TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 63)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.3.3 CURRENCY CONSIDERED

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

1.5.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY (Page No. - 68)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

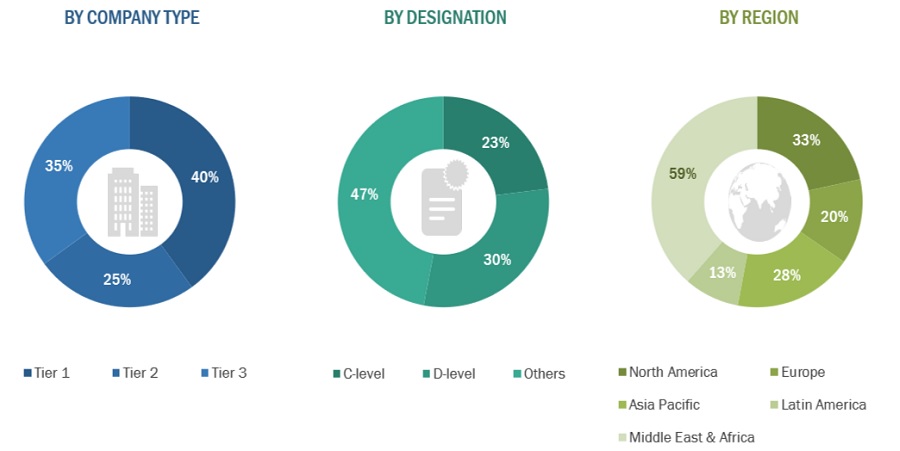

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

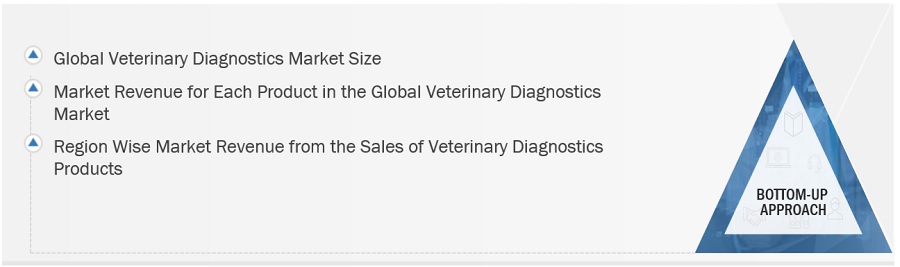

2.2 MARKET SIZE ESTIMATION

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION: IDEXX LABORATORIES, INC.

FIGURE 7 SUPPLY-SIDE ANALYSIS OF TOP COMPANIES: VETERINARY DIAGNOSTIC MARKET (2022)

FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF VETERINARY DIAGNOSTICS MARKET (2023–2029)

FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 10 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 11 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: VETERINARY DIAGNOSTIC INDUSTRY

2.8 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 82)

FIGURE 12 VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2023 VS. 2029 (USD MILLION)

FIGURE 13 VETERINARY DIAGNOSTIC INDUSTRY, BY TECHNOLOGY, 2023 VS. 2029 (USD MILLION)

FIGURE 14 MARKET, BY ANIMAL TYPE, 2023 VS. 2029 (USD MILLION)

FIGURE 15 MARKET, BY APPLICATION, 2023 VS. 2029 (USD MILLION)

FIGURE 16 MARKET, BY DISTRIBUTION CHANNEL, 2023 VS. 2029 (USD MILLION)

FIGURE 17 MARKET, BY END USER, 2023 VS. 2029 (USD MILLION)

FIGURE 18 GEOGRAPHICAL SNAPSHOT OF MARKET

4 PREMIUM INSIGHTS (Page No. - 87)

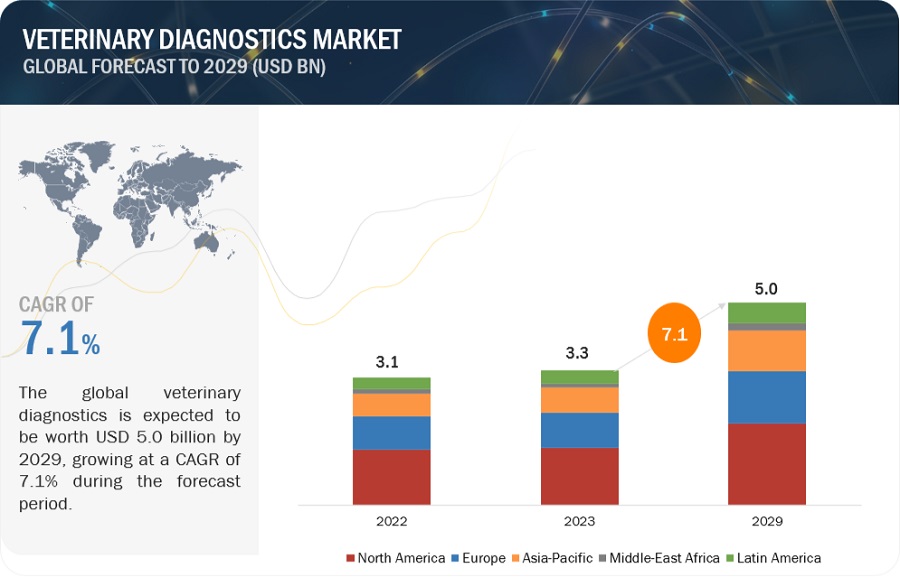

4.1 VETERINARY DIAGNOSTIC MARKET OVERVIEW

FIGURE 19 GROWING PREVALENCE OF ZOONOTIC DISEASES TO DRIVE MARKET GROWTH

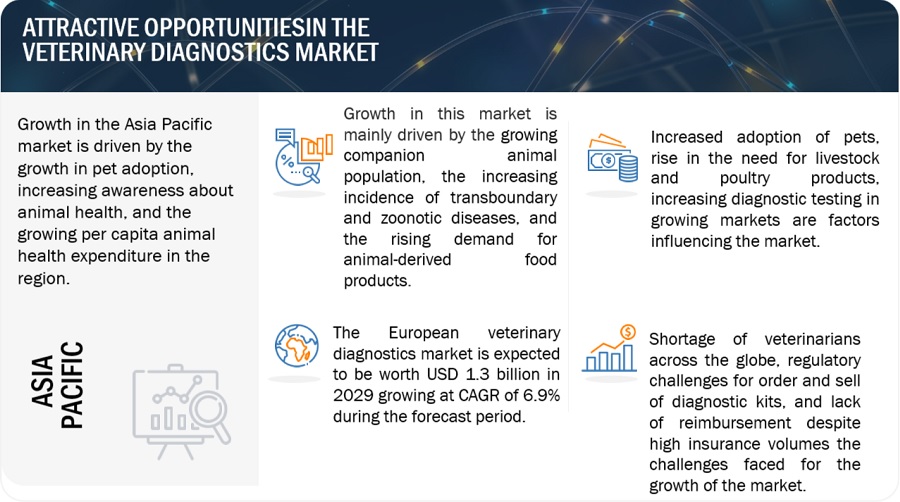

4.2 ASIA PACIFIC: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER AND COUNTRY (2022)

FIGURE 20 VETERINARY REFERENCE LABORATORIES ACCOUNTED FOR LARGEST SHARE OF APAC MARKET IN 2022

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH OVER FORECAST PERIOD

4.4 MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

FIGURE 22 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES OVER FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 91)

