Video Streaming Software Market by Component (Solutions, Services), Streaming Type, Deployment Mode, Delivery Channel (Pay-Tv, Internet Protocol Tv, Over-The-Top), Monetization Model, Vertical and Region - Global Forecast to 2028

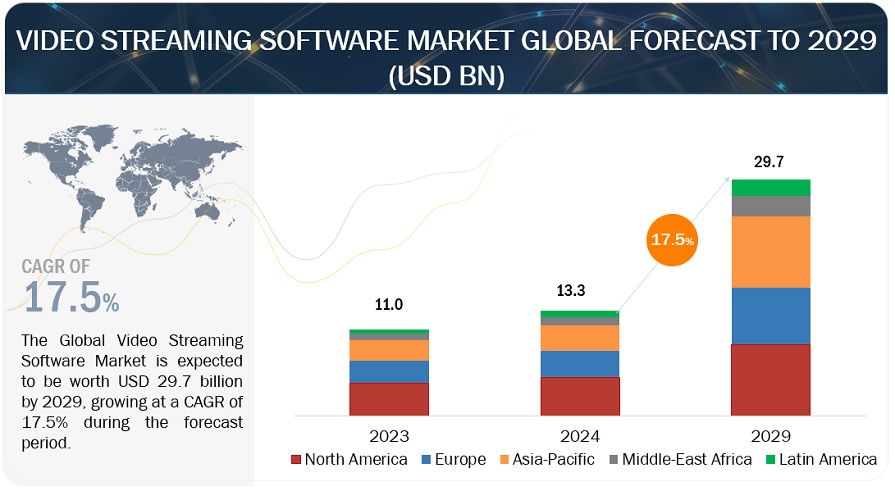

[351 Pages Report] The video streaming software market size is expected to grow from USD 11.0 billion in 2023 to USD 25.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 18.3% during the forecast period. In recent years, video streaming software has evolved to support advanced features such as virtual reality (VR) and 360-degree video streaming. These technologies have revolutionized the way we consume and interact with video content, opening new possibilities for entertainment, education, and even virtual tourism. The video streaming software market is sure to evolve even further, with new advancements in artificial intelligence (AI), machine learning (ML), and blockchain technology expected to enhance the user experience further. The global recession caused by the COVID-19 pandemic has had a mixed impact on the video streaming software market. The pandemic has increased demand for video streaming services, as people spent more time at home and looked for entertainment options. Streaming services like Netflix, Amazon Prime, and Disney+ have reported significant increases in subscribers during the pandemic. This trend is expected to continue even as the pandemic subsides, as consumers have become accustomed to the convenience and flexibility of streaming services.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Video Streaming Software Market

The global recession caused by the COVID-19 pandemic has had a mixed impact on the video streaming software market. The pandemic has increased demand for video streaming services, as people spent more time at home and looked for entertainment options. Streaming services like Netflix, Amazon Prime, and Disney+ have reported significant increases in subscribers during the pandemic. This trend is expected to continue even as the pandemic subsides, as consumers have become accustomed to the convenience and flexibility of streaming services. However, the recession has also had a negative impact on the video streaming software market. Many businesses have had to cut costs and reduce their budgets, leading to a slowdown in investment in new technologies and services. The recession has also led to a decline in advertising revenue for streaming services, as companies cut back on their marketing budgets. Furthermore, the pandemic has disrupted the production of new content, which has impacted the availability of new releases on streaming platforms. This has resulted in a reduced demand for subscriptions to certain services.

While the recession has had a mixed impact on the video streaming software market, the long-term prospects for the industry remain positive. The continued growth in internet penetration, the increasing popularity of mobile devices, and the convenience and flexibility of streaming services are likely to drive continued growth in the market. However, the impact of the recession on the market is likely to be felt for some time, particularly in terms of investment and advertising revenue.

