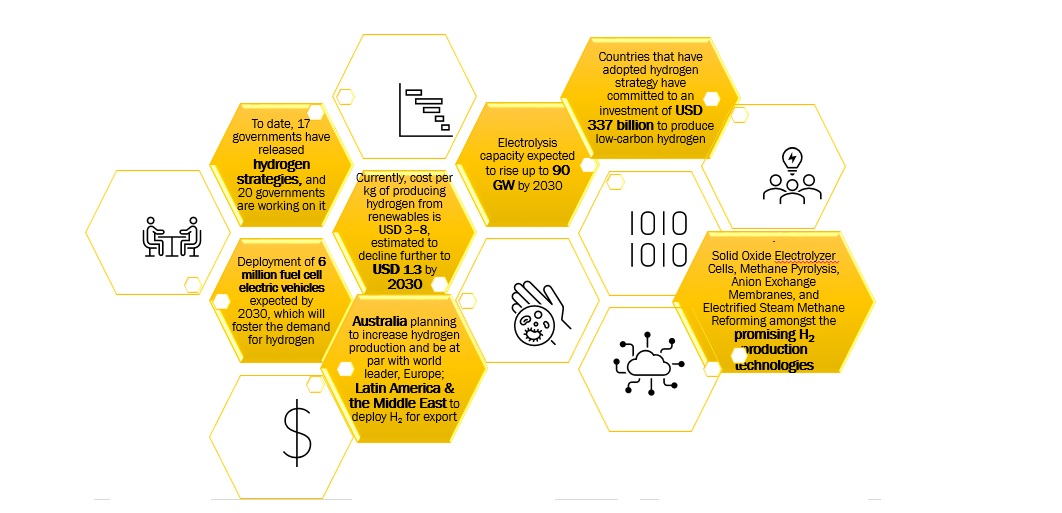

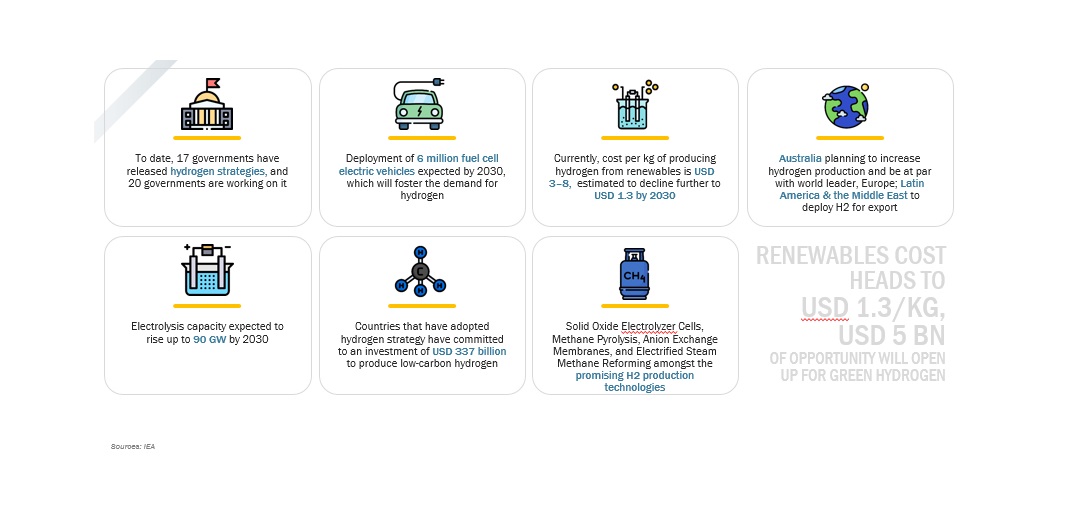

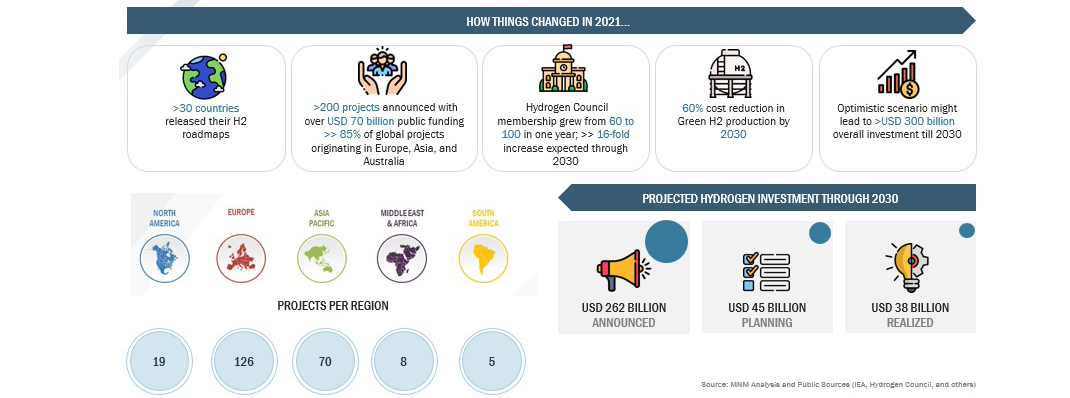

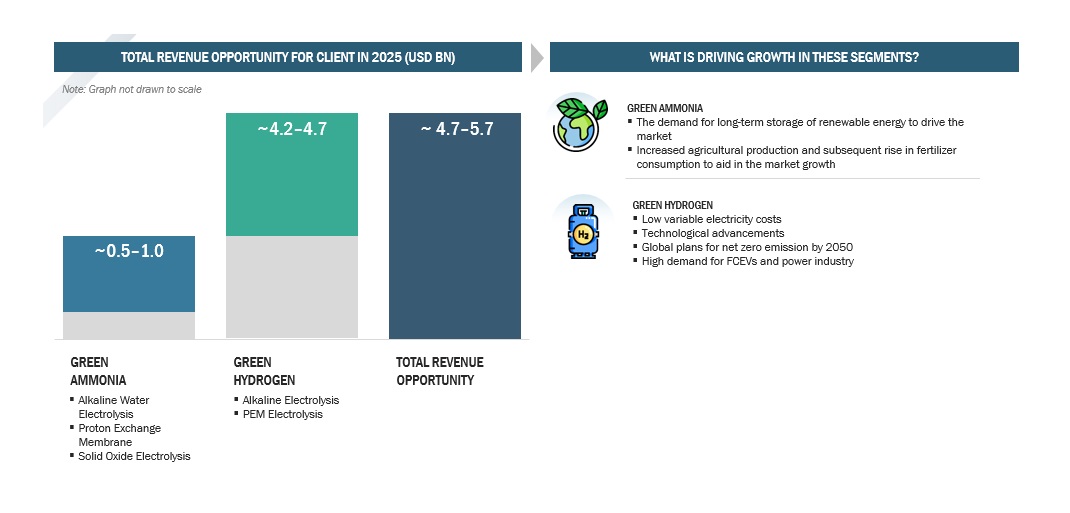

$5BN POTENTIAL OPPORTUNITY IS OPENING UP IN HYDROGEN ECONOMY

Download PDFDisruption - as hydrogen production USING renewables cost heads to usd 