Virtual Event Platform Market by Component (Platform and Services), Organization Size, End User (Corporations, Governments, Education, Healthcare, Third-party Planners, Associations, Non-Profit) and Region - Global Forecast to 2027

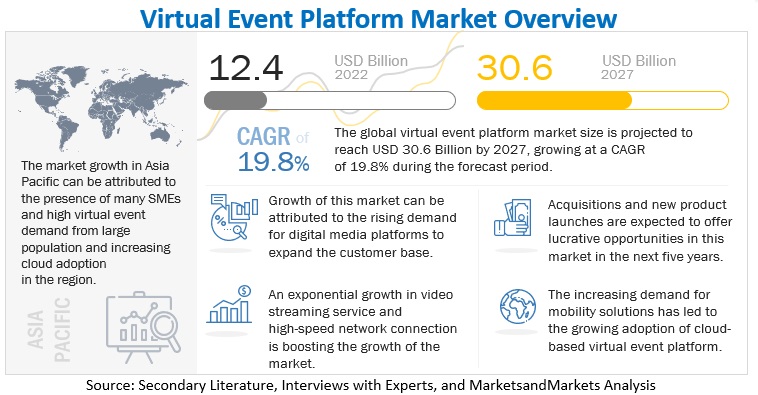

[238 Pages Report] The global virtual event platform market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 19.8% during the forecast period, to reach USD 30.6 billion in 2027 from USD 12.4 billion in 2022.

Key factors that are expected to drive the growth of the market are the increasing adoption of digital media marketing platforms, worldwide digitalization in order to expand the audience base, rise in corporate events year-on-year, the cost-effectiveness of virtual events and hybrid platforms, and significant technological advancements. According to the finding by International Telecommunication Union (2020), 75% of the global population has an active mobile broadband connection, and a mobile broadband network is accessible to nearly 90% of the world's population. This is evidence that digital media and widespread media penetration worldwide are boosting the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Recession impact analysis on the global virtual event platform market

In recent months, mostly during and after the second quarter of 2022, the tech, IT, and ITeS industries have seen a number of widely publicized layoffs and enterprise-wide downsizing as companies harbor to rebalance their headcount after growing rapidly with a significant pace during the pandemic, thereby miscalculating the length of that surge in demand. The slowing economy has had an impact on the technology sector's strong foothold over the last five years. Major tech giants like Infosys and TCS are resilient to the global recession as they are facing challenges in fewer sectors, namely retail and hi-tech, and are doing quite well in the energy and utilities sectors – for instance. The tech companies are showcasing indicative growth as compared to the COVID-19 times, yet research organizations and studies predict a 10-11% slowdown in the fiscal year 2023-24.

Global growth was forecasted to reduce from 6.0% in 2021 to 3.2% in 2022 and 2.7% by 2023. This was the weakest growth profile since 2001, except for the global financial crisis and the acute COVID-19 pandemic phase. Unemployment rates have been mostly stable, mostly from the second quarter of 2022, and remained relatively low in surveyed economies such as 3.5% in the US, 6.6% in the Eurozone (a record low), 6.4% in India, and 8.7% in Brazil.

Market Dynamics

Driver: Rise in popularity of online streaming to replace the in-person presentation

There has been a huge increase in the global live-streaming market since the outbreak of the COVID-19 pandemic. It has proved to be an effective solution to avoid in-person presentations and sessions. Many organizations connect with vendors in the online entertainment market, such as Netflix, Amazon Prime, Sony LIV, Zee5, Disney+Hotstar, Voot and Boxee. With digitalization and the onset of video-on-demand services, customers are making the switch to live streaming services to stream their preferred concerts and events at their preferred time, whenever and wherever they want. Live streaming events can be auto-archived and played back.

Moreover, the growth of 4G (and 5G gradually now) internet connection is contributing to the growth of mobile users, and consumers are benefitting from higher capacity connections. In 2019, India and China accounted for 56% and 80% of 4G internet connections, respectively. The growth of high-speed network connections drives the demand for online video streaming, which will impact the growth of the virtual event platform market.