Video Streaming Software Market Dynamics

Driver: Advancement in AI drives the demand for video streaming software

Artificial intelligence (AI) plays an important role in the growth of the video streaming software market. Its AI-powered solutions can help video streaming software providers deliver more personalized content recommendations, improve video quality, optimize video delivery, and enhance the overall user experience. One of the main benefits of AI in video streaming software is the ability to analyze large amounts of data in real-time. This enables providers better to understand user behavior, preferences, and interests, and to offer more relevant and personalized content recommendations. AI algorithms can also analyze video content to optimize encoding and compression, improving video quality while reducing bandwidth usage. AI-powered solutions can also help video streaming software providers improve video content delivery such as, machine learning algorithms can analyze network performance and make real-time adjustments to video quality to ensure smooth and uninterrupted playback. In addition, AI can help video streaming software providers detect and prevent content piracy, a major concern for the industry. AI algorithms can analyze user behavior and identify suspicious patterns indicating piracy, allowing providers to act before the content is widely distributed. Overall, advancements in AI are expected to drive the growth of the video streaming software market by improving the user experience, reducing costs, and enabling new services and solutions.

Restraint: High content creation cost and threat of content piracy

The demand for unique content is continuously rising, but as the content production costs rise, streaming services are under pressure to show a profit. Thus, companies tend to invest more than required for video creation due to unawareness of the various phases of video content delivery. The problems such as duplication of video content for content creation across regions and verticals has become a common trend, which in turn increases the overall cost structure as well. Video content piracy is at an all-time high and the professional digital pirates pose a major risk to all media companies. They can hack into computer systems and post the content online for free before the set release date of the content. The internet structure further makes it difficult to track pirated content as the servers that leak the content are spread worldwide and can be hosted in several countries under different jurisdictions.

Opportunity: Optimization of network bandwidth

The videos are extensively used by large enterprises and educational institutions for tasks such as corporate training, executive communication, event streaming, and knowledge sharing. Video Content Management (VCM) solutions provide a cost-effective infrastructure to mitigate video-buffering problems. VCMs often deliver streamed videos in chunks which helps the video content to sync well with caching proxies deployed across the WANs. Thus, WAN caching framework enables minimizing the overall bandwidth consumption. VCM can also use adaptive bitrate streaming to deliver on-demand and live videos. The adaptive bitrate analyzes the viewers’ bandwidth in real-time and adjusts the video quality accordingly which thus, enables viewers to watch buffer-free videos.

Challenge:Poor internet speed reduces quality of service

The lack of an efficient communication tools limits employee productivity as the noise during video or low-quality video can create misunderstandings or consume their time more. Low-quality of video streaming and disturbances limits effective data transfer among workers, especially in the COVID-19 situation. According to a Cisco global survey focused on the future of work, 98% of workers stated that they experienced frustration from the inability to grasp information during live video streams, especially from broadcasters.

Based on Solution, video analytics segment is estimated to account for the highest CAGR during the forecast period

Based on the Solution, the video analytics segment is estimated to account for the highest CAGR during the forecast period. Video analytics refers to the use of algorithms and artificial intelligence (AI) technologies to analyze video content in real-time. Video analytics helps to monitor and analyze video streams, providing valuable insights into viewer behavior and engagement. Video analytics is even used to track various metrics such as the number of viewers, duration of views, geographic location of viewers, and even the emotions of viewers. This information can be used by content creators and marketers to optimize video content, improve engagement, and increase revenue.

Based on services, the managed services is projected to witness the highest CAGR during the forecast period.

Managing and maintaining video streaming software in-house can be expensive, particularly for businesses that lack the expertise and resources to do so effectively. Managed services providers can help businesses save money by offering scalable solutions that are tailored to their needs, allowing them to pay only for the services they need. These services are built on a global infrastructure with integrated security services, security patching, hardened Operating System (OS) build, data isolation, and incident response. Managed security services provide real-time monitoring, compliance auditing and reporting, and proactive mitigation of security threats.

Based on vertical, the Healthcare vertical is projected to witness the highest CAGR during the forecast period.

Video streaming in the healthcare sector has become a critical enabler for quick and efficient communication of frequent policy changes or compliance and regulatory mandates required for timely dissemination and enforcement in highly regulated healthcare services. Some surgeries are now required for live broadcasting to a wider staff and students as a means for highly engaged learning in real-time. Live streaming can deliver high-quality video streaming in healthcare to any number of users and devices. Video streaming in healthcare surgeries carries a great variety of benefits, both for doctors and patients. Not only do recorded procedures create an opportunity for training, learning, and self-improvement of surgical teams, but they also enhance the overall treatment quality through accountability deterring malpractice, unprofessional behavior, or mere carelessness.

