Virtual Data Room Market by Component, Business Function (Finance and Legal), Application (Due Diligence and Fundraising), Deployment Mode, Organization Size, Vertical, and Region - Global Forecast to 2026

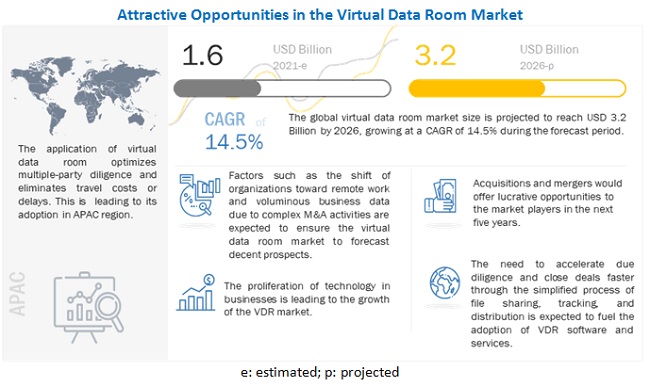

[269 Pages Report] The Virtual Data Room Market size was estimated to be worth USD 1.6 billion in 2021 and is anticipated to rise to USD 3.2 billion by 2026, exhibits a CAGR of 14.5% in between 2021 to 2026.

Various factors such as increasing volumes of business data due to complexities arising from M&A activities and the shift toward remote work during COVID-19 are expected to drive the adoption of Virtual Data Room software and services.

To know about the assumptions considered for the study, Request for Free Sample Report

Virtual Data Room Market Growth Dynamics

Driver: Increasing volumes of business data due to complexities arising from M&A activities

Virtual data rooms have changed the labor-intensive process of traditional methods, such as visiting physical data rooms to conduct the due diligence process for M&A transactions. The parties involved in M&A transactions use virtual data room software and services as the most reliable source to share documents. As businesses of all sizes are shifting from relying upon physical documents and have embraced digital solutions that improve the way a company operates, virtual data rooms have emerged as a common solution for storing and sharing sensitive corporate information. virtual data rooms are secure online repositories that give users the ability to precisely control who can access certain information in the repository, making virtual data rooms especially valuable for facilitating important financial transactions, such as M&A, fundraising, and IPOs. Currently, technological advancements drive M&A activities across the world. As a result, there are growing volumes of business data. Due to the growing importance of data and the increased demand to ensure that such data is adequately safeguarded, the virtual data room was born, and over the years, it has evolved into an important business solution used by organizations around the world.

Restraint: Concern about cybersecurity issues

According to a global survey, one of every five companies loses intellectual data due to cyberattacks. Cyber threats are hampering online transactions and data on a large scale. virtual data rooms that carry the data in the digital format are also hit by cyberattacks at times. Corporates often operate under pressure, which, at times, leads to the negligence of cyber threats. During the due diligence process of M&A activities, organizations are more vulnerable to security breaches due to the various technologies used by third parties in the process. Moreover, organizations do not have complete information about their own databases to anticipate potential attacks to manage them in advance. Therefore, identifying, tracking, and preventing cyberattacks are big challenges for organizations. The companies that are acquired go through financial pressure and cannot pay attention to potential cyberattacks.

Opportunity: Increasing need to deploy specific tools and technologies to increase data access and data convergence

Most enterprises are in the initial phase of adopting virtual data room software and services. Thus, key features such as data accessibility, data authenticity, and data convergence provided by the virtual data room software and services help secure and efficiently utilize stored and incoming data. Virtual data room software and service providers are vying to provide solutions. This would lead to the creation of metrics and standards and influence data accessibility and data convergence effectively. Due to the presence of data in different formats, such as transactional data, XML data, web-based data, and structured databases, it is important to introduce convergence and data preparation techniques to enhance the efficiency of data for analysis. Data scalability is a major issue, as organizational data is growing by multiple folds. Most virtual data room providers are ensuring data scalability and maintaining data integrity and consistency to support business processes effectively. With increasing online security concerns, virtual data room providers are coming up with more sophisticated security improvements to ensure data integrity. Capabilities such as digital rights management and secure document sharing, provide complete control over how a document is accessed and utilized. CapLinked’s FileProtect feature lets companies share documents while retaining the ability to deny access to anything even after it is downloaded.

Challenge: Data privacy and data integration issues

Data privacy and integration is an integral aspect of every data exchange process, as the data stored virtually is more prone to cyber threats. The data is used in various application areas across organizations. These application areas often include dealing with critical and sensitive enterprise data, such as customer data, employee data, legal data, and other transactional data. During M&As, buyers’ integration team needs to formulate a plan to securely integrate data with its own organizational data. Hence, trust issues related to the sharing of sensitive data, such as employee data, are common before closing business deals. Therefore, maintaining privacy and data protection during the M&A process is a big challenge for organizations. The data shared in a virtual data room is vulnerable to various risks. To address these risks, virtual data room software and service providers ensure the adoption of technologies, such as blockchain and AI, to enhance security in their virtual data room offerings. The majority of organizations operating across the US, Europe, and APAC have adhered their operations to regulations and data protection laws.

Services segment is expected to account for a higher CAGR during the forecast period

The services segment is further divided into professional services and managed services. These services are an integral step in deploying virtual data room software and are taken care of by software and service providers. While virtual data rooms provide similar services, such as secure data storage, data management, and data exchange, their roles may differ. Military-grade security, multi-language support, full-text search, in-document linking, and a variety of other advanced features are all available in the best online data rooms. The growing adoption of Virtual Data Room solutions is expected to boost the adoption of professional and managed services.

