Veterinary Surgical Instruments Market by Product (Sutures, Foreceps, Scissors, Electrosurgery Instruments, Cannulas), Animal (Canines, Felines, Large Animals), Application (Soft tissue, Sterilization, Gynecology, Orthopedic Surgery)

The global veterinary surgical instruments market size is projected to grow at a CAGR of 6.6%. The increasing demand for veterinary surgical instruments is driven by the rising companion animal population coupled with the growing demand for pet insurance, the rising animal health awareness levels along with the increasing animal healthcare expenditure. In addition, the growth in the number of veterinary practitioners and the growth in the number of soft tissue injuries and trauma surgeries among pets are responsible for driving the overall growth of this market. The emerging regions such as Asia-Pacific offer an added potential due to the large livestock population in this region and the rising disposable incomes in this region.

The major players in the global veterinary surgical instruments market are B. Braun Vet Care GmbH (Germany), Medtronic Plc.(Ireland), Ethicon Inc. (U.S.), JORGEN KRUSSE A/S (Denmark), Jorgensen Laboratories (U.S.), Smiths Group Plc (U.K.), Neogen Corporation (U.S.), Integra LifeSciences Holdings Corporation (U.S.), STERIS Corporation (U.S.), DRE Veterinary (U.S.), GerMedUSA, Inc. (U.S.), Surgical Holdings (U.K.), Sklar Surgical Instruments (U.S.), World Precision Instruments, Inc. (U.S.), Surgical Direct (U.S.), Antibe Therapeutics Inc. (Canada), and iM3 (U.S.).

Target Audience

- Veterinary Surgical Instrument Manufacturers and Distributors

- Veterinary Hospitals and Clinics

- Veterinary Institutes

- Research Institutes

- Government Associations

- Research and Consulting Firms

- Animal Health Research & Development (R&D) Companies

- Contract Manufacturing Organizations (CMOs)

The study answers several questions for the stakeholders, primarily which market segments to focus in the next five years for prioritizing efforts and investments and competitive landscape of the market.

Veterinary Surgical Instruments Market Report Scope

The research report categorizes the market into the following segments and subsegments:

By Product

- Sutures, Staplers and Accessories

-

Handheld Devices

- Forceps

- Scalpels

- Surgical Scissors

- Hooks & Retractors

- Trocars & Cannulas

- Electro-surgery Instruments

- Others

By Animal Type

-

Small Animals

- Canines

- Felines

- Other Small Animals

-

Large Animals

- Equines

- Other Large Animals

By Application

- Soft Tissue Surgery

- Sterilization Surgery

- Gynecology & Urology Surgery

- Dental Surgery

- Orthopedic Surgery

- Ophthalmic Surgery

- Others

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia-Pacific

- China

- Japan

- India

- Rest of Asia-Pacific (RoAPAC)

-

Rest of the World (RoW)

- Latin America

- Middle East and Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Latin American market into Brazil, Argentina, and Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Frequently Asked Questions (FAQ):

What is the size of Veterinary Surgical Instruments Market ?

The global Veterinary Surgical Instruments Market size is growing at a CAGR of 6.6%

What are the major growth factors of Veterinary Surgical Instruments Market ?

Factors such as rising animal health expenditure and pet insurance, growing companion animal market, growing demand for animal-derived food products, increasing number of veterinary practitioners and their income levels in developed regions are the primary growth drivers for the global market. However, shortage of skilled veterinarians in the developing economies and lack of animal health issues awareness in emerging markets may hinder the growth of this market to a certain extent.

Who all are the prominent players of Veterinary Surgical Instruments Market ?

