Event Management Software Market by Offering (Software (Event Planning, Venue Management), and Services), Event Type (Virtual, In-Person) Deployment Mode, Organization Size, End User and Region - Global Forecast to 2029

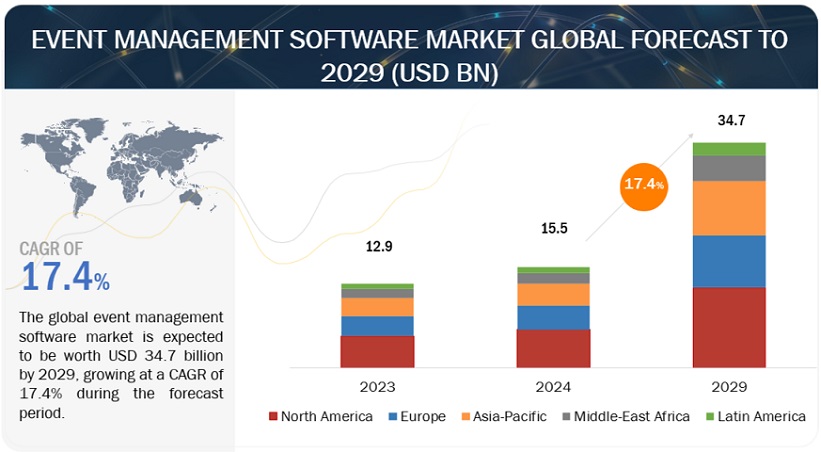

[330 Pages Report] The global event management software market will grow from USD 15.5 billion in 2024 to USD 34.7 billion by 2029 at a compounded annual growth rate (CAGR) of 17.4% during the forecast period.

The event management software market is experiencing rapid growth fueled by the increasing demand for streamlined and efficient event planning solutions. With the rise of both virtual and in-person events, there is a pressing need for digital tools that can handle various aspects of event management, from registration and marketing to logistics and analytics. This market encompasses multiple software offerings, including cloud-based platforms, mobile applications, and specialized tools tailored to specific events or industries.

The event management software market includes various drivers, such as the growing complexity of events, the desire for enhanced attendee experiences, and the need for improved efficiency and cost-effectiveness in event planning processes. Organizations seeking to optimize their event strategies increasingly use event management software to streamline workflows, increase productivity, and drive better outcomes. Moreover, the market is witnessing innovation in AI, VR, and blockchain, which are being integrated into event management software to enhance functionality, security, and engagement further. Overall, the event management software market is poised for continued expansion as organizations recognize the value of digital solutions in delivering successful and memorable events.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Event Management Software Market Dynamics

Driver: Rising demands to manage large volumes of data and automate event management tasks

In the event management software market, the surge in demand stems from the need to handle vast volumes of data efficiently and automate event management tasks. Organizations seek software solutions to streamline processes and maximize productivity as events become more complex and widespread. Managing attendee information, scheduling, ticketing, and logistics requires robust real-time software capable of handling large datasets. Moreover, automation of tasks such as email notifications, registration, and feedback collection is crucial to enhance efficiency and accuracy while reducing manual workload. These drivers push companies to invest in advanced event management software solutions that offer scalability, customization, and integration with other tools. Consequently, the market witnesses a steady growth trajectory driven by the need to adapt to the evolving event organization and management landscape.

Restraint: High initial cost associated with event management software

The event management software market faces a significant restraint due to the high initial costs of implementing such systems. For many organizations, the upfront investment required to purchase and customize event management software can be prohibitive, particularly for small businesses or those operating on tight budgets. Additionally, the costs of training staff to use the software effectively further add to the financial burden. As a result, some companies may opt to continue using manual or less efficient methods rather than investing in event management software, leading to missed opportunities for streamlining operations and enhancing productivity. Despite the long-term benefits of improved efficiency and scalability, the high initial cost is a barrier to entry for many potential users, slowing down the adoption rate and growth of the event management software market. Top of Form

Opportunity: Rising demand for communication platforms across enterprises

The event management software market presents a significant opportunity driven by the rising demand for communication platforms across enterprises. As businesses increasingly prioritize efficient collaboration and communication, there's a growing need for integrated solutions that streamline event planning and management processes. Event management software offers a comprehensive platform for organizing, coordinating, and communicating throughout the event lifecycle, aligning with enterprises' broader digital transformation trends. By leveraging these software solutions, organizations can enhance team collaboration, improve internal communication, and ensure seamless coordination across departments involved in event planning. Additionally, integrating communication features within event management software enables real-time interaction with attendees, sponsors, and stakeholders, facilitating engagement and enhancing the overall event experience. This surge in demand for communication-centric solutions presents lucrative opportunities for innovation and expansion within the event management software market.

