HVAC System Market by Cooling (Unitary Air Conditioner, VRF), Heating (Heat Pump, Furnace), Ventilation (AHU, Air Filter), Service Type (Installation, Maintenance & Repair), Implementation Type (New Construction, Retrofit) - Global Forecast to 2029

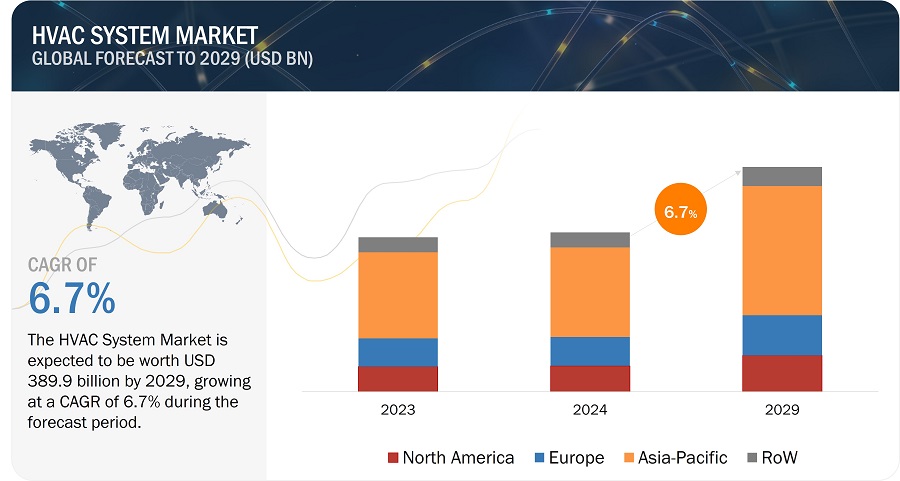

[288 Pages Report] The HVAC System Market is expected to be valued at USD 281.7 billion in 2024 and is projected to reach USD 389.9 billion by 2029 and grow at a CAGR of 6.7% from 2024 to 2029. The market is experiencing growth driven by an increasing demand for energy-efficient and sustainable buildings. This demand spans residential, commercial, and industrial properties, driven by the need for climate control and comfortable indoor air quality. Climate change is also intensifying the requirement for both cooling and heating systems. Furthermore, smart HVAC technologies, which offer real-time monitoring and energy-saving analytics, are propelling market growth. Changes in climate have boosted the need for climate control systems. Smart HVAC systems, with sensors and data-driven analytics, are also driving the industry's growth. However, challenges arise by the lack of awareness about the benefits of HVAC systems, as well as pressure to develop energy-efficient and ecofriendly solutions as the world moves towards sustainability.

HVAC System Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

HVAC System Market Dynamics

Driver: Increased levels of commercial activity are occurring in both residential and commercial sectors.

The HVAC industry's expansion is largely propelled by the construction sector's momentum. Demand for HVAC systems is on the rise in both residential and industrial domains, spurred primarily by increased construction activities. Global construction has seen substantial growth recently, driven by rapid urbanization, population expansion, and industrial development. According to a survey conducted by PICKHVAC, an organization offering reviews on HVAC systems, 83% of consumers identified HVAC systems as a priority, with nearly 38% prioritizing system reliability when selecting HVAC equipment.

Restraint: Elevated expenses associated with maintaining, repairing, and installing HVAC systems

Modern HVAC systems, boasting enhanced energy efficiency, are supplanting conventional ones. Emerging technologies like ice-powered air conditioning, motion-triggered AC units, and intelligent vents are being incorporated into contemporary HVAC systems to enhance energy efficiency, cut down on energy expenses, and mitigate carbon emissions. The installation expenses for energy-efficient HVAC equipment in residential, commercial, and industrial settings vary based on numerous additional factors.