Some of the prominent companies in the Veterinary Surgical Instruments Market are B. Braun Vet Care GmbH (Germany), Medtronic Plc (Ireland), Ethicon Inc. (U.S.), and JORGEN KRUSSE A/S (Denmark). Other players in this market are Jorgensen Laboratories (U.S.), Smiths Group Plc (U.K.), Neogen Corporation (U.S.),Integra LifeSciences Holdings Corporation (U.S.), STERIS Corporation (U.S.), DRE Veterinary (U.S.), GerMedUSA, Inc. (U.S.), Surgical Holdings (U.K.), Sklar Surgical Instruments (U.S.), World Precision Instruments, Inc. (U.S.), Surgical Direct (U.S.), Antibe Therapeutics Inc. (Canada), and iM3 (U.S.). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodolgy (Page No. - 21)

2.1 Research Approach

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumption for the Study

3 Executive Summary (Page No. - 30)

3.1 Introduction

3.2 Conclusion

4 Premium Insights (Page No. - 35)

4.1 Growth Potential of the Veterinary Surgical Instruments Market

4.2 Market: Geographic Growth Opportunities

4.3 North America Will Dominate the Market During the Forecast Period

4.4 Veterinary Surgical Instruments Market: Developed vs Developing Countries

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.3 Key Market Drivers

5.3.1 Growth in the Companion Animals Market

5.3.2 Rising Demand for Pet Health Insurance

5.3.3 Growth in the Number of Veterinary Practitioners in Developed Countries

5.4 Key Market Restraints

5.4.1 Shortage of Skilled Veterinarians in Developing Economies

5.5 Key Market Opportunities

5.5.1 Untapped Emerging Markets

5.5.2 Specialized Surgical Products

5.6 Key Challenges

5.6.1 Lack of Animal Health Awareness in Emerging Markets

6 Industry Insights (Page No. - 47)

6.1 Introduction

6.2 Industry Trends

6.2.1 Rising Funding in the Veterinary Industry

6.2.2 Growing Consolidation

6.3 Regulatory Analysis

7 Veterinary Surgical Instruments Market, By Product (Page No. - 50)

7.1 Introduction

7.2 Sutures, Staplers, and Accessories

7.3 Handheld Devices

7.3.1 Forceps

7.3.2 Scalpels

7.3.3 Surgical Scissors

7.3.4 Hooks & Retractors

7.3.5 Trocars & Cannulas

7.4 Electrosurgery Instruments

7.5 Other Surgical Instruments

8 Global Veterinary Surgical Instruments Market, By Type of Animal (Page No. - 65)

8.1 Introduction

8.2 Small Animals

8.2.1 Canines

8.2.2 Felines

8.2.3 Other Small Animals

8.3 Large Animals

8.3.1 Equines

8.3.2 Other Large Animals

9 Global Veterinary Surgical Instruments Market, By Application (Page No. - 79)

9.1 Introduction

9.2 Soft Tissue Surgery

9.3 Sterilization Surgery

9.4 Gynecological and Urological Surgery

9.5 Dental Surgery

9.6 Orthopedic Surgery

9.7 Ophthalmic Surgery

9.8 Other Surgeries

10 Veterinary Surgical Instruments Market, By Geography (Page No. - 91)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe (RoE)

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of Asia-Pacific (RoAPAC)

10.5 Rest of the World

10.5.1 Latin America

10.5.2 Middle East and Africa

11 Competitive Landscape (Page No. - 172)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Situation and Trends

11.3.1 Mergers & Acquisitions

11.3.2 Product Launches

11.3.3 Expansions

11.3.4 Collaborations & Agreements

12 Company Profiles (Page No. - 181)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 B. Braun Vet Care GmbH

12.3 Medtronic PLC.

12.4 Ethicon Inc.

12.5 Jørgen Kruuse A/S

12.6 Jorgensen Laboratories

12.7 Neogen Corporation

12.8 Smiths Group PLC.

12.9 DRE Veterinary

12.10 Integra Lifesciences Holdings Corporation

12.11 Steris Corporation

12.12 Germed USA, Inc.

12.13 Surgical Holdings

12.14 Sklar Surgical Instruments

12.15 IM3 Inc.

12.16 Antibe Therapeutics Inc.

12.17 World Precision Instruments

12.18 Surgical Direct

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 234)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (175 Tables)

Table 1 Companion Animal Population, By Country, 2014 (Million)