1.3/kg, USD 5 BN OF OPPORTUNITY WILL OPEN UP FOR GREEN HYDROGEN

TOP Hydrogen Economy GROWTH STORIES

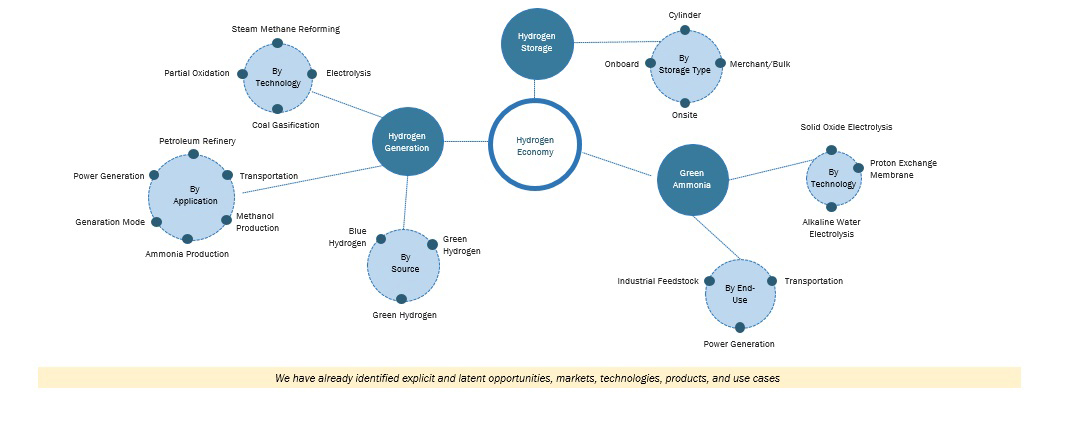

THERE IS ~USD 6 Bn POTENTIAL WITHIN hydrogen economy, more than HALF OF WHICH IS CONTRIBUTED BY green hydrogen production DRIVEN BY the need to find clean energy solutions

