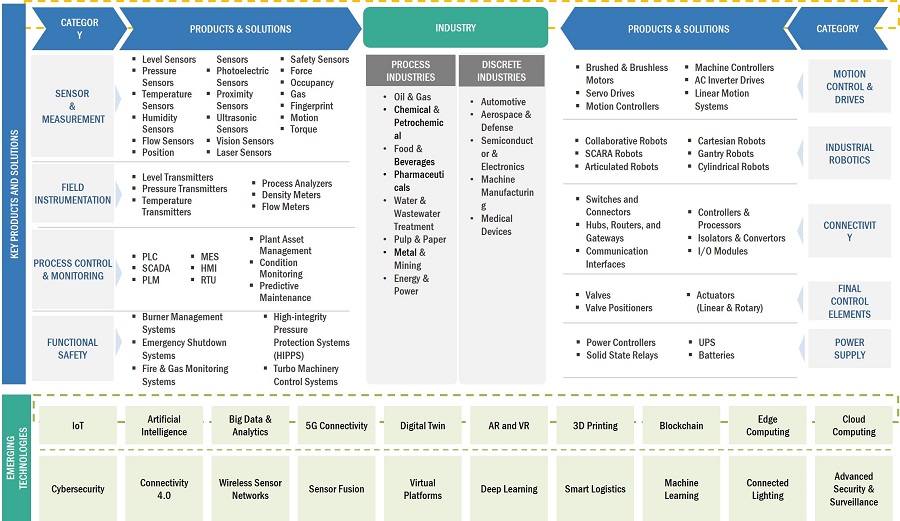

SCADA Market by Component (Programmable Logic Controller (PLC), Remote Terminal Unit (RTU), Human-Machine Interface (HMI), Communication Systems, I/O Devices, Storage Servers, Supervisory Systems), Offering, End User and Region - Global Forecast to 2029

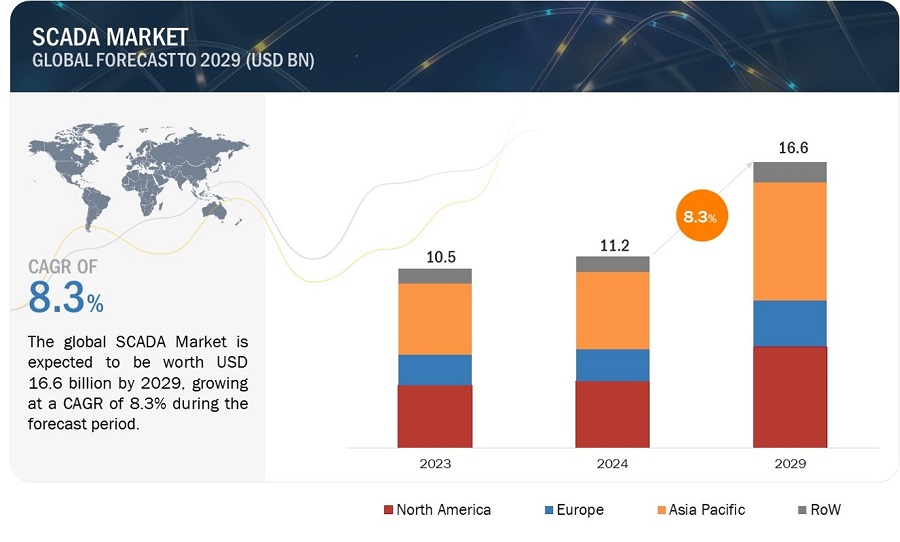

[302 Pages Report] The global SCADA market size is foreseen to grow from USD 11.2 billion in 2024 to USD 16.6 billion by 2029, at a CAGR of 8.3% from 2024 to 2029. The rapid growth of smart city projects underscores the rising need for robust SCADA systems to effectively manage and integrate complex urban infrastructure and transportation networks. These initiatives encompass a diverse array of applications, including smart grid management, traffic control, water and waste management, and public safety, all of which rely on SCADA technology to ensure seamless coordination and efficient operation. As urban populations continue to swell, driving the demand for sustainable and interconnected urban environments, the role of SCADA systems in enabling smart city development is expected to fuel further growth within the market.