Table 2 Key Market Drivers: Impact Analysis

Table 3 Key Market Restraints: Impact Analysis

Table 4 Key Market Opportunities: Impact Analysis

Table 5 Key Market Challenges: Impact Analysis

Table 6 Funding for the Veterinary Industry

Table 7 Global Veterinary Surgical Instruments Market Size, By Product, 2014–2021 (USD Million)

Table 8 Types of Sutures Used in Animal Surgery

Table 9 Global Veterinary Sutures, Staplers, and Accessories Market Size, By Country, 2014–2021 (USD Million)

Table 10 Global Veterinary Handheld Devices Market Size, By Type, 2014–2021 (USD Million)

Table 11 Global Veterinary Handheld Devices Market Size, By Country, 2014–2021 (USD Million)

Table 12 Global Veterinary Forceps Market Size, By Country, 2014–2021 (USD Million)

Table 13 Global Veterinary Scalpels Market Size, By Country, 2014–2021 (USD Million)

Table 14 Types of Surgical Scissors Used in Veterinary Surgeries

Table 15 Global Veterinary Surgical Scissors Market Size, By Country, 2014–2021 (USD Million)

Table 16 Global Veterinary Hooks and Retractors Market Size, By Country, 2014–2021 (USD Million)

Table 17 Global Veterinary Trocars and Cannulas Market Size, By Country, 2014–2021 (USD Million)

Table 18 Global Veterinary Electrosurgery Instruments Market Size, By Country, 2014–2021 (USD Million)

Table 19 Global Other Veterinary Surgical Instruments Market Size, By Country, 2014–2021 (USD Million)

Table 20 Pet Ownership in U.S. Households (2015)

Table 21 Global Market, By Type of Animal, 2014-2021 (USD Million)

Table 22 Global Market for Small Animals, By Type, 2014-2021 (USD Million)

Table 23 Global Market for Small Animals, By Country, 2014-2021 (USD Million)

Table 24 Global Market for Canines, By Country, 2014-2021 (USD Million)

Table 25 Global Market for Felines, By Country, 2014-2021 (USD Million)

Table 26 Global Market for Other Small Animals, By Country, 2014-2021 (USD Million)

Table 27 Global Market for Large Animals, By Type, 2014-2021 (USD Million)

Table 28 Global Market for Large Animals, By Country, 2014-2021 (USD Million)

Table 29 Global Market for Equines, By Country, 2014-2021 (USD Million)

Table 30 Global Market for Other Large Animals, By Country, 2014-2021 (USD Million)

Table 31 Market Size for Soft Tissue Surgery, By Country, 2014–2021 (USD Million)

Table 32 Market Size for Sterilization Surgery, By Country, 2014–2021 (USD Million)

Table 33 Market Size for Gynecological and Urological Surgery, By Country, 2014–2021 (USD Million)

Table 34 Market Size for Dental Surgery, By Country, 2014–2021 (USD Million)

Table 35 Market Size for Orthopedic Surgery, By Country, 2014–2021 (USD Million)

Table 36 Market Size for Ophthalmic Surgery, By Country, 2014–2021 (USD Million)

Table 37 Market Size for Other Surgeries, By Country, 2014–2021 (USD Million)

Table 38 Companion Animal and Livestock Population, By Country, 2013 (Million Head)

Table 39 Global Market Size, By Country, 2014–2021 (USD Million)

Table 40 North America: Market Size, By Country, 2014-2021 (USD Million)

Table 41 North America: Market Size, By Product, 2014-2021 (USD Million)

Table 42 North America: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 43 North America: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 44 North America: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 45 North America: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 46 North America: Market Size, By Application, 2014-2021 (USD Million)

Table 47 Conferences/Summits in the U.S.

Table 48 U.S.: Market Size, By Product, 2014-2021 (USD Million)

Table 49 U.S.: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 50 U.S.: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 51 U.S.: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 52 U.S.: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 53 U.S.: Market Size, By Application, 2014-2021 (USD Million)

Table 54 Canada: Number of Veterinarians

Table 55 Canada: Market Size, By Product, 2014-2021 (USD Million)

Table 56 Canada: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 57 Canada: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 58 Canada: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 59 Canada: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 60 Canada: Market Size, By Application, 2014-2021 (USD Million)

Table 61 Europe: Market Size, By Country, 2014-2021 (USD Million)

Table 62 Europe: Market Size, By Product, 2014-2021 (USD Million)

Table 63 Europe.: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 64 Europe: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 65 Europe: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 66 Europe: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 67 Europe: Market Size, By Application, 2014-2021 (USD Million)

Table 68 Pet Population in the U.K.