5.1 MARKET DYNAMICS

FIGURE 23 VETERINARY DIAGNOSTIC MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Growth in companion animal population

TABLE 2 NUMBER OF US HOUSEHOLDS THAT OWN A PET, BY ANIMAL TYPE (MILLIONS)

TABLE 3 PET POPULATION, BY ANIMAL, 2014–2022 (MILLION)

5.1.1.2 Rising demand for animal-derived food products

FIGURE 24 MAJOR PRODUCERS OF COW MILK WORLDWIDE IN 2022, BY COUNTRY (MILLION METRIC TONS)

TABLE 4 PAST AND PROJECTED TRENDS IN CONSUMPTION OF MEAT AND MILK IN DEVELOPED AND DEVELOPING COUNTRIES

TABLE 5 ASIA: COUNTRY-LEVEL CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2000 VS. 2030 (THOUSAND METRIC TONS)

TABLE 6 ASIA: COUNTRY-LEVEL PRODUCTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2000 VS. 2030 (THOUSAND METRIC TONS)

5.1.1.3 Increasing incidence of transboundary and zoonotic diseases

TABLE 7 ANIMAL DISEASE OUTBREAKS IN ASIA PACIFIC COUNTRIES (2009–2023)

5.1.1.4 Rising demand for pet insurance and growing animal health expenditure

TABLE 8 US: AVERAGE ANNUAL PREMIUMS PAID (2020–2022)

FIGURE 25 US VS CANADA: GROSS WRITTEN PREMIUMS FOR DOGS, 2020–2022 (IN USD MILLION)

FIGURE 26 US VS CANADA: GROSS WRITTEN PREMIUMS FOR CATS, 2020–2022 (IN USD MILLION)

FIGURE 27 US: PET INDUSTRY EXPENDITURE, 2010–2022

TABLE 9 US: BREAKDOWN OF PET INDUSTRY EXPENDITURE, 2020–2022 (USD BILLION)

TABLE 10 NORTH AMERICA: PET HEALTH INSURANCE MARKET, 2012–2022 (USD MILLION)

5.1.1.5 Growing number of veterinary practitioners and rising income levels in developed economies

TABLE 11 NUMBER OF VETERINARIANS AND PARAVETERINARIANS IN DEVELOPED COUNTRIES, 2012–2020

5.1.1.6 Increasing disease control and prevention measures

5.1.2 RESTRAINTS

5.1.2.1 Rising pet care costs

FIGURE 28 US: BASIC ANNUAL EXPENSES FOR DOGS AND CATS, 2022

5.1.2.2 High cost of veterinary diagnostic tests

5.1.3 OPPORTUNITIES

5.1.3.1 Untapped emerging markets

5.1.4 CHALLENGES

5.1.4.1 Lack of animal healthcare awareness in emerging countries

5.1.4.2 Shortage of veterinary practitioners in emerging economies

TABLE 12 NUMBER OF VETERINARY PROFESSIONALS, BY COUNTRY, 2005 VS 2014 VS 2018

5.2 INDUSTRY TRENDS

5.2.1 ADOPTION OF MULTIPLE TEST PANELS

TABLE 13 MULTIPLE TESTING PANELS VS. SINGLE TESTING PANELS

5.2.2 OUTSOURCING OF VETERINARY DIAGNOSTIC TESTING SERVICES

5.2.3 GROWING CONSOLIDATION IN VETERINARY DIAGNOSTICS INDUSTRY

TABLE 14 MAJOR ACQUISITIONS IN ANIMAL HEALTH DIAGNOSTICS INDUSTRY

5.2.4 GROWING SCALE OF VETERINARY BUSINESSES

5.3 DISEASE TRENDS

5.3.1 LIVESTOCK

5.3.1.1 Avian Influenza

5.3.1.2 African Swine Fever

5.3.1.3 Bovine Babesiosis

5.3.1.4 Peste des Petits Ruminants

5.3.1.5 West Nile Virus

5.3.2 COMPANION ANIMALS

5.3.2.1 Zoonotic diseases

TABLE 15 COMMON ZOONOTIC DISEASES SPREAD BY COMPANION ANIMALS

5.3.2.2 Obesity & diabetes

5.4 TECHNOLOGY ANALYSIS

5.4.1 KEY TECHNOLOGIES

5.4.1.1 Portable instruments for POC diagnostic services

TABLE 16 POC PORTABLE VETERINARY DIAGNOSTIC INSTRUMENTS AND MANUFACTURERS

5.4.2 ADJACENT TECHNOLOGIES

5.4.2.1 Rapid and sensitive veterinary diagnostic kits

5.4.3 COMPLEMENTARY TECHNOLOGIES

5.5 PRICING ANALYSIS

TABLE 17 REGIONAL PRICING ANALYSIS OF VETERINARY ANALYZERS, 2022 (USD)

5.5.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY APPLICATION

TABLE 18 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 APPLICATIONS (USD)

5.5.2 AVERAGE SELLING PRICE TRENDS, BY REGION

5.6 VALUE CHAIN ANALYSIS

FIGURE 29 VETERINARY DIAGNOSTIC INDUSTRY: VALUE CHAIN ANALYSIS

5.7 ECOSYSTEM/MARKET MAP

FIGURE 30 MARKET: ECOSYSTEM MARKET MAP

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 19 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 31 MARKET: SUPPLY CHAIN ANALYSIS

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 REGULATORY ANALYSIS

5.10.1.1 US

5.10.1.2 Europe

5.10.1.3 Rest of the world

5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2.1 North America

TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2.2 Europe

TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2.3 Rest of the world

TABLE 22 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 PATENT ANALYSIS

5.11.1 PATENT PUBLICATION TRENDS FOR VETERINARY DIAGNOSTICS

FIGURE 32 PATENT PUBLICATION TRENDS (JANUARY 2013-OCTOBER 2023)

5.11.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 33 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR VETERINARY DIAGNOSTICS PATENTS (JANUARY 2013–OCTOBER 2023)

FIGURE 34 TOP APPLICANT COUNTRIES/REGIONS FOR VETERINARY DIAGNOSTICS PATENTS (JANUARY 2013–OCTOBER 2023)

