Phase Change Materials Market by Type (Organic, Inorganic, Eutectic), Application (Building & Construction, HVAC, Cold Chain & Packaging, Electronics), and Region - Global Forecast to 2029

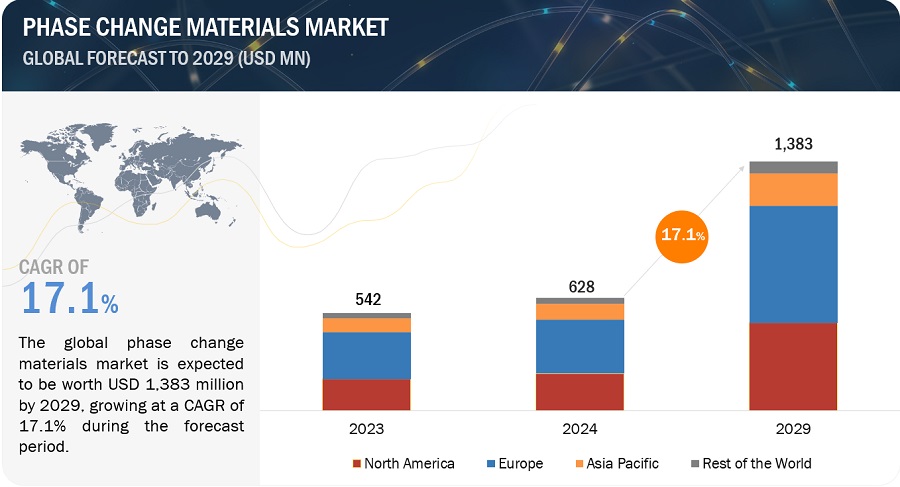

In terms of value, phase change materials market size is projected to increase from USD 628 million in 2024 to USD 1,383 million by 2029, at a CAGR of 17.1%. Phase change materials are utilized for their unique ability to store and release large amounts of thermal energy during phase transitions, such as melting and solidification. This property allows them to effectively regulate temperatures in various applications, ranging from thermal management in building & construction, HVAC, cold chain & packaging, thermal energy storage, refrigeration & equipment, textiles, electronics to temperature-controlled in other applications.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Use of phase change materials for peak load shifting

Phase change materials are emerging as a savvy solution for peak load shifting in various industries. By leveraging the unique ability of phase change materials to absorb and release large amounts of thermal energy during phase transitions, businesses can optimize energy consumption patterns. This technology enables the storing of excess energy during off-peak hours, when electricity rates are lower, and releasing it during peak demand periods, thus reducing reliance on expensive peak-time electricity. Implementing PCM-based peak load shifting strategies enhances operational efficiency, minimizes energy costs, and contributes to a more sustainable energy ecosystem, aligning with businesses' bottom-line goals and environmental stewardship initiatives.

Restraints: Lack of awareness of benefits of phase change materials

The lack of awareness regarding the benefits of phase change materials poses a significant restraint to their widespread adoption in various industries. Despite their potential to optimize energy usage, enhance thermal comfort, and improve sustainability, many businesses remain uninformed about phase change materials technology. This lack of awareness stems from limited education and outreach efforts, compounded by the complexity of understanding phase change materials applications and their potential advantages. As a result, decision-makers may overlook phase change materials solutions in favor of more familiar or conventional alternatives, missing out on opportunities for cost savings, efficiency gains, and environmental benefits that phase change materials technology can offer to their operations.

Opportunities: The rise in the need for cold chain logistics

The escalating demand for cold chain logistics presents a compelling opportunity for businesses across various sectors. As consumer preferences shift towards fresh and perishable goods, there's an increasing necessity for maintaining precise temperature control throughout the supply chain. This demand surge is particularly evident in industries like food, pharmaceuticals, and biotechnology. Businesses capable of offering robust cold chain logistics solutions stand to capitalize on this trend by ensuring product integrity, extending shelf life, and meeting stringent regulatory requirements. Moreover, catering to the growing global market for temperature-sensitive goods opens avenues for revenue growth, strategic partnerships, and differentiation in a competitive landscape.

Challenges: High cost of switching from conventional materials

The high cost of switching from conventional materials represents a significant challenge for businesses considering the adoption of alternative solutions, such as phase change materials. Transitioning from established materials to innovative phase change materials technology often involves substantial upfront investments in research, development, infrastructure, and retooling of manufacturing processes. Additionally, there may be expenses associated with staff training and reconfiguration of supply chains. Overcoming this challenge requires careful cost-benefit analysis, long-term planning, and effective change management strategies to justify and facilitate the transition to PCM-based solutions.

