Water Treatment Biocides Market by Product Type (Oxidizing Biocides, Non-Oxidizing Biocides), Application (Oil & Gas, Municipal Water Treatment, Power Plants, Mining, Pulp & Paper, Swimming Pools), and Region - Global Forecast to 2024

[161 Pages Report] The global water treatment biocides market size is projected to reach USD 4.7 billion by 2024 from USD 3.5 billion in 2019, at a CAGR of 6.2%. The increasing use of water treatment biocides in various applications such as oil & gas, municipal water treatment, power plants, mining, pulp & paper, and swimming pools, among others, is expected to drive the market growth. Europe was the largest market for water treatment biocides in 2018, followed by APAC, North America, the Middle East & Africa, and South America. The presence of a stringent regulatory environment, along with the growing demand for biocides from various applications, is the key factor driving the market for water treatment biocides. Furthermore, rising population and rapid urbanization in emerging economies act as an opportunity for the market.

Attractive Opportunities in the Water Treatment Biocides Market

Note: e-estimated, p-projected

Water Treatment Biocides Market Dynamics

Drivers: Stringent regulatory environment

The European Commission has laid stringent guidelines regarding the treatment of drinking water, which comes under the Drinking Water Directive (DWD). The objective of this regulation is to protect human health from adverse effects of any contamination of water by ensuring that it is safe and fit for human consumption. This regulation is applicable to all the water distribution systems, drinking water tankers, drinking water taps, bottles, containers, and the water used in the food processing industry. This also supports the most stringent norms in drinking water quality and wastewater treatment standards. In addition, in the US, the Environmental Protection Agency (EPA) has developed the Surface Water Treatment Rules (SWTRs) to improve the quality of drinking water.

Restraint: Lengthy and expensive registration process in the EU

In Europe, there is a stringent regulatory environment when it comes to the usage of biocides. The Biocidal Products Regulation (BPR, Regulation (EU) 528/2012) aims to improve the usage and functioning of biocidal products in the European Union (EU), by ensuring a high level of protection for humans, animals, and the environment. However, all biocidal products require authorization before they can be launched in the market.

Opportunities: Rising population and rapid industrialization in the emerging economies

Countries such as India, China, Indonesia, the US, Brazil, Mexico, Iraq, Iran, Saudi Arabia, Argentina, the UK, Australia, Malaysia, Canada, the UAE, Kuwait, and Germany have witnessed positive growth in population in the last few years. The growing population is driving the demand for potable water. According to Siemens Global, less than 1% of the worlds water is potable. With the increase in population, the scarce water resources must be sustainably used and made drinkable. In addition, wastewater must be treated as 80% of the wastewater flows untreated in the oceans, rivers, lakes, and ponds.

The non-oxidizing biocides segment is projected to be the largest product type of water treatment biocides market during the forecast period.

Non-oxidizing biocides are chemicals that function by mechanisms other than oxidation, which include interfering with reproduction and cell metabolism, lysis of cell wall, and stopping of respiration of the microorganisms. They are generally fed into a system for hours or up to a day to kill algae, bacteria, and fungi. The non-oxidizing biocides segment is projected to lead the water treatment biocides in terms of value during the forecast period. This is owing to their comparatively higher pricesthan that of oxidizing biocides. In addition, the growing use of non-oxidizing biocides in applications, such as oil & gas, power plants, and pulp & paper in driving the market.

The oil & gas application segment is projected to be the largest application of water treatment biocides during the forecast period.

The oil & gas application segment is projected to lead the global water treatment biocides market during the forecast period, in terms of value. There is a growing demand for water treatment biocides, such as glutaraldehyde and tetrakis hydroxymethyl-phosphonium sulfate (THPS) in the oil & gas application. In addition, increasing oil & gas exploration in countries such as the US and Canada is driving the demand for water treatment biocides in the oil & gas application. The major manufacturers of water treatment biocides in the oil & gas application segment are DuPont (US), Solvay (Belgium), Scotmas Limited (Scotland), Buckman (US), BWA Water Additives (UK), Kemira Oyj (Finland), Nouryon (Netherlands), Albemarle Corporation (US), and Shandong Taihe Water Treatment Technologies Co., Ltd. (China), among others.

