Women's Healthcare Market Size by Drugs (Prolia, Xgeva, Evista, Mirena, Zometa, Reclast, Nuvaring, Primarin, Actonel), Application (Female Infertility, Postmenopausal Osteoporosis, Endometriosis, Contraception, PCOS, Menopause) & Region - Global Forecast to 2024

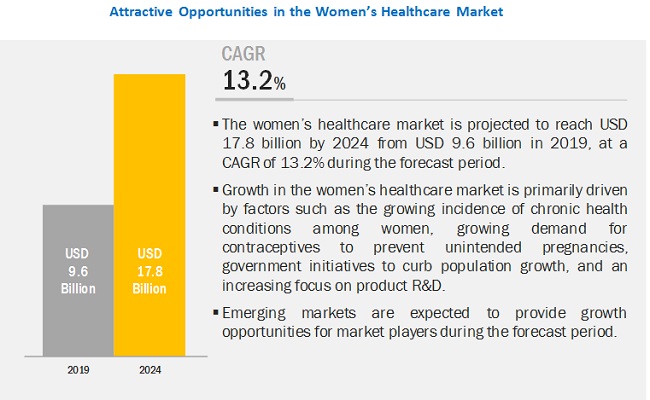

The global size of women's healthcare market in terms of revenue was estimated to be worth USD 9.6 billion in 2019 and is poised to reach USD 17.8 billion by 2024, growing at a CAGR of 13.2% from 2019 to 2024. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth of the market is primarily driven by factors such as the growing incidence of chronic health conditions among women, government initiatives to curb population growth, and growing demand for contraceptives to prevent unintended pregnancies. Moreover, the growing focus on R&D by key players for the development of advanced products is also a major factor in driving market growth.

The postmenopausal osteoporosis segment accounted for the largest share of the womens healthcare industry, by application, in 2019

Based on application, the women's healthcare market is segmented into hormonal infertility, postmenopausal osteoporosis, endometriosis, contraceptives, menopause, PCOS, and other applications. In 2018, the postmenopausal osteoporosis segment accounted for the largest market share during the forecast period. Factors such as the growing prevalence of postmenopausal osteoporosis, the focus of pharmaceutical players on providing effective drugs for postmenopausal osteoporosis, and the high risk of osteoporosis fractures supported the growth of this segment. Additionally, factors such as old age and obesity further add to the risk of osteoporosis in women. This segment is also expected to register the highest CAGR during the forecast period.

The Proila segment of the womens healthcare industry is expected to grow at the highest CAGR, by drug, during the forecast period.

Based on drug, the women's healthcare market is segmented into EVISTA, XGEVA, Prolia, Mirena, Zometa, Reclast/Aclasta, Minastrin 24 Fe, NuvaRing, FORTEO, Premarin, ACTONEL, and ORTHO-TRI-CY LO (28). Prolia is the fastest-growing segment of the market. Also, Prolia accounted for the larger share of the market in 2018. The increasing demand for Prolia due to the high prevalence of postmenopausal osteoporosis among women is the major factor responsible for the growth of this market segment.

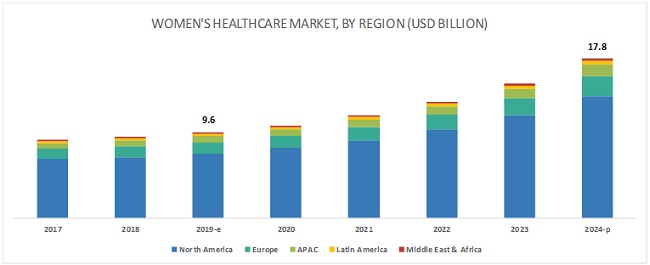

North America accounted for the largest share of the womens healthcare industry in 2019.

The global women's healthcare market is segmented into five major regions, namely, North America, Europe, APAC, Latin America, and the Middle East & Africa. In 2018, North America (US and Canada) was the largest and the fastest-growing regional market for women’s healthcare. The major factors supporting market growth include the growing prevalence of PCOS and postmenopausal osteoporosis, increasing median age of first-time pregnancies, and increased healthcare spending in the US and Canada. Also, the high awareness and understanding regarding contraceptives among American women and the easy access to modern contraception as compared to developing countries propel the market growth in this region.

