Water Treatment Chemicals Market by Type (Flocculant & Coagulant, Corossion Inhibitors, Scale Inhibitors, Biocides & Disinfectants, Chelating Agents), Source, End-use (Residential. Commercial & Industrial), and Region - Global Forecast to 2028

Water Treatment Chemicals Market Overview

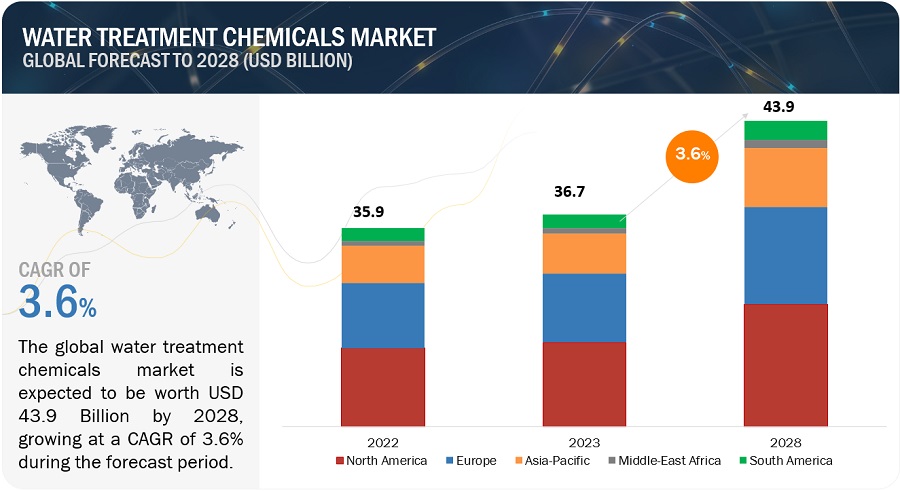

The global water treatment chemicals market size is estimated to be USD 36.7 billion in 2023 and projected to reach USD 43.9 billion in 2028, at a CAGR of 3.6%. Water treatment chemicals can be defined as chemical compounds used in the water treatment process to remove impurities which cause corrosion, scales, high turbidity, and biological imbalance. These impurities can be metallic, organic, or non-organic in nature. Rapid growth is fueled by increasing demand for treated water in various end-use industries, stringent water, and wastewater regulations.

Opportunities in the Water Treatment Chemicals Market

To know about the assumptions considered for the study, Request for Free Sample Report

Recession impact

During a recession, industries like construction, manufacturing, and mining may experience reduced activity, leading to decreased demand for water treatment chemicals. Companies may also cut costs, potentially affecting their investment in environmental compliance, including water treatment. Conversely, in some cases, there could be an increased need for efficient water treatment due to infrastructure maintenance and tighter regulatory controls during economic downturns. Overall, the impact depends on the severity and duration of the recession, industry-specific trends, and government policies concerning environmental standards and water management.

Water Treatment Chemicals Market Dynamics

Driver : Increasing demand for chemically treated water in various end-use industries

Global freshwater resources comprise a mere 2.5% of the total water supply, posing a significant challenge in meeting the needs of industries and households. To bridge the growing gap between water demand and supply, efficient water recycling is essential, achieved through the use of water treatment chemicals. As a result, various industries, including oil & gas, power, pulp & paper, mining, chemicals, and food & beverage, have seen a rapid rise in using treated wastewater. Emerging economies, like China, India, Brazil, Indonesia, Malaysia, Argentina, Chile, and Vietnam, are witnessing substantial industrial growth, intensifying the demand for clean water for domestic, agricultural, and industrial purposes. Water treatment chemicals offer a cost-effective solution, outshining pricier methods like ion exchange, UV filtration, and reverse osmosis. Large-scale water treatment plants find coagulation, flocculation, and disinfection costs notably lower than UV and RO alternatives. The expansion of power, oil & gas, mining, and chemical sectors, particularly in emerging markets, such as China and India, fuels the demand for these chemicals. Initiatives like the development of pre-salt oil fields in Brazil and the establishment of high-capacity power plants globally using fossil fuels, nuclear, or solar power further bolster the market for water treatment chemicals.

Restrain: Alternative water treatment technolgies

The emergence of alternative water treatment technologies, which are increasingly being recognized as more environmentally sustainable and cost-effective solutions restrains the growth of this market. Among these alternatives, membrane filtration systems stand out for their ability to offer precise control over contaminant removal without the necessity of chemical additives. This capability not only enhances the quality of treated water but also significantly reduces the reliance on traditional flocculants and coagulants. Additionally, ultraviolet (UV) disinfection systems have gained prominence for their eco-friendly approach to water treatment. By effectively eliminating pathogens without chemical intervention, UV disinfection not only addresses environmental concerns but also curtails the procurement and disposal costs associated with conventional treatment chemicals.