5.12 KEY CONFERENCES AND EVENTS (2023–2025)

TABLE 23 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY DIAGNOSTICS

TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY DIAGNOSTICS

5.13.2 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.14 TRADE ANALYSIS

TABLE 26 TOP EXPORTERS OF VETERINARY DIAGNOSTIC CONSUMABLES (REAGENTS; COMPOSITE DIAGNOSTIC OR LABORATORY), 2022

5.15 CASE STUDIES

TABLE 27 INCREASE IN PATIENT VISITS AND DIAGNOSTIC PROCEDURES

TABLE 28 UNMET CUSTOMER NEEDS IN LIVESTOCK DIAGNOSTICS MARKET

TABLE 29 OPPORTUNITY ASSESSMENT IN HIGH-END AUTOMATED IMMUNOASSAY ANALYZERS IN COMPANION ANIMAL IMMUNODIAGNOSTICS

TABLE 30 IDENTIFICATION OF INTESTINAL PARASITE

5.16 ADJACENT MARKETS

FIGURE 37 MARKET: ADJACENT MARKETS

5.17 END-USER PERSPECTIVE & UNMET NEEDS

5.18 AI INTEGRATION IN VETERINARY DIAGNOSTICS

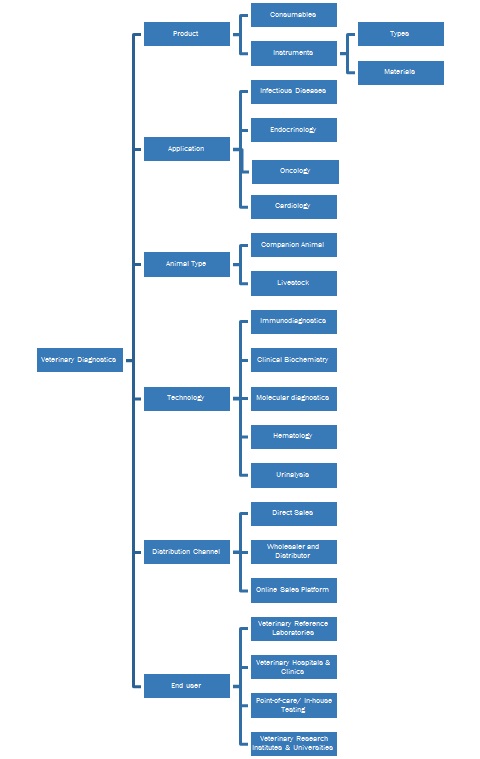

6 VETERINARY DIAGNOSTIC MARKET, BY PRODUCT (Page No. - 133)

6.1 INTRODUCTION

TABLE 31 VETERINARY DIAGNOSTIC INDUSTRY, BY PRODUCT, 2021–2029 (USD MILLION)

6.2 CONSUMABLES

6.2.1 CONSUMABLES TO HOLD LARGEST SHARE OF PRODUCTS MARKET

TABLE 32 KEY VETERINARY DIAGNOSTIC CONSUMABLES, BY COMPANY (2022)

TABLE 33 VETERINARY DIAGNOSTIC CONSUMABLES MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

6.3 INSTRUMENTS

6.3.1 INCREASING DEMAND FOR POC ANALYZERS TO DRIVE MARKET

TABLE 34 KEY VETERINARY DIAGNOSTIC INSTRUMENTS, BY COMPANY (2022)

TABLE 35 VETERINARY DIAGNOSTIC INSTRUMENTS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7 VETERINARY DIAGNOSTIC MARKET, BY TECHNOLOGY (Page No. - 139)

7.1 INTRODUCTION

TABLE 36 VETERINARY DIAGNOSTIC INDUSTRY, BY TECHNOLOGY, 2021–2029 (USD MILLION)

7.2 IMMUNODIAGNOSTICS

TABLE 37 KEY VETERINARY IMMUNODIAGNOSTIC PRODUCTS, BY COMPANY

TABLE 38 VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 39 VETERINARY IMMUNODIAGNOSTICS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.2.1 LATERAL FLOW ASSAYS

TABLE 40 LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 41 LATERAL FLOW ASSAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.2.1.1 Lateral flow rapid tests

7.2.1.1.1 Lateral flow rapid tests to dominate market

TABLE 42 LATERAL FLOW RAPID TESTS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.2.1.2 Lateral flow strip readers

7.2.1.2.1 Rising need for readers to determine analyte quantity to drive adoption

TABLE 43 LATERAL FLOW STRIP READERS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.2.2 ELISA

7.2.2.1 Cost-effectiveness and ease of use to drive demand

TABLE 44 ELISA MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.2.3 ALLERGEN-SPECIFIC IMMUNODIAGNOSTIC TESTS

7.2.3.1 Increasing incidence of allergies in companion animals to drive market growth

TABLE 45 ALLERGEN-SPECIFIC IMMUNODIAGNOSTIC TESTS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.2.4 IMMUNOASSAY ANALYZERS

7.2.4.1 Growing use of immunoassay analyzers for livestock to propel market

TABLE 46 IMMUNOASSAY ANALYZERS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.2.5 RADIOIMMUNOASSAYS

7.2.5.1 Growing importance, high sensitivity & specificity to drive market

TABLE 47 RADIOIMMUNOASSAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.2.6 OTHER IMMUNODIAGNOSTIC PRODUCTS

TABLE 48 OTHER IMMUNODIAGNOSTIC PRODUCTS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3 CLINICAL BIOCHEMISTRY

TABLE 49 KEY VETERINARY CLINICAL BIOCHEMISTRY PRODUCTS, BY COMPANY

TABLE 50 VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 51 VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.1 CLINICAL CHEMISTRY ANALYSIS

TABLE 52 CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 53 CLINICAL CHEMISTRY ANALYSIS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.1.1 Clinical chemistry reagent clips & cartridges

7.3.1.1.1 Rising number of screening tests performed to drive market

TABLE 54 CLINICAL CHEMISTRY REAGENT CLIPS & CARTRIDGES MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.1.2 Clinical chemistry analyzers

7.3.1.2.1 Increasing installations of clinical chemistry analyzers to propel growth

TABLE 55 CLINICAL CHEMISTRY ANALYZERS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.2 GLUCOSE MONITORING

TABLE 56 GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 57 GLUCOSE MONITORING MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.2.1 Blood glucose strips

7.3.2.1.1 Growing demand for blood glucose strips in home care settings to drive market

TABLE 58 BLOOD GLUCOSE STRIPS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.2.2 Glucose monitors

7.3.2.2.1 Growing incidence of diabetes in pet animals to drive adoption of glucose monitors

TABLE 59 GLUCOSE MONITORS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.2.3 Urine glucose strips

7.3.2.3.1 Growing risk of DKA in animals to drive market

TABLE 60 URINE GLUCOSE STRIPS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.3 BLOOD GAS & ELECTROLYTE ANALYSIS

TABLE 61 BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 62 BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.3.1 Blood gas & electrolyte reagent clips & cartridges

7.3.3.1.1 Easy availability of animal species-specific preloaded reagent clips to boost market growth

TABLE 63 BLOOD GAS & ELECTROLYTE REAGENT CLIPS & CARTRIDGES MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.3.3.2 Blood gas & electrolyte analyzers