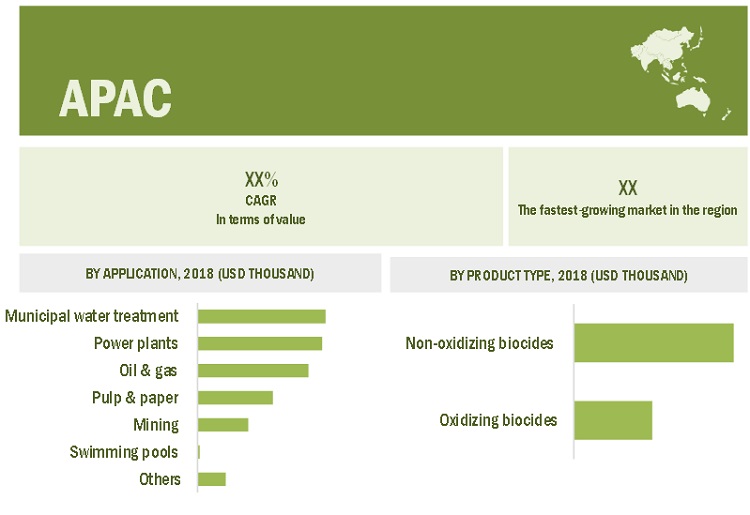

Asia Pacific is expected to be the largest market for water treatment biocides by 2024.

The primary energy demand in Asia Pacific is huge, mainly due to the continuous population growth. The energy sector is, therefore expected to drive the market in the region. China, Japan, and India are projected to have major shares in the water treatment biocides market in Asia Pacific, in terms of both value and volume due to the growing demand from application segments such as municipal water treatment, power plants, pulp & paper, oil & gas, and mining.

Key Market Players

The key players profiled in the water treatment biocides market report include as DuPont (US), Ecolab Inc. (US), Solenis (US), SUEZ (France), Innovative Water Care (US), BWA Water Additives (UK), Kemira Oyj (Finland), Veolia (France), Nouryon (Netherlands), Albemarle Corporation (US), LANXESS Group (Germany), and ICL Group (Israel).

DuPont (US) is one of the leading players of water treatment biocides, globally. The company has a strong product portfolio when it comes to non-oxidizing biocides. It offers water treatment biocides for applications such as oil & gas, pulp & paper, cooling towers used in power plants, mining, and reverse osmosis membrane. The company focuses on the new product launch strategy in order to remain competitive in the market.

Ecolab Inc. (US) is another dominant player in the water treatment biocides market. The company focuses on new product launches, expansions, and acquisitions to strengthen its position in the market. The company launched LegionGuard LG25, a chlorine dioxide product to reduce the waterborne pathogen Legionella pneumophila in drinking water systems, in May 2019.

Scope of the Report

|

Report Metric |

Details | |

| Years considered for the study |

| |

| 2018 | |

| Forecast period

|

20192024

| |

| Units considered

|

Value (USD thousand), Volume (Ton)

| |

| Segments covered

|

Product type, application, region

| |

| Regions covered

|

APAC, North America, South America, Europe, Middle East & Africa

| |

| Companies profiled

|

DuPont (US), Solenis (US), Ecolab Inc. (US), Innovative Water Care (US), SUEZ (France), Kemira Oyj (Finland), Nouryon (Netherlands), BWA Water Additives (UK), Veolia (France), LANXESS Group (Germany), Albemarle Corporation (US), ICL Group (Israel), and others Total 27 players are profiled in the report.

|

This report categorizes the global water treatment biocides market based on product type, application, and region.

On the basis of Product Type, the water treatment biocides market has been segmented as follows:

- Oxidizing biocides

- Non-oxidizing biocides

On the basis of Application, the water treatment biocides market has been segmented as follows:

- Municipal water treatment

- Oil & gas

- Power plants

- Pulp & paper

- Mining

- Swimming pools

- Others

On the basis of Region, the water treatment biocides market has been segmented as follows:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Recent Developments

- In May 2019, Ecolab Inc. launched LegionGuard LG25, a chlorine dioxide product to reduce the waterborne pathogen Legionella pneumophila in drinking water systems.

