It is mainly used in hospitals to treat chronic obstructive pulmonary disease (COPD), sleep apnea, acute lung injury, and hypoxemia.

Key Stakeholders

- Ventilator manufacturers

- Hospitals and clinics

- Home healthcare agencies

- Nursing homes

- Ambulatory care centers

- Assisted living facilities/home care settings

- Healthcare insurance providers

- Market research and consulting firms

- Venture capitalists and investors

Objectives of the Study

- To describe, analyze, and forecast the ventilators market by type, mobility, interface, mode of ventilation, end user, and region

- To describe and forecast the ventilators market for key regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the ventilators market

- To strategically analyze the ecosystem, regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To provide a detailed overview of the supply chain pertaining to the ventilator market ecosystem, along with the average selling prices of different types of ventilators

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile key players and comprehensively analyze their market shares and core competencies2 in the ventilators market

- To analyze competitive developments such as partnerships, collaborations, agreements and acquisitions, product launches, and expansions in the ventilators market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE ventilator market into Austria, Finland, and others

- Further breakdown of the RoLATAM ventilator market into Colombia, Chile, and others

Competitive Landscape Assessment

- Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the ventilator market

- Competitive leadership mapping for established players in the US

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ventilators Market