Table 69 U.K.: Pet Dog Insurance Cost, Regional Level (2016)

Table 70 U.K.: Practicing and Non-Practicing Veterinarians

Table 71 Veterinary Practice Premises Under the Royal College of Veterinary Surgeons (Rcvs) Practice Standards Scheme in U.K.

Table 72 U.K.: Market Size, By Product, 2014-2021 (USD Million)

Table 73 U.K.: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 74 U.K.: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 75 U.K.: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 76 U.K.: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 77 U.K.: Market Size, By Application, 2014-2021 (USD Million)

Table 78 Germany: Number of Veterinarians

Table 79 Germany: Market Size, By Product, 2014-2021 (USD Million)

Table 80 Germany: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 81 Germany: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 82 Germany: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 83 Germany: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 84 Germany: Market Size, By Application, 2014-2021 (USD Million)

Table 85 France: Annual Treatment Expenditure for Dog Owners, 2012 (USD)

Table 86 France: Annual Treatment Expenditure for Cat Owners, 2012 (USD)

Table 87 France: Market Size, By Product, 2014-2021 (USD Million)

Table 88 France: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 89 France: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 90 France: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 91 France: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 92 France: Market Size, By Application, 2014-2021 (USD Million)

Table 93 Italy: Livestock Population, 2012

Table 94 Italy: Number of Veterinarians

Table 95 Italy: Market Size, By Product, 2014-2021 (USD Million)

Table 96 Italy: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 97 Italy: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 98 Italy: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 99 Italy: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 100 Italy: Market Size, By Application, 2014-2021 (USD Million)

Table 101 Spain: Market Size, By Product, 2014-2021 (USD Million)

Table 102 Spain: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 103 Spain: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 104 Spain: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 105 Spain: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 106 Spain: Market Size, By Application, 2014-2021 (USD Million)

Table 107 RoE: Number of Veterinarians and Paraveterinarians

Table 108 RoE: Market Size, By Product, 2014-2021 (USD Million)

Table 109 RoE: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 110 RoE: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 111 RoE: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 112 RoE: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 113 RoE: Market Size, By Application, 2014-2021 (USD Million)

Table 114 APAC: Market Size, By Country, 2014-2021 (USD Million)

Table 115 APAC: Market Size, By Product, 2014-2021 (USD Million)

Table 116 APAC: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 117 APAC: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 118 APAC: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 119 APAC: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 120 APAC: Market Size, By Application, 2014-2021 (USD Million)

Table 121 China: Number of Veterinarians

Table 122 China: Market Size, By Product, 2014-2021 (USD Million)

Table 123 China: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 124 China: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 125 China: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 126 China: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 127 China: Market Size, By Application, 2014-2021 (USD Million)

Table 128 Japan: Number of Veterinarians

Table 129 Japan: Market Size, By Product, 2014-2021 (USD Million)

Table 130 Japan: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 131 Japan: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 132 Japan: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 133 Japan: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 134 Japan: Market Size, By Application, 2014-2021 (USD Million)

Table 135 India: Number of Veterinarians

Table 136 India: Market Size, By Product, 2014-2021 (USD Million)

Table 137 India: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 138 India: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 139 India: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 140 India: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 141 India: Market Size, By Application, 2014-2021 (USD Million)

Table 142 RoAPAC: Number of Veterinarians

Table 143 RoAPAC: Market Size, By Product, 2014-2021 (USD Million)

Table 144 RoAPAC: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 145 RoAPAC: Veterinary Surgical Instruments Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 146 RoAPAC: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 147 RoAPAC: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 148 RoAPAC: Market Size, By Application, 2014-2021 (USD Million)