SCADA Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing government support for SCADA adoption

Government initiatives play a significant role in driving the adoption and advancement of SCADA systems, particularly in sectors critical to national infrastructure and public services. Governments are focusing on enhancing water resource management and wastewater treatment processes to ensure environmental sustainability and public health. SCADA systems are deployed in water treatment plants and distribution networks to monitor water quality, manage pumping stations, detect leaks, and optimize resource utilization. For instance, in September 2023, in India, the Rajasthan State Water Informatic Centre, operating under the auspices of the State Water Resources Department (WRD) was preparing to integrate SCADA technology into the Indira Gandhi Canal. The deployment of SCADA was expected to help in timely information dissemination, transparent water distribution, and the assurance of water availability for all stakeholders. These enhancements are critical for effective irrigation water management.

Governments prioritize the protection of national security assets and critical defense infrastructure through the deployment of SCADA systems with advanced security features. SCADA is used in military installations, border surveillance, and cybersecurity operations to ensure resilience against cyber threats and hostile activities. Also, governments are rapidly increasing the cybersecurity of SCADA solutions that are being used in national security assets, and critical defense infrastructure. For instance, the US Department of Energy had declared 21 steps to improve the cyber security of SCADA networks across the US. Governments are developing and implementing stricter regulations for securing SCADA systems in critical infrastructure sectors. These regulations tend to mandate specific security protocols, vulnerability assessments, and incident response plans.

Restraint: Complexity and customization of SCADA systems

SCADA systems are sophisticated and multifaceted, involving a combination of hardware, software, and network infrastructure. Implementing these systems requires a deep understanding of industrial processes, automation technologies, and networking protocols. The complexity arises from the need to integrate SCADA components with existing infrastructure, configure software applications to monitor and control processes, and ensure seamless communication between various devices and sensors. Initially, SCADA systems were standalone, independent systems with no connectivity to other systems, using proprietary communication protocols and running on large minicomputers like the PDP-11. As SCADA systems progressed, they transitioned to distributed architectures where computing tasks were distributed across multiple stations connected through LAN networks, enabling real-time information sharing and task delegation, which reduced costs compared to earlier systems. The evolution continued with the growth of the internet, leading to the implementation of web technologies in SCADA systems, allowing users to access data, exchange information, and control processes remotely through web connections. The complexity in SCADA systems is further compounded by the need for customization to meet specific industry requirements, such as in water management, manufacturing, or energy sectors. Customization involves tailoring SCADA solutions to address unique operational needs, which can increase implementation time and costs due to the intricate nature of control logic, communication protocols, user interfaces, and cybersecurity measures.

Moreover, the complexity in SCADA systems stems from the integration of data analysis tools, business networks, and control networks, requiring the implementation of firewalls, virtual private networks, and dual-homed servers to ensure data security and operational efficiency. The interconnected nature of SCADA systems, coupled with the continuous expansion of infrastructure and the need for real-time monitoring and control, adds layers of complexity that demand robust solutions to manage and optimize system performance effectively.

Opportunity: Increasing adoption of SCADA in transportation, smart buildings, and agriculture

While SCADA systems have traditionally been used in industries such as energy, oil and gas, water and wastewater, and manufacturing, there is growing potential for expansion into new industry verticals. Sectors like transportation, smart buildings, and agriculture are increasingly recognizing the benefits of SCADA for improving operational visibility, control, and efficiency.

For instance, SCADA systems improve transportation system efficiency through resource optimization, reducing energy consumption, and automating processes. By remotely supervising and manipulating various components like traffic signals, trains, buses, bridges, tunnels, and airports, SCADA enhances operational efficiency and streamlines transportation processes. SCADA systems play a crucial role in detecting and diagnosing problems promptly, improving system reliability, and minimizing downtime. By providing real-time monitoring and control capabilities, SCADA helps in identifying issues, preventing risks, and ensuring the smooth operation of transportation systems.

Similarly, SCADA are being used in smart buildings. It provides real-time information about devices and processes in smart buildings, enabling digital transmission of data from Remote Terminal Units (RTUs) to the Human-Machine Interface (HMI). This accurate transfer of information eliminates the need for manual data entry or interpretation, ensuring precise monitoring and control. SCADA data facilitates proactive maintenance in smart buildings, enabling early intervention before minor issues escalate. By identifying components that require attention and allowing remote adjustments, SCADA systems help optimize maintenance processes and prevent costly downtime.

