Wi-Fi 6 Market by Offering (Hardware, Solution, and Services), Location Type, Application (Immersive Technologies, IoT & Industry 4.0, Telemedicine), Vertical (Education, Media & Entertainment, Retail & eCommerce) and Region - Global Forecast to 2028

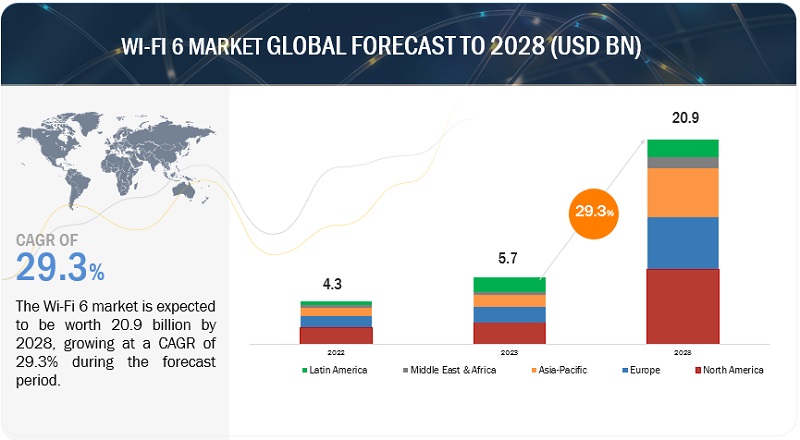

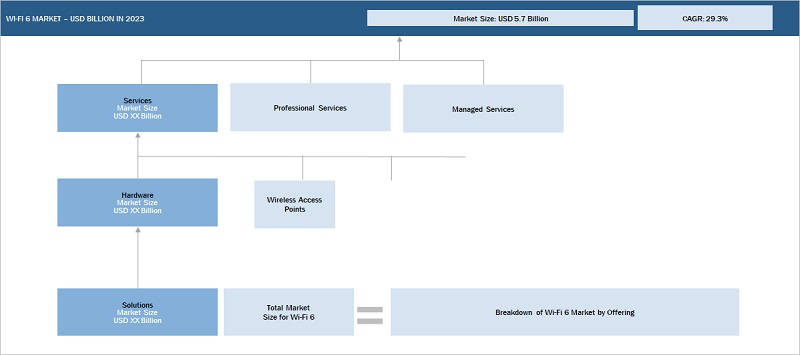

[298 Pages Report] The Wi-Fi 6 market is estimated at USD 5.7 billion in 2023 to USD 20.9 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 29.3%. One of the major factors driving the growth of the Wi-Fi 6 market is the growing popularity of smart homes, cloud computing, and virtual reality. Also, the emergence of the Internet of Things (IoT) and the implementation of smart office technologies require robust and reliable wireless connectivity. Wi-Fi 6's ability to handle numerous IoT devices simultaneously positions it as an essential enabler for IoT-driven business innovations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Wi-Fi 6 Market Dynamics

Driver: Rise in the adoption of IoT devices

IoT uses embedded technology to allow objects to perceive their surroundings, such as pressure, humidity, temperature, and motion. It works with network technologies to connect IoT devices and the cloud to transfer data as needed. This market is important for connecting things, and it has become a widely accepted standard of connectivity in a variety of physical contexts, including homes, businesses, schools, hospitals, and airports. Wireless Broadband Alliance (WBA) has recently revealed a survey stating that eighty three percent of service providers and equipment manufacturers and enterprises worldwide will have deployed Wi-Fi 6/6E or plan to do so before the end of 2022.

Restraint: Contention loss and co-channel interference

Wi-Fi 6, a cutting-edge wireless networking standard (also known as 802.11ax), the organizations face two critical factors impacting network performance and efficiency that includes: contention loss and co-channel interference. Contention loss arises when multiple devices compete for access to the same channel, resulting in data collisions and subsequent retransmissions, leading to increased latency and reduced overall network throughput. And, co-channel interference, emerges when multiple access points in the vicinity employ the same channel, resulting in overlapping signals and performance degradation. In busy environments or crowded areas, this interference can be especially detrimental to network efficiency.