Membrane filtration technologies, including microfiltration, ultrafiltration, nanofiltration, and reverse osmosis, provide a tailored approach to removing impurities from water. They are prized for their ability to remove particles, microorganisms, and even dissolved solutes, making them highly versatile across industries. These systems are particularly attractive due to their minimal chemical use, reducing the environmental footprint and operational costs. As industries increasingly prioritize both sustainability and cost-efficiency, the adoption of these innovative and environmentally conscious water treatment technologies can potentially restrain the growth of the traditional water treatment chemicals market.

Opportunity: Rising population and rapid urbanization in emerging economies

The emerging economies in the Asia Pacific region, especially China and India, present significant opportunities for the water treatment chemicals market. China, with its substantial population and limited freshwater resources, has made water quality a high priority in its Five-Year Plan for Ecological & Environmental Protection. The government's focus on unit-based management for water quality, pollution control, and urban water body improvement creates a strong demand for water treatment chemicals. In India, where freshwater resources are also constrained relative to the population, the potential for water treatment is evident. With 16% of the global population, India's growing need for clean water for agricultural and industrial use opens doors for water treatment solutions. As urbanization and environmental concerns rise, these countries offer a vast market for water treatment chemicals to address water quality challenges and bridge the gap between supply and demand. This presents an exciting growth opportunity for the industry.

Challenge: Need for eco-friendly formulations and vulnerability regarding copying patents

The primary factors inhibiting the growth of the water treatment chemicals market are the stringent environmental legislation implemented by various agencies, for instance, the EPA. Increasing concerns regarding the impact of chemicals on the environment have led to stringent regulatory constraints for water treatment chemical manufacturers. Currently, manufacturers of water treatment chemicals are encouraged to opt for green alternatives. The property of the performance of green alternative formulations under severe conditions makes it difficult for manufacturers to provide replacements for standard formulations. Manufacturers face problems in costs and profits in green chemistry, which leads to challenges in developing highly effective and economically viable environment-friendly water treatment chemicals. The use of green alternative chemical formulations leads to the risk of bio fouling for which, extra dosage of biocides is needed, which, in turn, affects the cost-efficiency of the installation. Water treatment chemicals need to be more robust to enable increased recycling and reuse of water, but the more robust chemistry has traditionally been less environment friendly. Once a patented water treatment chemical is made public, it becomes susceptible to being copied. Some manufacturers in Asia offer counterfeit products at lower costs, thus posing a major challenge for basic chemical manufacturers.

Water Treatment Chemicals Market: Ecosystem

Coagulants & Flocculants segment is the second-fastest growing type in the water treatment chemicals market during the forecast period.

The Coagulants & Flocculants segment is the second-fastest growing in the water treatment chemicals market due to its pivotal role in removing suspended particles and clarifying water. With rising industrialization and stringent water quality standards, there is an increased demand for effective treatment of raw water. Coagulants destabilize particles, and flocculants aid in their agglomeration, making them more manageable for removal, ensuring water quality compliance and driving the segment's growth.

Boiler Water Treatment segment is the fastest growing application in the water treatment chemicals market during the forecast period.

The Boiler Water Treatment segment experiences the fastest growth in the water treatment chemicals market due to its critical role in maintaining the efficiency and longevity of boilers and steam generators. Effective treatment chemicals prevent scale formation, corrosion, and damage to boiler systems, ensuring their optimal operation. As industries expand, the demand for reliable boiler performance increases, driving the growth of this application segment.

The commercial segment is the second-fastest growing end use industry in the water treatment chemicals market during the forecast period.

The Commercial segment is the second fastest-growing end user in the water treatment chemicals market due to a surge in demand for clean water in various businesses like hospitality, healthcare, retail, and institutions. These sectors rely on water treatment chemicals to maintain water quality for drinking, sanitation, and HVAC systems. As commercial activities expand globally, the need for effective water treatment solutions increases, driving growth in this segment.

