Veterinary Endoscopy Market by Product Type (Flexible, Videoscope, Fibreoptic, Rigid), Procedure (Bronchoscopy, Laparoscopy, Gastroduodenoscopy, Colonoscopy, Rhinoscopy), Animal (Companion, Large), End User (Hospitals, Clinics) - Global Forecasts to 2023

The global veterinary endoscopy market is expected to reach USD 219.0 million by 2023, at a CAGR of 6.5%. The market growth is primarily driven by the growing pet population, increasing number of pet health insurance, and advanced applications of veterinary endoscopes.

The objectives of this study are as follows:

- To define, describe, and forecast the market by product type, procedure, animal type, end user, and region

- To forecast the revenue of the market segments of North America, Europe, Asia Pacific and the Rest of the World (RoW)

- To identify the micromarkets with respect to drivers, restraints, industry-specific challenges, and opportunities affecting the growth of the market

- To analyze market segments and subsegments with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as partnerships, agreements, collaborations; mergers and acquisitions; product launches; and research and development activities in the veterinary endoscopy market

Research Methodology

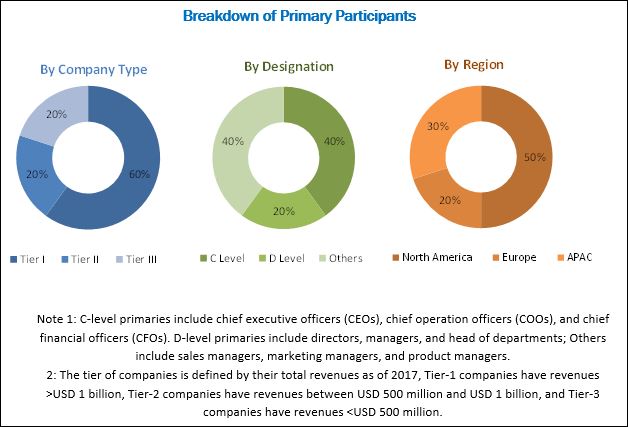

Top-down and bottom-up approaches were used to estimate and validate the size of veterinary endoscopy industry and to estimate the size of dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual submarkets (mentioned in the market segmentation by product type, procedure, animal type, end user, and region) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Various secondary sources such as the World Veterinary Association (WVA), American Veterinary Medical Association (AVMA), International Federation for Animal Health (IFAH), Animal Health Institute (AHI), Veterinary Endoscopy Society (VES), Canadian Veterinary Medical Association (CVMA), Federation of Veterinarians of Europe (FVE), Association of American Veterinary Medical Colleges (AAVMC), American Animal Hospital Association (AAHA), American Association of Industry Veterinarians (AAIV), European Society of Comparative Gastroenterology (ESCG), European School for Advanced Veterinary Studies (ESAVS), Japan Veterinary Medical Association (JVMA), Federation of Asian Veterinary Associations (FAVA), Indian Veterinary Association (IVA), North American Pet Health Insurance Association (NAPHIA), World Organization for Animal Health (OIE), and many others, have been used to identify and collect information useful for this extensive commercial study of the market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information and to assess prospects of the market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key players in the veterinary endoscopy market include Endoscopy Support Services (US), Biovision Veterinary Endoscopy (US), Welch Allyn (US), Dr. Fritz (Germany), KARL STORZ (Germany), Fujifilm (Japan), Olympus (Japan), Eickemeyer (Germany), B. Braun (Germany), and STERIS (UK).