Challenge: There is a wide gap between organizers' offerings and attendees' needs

The wide gap between organizers' offerings and attendees' needs is a significant challenge in the event management software market. Due to limited insight into their expectations, organizers often need help to gauge and fulfill attendees' diverse requirements and preferences accurately. This disparity can lead to mismatches in event planning, resulting in suboptimal experiences for attendees and missed opportunities for organizers. Additionally, as events become more complex and diverse, accommodating varying needs becomes increasingly challenging for traditional event management software solutions. Bridging this gap requires a deeper understanding of attendee demographics, preferences, behaviors, and innovative software features that enable personalized experiences and real-time feedback mechanisms. Overcoming this challenge is crucial for event management software providers to stay competitive and meet the evolving demands of organizers and attendees in a rapidly changing events landscape.

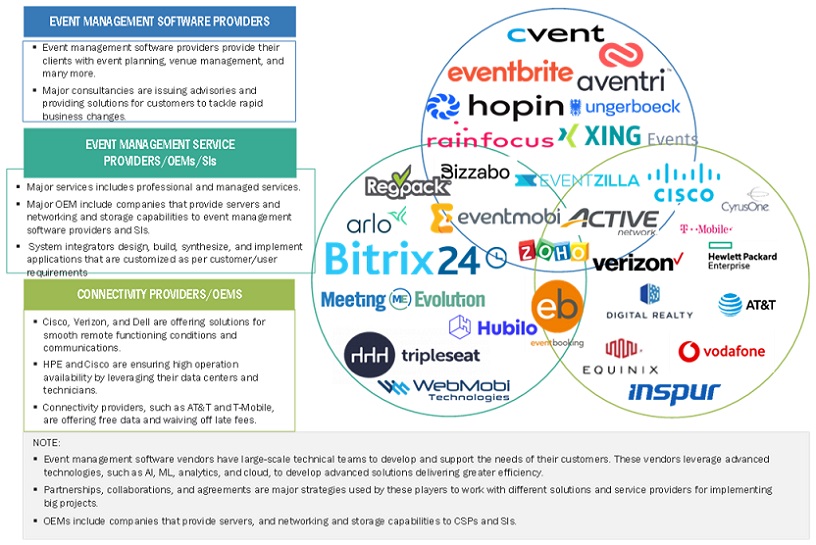

Event Management Software Market Ecosystem

Based on the end user, the event organizer's end user is expected to dominate the market during the forecast period.

Based on the end user, the event management software market is segmented into event organizers & planners, BFSI, government, education, healthcare & life sciences, manufacturing, IT & ITeS, and other end users. The event organizers & planners are expected to hold the largest market share during the forecast period. Event management software is a savior for event planners because it enables a seamless process throughout an event planning cycle. It is the most effective way of coordinating elements such as selecting venues, designing the budget, planning the guest list, scheduling the event, and promoting. By aggregating these into one convenient platform, the organizers can free up some time and resources that can then be channeled into ensuring that the attendees have the best experience possible at the gathering. It also brings customizable event websites, registration forms, and email correspondence tools to help publish most events and actively engage with attendees.

In addition, the event management system improves information exchange among co-workers by promptly identifying processes and allowing effortless communication. By integrating calendars, task assignments, and document exchange capabilities, team members can work out their schedules with extra care, ensuring that all event details are taken care of effectively and that the event is perfectly organized and conducted. This software is abundant with analytic and reporting tools for tracking the event's performance, measuring the ROI returns, and sharing helpful research data on upcoming events. Event management software enables organizers to succeed tremendously by accomplishing complex processes that nobody dares to take, fostering cooperation, and providing capstone information for decision-making.

Based on the organization size, the SME segment is expected to have the highest CAGR growth rate during the forecast period.