In agriculture, there is a significant increase in the use of SCADA systems. SCADA systems enable precision farming by providing real-time data on crop growth factors like soil moisture, temperature, and humidity. This data empowers farmers to make informed decisions about water, fertilizer, and pesticide usage, reducing waste and increasing crop yield. SCADA automates manual labour in agriculture, allowing farmers to remotely monitor and control irrigation systems, fertilizer application, and other farm machinery from a central location. This automation saves time, resources, and reduces the need for manual intervention, enhancing operational efficiency. Companies like SCADACore, which is a Canada based company that offers web SCADA, IIoT, cloud-ready industrial monitoring solutions, provides a solution - SCADACore Live, that provide remote agriculture monitoring for digital farming applications. Thus, adoption of SCADA in numerous industries like agriculture, transportation, healthcare are creating growth opportunities.

Challenge: Communication protocol incompatibility

SCADA systems often need to communicate with a wide range of devices, sensors, and controllers, each using different communication protocols. These protocols may include proprietary protocols developed by equipment manufacturers, industry-standard protocols like Modbus, DNP3, or OPC, and legacy protocols specific to older systems. Different vendors implement protocols in slightly different ways, leading to interoperability issues when integrating SCADA components from multiple vendors. Incompatibility may arise due to differences in message formats, data encoding, command structures, or error handling mechanisms.

Many industrial facilities operate legacy SCADA systems and equipment that use outdated or proprietary communication protocols. Integrating these legacy systems with modern SCADA solutions is challenging due to compatibility issues and limited support for legacy protocols in newer systems. Resolving this communication protocol incompatibility requires complex integration efforts, including protocol conversion, data mapping, and protocol translation. Organizations need to deploy additional hardware or software gateways to bridge the gap between incompatible protocols, adding complexity and cost to the integration process. Incompatibility between communication protocols increases the risk of communication errors, data loss, and system failures. Mismatched data formats or misinterpreted commands lead to inaccurate data readings, operational disruptions, and safety hazards in industrial environments. Also, Incompatibility between communication protocols hinders interoperability between different SCADA systems, devices, and applications. Lack of interoperability limits data sharing, collaboration, and system scalability, preventing organizations from fully leveraging the benefits of integrated SCADA solutions.

SCADA Market Ecosystem

The prominent players in the SCADA market are Schneider Electric (France), Siemens (Germany), ABB (Switzerland), Emerson Electric Co. (US), Rockwell Automation (US). These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint.

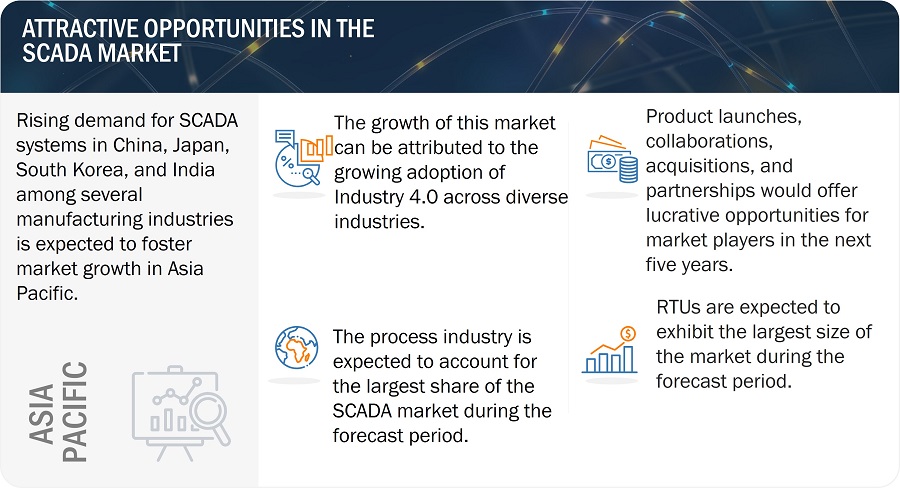

RTU component to account for the largest share of the SCADA market during the forecast period

Within the SCADA market, Remote Terminal Units (RTUs) have consistently held the dominant market share throughout the forecast period. These electronic devices serve as a critical backbone for SCADA systems. RTUs excel at collecting data from remote locations, a crucial function for geographically dispersed operations within the oil & gas industry, the primary end-user of SCADA systems. Their functionality involves collecting data from sensors and field devices, encoding it into a transmittable format, and then reliably transferring it to the central SCADA system for monitoring and analysis. The ongoing exploration and extraction of resources in challenging environments, such as deep-sea and shale gas reserves, further contributes to the rising demand for RTUs. As these activities necessitate robust data acquisition capabilities across vast distances, RTUs remain an indispensable technology for effective SCADA system implementation within the oil & gas sector.