Target Audience for this Report:

- Veterinary endoscope manufacturers

- Veterinary endoscope distributors

- Animal health research and development companies

- Veterinary reference laboratories

- Veterinary hospitals and Diagnostic Imaging laboratories

- Market research and consulting firms

- Venture capitalists and investors

- Government associations

Veterinary Endoscopy Market Scope

This report categorizes the veterinary endoscopy market into the following segments:

By Product Type

-

Flexible Endoscopes

- Video Endoscopes

- Fibre-optic Endoscopes

- Rigid Endoscopes

- Other Endoscopes

By Procedure

-

Flexible Endoscopy

- Gastroduodenoscopy

- Colonoscopy

- Bronchoscopy

- Male Urethrocystoscopy

- Tracheoscopy

- Other Flexible Endoscopy Procedures

-

Rigid Endoscopy

- Laparoscopy

- Otoscopy

- Rhinoscopy

- Thoracoscopy

- Arthroscopy

- Other Rigid Endoscopy Procedures

- Other Procedures

By Animal Type

- Companion Animals

- Large Animals

- Other Animals

By End User

- Hospitals & Academic Institutes

- Clinics

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World (RoW)

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

The global market is segmented by product type, procedure, animal type, end user, and region. By product type, the market is segmented into flexible endoscopes, rigid endoscopes, and other endoscopes. The flexible endoscopes segment is expected to dominate the market. The large share of this segment can primarily be attributed to wider applications of flexible endoscopes compared to rigid endoscopes.

On the basis of procedure type, the veterinary endoscopy market is segmented into flexible endoscopy, rigid endoscopy, and other procedures. The flexible endoscopy segment is expected to account for the largest share of the market. The large share of this segment can primarily be attributed to the increasing number of flexible endoscopy procedures across the globe.

By animal type, the market is segmented into companion animals, large animals, and other animals. The companion animals segment is expected to account for the largest share of the market. The large share can be attributed to the growing use of veterinary endoscopy for the diagnosis of gastrointestinal diseases in companion animals, increasing awareness about animal health among pet owners, rising pet healthcare expenditure, and the growing companion animal population worldwide.

On the basis of end users, the market is segmented into hospitals and academic institutes and clinics. The hospitals and academic institutes segment is expected to account for the largest share of the veterinary endoscopy market in 2018. Most endoscopy procedures are performed in hospital-based settings which is a key factor driving the growth of this segment.

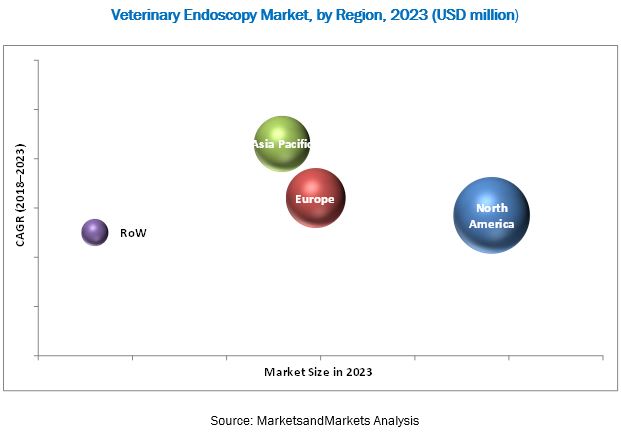

On the basis of region, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is expected to account for the largest share of the veterinary endoscopy market. Rising adoption of companion animals, increasing pet healthcare insurance, and improved veterinary healthcare infrastructure in the region are driving the market in North America.

The factors such as the high cost of veterinary endoscopes and the increasing cost of pet care may restrain market growth to a certain extent.

Major industry players adopted geographical expansions, product launches, and acquisitions to maintain and improve their position in the market. KARL STORZ (Germany), Olympus (Japan), and Fujifilm (Japan) have been identified as key players in this market. These companies have a broad product portfolio with comprehensive features and have also expanded their presence geographically. These leaders also have products for all end users in this market, a strong geographical presence, and they focus on continuous product innovations.

Frequently Asked Questions (FAQs):

What is the size of Veterinary Endoscopy Market?

The global veterinary endoscopy market is expected to reach USD 219.0 million by 2023, at a CAGR of 6.5%.

What are the major growth factors of Veterinary Endoscopy Market?

The market growth is primarily driven by the growing pet population, increasing number of pet health insurance, and advanced applications of veterinary endoscopes.

Who all are the prominent players of Veterinary Endoscopy Market?