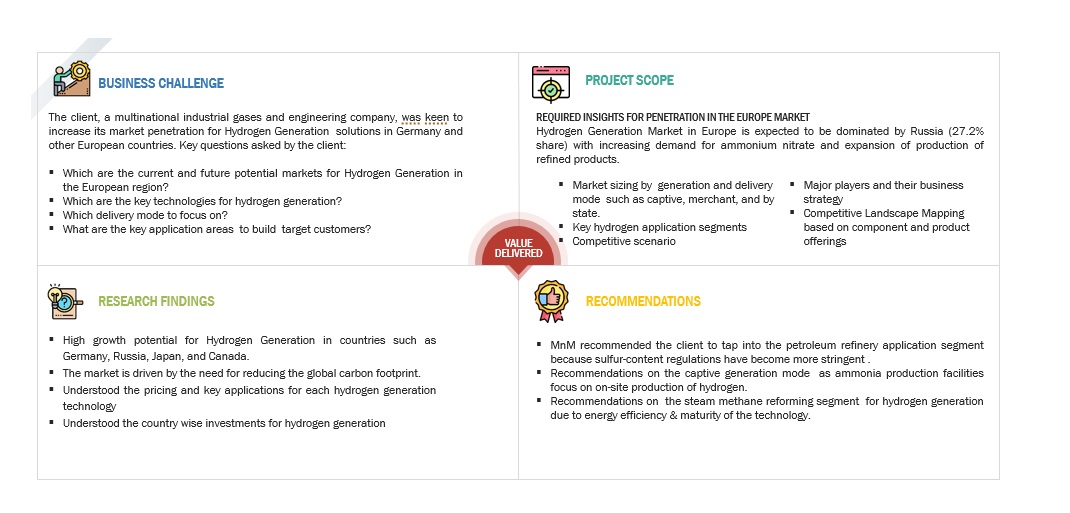

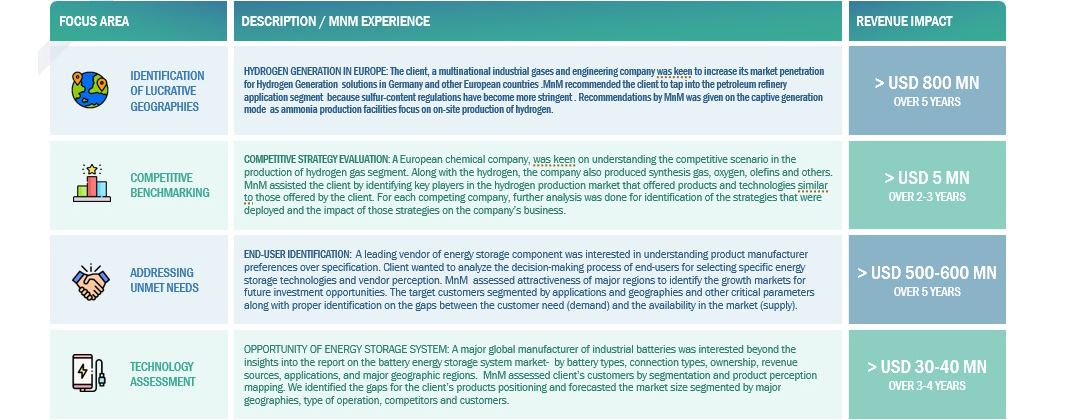

ADDITIONALLY, WE HAVE ASSISTED A HOST OF HYDROGEN PLAYERS to TAP HIGH GROWTH OPPORTUNITIES ACROSS EMERGING END-USERS, GEOGRAPHIES & COMPETITION

WHY DO COMPANIES NEED HELP TO GROW?

ABSENCE OF ORIGINAL RESEARCH:

- Complex and overlapping markets for library prep and target enrichment kits, hence difficult to calculate market potential and TAM

- Insufficient secondary research for strategic decisions

INTELLIGENCE IS NOT DEMOCRATISED:

- Client unmet needs need to be understood by all market facing employees for new product development and vendor selection.

- Limited knowledge about upcoming technologies and growing applications such as ride sharing, battery technologies/chemistry, fast chargers, EV services (MaaS) etc.

GROWTH PROGRAM DESIGN AND EXECUTION:

- Lack of GTM knowledge and practice in competitive intel, pricing and product features