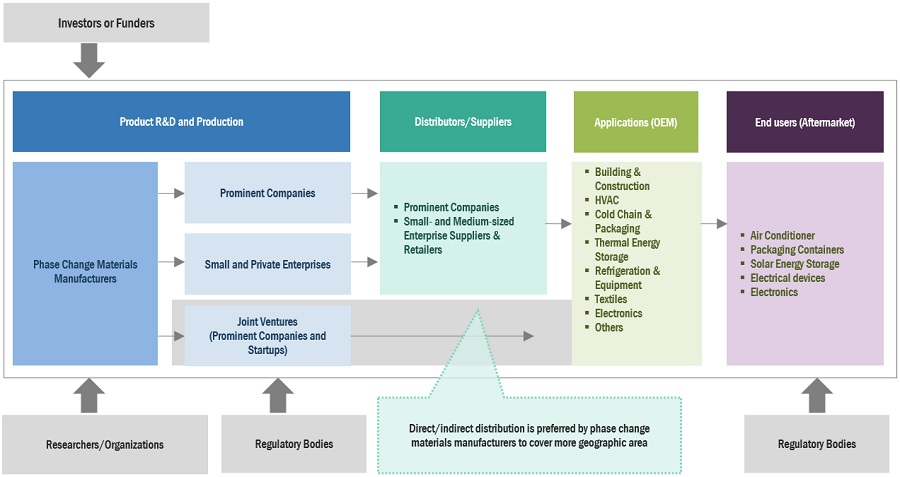

Phase Change Materials Market Ecosystem

Leading companies in this market include well-established phase change materials manufacturers. These businesses have been in business for a while and have an extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Honeywell International Inc. (US), DuPont de Nemours, Inc. (US), Croda International Plc (UK), Boyd Corporation (US), Sasol Limited (South Africa), Outlast Technologies LLC (US), Climator Sweden AB (Sweden), Rubitherm Technologies GmbH (Germany), PureTemp LLC (US), and Phase Change Solutions (US).

“Based on type, inorganic was the second largest type for phase change materials in 2023, in terms of value.”

Inorganic segment being the second largest type in the phase change materials market in 2023 is their compatibility with high-temperature applications. Inorganic phase change materials exhibit robustness and resilience under extreme conditions, making them suitable for use in industries such as automotive, aerospace, and electronics, where elevated temperatures are common. Moreover, the reliability and predictable performance of inorganic phase change materials makes them appealing for critical applications where precise temperature control is essential for operational efficiency and product integrity. Additionally, the expanding adoption of inorganic phase change materials in emerging sectors like renewable energy storage and waste heat recovery further bolstered their market share in 2023.

“Based on application, cold chain & packaging was the second largest application for phase change materials in 2023, in terms of value.”

The cold chain & packaging segment being the second largest application in the phase change materials market in 2023 is the increasing globalization of supply chains. As companies expand their operations globally, there is a growing need for efficient temperature-controlled logistics to ensure product quality and safety across long distances and diverse climates. PCM-based packaging materials offer a reliable solution to maintain stable temperatures during transit, reducing the risk of spoilage or damage to temperature-sensitive goods. Moreover, advancements in phase change materials technology have led to the development of tailored solutions that address specific requirements of different industries within the cold chain, further driving adoption and contributing to the segment's substantial market share in 2023.

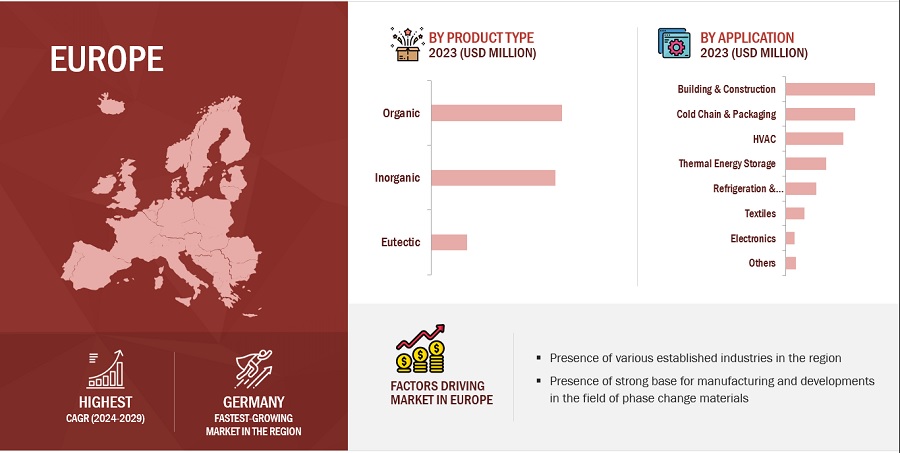

“Europe is estimated to be the largest region in phase change materials market 2023, in terms of value.”

