This study consisted of four major phases in estimating the current size of the energy as a service market. Extensive secondary research was done to extract information from the market, peer markets, and parent markets. The next stage was the validation of these data from secondary findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were incorporated in estimating the entire size of the market. Then, the market break-down and data triangulation were done for estimating the market size of the segments and sub-segments.

Secondary Research

The research study on energy as a service market included maximum utilization-or-indirect utilization-of directories, databases, and secondary sources, including Hoovers, Bloomberg, Businessweek, UN Comtrade Database, Factiva, International Energy Agency, International Monetary Fund, United Nations Conference on Trade and Development, US Energy Information Administration, BP Statistical Review of World Energy, US Energy Information Administration, European Committee of Electrical Installation Equipment Manufacturers, US Environmental Protection Agency, among others, to identify and gather relevant information helpful for preparing the technical, market-oriented and commercial study. Other secondary sources included white papers, articles by renowned authors, annual reports, press releases & investor presentations of companies, recognized publications, manufacturer associations, trade directories, and databases.and supply chain to identify key players based on products; services; market classification and segmentation according to offerings of major players; industry trends related to product types, deployment mode, architecture, end user and regions; and key developments from both market- and technology-oriented perspectives.

Primary Research

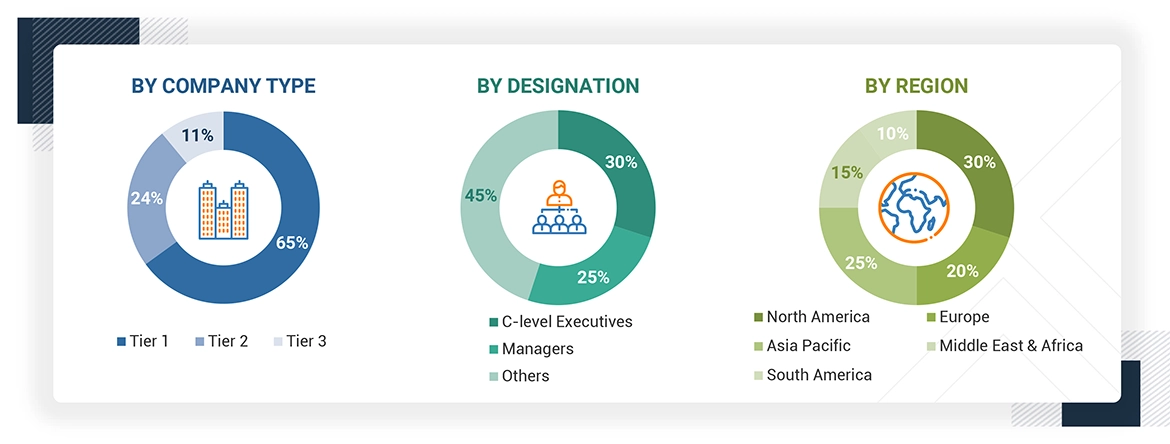

Amidst primary sources mentioned are various industry experts from core and allied industries, service providers, IoT, cloud-based solution providers, and utility provider in all segments of these industries' value chain. Several primary sources on both the supply side and demand sides of this market had been interviewed to gather qualitative and quantitative information. In the canvassing of primaries, several departments within organizations namely sales, engineering, operations, and managers were covered in order to provide an all-sided viewpoint in our report The primary respondents' breakdown is provided.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the energy as a service market and its dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was obtained through primary and secondary research. The research methodology includes the study of the annual and financial reports of top market players and interviews with industry experts, such as chief executive officers, vice presidents, directors, sales managers, and marketing executives, for key quantitative and qualitative insights related to the energy as a service market.

Energy as a Service (EAAS) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition

Energy as a Service (EaaS) is the process in which customers pay for energy services by means of subscription or pay-per-use, rather than installing a large piece of energy infrastructure. This in effect provides businesses and consumers access to energy solutions like renewable energy generation, energy efficiency upgrades, and energy management systems without the burden of ownership and maintenance. There are three key trends that define the EaaS market, viz., growing adoption of renewable energy sources, growing smart grid technologies, and the rise in reliance on data-driven decision making for energy management.

The EaaS market is rapidly evolving, driven by government initiatives and private sector investments, with a focus on various technologies such as AI, IoT, and energy management. The market for energy as a service is defined as the sum of revenues generated by global companies through the services offered by them.

Stakeholders

-

Analytics companies

-

Combined Heat and Power (CHP) project developers

-

Consulting companies in the power sector

-

Distributed Energy Resources (DER) technology manufacturers

-

End users with a heavy energy portfolio across industrial, commercial, military, and government sectors

-

Energy management companies

-

Energy service companies

-

Financiers

-

Microgrid developers

-

Solar PV project developers and technology manufacturers

-

Utilities

Report Objectives

-

To define, characterize, segment, and forecast the energy as a service market with respect to market size and volume, end-user, and region.

-

To forecast the market size by value, for five regions- South America, North America, Europe, Asia Pacific, and Middle East & Africa, and their key countries.

-

To strategically analyze each of the subsegments to understand individual growth trends, prospect, and contribution of segments to cumulative market size.

-

To provide detailed information about the key drivers, restraints, opportunities, and challenges affecting the growth of the market

-

To analyze the market opportunities for stakeholders and details of the competitive landscape for market leaders

-

To analyze competitive developments, like sales contracts, agreements, investments, expansions, new product launches, mergers, partnerships, joint ventures, collaborations, and acquisitions in the energy as a service market

-

To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them

-

To compare key market players for the market share, product specifications, and applications.

-

To strategically profile key players and comprehensively analyze their market ranking and core competencies.

Note: 1. Core competencies of companies are captured in terms of their key developments and product portfolios, as well as key strategies adopted to sustain their position in the energy as a service market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

-

Further breakdown of the energy as a service market, by country

Company Information

-

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Energy as a Service (EAAS) Market