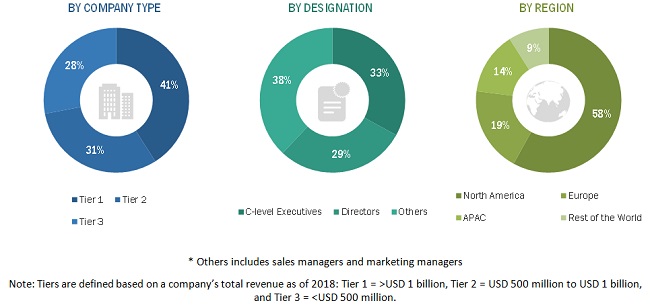

The women's healthcare market is fragmented in nature, with a large number of players, including tier 1 and mid-tier companies competing for market shares. The prominent players in the global market include Bayer AG (Germany), Allergan (Dublin), Merck & Co. (US), Pfizer Inc. (US), Amgen (US), Agile Therapeutics Inc. (US), Ferring Pharmaceuticals (US), Mylan N.V. (US), Lupin (India), Blairex Laboratories (US), and Apothecus Pharmaceutical (US).

Amgen (US): Amgen (US) is one of the leading providers of the women’s healthcare market. The company’s sales and marketing activities are greatly focused on the US and Europe. The company provides Prolia and Xgeva for the treatment of osteoporosis in postmenopausal women. These drugs have shown a year-on-year double-digit value gain as well as volume growth, and constitute the largest share of the market. Amgen’s EVENITY, meant for the treatment of osteoporosis in postmenopausal women, is also in phase 3 of development. It is being developed in collaboration with UCB (Belgium). The company’s high brand recognition and focus on product innovation have helped it to maintain its foothold in the market.

Scope of the Womens Healthcare Industry:

|

Report Metric |

Details |

|

Market Revenue in 2019 |

$9.6 billion |

|

Estimated Value by 2024 |

$17.8 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 13.2% |

|

Market Driver |

Growing focus on product R&D |

|

Market Opportunity |

Emerging markets |

The research report categorizes the women's healthcare market to forecast revenue and analyze trends in each of the following submarkets:

By Drug

- EVISTA

- XGEVA

- Prolia

- Mirena

- Zometa

- Reclast/Aclasta

- Minastrin 24 Fe

- NuvaRing

- FORTEO

- Premarin

- ACTONEL

- ORTHO TRI-CY LO (28)

By Application

- Hormonal Infertility

- Postmenopausal Osteoporosis

- Endometriosis

- Contraceptives

- Menopause

- Polycystic Ovary Syndrome

- Other Applications

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe (RoE)

-

APAC

- Japan

- China

- India

- Rest of the APAC

-

Latin America

- The Middle East & Africa

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global womens healthcare market?

The global womens healthcare market boasts a total revenue value of $17.8 billion by 2024.

What is the estimated growth rate (CAGR) of the global womens healthcare market?

The global womens healthcare market has an estimated compound annual growth rate (CAGR) of 13.2% and a revenue size in the region of $9.6 billion in 2019.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimations

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Womens Healthcare Market Overview

4.2 Women’s Healthcare Market, By Drug (2019–2024)

4.3 Global Womens Healthcare Industry, By Application (2019 vs 2024)

4.4 Global Market: Geographic Growth Opportunities

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Growing Incidence of Chronic Health Conditions Among Women