Opportunity: Increasing deployment of public Wi-Fi

The growing proliferation and widespread adoption of public Wi-Fi networks in various business and commercial settings present a lucrative opportunity for enterprises to leverage Wi-Fi 6 (802.11ax) technology. As the demand for seamless connectivity and high-speed internet continues to rise, businesses recognize the need to cater to their customers and patrons with reliable, efficient, and secure wireless networks. Wi-Fi 6’s advanced features, including Orthogonal Frequency Division Multiple Access (OFDMA) and Multi-User Multiple Input Multiple Output (MU-MIMO), enable enterprises to accommodate numerous devices concurrently while maintaining optimal performance and reducing latency. Furthermore, businesses are seeking robust and scalable wireless solutions with the ever-expanding Internet of Things (IoT) ecosystem and the rise of smart cities. Wi-Fi 6's ability to handle massive IoT deployments positions it as the preferred choice for enterprises aiming to provide cutting-edge IoT services and applications in public spaces.

Challenge: Data security and privacy concerns

Data security and privacy concerns pose significant challenges that require proactive measures. One of the primary challenges is the potential for unauthorized access to sensitive information. Without proper encryption and authentication protocols, hackers can intercept and exploit data transmitted over Wifi networks, leading to data breaches and financial losses. Moreover, the proliferation of Internet of Things (IoT) devices in business environments introduces additional vulnerabilities, as these devices may lack robust security measures and can serve as entry points for cyber attackers. In this scenario, Wi-Fi solutions and associated services offer secure, reliable, high–speed internet access. Any disruption to enterprise processes can significantly affect the entire business. As a result, several enterprises are reluctant to adopt Wi-Fi solutions and services. Hence, proper security and privacy are needed to successfully deploy Wi-Fi solutions and associated services. The factors mentioned above are some of the major challenges that may affect the market’s growth.

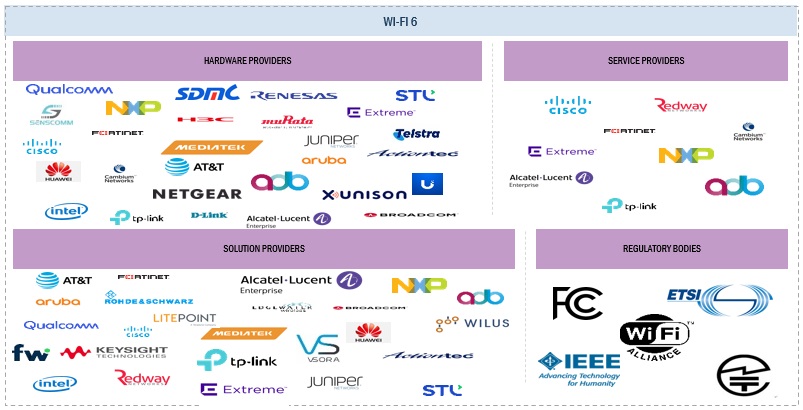

Wi-Fi 6 Market Ecosystem

Prominent companies in this market include well-established, financially stable Wi-Fi 6 hardware providers, solutions, services providers, and regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include Qualcomm (US), NXP (Netherlands), AT&T (US), and STL (India).

By vertical, the educated segment to hold the largest market size during the forecast period

Educational institutions will likely experience an influx of new wireless devices faster than any other sector. With students returning to schools, colleges, and universities, institutions need to be prepared to handle hundreds or even thousands of new devices in addition to all legacy devices. Wi-Fi 6 can significantly improve indoor and outdoor Wi-Fi performance, which benefits schools with a desire to offer excellent wireless connections. The demand for reliable and secure internet access has increased, especially with the advent of eLearning and online exam practices. Wi-Fi 6 solutions and services empower students and staff members to access the internet from diverse devices and locations. Moreover, Wi-Fi 6 caters to the increasing connectivity requirements of expanding online education, learning activities, and business operations.

By location type, the outdoor segment is expected to register the fastest growth rate during the forecast period.

The outdoor Wi-Fi 6 solution is when Wi-Fi access is provided outside of a building. Outdoor Wi-Fi 6 is usually used as an extension of the internal WLAN network of an organization to give users a continuous Wi-Fi 6 service. Scenarios for outdoor Wi-Fi 6 include the outdoor areas of a school, college, university, holiday park, hospital, hotel, or shopping center. Outdoor Wi-Fi 6 operates in the 2.4 or 5GHz frequency and can achieve theoretical throughputs of up to 1.7Gbps – true throughputs depend on client devices and the quality of WAP. Outdoor APs are often deployed with sectored antennas focusing on the wireless coverage of a specific area, thus providing a stronger and faster Wi-Fi 6 connection.