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the global Virtual Data Room Market. The key factors favoring the growing adoption of virtual data room software and services in North America are the increasing merger and acquisition activities and the advent of new and advanced technologies, such as IoT and smart cities, and the increasing technological advancements in the region. Data security and protected sharing solutions are expected to be in high demand across the region during the forecast period, owing to the rising demand for simple and safe methods for storing essential data and the growing need for transparent and efficient data sharing choices.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Virtual Data Room vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Virtual Data Room market Citrix Systems (US), SS&C Intralinks (US), Axway (US), Donnelley Financial Solutions (US), Thomson Reuters (Canada), Datasite (US), iDeals Solutions (China), Drooms (Germany), EthosData (India), SecureDocs (US), Diligent Corporation (US), Ansarada (Australia), SmartRoom (US), CapLinked (US), Vault Rooms (US), Vitrium Systems (Canada), Onehub (US), ShareVault (US), FORDATA (Poland), Digify (Singapore), FirmsData (India), Confiex Data Room (India), PactCentral (US), kamzan (Italy), bit.ai (US), DocuFirst (US), DCirrus (India), and Kasm Technologies (US). The study includes an in-depth competitive analysis of these key players in the Virtual Data Room market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attributes |

Details |

|

Market Size Value in 2021 |

US$ 1.6 billion |

|

Revenue Forecast Size Value in 2026 |

US$ 3.2 billion |

|

Growth Rate |

14.5% CAGR |

|

Key Market Opportunities |

Increasing need to deploy specific tools and technologies to increase data access and data convergence |

|

Key Market Growth Drivers |

Increasing volumes of business data due to complexities arising from M&A activities |

|

Market size available for years |

2015–2026 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2026 |

|

Segments covered |

Component, Deployment Mode, Organization Size, Business Function, Applications, Vertical, And Region |

|

Geographies covered |

North America, Europe, APAC, Latin America and MEA |

|

Major Vendors covered |

Citrix Systems (US), SS&C Intralinks (US), Axway (US), Donnelley Financial Solutions (US), Thomson Reuters (Canada), Datasite (US), iDeals Solutions (China), Drooms (Germany), EthosData (India), SecureDocs (US), Diligent Corporation (US), Ansarada (Australia), SmartRoom (US), CapLinked (US), Vault Rooms (US), Vitrium Systems (Canada), Onehub (US), ShareVault (US), FORDATA (Poland), Digify (Singapore), FirmsData (India), Confiex Data Room (India), PactCentral (US), kamzan (Italy), bit.ai (US), DocuFirst (US), DCirrus (India), and Kasm Technologies (US) |

This research report categorizes the Virtual Data Room Market based on Component, Deployment Mode, Organization Size, Business Function, Applications, Vertical, And Region.

By Component:

- Software

- Services

- Professional Services

- Consulting

- Deployment and Integration

- Support and Maintenance

- Managed Services

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Applications

- Merger And Acquisition

- Due Diligence

- Fundraising, Audit Preparation

- Ip Management

- Board/Investor Communications

- Secure Document Repository

- IPO

- Other Applications (streamlining Q&A and joint venture)

By Business Function

- Marketing And Sales

- Legal And Compliance

- Finance

- Workforce Management

By Vertical:

- BFSI

- Retail and eCommerce

- Government and Defense

- IT and Telecom

- Media and Entertainment

- Manufacturing

- Healthcare and Life sciences

- Real Estate

- Energy and Utilities

- Other Verticals [transportation and logistics, travel and hospitality, and media and entertainment]

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Singapore

- Rest of APAC

-

MEA

- UAE

- South Africa

- Rest of Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In August 2021, FORTUNE launched a partnership program, The Modern Board, in collaboration with Diligent, premier governance, risk, and compliance SaaS provider. The Modern Board is a thought leadership program that includes a monthly newsletter, quarterly virtual events, and more. It is edited by FORTUNE's award-winning journalists. In a new era of stakeholder capitalism, the new digital experience will assist board members and C-suite executives in discovering what it means to effectively govern, mitigate risk, assure compliance, and lead on ESG.

- In July 2021, Firmex has been acquired by Datasite, a prominent SaaS-based technology solution for worldwide M&A professionals. Datasites' ambitious growth strategy into new areas will be aided by the acquisition of Firmex, which will enable the company to handle a larger range of use cases.

- In Jan 2021, DFIN announced a partnership with FloQast, a business that specializes in accounting workflow automation software. The alliance intends to improve financial closing and reporting processes' accuracy and openness, especially for companies intending to go public.

- In September 2020, Thomson Reuters has expanded its partnership with KPMG in the UK, which will now serve as an implementation partner for the Thomson Reuters HighQ platform for corporate legal departments. This alliance aligns Thomson Reuters’ leading legal technology and knowledge with KPMG’s expertise in delivering legal solutions, providing customers with enhanced capabilities that will generate more efficiencies, lower costs, improve accuracy, and reduce risk.

- In August 2020, FORDATA launched a campaign to aid in the fight against the coronavirus. Any company that donates to fundraising or shows what steps it has made to combat COVID-19 will receive a certificate for a free month of FORDATA VIRTUAL DATA ROOM Lite, available until December 31, 2020, with no strings attached.

- In March 2020, Axway announced a temporary campaign to make Syncplicity for Remote Work file sharing and content collaboration available for free. Axway's Syncplicity may be swiftly deployed to provide support and relief to users new to working remotely.

- In October 2019, Datasite launched DatasiteOne Marketing app to help investment bankers and advisers save time identifying, marketing to, and tracking potential buyers for deals. DatasiteOne Marketing optimizes the early-stage asset marketing processes for dealmakers, including buyer outreach, workflow tracking, and reporting.

Frequently Asked Questions (FAQ):

What is Virtual Data Room?

How big is the virtual data room market?

What is the Virtual Data Room Market growth?

Who are the major vendors in the Virtual Data Room market?

Which countries are considered in the European region?

Which are key verticals adopting Virtual Data Room software and services?