5.2.1.2 Demand for Contraceptives to Prevent Unintended Pregnancies

5.2.1.3 Government Initiatives to Curb Population Growth

5.2.1.4 Growing Focus on Product R&D

5.2.2 Market Opportunities

5.2.2.1 Emerging Markets

5.2.3 Market Challenges

5.2.3.1 Reluctance to Use Contraceptives

6 Women's Healthcare Market, By Drug (Page No. - 39)

6.1 Introduction

6.2 Prolia

6.2.1 Prolia Accounts for the Largest Share of the Women’s Healthcare Market

6.3 Xgeva

6.3.1 Xgeva is Primarily Marketed in the US and European Countries

6.4 Forteo

6.4.1 Eli Lilly is Expected to Experience A Revenue Decline in the Coming Years Due to the Patent Expiry of Forteo

6.5 Mirena

6.5.1 Mirena is Widely Accepted Amongst End Users Owing to the Minimal Side-Effects Associated With It

6.6 Nuvaring

6.6.1 Nuvaring is One of the Top-Selling Drugs From Merck in the Women’s Health Category

6.7 Premarin

6.7.1 Premarin is Used for the Treatment of Osteoporosis in Women

6.8 Ortho Tri-Cy Lo (28)

6.8.1 Growing Number of Anda to Market Generic Versions of Ortho Tri-Cy Lo (28) to Hamper Its Sales in the Coming Years

6.9 Evista

6.9.1 Intense Generic Competition has Led to A Year-On-Year Decline in Evista’s Sales

6.10 Reclast/Aclasta

6.10.1 Aclasta has More Benefits as Compared to Other Drugs

6.11 Zometa

6.11.1 Early Patent Expiry of Zometa in the US and Europe has Affected Its Sales

6.12 Minastrin 24 Fe

6.12.1 Availability of Low-Priced Generic Versions of Minastrin 24 Fe is One of the Main Reasons for the Lower Sales of This Drug

6.13 Actonel

6.13.1 Intense Competition in the Osteoporosis Market has Led to A Sales Decline in Actonel in the Last Few Years

6.14 Pipeline Drugs

7 Women's Healthcare Market, By Application (Page No. - 65)

7.1 Introduction

7.2 Postmenopausal Osteoporosis

7.2.1 High Prevalence of Osteoporosis in Women has Prompted Companies to Focus on This Therapeutic Area

7.3 Contraceptives

7.3.1 Benefits Offered By Contraceptives Driving Their Demand Among End Users

7.4 Menopause

7.4.1 Demand for Non-Hormonal Therapies has Increased Over the Last Few Years

7.5 Hormonal Infertility

7.5.1 Increasing Awareness About Ovulation Health to Support Market Growth

7.6 Polycystic Ovary Syndrome

7.6.1 Growing Prevalence of Pcos is Responsible for Market Growth

7.7 Endometriosis

7.7.1 Orilissa is the First and Only Oral Treatment Specifically Available for Women With Endometriosis Pain

7.8 Other Applications

8 Women's Healthcare Market, By Region (Page No. - 79)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Strong Economy and High Contraception Awareness are Key Factors Driving Market Growth in the US

8.2.2 Canada

8.2.2.1 Growing Prevalence of Pcos and Obesity to Support Market Growth in Canada

8.3 Europe

8.3.1 Germany

8.3.1.1 Germany Holds the Largest Share of the Women’s Healthcare Market in Europe

8.3.2 UK

8.3.2.1 Government Support and Favorable Training Programs are Major Market Drivers in the UK

8.3.3 France

8.3.3.1 High Prevalence of Lifestyle Disorders Among Women in France to Support Market Growth

8.3.4 Italy

8.3.4.1 Relatively High Awareness of Contraceptives to Drive Market Growth in Italy

8.3.5 Spain

8.3.5.1 Improved Healthcare Expenditure to Support the Market in Spain

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 Japan

8.4.1.1 Japan Dominates the APAC Market for Women’s Healthcare

8.4.2 China

8.4.2.1 Growing Population and Urbanization are Factors Responsible for the Growth of the Market in China

8.4.3 India

8.4.3.1 Increasing Government Initiatives to Curb Population Growth Will Drive Market Growth in India

8.4.4 Rest of APAC

8.5 Latin America

8.5.1 Increasing Lifestyle Diseases and Awareness Among Women to Drive Market Growth in Latin America

8.6 Middle East & Africa

8.6.1 Increasing Government Initiatives to Curb Population Growth Will Drive Market Growth in India

9 Competitive Landscape (Page No. - 110)

9.1 Overview

9.2 Market Share Analysis

9.3 Competitive Leadership Mapping

9.3.1 Visionary Leaders

9.3.2 Dynamic Differentiators

9.3.3 Innovators

9.3.4 Emerging Companies

10 Company Profiles (Page No. - 114)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Amgen

10.2 Bayer AG

10.3 Eli Lilly and Company

10.4 Merck & Co.

10.5 Pfizer

10.6 Allergan

10.7 Johnson & Johnson Services Inc.

10.8 Novartis AG

10.9 Mylan NV

10.10 Lupin Limited

10.11 Agile Therapeutics

10.12 Ferring Pharmaceuticals

10.13 Blairex Laboratories, Inc.

10.14 Apothecus Pharmaceutical Corporation

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 140)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (127 Tables)