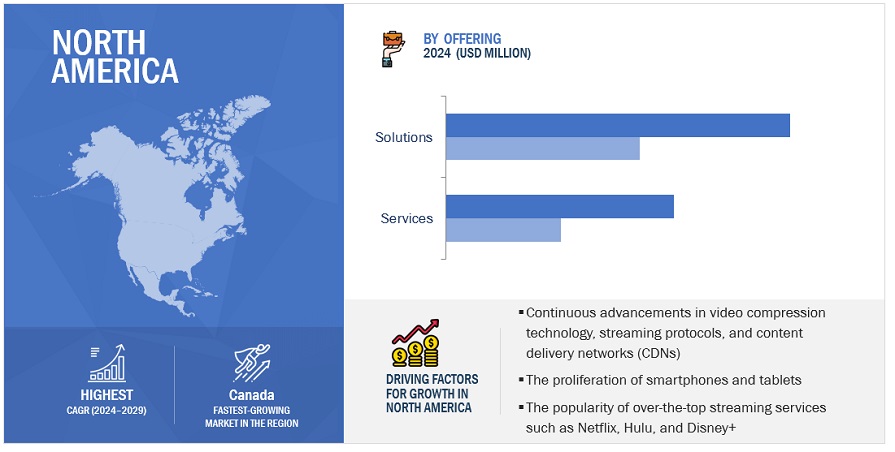

The US market is projected to contribute the largest share for the video streaming software market in North America.

North America is expected to lead the video streaming software market in 2023. The US is estimated to account for the largest market share in North America in 2023 in the video streaming software market, and the trend is expected to continue until 2028. Due to a number of factors, including advanced IT infrastructure, the existence of numerous businesses, and the availability of technical skills, it is the most developed market in terms of the adoption of video streaming software. Legal requirements, such as FedRAMP, a standardized approach to security assessment, authorization, and continuous monitoring for cloud products and services, also influence the adoption of video streaming software. One of the main forces behind the expansion of the video streaming software industry in the US is the presence of a number of small and large video streaming software providers in the country, including IBM, Kaltura, Brightcove, Panopto, Haivision, Vimeo, VBrick, Qumu, Akamai, and more.

Key Market Players

The video streaming software market is dominated by a few globally established players such as IBM (US), Kaltura (US), Brightcove (US), Agile Content (Spain), and Haivision (US), among others, are the key vendors that secured video streaming software contracts in last few years. These vendors can bring global processes and execution expertise to the table, the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the video streaming software market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Million/Billion(USD) |

|

Segments Covered |

Component, Deployment Mode, Streaming Type, Monetization Model, Delivery Channel, and Vertical |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Some of the major vendors offering video streaming software across the globe include IBM (US), Kaltura (US), Brightcove, (US), Agile Content (Spain), Haivision (US), Vimeo (US), Panopto (US), VBrick (US), Edgio (US), Akamai (US), Sonic Foundry (US), Qumu(US) and more. |

This research report categorizes the video streaming software market based on component, streaming type, deployment mode, monetization model, delivery channel, verticals, and regions.

Based on the Component:

-

Solutions

- Transcoding & Processing

- Video Management Software

- Video Distribution

- Video Analytics

- Video Security

- Other Solutions

-

Services

- Managed Services

-

Professional Services

- Consulting

- Integration & Implementation

- Support & Maintenance

Based on the Deployment Mode:

- On-Premises

- Cloud

Based on the Streaming Type:

- Live Streaming

- Video-on-Demand (VoD) Streaming

Based on the Delivery Channel:

- Pay-Tv

- Internet Protocol TV (IPTV)

- Over-The-Top (OTT)

Based on the Monetization Model:

- Subscription-Based

- Advertising-Based

- Transaction-Based

Based on the Vertical:

- Media and Entertainment

- BFSI

- Academia and Education

- Healthcare

- Government

- Other Verticals

Based on the Region:

-

North America

- United States

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- KSA

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In April 2023, Akamai Technologies has announced new cloud computing capabilities for streaming video at the 2023 NAB Show. The capabilities are designed to help OTT operators deliver higher quality and more personalized video experiences to viewers. They can also help operators realize lower, more predictable operational costs and improve efforts to monetize content. Additionally, Akamai has also announced enhancements to its support of the Common Media Client Data (CMCD) specification and highlighted the latest members of its Qualified Computing Partner program.