Which are the key drivers supporting the growth of the Virtual Data Room market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 6 VIRTUAL DATA ROOM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOFTWARE/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF THE VIRTUAL DATA ROOM MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE/SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF VIRTUAL DATA ROOM THROUGH OVERALL VIRTUAL DATA ROOM SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 51)

TABLE 4 GLOBAL VIRTUAL DATA ROOM MARKET SIZE AND GROWTH RATE, 2015–2020 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y%)

FIGURE 15 SOFTWARE SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 16 PROFESSIONAL SERVICES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 17 MERGER AND ACQUISITION SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2021

FIGURE 18 CLOUD SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 19 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 20 FINANCE SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2021

FIGURE 21 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SIZE IN 2021

FIGURE 22 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN THE VIRTUAL DATA ROOM MARKET

FIGURE 23 THE SHIFT OF ORGANIZATIONS TOWARD REMOTE WORK DUE TO COVID-19 TO BOOST THE MARKET GROWTH

4.2 MARKET, BY VERTICAL

FIGURE 24 RETAIL AND ECOMMERCE VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 25 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE BY 2026

4.4 MARKET: TOP THREE APPLICATIONS AND VERTICALS

FIGURE 26 MERGER AND ACQUISITION AND BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENTS TO HOLD THE LARGEST MARKET SHARES BY 2026

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: VIRTUAL DATA ROOM MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing volumes of business data due to complexities arising from M&A activities

5.2.1.2 The shift toward remote work during COVID-19

5.2.2 RESTRAINTS

5.2.2.1 Concern about cybersecurity issues

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing need to deploy specific tools and technologies to increase data access and data convergence

5.2.3.2 Rise of on-demand business models

5.2.4 CHALLENGES

5.2.4.1 Data privacy and data integration issues

5.3 PATENT ANALYSIS

5.3.1 METHODOLOGY

5.3.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED, 2018–2021

5.3.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 28 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.3.3.1 Top applicants

FIGURE 29 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

TABLE 7 TOP TEN PATENT OWNERS (US) IN THE VIRTUAL DATA ROOM MARKET, 2018–2021

5.4 CASE STUDY ANALYSIS

TABLE 8 USE CASES SUMMARY TABLE

5.4.1 TELECOM AND IT

5.4.1.1 Use case 1: To perform due diligence activities in the business units in MEA

5.4.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

5.4.2.1 Use case 2: Moody’s Analytics used EthosData Data Room Platform for its social performance assessments

5.4.3 HEALTHCARE AND LIFE SCIENCES

5.4.3.1 Use case 3: Virtual data rooms helped Kurmann Partners keep pharma clients’ information safe

5.4.4 REAL ESTATE

5.4.4.1 Use case 4: Virtual Dataroom for large mortgage bank to help look for potential buyers in real estate

5.4.5 GOVERNMENT AND DEFENSE

5.4.5.1 Use case 5: Secure data storage facility for local government

5.4.6 RETAIL AND ECOMMERCE

5.4.6.1 Use case 6: Sara Lee Corporation chose Imprima VDRs to help investors with their due diligence and asset management.

5.4.7 ENERGY AND UTILITIES

5.4.7.1 Use case 7: Hess Corporation utilized CapLinked to protect trade secrets

5.4.8 MANUFACTURING

5.4.8.1 Use case 8: World's largest industrial gas company integrated kiteworks with SAP to streamline billing and accelerate revenue recognition

5.5 VIRTUAL DATA ROOM: EVOLUTION

FIGURE 30 EVOLUTION OF VIRTUAL DATA ROOM

5.6 VIRTUAL DATA ROOM: ECOSYSTEM

FIGURE 31 ECOSYSTEM OF VIRTUAL DATA ROOM

5.7 VIRTUAL DATA ROOM MARKET: COVID-19 IMPACT

FIGURE 32 MARKET TO WITNESS SLIGHT GROWTH BETWEEN 2020 AND 2021

5.8 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE MARKET

FIGURE 33 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.9 VALUE/SUPPLY CHAIN ANALYSIS

FIGURE 34 VALUE/SUPPLY CHAIN ANALYSIS

TABLE 9 MARKET: VALUE/SUPPLY CHAIN

5.10 PRICING MODEL ANALYSIS

5.11 TECHNOLOGY ANALYSIS

5.11.1 ARTIFICIAL INTELLIGENCE (AI), MACHINE LEARNING (ML), AND VIRTUAL DATA ROOM

5.11.2 CLOUD COMPUTING AND VIRTUAL DATA ROOM

5.11.3 BIG DATA AND VIRTUAL DATA ROOM

5.11.4 BLOCKCHAIN AND VIRTUAL DATA ROOM

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 35 VIRTUAL DATA ROOM MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 10 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 REGULATORY IMPLICATIONS

5.13.1 INTRODUCTION

5.13.2 SARBANES-OXLEY ACT OF 2002

5.13.3 GENERAL DATA PROTECTION REGULATION

5.13.4 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

6 VIRTUAL DATA ROOM MARKET, BY COMPONENT (Page No. - 82)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

FIGURE 36 SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 11 MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 12 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOFTWARE

6.2.1 RISING IMPORTANCE OF SAFEGUARDING BUSINESS DATA AND GROWING DEMAND FOR SECURED DATA SHARING IN VIRTUAL DATA ROOM SOLUTIONS TO BOOST THE GROWTH RATE OF SOFTWARE

TABLE 13 SOFTWARE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 14 SOFTWARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 37 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 15 SERVICES: VIRTUAL DATA ROOM MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 16 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 17 MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 18 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

6.3.1.1 Growing requirement for customized solutions to boost the professional services industry

FIGURE 38 CONSULTING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 19 MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 20 MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 22 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.2 Consulting

TABLE 23 CONSULTING: VIRTUAL DATA ROOM MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 24 CONSULTING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.3 Deployment and Integration

TABLE 25 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 26 DEPLOYMENT AND INTEGRATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.4 Support and Maintenance

TABLE 27 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 28 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 To achieve short and long-term goals in business to support managed services

TABLE 29 MANAGED SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 30 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 VIRTUAL DATA ROOM MARKET, BY DEPLOYMENT MODE (Page No. - 94)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 39 CLOUD SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 31 MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 32 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