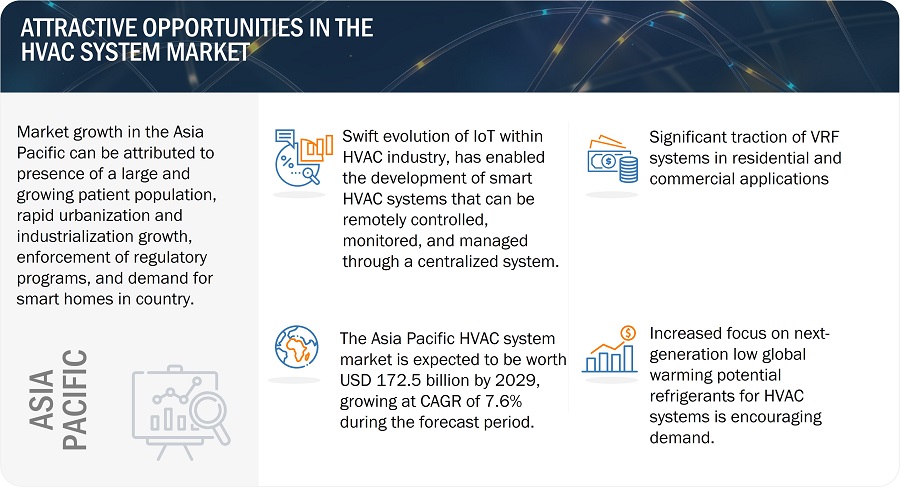

Opportunity: The rapid advancement of IoT technology within the HVAC industry.

The rapid increase of the IoT has brought about significant changes across numerous sectors in recent years, including the HVAC industry. Within this sector, IoT technology has facilitated the creation of intelligent HVAC systems capable of remote control, monitoring, and centralized management. The swift integration of IoT technology within the HVAC industry offers various prospects for advancement and expansion.

Challenge: Mounting environmental concerns and aging infrastructure.

The HVAC industry is pressured to develop energy-efficient and eco-friendly solutions as the world moves toward sustainability. Additionally, the existing infrastructure of HVAC systems in buildings, factories, and other facilities is aging and needs to be updated to meet the new requirements. HVAC systems account for a significant amount of energy consumption and greenhouse gas emissions. Therefore, the focus on developing environmentally sustainable and energy-efficient systems is necessary. Furthermore, the aging infrastructure of HVAC systems poses a challenge in maintenance and repair.

HVAC System Market Ecosystem

The HVAC system ecosystem comprises equipment manufacturers, control providers, system integrators, and distributors. HVAC end users include residential, commercial, and industrial. Across the commercial segment, HVAC systems are used across offices, government organizations, airports, healthcare facilities, educational institutions, and retail shops.

Based on the cooling equipment type, VRF system to hold the highest market growth during the forecast period

Cooling systems are used to lower the temperature, enable proper air distribution, and control humidification in a space. Cooling systems are available in various forms, from portable to massive systems designed to cool the entire space. HVAC cooling equipment encompasses various systems designed to regulate indoor temperature and humidity. Variable refrigerant flow (VRF) systems fluctuate the refrigerant flow in indoor units based on the requirement. VRF systems are available as heat pump systems or heat recovery systems for applications requiring simultaneous heating and cooling. It provides wind-free cooling that powerfully and gently cools the ambient temperature of the room, primarily used in residential complexes and commercial spaces, fostering increased demand throughout the forecast period.

Based on heating equipment, Heat pumps to hold the highest market share during the forecast period

Heating equipment forms an integral part of HVAC systems. They are used to heat buildings to a particular temperature. Heat pumps accounted for the largest share of the HVAC system market in 2023. The equipment is gaining higher acceptance owing to its multiple capabilities. Many models feature cooling and space-heating capabilities, and a few can heat water. Furthermore, heat pumps have higher efficiency than many other cooling or space heating units, which is expected to increase their demand. The residential application led the HVAC system market for heating equipment. The low operating cost and high operating capacity of heat pumps make them suitable and eco-friendly substitutes for conventional heating appliances in residential applications.

Based on Ventilation equipment, the air-handling unit to hold the highest market share during the forecast period

Ventilation equipment refers to mechanical devices used to maintain and improve air quality in an indoor environment by increasing the circulation and exchange of fresh air. Proper ventilation is important for maintaining a healthy indoor environment. Air-handling units held the largest size of the HVAC system market for ventilation equipment in 2023. The AHU reconditions and circulates the air as a part of a heating, ventilating, and air conditioning system. It is a portable and simple system requiring minimum air regulation space. The rising use of air-handling units in commercial buildings, hospitals, and universities is expected to fuel the growth of the market.