The key players in the veterinary endoscopy market include Endoscopy Support Services (US), Biovision Veterinary Endoscopy (US), Welch Allyn (US), Dr. Fritz (Germany), KARL STORZ (Germany), Fujifilm (Japan), Olympus (Japan), Eickemeyer (Germany), B. Braun (Germany), and STERIS (UK).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Veterinary Endoscopy: Market Overview

4.2 Asia Pacific: Veterinary Flexible Endoscopy Market, By Procedure and Country (2017)

4.3 Veterinary Endoscopy Market, By Product Type (2018–2023)

4.4 Geographical Snapshot of the Market

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use of Endoscopes in the Diagnosis of Gastrointestinal Diseases

5.2.1.2 Rising Number of Veterinary Endoscopy Training Programs

5.2.1.3 Increasing Pet Insurance and Growing Animal Health Expenditure

5.2.1.4 Growing Population of Companion Animals

5.2.1.5 Advanced Applications of Veterinary Endoscopy

5.2.1.6 Rising Demand for Animal-Derived Food Products

5.2.1.7 Growth in the Number of Veterinary Practitioners

5.2.2 Restraints

5.2.2.1 High Cost of Veterinary Endoscopes

5.2.2.2 Increasing Pet Care Costs

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of Capsule Endoscopy

5.2.3.2 Growth Opportunities in Emerging Economies

5.2.4 Challenges

5.2.4.1 Lack of Animal Health Awareness in Emerging Economies

5.2.4.2 Shortage of Veterinarians in Developing Countries

6 Veterinary Endoscopy Market, By Product Type (Page No. - 45)

6.1 Introduction

6.2 Flexible Endoscopes

6.2.1 Flexible Endoscopes Market, By Type

6.2.1.1 Video Endoscopes

6.2.1.2 Fibre-Optic Endoscopes

6.3 Rigid Endoscopes

6.4 Other Endoscopes

7 Veterinary Endoscopy Market, By Procedure (Page No. - 53)

7.1 Introduction

7.2 Flexible Endoscopy

7.2.1.1 Gastroduodenoscopy

7.2.1.2 Colonoscopy

7.2.1.3 Bronchoscopy

7.2.1.4 Male Urethrocystoscopy

7.2.1.5 Tracheoscopy

7.2.1.6 Other Flexible Endoscopy Procedures

7.3 Rigid Endoscopy

7.3.1.1 Laparoscopy

7.3.1.2 Otoscopy

7.3.1.3 Rhinoscopy

7.3.1.4 Thoracoscopy

7.3.1.5 Arthroscopy

7.3.1.6 Other Rigid Endoscopy Procedures

7.4 Other Procedures

8 Veterinary Endoscopy Market, By Animal Type (Page No. - 69)

8.1 Introduction

8.2 Companion Animals

8.3 Large Animals

8.4 Other Animals

9 Veterinary Endoscopy Market, By End User (Page No. - 74)

9.1 Introduction

9.2 Hospitals & Academic Institutes

9.3 Clinics

10 Veterinary Endoscopy Market, By Region (Page No. - 79)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of Asia Pacific

10.5 Rest of the World

11 Competitive Landscape (Page No. - 126)

11.1 Overview

11.2 Ranking of Key Players

11.3 Competitive Scenario

11.3.1 Expansions

11.3.2 Product Launches and Approvals

11.3.3 Acquisitions

12 Company Profiles (Page No. - 129)

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1 Karl Storz

12.2 Olympus

12.3 Fujifilm

12.4 Eickemeyer

12.5 B. Braun Melsungen

12.6 Steris

12.7 Endoscopy Support Services

12.8 Biovision Veterinary Endoscopy

12.9 Welch Allyn

12.10 Dr. Fritz

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 146)

13.1 Industry Insights

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (113 Tables)

Table 1 UK: Prevalence of Gastrointestinal Diseases in Pets, 2015 (Per 1,000 Animals)

Table 2 Key Veterinary Training Programs & Courses

Table 3 Trends in Meat and Milk Consumption in Developed and Developing Countries