7.2 CLOUD

7.2.1 REDUCED OPERATIONAL COST AND HIGHER SCALABILITY TO ENABLE GROWTH IN VIRTUAL DATA ROOM CLOUD-BASED DEPLOYMENTS

TABLE 33 CLOUD: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 34 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 ON-PREMISES

7.3.1 DUE TO THE GROWING THREAT OF DATA THEFTS, SOME ORGANIZATIONS TO PREFER VIRTUAL DATA ROOM TO REMAIN ON-PREMISES

TABLE 35 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 36 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 VIRTUAL DATA ROOM MARKET, BY ORGANIZATION SIZE (Page No. - 99)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZES: COVID-19 IMPACT

FIGURE 40 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 37 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 38 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 INCREASING DEMAND IN BANKING, HEALTHCARE, AND LEGAL VERTICALS TO DRIVE THE ADOPTION OF VIRTUAL DATA ROOM SOLUTIONS ACROSS LARGE ENTERPRISES

TABLE 39 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 40 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 ROBUST CLOUD-BASED DEPLOYMENTS AND PRODUCT OFFERINGS TO LEAD SMALL AND MEDIUM-SIZED ENTERPRISES TO RECORD A HIGHER GROWTH RATE

TABLE 41 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 VIRTUAL DATA ROOM MARKET, BY BUSINESS FUNCTION (Page No. - 104)

9.1 INTRODUCTION

9.1.1 BUSINESS FUNCTIONS: COVID-19 IMPACT

FIGURE 41 MARKETING AND SALES SEGMENT TO RECORD THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 43 MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 44 MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

9.2 MARKETING AND SALES

9.2.1 RISE IN DIGITALIZATION AND THE URGE OF ENSURING SECURITY IN MEETINGS TO LEAD THE GROWTH IN VIRTUAL DATA ROOM

TABLE 45 MARKETING AND SALES: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 46 MARKETING AND SALES: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3 LEGAL AND COMPLIANCE

9.3.1 HIGH DATA SECURITY AND SECURE FILE SHARING TO INCREASE THE DEMAND FOR VIRTUAL DATA ROOM

TABLE 47 LEGAL AND COMPLIANCE: VIRTUAL DATA ROOM MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 48 LEGAL AND COMPLIANCE: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4 FINANCE

9.4.1 TRANSFERRING CONFIDENTIAL FINANCE-RELATED DOCUMENTS AND OTHER FINANCE FUNCTIONS TO DRIVE THE DEMAND FOR VIRTUAL DATA ROOM

TABLE 49 FINANCE: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 50 FINANCE: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.5 WORKFORCE MANAGEMENT

9.5.1 USE OF VIRTUAL DATA ROOM FOR SMOOTH AND EFFICIENT WORKFORCE MANAGEMENT

TABLE 51 WORKFORCE MANAGEMENT: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 52 WORKFORCE MANAGEMENT: MARKET, BY REGION, 2021–2026 (USD MILLION)

10 VIRTUAL DATA ROOM MARKET, BY APPLICATION (Page No. - 111)

10.1 INTRODUCTION

10.1.1 APPLICATIONS: COVID-19 IMPACT

FIGURE 42 IPO SEGMENT TO RECORD THE HIGHEST GROWTH RATE IN DEPLOYING VIRTUAL DATA ROOM SOLUTIONS

TABLE 53 MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 54 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.2 MERGER AND ACQUISITION

10.2.1 DECISIONS CAN BE TAKEN SECURELY AND SMOOTHLY BY VIRTUAL DATA ROOM SERVICES FOR MERGER AND ACQUISITION

TABLE 55 MERGER AND ACQUISITION: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 56 MERGER AND ACQUISITION: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.3 FUNDRAISING

10.3.1 SHARING BUSINESS-CRITICAL DATA IN A SECURE MANNER WITH THE USE OF VIRTUAL DATA ROOM

TABLE 57 FUNDRAISING: VIRTUAL DATA ROOM MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 58 FUNDRAISING: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.4 AUDIT PREPARATION

10.4.1 TO HELP IN A SECURE DOCUMENT SHARING FOR AUDIT PREPARATION

TABLE 59 AUDIT PREPARATION: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 60 AUDIT PREPARATION: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 IP MANAGEMENT

10.5.1 COMPANIES WITH HIGHLY SENSITIVE INTELLECTUAL PROPERTY POSSESSION TO REQUIRE VIRTUAL DATA ROOM TO ENHANCE THE SECURITY

TABLE 61 IP MANAGEMENT: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 62 IP MANAGEMENT: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 BOARD/INVESTOR COMMUNICATIONS

10.6.1 TO ENSURE THAT DOCUMENTS ARE SHARED QUICKLY AND SAFELY BY STORING THEM IN A VIRTUAL DATA ROOM

TABLE 63 BOARD/INVESTOR COMMUNICATIONS: VIRTUAL DATA ROOM MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 64 BOARD/INVESTOR COMMUNICATIONS: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 SECURE DOCUMENT REPOSITORY

10.7.1 TO SECURELY COMMUNICATE DOCUMENTS WITH OTHER PARTIES TO LEAD TO THE GROWTH OF THE VIRTUAL DATA ROOM

TABLE 65 SECURE DOCUMENT REPOSITORY: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 66 SECURE DOCUMENT REPOSITORY: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.8 IPO

10.8.1 COMPLETION OF AN IPO TO REQUIRE SEVERAL THINGS THAT CAN BE PERFORMED BY VIRTUAL DATA ROOM IN AN EFFECTIVE WAY

TABLE 67 IPO: VIRTUAL DATA ROOM MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 68 IPO: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.9 DUE DILIGENCE

10.9.1 EASE IN SHARING DUE DILIGENCE INFORMATION BY VIRTUAL DATA ROOM

TABLE 69 DUE DILIGENCE: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 70 DUE DILIGENCE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.10 OTHER APPLICATIONS