The market for process industries is expected to account for largest market share during the forecast period.

The process industry is experiencing a surge in SCADA system adoption, driven by the ever-increasing pressure on manufacturers to optimize production costs and processes. This trend is fuelled by the growing demand for real-time visibility into complex activities across various sectors, including oil & gas, chemicals, metals & mining, and food & beverages. Within the process industry SCADA market, the oil & gas sector is projected to maintain dominance throughout the forecast period. SCADA systems offer oil & gas companies the ability to remotely monitor facilities, gaining valuable insights into daily inventory levels and equipment health. This remote monitoring capability helps address the challenge of a potential shortage of qualified personnel for on-site data collection. Furthermore, SCADA systems enhance overall safety and operational efficiency within these facilities, ultimately minimizing risk to worker safety.

Services segment to account for the largest share of the SCADA market during 2024-2029.

Market saturation of SCADA systems in established regions like the Americas and Europe presents a shift in growth opportunities. While new system implementations might see a slowdown, the focus is likely to transition towards SCADA system modification and maintenance services. Throughout a SCADA system's lifespan, organizations require ongoing modifications and maintenance to ensure optimal performance and adapt to evolving needs. Cybersecurity services are a particularly crucial consideration during customization or modification of these systems, as they play a vital role in safeguarding against emerging threats. This trend highlights the growing demand for robust post-implementation support within the SCADA market of these mature regions.

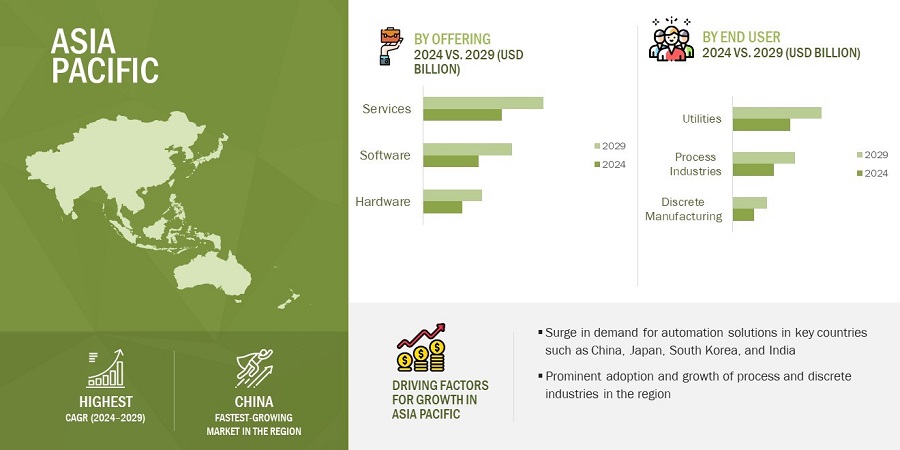

Asia Pacific to account for the largest share of the SCADA market during the forecast period.

SCADA Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific emerges as a burgeoning market for SCADA, propelled by the rapid expansion of its economies and the escalating adoption of SCADA systems across diverse sectors including power, electrical utilities, process automation, and communications. APAC has witnessed a surge in the establishment of manufacturing plants across industries such as automotive, textile, power, and pharmaceuticals, further amplifying the demand for automation solutions. This trend is underpinned by the growing emphasis on automation to meet the increasing demand for high-quality products and heightened production rates across Asia Pacific. Additionally, the surging development of the oil & gas sector in the region has spurred a significant demand for automation products, thereby fuelling the anticipated growth of the SCADA market throughout the forecast period.

Key Market Players

The SCADA Companies players have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, partnerships, and acquisitions to strengthen their offerings in the market. The major players in the market are Rockwell Automation (US), Schneider Electric (France), Emerson Electric Co. (US), Siemens (Germany), and ABB (Switzerland).

