Control Valve Market by Material (Stainless Steel, Cast Iron, Cryogenic, Alloy Based), Component (Actuators, Valve Body), Size, Type (Rotary, Linear), Industry (Oil & Gas, Water & Wastewater, Energy & Power, Chemicals) & Region - Global Forecast to 2029

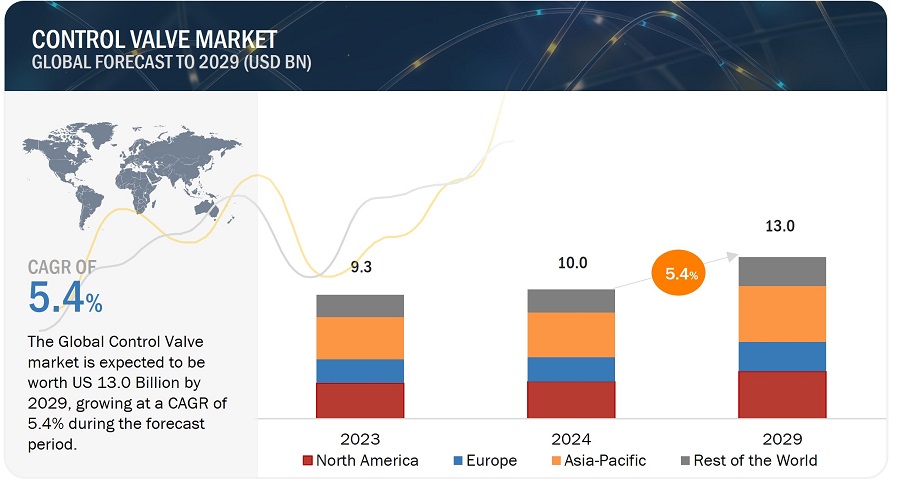

[215 Pages Report] The global Control Valve market is expected to grow from USD 10.0 billion in 2024 to USD 13.0 billion by 2029, registering a CAGR of 5.4%. The expansion of control valves in the global market has been fueled by increased industrial automation, a rising demand for precise process control, and innovations in valve technology, all contributing to improved operational efficiency and reliability.

Control Valve Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Rising Surge in Control Valve Demand in the Oil & Gas Industry

In the oil and gas industry, the demand for control valves has been steadily rising due to several factors driving the need for efficient process control and optimization. Control valves play a crucial role in regulating the flow, pressure, temperature, and level of fluids in various processes within the oil and gas production, refining, and distribution systems. One significant driver of the increasing demand is the industry's continuous expansion and exploration efforts, necessitating the deployment of advanced control systems to ensure safe and efficient operations. Additionally, stricter regulatory requirements and environmental standards have compelled companies to invest in control valve technologies that enhance process efficiency and reduce emissions. Furthermore, as oil and gas operations become increasingly complex and remote, there is a growing emphasis on automation and digitalization, leading to a higher adoption of smart control valves equipped with advanced features such as remote monitoring, predictive maintenance, and real-time data analytics. Moreover, the ongoing modernization and upgrade initiatives in existing oil and gas facilities to enhance productivity and reliability have also contributed to the surge in demand for control valves. Overall, the rising demand for control valves in the oil and gas industry underscores the critical role these devices play in ensuring operational efficiency, safety, and compliance with industry standards and regulations.

Restraint: Complexity of Installation and Maintenance

Control valves are essential components requiring precise installation and regular maintenance for optimal performance. However, the complexity of these tasks can deter end-users lacking expertise or resources. The intricate setup process involves understanding fluid dynamics, system integration, and compliance with regulations. Similarly, ongoing maintenance necessitates vigilant monitoring and timely repairs. For organizations without specialized teams, navigating these challenges can lead to inefficiencies or system failures. To alleviate these barriers, control valve manufacturers can offer comprehensive training, user-friendly guides, and accessible technical support. Simplifying installation processes, providing clear documentation, and offering remote troubleshooting assistance can empower end-users. Implementing predictive maintenance technologies, such as condition monitoring sensors, further streamlines maintenance efforts. By enhancing accessibility and support mechanisms, the control valve industry can broaden its user base and facilitate smoother adoption and operation across various applications.

