Workplace Safety Market by Component (Hardware, Software & Services), System (Real-Time Location Monitoring, Environmental Health & Safety, Access Control & Surveillance System), Application, Deployment Mode, End User and Region - Global Forecast to 2028

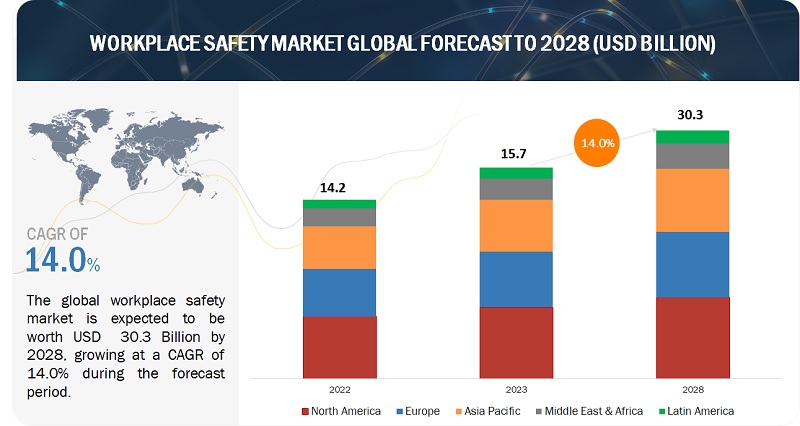

[353 Pages Report] The global workplace safety market size is projected to grow from USD 15.7 billion in 2023 to USD 30.3 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period. The expansion of the workplace safety market can be attributed to strict industrial health and safety regulations and a growing number of work injuries and deaths.

Moreover, the workplace safety market is experiencing growth due to the introduction of drones, Augmented Reality (AR), Virtual Reality (VR), and artificial intelligence. These factors contribute to the market’s promising growth potential, providing organizations with enhanced security measures.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Workplace Safety Market Dynamics

Driver: Growing work injuries and deaths have raised workplace safety concerns

With organizations realizing that a proactive approach to injury prevention and treatment reflects an organization's commitment to employee well-being, workplace safety has become an on-the-job priority. According to the U.S. Bureau of Labor Statistics, private industry employers reported 2.8 million non-fatal workplace injuries and illnesses in 2022, up 7.5 percent from 2021. This alarming increase is evident in injuries, up 4.5 percent to 2.3 million cases, and diseases, up 26.1 percent to 460,700 cases. The gravity of the situation becomes even more evident when considering the National Safety Council's statistic that a worker is injured on the job every seven seconds.

In response to these escalating figures, the National Institute for Occupational Health (NIOSH) introduced the Total Worker Health concept, signaling a significant paradigm shift within the industry toward a more comprehensive approach to employee well-being. This transformative program has redirected the focus of workplace safety initiatives from merely detecting unsafe conditions to proactively identifying risks for prevention-based programs. Employers are increasingly investing in adopting this standard by emphasizing education training and preemptively addressing potential issues before they result in harm. Consequently, this shift is expected to drive the workplace safety market as organizations recognize the imperative of safeguarding their workforce.

Restraint: High initial implementation costs

Implementing workplace safety systems is crucial for protecting employees and machinery during emergencies. However, the significant expenses related to safety components, implementation, installation, and maintenance pose a substantial financial burden on organizational budgets. These solutions' rising installation and subscription fees further contribute to the financial strain. While large organizations can manage the excessive costs associated with these safety measures, they pose a formidable obstacle for small enterprises and organizations in low-income countries.

Moreover, the evolving nature of safety standards, driven by technological advancements and new mandates, necessitates regular upgrades to safety systems. These upgrades, in turn, require additional investments, leading to higher overall costs for organizations. According to a report from the United States Department of Labor, the direct workers' compensation costs alone amounted to nearly USD 1 billion per week for employers. Additionally, an Occupational Health and Safety article highlights that U.S. employers face an annual fee of USD 171 billion in payouts related to disabling or non-fatal workplace injuries.