SOME UNKNOWNS & ADJACENCIES

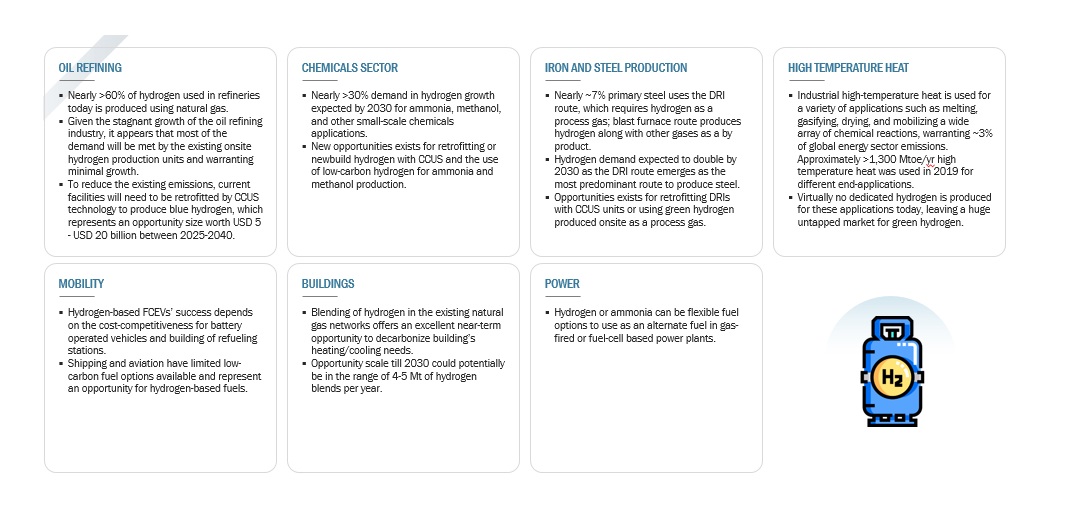

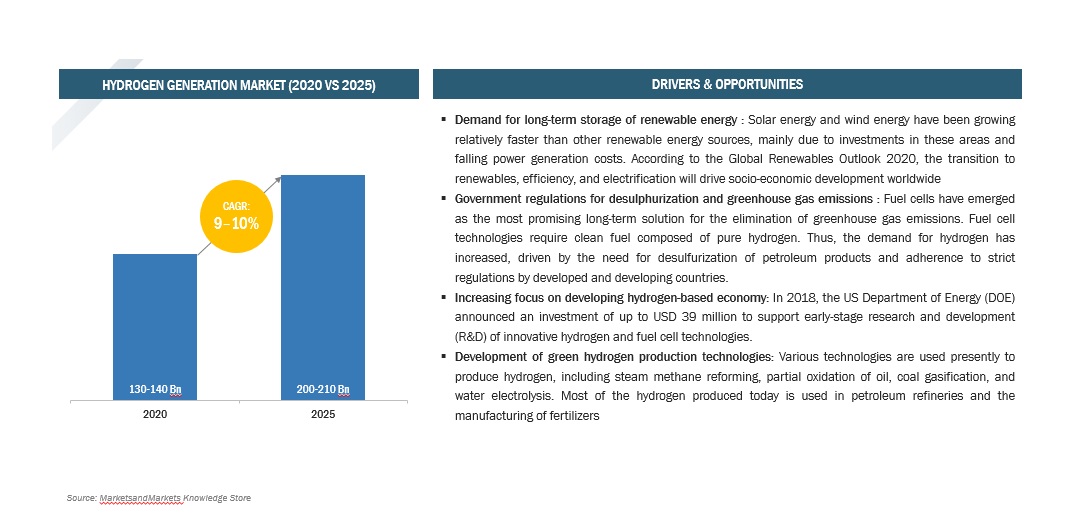

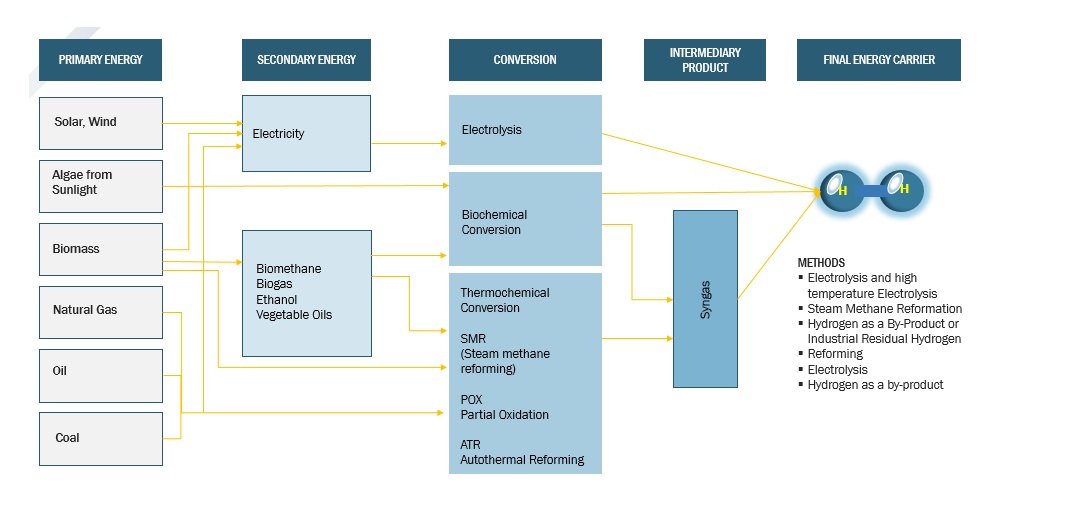

- Increased focus on hydrogen based economy for applications such as power generation or fueling cars and buses, that during combustion can cause less carbon emissions has led to increased investments in the enhancement of strong hydrogen-based economy.

- Furthermore, the hydrogen generation market is driven by the increased government regulations for desulphurization and green house gas emissions.

- The rise in consumption of hydrogen by petroleum refineries has increased recently due to clean-fuel programs, which require refiners to produce low-sulfur gasoline and ultra-low-sulfur diesel fuel.

- The blue hydrogen segment is expected to grow at the highest growth rate owing to the increasing demand for capturing and reusing carbon emissions.