Europe's leadership in phase change materials market in 2023 can be attributed to its proactive approach towards mitigating climate change. The region's ambitious carbon reduction goals and stringent regulations aimed at promoting energy efficiency have accelerated the adoption of phase change materials solutions. Furthermore, strong government support through incentives and funding for research and development in sustainable technologies has fostered innovation and commercialization of phase change products. Additionally, Europe's well-established manufacturing infrastructure and extensive network of suppliers have facilitated the production and distribution of PCM-based solutions, further strengthening its position as the largest market for phase change materials in 2023. The region houses major phase change materials producing companies, such as Croda International Plc (UK), Climator Sweden AB (Sweden), and Rubitherm Technologies GmbH (Germany).

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players profiled in the report Honeywell International Inc. (US), DuPont de Nemours, Inc. (US), Croda International Plc (UK), Boyd Corporation (US), Sasol Limited (South Africa) among others, are the key manufacturers that holds major market share in the last few years. A major focus was given to collaborations, partnerships, and new product development due to the changing requirements of users across the world.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2017–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Value (USD Thousand) and Volume (Ton) |

|

Segments Covered |

Type, Application, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, and Rest of the World |

|

Companies profiled |

Honeywell International Inc. (US), DuPont de Nemours, Inc. (US), Croda International Plc (UK), Boyd Corporation (US), Sasol Limited (South Africa), Outlast Technologies LLC (US), Climator Sweden AB (Sweden), Rubitherm Technologies GmbH (Germany), PureTemp LLC (US), and Phase Change Solutions (US) |

This report categorizes the global phase change materials market based on type, application, and region.

Based on type, the phase change materials market has been segmented as follows:

- Organic

- Inorganic

- Eutectic

Based on application, the phase change materials market has been segmented as follows:

- Building & Construction

- HVAC

- Cold Chain & Packaging

- Thermal Energy Storage

- Refrigeration & Equipment

- Textiles

- Electronics

- Others

Based on region, the phase change materials market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Rest of the World

Recent Developments

- In 2021, DuPont De Nemours, Inc. signed an agreement to acquire the performance materials segment of Laird Plc. This acquisition will strengthen the company’s market position and expand its global reach in the phase change material market.

- In 2021, Cold Chain Technologies announced their expansion in Europe and the Middle East & African regions with the opening of their new regional headquarters based in the Netherlands.

- In 2020, DuPont De Nemours, Inc. (US) and Cold Chain Technologies, Inc. partnered for global production, sales, distribution, and technical service of Tyvek Cargo Covers for life sciences. The partnership is expected to help the company cover the untapped market potential and new product opportunities that this partnership is expected to create. In addition, the partnership is expected to open the doors for the company to gain access to the best materials and technologies in the marketplace; and is expected to help the company to better serve its customers.

Frequently Asked Questions (FAQ):

What are the major developments impacting the market?

Regulations for the reduction of greenhouse gas emissions are expected to shift market demand.

Who are major players in the phase change materials market?

Honeywell International Inc. (US), DuPont de Nemours, Inc. (US), Croda International Plc (UK), Boyd Corporation (US), Sasol Limited (South Africa).

What are the major applications of phase change materials market?

Building & Construction and Cold Chain & Packaging is the major application for phase change materials market during the forecast period.

What are the major factors restraining market growth during the forecast period?

Lack of awareness of the benefits of Phase Change Material.

What are the various strategies key players are focusing within the phase change materials market?