Restraint: Network inconsistency and lack of communication infrastructure

Though most developed countries have highly developed communication infrastructure, some developing and underdeveloped countries lack the necessary communication infrastructure to support high-quality virtual events. People in such countries rely more on audio-based communication software to avoid the frustration of low-quality video events due to unstable internet connection and switching bandwidth. Audio-based communication software requires significantly lower bandwidth and hence, can be operated on significantly a low-capacity infrastructure as compared to video events. Moreover, private corporate events require a virtual private network for speed and a stable internet connection. For such events, network bandwidth capacity and security are critical factors for hosting a virtual event. Thus, the lack of strong communication infrastructure and internet connectivity represents a significant challenge for the growth of the virtual event platform market.

Opportunity: Surge in dependence on BYOD and CYOD Solutions

Many organizations are adopting bring-your-own-device (BYOD) and carry-your-own-device (CYOD) solutions to overcome the challenges faced by the organization due to the outbreak of COVID-19. These solutions offer employees easy accessibility to corporate data from remote locations. As organizations are increasingly adopting BYOD and CYOD solutions, they are also likely to adopt virtual event software solutions to interact and communicate with a large number of people on a real-time basis. The virtual event software solution allows organizations to host trade fairs, exhibitions, new product launches, and advertising campaigns from remote locations. Thus, the demand for these solutions is expected to boost thevirtual event platform market growth across industries.

Challenge: Lack of two-way communication

There are many ways in which the audience participates in a physical event, such as scheduled meetings, Q&A sessions, and coffee breaks. These opportunities are somewhat missing when an organization is planning an online event. Many virtual events are typically one-way communication events with live or recorded video events. To overcome these challenges, the virtual event platform vendors can innovate added features to avoid such boring scenarios and make people talk through live question-answer sessions, feedback and opinions options, polls, virtual breakout rooms, and tracking user activity logs. Thus, integrating these features into virtual event platforms will improve communication gaps and help understand audience behavior.

Services segment is expected to grow at a higher CAGR during the forecast period

Based on component, the virtual event platform market is segmented into platform and services. The services segment is very necessary for easy deployment, integration, and proper functioning of the virtual event platform. The services segment has been further bifurcated into training and consulting support & maintenance and deployment and integration.

Small enterprises segment is to grow at the highest CAGR during the forecast period.

Small enterprises generate an overall revenue of less than USD 1 billion. Being new to the market, they have restricted budgets for marketing, recruitment, and sales activities; hence, they take the benefits of virtual event solutions. Small enterprises have a low market share compared to medium-sized and large enterprises but are trying their best to sustain it. As these enterprises have a low budget and market share; hence, virtual events help them in the reduction of overall costs associated with organizing a physical seminar, conference, or meeting. Here, planners may save on venue, staff, meals, attendee's accommodation, and travel costs. Hence, small enterprises are adopting virtual events instead of physical ones as they are quick to arrange, inexpensive, and help to connect relevant people to meetings, irrespective of their locations.

