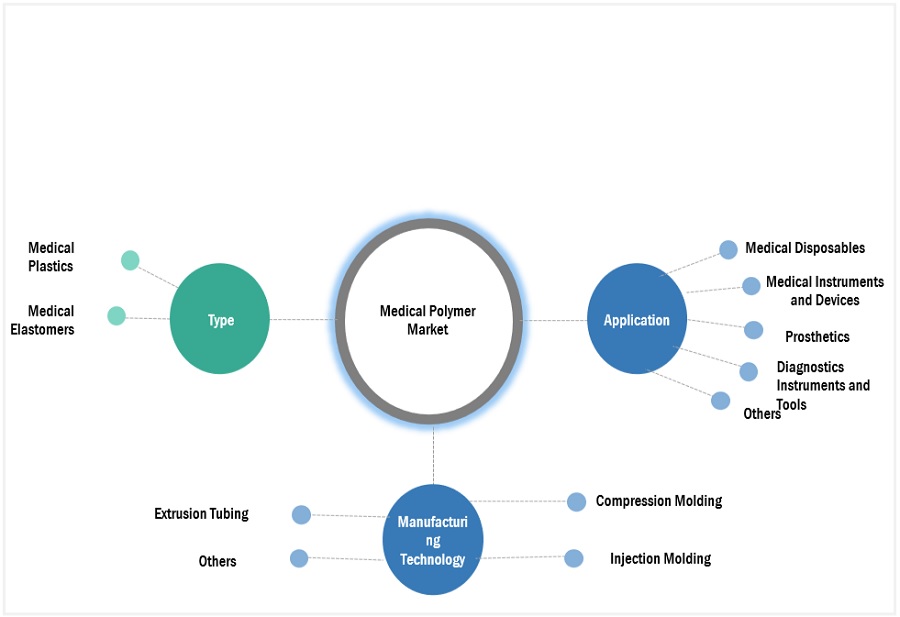

Medical Polymer Market by type (Medical plastics, Medical elastomers), Application (Medical Disposables, Medical Instruments And Devices, Prosthetics, Diagnostics Instruments And Tools), Manufacturing Technology, and Region - Global Forecast to 2029

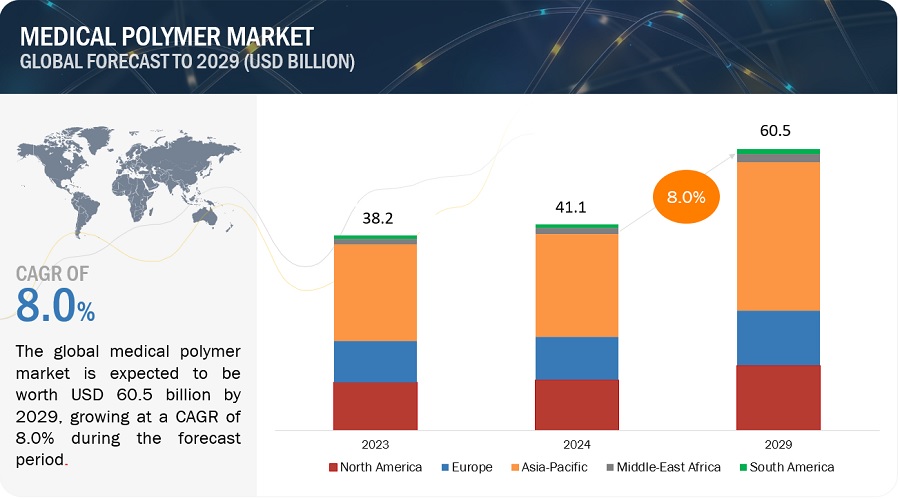

The global medical polymer market is expected to grow at a CAGR of 8.0% during the forecast period, from an estimated USD 41.1 billion in 2024 to USD 60.5 billion by 2029. The surge in demand for medical polymers stems from the heightened focus on enhancing healthcare standards and safety protocols, spurring the creation of cutting-edge medical tools and apparatus. Furthermore, advancements in polymer technology have broadened the scope and utility of medical polymers, prompting their integration into diverse medical domains. This escalating demand is further propelled by the necessity for materials that ensure biocompatibility, resilience, and straightforward sterilization procedures in medical environments.