- In January 2019, Solenis (US) and BASF SE (Germany) combined their paper and water chemical businesses to expand their chemical offerings and offer cost-effective solutions to the customers in the pulp & paper, oil & gas, mining, biorefining, power, municipal, and other industrial markets.

- In October 2018, DuPont launched two new biocides, i.e., AQUCAR TN 250 LT Water Treatment Microbiocide and AQUCAR 7140 LT Water Treatment Microbiocide, to provide microbial control below minus 40°F.

- In January 2018, Ecolab Inc. acquired Cascade Water Services, Inc. (US), a privately held company based in New York that provides water treatment programs and services to New York and Florida. As concerns regarding Legionnaires disease are increasing, the acquisition helped the company offer its customers a broad range of products and services for water treatment.

- In November 2017, Ecolab Inc. acquired the paper chemical business from Georgia-Pacific (US). The acquisition helped the company enhance its pulp & paper business. It helped pulp & paper producers improve machine efficiency, water and energy savings, product quality, and profitability.

- In May 2017, SUEZ acquired GE Water (US), which gave access to various end-use industries such as food & beverage, oil & gas, power, mining, pharmaceuticals, and microelectronics. This strengthened the companys water technologies & solutions business segment.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the water treatment biocides market during 2019-2024?

The global water treatment biocides market is expected to record a CAGR of 6.2% from 20192024.

What are the driving factors for the water treatment biocides?

The stringent regulatory environment and increasing demand for water treatment biocides from various applications have a positive impact on the water treatment biocides market. The market is expected to witness further growth due to the rising population and rapid industrialization in emerging economies.

Which are the significant players operating in the water treatment biocides market?

DuPont (US), Ecolab Inc. (US), Solenis (US), SUEZ (France), Innovative Water Care (US), BWA Water Additives (UK), Kemira Oyj (Finland), Veolia (France), Nouryon (Netherlands), Albemarle Corporation (US), LANXESS Group (Germany), and ICL Group (Israel).

Which region will lead the water treatment biocides market in the future?

Asia Pacific is expected to lead the water treatment biocides market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Water Treatment Biocides Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation s

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Water Treatment Biocides Market Calculation Methodology

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Water Treatment Biocides Market

4.2 Water Treatment Biocide Market, By Region

4.3 APAC Water Treatment Biocide Market, By Application and Country, 2018

4.4 Water Treatment Biocide Market, By Major Countries

4.5 Water Treatment Biocide Market, By Application

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Regulatory Environment

5.2.1.2 Increasing Demand From Various Applications

5.2.2 Restraints

5.2.2.1 Lengthy and Expensive Registration Process in the EU

5.2.3 Opportunities

5.2.3.1 Rising Population and Rapid Industrialization in the Emerging Economies

5.2.4 Challenges

5.2.4.1 Fluctuating Raw Material Prices

5.3 Porters Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 GDP Trends and Forecast of Major Economies

5.5 Policy & Regulations

5.5.1 Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH)

5.5.2 Environmental Protection Agency (EPA)

5.5.3 The Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA)

5.5.4 Biocidal Products Regulations (BPR)

6 Water Treatment Biocides Market, By Product Type (Page No. - 49)

6.1 Introduction

6.2 Oxidizing Biocides

6.2.1 The Growing Demand for Treated Municipal Water With the Growing Population is Expected to Drive Market

6.3 Non-Oxidizing Biocides

6.3.1 The Increasing Oil & Gas Production is Boosting the Demand for Non-Oxidizing Biocides

7 Water Treatment Biocides Market, By Application (Page No. - 54)

7.1 Introduction

7.2 Municipal Water Treatment

7.2.1 Growing Population, Limited Freshwater Resources, and Increasing Water Scarcity are Propelling the Demand for Water Treatment Biocides in Municipal Water Treatment Application