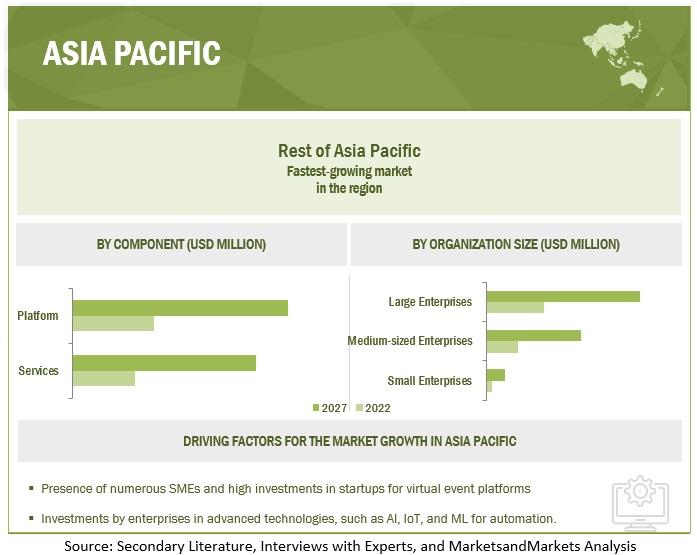

Asia Pacific to grow at the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region in terms of cloud workloads and gaining traction mainly due to the high growth of technological adoption in China, Japan, and India, among other countries. Asia Pacific organizations spend more on cloud services. According to NTT Hybrid Cloud Report, about 96% of businesses see the cloud as a critical tool to meet business requirements amid the COVID-19 pandemic outbreak. Digital transformation acceleration would create a surge in data that would further increase spending on data management tools.

The adoption of virtual event platforms is expected to grow in the coming years due to the availability of skilled labor and the growth in the number of small and medium businesses in the region. The region consists of a broad customer base for many industries; thus, it needs brand marketing activities to reach out to potential clients. Countries such as China and Japan are expected to contribute majorly to the virtual event platform market growth in the Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The virtual event platform vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market.

The major vendors offering virtual event platform and services globally are 6Connex (US), Cvent (US), Remo (US), Hubilo (US), vFairs (US), BigMarker (US), Zoom (US), Hopin (UK), , Microsoft (US), Cisco (US), Kestone (India), Accelevents (US), Whova (US), EventMobi (Canada), On24(US), Vconfex (India), Samaaro (India), Aventri (US), Intrado (US), Bizzabo (US), Airmeet (India), Attendify (India), Splash (US), HeySummit (UK), Pheedloop (Canada), Socio (US), Vconferenceonline (US), SpotMe (Switzerland), Orbits (Australia), Brella (US), Run the World (US) and Eventcube (UK).

The study includes an in-depth competitive analysis of key players in the virtual event platform market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Organization Size, End-user, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

6Connex (US), Cvent (US), Remo (US), Hubilo (US), vFairs (US), BigMarker (US), Zoom (US), Hopin (UK), , Microsoft (US), Cisco (US), Kestone (India), Accelevents (US), Whova (US), EventMobi (Canada), On24(US), Vconfex (India), Samaaro (India), Aventri (US), Intrado (US), Bizzabo (US), Airmeet (India), Attendify (India), Splash (US), HeySummit (UK), Pheedloop (Canada), Socio (US), Vconferenceonline (US), SpotMe (Switzerland), Orbits (Australia), Brella (US), Run the World (US) and Eventcube (UK). |

This research report categorizes the virtual event platform market based on component, organization size, end user, and region.

Based on the Component:

- Platform

- Services

- Training and Consulting

- Support and Maintenance

- Deployment and Integration

Based on Organization Size:

- Large enterprises

- Medium-sized enterprises

- Small enterprises

Based on End-user:

- Non Profit

- Government

- Education

- Healthcare and Lifesciences

- Third-Party Planner

- Associations

- Corporations

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Rest of Asia Pacific

-

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In October 2022, the partnership between Microsoft and Cisco wherein Microsoft would run by default on Cisco Room and Desk devices. This would allow Microsoft Teams’ customers to enjoy the digital workplace appropriately where they can connect and collaborate with their colleagues, business partners, prospects, and customers, combined with Cisco's cutting-edge quality, reliable video technology associated with powerful camera intelligence and noise removal technologies/active noise cancellation capability. This allows experiencing inclusive and collaborative meeting experiences. All certified devices will be manageable in the Teams Admin Center and at the new Teams Rooms Pro Management Portal, as well as through the Cisco Control Hub -.

- In April 2022, Aventri and MettingPlay together launched ExpoPRO, the most innovative exhibitor task management platform to hit the market. ExpoPRO offers a complete solution for on-site, hybrid, and virtual formats and aims to resolve major pain points for event planners and exhibitors in the large-scale exhibition market globally.