The event management software market by organization size is segmented into large enterprises and SMEs. As per the organization size, the SME segment is expected to hold the highest CAGR during the forecast period. SMEs are crucial as consumers and providers in the event management software market. Concerning functioning SMEs, here are software development centers with particular expertise in developing tools for narrow niche markets that involve wedding planners, small event agencies, or local community organizers. These SMEs focus on offering cost-effective, easy-to-use software solutions that cater specifically to the needs and budget constraints of smaller-scale event organizers.

Furthermore, SMEs play a significant role in providing consulting services that enable organizations to form the right team and use and run event management software efficiently, according to their needs. Some SMEs offer complementary services such as event marketing, attendee engagement solutions, or technical support, further enriching the event management software ecosystem. In general, SMEs have to do with adding diversity and dynamism to the traditional event management software market by providing customized solutions and exceptional services mainly devoted to start-up event organizers and promoting innovation to suit the needs of smaller organizers.

The US market contributes the largest share of North America's event management software market.

North America is expected to lead the event management software market in 2024. The US is estimated to account for the largest market share in North America in 2024, the event management software market, and the trend is expected to continue until 2029. In the US region, event management software plays a pivotal role in revolutionizing the way events are planned, executed, and analyzed. These software platforms streamline various aspects of event management, including registration, ticketing, marketing, venue selection, scheduling, and attendee engagement. With the diverse range of events hosted across the country, from corporate conferences and trade shows to music festivals and sports events, event management software empowers organizers to coordinate logistics efficiently, engage attendees, and ensure the success of their events.

Several major companies operate in the US event management software sector, offering innovative solutions tailored to the needs of different industries and event types. One prominent example is Cvent, a leading event management software provider that provides comprehensive solutions to event planning, marketing, registration, and analytics. Another major player is Eventbrite, which specializes in ticketing and event promotion, enabling organizers to sell tickets, manage registrations, and market their events effectively. Additionally, companies such as Bizzabo, Aventri, and Social Tables contribute significantly to the event management software landscape in the US, providing platforms equipped with advanced features to enhance event experiences and drive success.

Key Market players

The event management software market is dominated by a few globally established players such as Cvent (US), Stova (US), Eventbrite (US), Zoom (US), RingCentral (US), Zoho Corporation (India), Momentus Technologies (US), Active Network (US), RainFocus (US), and 6Connex (US). among others, are the key vendors that secured event management software contracts in last few years. Local participants only have local experience, while these vendors can add global processes and execution expertise. Customers are likelier to try new things in the event management software market because of their higher

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Organization Size, Event Type, Deployment Mode, and End User |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East Africa, and Latin America |

|

Companies Covered |

Some of the significant event management software market vendors are Cvent (US), Stova (US), Eventbrite (US), Zoom (US), RingCentral (US), Zoho Corporation (India), Momentus Technologies (US), Active Network (US), RainFocus (US), 6Connex (US), Hubilo (US), Circa (US), Whova (US), loom (Belgium), Hubb (US), Grenadine Technologies (Canada), EVENTBOOST (Switzerland), Airmeet (US), Notified (Sweden), and Kaltura (US). |

This research report categorizes the event management software market based on offering type, monetization model, content type, platform type, deployment model, vertical, and region.

Based on the Offering:

-

Software

- All-in-One Event Management Platforms

- Event Ticketing & Registration Software

- Event Planning Software

- Event Marketing & Promotion Software

- Venue Management Software

- Other Software

-

Services

-

Professional Services

- Deployment & Integration

- Consulting

- Support & Maintenance

-

Managed Services

- Data Backup & Recovery

- Analytics & Insights Services

- On-Site Support Services

-

Professional Services

Based on the Event Type:

- Virtual

- In-Person

Based on the Deployment Mode:

- Cloud

- On-premises

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on the End User:

- Event Organizers & Planners

- IT & ITeS

- BFSI

- Education

- Government

- Healthcare & Life Sciences

- Manufacturing

- Other Verticals

Based on the Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

-

Gulf Cooperation Councils (GCC)

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of GCC Countries

- South Africa

- Rest of the Middle East Africa

-

Gulf Cooperation Councils (GCC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2024, Cvent introduced new features for attendee engagement, which can easily crop graphics to meet precise requirements in Attendee Hub and eliminate the need for external image editing tools. The latest schedule format allows attendees to view complex agendas, especially in events with several concurrent sessions.