7.3 Oil & Gas

7.3.1 Need for Microbial Control for Operational Efficiency is the Key Governing Factor for the Market in This Segment

7.4 Power Plants

7.4.1 The Growth in the Power Generation Industry is Expected to Further Drive the Demand in Power Plants Application

7.5 Pulp & Paper

7.5.1 The Use of High Volume of Process Water for Various Processes is Increasing the Demand for Water Treatment Biocides in Pulp & Paper Application

7.6 Swimming Pools

7.6.1 Chlorine is Among the Various Water Treatment Biocides Used in Swimming Pools for Disinfection

7.7 Mining

7.7.1 The Use of Water Treatment Biocides is Extensive in Water-Intensive Mining Applications

7.8 Others

8 Water Treatment Biocides Market, By Region (Page No. - 66)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 The Water Treatment Biocide Market in the Country is Characterized By the Presence of Various Small and Big Players

8.2.2 Japan

8.2.2.1 Rising Need for Water Treatment and High Population Density are Contributing to the Market Growth

8.2.3 India

8.2.3.1 The Presence of A Strong Energy Sector and Diversified Mining Industry are Helpful for the Market Growth

8.2.4 Australia

8.2.4.1 The Countrys Strong Mining Industry is Boosting the Demand for Water Treatment Biocides

8.2.5 Indonesia

8.2.5.1 The Countrys Mining and Crude Oil Sectors are the Main Contributors to Its Economic Growth, Thereby, Driving the Water Treatment Biocide Market

8.2.6 Malaysia

8.2.6.1 The Industrial Sector of the Country is Leading to Market Growth

8.2.7 Rest of APAC

8.3 North America

8.3.1 US

8.3.1.1 The Presence of Major Oil & Gas Industry Players in the Country is Influencing the Market Positively

8.3.2 Canada

8.3.2.1 The Countrys Strong State-Level and National-Level Municipal Regulations are Generating A Positive Impact on the Market

8.3.3 Mexico

8.3.3.1 Growing Industrialization and Population are the Key Drivers for the Market

8.4 Europe

8.4.1 Russia

8.4.1.1 The Country is Home to Major Oil-Producing Companies, Which is Favorable for the Market Growth

8.4.2 Germany

8.4.2.1 Established Water Infrastructure and Industrial Base is Helping in the Market Growth

8.4.3 UK

8.4.3.1 The Presence of A Stringent Regulatory Environment is Leading to the Demand for Water Treatment Biocides

8.4.4 Italy

8.4.4.1 The Rising Demand for Good Quality Water has Increased the Use of Water Treatment Biocides in the Country

8.4.5 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Water Scarcity and Significant Proven Oil Reserves are Driving the Market

8.5.2 Iran

8.5.2.1 as the Second-Largest Producer of Oil in the Region, Iran Offers High Growth Prospects for the Market

8.5.3 Iraq

8.5.3.1 Increasing Investments in the Power Sector and Growth of the Non-Oil Sectors in the Country are Expected to Drive the Market

8.5.4 UAE

8.5.4.1 Initiatives for Wastewater and Drinking Water Treatment are Likely to Spur the Market Growth

8.5.5 Kuwait

8.5.5.1 Industrialization in the Country is Driving the Demand for Water Treatment Biocides

8.5.6 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Rapidly Expanding Economy Stimulated By Increasing Investment is Expected to Drive the Market

8.6.2 Argentina

8.6.2.1 The Pulp & Paper Industry is A Key Driver for the Water Treatment Biocide Market

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 112)