- In March 2023, Brightcove has expanded its E-Commerce capabilities with new platform integrations with Shopify, Instagram, and Salesforce Sales Cloud to its video cloud platform. The integrations are designed to enable companies to reach, engage and activate audiences with immersive, interactive, and live and on-demand video content.

- In January 2023, IBM Watson Media has announced new event registration features added to IBM enterprise video streaming. These virtual event enhancements for registration form logic and improved editing make it easier and more efficient for users to manage their digital events. The enhancements include advanced form logic to control what fields are displayed for specific attendees as well as increased flexibility for editing a form once it’s been published and there are active registrations.

- In December 2022, Vbrick has acquired Ramp Holdings, Inc., an enterprise content delivery network (eCDN) provider. Vbrick and Ramp are among the industry’s leading eCDN providers, each offering multiple video distribution modalities to support a variety of network configurations, giving customers flexible options to meet any enterprise use case. The acquisition creates an unparalleled solution for delivering flawless live and on-demand video.

- In November 2022, Sonic Foundry has announced the launch of Video Solutions, a new business unit providing comprehensive video services to enterprise and events customers. Video Solutions incorporates many of the services previously offered under the umbrella of Sonic Foundry’s Mediasite Events brand with a variety of additional enterprise-facing services.

- In June 2022, Haivision Systems Inc. and CarteNav have announced the implementation of Haivision video technology, including the Haivision Media Platform for live streaming over IP networks and the Kraken low latency transcoder, to power real-time full-motion video (FMV) within CarteNav’s AIMS-C4 Common Operating Picture (COP) solution.

- In March 2022, K16 Solutions, an EdTech company for learning management system (LMS) course migration, student data archiving, and content replacement, has partnered with Panopto for higher education. This partnership will streamline the migration process for customers moving to Panopto’s video platform from their legacy provider.

- In March 2022, Panopto has announced the integration with Microsoft Teams. Teams users can now use core Panopto functionality and workflows without ever leaving Teams. Panopto’s robust video search capabilities are also integrated with Microsoft 365 applications via Microsoft Graph. Teams users see federated search results for Panopto videos in Microsoft 365. Users can search every word spoken within every video, and their videos become discoverable alongside Word documents, Excel spreadsheets, and other important digital assets.

- In November 2021, Agile Content has announced two innovations that are available for a virtual demonstration. The Agile Cloud Production and FAST & VoD2Livesolutions will enable broadcasters and TV providers to revolutionize how live content is produced and how linear channels can be created costefficiently and with a higher degree of personalization.

- In July 2021, Agile Content has announced the acquisition of WeTek, the Portuguese company dedicated to the R&D of the Android ecosystem. The addition of WeTek’s line of products to the Agile Content offering furthers its range of innovative end-to-end services, brings multiple benefits to new and existing customers and end users, and strengthens Agile’s market position in Portugal.

Frequently Asked Questions (FAQ):

What is Video Streaming Software?

Video streaming enables enterprises to continuously deliver video data over a network or the internet to a remote user. A streaming provider offers various hosting options, such as on-premises and cloud-based, to meet users' needs. Video content such as TV shows, movies, and live streams is delivered on-demand or via live broadcast, usually from a cloud-based network. The video streaming software empowers enterprises to create, store, manage, monitor, and share video content across their systems for internal communication purposes or to present the information externally to a live audience.

Which country is early adopters of Video Streaming Software?

The US is at the initial stage of the adoption of Video Streaming Software.

Which are key verticals adopting Video Streaming Software?