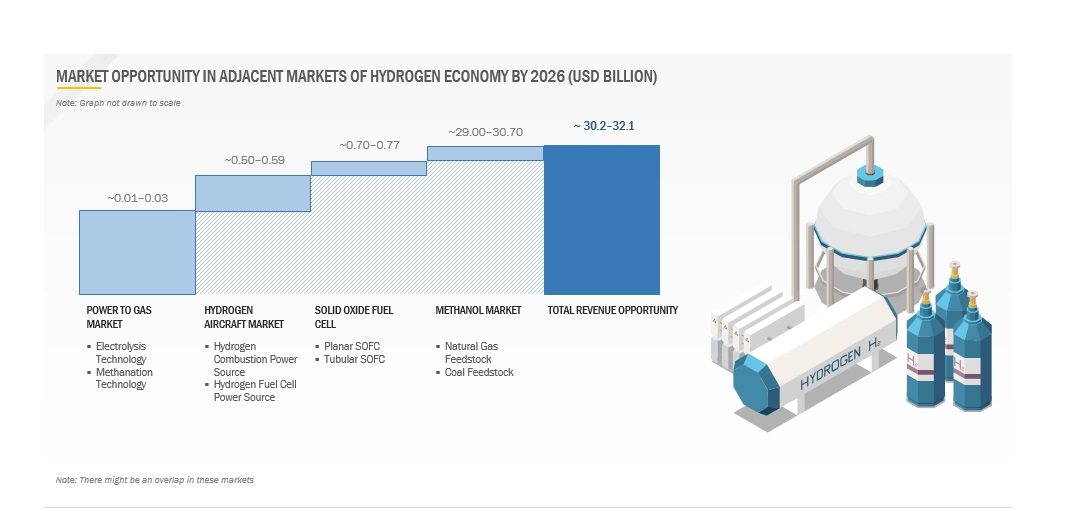

- Adjacent markets such as solid oxide fuel cells, solid oxide electrolyzers, flow batteries, and required services to provide immense growth opportunities

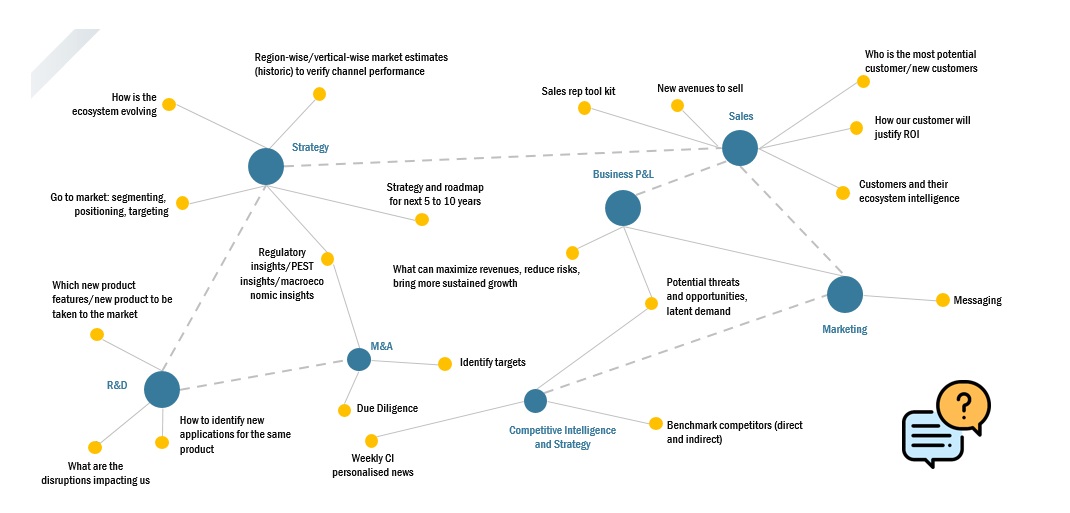

GROWTH PROBLEMS ENCOUNTERED BY HYDROGEN COMPANIES

Customer prioritization and assessing unmet needs:

- What are the disruptions in our clients' businesses? How can we support them for our own growth?

- Who are the most potential customers going forward?

- What are the key unmet needs of customers? Who are the key stakeholders in different settings? Do vendor selection criteria differ by settings? Which new product features should be added to the existing products?

Where to Play:

- Which technology should we focus on? Should it be green hydrogen, gray hydrogen, any other?

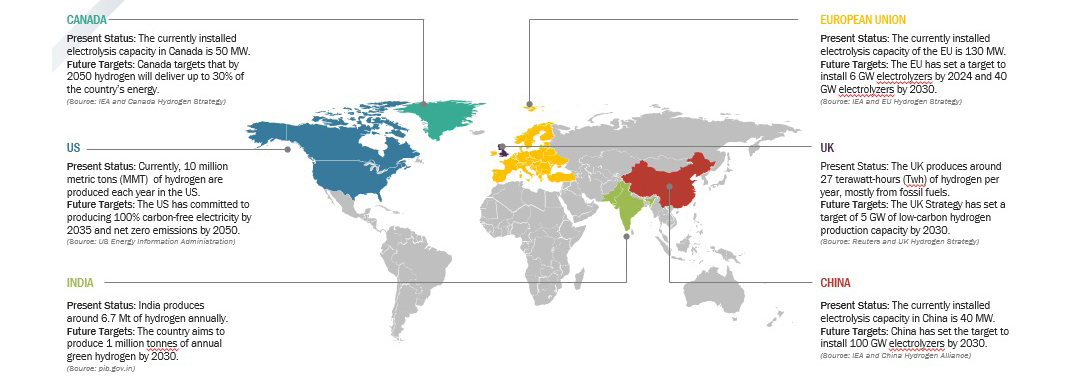

- Which regions should we place our bets on? Should we continue with developed countries or do developing countries offer more growth opportunities?