Based on Implementation type, the new construction building to hold the highest market share during the forecast period

HVAC system is installed in a building during construction. They can also be retrofitted. Retrofitting can be done to upgrade the existing HVAC systems making them more energy-efficient and providing additional functionality. Thus, implementing HVAC controls can be classified into new construction buildings and retrofit buildings. The new construction buildings segment will lead the global HVAC system market during the forecast period. The governments of various countries are making high investments in infrastructure development, such as expansion projects of hotels, retail stores, airports, and educational buildings. For example, the Energy Star program by the US government provides resources and recognition to organizations that implement energy-efficient practices, including installing energy-efficient HVAC systems.

Based on Service type, the Installation services to hold the highest market share during the forecast period

The HVAC industry offers a variety of services to ensure comfortable and healthy indoor environments in residential and commercial buildings. These services include installation, maintenance, and repair of heating, ventilation, and air conditioning systems. The installation services segment is expected to lead the global HVAC system market during the forecast period. As more buildings require efficient heating and cooling solutions, the need for professional installation services grows, driving market share. Additionally, complex regulations and the necessity for specialized expertise further solidify the demand for installation services, positioning them for substantial growth in the future.

Based on Application type, the Commercial segment to hold the highest market share during the forecast period

The HVAC system market based on application has been segmented into commercial, residential, and industrial. The commercial application has been divided into healthcare, education, government, office, airport, and retail. The commercial application segment is expected to hold the largest market share during the forecast period. The growth is attributed to the increasing adoption of HVAC systems in commercial buildings, growing demand for energy-efficient devices, and rising awareness regarding energy conservation in developing regions such as Asia Pacific and RoW. Moreover, increasing investments by governments in the construction of commercial spaces are also expected to propel the growth of the HVAC system market for commercial applications.

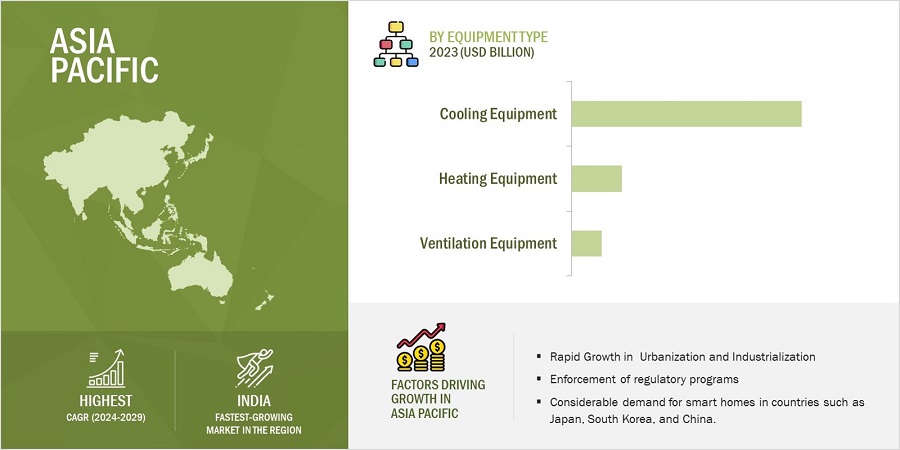

HVAC System Market in Asia Pacific to hold the highest market share during the forecast period

The HVAC system market has been segmented into four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW). The HVAC system market in China and India are expected to grow highly. This can be attributed to the expansion of the construction sector and the rising number of data centers in these countries. The Asia Pacific region is expected to lead the HVAC system market, expanding at the highest CAGR during the forecast period. Increasing construction activities, rising population, per capita income, growing need for energy-efficient devices, and favorable energy efficiency incentives by the government are key factors driving the growth of the HVAC system market in the region. Countries such as China, Japan, and India are propelling the development of the HVAC system market in the Asia Pacific. China held the largest size of the HVAC system market in Asia Pacific in 2023. Rapid industrialization and urbanization have created the need for energy saving.