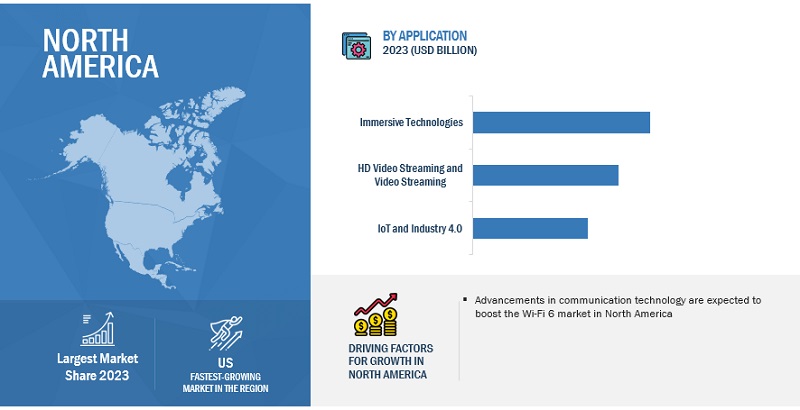

North America is expected to hold the largest market size during the forecast period

North America is expected to dominate the Wi-Fi 6 market and continue to do so for the forecast period. It is due to its expanding start-up culture, aided by establishing SMEs and expanding large corporations' R&D efforts. Using integrated enterprises and business solutions drives North America’s growth, offering significantly more flexible and agile business processes and operations.

Market Players:

The major players in the Wi-Fi 6 market are Cisco Systems Inc. (US), Qualcomm Technologies Inc. (US), Broadcom Inc (US), Intel Corporation (US), Huawei technologies (China), NETGEAR Inc (US), Juniper Networks Inc (US), Extreme Networks Inc. (US), Ubiquiti Inc. (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), D–Link Corporation (Taiwan), Alcatel Lucent Enterprise (France), TP–Link Corporation Limited (China), MediaTek Inc. (Taiwan), Telstra (Australia), Murata Manufacturing Co., Ltd. (Japan), Sterlite Technologies Limited (India), Renesas Electronics (Japan), H3C Technologies Co., Ltd. (China), Keysight Technologies (US), LitePoint (US), Rohde & Schwarz (Germany), Cambium Networks, Ltd. (US), Senscomm Semiconductors Co., Ltd. (China), XUNISON (Ireland), Redway Networks Ltd. Company (England), VSORA SAS (France), WILUS Inc. (South Korea), Federated Wireless, Inc. (US), Actiontec Electronics (US), ADB Global (Switzerland), SDMC Technology (China), and Edgewater Wireless (Canada). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the Wi-Fi 6 market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Offering (Hardware, Solutions, and Services), Location Type, Application, Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

Cisco Systems Inc. (US), Qualcomm Technologies Inc. (US), Broadcom Inc (US), Intel Corporation (US), Huawei technologies (China), NETGEAR Inc (US), Juniper Networks Inc (US), Extreme Networks Inc. (US), Ubiquiti Inc. (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), D–Link Corporation (Taiwan), Alcatel Lucent Enterprise (France), TP–Link Corporation Limited (China), MediaTek Inc. (Taiwan), Telstra (Australia), Murata Manufacturing Co., Ltd. (Japan), Sterlite Technologies Limited (India), Renesas Electronics (Japan), H3C Technologies Co., Ltd. (China), Keysight Technologies (US), LitePoint (US), Rohde & Schwarz (Germany), Cambium Networks, Ltd. (US), Senscomm Semiconductors Co., Ltd. (China), XUNISON (Ireland), Redway Networks Ltd. Company (England), VSORA SAS (France), WILUS Inc. (South Korea), Federated Wireless, Inc. (US), Actiontec Electronics (US), ADB Global (Switzerland), SDMC Technology (China), and Edgewater Wireless (Canada). |

This research report categorizes the Wi-Fi 6 market to forecast revenues and analyze trends in each of the following submarkets:

Based on Offering:

-

Hardware

- Wireless Access Points

- Mesh Routers

- Home Gateways

- Wireless Controllers

- System on Chip

- Other Hardware

- Solutions

-

Services

-

Professional Services

- Consulting

- Deployment & Integration

- Support & Maintenance

- Managed Services

-

Professional Services

Based on Location Type:

- Indoor

- Outdoor

Based on Application:

- Immersive Technologies

- HD Video Streaming and Video Streaming

- Smart Home Devices

- IoT and Industry 4.0

- Telemedicine

- Public Wi-Fi and Dense Environments

- Other Applications

Based on Vertical:

- Retail and Ecommerce

- Government and Public Sector

- Manufacturing

- Media and Entertainment

- Healthcare and Life Sciences

- Transportation and Logistics

- Travel and Hospitality

- Education

- Residential

- Other Verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- South Korea

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- South Africa

- Rest of Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2023, Halford partnered with Juniper Networks to provide AI-driven wired and wireless access solutions in its stores, garages, and offices.