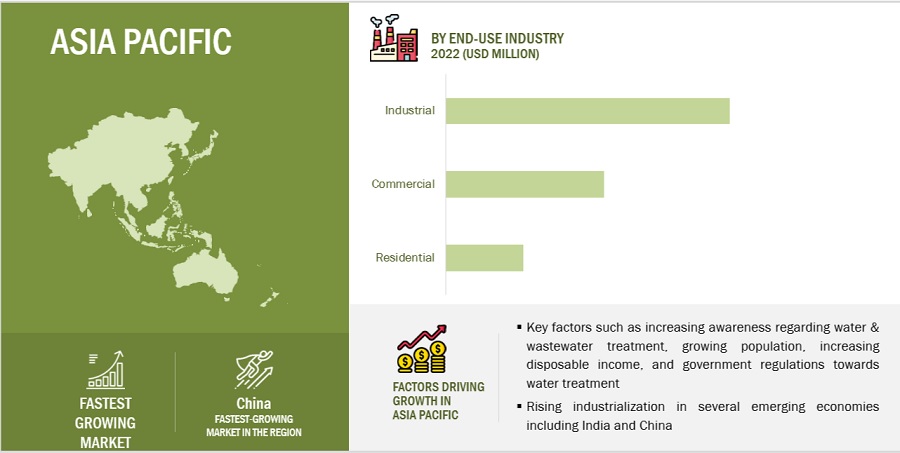

Asia Pacific has the second largest market share in the water treatment chemicals market, in terms of value.

Asia Pacific occupies the second-largest share in the water treatment chemicals market due to several factors. Emerging economies like China, India, Indonesia, and South Korea are experiencing growing demand for these chemicals due to heightened awareness of water treatment and rapid industrial and infrastructure development. Government regulations related to water treatment also contribute to increased demand. These factors collectively contribute to the expansion of the water treatment chemicals market in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Kemira OYJ (Finland), BASF SE (Germany), Ecolab Inc. (U.S.), Dow Inc. (U.S.), and Solenis LLC (U.S.). These players have established a strong foothold in the market by adopting strategies, such expansions, joint ventures, and mergers & acquisitions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kiloton) and Value (USD Million/Billion) |

|

Segments |

By Type, Source, Application, End-use Industry, and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

Kemira OYJ (Finland), BASF SE (Germany), Ecolab Inc. (U.S.), Dow Inc. (U.S.), and Solenis LLC (U.S.). |

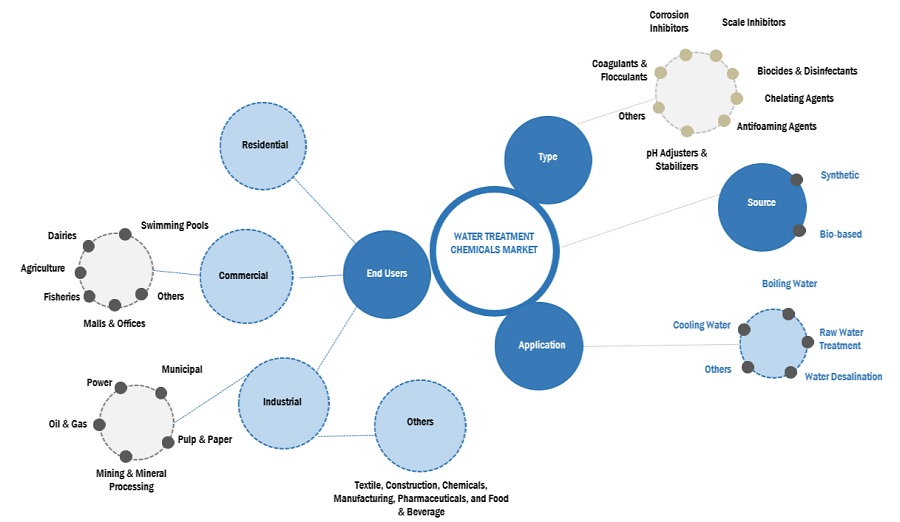

This research report categorizes the water treatment chemicals market based on type, end-use industry, and region.

By type:

- Corrosion inhibitors

- Scale inhibitors

- Biocides & disinfectants

- Coagulants & flocculants

- Chelating agents

- Anti-foaming agents

- pH adjusters and stabilizers

- Others

By application:

- Boiler water treatment

- Cooling water treatment

- Raw water treatment

- Water Desalination

- Others

By end-user:

- Residential

- Commercial

- Industrial

By source:

- Synthetic

- Bio-based

By region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In October 2023, Solenis acquired CedarChem headquarters in Cedartown, Georgia. CedarChem provides a comprehensive range of water and wastewater treatment products tailored for both industrial and municipal markets, with a primary focus on serving the southeastern US. Through this acquisition the company has strengthened its market position in US.

- In December 2021, Ecolab Inc. closed the acquisition of Purolite, a global provider of ion exchange resins for the separation and purification of solutions for pharmaceutical and industrial applications. US-based Purolite has a presence in more than 30 countries.

- In June 2019, Dow and Modern Water Inc., a global leader in technologies for water and wastewater treatment, and brine monitoring, have announced collaboration whereby Modern Water will globally distribute Dow’s products. This partnership will expand Dow’s global reach.

Frequently Asked Questions (FAQ):

What is the current size of the global water treatment chemicals market?

Global water treatment chemicals market size is estimated to reach USD 43.9 billion by 2028 from USD 36.7 billion in 2023, at a CAGR of 3.6% during the forecast period.