Table 149 RoW: Market Size, By Region, 2014-2021 (USD Million)

Table 150 RoW: Market Size, By Product, 2014-2021 (USD Million)

Table 151 RoW: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 152 RoW: Veterinary Surgical Instruments Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 153 RoW: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 154 RoW: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 155 RoW: Market Size, By Application, 2014-2021 (USD Million)

Table 156 Latin America: Number of Veterinarians

Table 157 Latin America: Veterinary Surgical Instruments Market Size, By Product, 2014-2021 (USD Million)

Table 158 Latin America: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 159 Latin America: Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 160 Latin America: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 161 Latin America: Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 162 Latin America: Veterinary Surgical Instruments Market Size, By Application, 2014-2021 (USD Million)

Table 163 Middle East: Number of Veterinarians

Table 164 Africa: Number of Veterinarians

Table 165 Middle East and Africa: Veterinary Surgical Instruments Market Size, By Product, 2014-2021 (USD Million)

Table 166 Middle East and Africa: Veterinary Handheld Devices Market Size, By Type, 2014-2021 (USD Million)

Table 167 Middle East and Africa: Veterinary Surgical Instruments Market Size, By Type of Animal, 2014-2021 (USD Million)

Table 168 Middle East and Africa: Market Size for Small Animals, By Type, 2014-2021 (USD Million)

Table 169 Middle East and Africa: Veterinary Surgical Instruments Market Size for Large Animals, By Type, 2014-2021 (USD Million)

Table 170 Middle East and Africa: Market Size, By Application, 2014-2021 (USD Million)

Table 171 Growth Strategy Matrix, 2012–2016

Table 172 Mergers & Acquisitions, 2012–2016

Table 173 Product Launches, 2012–2016

Table 174 Expansions, 2012–2016

Table 175 Collaborations & Agreements, 2012–2016

List of Figures (32 Figures)

Figure 1 Global Veterinary Surgical Instruments Market

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Veterinary Surgical Instruments Market, By Product, 2016 vs 2021

Figure 7 Market, By Type of Animal, 2016 vs 2021

Figure 8 Market, By Application, 2016 vs 2021

Figure 9 Geographic Snapshot: Veterinary Surgical Instruments Market

Figure 10 Attractive Growth Opportunities in the Global Market

Figure 11 The U.S. Dominated the Global Market in 2015

Figure 12 Veterinary Surgical Instruments Market: Geographic Mix

Figure 13 China to Register Highest Growth in the Forecast Period

Figure 14 Veterinary Surgical Instruments: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Rising Availability of Funding for the Veterinary Industry to Drive the Growth of the Market

Figure 16 Sutures, Staplers, and Accessories to Dominate the Veterinary Surgical Instruments Market During the Forecast Period

Figure 17 Small Animals Segment to Dominate the Market During the Forecast Period

Figure 18 The Soft Tissue Surgery Application Segment is Expected to Dominate the Veterinary Surgical Instruments Market During the Forecast Period

Figure 19 Veterinary Surgical Instruments Market

Figure 20 North America: Veterinary Surgical Instruments Market Snapshot

Figure 21 Europe: Market Snapshot

Figure 22 Asia Pacific: Market Snapshot

Figure 23 Market Players Adopted Mergers and Acquisitions as A Key Growth Strategy Between 2012 and 2016

Figure 24 Veterinary Surgical Instruments Market Share Analysis, 2015

Figure 25 Battle for Market Share: Mergers and Acquisitions—Key Growth Strategy for Players