Opportunity: Requirement for replacing obsolete valves and embracing intelligent valve solutions

The aging infrastructure within the oil & gas and water & wastewater treatment sectors poses a significant concern in various nations. Take, for example, the United States, which harbors an extensive network of aging pipelines vital for transporting essential commodities such as natural gas, oil, water, and wastewater. Valves employed within this aged infrastructure are approaching the end of their operational lifespan, necessitating replacement. Therefore, the replacement of these outdated valves is crucial to enhance performance and ensure improved worker safety. This imperative for infrastructure renewal or repair is anticipated to drive demand for new control valves. Consequently, end-users are increasingly prioritizing the adoption of highly reliable, integrated, and cutting-edge solutions to address maintenance challenges. The valve industry is also employing advanced technologies its offerings. Smart valves offer several benefits to end-user industries or operators of valves. For instance, when residential applications such as traditional taps are considered, turning on and off the valves can be easily operated manually; however, it is very complex to operate hundreds of valves across a wide area of a utility network. Also, on a commercial scale, controlling the flow of water in a network requires personnel to release the water, thereby incurring an additional cost to a utility company, mine, or industrial facility and leading to inefficient and non-accurate process handling. However, smart valves give the user complete control over the flow of a pipe network. Smart valves enable the operator to control the valve from a long distance both from inside the building or from some other area. Smart valves will prove a great solution for utility companies, factories, housing estates, mining and irrigation systems, adding significant value to many industrial and residential use cases. Various valve manufacturers are investing in research and development activities related to smart valves.

Challenge: Unexpected operational halts caused by valve malfunctions or failures

Valve malfunctions or failures lead to unplanned plant downtime or shutdowns, necessitating valve replacement or repair as the sole recourse. Such unplanned downtime can incur substantial losses, including production downtime costs, emergency repair expenses, raw material wastage, customer dissatisfaction from delayed deliveries or subpar product quality, and more. Nevertheless, industry stakeholders are actively addressing this challenge by embracing monitoring, predictive maintenance, connected infrastructure, and condition monitoring solutions.

Control Valve Market Ecosystem

The figure below shows the Control Valve ecosystem.

Actuator component holds the largest market share in the year 2023.

The Actuator in Control Valve market is seeing substantial growth, powered by increasing demands for industrial automation and the necessity for precise regulation in sectors such as oil & gas, water treatment, and manufacturing. Technological advancements and a focus on efficiency are additionally propelling market expansion, fostering innovation and adoption.

Rotary Valves component holds the largest market share in the year 2023.

The adoption of rotary valves in the control valve market has surged due to their reputation for precise control and reliability. With diverse applications in industries such as oil and gas, chemicals, and power generation, their effective flow regulation capabilities and advancements in design and materials have propelled their widespread adoption and prominence in the market

>6"-25" size segment to hold largest market share in 2023.

The global market for control valves sized between 6 and 25 inches has experienced substantial growth, fueled by the expansion of industrial infrastructure, notably in energy, oil and gas, and water treatment sectors. This expansion is further propelled by rising automation demands and advancements in valve technology, serving diverse industrial needs across the world.

Pulp & paper is expected to register highest CAGR during the forecast period

Control valves have seen significant expansion within the pulp and paper industry, serving as essential tools for regulating fluid flow in manufacturing processes. This growth has been driven by automation advancements, efficiency requirements, and environmental standards. As production optimization and waste reduction gain importance, control valves have become indispensable, ensuring the efficient and productive operation of pulp and paper mills..