Building a compelling Right to Win (RTW):

- Should we enter new markets directly or through partners?

- How can we differentiate from top players? What is their right-to-win vs ours?

OBSTACLES TO GROWTH FOR CURRENT PLAYERS

- Not able to keep pace with fast evolving hydrogen industry - New technologies are emerging leading to increasing government initiatives

- Many start-ups and emerging companies eating up market share of established companies

- Limited clarity on unmet needs, hence requirements for product features

- Unclear picture about the regulatory and policy scenario

KEY UNCERTAINTIES/ PERSPECTIVES WHICH INDUSTRY LEADERS SEEK ANSWERS TO:

KEY QUESTIONS FOR HYDROGEN COMPANIES

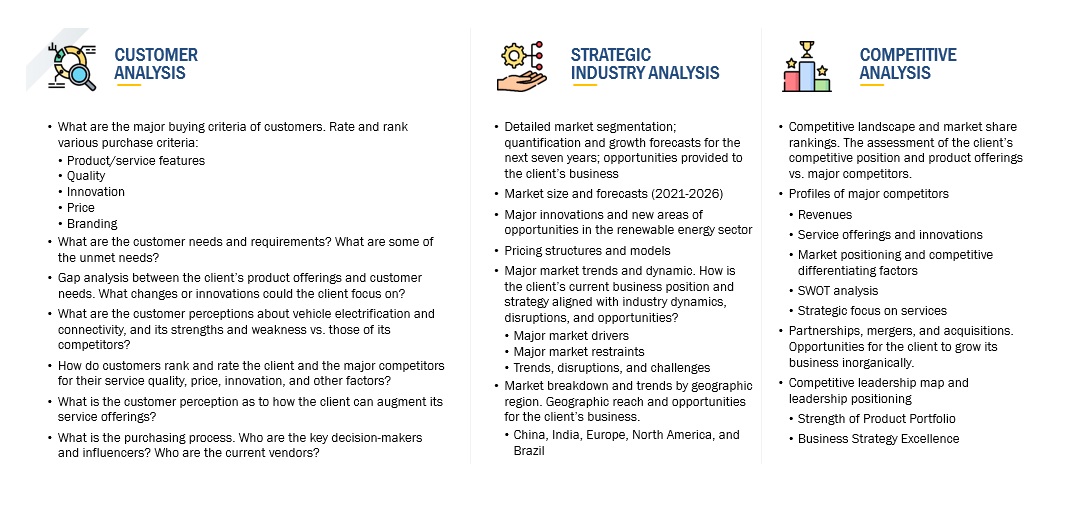

Customer prioritization and assessing unmet needs:

- What are the disruptions in our clients' businesses? How can we support them for our own growth?

- Who are the most potential customers going forward?

- What are the key unmet needs of customers? Who are the key stakeholders in different settings? Do vendor selection criteria differ by settings? Which new product features should be added to the existing products?

Where to Play:

- Which technology should we focus on? Should it be green hydrogen, gray hydrogen, any other?

- Which regions should we place our bets on? Should we continue with developed countries or do developing countries offer more growth opportunities?

Building a compelling Right to Win (RTW):

- Should we enter new markets directly or through partners?

- How can we differentiate from top players? What is their right-to-win vs ours?

KEY QUESTIONS FOR COMPANIES OPERATING IN THE ADJACENT MARKET

- Not able to keep pace with fast evolving hydrogen industry – New technologies are emerging leading to increasing government initiatives. What are the key regulations surrounding fuel cells?

- Major Market Trends and Dynamic. How is Client's current business position and strategy aligned with industry dynamics, disruptions, and opportunities

- What are the key components that the clients are keen ?

- When fuel cells tipping point can be achieved?

- Competitive Landscape and Market Share Rankings. Assessment of Client's competitive position and product offerings vs. major competitors.

- What should be our key differentiations/ Value Proposition in company's offerings? Many start-ups and emerging companies eating up market share of established companies. Which are the key regions for fuel cells?