TABLE 71 OTHER APPLICATIONS: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 72 OTHER APPLICATIONS: MARKET, BY REGION, 2021–2026 (USD MILLION)

11 VIRTUAL DATA ROOM MARKET, BY VERTICAL (Page No. - 123)

11.1 INTRODUCTION

11.1.1 VERTICAL: COVID-19 IMPACT

FIGURE 43 GOVERNMENT AND DEFENSE VERTICAL TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 73 MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 74 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 75 DRIVERS AND CHALLENGES, BY VERTICAL

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

11.2.1 TO IMPROVE BUSINESS PERFORMANCE AND MINIMIZE DATA SECURITY RISKS WITH THE HELP OF VIRTUAL DATA ROOM

TABLE 76 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 77 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 RETAIL AND ECOMMERCE

11.3.1 ADOPTION OF VIRTUAL DATA ROOM SOFTWARE AND SERVICES TO GAIN COMPETITIVE ADVANTAGE

TABLE 78 RETAIL AND ECOMMERCE: VIRTUAL DATA ROOM MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 79 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4 GOVERNMENT AND DEFENSE

11.4.1 RISING CONTENT CONSUMPTION AND DIGITAL ENTERTAINMENT ADOPTION TO GENERATE DEMAND FOR VIRTUAL DATA ROOM

TABLE 80 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 81 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.5 HEALTHCARE AND LIFE SCIENCES

11.5.1 REAL-TIME DECISION-MAKING TO PROVIDE NEW INNOVATIVE SOLUTIONS AND DELIVER PROPER INSIGHTS FOR PATIENTS TO LEAD TO THE RISING NEED FOR VIRTUAL DATA ROOM SOLUTIONS

TABLE 82 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 83 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.6 MANUFACTURING

11.6.1 TO EASILY SHARE NEW DESIGNS AND DATA WITH THE HELP OF THE VIRTUAL DATA ROOM

TABLE 84 MANUFACTURING: VIRTUAL DATA ROOM MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 85 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.7 TELECOM AND IT

11.7.1 TO STRENGTHEN THE ORGANIC AND INORGANIC GROWTH STRATEGIES AND CATER TO CUSTOMER NEEDS IN A BETTER MANNER BY VIRTUAL DATA ROOM

TABLE 86 TELECOM AND IT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 87 TELECOM AND IT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.8 REAL ESTATE

11.8.1 VIRTUAL DATA ROOM TO HELP ORGANIZE AND SHARE THE CRUCIAL DOCUMENTS SAFELY

TABLE 88 REAL ESTATE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 89 REAL ESTATE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.9 ENERGY AND UTILITIES

11.9.1 REDUCED TRANSACTIONAL COSTS AND CONSUMPTION OF ENERGY AND UTILITIES TO LEAD TO THE GROWTH OF VIRTUAL DATA ROOM

TABLE 90 ENERGY AND UTILITIES: VIRTUAL DATA ROOM MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 91 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.10 OTHER VERTICALS

TABLE 92 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 93 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 VIRTUAL DATA ROOM MARKET, BY REGION (Page No. - 136)

12.1 INTRODUCTION

FIGURE 44 SINGAPORE TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 45 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 94 MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 95 VIRTUAL DATA ROOM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: COVID-19 IMPACT

TABLE 96 NORTH AMERICA: PROMINENT PLAYERS

12.2.2 NORTH AMERICA: REGULATIONS

12.2.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

12.2.2.2 Gramm–Leach–Bliley (GLB) Act

12.2.2.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

12.2.2.4 Federal Information Security Management Act (FISMA)

12.2.2.5 Federal Information Processing Standards (FIPS)

12.2.2.6 California Consumer Privacy Act (CSPA)

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

TABLE 97 NORTH AMERICA: VIRTUAL DATA ROOM MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 107 NORTH AMERICA: VIRTUAL DATA ROOM MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.3 UNITED STATES

12.2.3.1 Rapid adoption and use of digitally innovative solutions, the presence of tech-giants, and the increased use of the internet to drive the virtual data room market growth

12.2.4 CANADA

12.2.4.1 Startup ecosystem and the transformation into data-driven organizations to drive the growth of virtual data room solutions in Canada

12.3 EUROPE

12.3.1 EUROPE: COVID-19 IMPACT

TABLE 115 EUROPE: PROMINENT PLAYERS

12.3.2 EUROPE: REGULATIONS

12.3.2.1 General Data Protection Regulation (GDPR)

12.3.2.2 European Committee for Standardization (CEN)

12.3.2.3 EU’s General Court

TABLE 116 EUROPE: VIRTUAL DATA ROOM MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 125 EUROPE: VIRTUAL DATA ROOM MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.3 UNITED KINGDOM

12.3.3.1 Advanced IT infrastructure, technologies, and continued transition toward online services to drive the growth of virtual data room solutions in the UK

12.3.4 GERMANY

12.3.4.1 Government initiatives for technological developments in the manufacturing vertical to drive the growth of virtual data room solutions in Germany

12.3.5 FRANCE

12.3.5.1 Heavy R&D investments; digitalization; and strong hold of retail, aerospace and defense, and manufacturing verticals to drive the growth of the virtual data room market in France

12.3.6 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: COVID-19 IMPACT

TABLE 134 ASIA PACIFIC: PROMINENT PLAYERS

12.4.2 ASIA PACIFIC: REGULATIONS

12.4.2.1 Personal Data Protection Act (PDPA)

12.4.2.2 International Organization for Standardization (ISO) 27001

FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 135 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: VIRTUAL DATA ROOM MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.3 CHINA

12.4.3.1 The use of virtual data room services in M&A deals to fuel the adoption of virtual data rooms in China

12.4.4 JAPAN

12.4.4.1 Rise of innovative technologies and collaboration between governments and businesses for digital transformation in Japan