HVAC System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The HVAC System companies is dominated by players such as Daikin Industries (Japan), Johnson Controls (Ireland), LG Electronics (Korea), Midea (China), Carrier and others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

Cooling equipment, Heating equipment, Ventilation equipment, Implementation type, Service type, Application, and Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

DAIKIN INDUSTRIES (Japan), Johnson Controls (Ireland), LG Electronics (South Korea), Midea (China), Carrier (US), Trane Technologies plc (Ireland), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), Madison Air (US) are the major players in the market. (Total 25 players are profiled) |

HVAC System Market Highlights

The study categorizes the Electric heat tracing market based on the following segments:

|

Segment |

Subsegment |

|

By Cooling EquipmentSelf-Regulating |

|

|

By Heating Equipment |

|

|

By Ventilation Equipment |

|

|

By Implementation Type |

|

|

By Service Type |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In March 2024, LG Electronics launched Dual Air Conditioner which combines style with functionality, featuring a dual outlet structure for rapid, precise temperature control and indirect airflow to avoid discomfort. With the Dual Inverter Heat Pump Compressor™, it delivers efficient performance year-round, boasting an A+++ EU energy efficiency rating.

- In March 2024, Midea launched MARS series R290 commercial heat pump which has has earned the prestigious Ultra-High-Temperature Hot Water Performance Certification from Intertek, signifying outstanding efficiency and performance. The use of the eco-friendly R290 refrigerant highlights the series' commitment to sustainability and lower environmental impact.

- In January 2024, LG Electronics launched R32 air-to-water heat pump and furnace which utilizes the environmentally friendly refrigerant R32, meeting the latest standards and ensuring reliable heating performance even at low temperatures.

- In January 2024, LG Electronics launched Multi F heat pump that offers flexibility and comfort in all climates, with year-round temperature control and versatile installation options for seamless integration into existing setups.

- In September 2023, Johnson Controls launched YMAE Air-to-Water Inverter Scroll Modular Heat Pump, designed for the North American market, offers high efficiency and sustainability for offices and schools seeking to reduce environmental impact and transition to electric heating and cooling. Utilizing R-454B refrigerant, it slashes climate impact by nearly 80% compared to R-410A and will be available in both single and packaged-module configurations.

Frequently Asked Questions:

What are the major driving factors and opportunities in the HVAC System Market?

Several key driving factors are propelling the HVAC System Market and presents abundant opportunities for growth. Major driving factors for the HVAC system market include rising construction activities, especially in emerging markets, growing emphasis on energy efficiency, and increased awareness of indoor air quality. Opportunities in this market are driven by advancements in smart technology, government incentives for green buildings, and a growing demand for HVAC systems that can adapt to climate change and sustainability goals.

Which region is expected to hold the highest market share?

Asia Pacific is set to hold the largest market share in the HVAC market due to several compelling reasons. Rapid urbanization and industrialization in countries like China and India are driving significant construction activity, leading to increased demand for HVAC systems in both residential and commercial sectors. Additionally, rising disposable incomes and a growing middle class are boosting the demand for improved comfort and indoor air quality. The region's hot and humid climate further fuels the need for effective cooling solutions. Government policies promoting energy efficiency and sustainable building practices also contribute to the growth of the HVAC market in Asia Pacific.

Who are the leading players in the HVAC System Market?

Companies such as Daikin Industries (Japan), Johnson Controls (Ireland), LG Electronics (Korea), Midea (China), Carrier and others are the leading players in the market.

What are some of the technological advancements in the market?

The HVAC System Market has witnessed significant technological advancements that are transforming the landscape of this HVAC solution. These advancements in the HVAC market encompass a range of innovative approaches. New refrigerants with lower global warming potential (GWP) are being developed to meet environmental regulations and support sustainability. The drive towards net-zero emissions has led to HVAC systems with improved energy efficiency and integration with renewable energy sources. Smart, IoT-enabled features allow for better monitoring, automation, and control, leading to optimized performance and energy savings. Overall, these advancements enhance HVAC system efficiency, reduce carbon footprints, and improve user experience.

What is the impact of the global recession on the market?