- In March 2024, Zoom and Swoogo launched an integration to streamline and increase engagement for hybrid events. This integration combines Zoom Event's virtual platform and Swoogo's in-person event management technology to empower event organizers to reach broader audiences.

- In February 2024, Stova announced BadgeNext, an enhanced DIY Badging solution designed to make attendee check-in and badging seamless and easy for event marketers. The new solution is designed to provide event leaders and marketers with a flexible, DIY badging option for all their small- to medium-sized events.

- In May 2023, Eventbrite introduced AI-powered tools to revolutionize event marketing and empower creators. These tools help automatically generate compelling text for event pages, emails, and social media ads, enhancing creativity, saving time, and streamlining the copywriting process.

- In November 2023, RingCentral announced the global availability of RingCentral Events, an all-in-one solution for virtual, onsite, and hybrid event needs. Formerly Hopin Events, RingCentral Events is designed to be immersive and personalized, enabling businesses to provide engaging experiences that take events to the next level.

Frequently Asked Questions (FAQ):

What is event management software?

Event management software is a digital tool designed to facilitate the planning, organization, and execution of events. It provides a comprehensive platform that helps event planners and organizers manage various aspects of an event, from initial conception to post-event analysis. Event management software typically includes features such as attendee registration, venue selection, budgeting, marketing, scheduling, logistics coordination, and attendee engagement tools.

Which country was the early adopter of event management software?

The US was at the initial stage of the adoption of event management software.

Which are the key vendors exploring event management software?

Some of the significant vendors offering event management software across the globe include Cvent (US), Stova (US), Eventbrite (US), Zoom (US), RingCentral (US), Zoho Corporation (India), Momentus Technologies (US), Active Network (US), RainFocus (US), 6Connex (US), Hubilo (US), Circa (US), Whova (US), loom (Belgium), Hubb (US), Grenadine Technologies (Canada), EVENTBOOST (Switzerland), Airmeet (US), Notified (Sweden), and Kaltura (US).

What is the total CAGR recorded for the event management software market from 2024 to 2029?

The event management software market will record a CAGR of 17.4% from 2024 to 2029.

Who are vital clients adopting the event management software market?