Table 1 Women's Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 2 Prolia: Product Highlights

Table 3 Women’s Healthcare Market for Prolia, By Region, 2017–2024 (USD Million)

Table 4 North America: Womens Healthcare Industry for Prolia, By Country, 2017–2024 (USD Million)

Table 5 Europe: Market for Prolia, By Country, 2017–2024 (USD Million)

Table 6 APAC: Market for Prolia, By Country, 2017–2024 (USD Million)

Table 7 Xgeva: Product Highlights

Table 8 Globsl Market for Xgeva, By Region, 2017–2024 (USD Million)

Table 9 North America: Market for Xgeva, By Country, 2017–2024 (USD Million)

Table 10 Europe: Market for Xgeva, By Country, 2017–2024 (USD Million)

Table 11 APAC: Market for Xgeva, By Country, 2017–2024 (USD Million)

Table 12 Forteo: Product Highlights

Table 13 Women's Healthcare Market for Forteo, By Region, 2017–2024 (USD Million)

Table 14 North America: Women’s Healthcare Market for Forteo, By Country, 2017–2024 (USD Million)

Table 15 Europe: Market for Forteo, By Country, 2017–2024 (USD Million)

Table 16 APAC: Market for Forteo, By Country, 2017–2024 (USD Million)

Table 17 Mirena: Product Highlights

Table 18 Global Market for Mirena, By Region, 2017–2024 (USD Million)

Table 19 North America: Market for Mirena, By Country, 2017–2024 (USD Million)

Table 20 Europe: Market for Mirena, By Country, 2017–2024 (USD Million)

Table 21 APAC: Market for Mirena, By Country, 2017–2024 (USD Million)

Table 22 Nuvaring: Product Highlights

Table 23 Women's Healthcare Market for Nuvaring, By Region, 2017–2024 (USD Million)

Table 24 North America: Womens Healthcare Industry for Nuvaring, By Country, 2017–2024 (USD Million)

Table 25 Europe: Market for Nuvaring, By Country, 2017–2024 (USD Million)

Table 26 APAC: Market for Nuvaring, By Country, 2017–2024 (USD Million)

Table 27 Premarin: Product Highlights

Table 28 Global Market for Premarin, By Region, 2017–2024 (USD Million)

Table 29 North America: Women’s Healthcare Market for Premarin, By Country, 2017–2024 (USD Million)

Table 30 Europe: Market for Premarin, By Country, 2017–2024 (USD Million)

Table 31 APAC: Market for Premarin, By Country, 2017–2024 (USD Million)

Table 32 Ortho Tri-Cy Lo (28): Product Highlights

Table 33 Women's Healthcare Market for Ortho Tri-Cy Lo (28), By Region, 2017–2024 (USD Million)

Table 34 North America: Womens Healthcare Industry for Ortho Tri-Cy Lo (28), By Country, 2017–2024 (USD Million)

Table 35 Europe: Market for Ortho Tri-Cy Lo (28), By Country, 2017–2024 (USD Million)

Table 36 APAC: Market for Ortho Tri-Cy Lo (28), By Country, 2017–2024 (USD Million)

Table 37 Evista: Product Highlights

Table 38 Global Market for Evista, By Region, 2017–2024 (USD Million)

Table 39 North America: Market for Evista, By Country, 2017–2024 (USD Million)

Table 40 Europe: Market for Evista, By Country, 2017–2024 (USD Million)

Table 41 APAC: Market for Evista, By Country, 2017–2024 (USD Million)

Table 42 Reclast/Aclasta: Product Highlights

Table 43 Women's Healthcare Market for Reclast/Aclasta, By Region, 2017–2024 (USD Million)

Table 44 North America: Womens Healthcare Industry for Reclast/Aclasta, By Country, 2017–2024 (USD Million)

Table 45 Europe: Market for Reclast/Aclasta, By Country, 2017–2024 (USD Million)

Table 46 APAC: Market for Reclast/Aclasta, By Country, 2017–2024 (USD Million)

Table 47 Zometa: Product Highlights

Table 48 Global Womens Healthcare Industry for Zometa, By Region, 2017–2024 (USD Million)

Table 49 North America: Women’s Healthcare Market for Zometa, By Country, 2017–2024 (USD Million)