Opportunity: Introduction of new trends such as smart PPE, intelligent clothing, autonomous vehicles, and smart safety

The integration of cutting-edge technologies in workplace safety has ushered in a new era, presenting diverse opportunities for advancements. Notably, the incorporation of Personal Protective Equipment (PPE) equipped with sensors for real-time monitoring of biometric, location, and movement data is rising. Similarly, the utilization of autonomous vehicles, including self-driving cars, designed with advanced sensors and software, is gaining traction across various industries, such as production, manufacturing, and heavy engineering. Companies like Guardhat contribute to this paradigm shift by offering smart hardhats embedded with sensors and communication capabilities. This ensures real-time safety monitoring and hazard alerts in challenging environments. ProGlove enhances worker safety and productivity through smart gloves featuring integrated scanners and sensors, which are particularly beneficial in industrial settings. RealWear's AR-enabled smart glasses facilitate hands-free operation and remote assistance in both industrial and field service applications. Complementing these innovations, SafeSite introduces a smart safety platform leveraging IoT sensors and real-time data, addressing crucial aspects like social distancing monitoring and contact tracing. This integration enhances workplace safety and presents lucrative opportunities for vendors offering innovative safety solutions and services.

Challenge: Shortage of Skilled Workplace Safety and Health Professionals

The scarcity of skilled workplace safety and health professionals poses a critical challenge for organizations as they navigate the multifaceted landscape of employee well-being. Safety professionals, tasked with specific health and safety responsibilities, play a pivotal role in addressing the myriad challenges that workplaces encounter, directly influencing the physical and mental well-being of employees. To effectively tackle these challenges, upskilling workers in health, safety, and well-being is imperative, offering a proactive approach to risk mitigation. However, the evolving nature of workplaces has expanded the responsibilities of safety professionals, necessitating proficiency in various domains. Organizations must guide these professionals towards utilizing integrated tools and resources to enhance workplace safety solutions, thereby enriching the lives of workers. Despite the demand, finding safety professionals with comprehensive skill sets remains a challenge. Recognizing the significance, employers are investing in training existing safety professionals to meet regulatory requirements and prevent costly accidents. The U.S. Bureau of Labor Statistics projects a substantial growth in demand for safety professionals, particularly in manufacturing and construction industries, reflecting an industry-wide recognition of the pivotal role these experts play in fostering a secure work environment.

Workplace Safety Market Ecosystem

By end user, healthcare is expected to grow at the highest CAGR during the forecast period.

The healthcare segment is poised to experience the fastest growth rate globally, driven by the continuous expansion of the industry. As a crucial player in the provision of health services, healthcare faces numerous challenges, with workers encountering a myriad of safety and health hazards. From potential chemical and drug exposures to ergonomic risks arising from lifting and repetitive tasks, healthcare professionals navigate a complex landscape. The industry is grappling with a rising incidence of workplace injuries and illnesses, necessitating concerted efforts to address these concerns.

Governments worldwide are actively engaged in initiatives aimed at safeguarding healthcare workers. Through the implementation of regulations and training programs, authorities seek to mitigate risks. An example of such an effort is the NIOSH Training for Nurses on Shift Work and Long Work Hours, an online program designed to educate nurses and their managers about the associated health and safety risks. This collective approach underscores the commitment to fostering a secure and healthy environment within the rapidly evolving healthcare sector.

By deployment mode, the cloud is expected to grow at the highest CAGR during the forecast period.

Cloud deployment mode is poised to experience the most rapid growth, driven by its ability to offer enhanced control over data, mitigating the risk of loss and alleviating concerns surrounding regulatory compliance. The decision to embrace this deployment model hinges on the unique requirements of businesses seeking to fortify their security measures. In the realm of cloud computing, external providers assume responsibility for hosting all facets of operations, enabling enterprises to adopt a flexible payment structure aligned with their specific needs. This scalability, allowing seamless adjustments based on usage and user demands, has fueled the momentum behind cloud solutions. As the adoption of cloud-based functionalities accelerates, the trend is expected to persist, fostering a dynamic landscape of technological evolution.