Table 4 Number of Veterinary Professionals in Developed Economies (2014 vs 2016)

Table 5 Market, By Product Type, 2016–2023 (USD Million)

Table 6 Veterinary Endoscopy Market, By Product Type, 2016–2023 (Unit)

Table 7 Flexible Endoscopes Market, By Region, 2016–2023 (USD Million)

Table 8 Flexible Endoscopes Market, By Type, 2016–2023 (USD Million)

Table 9 Flexible Videoendoscopes Market, By Region, 2016–2023 (USD Million)

Table 10 Fibre-Optic Endoscopes Market, By Region, 2016–2023 (USD Million)

Table 11 Rigid Endoscopes Market, By Region, 2016–2023 (USD Million)

Table 12 Other Endoscopes Market, By Region, 2016–2023 (USD Million)

Table 13 Market, By Procedure, 2016–2023 (USD Million)

Table 14 Flexible Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 15 Flexible Endoscopy Market, By Region, 2016–2023 (USD Million)

Table 16 Gastroduodenoscopy Market, By Region, 2016–2023 (USD Million)

Table 17 Colonoscopy Market, By Region, 2016–2023 (USD Million)

Table 18 Bronchoscopy Market, By Region, 2016–2023 (USD Million)

Table 19 Male Urethrocystoscopy Market, By Region, 2016–2023 (USD Million)

Table 20 Tracheoscopy Market, By Region, 2016–2023 (USD Million)

Table 21 Other Flexible Endoscopy Procedures Market, By Region, 2016–2023 (USD Million)

Table 22 Rigid Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 23 Rigid Endoscopy Market, By Region, 2016–2023 (USD Million)

Table 24 Laparoscopy Market, By Region, 2016–2023 (USD Million)

Table 25 Otoscopy Market, By Region, 2016–2023 (USD Million)

Table 26 Rhinoscopy Market, By Region, 2016–2023 (USD Million)

Table 27 Thoracoscopy Market, By Region, 2016–2023 (USD Million)

Table 28 Arthroscopy Market, By Region, 2016–2023 (USD Million)

Table 29 Other Rigid Endoscopy Procedures Market, By Region, 2016–2023 (USD Million)

Table 30 Other Veterinary Endoscopy Procedures Market, By Region, 2016–2023 (USD Million)

Table 31 Veterinary Endoscopy Market, By Animal Type, 2016–2023 (USD Million)

Table 32 Market for Companion Animals, By Region, 2016–2023 (USD Million)

Table 33 Market for Large Animals, By Region, 2016–2023 (USD Million)

Table 34 Other Animals Market, By Region, 2016–2023 (USD Million)

Table 35 Veterinary Endoscopy Market, By End User, 2016–2023 (USD Million)

Table 36 Market for Hospitals & Academic Institutes, By Region, 2016–2023 (USD Million)

Table 37 Number of Private Veterinary Professionals in Major Countries (2012 vs 2016)

Table 38 Market for Clinics, By Region, 2016–2023 (USD Million)

Table 39 Market, By Region, 2016–2023 (USD Million)

Table 40 North America: Market, By Country, 2016–2023 (USD Million)

Table 41 North America: Veterinary Endoscopy Market, By Product Type, 2016–2023 (USD Million)

Table 42 North America: Flexible Endoscopes Market, By Type, 2016–2023 (USD Million)

Table 43 North America: Veterinary Endoscopy Market, By Procedure, 2016–2023 (USD Million)

Table 44 North America: Flexible Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 45 North America: Rigid Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 46 North America: Market, By Animal Type, 2016–2023 (USD Million)

Table 47 North America: Market, By End User, 2016–2023 (USD Million)

Table 48 US: Companion Animal Population, 2014 vs 2016 (Million)

Table 49 US: Number of Veterinarians in Private Clinics Practices, 2016 vs 2017

Table 50 US: Veterinary Endoscopy Market, By Product Type, 2016–2023 (USD Million)

Table 51 US: Flexible Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 52 US: Rigid Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 53 US: Market, By Animal Type, 2016–2023 (USD Million)