7.3.3.2.1 Growing adoption of analyzers to determine oxygen and carbon dioxide levels in blood to drive market

TABLE 64 BLOOD GAS & ELECTROLYTE ANALYZERS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.4 MOLECULAR DIAGNOSTICS

TABLE 65 VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 66 VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.4.1 PCR TESTS

7.4.1.1 Increased laboratory usage of PCR in proteomics and genomics to support growth

TABLE 67 PCR TESTS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.4.2 MICROARRAYS

7.4.2.1 Growing applications of biochips in identifying infectious diseases to propel market

TABLE 68 MICROARRAYS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.4.3 NUCLEIC ACID SEQUENCING

7.4.3.1 Increased application of nucleic acid sequencing in diagnosis to drive market

TABLE 69 NUCLEIC ACID SEQUENCING MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.4.4 OTHER MOLECULAR DIAGNOSTIC PRODUCTS

TABLE 70 OTHER MOLECULAR DIAGNOSTIC PRODUCTS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.5 URINALYSIS

TABLE 71 KEY VETERINARY URINALYSIS PRODUCTS, BY COMPANY

TABLE 72 VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 73 VETERINARY URINALYSIS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.5.1 URINALYSIS CLIPS & CARTRIDGES/PANELS

7.5.1.1 Growing use of clips and cartridges in urine analyzers to detect electrolytes to drive market

TABLE 74 URINALYSIS CLIPS & CARTRIDGES/PANELS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.5.2 URINE ANALYZERS

7.5.2.1 Development of easy-to-use urine analyzers for POC testing to drive market

TABLE 75 URINE ANALYZERS MARKET, BY COUNTRY, 2021–2029 USD MILLION)

7.5.3 URINE TEST STRIPS

7.5.3.1 Rising occurrence of kidney diseases in cats and dogs to support market

TABLE 76 URINE TEST STRIPS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.6 HEMATOLOGY

TABLE 77 KEY VETERINARY HEMATOLOGY PRODUCTS, BY COMPANY

TABLE 78 VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 79 VETERINARY HEMATOLOGY MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.6.1 HEMATOLOGY CARTRIDGES

7.6.1.1 Extensive use of hematology cartridges along with hematology analyzers for complete blood analysis to fuel growth

TABLE 80 HEMATOLOGY CARTRIDGES MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.6.2 HEMATOLOGY ANALYZERS

7.6.2.1 High usage of hematology analyzers by veterinary hospitals & clinics to support growth

TABLE 81 HEMATOLOGY ANALYZERS MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

7.7 OTHER TECHNOLOGIES

TABLE 82 OTHER VETERINARY DIAGNOSTIC TECHNOLOGIES MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

8 VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE (Page No. - 184)

8.1 INTRODUCTION

TABLE 83 VETERINARY DIAGNOSTIC INDUSTRY, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

8.2 COMPANION ANIMALS

TABLE 84 MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 85 MARKET FOR COMPANION ANIMALS, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 86 MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2021–2029 (USD MILLION)

8.2.1 DOGS

8.2.1.1 High insurance coverage for dogs to drive market

TABLE 87 CANINE POPULATION, BY COUNTRY, 2014–2022 (MILLION)

TABLE 88 MARKET FOR DOGS, BY COUNTRY, 2021–2029 (USD MILLION)

8.2.2 CATS

8.2.2.1 Growing pet cat population to support growth

TABLE 89 FELINE POPULATION, BY COUNTRY, 2012–2020 (MILLION)

TABLE 90 MARKET FOR CATS, BY COUNTRY, 2021–2029 (USD MILLION)

8.2.3 HORSES

8.2.3.1 Growing equine health awareness to drive market

FIGURE 38 US: NUMBER OF PRIVATE EQUINE CLINICAL PRACTICES, 2009–2022

TABLE 91 MARKET FOR HORSES, BY COUNTRY, 2021–2029 (USD MILLION)

8.2.4 OTHER COMPANION ANIMALS

TABLE 92 MARKET FOR OTHER COMPANION ANIMALS, BY COUNTRY, 2021–2029 (USD MILLION)

8.3 LIVESTOCK

TABLE 93 MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 94 MARKET FOR LIVESTOCK, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 95 MARKET FOR LIVESTOCK, BY COUNTRY, 2021–2029 (USD MILLION)

8.3.1 CATTLE

8.3.1.1 Growing consumption of meat to support market growth

FIGURE 39 MEAT PRODUCTION, BY TYPE, 2021–2022 (MILLION TONS)

FIGURE 40 MILK PRODUCTION, BY REGION, 2021–2022 (MILLION TONS)

TABLE 96 MARKET FOR CATTLE, BY COUNTRY, 2021–2029 (USD MILLION)

8.3.2 PIGS

8.3.2.1 Growing incidence of infectious diseases to drive market

FIGURE 41 ANNUAL PER CAPITA MEAT CONSUMPTION PROJECTIONS, EMERGING ECONOMIES VS. DEVELOPED COUNTRIES, 2020–2030

TABLE 97 MARKET FOR PIGS, BY COUNTRY, 2021–2029 (USD MILLION)

8.3.3 POULTRY

8.3.3.1 Increasing demand for poultry meat to contribute to market growth

TABLE 98 MARKET FOR POULTRY, BY COUNTRY, 2021–2029 (USD MILLION)

8.3.4 OTHER LIVESTOCK

TABLE 99 MARKET FOR OTHER LIVESTOCK, BY COUNTRY, 2021–2029 (USD MILLION)

9 VETERINARY DIAGNOSTIC MARKET, BY APPLICATION (Page No. - 203)

9.1 INTRODUCTION

TABLE 100 VETERINARY DIAGNOSTIC INDUSTRY, BY APPLICATION, 2021–2029 (USD MILLION)

9.2 INFECTIOUS DISEASES

TABLE 101 MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 102 MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2021–2029 (USD MILLION)

9.2.1 BACTERIAL INFECTIONS

9.2.1.1 Bacterial infections to hold largest share of infectious disease diagnostics

TABLE 103 MARKET FOR BACTERIAL INFECTIONS, BY COUNTRY, 2021–2029 (USD MILLION)

9.2.2 VIRAL INFECTIONS

9.2.2.1 High mutation rate to ensure continued demand for diagnostics

TABLE 104 MARKET FOR VIRAL INFECTIONS, BY COUNTRY, 2021–2029 (USD MILLION)

9.2.3 PARASITIC INFECTIONS

9.2.3.1 High prevalence of parasitic infections to propel demand

TABLE 105 MARKET FOR PARASITIC INFECTIONS, BY COUNTRY, 2021–2029 (USD MILLION)

9.2.4 OTHER INFECTIONS

TABLE 106 MARKET FOR OTHER INFECTIONS, BY COUNTRY, 2021–2029 (USD MILLION)