9.1 Overview

9.2 Competitive Leadership Mapping

9.2.1 Visionary Leaders

9.2.2 Innovators

9.2.3 Dynamic Differentiators

9.2.4 Emerging Companies

9.3 Strength of Product Portfolio

9.4 Business Strategy Excellence

9.5 Market Share Analysis

9.6 Competitive Situation and Trends

9.6.1 Expansion

9.6.2 New Product Launch

9.6.3 Merger and Acquisition

9.6.4 Contract & Agreement

9.6.5 Joint Venture

10 Company Profiles (Page No. - 124)

10.1 Dupont

10.2 Ecolab Inc.

10.3 Suez

10.4 Innovative Water Care

10.5 Solenis

10.6 BWA Water Additives

10.7 Kemira OYJ

10.8 Veolia

10.9 Nouryon

10.10 Albemarle Corporation

10.11 Lanxess Group

10.12 ICL Group

10.13 Additional Market Players

10.13.1 Accepta Water Treatment

10.13.2 Buckman

10.13.3 B&V Chemicals

10.13.4 Industrial Specialty Chemicals, Inc.

10.13.5 Kimberlite Chemicals (India) Pvt. Ltd.

10.13.6 Kurita Water Industries Ltd.

10.13.7 Melzer Chemicals Pvt. Ltd.

10.13.8 Momar, Inc.

10.13.9 Ozone Tech Systems OTS AB

10.13.10 Scotmas Limited

10.13.11 Shandong Taihe Water Treatment Technologies Co. Ltd.

10.13.12 Solvay

10.13.13 Thor Corporation

10.13.14 Uniphos Chemicals

10.13.15 U.S. Steriles

11 Appendix (Page No. - 155)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (113 Tables)

Table 1 Fees Payable to European Chemical Agency Concerning the Use and Marketing of Biocidal Products in European Union

Table 2 Year-On-Year Growth in Population, By Country (Numbers)

Table 3 Trends and Forecast of GDP, By Major Economy, 2017-2024 (USD Billion)

Table 4 BPR Regulations

Table 5 Water Treatment Biocides Market Size, By Product Type, 20172024 (Ton)

Table 6 Water Treatment Biocides Market Size, By Product Type, 20172024 (USD Thousand)

Table 7 Oxidizing Biocides Market Size, By Region, 20172024 (Ton)

Table 8 Oxidizing Biocides Market Size, By Region, 20172024 (USD Thousand)

Table 9 Advantages and Disadvantages of Some of the Non-Oxidizing Biocides

Table 10 Non-Oxidizing Biocides Market Size , By Region, 20172024 (Ton)

Table 11 Non-Oxidizing Biocides Market Size, By Region, 20172024 (USD Thousand)

Table 12 Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 13 Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 14 Population, By Country, 20132018 (Thousand)

Table 15 Water Treatment Biocides Market Size in Municipal Water Treatment Application, By Region, 20172024 (Ton)

Table 16 Water Treatment Biocides Market Size in Municipal Water Treatment Application, By Region, 20172024 (USD Thousand)

Table 17 Water Treatment Biocides Market Size in Oil & Gas Application, By Region, 20172024 (Ton)

Table 18 Water Treatment Biocides Market Size in Oil & Gas Application, By Region, 20172024 (USD Thousand)

Table 19 Water Treatment Biocides Market Size in Power Plants Application, By Region, 20172024 (Ton)

Table 20 Water Treatment Biocides Market Size in Power Plants Application, By Region, 20172024 (USD Thousand)

Table 21 Water Treatment Biocides Market Size in Pulp & Paper Application, By Region, 20172024 (Ton)

Table 22 Water Treatment Biocides Market Size in Pulp & Paper Application, By Region, 20172024 (USD Thousand)

Table 23 Water Treatment Biocides Market Size in Swimming Pools Application, By Region, 20172024 (Ton)

Table 24 Water Treatment Biocides Market Size in Swimming Pools Application, By Region, 20172024 (USD Thousand)

Table 25 Water Treatment Biocides Market Size in Mining Application, By Region, 20172024 (Ton)

Table 26 Water Treatment Biocides Market Size in Mining Application, By Region, 20172024 (USD Thousand)

Table 27 Water Treatment Biocides Market Size in Other Applications, By Region, 20172024 (Ton)

Table 28 Water Treatment Biocides Market Size in Other Applications, By Region, 20172024 (USD Thousand)

Table 29 Water Treatment Biocides Market Size, By Region, 20172024 (Ton)

Table 30 Water Treatment Biocides Market Size, By Region, 20172024 (USD Thousand)

Table 31 APAC: Water Treatment Biocides Market Size, By Country, 20172024 (Ton)

Table 32 APAC: Water Treatment Biocides Market Size, By Country, 20172024 (USD Thousand)