Attractive Opportunities in the Medical Polymer Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Polymer Market Dynamics

Driver: Increasing demand for biocompatible materials

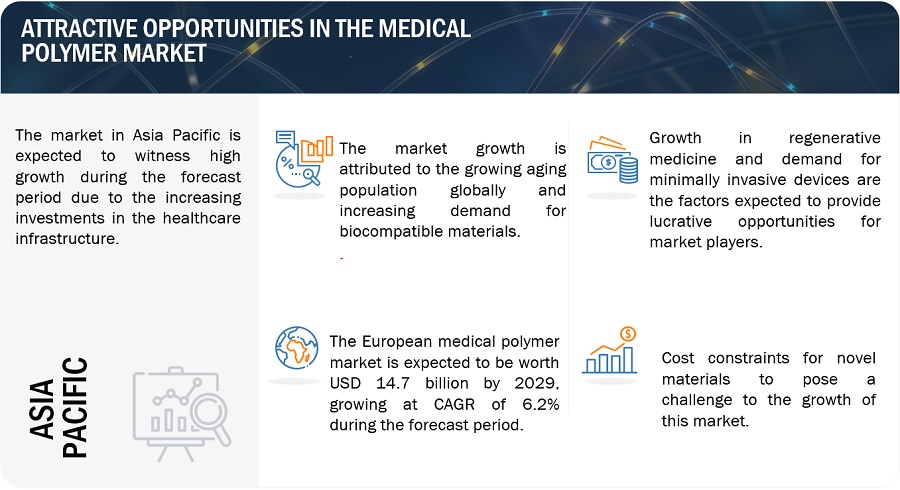

The increasing demand for biocompatible materials is a pivotal driver propelling the growth of the medical polymer market. Biocompatible materials refer to substances that are compatible with living tissues and organisms without causing adverse reactions such as inflammation or rejection. In the healthcare sector, the demand for biocompatible materials stems from their critical role in medical devices, implants, and drug delivery systems. Patients and healthcare providers alike prioritize materials that seamlessly integrate with the body, minimizing the risk of complications and enhancing treatment outcomes. One of the key factors driving this demand is the rising prevalence of chronic diseases and age-related conditions globally. As the incidence of conditions such as cardiovascular diseases, orthopedic disorders, and diabetes continues to increase, there is a growing need for medical devices and implants made from materials that are not only durable and functional but also compatible with biological systems. Biocompatible polymers such as polyethylene glycol (PEG), polylactic acid (PLA), and polyvinyl alcohol (PVA) have gained traction due to their biodegradability, low toxicity, and ability to mimic natural tissues. Moreover, advancements in material science and polymer engineering have led to the development of innovative biocompatible polymers with tailored properties, including enhanced mechanical strength, controlled degradation rates, and improved biocompatibility profiles. These materials play a crucial role in areas such as tissue engineering, regenerative medicine, and minimally invasive surgeries, driving the adoption of biocompatible polymers across diverse medical applications. As healthcare technologies continue to evolve, the demand for biocompatible materials is expected to remain strong, creating opportunities for market players to innovate and meet the evolving needs of the healthcare industry.