9.3 ENDOCRINOLOGY

9.3.1 GROWING RISK OF DIABETES TO SUPPORT DEMAND

TABLE 107 MARKET FOR ENDOCRINOLOGY, BY COUNTRY, 2021–2029 (USD MILLION)

9.4 CARDIOLOGY

9.4.1 RISING INCIDENCE OF CARDIAC DISEASES IN DOGS TO DRIVE MARKET

TABLE 108 MARKET FOR CARDIOLOGY, BY COUNTRY, 2021–2029 (USD MILLION)

9.5 ONCOLOGY

9.5.1 HIGH INCIDENCE OF CANINE CANCER TO DRIVE MARKET

TABLE 109 MARKET FOR ONCOLOGY, BY COUNTRY, 2021–2029 (USD MILLION)

9.6 OTHER APPLICATIONS

TABLE 110 MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2029 (USD MILLION)

10 VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL (Page No. - 216)

10.1 INTRODUCTION

TABLE 111 VETERINARY DIAGNOSTIC INDUSTRY, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

10.2 DIRECT SALES

10.2.1 DIRECT SALES TO HOLD LARGEST MARKET SHARE

TABLE 112 MARKET FOR DIRECT SALES, BY COUNTRY, 2021–2029 (USD MILLION)

10.3 WHOLESALERS & DISTRIBUTORS

10.3.1 GROWING VOLUME OF INTERNATIONAL SALES TO SUPPORT SEGMENT GROWTH

TABLE 113 MARKET FOR WHOLESALERS & DISTRIBUTORS, BY COUNTRY, 2021–2029 (USD MILLION)

10.4 ONLINE SALES PLATFORMS

10.4.1 ONLINE SALES TO SEE HIGHEST GROWTH

TABLE 114 MARKET FOR ONLINE SALES PLATFORMS, BY COUNTRY, 2021–2029 (USD MILLION)

11 VETERINARY DIAGNOSTIC MARKET, BY END USER (Page No. - 223)

11.1 INTRODUCTION

TABLE 115 VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

11.2 VETERINARY REFERENCE LABORATORIES

11.2.1 LARGE VOLUME OF SAMPLES RECEIVED BY VETERINARY REFERENCE LABORATORIES TO DRIVE MARKET GROWTH

TABLE 116 MARKET FOR VETERINARY REFERENCE LABORATORIES, BY COUNTRY, 2021–2029 (USD MILLION)

11.3 VETERINARY HOSPITALS & CLINICS

11.3.1 GROWING PET OWNERSHIP AND SPENDING ON PET CARE TO PROPEL MARKET

FIGURE 42 US: VETERINARIAN CLINICAL PRACTICES, BY TYPE, 2022

TABLE 117 MARKET FOR VETERINARY HOSPITALS & CLINICS, BY COUNTRY, 2021–2029 (USD MILLION)

11.4 POC/IN-HOUSE TESTING

11.4.1 EASE OF USE, COST-EFFECTIVENESS, AND SWIFT RESULTS OFFERED BY POINT-OF-CARE TESTS TO DRIVE DEMAND

TABLE 118 MARKET FOR POC/IN-HOUSE TESTING, BY COUNTRY, 2021–2029 (USD MILLION)

11.5 VETERINARY RESEARCH INSTITUTES & UNIVERSITIES

11.5.1 INCREASING COLLABORATIONS BETWEEN PRIVATE COMPANIES AND VETERINARY RESEARCH INSTITUTES TO SUPPORT GROWTH

TABLE 119 MARKET FOR VETERINARY RESEARCH INSTITUTES & UNIVERSITIES, BY COUNTRY, 2021–2029 (USD MILLION)

12 VETERINARY DIAGNOSTIC MARKET, BY REGION (Page No. - 230)

12.1 INTRODUCTION

TABLE 120 VETERINARY DIAGNOSTIC INDUSTRY, BY REGION, 2021–2029 (USD MILLION)

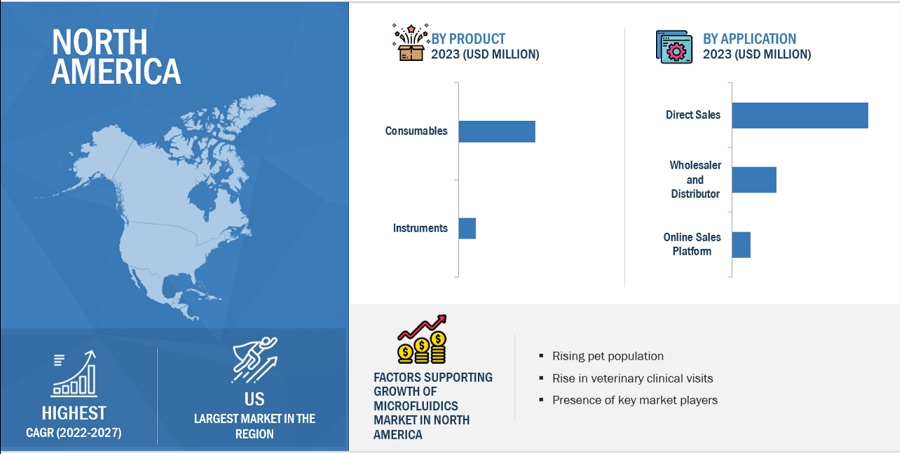

12.2 NORTH AMERICA

FIGURE 43 NORTH AMERICA: PROJECTED GROWTH IN NUMBER OF VETERINARIANS

12.2.1 NORTH AMERICA: RECESSION IMPACT

FIGURE 44 NORTH AMERICA: VETERINARY DIAGNOSTIC MARKET SNAPSHOT

TABLE 121 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 123 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 124 NORTH AMERICA: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 125 NORTH AMERICA: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 126 NORTH AMERICA: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 127 NORTH AMERICA: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 128 NORTH AMERICA: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 129 NORTH AMERICA: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 130 NORTH AMERICA: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 131 NORTH AMERICA: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 132 NORTH AMERICA: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 133 NORTH AMERICA: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 134 NORTH AMERICA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 136 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 138 NORTH AMERICA: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 139 NORTH AMERICA: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.2.2 US

12.2.2.1 US to dominate North American market during forecast period

FIGURE 45 US: POPULATION OF DOGS, 2012–2022 (MILLION)

FIGURE 46 US: EXPENDITURE ON VET VISITS, 2013–2021

TABLE 140 HEALTHCARE EXPENDITURE ON COMPANION ANIMALS, 2018 VS. 2020 VS 2021

FIGURE 47 US: VETERINARIAN INCOME LEVELS, 2017–2022

FIGURE 48 US: NUMBER OF VETERINARIANS, 2016–2021

TABLE 141 US: FOOD-PRODUCING ANIMAL POPULATION, 2001–2019 (MILLION)