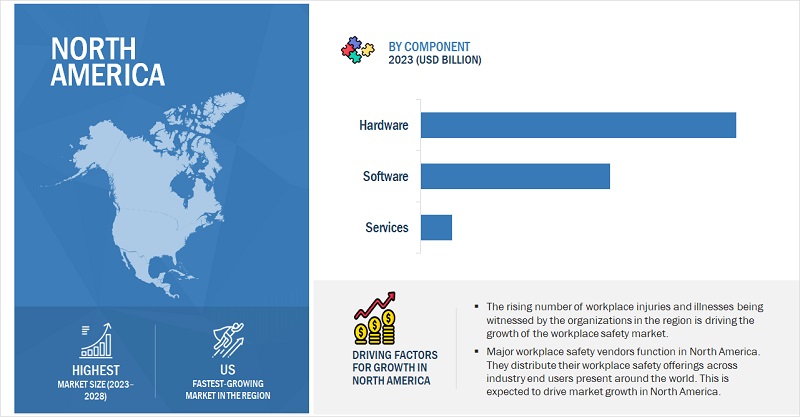

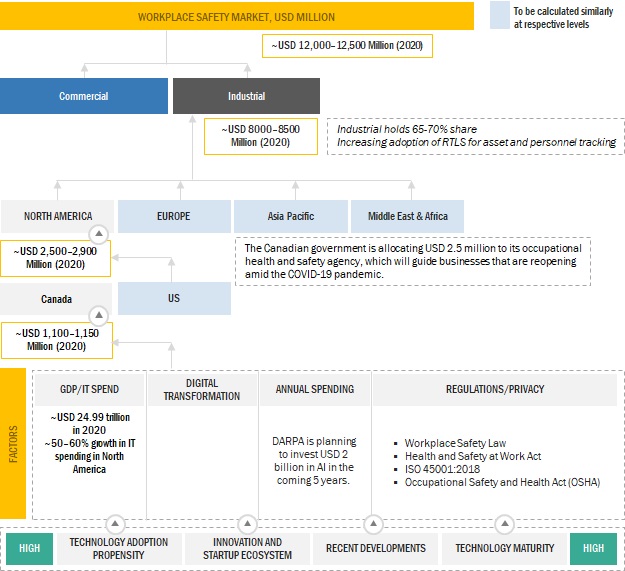

By region, North America accounts for the second highest market size during the forecast period.

The rising number of workplace injuries and illnesses within North American organizations is prompting businesses to adopt products and solutions available in the workplace safety market. The significant presence of key industry players offering workplace safety technology solutions in the region plays a crucial role in driving market growth.

A key factor contributing to the expansion of the workplace safety market in the region is the reinforcement of safety standards and government regulations. In the United States, three Department of Labor agencies are instrumental in administering and enforcing laws dedicated to safeguarding the health and safety of workers. The Occupational Safety and Health Administration (OSHA) oversees safety and health conditions in most private industries. At the same time, the Mine Safety and Health Administration (MSHA) focuses on the well-being of employees in mines.