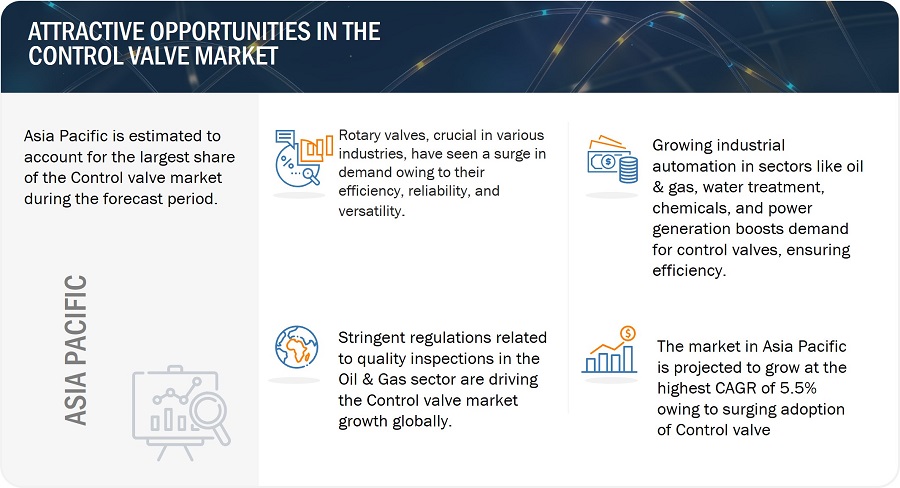

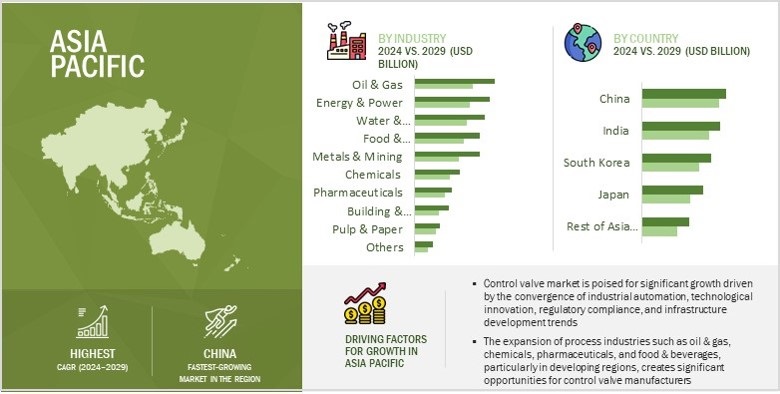

Asia Pacific to hold largest market share in the year 2023.

The control valve market in the Asia Pacific region has experienced notable expansion attributed to industrial growth, infrastructure development, and heightened demand for process automation across key sectors such as oil & gas, power generation, and water treatment. Technological advancements and the integration of smart valve solutions have been instrumental in driving this upward trajectory. This trend is poised to persist as industries prioritize augmenting operational efficiency, reliability, and safety standards.

Control Valve Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Control Valve Companies players have implemented various organic and inorganic growth strategies, such as product launches, collaborations, partnerships, and acquisitions, to strengthen their offerings in the market. The major players in the market are Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), Curtiss-Wright Corporation (US), Valmet (Finland), SLB (US), Spirax Sarco Limited (US), Crane Company (US), KITZ Corporation (Japan)

The study includes an in-depth competitive analysis of these key players in the Control Valve market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Estimated Value |

USD 10.0 billion |

|

Expected Value |

USD 13.0 billion |

|

Growth Rate |

CAGR of 5.4% |

|

Years Considered |

2020–2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By Component, By Material, By Type, By Size By Industry and By Region |

|

Regions Covered |

North America, Asia Pacific, Europe, and the Rest of the World |

|

Companies Covered |

Christian Bürkert GmbH & Co. KG (Germany), Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), Curtiss-Wright Corporation (US), Valmet (Finland), SLB (US), Spirax Sarco Limited (US), Crane Company (US), KITZ Corporation (Japan)and a total of 25 players covered |

Control Valve Market Highlights

This report has segmented the Control valve market based on Offerings, Component and Industry and Region.

|

Segment |

Subsegment |

|

By Component |

|

|

By Material |

|

|

By Type |

|

|

By Size |

|

|

By Process Industry |

|

|

By Region |

|

Recent Developments:

- In November 2023, Emerson Electric Co has introduced its pioneering Fisher™ Whisper™ Trim Technology, designed for rotary and globe valves. This advancement expands Emerson's existing Whisper noise solutions portfolio. Leveraging additive manufacturing and advanced methods, this next-gen Fisher Whisper Trim technology tackles noise challenges by enhancing trim designs for superior performance.

- In June 2023, Flowserve Corporation a prominent supplier of flow control solutions and services, has declared that its Valtek® Valdisk™ high-performance butterfly valve has received approval from licensors for utilization in pressure swing adsorption (PSA) applications.