Restraint: Environmental sustainability concerns

Environmental sustainability concerns pose a significant restraint in the medical polymer market, impacting the entire lifecycle of polymer-based medical products from production to disposal. The growing emphasis on environmental stewardship, resource conservation, and waste reduction has prompted increased scrutiny of the environmental footprint associated with medical polymers. Key areas of concern include raw material sourcing, manufacturing processes, product design, packaging, and end-of-life disposal or recycling. One of the primary challenges related to environmental sustainability is the reliance on petrochemical-derived polymers, such as polyethylene, polypropylene, and PVC, which are non-biodegradable and contribute to plastic pollution. The extraction and processing of fossil fuel-based feedstocks raises concerns about carbon emissions, energy consumption, and environmental impact. Additionally, the disposal of medical devices and packaging made from these polymers can lead to landfill accumulation and environmental degradation if not managed responsibly. Furthermore, the use of certain additives, fillers, and processing aids in medical polymers, such as plasticizers, flame retardants, and antimicrobial agents, raises questions about their potential environmental toxicity and persistence in ecosystems. Regulatory restrictions on hazardous substances, such as REACH regulations in Europe or FDA guidelines in the United States, add complexity to material selection and product development in the medical polymer industry. Moreover, the lack of standardized recycling infrastructure and limited options for recycling medical polymers further exacerbate environmental concerns. While initiatives to promote recycling and circular economy principles are emerging, challenges remain in establishing efficient collection, sorting, and processing systems for medical plastic waste. Addressing environmental sustainability concerns requires collaboration among stakeholders, including manufacturers, regulators, healthcare providers, and consumers. Strategies such as using bio-based polymers, implementing eco-friendly manufacturing processes, designing recyclable or biodegradable products, and adopting closed-loop recycling systems are critical to mitigating environmental impacts and ensuring long-term sustainability in the medical polymer market.

Opportunities: Demand for minimally invasive devices

The rise of minimally invasive devices presents a significant opportunity in the medical polymer market, driving demand for specialized materials that enable the development of innovative medical technologies and procedures. Minimally invasive procedures involve accessing and treating internal organs or structures through small incisions or natural body openings, reducing patient trauma, recovery time, and healthcare costs compared to traditional surgical approaches. Medical polymers play a crucial role in the fabrication of minimally invasive devices, providing properties such as flexibility, biocompatibility, and precision engineering that are essential for their functionality and performance. One of the key advantages of medical polymers in minimally invasive devices is their ability to be molded into complex shapes, miniaturized components, and catheter-based systems that navigate through narrow anatomical pathways. Polymers such as polyurethane, polyethylene, and PEEK (polyether ether ketone) are commonly used in catheters, guidewires, stents, and endoscopic tools, offering low friction, high strength, and compatibility with medical imaging techniques. Moreover, advancements in polymer processing technologies, such as extrusion, injection molding, and additive manufacturing (3D printing), enable the customization and production of minimally invasive devices with precise dimensions, surface textures, and functionalities. These manufacturing capabilities facilitate rapid prototyping, iteration, and scale-up of device designs, accelerating time-to-market and innovation cycles. The expanding applications of medical polymers in minimally invasive devices include cardiovascular interventions, endoscopy procedures, laparoscopic surgeries, and neurovascular interventions. Collaboration between medical device manufacturers, polymer suppliers, and healthcare providers drives product development and adoption, fostering a dynamic ecosystem of technological advancements and clinical outcomes. Furthermore, the growing trend towards outpatient procedures, ambulatory care, and remote monitoring systems creates opportunities for miniaturized, implantable, and wearable devices made from biocompatible and bioresorbable polymers. As healthcare systems prioritize patient-centric care, cost-effectiveness, and improved clinical outcomes, the demand for medical polymers in minimally invasive devices is expected to continue growing, shaping the future of healthcare delivery and medical innovations.