Table 33 APAC: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 34 APAC: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 35 APAC: Water Treatment Biocides Market Size, By Product Type, 20172024 (Ton)

Table 36 APAC: Water Treatment Biocides Market Size, By Product Type, 20172024 (USD Thousand)

Table 37 China: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 38 China: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 39 Japan: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 40 Japan: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 41 India: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 42 India: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 43 Australia: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 44 Australia: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 45 Indonesia: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 46 Indonesia: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 47 Malaysia: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 48 Malaysia Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 49 Rest of APAC: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 50 Rest of APAC: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 51 North America: Water Treatment Biocides Market Size, By Country, 20172024 (Ton)

Table 52 North America: Water Treatment Biocides Market Size, By Country, 20172024 (USD Thousand)

Table 53 North America: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 54 North America: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 55 North America: Water Treatment Biocides Market Size, By Product Type, 20172024 (Ton)

Table 56 North America: Water Treatment Biocides Market Size, By Product Type, 20172024 (USD Thousand)

Table 57 US: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 58 US: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 59 Canada: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 60 Canada: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 61 Mexico: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 62 Mexico: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 63 Europe: Water Treatment Biocides Market Size, By Country, 20172024 (Ton)

Table 64 Europe: Water Treatment Biocides Market Size, By Country, 20172024 (USD Thousand)

Table 65 Europe: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 66 Europe: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 67 Europe: Water Treatment Biocides Market Size, By Product Type, 20172024 (Ton)

Table 68 Europe: Water Treatment Biocides Market Size, By Product Type, 20172024 (USD Thousand)

Table 69 Russia: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 70 Russia: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 71 Germany: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 72 Germany: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 73 UK: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 74 UK: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 75 Italy: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 76 Italy: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 77 Rest of Europe: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 78 Rest of Europe: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 79 Middle East & Africa: Water Treatment Biocides Market Size, By Country, 20172024 (Ton)

Table 80 Middle East & Africa: Water Treatment Biocides Market Size, By Country, 20172024 (USD Thousand)

Table 81 Middle East & Africa: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 82 Middle East & Africa: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 83 Middle East & Africa: Water Treatment Biocides Market Size, By Product Type, 20172024 (Ton)

Table 84 Middle East & Africa: Water Treatment Biocides Market Size, By Product Type, 20172024 (USD Thousand)

Table 85 Saudi Arabia: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 86 Saudi Arabia: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 87 Iran: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 88 Iran: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 89 Iraq: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 90 Iraq: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 91 UAE: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 92 UAE: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 93 Kuwait: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 94 Kuwait: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 95 Rest of Middle East & Africa: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 96 Rest of Middle East & Africa: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 97 South America: Water Treatment Biocides Market Size, By Country, 20172024 (Ton)

Table 98 South America: Water Treatment Biocides Market Size, By Country, 20172024 (USD Thousand)

Table 99 South America: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 100 South America: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 101 South America: Water Treatment Biocides Market Size, By Product Type, 20172024 (Ton)

Table 102 South America: Water Treatment Biocides Market Size, By Product Type, 20172024 (USD Thousand)

Table 103 Brazil: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 104 Brazil: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 105 Argentina: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 106 Argentina: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 107 Rest of South America: Water Treatment Biocides Market Size, By Application, 20172024 (Ton)

Table 108 Rest of South America: Water Treatment Biocides Market Size, By Application, 20172024 (USD Thousand)

Table 109 Expansion, 20172019

Table 110 New Product Launch, 20172019

Table 111 Merger and Acquisition, 20172019

Table 112 Contract & Agreement, 20172019

Table 113 Joint Venture, 20172019

List of Figures (40 Figures)

Figure 1 Water Treatment Biocides Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Water Treatment Biocides Market Calculation Methodology: Forecast Till 2024

Figure 5 Water Treatment Biocides Market: Demand Side Approach

Figure 6 Water Treatment Biocides Market: Supply Side Approach

Figure 7 Water Treatment Biocides Market: Data Triangulation

Figure 8 Non-Oxidizing Biocides Segment Accounted for the Larger Market Share in 2018