Key players are majorly focused on new product launches and partnering with local or regional players within the market, to attract larger market share globally. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

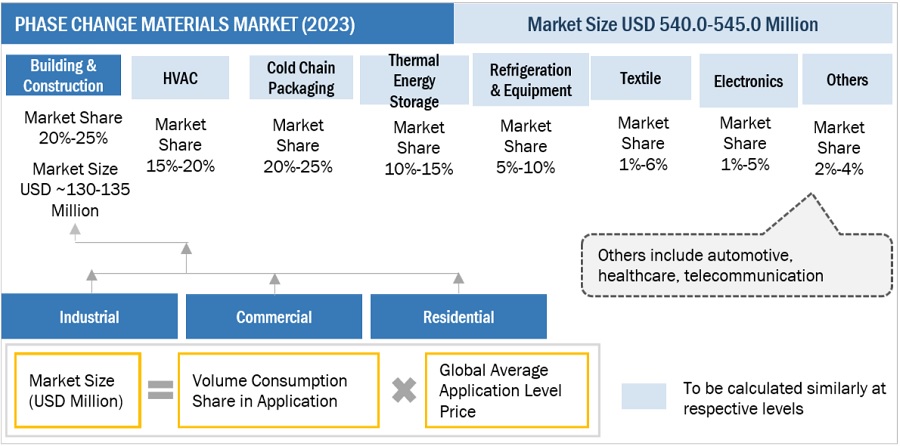

The study involved four major activities in estimating the market size for phase change materials market. Intensive secondary research was done to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

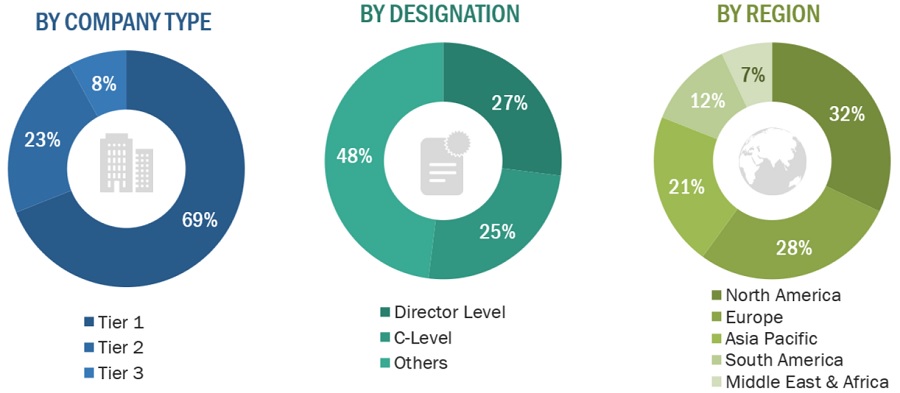

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The phase change materials market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized from key opinion leaders in various applications for the phase change materials. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Honeywell International Inc. |

Global Strategy & Innovation Manager |

|

DuPont de Nemours, Inc. |

Technical Sales Manager |

|

Croda International Plc |

Senior Supervisor |

|

Boyd Corporation |

Production Supervisor |

|

Sasol Limited |

Production Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the phase change materials market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Phase change materials market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Phase change materials market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into respective segments and subsegments. To realize the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the phase change materials industry.

Market Definition

According to Phase Change Material Industry Association (PCMIA), Phase Change Materials (PCMs) are compounds that absorb, store, and release a large amount of heat at a relatively constant temperature by changing their physical state. When a PCM freezes, it releases a large amount of energy as latent heat whereas, when such material melts, it absorbs a large amount of heat from the environment. Heat stored in the materials is called latent heat, due to which, PCMs are also known as latent heat storage materials. PCMs absorb and release heat by liquefying and solidifying at set temperatures. The natural latent heat property of PCMs helps in maintaining a structure’s temperature and preventing sudden external changes. Fluctuations in ambient temperature recharge advanced PCMs, making them suitable for everyday applications.

High demand for phase change materials market in the building & construction industry is the main factor driving the market for phase change materials.

Key Stakeholders

- Phase change materials manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the phase change materials market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the phase change materials market based on type and application

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, and Rest of the World

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type and application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Phase Change Materials Market

Irrelevant

Phase change material market report

Phase Change Material Market Report

General information on BIO Based PCM

Specific interest on major suppliers of encapsulated organic phase change material in South East Asia

Information on the global market of the products and a description.

flexible polyurethane foam market by Application

Specific information on Phase Change Material market for automotive industry

Directory of global PCM manufacturers, including, key contacts data leading players and 2nd tier players.

Market information PCM materials for the thermal energy storage

Do you have a phase change material (beeswax)?what is the price?And what are the specifications?I want to use it to cool photovoltaic panels.I want to mix it with glycerol, what do you think?

Phase Change Material (PCM) Market

Specific information on the Phase Change Materials Market in food packaging applications

Sample document for Phase Change Material Market Report

Interested in Engine Controls market

General information on fabrics market and current market trends

Interested in PCM reports

Interested to be listed in the Company Profiles section of the specific report