Key verticals adopting the Video Streaming Software market include: -

- Media & Entertainment

- BFSI

- Academia & Education

- Healthcare

- Government

- Other Verticals

Which are the key vendors exploring Video Streaming Software?

Some of the major vendors offering video streaming software across the globe IBM (US), Kaltura (US), Brightcove, (US), Agile Content (Spain), Haivision (US), Vimeo (US), Panopto (US), VBrick (US), Edgio (US), Akamai (US), Sonic Foundry (US), Qumu (US), MediaPlatform (US), Dailymotion (France), Netgem (France), Vixy (Netherlands), Kinura (England), Piksel (Italy), Hive Streaming (Sweden), SproutVideo (US), Wowza (US), Dacast (US), Zixi (US), Kollective Technology (US), Muvi (US), Movingimage (Germany), VIDIZMO (US), Ravnur (US), uStudio, (US), CONTUS TECH (India), and Vidyard (Canada).

What is the total CAGR expected to be recorded for the Video Streaming Software market during 2023-2028?

The video streaming software market is expected to record a CAGR of 18.3% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

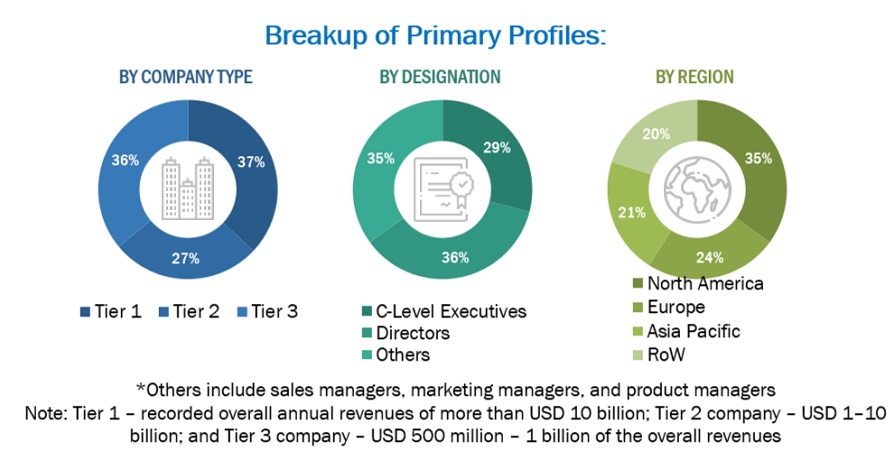

The study involved four major activities in estimating the size of the video streaming software market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering video streaming software solutions and services was derived on the basis of the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was majorly used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from video streaming software vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, component, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using video streaming software solutions, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall video streaming software market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the video streaming software market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides in media & entertainment, BFSI, academia & education, healthcare, government, and other verticals (manufacturing, retail & eCommerce, and telecommunications).

Market Definition

Video streaming enables enterprises to continuously deliver video data over a network or the internet to a remote user. A streaming provider offers various hosting options, such as on-premises and cloud-based, to meet users' needs. Video content such as TV shows, movies, and live streams is delivered on-demand or via live broadcast, usually from a cloud-based network. The video streaming software empowers enterprises to create, store, manage, monitor, and share video content across their systems for internal communication purposes or to present the information externally to a live audience. With different streaming types such as on-demand or live stream videos, customers can select and watch content with the help of different delivery channels. These channels include Pay-Television (TV), Internet Protocol TV (IPTV), and Over-The-Top (OTT) services. The video streaming software offers solutions, such as on-demand or live streaming, video delivery, transcoding & processing, video management, distribution, video analytics, and security, to help minimize upfront investment and ongoing maintenance costs. The video content is generally delivered through an enterprise Content Delivery Network (eCDN) that leverages private networks, including LANs and Wide Area Networks (WANs), for delivering content.

Key Stakeholders

- Video streaming software vendors

- Technology partners

- Consulting firms

- Resellers and distributors

- Enterprise users

- Technology providers

- Value-Added Resellers (VARs)

- End users

- System integrators

Report Objectives

- To define, describe, and forecast the global video streaming software market based on component (solutions and services), streaming types, deployment modes, monetization models, delivery channels, verticals, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the video streaming software market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Video Streaming Software Market