Key Market Players

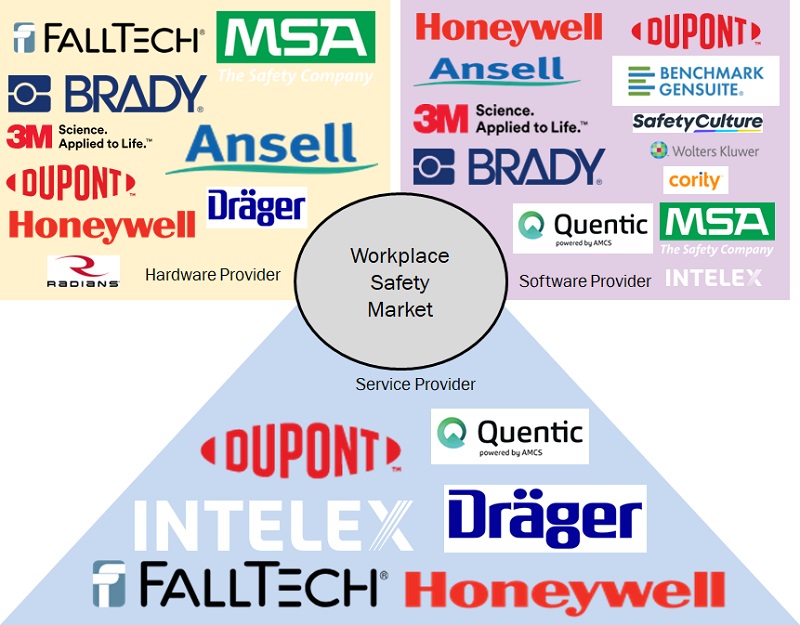

The key players in the workplace safety market are IBM (US), Honeywell (US), 3M (US), Hexagon AB (Sweden), Appian (US), Microsoft (US), Bosch (Germany), Cority (Canada), Wolters Kluwer (Netherland) and others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

|

The study categorizes the workplace safety market by segments – component, system, application, deployment mode, end user, and region.

By Component:

- Hardware

- Software

- Services

By System:

- Real-Time Location Monitoring

- Environmental Health and Safety

- Access Control and Surveillance System

- Other Systems

By Application:

- Incident and Emergency Management

- Asset Tracking and Management

- Personal Protective Equipment Detection

- Personnel/Staff Tracking

By Deployment Mode:

- On-Premises

- Cloud

End User:

- Energy and Utilities

- Construction and Engineering

- Chemicals and Materials

- Government and Defense

- Healthcare

- Food and Beverage

- Other End Users

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In April 2022, Cority announced the launch of two solutions to help guide organizations through the digital transformation of their EHS programs: Cority’s Learning Management Solution and Cority Academy. The new learning management solution will help organizations engage and empower employees with relevant, dynamic, data-driven EHS training to meet employee needs.

- In April 2022, Wolters Kluwer’s Enablon unveiled the next generation of vision platform software, featuring enhancements that empower organizations to be more responsible, productive, and safe. Enablon has released Version 9.4 of its integrated risk management platform. Version 9.4 of the Enablon Vision Platform features enhancements enabling greater collaboration and integration, streamlining communications and mobility, and more.

- In March 2022, Honeywell unveiled the Honeywell Safety Watch, a robust real-time location solution (RTLS) designed for industrial operations. Integrated with Honeywell OneWireless infrastructure, it offers enhanced features, including extended battery life, extended transmission range, and a business rule engine for improved safety, compliance, and productivity in Industry 4.0 settings.

- In November 2021, Bosch Building Technologies announced the acquisition of British Protec Fire and Security Group Ltd. Protec is one of the largest system integrators for fire detection and security technology in the UK. With the acquisition, Bosch Building Technologies is expanding its European business.

- In March 2021, Cority, a global EHS software provider, collaborated with 3M's Personal Safety Division on Connected Safety technologies. Leveraging 3M's IoT platform and Cority's EHS expertise, the partnership aims to enhance worker safety, compliance workflows, and safety process automation through innovative PPE technologies and data science.

Frequently Asked Questions (FAQ):

What are the opportunities in the global workplace safety market?

Integration of big data use of safety data as a predictive tool for risk management and introduction of new trends such as smart PPE, intelligent clothing, autonomous vehicles, and smart safety are a few factors contributing to the growth and new opportunities for the workplace safety security market.

What is the definition of the workplace safety market?

MarketsandMarkets defines workplace safety as providing a safe work environment and equipment to ensure workers’ health and safety. Workplace safety systems are implemented in industrial and commercial sectors to ensure higher productivity and reduce overall energy consumption during the production process. Smart workplace safety solutions are used to increase worker’s safety in industrial environments, along with tracking employees' work in the most efficient way. Workplace safety solutions include hardware and real-time software solutions, such as Personal Protective Equipment (PPE), head protection equipment, and eyewear and protection devices that are connected remotely using embedded software.