Figure 9 Oil & Gas to Be the Leading Application of Water Treatment Biocides

Figure 10 Europe Accounted for the Largest Market Share in 2018

Figure 11 Growing Demand for Water Treatment Biocides in Oil & Gas Application to Drive the Market

Figure 12 APAC to Be the Fastest-Growing Water Treatment Biocides Market

Figure 13 Municipal Water Treatment Segment and China Accounted for the Largest Market Shares

Figure 14 Iraq to Be the Fastest-Growing Water Treatment Biocides Market

Figure 15 Municipal Water Treatment Was the Largest Application in the Water Treatment Biocides Market of Major Regions, in 2018

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Water Treatment Biocides Market

Figure 17 Fragmented Market of Water Treatment Biocides Due to Presence of A Large Number of Players

Figure 18 Non-Oxidizing Biocides to Be the Larger Segment in Terms of Value

Figure 19 Oil & Gas Application to Lead the Water Treatment Biocides Market

Figure 20 APAC to Be the Largest Water Treatment Biocides Market, in Terms of Value

Figure 21 APAC: Water Treatment Biocides Market Snapshot

Figure 22 North America: Water Treatment Biocides Market Snapshot

Figure 23 Europe: Water Treatment Biocides Market Snapshot

Figure 24 Water Treatment Biocides Market (Global) Competitive Leadership Mapping, 2018

Figure 25 New Product Launch Was the Key Growth Strategy Adopted By the Market Players Between 2017 and 2019

Figure 26 Global Water Treatment Biocides Market Share Analysis, By Company, 2018

Figure 27 Dupont: Company Snapshot

Figure 28 Dupont: SWOT Analysis

Figure 29 Ecolab: Company Snapshot

Figure 30 Ecolab: SWOT Analysis

Figure 31 Suez: Company Snapshot

Figure 32 Suez: SWOT Analysis

Figure 33 Innovative Water Care: SWOT Analysis

Figure 34 Solenis: SWOT Analysis

Figure 35 BWA Water Additives: Company Snapshot

Figure 36 Kemira OYJ: Company Snapshot

Figure 37 Veolia: Company Snapshot

Figure 38 Albemarle Corporation: Company Snapshot

Figure 39 Lanxess Group: Company Snapshot

Figure 40 ICL Group: Company Snapshot

The study involved four major activities for estimating the market size for water treatment biocides. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments.

Secondary Research

Secondary sources used in this study included annual reports, sustainability report, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites, such as Factiva, ICIS, Bloomberg, United Nations Statistical Commission, Food and Agriculture Organization Corporate Statistical (FAOSTAT), Environmental Protection Agency (EPA), European Chemicals Agency (ECHA), and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) . The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The water treatment biocides market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of oil & gas, municipal water treatment, pulp & paper, mining, power plants, swimming pools, and other applications. The supply side is characterized by advancements in technology and diverse end-use applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

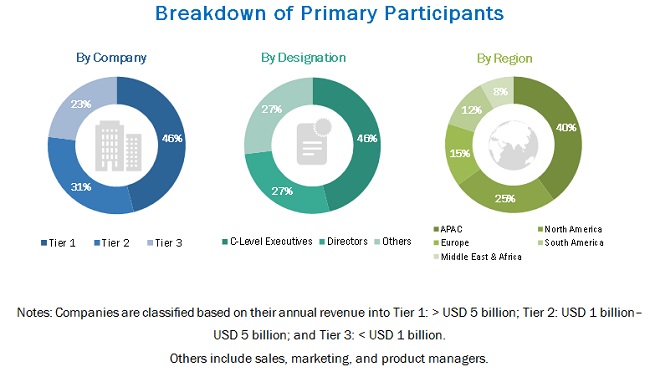

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the water treatment biocides market. These methods were also used extensively to estimate the size of the market in each application. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Tringulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the water treatment biocides market in terms of value and volume

- To provide detailed information regarding key factors such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the water treatment biocides market based on application and product type

- To forecast the size of the market for regions such as APAC, North America, South America, Europe, and Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, new product launch, merger and acquisition, joint venture, and contract & agreement in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Water Treatment Biocides Market