Key clients adopting the event management software market include: -

- Government Agencies

- Resellers and Distributors

- Research Organizations

- Corporates

- Administrators

- End Users

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

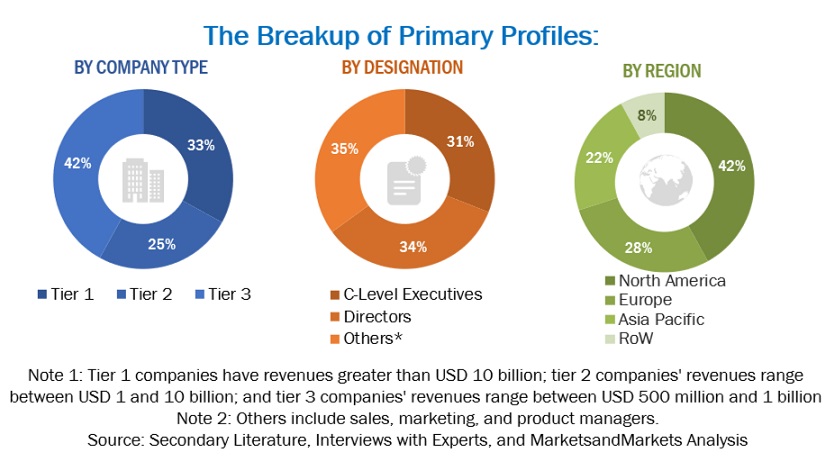

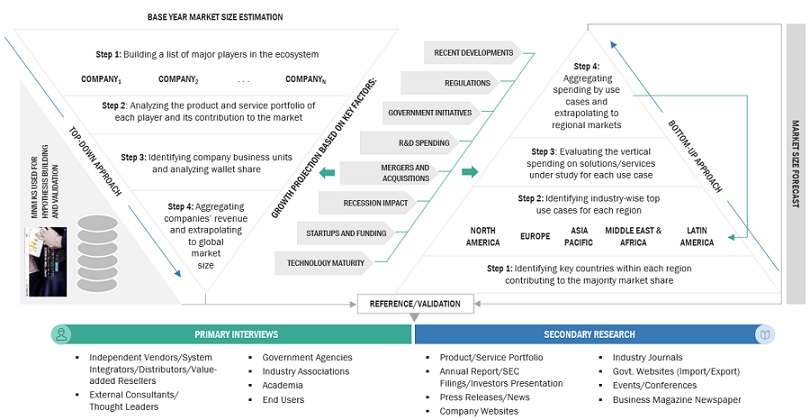

The study comprised four main activities to estimate the event management software market size. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions and hypotheses and sizing with industry experts throughout the value chain. The overall market size was evaluated using a blend of top-down and bottom-up approach methodologies. After that, we estimated the market sizes of the various event management software market segments using the market breakup and data triangulation techniques.

Secondary Research

The secondary research process referred to various secondary sources to identify and collect information for this study. These included annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Other sources include journals such as the International Journal of Computer Science, Information Technology and Security (IJCSITS), Journal of Information Security and Applications, and The Journal of Network and Computer Applications; and associations such as the Technology Services Industry Association (TSIA) and The World Information Technology and Services Alliance (WITSA).

Secondary research was mainly used to obtain key information about the industry insights, the market's monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both markets- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the event management software market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from vendors providing event management software offerings; associated service providers; and is operating in the targeted countries. all possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research also helped identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies. In the complete market engineering process, the bottom-up approach and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. An extensive qualitative and quantitative analysis of the complete market engineering process was performed to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The event management software market and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. The bottom-up method was used to determine the size of the market overall, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, the overall market size was utilized in the top-down approach to estimate the size of other individual markets.

Top Down and Bottom Up Approach of Event Management Software Market.

To know about the assumptions considered for the study, Request for Free Sample Report

The research methodology used to estimate the market size included the following:

- Primary and secondary research was utilized to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

- Throughout the process, critical insights were obtained by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, which were calculated using secondary sources.

Data Triangulation

The market was divided into several segments and subsegments using the previously described market size estimation procedures once the overall market size was determined. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

MarketsandMarkets defines Event management software as a digital tool or platform designed to assist organizers in planning, coordinating, and managing events more efficiently. Event management software is an application or platform with a centralized system to automate and streamline event planning, coordination, and management. Event management software is typically built using technologies such as databases for storing event data, web servers for handling online registrations and interactions, and APIs (Application Programming Interfaces) for integrating with other tools and platforms. The software may be deployed as a cloud-based solution, on-premises, or hybrid model, depending on the needs and preferences of the organization.

Key Stakeholders

- Event management software platform providers

- Technology services providers

- Government organizations

- Consultants/consultancies/advisory firms

- Support and maintenance service providers

- Information Technology (IT) infrastructure providers

- System Integrators (SIs)

- Regional associations

- Independent software vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the global event management software market based on offering, organization size, event type, deployment mode, end user, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the event management software market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the event management software market

- To forecast the market size concerning five central regions - North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the event management software market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and product launches, acquisitions, and partnerships and collaborations, in the event management software market globally

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the event management software market

Company Information

- Detailed analysis and profiling of five additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Event Management Software Market

Deep understanding of the Event Promotion Market.

Gather insight into the market shares that the SaaS providers are currently possessing, its growth and impact on the industry also understand the event management software in the MEA market.

Understanding of the event management market broke down by software type and region.

Understand the global aspects of event management software market.

Deep understanding of the Event Marketing software.

Gather insights into sizing & scoping global event management software market, its growth rates, buyer personas and how they buy.

Understanding the event supplier market size and percentage of the companies that use temporary workforces to deliver their services.

Interested in Event Management Software Market,its emerging markets, event software companies offering the software in the emerging markets and also their market share.

Indepth understanding of the Event Management Software Market.

Interested in Event management software and its market size, segmentation by region, global forecast and trends.

Gather insights into global event management software market especially market size by vertical and by Region.

Gather insights into size of music event management software solutions, market leaders within the market, Market growth per individual market and further segmentation of the market between small, medium and large events.

Need analysis in comparing between available Conference registration software like Regics.

Interested in the Market Size of event management softwares/ companies in the Middle East and specifically in Kuwait.

Gather insights into event technology market in Europe, in scandinavia and in Denmark.

Indepth understanding of event management industry.