Table 50 Europe: Market for Zometa, By Country, 2017–2024 (USD Million)

Table 51 APAC: Market for Zometa, By Country, 2017–2024 (USD Million)

Table 52 Minastrin 24 Fe: Product Highlights

Table 53 North America: Market for Minastrin 24 Fe, By Country, 2017–2024 (USD Million)

Table 54 Actonel: Product Highlights

Table 55 Women's Healthcare Market for Actonel, By Region, 2017–2024 (USD Million)

Table 56 North America: Womens Healthcare Industry for Actonel, By Country, 2017–2024 (USD Million)

Table 57 Europe: Market for Actonel, By Country, 2017–2024 (USD Million)

Table 58 APAC: Market for Actonel, By Country, 2017–2024 (USD Million)

Table 59 Indicative List of Drugs in Phase Iii

Table 60 Global Market, By Application, 2017–2024 (USD Million)

Table 61 Women’s Healthcare Market for Postmenopausal Osteoporosis, By Region, 2017–2024 (USD Million)

Table 62 North America: Market for Postmenopausal Osteoporosis, By Country, 2017–2024 (USD Million)

Table 63 Europe: Market for Postmenopausal Osteoporosis, By Country, 2017–2024 (USD Million)

Table 64 APAC: Market for Postmenopausal Osteoporosis, By Country, 2017–2024 (USD Million)

Table 65 Women's Healthcare Market for Contraceptives, By Region, 2017–2024 (USD Million)

Table 66 North America: Womens Healthcare Industry for Contraceptives, By Country, 2017–2024 (USD Million)

Table 67 Europe: Market for Contraceptives, By Country, 2017–2024 (USD Million)

Table 68 APAC: Market for Contraceptives, By Country, 2017–2024 (USD Million)

Table 69 Global Market for Menopause, By Region, 2017–2024 (USD Million)

Table 70 North America: Market for Menopause, By Country, 2017–2024 (USD Million)

Table 71 Europe: Market for Menopause, By Country, 2017–2024 (USD Million)

Table 72 APAC: Market for Menopause, By Country, 2017–2024 (USD Million)

Table 73 Women's Healthcare Market for Hormonal Infertility, By Region, 2017–2024 (USD Million)

Table 74 North America: Women’s Healthcare Market for Hormonal Infertility, By Country, 2017–2024 (USD Million)

Table 75 Europe: Market for Hormonal Infertility, By Country, 2017–2024 (USD Million)

Table 76 APAC: Market for Hormonal Infertility, By Country, 2017–2024 (USD Million)

Table 77 Global Market for Polycystic Ovary Syndrome, By Region, 2017–2024 (USD Million)

Table 78 North America: Market for Polycystic Ovary Syndrome, By Country, 2017–2024 (USD Million)

Table 79 Europe: Market for Polycystic Ovary Syndrome, By Country, 2017–2024 (USD Thousand)

Table 80 APAC: Market for Polycystic Ovary Syndrome, By Country, 2017–2024 (USD Million)

Table 81 Women's Healthcare Market for Endometriosis, By Region, 2017–2024 (USD Million)

Table 82 North America: Womens Healthcare Industry for Endometriosis, By Country, 2017–2024 (USD Million)

Table 83 Europe: Market for Endometriosis, By Country, 2017–2024 (USD Thousand)

Table 84 APAC: Market for Endometriosis, By Country, 2017–2024 (USD Million)

Table 85 Global Market for Other Applications, By Region, 2017–2024 (USD Million)

Table 86 North America: Market for Other Applications, By Country, 2017–2024 (USD Million)

Table 87 Europe: Market for Other Applications, By Country, 2017–2024 (USD Million)

Table 88 APAC: Market for Other Applications, By Country, 2017–2024 (USD Million)

Table 89 Women's Healthcare Market, By Region, 2017–2024 (USD Million)

Table 90 North America: Womens Healthcare Market, By Country, 2017–2024 (USD Million)

Table 91 North America: Women’s Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 92 North America: Market, By Application, 2017–2024 (USD Million)

Table 93 US: Women’s Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 94 US: Market, By Application, 2017–2024 (USD Million)

Table 95 Canada: Women's Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 96 Canada: Women’s Healthcare Market, By Application, 2017–2024 (USD Million)

Table 97 Europe: Women’s Healthcare Market, By Country, 2017–2024 (USD Million)