Who are the winners in the global water treatment chemicals market?

Kemira OYJ, BASF SE, Ecolab Inc., Dow Inc., and Solenis LLC fall under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use expansions, joint ventures, and mergers & acquisitions as important growth tactics.

What is the recession on water treatment chemicals manufacturers?

Companies may focus more on cost-cutting measures and short-term survival strategies rather than long-term investments. Recessions might bring about shifts in consumer preferences and market demands.

What are some of the drivers in the market?

Increasing demand for chemically treated water in various end-use industries .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

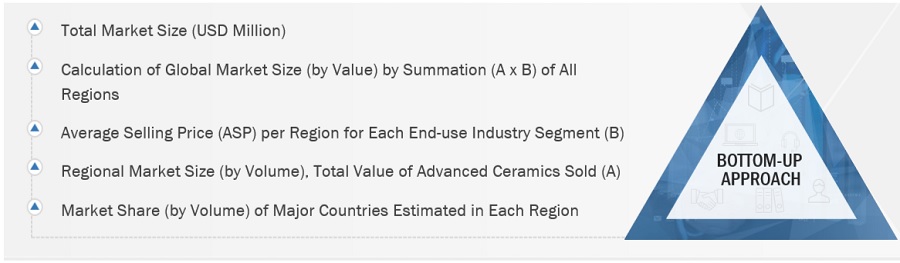

The study involved four major activities in estimating the current market size for water treatment chemicals. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

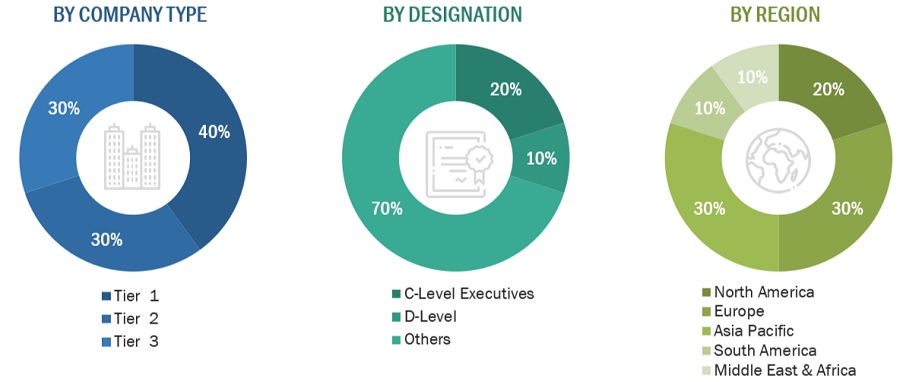

Water treatment chemicals market involves a variety of stakeholders across the value chain, including raw material suppliers, manufacturers, and end-users. For this study, both the supply and demand sides of the market were interviewed to gather qualitative and quantitative information. Key opinion leaders from various end-use sectors were interviewed from the demand side, while manufacturers and associations were interviewed from the supply side.

Primary interviews helped to gather insights on market statistics, revenue data, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to identify trends related to grade, application, end-use industries, and region. C-level executives from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand their perspective on suppliers, products, and component providers, which will affect the overall market.

Breakdown of Primaries

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The top-down approach was used to estimate and validate the size of various submarkets for water treatment chemicals for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on type, end-use industry, and country were determined using secondary sources and verified through primary sources.

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Water Treatment Chemicals Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Water Treatment Chemicals Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of water treatment chemicals and their applications.

Market Definition

Water treatment chemicals can be defined as chemical compounds used in the water treatment process to remove impurities which cause corrosion, scales, high turbidity, and biological imbalance. These impurities can be metallic, organic, or non-organic in nature. The chemicals that are used to eliminate the impurities are corrosion inhibitors, coagulants & flocculants, scale inhibitors, chelating agents, biocides & disinfectants, and pH adjusters, among others.

Stakeholders

- Manufacturers of water treatment chemicals

- Raw Material Suppliers

- Manufacturers In End-use Industries

- Traders, Distributors, and Suppliers

- Regional Manufacturers’ Associations

- Government & Regional Agencies and Research Organizations

The main objectives of this study are as follows:

- To analyze and forecast the size of the water treatment chemicals market in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze and forecast the market by type, source, application, end-use industry, and region.

- To forecast the size of the market with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders.

- To analyze competitive developments in the market, such as investment & expansion, joint venture, partnership, and merger & acquisition

- To strategically profile key players and comprehensively analyze their market shares and core competencies2.

- Notes: Micromarkets1 are the sub-segments of the water treatment chemicals market included in the report.

- Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report.

- Additional country-level analysis of water treatment chemicals market

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Water Treatment Chemicals Market