Challenges: Long term durability and degradation control

Long-term durability and degradation control present significant challenges in the medical polymer market, impacting the performance, reliability, and safety of medical devices and implants over time. Medical polymers are designed to withstand physiological conditions, mechanical stresses, and environmental factors while maintaining their structural integrity, biocompatibility, and functionality throughout their intended lifespan. However, ensuring long-term durability and degradation control poses several complex challenges that require careful material selection, design optimization, and regulatory compliance. One of the key challenges related to long-term durability is predicting and controlling the degradation kinetics of biodegradable polymers used in implantable devices or drug delivery systems. Biodegradable polymers such as poly(lactic acid) (PLA), poly(glycolic acid) (PGA), and their copolymers (PLGA) are susceptible to hydrolytic and enzymatic degradation processes in vivo, leading to changes in mechanical properties, degradation rates, and degradation byproducts. Balancing degradation rates with tissue integration and therapeutic release profiles is essential to ensure optimal performance and safety of biodegradable medical polymers. Moreover, achieving long-term durability requires comprehensive testing, validation, and post-market surveillance to assess material stability, degradation behavior, and biocompatibility over extended periods. Accelerated aging studies, biocompatibility testing according to ISO 10993 standards, and real-world clinical evaluations are essential to evaluate the long-term performance and safety of medical polymers in clinical use. Additionally, the control of degradation products and their potential impact on surrounding tissues, immune responses, and inflammatory reactions is a critical consideration in medical polymer design. Minimizing the formation of acidic byproducts, cytotoxic compounds, or inflammatory responses during polymer degradation is essential to prevent adverse effects and ensure patient safety. Furthermore, regulatory requirements for long-term durability and degradation control add complexity to product development and market approval processes. Demonstrating compliance with regulatory standards such as ISO 10993, FDA guidance documents, and international guidelines requires robust scientific evidence, documentation, and risk assessment strategies. Furthermore, regulatory requirements for long-term durability and degradation control add complexity to product development and market approval processes. Demonstrating compliance with regulatory standards such as ISO 10993, FDA guidance documents, and international guidelines requires robust scientific evidence, documentation, and risk assessment strategies.

MEDICAL POLYMER MARKET: ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of centrifuges. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include BASF SE (Germany), SABIC (Saudi Arabia), Covestro AG (Germany), Celanese Corporation (US), Evonik Industries (Germany).

Based on type, medical plastics is the fastest growing type segment in medical polymer market.

Medical plastics are experiencing rapid growth as the fastest-growing type segment in the medical polymer market for several compelling reasons. Firstly, the versatility and adaptability of medical plastics make them essential in a wide range of medical applications, from disposable syringes to advanced surgical equipment. Their properties such as biocompatibility, durability, and ease of processing meet the stringent requirements of the healthcare industry. Additionally, the shift towards single-use medical products and the increasing demand for minimally invasive procedures are driving the adoption of medical plastics. Moreover, ongoing advancements in polymer technology, including the development of bio-based and sustainable plastics, further contribute to the significant growth of medical plastics in the medical polymer market.

Based on application, medical instruments and devices is the fastest growing application in the medical polymer market.

The medical instruments and devices segment is experiencing rapid growth as the fastest-growing application in the medical polymer market due to several key factors. Firstly, the rising demand for advanced medical technologies and the increasing prevalence of chronic diseases are driving the need for innovative medical devices and instruments. These devices require materials with specific properties like biocompatibility, sterilizability, and chemical resistance, all of which medical polymers can provide. Additionally, the trend towards minimally invasive procedures is driving the development of lightweight and durable medical devices, further boosting the demand for medical polymers in this segment. Furthermore, ongoing technological advancements in medical polymer formulations and manufacturing processes are enhancing the performance and reliability of medical instruments and devices, reinforcing their rapid growth in the market.

Based on manufacturing technology, injection molding is the fastest growing manufacturing technology in the medical polymer market.

Injection molding stands out as the fastest-growing manufacturing technology in the medical polymer market due to several key factors. Firstly, its ability to produce complex and customized medical components with high precision and efficiency makes it indispensable in the medical device manufacturing sector. This technology enables the mass production of medical products such as syringes, catheters, and implants, meeting the growing demand for these devices globally. Additionally, injection molding offers advantages such as cost-effectiveness, shorter production lead times, and minimal material wastage, making it highly attractive to medical device manufacturers seeking efficient and scalable production solutions. Moreover, ongoing advancements in injection molding processes, including automation and digitalization, continue to enhance its capabilities and contribute to its rapid growth in the medical polymer market.

Asia Pacific is expected to be the fastest-growing market during the forecast period.