TABLE 142 US: NUMBER OF VETERINARIANS IN PRIVATE CLINICAL PRACTICES, 2014–2020

TABLE 143 US: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 144 US: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 145 US: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 146 US: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 147 US: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 148 US: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 149 US: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 150 US: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 151 US: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 152 US: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 153 US: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 154 US: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 155 US: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 156 US: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 157 US: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 158 US: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 159 US: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 160 US: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Growing pet adoption in Canada to drive market growth

FIGURE 49 CANADA: COMPANION ANIMAL POPULATION, 2020–2022 (MILLION)

TABLE 161 CANADA: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 162 CANADA: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 163 CANADA: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 164 CANADA: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 165 CANADA: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 166 CANADA: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 167 CANADA: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 168 CANADA: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 169 CANADA: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 170 CANADA: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 171 CANADA: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 172 CANADA: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 173 CANADA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 174 CANADA: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 175 CANADA: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 176 CANADA: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 177 CANADA: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 178 CANADA: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.3 EUROPE

TABLE 179 EUROPE: COMPANION POPULATION, 2022 (MILLION)

12.3.1 EUROPE: RECESSION IMPACT

TABLE 180 EUROPE: VETERINARY DIAGNOSTIC MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

TABLE 181 EUROPE: MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 182 EUROPE: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 183 EUROPE: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 184 EUROPE: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 185 EUROPE: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 186 EUROPE: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 187 EUROPE: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 188 EUROPE: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 189 EUROPE: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 190 EUROPE: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 191 EUROPE: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 192 EUROPE: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 193 EUROPE: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 194 EUROPE: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 195 EUROPE: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 196 EUROPE: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 197 EUROPE: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 198 EUROPE: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Rising awareness of zoonotic diseases to drive market growth

TABLE 199 GERMANY: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 200 GERMANY: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 201 GERMANY: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 202 GERMANY: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 203 GERMANY: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 204 GERMANY: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 205 GERMANY: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 206 GERMANY: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 207 GERMANY: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 208 GERMANY: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 209 GERMANY: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 210 GERMANY: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 211 GERMANY: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 212 GERMANY: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 213 GERMANY: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 214 GERMANY: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 215 GERMANY: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 216 GERMANY: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.3.3 UK

12.3.3.1 Increasing pet ownership to drive market

TABLE 217 UK: HOUSEHOLDS WITH PETS (2022)

TABLE 218 UK: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 219 UK: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 220 UK: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 221 UK: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 222 UK: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 223 UK: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 224 UK: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 225 UK: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 226 UK: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 227 UK: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 228 UK: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 229 UK: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 230 UK: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 231 UK: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 232 UK: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 233 UK: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 234 UK: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 235 UK: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Willingness of pet owners to spend on pet health to drive market

TABLE 236 FRANCE: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 237 FRANCE: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 238 FRANCE: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 239 FRANCE: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 240 FRANCE: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 241 FRANCE: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 242 FRANCE: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 243 FRANCE: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 244 FRANCE: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 245 FRANCE: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 246 FRANCE: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 247 FRANCE: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 248 FRANCE: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 249 FRANCE: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 250 FRANCE: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 251 FRANCE: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 252 FRANCE: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 253 FRANCE: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.3.5 ITALY

12.3.5.1 Rising awareness about pet healthcare to propel market growth

TABLE 254 ITALY: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 255 ITALY: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 256 ITALY: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 257 ITALY: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 258 ITALY: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 259 ITALY: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 260 ITALY: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 261 ITALY: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 262 ITALY: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 263 ITALY: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 264 ITALY: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 265 ITALY: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 266 ITALY: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 267 ITALY: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 268 ITALY: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 269 ITALY: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 270 ITALY: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 271 ITALY: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.3.6 SPAIN

12.3.6.1 Growing demand for pig and poultry products to aid adoption of veterinary diagnostic products

TABLE 272 SPAIN: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 273 SPAIN: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 274 SPAIN: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 275 SPAIN: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 276 SPAIN: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 277 SPAIN: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 278 SPAIN: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 279 SPAIN: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 280 SPAIN: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 281 SPAIN: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 282 SPAIN: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 283 SPAIN: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 284 SPAIN: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 285 SPAIN: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 286 SPAIN: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 287 SPAIN: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 288 SPAIN: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 289 SPAIN: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.3.7 REST OF EUROPE

TABLE 290 REST OF EUROPE: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 291 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 292 REST OF EUROPE: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 293 REST OF EUROPE: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 294 REST OF EUROPE: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 295 REST OF EUROPE: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 296 REST OF EUROPE: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 297 REST OF EUROPE: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 298 REST OF EUROPE: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 299 REST OF EUROPE: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 300 REST OF EUROPE: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 301 REST OF EUROPE: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 302 REST OF EUROPE: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 303 REST OF EUROPE: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 304 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 305 REST OF EUROPE: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 306 REST OF EUROPE: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 307 REST OF EUROPE: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: RECESSION IMPACT

FIGURE 50 ASIA PACIFIC: VETERINARY DIAGNOSTIC MARKET SNAPSHOT

TABLE 308 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

TABLE 309 ASIA PACIFIC: MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 310 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 311 ASIA PACIFIC: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 312 ASIA PACIFIC: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 313 ASIA PACIFIC: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 314 ASIA PACIFIC: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 315 ASIA PACIFIC: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 316 ASIA PACIFIC: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 317 ASIA PACIFIC: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 318 ASIA PACIFIC: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 319 ASIA PACIFIC: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 320 ASIA PACIFIC: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 321 ASIA PACIFIC: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 322 ASIA PACIFIC: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 323 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 324 ASIA PACIFIC: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 325 ASIA PACIFIC: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 326 ASIA PACIFIC: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Large pool of food-producing animals in China to drive market

TABLE 327 CHINA: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 328 CHINA: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 329 CHINA: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 330 CHINA: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 331 CHINA: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 332 CHINA: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 333 CHINA: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 334 CHINA: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 335 CHINA: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 336 CHINA: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 337 CHINA: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 338 CHINA: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 339 CHINA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 340 CHINA: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 341 CHINA: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 342 CHINA: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 343 CHINA: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 344 CHINA: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Rising awareness about zoonotic diseases and increased pet expenditure to support adoption

FIGURE 51 JAPAN: FOOD, SNACK, AND MEDICAL EXPENDITURE FOR CATS AND DOGS (USD)

TABLE 345 NUMBER OF DOMESTICATED DOGS AND CATS IN JAPAN, 2012–2020 (THOUSAND)

TABLE 346 PRODUCTION, CONSUMPTION, IMPORT, AND EXPORT OF ANIMAL-DERIVED FOOD PRODUCTS IN JAPAN, 2000 VS. 2030 (THOUSAND METRIC TONS)