The HVAC system industry is projected to be adversely impacted by the recession and rising inflation in 2023. This leads to higher prices for homeowners and potential delays in HVAC services. The growth primarily depends on producing and selling consumer-based devices, air conditioners, heat pumps, air filters, air purifiers, and other primary component systems. With the increased inflation, interest rates, and unemployment, consumer and industry demand for HVAC system solutions is bound to be less, affecting production and investment across the globe. Due to the recession, end-user industries of HVAC system solutions, such as commercial and industrial, would have low CAPEX spending for HVAC systems-based development. The implementation of new energy efficiency standards in 2023 has further contributed to rising costs, as all HVAC systems must now have a seasonal energy efficiency ratio (SEER) between 14 and 15. Additionally, the mandated phasing out of certain refrigerants in residential air conditioning systems has increased the demand for replacement units that meet these new standards. While these updated systems are designed to be more energy-efficient and environmentally friendly, the overall rise in costs and regulatory changes translate into more expensive HVAC installations and maintenance for consumers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

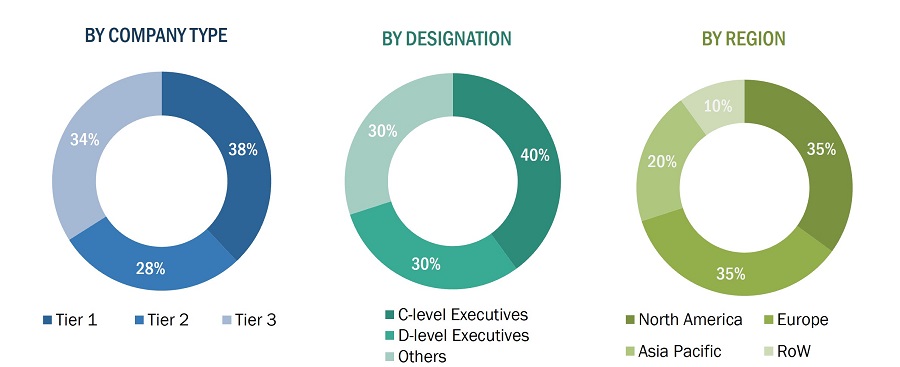

This research study extensively used secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource. It was used to identify and collect information useful for a technical, market-oriented, and commercial study of the HVAC system market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Primary sources included experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations related to all segments of the value chain of the HVAC ecosystem. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

International Energy Agency (IEA) |

https://www.iea.org/ |

|

The Japan Refrigeration and Air-conditioning Industry Association (JRAIA) |

https://www.jraia.or.jp/english/ |

|

Department of Energy |

https://www.energy.gov/ |

|

The American Society of Heating, Refrigerating, and Air Conditioning Engineers (ASHRAE) |

https://www.ashrae.org/ |

|

Air Conditioning Contractors of America Association (ACCA) |

https://www.acca.org/home |

|

Air-Conditioning, Heating, and Refrigeration Institute (AHRI) |

https://www.ahrinet.org/Home |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the electric heat tracing market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the HVAC system market and its various submarkets, both top-down and bottom-up methods were employed. Leading market players were identified through secondary research, with their market share in specific regions determined through a combination of primary and secondary research. This comprehensive process included reviewing annual and financial reports from key industry players and conducting in-depth interviews with senior industry executives, including CEOs, VPs, directors, and marketing executives. Percentage distributions and breakdowns were initially derived from secondary data and subsequently validated through primary sources. Every relevant parameter influencing the markets in this study was meticulously considered, verified through primary research, and examined to derive final quantitative and qualitative data. The resulting data was aggregated and enhanced with detailed insights and analysis from MarketsandMarkets, ultimately forming the basis of this report.

Bottom-Up Approach

The bottom-up approach was used to determine the overall size of the revenues of key players and their shares in the market. The overall market size was calculated based on the revenues of key players identified in the market.

- The first step involved identifying companies that offer heating, ventilation, and cooling equipment, followed by mapping their products according to various parameters, such as implementation type and application.

- The size of the HVAC system market was calculated based on the demand from various application areas and the revenue generated by companies within the HVAC ecosystem.

- To confirm the global market size, primary interviews were conducted with a few major players in the HVAC industry.