- In October 2021, On24 Go Live expanded the type of experiences customers can create with a new video-centric virtual event solution so as to set up events rapidly and provide a destination for audiences to interact while capturing actionable insights which seamlessly integrate with sales and marketing processes.

- In June 2021, 6Connex integrated Amazon Personalize into 6Connex SoarSM and RiseSM to offer personalized recommendations by utilizing AI. With this integration, the user will utilize AI capabilities to offer customized recommendations to the event participants.

- In May 2021, Cisco made a product enhancement with the new Webex Events service that is video-centric, intelligent, and simple to use. It provides an efficient virtual event experience. Hosts can choose between the webinar mode for an interactive and highly engaging event and the webcast mode for events with limited attendee interactions.

Frequently Asked Questions (FAQ):

What is the projected market value of the virtual event platform market?

The global virtual event platform market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 19.8% during the forecast period, to reach USD 30.6 billion in 2027 from USD 12.4 billion in 2022.

Which region has the highest market share in the virtual event platform market?

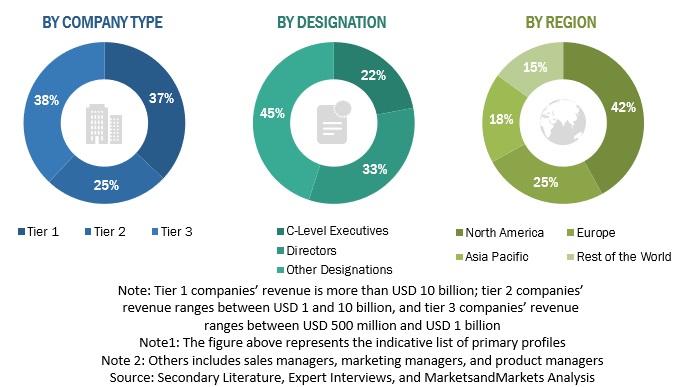

North America and Europe region have the highest market share in the virtual event platform market, where these two regions together contribute more than half of the global virtual event platform market in the year 2020.

Who are the major vendors in the virtual event platform market?

Despite the presence of a large number of vendors, the market is dominated mainly by vendors such as 6Connex (US), Cvent (US), Hopin (UK), Remo (US), Hubilo (US), Vfairs (US), BigMarker (US), Zoom (US), Microsoft (US), Cisco (US), Kestone (India), Accelevents (US), Whova (US), EventMobi (Canada), On24(US), Vconfex (India), Samaaro (India), Aventri (US), Intrado (US), Bizzabo (US), Airmeet (India), Attendify (India), Splash (US), HeySummit (UK), Pheedloop (Canada), Socio (US), Vconferenceonline (US), SpotMe (Switzerland), Orbits (Australia), Brella (US), Run the World (US) and Eventcube (UK).

What are some of the latest trends that will shape the virtual event platform market in the future?

The emergence of technologies, including augmented reality, virtual reality, Artificial intelligence, cloud, machine learning, IoT, and data analytics which significantly improve the virtual event platform market, is expected to shape the market in coming years.

What are some of the latest statistical data or sections included in the report to understand virtual event platform market better?

Competitive benchmarking, vendor share analysis, Magic quadrant methodology, market share of players, company footprint tables, among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the global virtual event platform market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total virtual event platform market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from virtual event platform vendors, industry associations, and independent consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making the market estimates and forecasting the virtual event platform market, the top-down and bottom-up approaches were used to estimate and validate the size of the virtual event platform market and various other dependent subsegments. The research methodology used to estimate the market size includes the following:

- The key players in the virtual event platform market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the virtual event platform market based on component, organization size, end user and regions

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the virtual event platform market.

- To analyze the impact of COVID-19 on component, organization size, end user, and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the virtual event platform market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the virtual event platform market

- To profile key players in the virtual event platform market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and mergers and acquisitions, in the virtual event platform market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Virtual Event Platform Market