TABLE 347 JAPAN: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 348 JAPAN: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 349 JAPAN: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 350 JAPAN: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 351 JAPAN: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 352 JAPAN: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 353 JAPAN: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 354 JAPAN: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 355 JAPAN: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 356 JAPAN: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 357 JAPAN: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 358 JAPAN: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 359 JAPAN: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 360 JAPAN: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 361 JAPAN: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 362 JAPAN: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 363 JAPAN: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 364 JAPAN: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.4.4 INDIA

12.4.4.1 Growing demand for livestock products to support market growth

TABLE 365 INDIA: PRODUCTION AND CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2000 VS. 2030 (THOUSAND METRIC TONS)

TABLE 366 INDIA: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 367 INDIA: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 368 INDIA: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 369 INDIA: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 370 INDIA: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 371 INDIA: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 372 INDIA: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 373 INDIA: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 374 INDIA: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 375 INDIA: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 376 INDIA: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 377 INDIA: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 378 INDIA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 379 INDIA: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 380 INDIA: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 381 INDIA: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 382 INDIA: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 383 INDIA: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.4.5 AUSTRALIA

12.4.5.1 Increase in pet ownership will support market growth

TABLE 384 AUSTRALIA: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 385 AUSTRALIA: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 386 AUSTRALIA: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 387 AUSTRALIA: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 388 AUSTRALIA: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 389 AUSTRALIA: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 390 AUSTRALIA: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 391 AUSTRALIA: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 392 AUSTRALIA: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 393 AUSTRALIA: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 394 AUSTRALIA: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 395 AUSTRALIA: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 396 AUSTRALIA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 397 AUSTRALIA: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 398 AUSTRALIA: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 399 AUSTRALIA: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 400 AUSTRALIA: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 401 AUSTRALIA: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.4.6 SOUTH KOREA

12.4.6.1 Growing companion animal population to drive market

TABLE 402 SOUTH KOREA: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 403 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 404 SOUTH KOREA: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 405 SOUTH KOREA: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 406 SOUTH KOREA: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 407 SOUTH KOREA: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 408 SOUTH KOREA: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 409 SOUTH KOREA: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 410 SOUTH KOREA: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 411 SOUTH KOREA: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 412 SOUTH KOREA: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 413 SOUTH KOREA: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 414 SOUTH KOREA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 415 SOUTH KOREA: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 416 SOUTH KOREA: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 417 SOUTH KOREA: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 418 SOUTH KOREA: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 419 SOUTH KOREA: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.4.7 REST OF ASIA PACIFIC

TABLE 420 REST OF ASIA PACIFIC: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 421 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 422 REST OF ASIA PACIFIC: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 423 REST OF ASIA PACIFIC: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 424 REST OF ASIA PACIFIC: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 425 REST OF ASIA PACIFIC: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 426 REST OF ASIA PACIFIC: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 427 REST OF ASIA PACIFIC: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 428 REST OF ASIA PACIFIC: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 429 REST OF ASIA PACIFIC: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 430 REST OF ASIA PACIFIC: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 431 REST OF ASIA PACIFIC: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 432 REST OF ASIA PACIFIC: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 433 REST OF ASIA PACIFIC: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 434 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 435 REST OF ASIA PACIFIC: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 436 REST OF ASIA PACIFIC: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 437 REST OF ASIA PACIFIC: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.5 LATIN AMERICA

TABLE 438 LATIN AMERICA: LIVESTOCK POPULATION, BY COUNTRY, 2010–2022 (MILLION)

12.5.1 LATIN AMERICA: RECESSION IMPACT

TABLE 439 LATIN AMERICA: VETERINARY DIAGNOSTIC MARKET, BY COUNTRY, 2021–2029 (USD MILLION)

TABLE 440 LATIN AMERICA: MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 441 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 442 LATIN AMERICA: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 443 LATIN AMERICA: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 444 LATIN AMERICA: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 445 LATIN AMERICA: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 446 LATIN AMERICA: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 447 LATIN AMERICA: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 448 LATIN AMERICA: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 449 LATIN AMERICA: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 450 LATIN AMERICA: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 451 LATIN AMERICA: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 452 LATIN AMERICA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 453 LATIN AMERICA: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 454 LATIN AMERICA: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 455 LATIN AMERICA: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 456 LATIN AMERICA: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 457 LATIN AMERICA: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.5.2 BRAZIL

12.5.2.1 Well-established and rapidly growing livestock industry in Brazil to promote growth

TABLE 458 BRAZIL: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 459 BRAZIL: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 460 BRAZIL: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 461 BRAZIL: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 462 BRAZIL: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 463 BRAZIL: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 464 BRAZIL: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 465 BRAZIL: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 466 BRAZIL: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 467 BRAZIL: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 468 BRAZIL: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 469 BRAZIL: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 470 BRAZIL: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 471 BRAZIL: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 472 BRAZIL: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 473 BRAZIL: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 474 BRAZIL: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 475 BRAZIL: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.5.3 MEXICO

12.5.3.1 Mexico to retain second-largest share in Latin America till 2029

TABLE 476 MEXICO: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 477 MEXICO: MARKET, BY TECHNOLOGY, 2021–2029(USD MILLION)

TABLE 478 MEXICO: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 479 MEXICO: VETERINARY LATERAL FLOW ASSAYS MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 480 MEXICO: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 481 MEXICO: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 482 MEXICO: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 483 MEXICO: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 484 MEXICO: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 485 MEXICO: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 486 MEXICO: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 487 MEXICO: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 488 MEXICO: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 489 MEXICO: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 490 MEXICO: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 491 MEXICO: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 492 MEXICO: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 493 MEXICO: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 494 MEXICO: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.5.4 REST OF LATIN AMERICA

TABLE 495 REST OF LATIN AMERICA: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 496 REST OF LATIN AMERICA: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 497 REST OF LATIN AMERICA: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 498 REST OF LATIN AMERICA: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 499 REST OF LATIN AMERICA: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 500 REST OF LATIN AMERICA: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 501 REST OF LATIN AMERICA: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 502 REST OF LATIN AMERICA: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 503 REST OF LATIN AMERICA: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 504 REST OF LATIN AMERICA: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 505 REST OF LATIN AMERICA: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 506 REST OF LATIN AMERICA: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 507 REST OF LATIN AMERICA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 508 REST OF LATIN AMERICA: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 509 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 510 REST OF LATIN AMERICA: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 511 REST OF LATIN AMERICA: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 512 REST OF LATIN AMERICA: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

12.6 MIDDLE EAST & AFRICA

12.6.1 LOW PORK PRODUCTION AND CONSUMPTION IN MIDDLE EASTERN COUNTRIES DUE TO RELIGIOUS CUSTOMS TO LIMIT GROWTH

12.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

TABLE 513 MIDDLE EAST & AFRICA: VETERINARY DIAGNOSTIC MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 514 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2021–2029 (USD MILLION)

TABLE 515 MIDDLE EAST & AFRICA: VETERINARY IMMUNODIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 516 MIDDLE EAST & AFRICA: VETERINARY LATERAL FLOW ASSAYS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 517 MIDDLE EAST & AFRICA: VETERINARY CLINICAL BIOCHEMISTRY MARKET, BY TYPE, 2021–2029 (USD MILLION)