The Asia Pacific region emerges as the fastest-growing region in the medical polymer market due to several key factors. Firstly, the region's rapid economic development and increasing healthcare expenditure are driving the demand for advanced medical devices and equipment, which heavily rely on medical polymers. Moreover, the region benefits from a large and aging population, leading to a higher prevalence of chronic diseases and the need for medical interventions. Additionally, favorable government initiatives, investments in healthcare infrastructure, and a robust manufacturing ecosystem contribute to the region's growth. Furthermore, the shift towards personalized medicine and the adoption of innovative medical technologies further propel market expansion in the Asia Pacific region, positioning it as a dynamic and lucrative market for medical polymers.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The medical polymer market is dominated by a few major players that have a wide regional presence. The key players in the medical polymer market are as as as BASF SE (Germany), SABIC (Saudi Arabia), Covestro AG (Germany), Celanese corporation (US), Evonik Industries (Germany), Arkema (France), Solvay (Belgium), Kuraray Co., Ltd. (Japan), Momentive Performance Materials Inc. (US), DuPont (US). In the last few years, the companies have adopted growth strategies such as Product launches, Investments, Acquisitions, and expansions to capture a larger share of the medical polymer market.

Read More: Medical Polymer Companies

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2020-2029 |

|

Base Year |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Type, Application, Manufacturing Technology, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

BASF SE (Germany), SABIC (Saudi Arabia), Covestro AG (Germany), Celanese corporation (US), Evonik Industries (Germany), Arkema (France), Solvay (Belgium), Kuraray Co., Ltd. (Japan), Momentive Performance Materials Inc. (US), DuPont (US) |

This report categorizes the global medical polymer market based on type, application, manufacturing technology, and region.

On the basis of type, the medical polymer market has been segmented as follows:

-

Medical Plastics

- PP

- PVC

- PE

- PS

- Engineering and High-Performance Plastics

- PEEK

- PA

- PPSU

- PSU

- PMMA

- PC

- ABS

- Other Engineering and High-Performance Plastics

- Other Medical Plastics

-

Medical Elastomers

- Silicone

- Thermoplastic Elastomers

- TPU

- TPV

- TPS

- SBS

- SUBS

- SBC, TPO, and Other TPS

- TPC-ET

- Other Medical Elastomers

On the basis of application, the medical polymer market has been segmented as follows:

- Medical Disposables

- Gloves

- Syringes

- Medical Bags

- Others

- Medical Instruments & Devices

- Medical Tube

- Catheters

- Drug Delivery

- Others

- Prosthetics

- Implants

- Limb Prosthetics

- Others

- Diagnostic Instruments & Tools

- Dental Tools

- Surgical Instruments

- Others

- Other Applications

On the basis of manufacturing technology, the medical polymer market has been segmented as follows:

- Extrusion Tubing

- Compression Moulding

- Injection Moulding

- Others

On the basis of region, the medical polymer market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2024, SABIC, a global leader in the chemical industry, has successfully demonstrated the feasibility of recycling used medical plastic back into the medical materials stream with the dialysis department at Jessa Hospital, one of the largest non-university medical clusters in the Limburg region of Flanders, Belgium. Serving as a pilot proof-of-concept, used medical plastic generated at Jessa’s hospitals was converted to pyrolysis oil in an advanced recycling process, delivering circular feedstock for SABIC’s production of TRUCIRCLE polymers in medical grade quality with same performance, purity, and physiological safety as virgin-based medical grade polymers.

- In October 2023, Covestro has commenced operations at its first dedicated mechanical recycling (MCR) compounding line for polycarbonates at its integrated site in Shanghai, China. This line is set to produce over 25,000 tons of premium-quality polycarbonates and blends containing mechanically recycled materials annually, in response to the growing demand for post-consumer-recycled (PCR) plastics, particularly in applications within the electrical and electronic products, automotive, healthcare, and consumer goods sectors.

- In October 2023, Covestro has expanded its production capacities for thermoplastic polyurethane (TPU) films in the Platilon range, as well as the associated infrastructure and logistics in Bomlitz, Lower Saxony, Germany. These thermoplastic polyurethane (TPU) films are highly utilized in medical polymers market.