12.4.5 INDIA

12.4.5.1 Local entrepreneurs with the shift in technologies to provide support to Indian companies in the virtual data room market

12.4.6 SINGAPORE

12.4.6.1 Adoption of advanced technologies and increase in business deals to increase the demand for virtual data room

12.4.7 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 153 MIDDLE EAST AND AFRICA: PROMINENT PLAYERS

12.5.2 MIDDLE EAST AND AFRICA: REGULATIONS

12.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

12.5.2.2 GDPR Applicability in KSA

12.5.2.3 Protection of Personal Information Act (POPIA)

TABLE 154 MIDDLE EAST AND AFRICA: VIRTUAL DATA ROOM MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: VIRTUAL DATA ROOM MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.5.3 UAE

12.5.3.1 New investments, strategies, and products to drive the adoption of virtual data room solutions in the region

12.5.4 SOUTH AFRICA

12.5.4.1 Growing digitalization in African countries to offer opportunities for deploying virtual data room solutions in South Africa

12.5.5 REST OF MIDDLE EAST AND AFRICA

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: COVID-19 IMPACT

TABLE 172 LATIN AMERICA: PROMINENT PLAYERS

12.6.2 LATIN AMERICA: REGULATIONS

12.6.2.1 Brazil Data Protection Law

12.6.2.2 Argentina Personal Data Protection Law No. 25.326

TABLE 173 LATIN AMERICA: VIRTUAL DATA ROOM MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2020 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 183 LATIN AMERICA: VIRTUAL DATA ROOM MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 Increased use of the internet, technologies, M&A deals, and government organizations to increase the demand in Brazil

12.6.4 MEXICO

12.6.4.1 Increasing trade, rising customer base, and government initiatives to fuel the growth of virtual data rooms

12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 186)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES

TABLE 191 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE VIRTUAL DATA ROOM MARKET

13.3 REVENUE ANALYSIS

FIGURE 48 REVENUE ANALYSIS FOR KEY PUBLIC COMPANIES IN THE PAST FIVE YEARS

13.4 MARKET SHARE ANALYSIS

FIGURE 49 MARKET: MARKET SHARE ANALYSIS

TABLE 192 MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 50 KEY VIRTUAL DATA ROOM MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

13.6 COMPETITIVE BENCHMARKING

TABLE 193 COMPANY TOP THREE APPLICATION FOOTPRINT

TABLE 194 COMPANY REGION FOOTPRINT

13.7 STARTUP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 51 STARTUP/SME VIRTUAL DATA ROOM MARKET EVALUATION MATRIX, 2021

13.8 COMPETITIVE SCENARIO

13.8.1 PRODUCT LAUNCHES

TABLE 195 PRODUCT LAUNCHES, NOVEMBER 2018–JULY 2021

13.8.2 DEALS

TABLE 196 DEALS, AUGUST 2018– JULY 2021

13.8.3 OTHERS

TABLE 197 OTHERS, AUGUST 2020–AUGUST 2021

14 COMPANY PROFILES (Page No. - 199)

14.1 INTRODUCTION

(Business Overview, Products & Solutions, Key Insights, Recent Developments, MnM View)*

14.2 KEY PLAYERS

14.2.1 CITRIX SYSTEMS

TABLE 198 CITRIX SYSTEMS: BUSINESS OVERVIEW

FIGURE 52 CITRIX SYSTEMS: FINANCIAL OVERVIEW

TABLE 199 CITRIX SYSTEMS: SOLUTIONS OFFERED

TABLE 200 CITRIX SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 201 CITRIX SYSTEMS: DEALS

14.2.2 SS&C INTRALINKS

TABLE 202 SS&C INTRALINKS: BUSINESS OVERVIEW

FIGURE 53 SS&C INTRALINKS: COMPANY SNAPSHOT

TABLE 203 SS&C INTRALINKS: SOLUTIONS OFFERED

TABLE 204 SS&C INTRALINKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 205 SS&C INTRALINKS: DEALS

14.2.3 DATASITE

TABLE 206 DATASITE: BUSINESS OVERVIEW

TABLE 207 DATASITE: SOLUTIONS OFFERED

TABLE 208 DATASITE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 209 DATASITE: DEALS

14.2.4 DROOMS

TABLE 210 DROOMS: BUSINESS OVERVIEW

TABLE 211 DROOMS: SOLUTIONS OFFERED

TABLE 212 DROOMS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 213 DROOMS: DEALS

14.2.5 DILIGENT CORPORATION

TABLE 214 DILIGENT CORPORATION: BUSINESS OVERVIEW

TABLE 215 DILIGENT CORPORATION: SOLUTIONS OFFERED

TABLE 216 DILIGENT CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 217 DILIGENT CORPORATION: DEALS

TABLE 218 DILIGENT CORPORATION: OTHERS

14.2.6 AXWAY

TABLE 219 AXWAY: BUSINESS OVERVIEW

FIGURE 54 AXWAY: COMPANY SNAPSHOT

TABLE 220 AXWAY: SOLUTIONS OFFERED

TABLE 221 AXWAY: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 222 AXWAY: DEALS

14.2.7 THOMSON REUTERS

TABLE 223 THOMSON REUTERS: BUSINESS OVERVIEW

FIGURE 55 THOMSON REUTERS: FINANCIAL OVERVIEW

TABLE 224 THOMSON REUTERS: SOLUTIONS OFFERED

TABLE 225 THOMSON REUTERS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 226 THOMSON REUTERS: DEALS

14.2.8 DONNELLEY FINANCIAL SOLUTIONS

TABLE 227 DONNELLEY FINANCIAL SOLUTIONS: BUSINESS OVERVIEW

FIGURE 56 DONNELLY FINANCIAL SOLUTIONS: FINANCIAL OVERVIEW

TABLE 228 DONNELLEY FINANCIAL SOLUTIONS: SOLUTIONS OFFERED

TABLE 229 DONNELLY FINANCIAL SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 230 DONNELLY FINANCIAL SOLUTIONS: DEALS