The study includes an in-depth competitive analysis of these key players in the SCADA market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments Covered |

Offering, Component, End User and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Rockwell Automation (US), Schneider Electric (France), Emerson Electric Co. (US), Siemens (Germany), and ABB (Switzerland) |

SCADA Market Highlights

In this report, the overall SCADA market has been segmented based on offering, component, end user and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Component |

|

|

By End User |

|

|

By Region |

|

Recent Developments

- In February 2024, Rockwell Automation launched Embedded Edge Compute Module, which extends Rockwell Automation's track record of integrating PC or compute capabilities with the strength of Logix. This Edge solution offers essential scalability and remote support features to enhance the capabilities of modern workforces.

- In February 2024, Emerson Electric Co. launched the latest addition to its lineup, the PACSystems IPC 2010 Compact Industrial PC (IPC), engineered to withstand the demands of various machine and discrete part manufacturing automation tasks. This robust solution caters to manufacturing facilities and OEM machine builders requiring a resilient, space-efficient IPC to efficiently bolster their Industrial Internet of Things (IIoT) endeavors and other digital transformation initiatives while maintaining cost-effectiveness.

- In October 2023, Emerson Electric Co. confirmed the completion of its acquisition of National Instruments Corp. (NI), a renowned provider of software-enabled automated test and measurement systems, at an equity value totaling USD 8.2 billion. This strategic acquisition fortified Emerson Electric Co.'s position as a global leader in automation and broadens its scope to leverage significant industry trends such as nearshoring, digital transformation, sustainability, and decarbonization. NI already has a strong portfolio of SCADA products such as Generic SCADA software.

- In February 2023, ABB launched the latest release of its ABB Ability Symphony Plus distributed control system, aimed at bolstering digital transformation within the power generation and water industries.

- In August 2022, Honeywell International Inc. announced that it had launched an Industrial Automation Lab in partnership with the Department of Automation and Computer Science at the University Politehnica of Bucharest. This initiative aimed to empower students with the necessary technical skills and expertise to excel in the competitive global industrial automation industry.

Frequently Asked Questions(FAQs):

Who are the key players in the SCADA market? What are the major growth strategies they have taken to strengthen their position in the market?

Major players of SCADA market include Schneider Electric (France), ABB (Switzerland), Siemens (Germany), Emerson Electric Co. (US), Rockwell Automation (US). These companies offer a wide portfolio for SCADA with global presence across various countries to meet the requirements of customers. Strategies such as acquisitions, product launches, collaborations, agreements and contracts were adopted by these companies to withstand the competitive landscape of this market.

What are the new opportunities for emerging players in the SCADA value chain?

Leading SCADA companies have an opportunity to solidify their dominance. They can achieve this by developing next-generation hardware like RTUs, PLCs, and HMIs that prioritize deep integration with advanced technologies and robust data management features. Furthermore, by investing in innovative software solutions specifically designed for SCADA systems, these established players can leverage advancements like AI, machine learning, and cloud computing to optimize functionalities and capture a larger share of the SCADA market.

Which region to offer lucrative growth for the SCADA market by 2029?

During the forecast period, Asia Pacific is expected to dominate the SCADA market. In addition to that, the region is also projected to be depiciting highest CAGR from 2024 to 2029.

Which offering of the SCADA market is expected to drive the market's growth in the next five years?

Software segment to have the highest CAGR during 2024–2029 forecast period. This growth is attributed to increase demand for remote monitoring in varios verticals with the help of SCADA systems.

Which end-user of the SCADA market is expected to drive the market's growth in the next five years?

Process Industries segment is expected to hold larger market share during the forecast period. This can be attributed to increasing demand to attain optimized productionin terms of cost and processes along with growing demand for real-time visibility and monitoring into complex manufacturing and processes for oil & gas, chemicals, and food & beverages sectors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves four major activities for estimating the size of the SCADA market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the SCADA market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