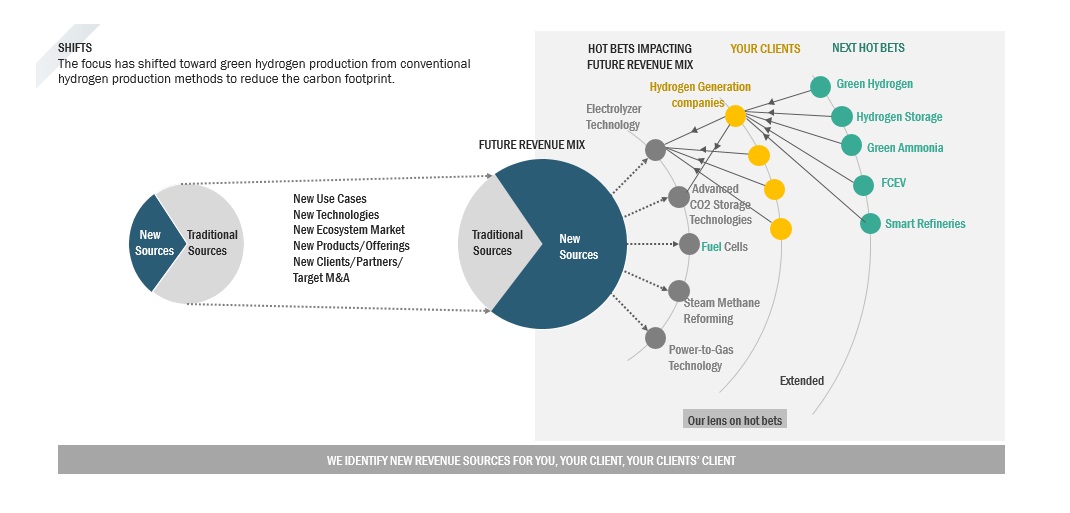

What is driving change

in your business

- Product life cycles getting shorter.

- Ecosystems getting converged.

- Newer technologies and new use-cases disrupting.

- New markets, new geographies, new clients, competition and partners.

Are changes only impacting you or your clients and their clients as well?

The trial will be a guided tour by our representative to help you discover the shift in revenue sources of your clients and clients' clients that will impact your revenue. This is your opportunity to unlock the research IP worth $100 million

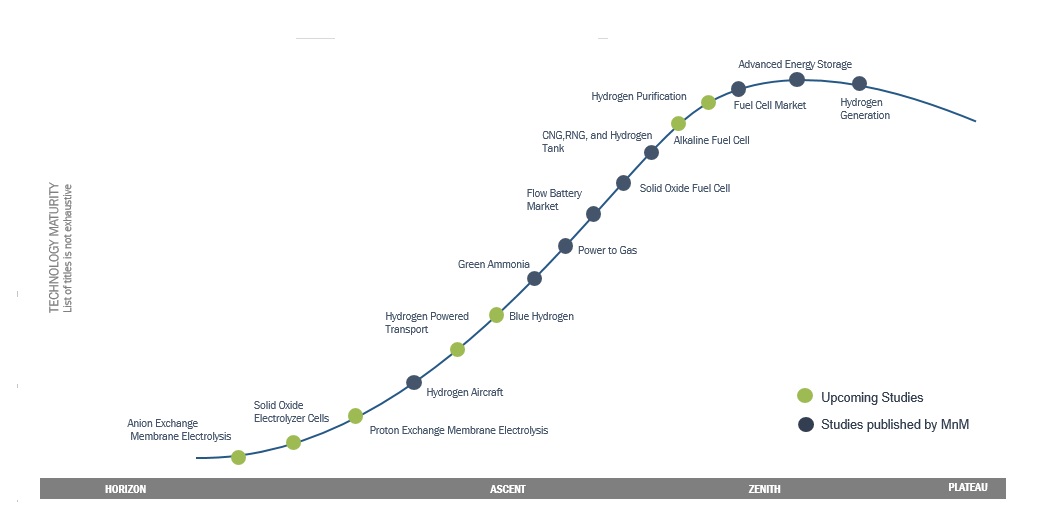

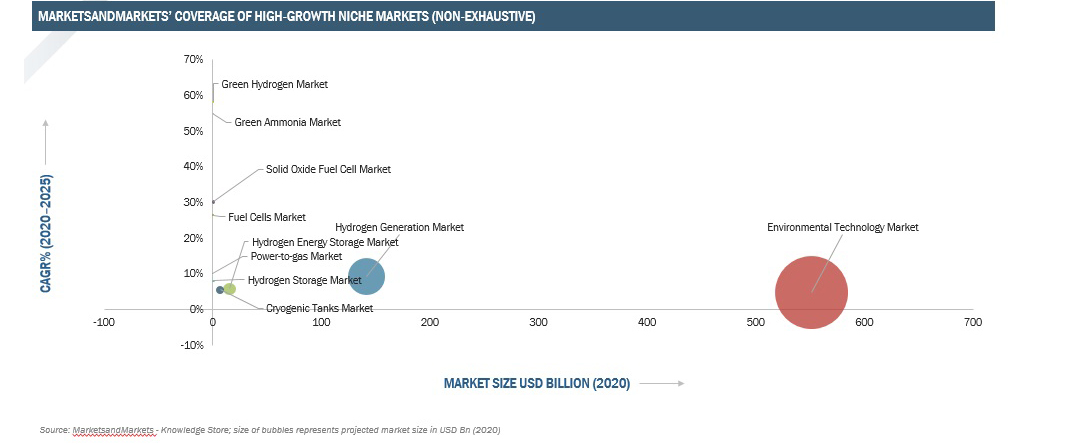

MarketsandMarkets™ RESEARCH FOCUSES ON HIGH GROWTH & NICHE MARKETS - such GREEN AMMONIA, ENVIRONMENTAL TECHNOLOGY , POWER TO GAS, SOLID OXIDE FUEL CELLS AND RELATED MARKETS