14.2.9 IDEALS

TABLE 231 IDEALS: BUSINESS OVERVIEW

TABLE 232 IDEALS: SOLUTIONS OFFERED

TABLE 233 IDEALS: PRODUCT LAUNCHES AND ENHANCEMENTS

14.2.10 SMARTROOM

TABLE 234 SMARTROOM: BUSINESS OVERVIEW

TABLE 235 SMARTROOM: SOLUTIONS OFFERED

TABLE 236 SMARTROOM: DEALS

14.2.11 VITRIUM SYSTEMS

TABLE 237 VITRIUM SYSTEMS: BUSINESS OVERVIEW

TABLE 238 VITRIUM SYSTEMS: SOLUTIONS OFFERED

TABLE 239 VITRIUM SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

14.2.12 SHAREVAULT

TABLE 240 SHAREVAULT: BUSINESS OVERVIEW

TABLE 241 SHAREVAULT: SOLUTIONS OFFERED

TABLE 242 SHAREVAULT: PRODUCT LAUNCHES AND ENHANCEMENTS

14.2.13 FORDATA

TABLE 243 FORDATA: BUSINESS OVERVIEW

TABLE 244 FORDATA: SOLUTIONS OFFERED

TABLE 245 FORDATA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 246 FORDATA: OTHERS

14.2.14 ETHOSDATA

14.2.15 ANSARADA

14.2.16 SECUREDOCS

14.2.17 CAPLINKED

14.2.18 DIGIFY

14.2.19 VAULT ROOMS

14.2.20 ONEHUB

*Details on Business Overview, Products & Solutions, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

14.3 STARTUPS/SMES

14.3.1 FIRMSDATA

14.3.2 CONFIEX DATA ROOM

14.3.3 PACTCENTRAL

14.3.4 KAMZAN

14.3.5 BIT.AI

14.3.6 DOCUFIRST

14.3.7 KASM TECHNOLOGIES LLC

14.3.8 DCIRRUS

15 APPENDIX (Page No. - 245)

15.1 ADJACENT AND RELATED MARKETS

15.1.1 INTRODUCTION

15.1.2 BIG DATA MARKET - GLOBAL FORECAST TO 2025

15.1.2.1 Market definition

15.1.2.2 Market overview

15.1.2.2.1 Big data market, by component

TABLE 247 BIG DATA MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 248 SOLUTIONS: BIG DATA MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 249 BIG DATA MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 250 PROFESSIONAL SERVICES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

15.1.2.2.2 Big data market, by deployment mode

TABLE 251 BIG DATA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 252 CLOUD: BIG DATA MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

15.1.2.2.3 Big data market, by organization size

TABLE 253 BIG DATA MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

15.1.2.2.4 Big data market, by business function

TABLE 254 BIG DATA MARKET SIZE, BY BUSINESS FUNCTION, 2018–2025 (USD MILLION)

15.1.2.2.5 Big data market, by vertical

TABLE 255 BIG DATA MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

15.1.2.2.6 Big data market, by region

TABLE 256 BIG DATA MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

15.1.3 DATA DISCOVERY MARKET—GLOBAL FORECAST TO 2025

15.1.3.1 Market definition

15.1.3.2 Market overview

15.1.3.2.1 Data discovery market, by component

TABLE 257 DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 258 DATA DISCOVERY MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 259 DATA DISCOVERY MARKET SIZE, BY SERVICE,2014–2019 (USD MILLION)

TABLE 260 DATA DISCOVERY MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 261 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 262 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

15.1.3.2.2 Data discovery market, by organization size

TABLE 263 DATA DISCOVERY MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 264 DATA DISCOVERY MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

15.1.3.2.3 Data discovery market, by deployment mode

TABLE 265 DATA DISCOVERY MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 266 DATA DISCOVERY MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 267 CLOUD: DATA DISCOVERY MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 268 CLOUD: DATA DISCOVERY MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

15.1.3.2.4 Data discovery market, by functionality

TABLE 269 DATA DISCOVERY MARKET SIZE, BY FUNCTIONALITY, 2014–2019 (USD MILLION)

TABLE 270 DATA DISCOVERY MARKET SIZE, BY FUNCTIONALITY, 2019–2025 (USD MILLION)

15.1.3.2.5 Data discovery market, by application

TABLE 271 DATA DISCOVERY MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 272 DATA DISCOVERY MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

15.1.3.2.6 Data discovery market, by vertical

TABLE 273 DATA DISCOVERY MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 274 DATA DISCOVERY MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

15.1.3.2.7 Data discovery market, by region

TABLE 275 DATA DISCOVERY MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 276 DATA DISCOVERY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of the Virtual Data Room market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Virtual Data Room market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Virtual Data Room solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

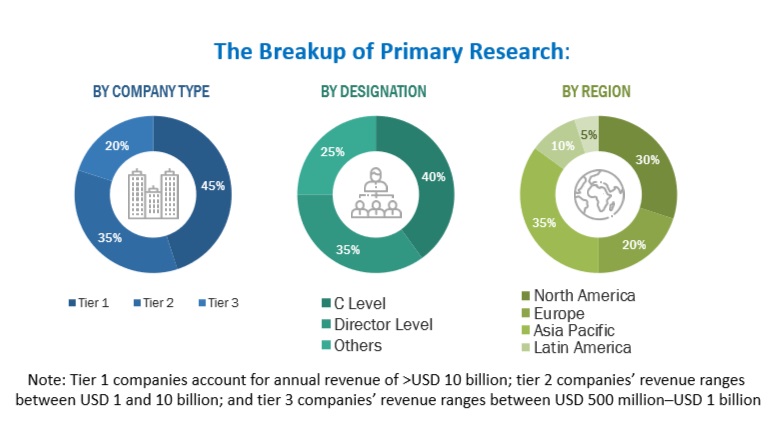

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Virtual Data Room market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the Vmarket. The bottom-up approach was used to arrive at the overall market size of the global Virtual Data Room market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the Virtual Data Room market by component (solutions and services), mode, organization size, deployment mode, end user, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Virtual Data Room market

- To analyze the impact of the COVID-19 pandemic on the Virtual Data Room market

VDR Market & its impact on Virtual Data Room Market

VDR stands for Virtual Data Room, so the VDR market and the Virtual Data Room market are one and the same thing. A Virtual Data Room is a secure online repository used for storing and sharing confidential information during financial transactions, such as mergers and acquisitions, fundraising, and IPOs.