Table 98 Europe: Market, By Drug, 2017–2024 (USD Million)

Table 99 Europe: Market, By Application, 2017–2024 (USD Million)

Table 100 Germany: Women's Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 101 Germany: Women’s Healthcare Market, By Application, 2017–2024 (USD Million)

Table 102 UK: Women’s Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 103 UK: Market, By Application, 2017–2024 (USD Million)

Table 104 France: Womens Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 105 France: Women’s Healthcare Market, By Application, 2017–2024 (USD Million)

Table 106 Italy: Women’s Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 107 Italy: Market, By Application, 2017–2024 (USD Million)

Table 108 Spain: Womens Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 109 Spain: Women’s Healthcare Market, By Application, 2017–2024 (USD Thousand)

Table 110 RoE: Women’s Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 111 RoE: Market, By Application, 2017–2024 (USD Million)

Table 112 Asia Pacific: Women's Healthcare Market, By Country, 2017–2024 (USD Million)

Table 113 Asia Pacific: Women’s Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 114 Asia Pacific: Market, By Application, 2017–2024 (USD Million)

Table 115 Japan: Indicative List of Conferences

Table 116 Japan: Women’s Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 117 Japan: Market, By Application, 2017–2024 (USD Million)

Table 118 China: Women's Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 119 China: Women’s Healthcare Market, By Application, 2017–2024 (USD Million)

Table 120 India: Women’s Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 121 India: Market, By Application, 2017–2024 (USD Million)

Table 122 RoAPAC: Womens Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 123 RoAPAC: Women’s Healthcare Market, By Application, 2017–2024 (USD Million)

Table 124 Latin America: Women’s Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 125 Latin America: Market, By Application, 2017–2024 (USD Million)

Table 126 Middle East & Africa: Womens Healthcare Market, By Drug, 2017–2024 (USD Million)

Table 127 Middle East & Africa: Women’s Healthcare Market, By Application, 2017–2024 (USD Million)

List of Figures (27 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Womens Healthcare Market, By Drug, 2019 vs 2024 (USD Million)

Figure 7 Women’s Healthcare Market, By Application, 2019 vs 2024 (USD Million)

Figure 8 Geographical Snapshot of the Global Market

Figure 9 Growing Incidence of Chronic Health Conditions Among Women is A Major Factor Driving the Global Womens Healthcare Industry

Figure 10 Prolia to Witness the Highest Growth During the Forecast Period

Figure 11 Postmenopausal Osteoporosis to Dominate the Women’s Healthcare Applications Market During the Forecast Period

Figure 12 North America is the Fastest-Growing Regional Market for Women’s Healthcare Products

Figure 13 Womens Healthcare Market: Drivers, Opportunities, and Challenges

Figure 14 North America: Womens Healthcare Industry Snapshot

Figure 15 Europe: Womens Healthcare Industry Snapshot

Figure 16 Womens Healthcare Market Share Analysis, By Key Player, 2018

Figure 17 Competitive Leadership Mapping of the Womens Healthcare Market, 2018

Figure 18 Amgen: Company Snapshot

Figure 19 Bayer AG: Company Snapshot

Figure 20 Eli Lilly and Company: Company Snapshot

Figure 21 Merck & Co.: Company Snapshot

Figure 22 Pfizer: Company Snapshot

Figure 23 Allergan: Company Snapshot

Figure 24 Johnson & Johnson Services, Inc.: Company Snapshot

Figure 25 Novartis AG: Company Snapshot

Figure 26 Mylan NV: Company Snapshot

Figure 27 Lupin Limited: Company Snapshot

The study involved four major activities in estimating the current size of the global womens healthcare market. Exhaustive secondary research was conducted to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing values with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was mainly used to identify and collect information for the extensive, technical, market-oriented, and commercial study of the women’s healthcare market. Secondary sources include directories; databases such as Bloomberg Businessweek, Factiva, and Wall Street Journal; white papers; and annual reports that were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the women’s healthcare market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The revenue generated from the sales of respective products from the respective geographies in the market by leading players were aggregated to get the market value for individual products at the global level. The global market values obtained for each product were added together to get the total global market value for the market.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the women’s healthcare market on the basis of drug, application, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa

- To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches; partnerships, agreements, & collaborations; expansions & strategic alliances; and acquisitions in the market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product excellence strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Women's Healthcare Market