- In February 2023, Cisco and Federated Wireless collaborated to integrate Automated Frequency Coordination (AFC) solution into its wireless 6 GHz-capable access points.

- In December 2022, Skyworks partnered with Broadcom to deliver power efficiency for Wi-Fi 6/6E devices.

Frequently Asked Questions (FAQ):

What is the definition of the Wi-Fi 6 market?

What is the market size of the Wi-Fi 6 market?

The Wi-Fi 6 market is estimated at USD 5.7 billion in 2023 and is projected to reach USD 20.9 billion by 2028, at a CAGR of 29.3% from 2023 to 2028.

What are the major drivers in the Wi-Fi 6 market?

The major drivers in Wi-Fi 6 market are the rising adoption of the increasing number of internet users, the rise in the adoption of IoT devices, and the growing need for faster and more secure networks.

Who are the key players operating in the Wi-Fi 6 market?

The key market players profiled in the Wi-Fi 6 market are Cisco Systems Inc. (US), Qualcomm Technologies Inc. (US), Broadcom Inc (US), Intel Corporation (US), Huawei technologies (China), NETGEAR Inc (US), Juniper Networks Inc (US), Extreme Networks Inc. (US), Ubiquiti Inc. (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), D–Link Corporation (Taiwan), Alcatel Lucent Enterprise (France), TP–Link Corporation Limited (China), MediaTek Inc. (Taiwan), Telstra (Australia), Murata Manufacturing Co.

What are the key technology trends prevailing in Wi-Fi 6 market?

The integration of Wi-Fi 6 with Target Wake Time (TWT), Orthogonal frequency-division multiple access (OFDMA), and Multi-link operation for advanced data analytics and predictive insights.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

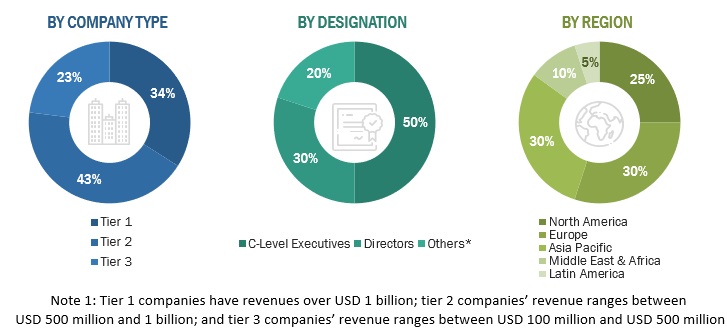

The Wi-Fi 6 market study extensively used secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva. Other market-related sources, such as journals and white papers from industry associations, were also considered while conducting the secondary research. Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents to obtain and verify critical qualitative and quantitative information and assess the market’s prospects. These respondents included key industry participants, subject matter experts, C-level executives of key market players, and industry consultants.

Secondary Research

The market for the companies offering Wi-Fi 6 solutions and services for various industry verticals is arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, journals, and certified publications and articles from recognized authors, directories, and databases. Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Wi-Fi 6 market. The primary sources from the demand side included Wi-Fi 6 end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations. After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the market’s competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to estimate and forecast the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

The break-up of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the Wi-Fi 6 market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of Wi-Fi 6 offerings, such as hardware, solutions, and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Wi-Fi 6 market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Wi-Fi 6 Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Wi-Fi 6 Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the Wi-Fi 6 market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

According to Cisco, the next generation of the Wi-Fi standard is Wi-Fi 6, also known as 802.11ax, the latest step in a journey of nonstop innovation. The standard builds on the strengths of 802.11ac while adding efficiency, flexibility, and scalability that allows new and existing networks to increase speed and capacity with next-generation applications. The Institute of Electrical and Electronics Engineers (IEEE) proposed the Wi-Fi 6 standards so it can couple the freedom and high speed of Gigabit Ethernet wireless with the reliability and predictability found in licensed radio.

Key Stakeholders

- Wi-Fi 6 solution providers

- Wi-Fi 6 service providers

- Wireless service providers

- Information Technology (IT) solution providers

- Telecom providers

- Cloud service providers

- Network solution providers

- System integrators

- Independent service providers

- Consultants/consultancies/advisory firms

- Training providers

Report Objectives

- To determine and forecast the global Wi-Fi 6 market by offering (hardware, solutions, and services), location type, application, vertical, and region from 2023 to 2030, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Wi-Fi 6 market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall Wi-Fi 6 market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Wi-Fi 6 market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market's competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wi-Fi 6 Market