Virtual Data Rooms (VDRs) are often used in industries such as finance, healthcare, legal, and real estate, where the exchange of confidential information is crucial. VDRs provide a secure and centralized platform for storing, managing, and sharing confidential documents, and offer features such as access control, audit trails, and watermarks to ensure that the information is only accessible to authorized parties.

The emergence of VDRs has changed the way businesses manage their sensitive information and data, particularly during mergers and acquisitions, due diligence, fundraising, and other similar processes. VDRs offer secure online storage, collaboration, and sharing features that are essential in these scenarios, making them a crucial tool for businesses.

The VDR market has been growing steadily, and it is expected to continue to grow in the coming years. This growth is driven by several factors, including the increasing need for secure and efficient data management solutions, the rising adoption of cloud-based technologies, and the growing demand for VDRs in emerging markets.

Overall, the growth of the VDR market is likely to have a positive impact on the virtual data room market as a whole, as it will increase awareness and demand for these types of solutions. As businesses become more aware of the benefits of VDRs, they will be more likely to adopt them, leading to increased demand for virtual data room services.

Futuristic Growth Use-Cases of VDR Market

As technology continues to evolve, the VDR market is expected to grow and offer a wide range of use cases. Here are some futuristic growth use-cases of VDR market:

- Artificial Intelligence (AI) Integration: AI has the potential to revolutionize VDRs by automating routine tasks such as data entry, document categorization, and data analysis. This integration can help businesses save time and reduce the risk of human error.

- Blockchain Integration: The integration of blockchain technology into VDRs can help businesses securely store and share information, making it virtually impossible to tamper with or manipulate data.

- Virtual Reality (VR) Integration: With the help of VR, VDRs can provide a more immersive experience, allowing users to interact with data and documents in a more intuitive way.

- Increased Automation: As the VDR market continues to grow, we can expect to see an increase in automation, where tasks such as document management, data entry, and report generation are automated.

- Cloud-Based Solutions: Cloud-based VDRs can offer more flexibility and accessibility to businesses, enabling them to store and share information from anywhere in the world.

Overall, the VDR market is expected to continue to grow and offer a wide range of use cases as technology continues to evolve.

Some of the Top players in VDR market are Merrill Corporation, Intralinks Holdings Inc, Drooms GmbH, Firmex Inc., Citrix Systems Inc., Box Inc., Brainloop AG, Ansarada Pty Ltd, CapLinked Inc. and Onehub Inc.

New Business Opportunities in VDR Market

Here are some new business opportunities in the VDR market:

- Customization Services: Many businesses have unique needs when it comes to VDRs, and they may require customized solutions to meet their specific requirements. Companies that offer customization services for VDRs can create tailored solutions for clients, providing them with a competitive advantage.

- Integration Services: As businesses increasingly use multiple software tools and platforms, there is a growing need for VDRs to integrate seamlessly with these tools. Companies that offer integration services for VDRs can help clients streamline their workflows and improve efficiency.

- Consulting Services: Many businesses may not be familiar with VDRs or may not know how to use them effectively. Companies that offer consulting services for VDRs can provide guidance on how to use these tools to achieve their business objectives.

- Security Services: As the amount of data stored in VDRs increases, so does the risk of data breaches. Companies that offer security services for VDRs can help clients protect their sensitive information and prevent unauthorized access.

- Localization Services: As the VDR market expands globally, there is a growing need for localization services that can help businesses navigate language and cultural barriers. Companies that offer localization services for VDRs can provide support for clients in different regions, improving their ability to work with global partners.

Overall, the VDR market presents a range of new business opportunities, and companies that can offer innovative solutions to meet the growing demand for VDRs can position themselves for success in this market.

Growth Drivers for VDR Business from Macro to Micro

Here are some growth drivers for the VDR business:

Macro Factors:

- Increasing Digitization: The shift towards digital technologies has driven the demand for VDRs, which provide a secure way to store and share sensitive information online.

- Growing M&A Activities: The rise in M&A activities across various industries has created a need for secure information sharing platforms, such as VDRs, to facilitate due diligence and deal-making processes.

- Increasing Data Security Concerns: The increasing threat of data breaches and cyber attacks has driven the demand for secure information sharing platforms, such as VDRs, to protect sensitive data.

- Globalization: The increasing globalization of businesses has created a need for secure and efficient ways to share information with partners, suppliers, and clients across different regions.

Micro Factors:

- User-friendly Interfaces: The availability of user-friendly interfaces in VDRs has increased the ease of use and accessibility, which has led to wider adoption across industries.

- Customization and Integration Capabilities: The ability to customize and integrate VDRs with other software tools and platforms has made them more adaptable and suited to the needs of individual businesses.

- Cost-effectiveness: VDRs offer a cost-effective way to store and share information compared to traditional methods, such as physical data rooms or courier services.

- Regulatory Compliance: VDRs can help businesses comply with regulatory requirements by providing a secure way to store and share sensitive information, such as financial data or patient records.

Overall, the growth of the VDR market is driven by a combination of macro and micro factors, and businesses that can offer innovative solutions to meet the growing demand for VDRs can position themselves for success in this market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American Virtual Data Room market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Virtual Data Room Market

The informations presented above are very interesting. I have also read an article about VDT on this website https://valahia.news/vdr-a-safer-solution-for-sensitive-documentation-sharing/