Table 54 US: Market, By End User, 2016–2023 (USD Million)

Table 55 Canada: Food-Producing Animal Population, 2011–2016 (Million)

Table 56 Canada: Veterinary Endoscopy Market, By Product Type, 2016–2023 (USD Million)

Table 57 Canada: Flexible Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 58 Canada: Rigid Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 59 Canada: Veterinary Endoscopy Market, By Animal Type, 2016–2023 (USD Million)

Table 60 Canada: Market, By End User, 2016–2023 (USD Million)

Table 61 Europe: Veterinary Endoscopy Market, By Country, 2016–2023 (USD Million)

Table 62 Europe: Market, By Product Type, 2016–2023 (USD Million)

Table 63 Europe: Flexible Endoscope Market, By Type, 2016–2023 (USD Million)

Table 64 Europe: Veterinary Endoscopy Market, By Procedure, 2016–2023 (USD Million)

Table 65 Europe: Flexible Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 66 Europe: Rigid Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 67 Europe: Veterinary Endoscopy Market, By Animal Type, 2016–2023 (USD Million)

Table 68 Europe: Market, By End User, 2016–2023 (USD Million)

Table 69 Germany: Market, By Product Type, 2016–2023 (USD Million)

Table 70 Germany: Veterinary Endoscopy Market, By Animal Type, 2016–2023 (USD Million)

Table 71 Germany: Market, By End User, 2016–2023 (USD Million)

Table 72 UK: Market, By Product Type, 2016–2023 (USD Million)

Table 73 UK: Veterinary Endoscopy Market, By Animal Type, 2016–2023 (USD Million)

Table 74 UK: Market, By End User, 2016–2023 (USD Million)

Table 75 France: Market, By Product Type, 2016–2023 (USD Million)

Table 76 France: Market, By Animal Type, 2016–2023 (USD Million)

Table 77 France: Veterinary Endoscopy Market, By End User, 2016–2023 (USD Million)

Table 78 Italy: Market, By Product Type, 2016–2023 (USD Million)

Table 79 Italy: Veterinary Endoscopy Market, By Animal Type, 2016–2023 (USD Million)

Table 80 Italy: Market, By End User, 2016–2023 (USD Million)

Table 81 Spain: Veterinary Endoscopy Market, By Product Type, 2016–2023 (USD Million)

Table 82 Spain: Market, By Animal Type, 2016–2023 (USD Million)

Table 83 Spain: Veterinary Endoscopy Market, By End User, 2016–2023 (USD Million)

Table 84 RoE: Market, By Product Type, 2016–2023 (USD Million)

Table 85 RoE: Veterinary Endoscopy Market, By Animal Type, 2016–2023 (USD Million)

Table 86 RoE: Market, By End User, 2016–2023 (USD Million)

Table 87 Asia Pacific: Market, By Country, 2016–2023 (USD Million)

Table 88 Asia Pacific: Veterinary Endoscopy Market, By Product Type, 2016–2023 (USD Million)

Table 89 Asia Pacific: Flexible Endoscopes Market, By Type, 2016–2023 (USD Million)

Table 90 Asia Pacific: Veterinary Endoscopy Market, By Procedure, 2016–2023 (USD Million)

Table 91 Asia Pacific: Flexible Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 92 Asia Pacific: Rigid Endoscopy Market, By Type, 2016–2023 (USD Million)

Table 93 Asia Pacific: Market, By Animal Type, 2016–2023 (USD Million)

Table 94 Asia Pacific: Veterinary Endoscopy Market, By End User, 2016–2023 (USD Million)

Table 95 China: Market, By Product Type, 2016–2023 (USD Million)

Table 96 China: Veterinary Endoscopy Market, By Animal Type, 2016–2023 (USD Million)

Table 97 China: Market, By End User, 2016–2023 (USD Million)

Table 98 Japan: Veterinary Endoscopy Market, By Product Type, 2016–2023 (USD Million)

Table 99 Japan: Market, By Animal Type, 2016–2023 (USD Million)