Figure 26 B. Braun Melsungen AG: Company Snapshot

Figure 27 Medtronic PLC.: Company Snapshot

Figure 28 Johnson & Johnson: Company Snapshot

Figure 29 Neogen Corporation: Company Snapshot

Figure 30 Smiths Group PLC.: Company Snapshot

Figure 31 Integra Lifesciences Holdings Corporation: Company Snapshot

Figure 32 Steris Corporation: Company Snapshot

Research Methodology

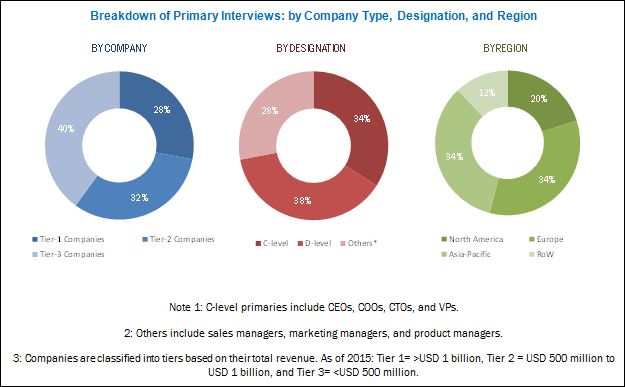

This study estimates the veterinary surgical instruments market size. It also provides a detailed qualitative and quantitative analysis of the market. Various secondary sources such as directories, industry journals, and databases have been used to identify and collect information useful for this extensive commercial study of the market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the market. All possible factors that affect the market included in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was combined and added with detailed inputs and analysis from MarketsandMarkets and presented in this report. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The veterinary surgical instruments market is expected to witness significant growth in the coming years, with a growing demand for pet insurance and rising animal health expenditure, growing companion animal market and increasing veterinary practitioners in the developed economies. However, shortage of skilled veterinarians in the developing economies and lack of animal health issues awareness in emerging markets may hinder the growth of this market to a certain extent.

Factors such as rising animal health expenditure and pet insurance, growing companion animal market, growing demand for animal-derived food products, increasing number of veterinary practitioners and their income levels in developed regions are the primary growth drivers for the global market. However, shortage of skilled veterinarians in the developing economies and lack of animal health issues awareness in emerging markets may hinder the growth of this market to a certain extent. Emerging markets such as China, India, and Brazil offer significant opportunities for the growth of market. Lack of animal health awareness and shortage of veterinarians in emerging countries are the major market challenges.

The report analyzes the veterinary surgical instruments market by product, animal type, application, and region. On the basis of product, the market is segmented into sutures, staplers and accessories, handheld devices, electro-surgery instruments, and others. The handheld devices are further segmented into forceps, scalpels, surgical scissors, hooks & retractors, and trocars & cannulas. On the basis of animal type, the global market is segmented into small animals and large animals. Based on application, the market is segmented into soft- tissue surgery, sterilization surgery, gynecology & urology, dental surgery, orthopedic surgery, ophthalmic surgery and others

In 2015, North America dominated the veterinary surgical instruments market followed by Europe, Asia-pacific, and Rest of the World. Increasing number of companion animals, rising animal healthcare expenditure, increasing awareness about animal diseases, growing number of veterinary practitioners and their income levels, and growth in the pet insurance market are factors driving the growth of this market. On the other hand, the Asia-Pacific (APAC) region is expected to witness the highest growth rate during the forecast period. This can be mainly attributed to the rising livestock population, growing pet adoption, increasing awareness about animal health, progressive urbanization, and growing per capita animal health expenditure in this region.

The global veterinary surgical instruments market is characterized by the presence of a large number of players. Amidst intense market competition, major players are continuously focusing on achieving higher market shares through new product launches, and collaborations and agreements in the market. The global market is fragmented in nature, with a large number of companies continuously trying to mark their presence. The market is led by B. Braun Vet Care GmbH (Germany), Medtronic Plc (Ireland), Ethicon Inc. (U.S.), and JORGEN KRUSSE A/S (Denmark). Other players in this market are Jorgensen Laboratories (U.S.), Smiths Group Plc (U.K.), Neogen Corporation (U.S.),Integra LifeSciences Holdings Corporation (U.S.), STERIS Corporation (U.S.), DRE Veterinary (U.S.), GerMedUSA, Inc. (U.S.), Surgical Holdings (U.K.), Sklar Surgical Instruments (U.S.), World Precision Instruments, Inc. (U.S.), Surgical Direct (U.S.), Antibe Therapeutics Inc. (Canada), and iM3 (U.S.).

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Surgical Instruments Market