TABLE 518 MIDDLE EAST & AFRICA: CLINICAL CHEMISTRY ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 519 MIDDLE EAST & AFRICA: GLUCOSE MONITORING MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 520 MIDDLE EAST & AFRICA: BLOOD GAS & ELECTROLYTE ANALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 521 MIDDLE EAST & AFRICA: VETERINARY MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 522 MIDDLE EAST & AFRICA: VETERINARY HEMATOLOGY MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 523 MIDDLE EAST & AFRICA: VETERINARY URINALYSIS MARKET, BY PRODUCT, 2021–2029 (USD MILLION)

TABLE 524 MIDDLE EAST & AFRICA: VETERINARY DIAGNOSTIC MARKET, BY ANIMAL TYPE, 2021–2029 (USD MILLION)

TABLE 525 MIDDLE EAST & AFRICA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2021–2029 (USD MILLION)

TABLE 526 MIDDLE EAST & AFRICA: MARKET FOR LIVESTOCK, BY TYPE, 2021–2029 (USD MILLION)

TABLE 527 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2021–2029 (USD MILLION)

TABLE 528 MIDDLE EAST & AFRICA: MARKET FOR INFECTIOUS DISEASES, BY TYPE, 2021–2029 (USD MILLION)

TABLE 529 MIDDLE EAST & AFRICA: VETERINARY DIAGNOSTIC MARKET, BY DISTRIBUTION CHANNEL, 2021–2029 (USD MILLION)

TABLE 530 MIDDLE EAST & AFRICA: VETERINARY DIAGNOSTIC INDUSTRY, BY END USER, 2021–2029 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 424)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

13.3 REVENUE ANALYSIS

FIGURE 52 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST FIVE YEARS

13.4 MARKET SHARE ANALYSIS

FIGURE 53 VETERINARY DIAGNOSTIC MARKET: MARKET SHARE ANALYSIS, 2022

13.5 COMPANY EVALUATION MATRIX

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 54 VETERINARY DIAGNOSTIC INDUSTRY: COMPANY EVALUATION MATRIX, 2022

13.5.5 COMPANY FOOTPRINT

TABLE 531 PRODUCT FOOTPRINT

TABLE 532 TECHNOLOGY FOOTPRINT

TABLE 533 END-USER FOOTPRINT

TABLE 534 REGION FOOTPRINT

TABLE 535 COMPANY FOOTPRINT

13.6 START-UP/SME EVALUATION MATRIX

13.6.1 PROGRESSIVE COMPANIES

13.6.2 DYNAMIC COMPANIES

13.6.3 STARTING BLOCKS

13.6.4 RESPONSIVE COMPANIES

FIGURE 55 VETERINARY DIAGNOSTIC INDUSTRY: START-UP/SME EVALUATION MATRIX (2022)

13.6.5 COMPETITIVE BENCHMARKING

13.7 COMPETITIVE SCENARIO

13.7.1 PRODUCT LAUNCHES

TABLE 536 PRODUCT LAUNCHES

13.7.2 DEALS

TABLE 537 DEALS

13.7.3 OTHER DEVELOPMENTS

TABLE 538 OTHER DEVELOPMENTS

14 COMPANY PROFILES (Page No. - 439)

14.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1.1 IDEXX LABORATORIES, INC.

TABLE 539 IDEXX LABORATORIES, INC.: COMPANY OVERVIEW

FIGURE 56 IDEXX LABORATORIES: COMPANY SNAPSHOT (2022)

14.1.2 ZOETIS, INC.

TABLE 540 ZOETIS, INC.: COMPANY OVERVIEW

FIGURE 57 ZOETIS, INC.: COMPANY SNAPSHOT (2022)

14.1.3 THERMO FISHER SCIENTIFIC, INC.

TABLE 541 THERMO FISHER SCIENTIFIC: COMPANY OVERVIEW

FIGURE 58 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (20222)

14.1.4 HESKA CORPORATION (MARS INCORPORATED)

TABLE 542 HESKA CORPORATION: COMPANY OVERVIEW

FIGURE 59 HESKA CORPORATION: COMPANY SNAPSHOT (2022)

14.1.5 BIOMÉRIEUX SA

TABLE 543 BIOMÉRIEUX SA: COMPANY OVERVIEW

FIGURE 60 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2022)

14.1.6 NEOGEN CORPORATION

TABLE 544 NEOGEN CORPORATION: COMPANY OVERVIEW

FIGURE 61 NEOGEN CORPORATION: COMPANY SNAPSHOT (2022)

14.1.7 BIO-RAD LABORATORIES, INC.

TABLE 545 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

FIGURE 62 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

14.1.8 VIRBAC

TABLE 546 VIRBAC: COMPANY OVERVIEW

FIGURE 63 VIRBAC: COMPANY SNAPSHOT (2022)

14.1.9 FUJIFILM HOLDINGS CORPORATION

TABLE 547 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

FIGURE 64 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

14.1.10 SHENZHEN MINDRAY ANIMAL MEDICAL TECHNOLOGY CO., LTD.

TABLE 548 SHENZHEN MINDRAY ANIMAL MEDICAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

FIGURE 65 MINDRAY GROUP: COMPANY SNAPSHOT (2022)

14.1.11 INDICAL BIOSCIENCE GMBH

TABLE 549 INDICAL BIOSCIENCE GMBH: COMPANY OVERVIEW

14.1.12 BIONOTE INC.

TABLE 550 BIONOTE INC.: COMPANY OVERVIEW

14.1.13 BIOGAL GALED LABS

TABLE 551 BIOGAL GALED LABS: COMPANY OVERVIEW

14.1.14 AGROLABO S.P.A.

TABLE 552 AGROLABO S.P.A.: COMPANY OVERVIEW

14.1.15 INNOVATIVE DIAGNOSTICS

TABLE 553 INNOVATIVE DIAGNOSTICS: COMPANY OVERVIEW 14.2 OTHER PLAYERS

14.2.1 RANDOX LABORATORIES LTD.

14.2.2 BIOCHEK

14.2.3 FASSISI GMBH

14.2.4 ALVEDIA

14.2.5 SKYER, INC.

14.2.6 SHENZHEN BIOEASY BIOTECHNOLOGY CO., LTD.

14.2.7 PRECISION BIOSENSOR

14.2.8 EUROIMMUN MEDIZINISCHE LABORDIAGNOSTIKA AG

14.2.9 GOLD STANDARD DIAGNOSTICS

14.2.10 ANTECH DIAGNOSTICS, INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 519)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Diagnostic Market

Which is the leading segment dominating the Veterinary Diagnostics Market?

Can you give some more information on the key factors impacting the Veterinary Diagnostics Market?

Which are the latest trends to focus for revenue expansion in Veterinary Diagnostics Market?