Table 100 Japan: Veterinary Endoscopy Market, By End User, 2016–2023 (USD Million)

Table 101 India: Market, By Product Type, 2016–2023 (USD Million)

Table 102 India: Veterinary Endoscopy Market, By Animal Type, 2016–2023 (USD Million)

Table 103 India: Market, By End User, 2016–2023 (USD Million)

Table 104 RoAPAC: Veterinary Endoscopy Market, By Product Type, 2016–2023 (USD Million)

Table 105 RoAPAC: Market, By Animal Type, 2016–2023 (USD Million)

Table 106 RoAPAC: Market, By End User, 2016–2023 (USD Million)

Table 107 RoW: Veterinary Endoscopy Market, By Product Type, 2016–2023 (USD Million)

Table 108 RoW: Market, By Animal Type, 2016–2023 (USD Million)

Table 109 RoW: Market, By End User, 2016–2023 (USD Million)

Table 110 Ranking of Companies in the Global Veterinary Endoscopy Market (2017)

Table 111 Expansions, 2015–2018

Table 112 Product Launches and Approvals, 2015–2018

Table 113 Acquisitions, 2015–2018

List of Figures (37 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Veterinary Endoscopy Market, By Product Type, 2018 vs 2023 (USD Million)

Figure 7 Market, By Procedure, 2018 vs 2023 (USD Million)

Figure 8 Market, By Animal Type, 2018 vs 2023 (USD Million)

Figure 9 Veterinary Endoscopy Market, By End User, 2018 vs 2023 (USD Million)

Figure 10 Market, By Region, 2018 vs 2023 (USD Million)

Figure 11 Increasing Usage of Endoscopes in the Diagnosis of Gastrointestinal Diseases is Expected to Drive Market Growth

Figure 12 Gastroduodenoscopy Held the Largest Share of the Asia Pacific Veterinary Flexible Endoscopy Market in 2017

Figure 13 Flexible Endoscopes Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 14 China & India to Witness the Highest Growth Rates in the Veterinary Endoscopy Market From 2018 to 2023

Figure 15 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 North America: Pet Insurance GWP, By Country, 2013 vs 2014 vs 2015 (USD Million)

Figure 17 US: Pet Industry Expenditure, 2007–2016 (USD Billion)

Figure 18 Flexible Endoscopes Segment to Dominate the Market During the Forecast Period

Figure 19 Video Endoscopes Segment to Dominate the Flexible Endoscopes Market During the Forecast Period

Figure 20 Flexible Endoscopy to Dominate the Veterinary Endoscopy Market During the Forecast Period

Figure 21 Gastroduodenoscopy to Be the Fastest-Growing Segment in the Flexible Endoscopy Market During the Forecast Period (2018–2023)

Figure 22 Laparoscopy Segment to Dominate the Rigid Endoscopy Market During the Forecast Period

Figure 23 Companion Animals to Dominate the Market During the Forecast Period

Figure 24 Hospitals & Academic Institutes Segment to Dominate the Veterinary Endoscopy Market in 2023

Figure 25 North America to Dominate the Global Market in 2018

Figure 26 North America: Market Snapshot

Figure 27 Video Endoscopes to Dominate the North American Flexible Endoscopes Market in 2018

Figure 28 Gastroduodenoscopy Segment to Register the Highest Growth Rate in the European Flexible Endoscopy Market

Figure 29 Asia Pacific: Veterinary Endoscopy Market Snapshot

Figure 30 Companion Animals Segment to Dominate the Asia Pacific Market in 2018

Figure 31 Hospitals & Academic Institutes Segment to Dominate the RoW Veterinary Endoscopy Market in 2018

Figure 32 Expansions Was the Key Strategy Adopted By Players Between 2015 and 2018

Figure 33 Olympus: Company Snapshot (2017)

Figure 34 Fujifilm: Company Snapshot (2017)

Figure 35 B. Braun: Company Snapshot (2017)

Figure 36 Steris: Company Snapshot (2017)

Figure 37 Hill-Rom: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Endoscopy Market