- In September 2021, BASF SE has made a strategic partnership with Sanyo Chemical Industries Ltd. for the development of polyurethane dispersions (PUD)s, which are highly utilized in medical polymers market. The two parties aim to jointly develop and produce innovative products with strong sustainability contribution. Newly developed technologies and products will have worldwide market access through the two companies global production.

- In July 2021, Celanese Corporation a global chemical and specialty materials company has announced an expansion of its Florence, Kentucky research and development center with the addition of a Pharmaceutical Drug Delivery Feasibility Lab. The new feasibility lab will drive new development for long-acting controlled release drug delivery.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the medical polymer market?

The growth of the medical polymer market is influenced by factors such as the increasing demand for minimally invasive surgical procedures, technological advancements in medical devices, the rise in chronic diseases, and the expanding geriatric population requiring healthcare.

Which are the key applications driving the medical polymer market?

The key applications driving the demand for medical polymer are medical disposables, prosthetics, medical instruments and devices, and others.

Who are the major manufacturers?

Major manufacturers include BASF SE (Germany), SABIC (Saudi Arabia), Covestro AG (Germany), Celanese Corporation (US), Evonik Industries (Germany).

What will be the growth prospects of the medical polymer market?

The medical polymer market is expected to witness robust growth due to rising healthcare needs globally, advancements in polymer technology for medical applications, increasing demand for biocompatible materials, and expanding applications in areas like drug delivery systems and implants, driving market expansion in the coming years.

What will be the growth prospects of the medical polymer market in terms of CAGR in next five years?

The CAGR of the market will be in between 8-9% in next five years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the medical polymer market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key medical polymer, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

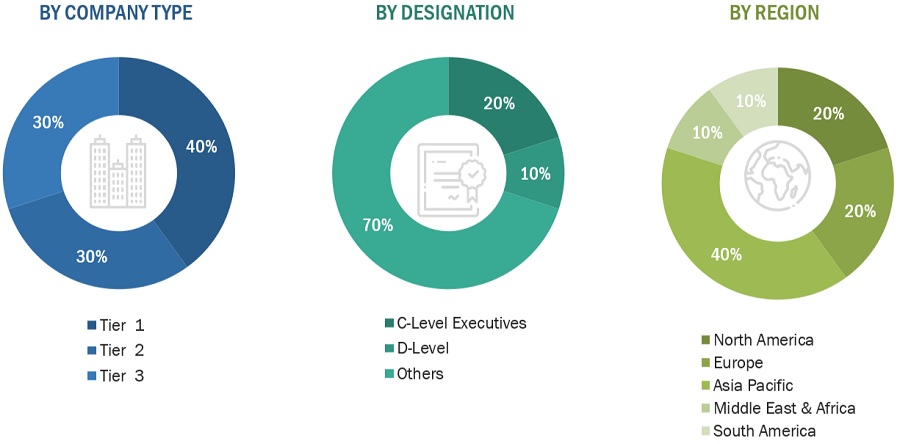

The medical polymer market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the medical polymer market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the medical polymer industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, manufacturing technology, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of medical polymer and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for medical polymer for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on type, application, manufacturing technology, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Medical Polymer Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Polymer Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process medical polymer above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Medical polymers refer to a specialized class of polymers designed and utilized specifically for medical and healthcare applications. These polymers are engineered to meet stringent requirements such as biocompatibility, sterilizability, and chemical resistance, making them suitable for use in medical devices, equipment, implants, and packaging materials. Medical polymers play a crucial role in modern healthcare by providing properties like flexibility, durability, transparency, and ease of processing, which are essential for the development and production of safe and effective medical products. They are used in a wide range of medical applications, including surgical instruments, catheters, implants, drug delivery systems, and diagnostic equipment, contributing significantly to advancements in medical technology and patient care.

Key Stakeholders

- Medical polymer Manufacturers

- Medical polymer Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the medical polymer market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on type, application, manufacturing technology, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on medical polymer market

Growth opportunities and latent adjacency in Medical Polymer Market