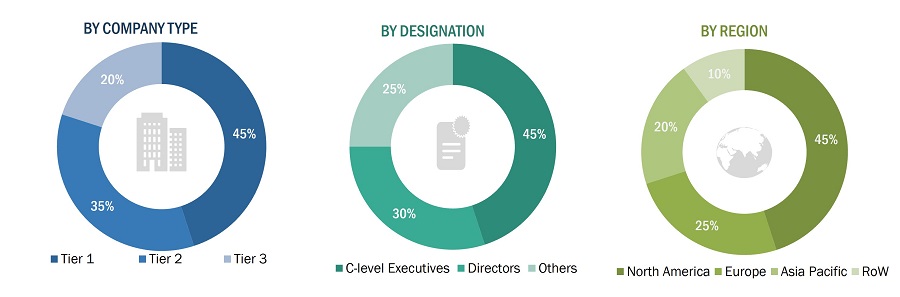

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the SCADA market through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

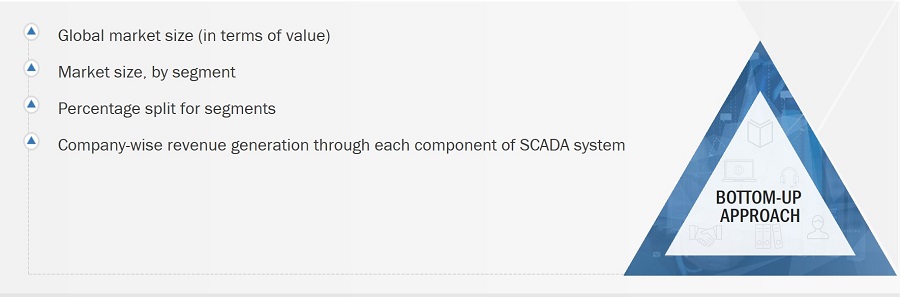

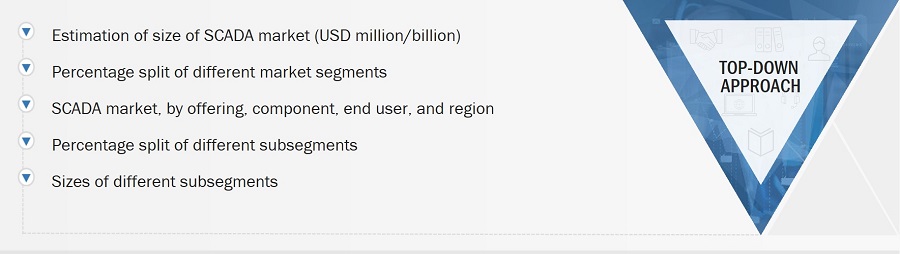

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the SCADA market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global SCADA Market Size: Bottom-Up Approach

Global SCADA Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

SCADA is an automation system designed to monitor and control complex systems/processes deployed in several industrial plants, including oil & gas, power, and water & wastewater treatment. This system allows gathering data from field devices and processing this data in real time to send commands that regulate or control industrial equipment or processes. It acts as an interface between plant machinery and input devices such as sensors, valves, pumps, and motors, which are part of SCADA system components such as the human–machine interface (HMI) and programmable logic controller (PLC). SCADA provides plant operators with crucial data regarding industrial processes and helps them make appropriate response and control decisions. The system records and maintains all real-time data related to machines in a log file.

Stakeholders:

- Application providers

- Automation consultants

- Integrators of automation systems

- Distributors and providers of SCADA

- Companies developing and integrating industrial software

- Companies providing industrial control systems (ICS) cybersecurity

- Vendors of SCADA software package

- Suppliers of SCADA components

- Providers of professional services/solutions

- Research organizations and consulting companies

- Technology investors

- Technology standards organizations, forums, alliances, and associations

Report Objectives:

- To describe and forecast the global SCADA market by offering, component, end user, and region, in terms of value

- To forecast the market with respect to 4 main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To describe the on-premises, cloud-based, and hybrid deployment models of SCADA systems

- To describe the leading features of latest SCADA systems.

- To provide detailed information regarding the major factors, namely, drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the competitive intelligence of players on the basis of company profiles, key growth strategies, and game-changing developments, such as product launches, product developments, partnership, agreement, and acquisitions

- To study the SCADA value chain and analyze the current and future market trends

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their rankings and core competencies2, along with a detailed competitive landscape for the market leaders

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Company Information:

- Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in SCADA Market

"Benchmarking the rapid strategy shifts of the Top 100 companies in the SCADA Market - on pricing and sales/revenue." Need special pricing on SCADA for companies in this industry.