- In March 2023, Flowserve Corporation, a prominent supplier of flow control solutions, revealed today the launch of the Worcester® 51/52 Series Reduced Port Flanged Ball Valves. These quarter-turn, floating ball valves have undergone a comprehensive redesign to ensure global availability through standardization of design, materials, construction, and product certifications. The valves are tailored for various industries, including chemical processing, petrochemicals, energy, defense, food and beverage, industrial gases, pharmaceuticals, and water, where precise control of liquid or gas flow is essential.

FAQ:

What will the size of the Control Valve market be in 2024?

The Control Valve market will be valued at USD 10.0 billion in 2024.

What CAGR will be recorded for the Control Valve market from 2024 to 2029?

The global Control Valve market is expected to record a CAGR of 5.4% from 2024 to 2029.

Who are the top players in the Control Valve market?

The significant vendors operating in the Control Valve market include Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), Curtiss-Wright Corporation (US), Valmet (Finland), SLB (US), Spirax Sarco Limited (US), Crane Company (US), KITZ Corporation (Japan) and among others.

Which significant countries are considered in the Asia Pacific region?

The report includes an analysis of China, Japan, India, and the rest of the Asia Pacific region.

Which Type have been considered in the Control Valve market?

Rotary Valves and Linear Valves are considered in the market study.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

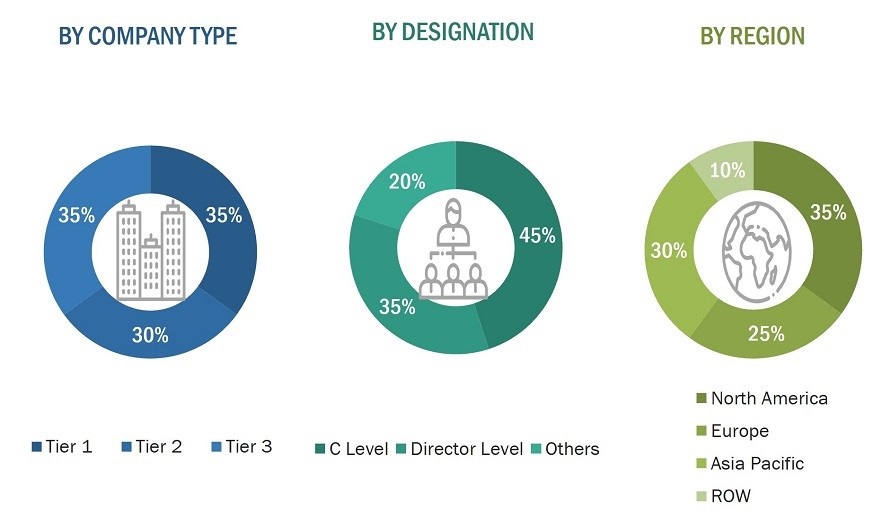

The study involves four significant activities for estimating the size of the Control valve market. Exhaustive secondary research has been conducted to collect information related to the market. The next step is to validate these findings and assumptions related to the market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the Control valve market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications, articles by recognized authors; directories; and databases. The secondary data has been collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the Control valve market through secondary research. Several primary interviews have been conducted with experts from the supply and demand sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been implemented to estimate and validate the size of the Control valve market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Control Valve Market: Top-Down Approach

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For calculating the Control valve market segments, the market size obtained by implementing the bottom-up approach has been used to implement the top-down approach, which was later confirmed with the primary respondents across different regions.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the market size of various segments.

- Each company’s market share has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the help of data triangulation and validation of data through primary, the size of the overall Control valve and each market have been determined and confirmed in this study.

Control Valve Market: Bottom-up Approach

- The bottom-up approach was used to arrive at the overall size of the Control valve market from the revenue of key players and their market share.

- Identifying various industries using or expected to deploy Control valve by its type at their facilities.

- Analyzing the use cases across different regions and companies.

- Estimating the size of the Control valve market on the basis of the demand from these industries and companies

- Tracking the ongoing and upcoming installation contracts, acquisitions, expansions, and product launches by various companies, and forecasting the market based on these developments and other critical parameters.

- Conducting multiple discussions with key opinion leaders to understand Control valve Type & Component by companies in these industries to analyze the break-up of the scope of work carried out by each major company providing Control valve components.