- The market size was also cross-checked using secondary sources, which included the International Energy Agency (IEA), the Japan Refrigeration and Air Conditioning Industry Association (JRAIA), Department of Energy (DOE), the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE), and the Air Conditioning Contractors of America (ACCA). Other secondary sources comprised company websites, press releases, and research journals.

- To determine the Compound Annual Growth Rate (CAGR) of the HVAC system market, both historical and projected market trends were analyzed by examining the industry's penetration rate, as well as the supply and demand in various application areas.

- All estimates at each stage were confirmed through discussions with key opinion leaders, including corporate executives (CXOs), directors, and sales heads, as well as industry experts from MarketsandMarkets.

- Several paid and unpaid information sources, such as annual reports, press releases, white papers, and databases, were also reviewed during the research process.

Top-Down Approach

In the top-down approach, the total size of the HVAC system market, derived from percentage splits obtained through both secondary and primary research, was used to estimate the sizes of individual markets, as detailed in the market segmentation.

To estimate the size of specific market segments, the top-down approach involved using the overall market size as a reference point. This approach was also applied to secondary research data to confirm the estimated market sizes for different segments.

The market share of each company was calculated to validate the revenue distribution used earlier in the top-down approach. Using data triangulation and validation through primary research, the study established and confirmed the sizes of both the entire parent market and the individual segments. The data triangulation process employed for this study is detailed in the following section.

- Revenue information from leading manufacturers and providers of HVAC systems was gathered and analyzed to estimate the global size of the HVAC system market.

- The HVAC system market is projected to exhibit a steady growth trend during the forecast period, reflecting its maturity and the presence of numerous well-established players across various sectors.

- The revenues, geographic footprint, key market sectors, and product offerings of all identified players in the HVAC system market were studied to estimate the percentage distribution of different market segments.

- Major players in each category (by equipment type and application) within the HVAC system market were identified through secondary research, and information was confirmed through brief discussions with industry experts.

- Several discussions with key opinion leaders from leading companies involved in developing HVAC systems were conducted to validate the market segmentation based on heating equipment, ventilation equipment, cooling equipment, implementation type, service type, application, and geography.

- Geographic splits were estimated using secondary sources, considering various factors, such as the number of companies offering HVAC systems in a specific country or region, and the types of HVAC equipment provided by these players.

Data Triangulation

After arriving at the overall size of the HVAC system market from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches.

Market Definition

HVAC systems are used to maintain comfortable indoor environments by controlling temperature, humidity, and air quality in residential, commercial, and industrial spaces. The HVAC system market encompasses the production, distribution, installation, and maintenance of heating, ventilation, and air conditioning systems. These systems are designed to regulate indoor temperature, humidity, and air quality in residential, commercial, and industrial settings. The market includes a range of products, from basic air conditioners and heaters to complex, integrated systems with smart technology. It also covers related services like system design, maintenance, and energy optimization.

Key Stakeholders

- Component Manufacturers

- Government and Research Organizations

- HVAC System Providers

- HVAC Software and Service Providers

- Maintenance and Service Providers

- Original Equipment Manufacturers (OEMs)

- Professional Services/Solution Providers

- Research Institutions and Organizations

- System Integrators

Report Objectives

- To estimate and forecast the size of the HVAC system market, in terms of value, based on cooling equipment, heating equipment, ventilation equipment, implementation type, service type, application, and region.

- To describe and forecast the market size, in terms of volume, based on cooling equipment, heating equipment, ventilation equipment, and region.

- To describe and forecast the market size, in terms of value, for four major regions-North America, Europe, Asia Pacific, and RoW

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the HVAC system market

- To strategically analyze micro markets with regard to individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape for the market leaders.

- To analyze major growth strategies such as product launches, expansions, joint ventures, agreements, and acquisitions adopted by the key market players to enhance their position in the market.

- To analyze the impact of the recession on the HVAC system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the HVAC system market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Electric heat tracing market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in HVAC System Market

Do you have Saudi Arabia market data in addition to global market data? We are interested in the following information in relation to Saudi Arabia market: - Trends - Market size in value / volume by segments - Details about leading players - Consumers

what is the market size for India in Domestic (Window Air conditioners, Split AC and Refrigerator)? What is the market size for central plants in INDIA?