Which region is expected to show the highest market share in the workplace safety market?

Europe is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include IBM (US), Honeywell (US), 3M (US), Hexagon AB (Sweden), Appian (US), Microsoft (US), Bosch (Germany), Cority (Canada) and Wolters Kluwer (Netherland).

What is the current size of the global workplace safety market?

The global workplace safety market size is projected to grow from USD 15.7 billion in 2023 to USD 30.3 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

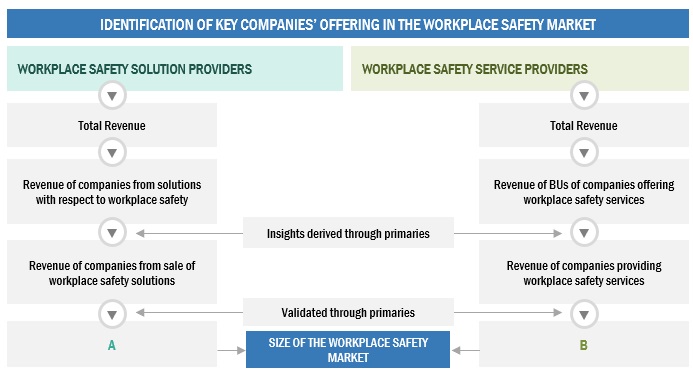

The study involved major activities in estimating the current market size for the workplace safety market. Exhaustive secondary research was done to collect information on the workplace safety industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the workplace safety market.

Secondary Research

The market for the companies offering workplace safety solutions and services is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of workplace safety vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the workplace safety market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of workplace safety solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

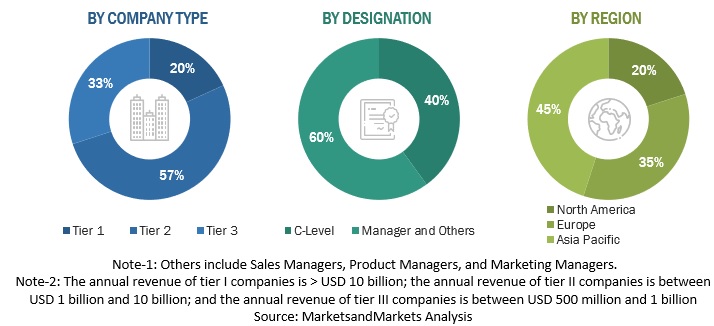

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global workplace safety market and estimate the size of various other dependent sub-segments in the overall workplace safety market. The research methodology used to estimate the market size includes the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Infographic Depicting Bottom-Up And Top-Down Approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

MarketsandMarkets defines workplace safety as the provision of a safe work environment and safe equipment to ensure workers’ health and safety. Workplace safety systems are implemented in industrial and commercial sectors to ensure higher productivity and reduce the overall energy consumption during the production process. Smart workplace safety solutions are used to increase worker safety in industrial environments, along with tracking the work of employees in the most efficient way. Workplace safety solutions include hardware and real-time software solutions, such as Personal Protective Equipment (PPE), head protection equipment, and eyewear and protection devices that are connected remotely using embedded software.

Key Stakeholders

- Chief Technology and Data Officers

- Workplace Safety Service Professionals

- Business Analysts

- Information Technology (IT) Professionals

- Government Agencies

- Investors and Venture Capitalists

- Small and Medium-Sized Enterprises (SMEs) And Large Enterprises

- Third-Party Providers

- Consultants/ Consultancies/ Advisory Firms

- Managed and Professional Service Providers

Report Objectives

To define, describe, and forecast the workplace safety market based on - component, system, application, deployment mode, end user, and region.

- To define, describe, and forecast the workplace safety market by – component, system, application, deployment mode, end user, and region.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market.

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the workplace safety market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the workplace safety market.

- To profile the key players of the workplace safety market and comprehensively analyze their market size and core competencies in the market.

- To track and analyze competitive developments, such as new product launches, mergers and acquisitions, and partnerships, agreements, and collaborations in the global workplace safety market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Workplace Safety Market