MarketsandMarkets™ COVERAGE OF HIGH-GROWTH NICHE MARKETS (NON-EXHAUSTIVE)

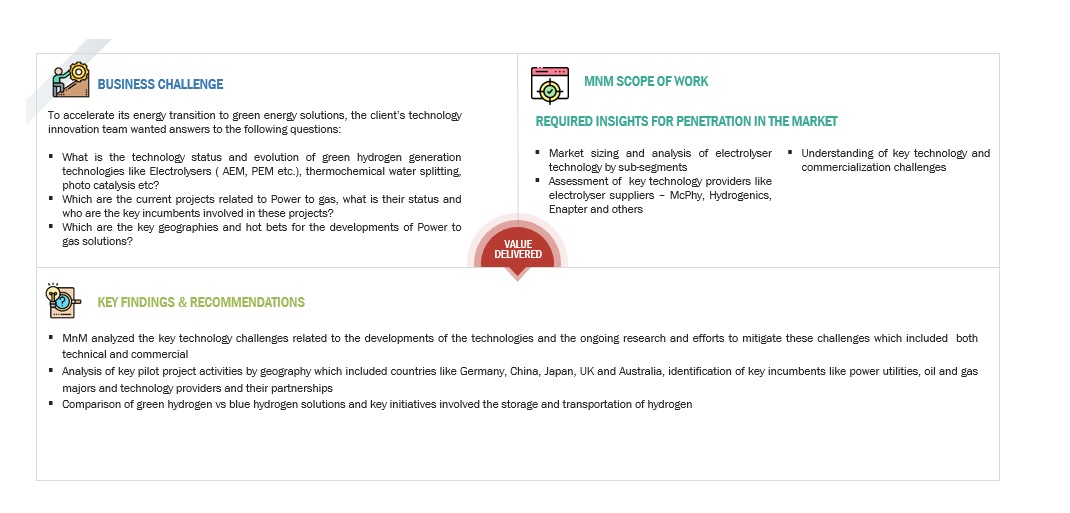

INDICATIVE LIST OF OTHER PROJECTS EXECUTED FOR hydrogen COMPANIES:

- STUDY

- Solid Oxide Electrolyser Cell (SOEC) Market Assessment

- Market Assessment & End-user Perception Analysis Study for Solid Oxide Fuel Cell (SOFC)

- Material Analysis for SOEC and SOFC

- Trends in Prices for SOEC and SOFC

- Market Assessment & End-user Perception Analysis Study for Green Ammonia

- Company Profiles and Technology Analysis for Green Hydrogen Market

- Market Assessment & End User Analysis for Direct methanol fuel cell

WE HAVE A COMPREHENSIVE UNDERSTANDING OF THE HYDROGEN ECOSYSTEM THROUGH OUR PROPRIETARY PLATFORM 'KNOWLEDGESTORE'.

impacting you and

your clients

Hydrogen Economy COMPANIES

DARRICK HUEBER

Business Development Leader

Nexus Controls LLC,

Leading Manufacturer of Automation System & Electrical Panelswww.bakerhughesds.com/nexus-controls

We partnered with MarketsandMarkets™ to expand our business further by tapping into new industrial segments. It was critical for us to gather crucial business insights about specific markets to achieve this goal. MarketsandMarkets™ engagement model and client services helped us provide those insights, it was really impressive and valuable for my business. The team was extremely flexible and helpful.

Kimberly Murphy

GLOBAL MARKETING DIRECTOR

Bently Nevada,

Leading Condition Monitoring & Asset Protectionwww.bakerhughesds.com/bently-nevada

MarketsandMarkets™ showed consistent rigor for success and relentlessly worked with Bently Nevada stakeholders to positively impact go-to-market strategy. Their proactiveness and flexibility has been instrumental in achieving the objectives to grow our sales pipeline in key industrial markets.

Mike Schoff

Global Industrial Commercial Strategy Leader

Nexus Controls LLC

Leading Manufacturer of Automation System & Electrical Panelswww.bakerhughesds.com/nexus-controls

We consulted MarketsandMarkets™ for potential Partner Identification. Overall, it was a good experience. The insights provided through interviews conducted by the team helped us put together the questionnaire required for discussion with the selected partners. Their ability to provide insights through interviews with customers in a timely manner was quite impressive.

Second Panel

Third Panel