- Arriving at the market estimates by analyzing the country-wise sales of Control valve solutions companies and combining this data to get the regional market estimates.

- Verifying and crosschecking the estimates at every level through discussions with key opinion leaders, including CEOs, directors, operations managers, and domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources, such as annual reports, press releases, and white papers.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments. The data was then triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A valve is a mechanical device that regulates the flow of liquid or gas in a process stream. A control valve is a device that uses an actuator to provide power for flow control. It is the most common final control element used in process industries to automatically regulate the pressure and flow rate of media (flowing gas, steam, water, or chemical compounds) within the required operating range. Control valves are vital when reliability and productivity are the primary objectives. The use of control valves helps prevent revenue loss due to leakages. Hence, these valves are an integral part of every industrial process. Varieties of valves, such as ball valves, butterfly valves, plug valves, and globe valves, are available in the market. Ball and globe valves are the most widely used valves in several end-user industries, such as oil & gas, energy & power, and water & wastewater treatment. The key players operating in this market are Christian Bürkert GmbH & Co. KG (Germany), Emerson Electric Co. (US), Flowserve Corporation (US), IMI (UK), Curtiss-Wright Corporation (US), Valmet (Finland), SLB (US), Spirax Sarco Limited (US), Crane Company (US), KITZ Corporation (Japan).

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Providers of technology solutions

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations related to Control valve

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- Existing end users and prospective ones

Report Objectives:

- To describe and forecast the Control valve market in terms of value based on Component, Material, Type, Size, Industry and Region

- To describe and forecast the Control valve market size in terms of value for four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the Control valve market

- To provide a detailed overview of the supply chain of the ecosystem

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To analyze the probable impact of the recession on the market in the future

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio.

- To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the Control valve market

Available Customization:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for this report:

Company Information:

- Detailed analysis and profiling of additional five market players

Growth opportunities and latent adjacency in Control Valve Market

We would like to know market size, industry trends, and industry players information operating into 6" to 60" Control Flow Valves business used for liquids, cryogenics, gasses, and steam applications.

Dose this report contains shipments for different valve sizes, specially for liquid applications?

As I am focusing on solenoid valves, angle seat valves, media separated valves. I want to know weather it is part of the market mentioned in this report and what all details I would able to extract from your report.

I am interesting to get complete report of Control Valve Market, but I want more specific data on actuators and European countries.

I am interested for market sizing of solenoid valves, angle seat valves, media separated valves for North America region. Specifically US and Canada

Dose this report covers middle east countries market size in detail? We would like to understand oil & gas market of control valve for all middle east countries.

Do you provide excel version of the underlying data used in the report? We would like to understand methodology of the report and scope of control valves?

I would like to see a summary of the control valves report. We are into global market, we want to understand futuristic market and impact of IIOT on control valve business.

We intend to invest in production of control valves for oil & gas industries. Need to collect some information about control valve markets locally and internationally. What all you can provide us?

Could you please mention what is included in this category. We are more intrested into pressure relief valves, hydronic heating valves and respective global market size?

We would like to have a better understanding of the valves sold around the US and specifically in Texas. What information you can provide for the same.

dose this report includes shipments for rotary and linear control valves? We need to understand technological shift happening into this market.

I am really looking for Marketing research on the the usage of Rotary Valves in the NAFTA region, market size, competitors, products offerings. Is it covered in your report?

I am looking for information on global USD market volume of Butterfly Valves and tripple eccentric valves. Do you have any seprate report for the same.

Mostly interested in Actuators, Valve Body and Diaphragm Valves (Sanitary/Hygienic Valves) specifically US, Europe and Asia Pacific region. What granularity is covered into the report?

we are planning to enter into APAC market for control valve business, we want to understand APAC market trend, industry players strategies, and rules & regulation into this region. Dose report include all these?

I am working in industrial and control valves business, I need to understand the scope difference between industrial valve and control valve reports. I would like to see sample and research methodology behind both the reports.

I am more intrested in actuators used along with control valves. I would like to know market size of various actuators types by industries.

we are more keen to know European valve market particularly for Power and Steam Conditioning applications. In addition, looking for brief about valve business with deep dive on Control Valves.