Smart Buildings Market by Component (Solution (Safety and Security Management, Building Infrastructure Management, Network Management, and IWMS) and Services), Building Type (Residential, Commercial, and Industrial), and Region (2022 - 2026)

Smart Buildings Market Analysis

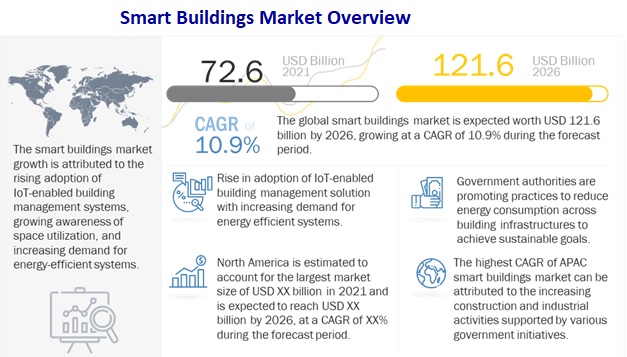

The global smart buildings market size stood at USD 72.6 billion in 2021 and is projected to grow at a CAGR of 10.9% to reach over USD 121.6 billion by the end of 2026. Various factors such as increased demand for energy-efficient systems due to increasing energy consumption and costs, advancement in IoT and PoE solution, the increasing net zero, and regulatory changes are expected to drive the adoption of Smart Buildings solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing demand for energy-efficient systems

Buildings are the biggest consumers of energy. They consume almost 40% share of the world's energy consumption. Energy-efficient buildings have become a necessity worldwide to help reduce greenhouse gas emissions. Building management systems are important in optimizing energy usage and reducing energy costs. Smart building solutions generate important insights into energy consumption across the entire building infrastructure. They help in efficiently monitoring and controlling HVAC and other systems. Building analytics helps reduce overall building maintenance costs by detecting problems in the operation of various equipment, thus helping in the early diagnosis of the issues. The increasing energy consumption and expenses provide an opportunity to implement advanced technologies and systems that create clean, optimized, automated energy driving the smart building market.

Restraint: High cost of implementation

Building owners are unaware that costs are primarily dependent on integration complexities related to specific applications. End users demand cost-effective systems for energy savings but fail to realize the extent of the energy savings and associated long-term cost savings. On average, lighting accounts for about 25% of buildings' energy usage. With lighting control systems, lighting costs can be reduced by 30–60% while enhancing lighting quality and reducing environmental impacts. As per an article published by Verdantix in June 2021, the integration of predictive energy insights with automated building controls can enable firms to achieve 20% in annual energy savings by optimizing asset runtime based on changing energy prices or space utilization. The perception of the high cost of building analytics solution implementation and lack of awareness about its long-term cost-savings can obstruct the deployment and growth of smart building solutions across the globe.

Opportunity: Emergence of the 5G technology

The introduction of 5G technology enhances new and powerful intelligent building capabilities. It plays a pivotal role in expanding IoT-enabled devices by providing efficient real-time operational and analytics capabilities. A huge amount of data is generated due to IoT-enabled devices in smart buildings; however, the 5G technology enables the quick building of data transport, interpretation, and efficient actions taken economically. 5G significantly enhances user/occupant experience and provides many other creative and useful Building Internet of Things (BIoT) and AI-enabled innovations. According to GSMA, investments in 5G networks will reach USD 1 trillion worldwide by 2025, and the global 5G network will serve a longer investment cycle than 4G, which indicates that the coexistence of 4G and 5G will last into the 2030s.

Challenge: Rise in privacy and security concerns due to IoT-enabled devices

Many buildings are now integrating smart technology with their designs and operations. Adopting technologies such as IoT and sensors offers tenants and landlords tremendous convenience. However, the adoption of these technologies poses a security threat to buildings. Most IoT devices and sensors have weak security, use non-standard communication protocols, and are operated by old, unpatched software, which could expose smart buildings to various vulnerabilities. Hackers always scan targets for technology weaknesses to infiltrate a particular network, steal valuable data, or take control of a facility. For instance, cybercriminals infiltrate Business Activity Statement to stop the working of passenger lifts, gain access to security feeds from Closed-Circuit Televisions (CCTVs), and disrupt power supplies to the entire building or parts of it. A well-planned cyber-attack involving readily available IoT devices and sensors in any smart building could potentially expose sensitive data storage, servers, and employee and customer information, which could be used for malicious purposes. Thus, the rising privacy and security concerns due to adopting IoT-enabled devices restrict the smart building market growth.

The service segment is expected to account for a higher CAGR during the forecast period

Smart Buildings market solution providers offer various services. Smart Buildings solutions are segmented into consulting, implementation, support, and maintenance. The growing demand for smart building solutions to improve facility performance and management propels the market's growth for the services segment. Also, the need to achieve efficiency and sustainability will drive the market

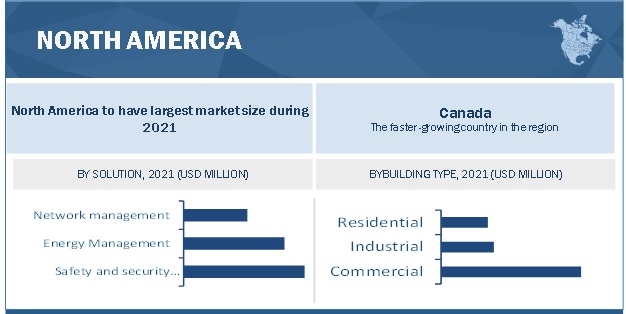

North America to account for the largest market share during the forecast period

North America is estimated to hold the highest market share of the smart building market in 2021. North America is estimated to capture the largest share of the overall Smart Buildings market. The US and Canada are major countries contributing to technology development in this region. The rapid digitalization across industry verticals, the increasing adoption of smart connected devices, and the rising technological advancements have further fueled the growth of the smart building market in this region. Also, Government initiatives and awareness plans for energy-efficient and cost-effective smart buildings to drive market growth in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Smart Buildings market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Smart Buildings market include Cisco (US), IBM (US), Honeywell (US), Siemens (Germany), Johnson Controls (Ireland), Huawei (China), Intel (US), PTC (US), ABB (Switzerland), Hitachi (Japan), Schneider Electric (France), Telit (UK), Legrand (France), Bosch (Germany), KMC Controls (US), Verdigris Technologies (US), Aquicore (US), 75F (US), BuildingIQ (US), ENTOUCH (US), Gaia (India), Softdel System (US), Mode: Green (New Jersey), CopperTree Analytics (Canada), Spaceti (Netherlands), Igor (US), eFACiLiTY (India), and Spacewell (Belgium). The study includes an in-depth competitive analysis of these key players in the Smart Buildings market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By component, building type, and region |

|

Estimated Value |

USD 72.6 billion |

|

Forecast Value |

USD 121.6 billion |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Companies covered |

Cisco (US), IBM (US), Honeywell (US), Siemens (Germany), Johnson Controls (Ireland), Huawei (China), Intel (US), PTC (US), ABB (Switzerland), Hitachi (Japan), Schneider Electric (France), Telit (UK), Legrand (France), Bosch (Germany), KMC Controls (US), Verdigris Technologies (US), Aquicore (US), 75F (US), BuildingIQ (US), ENTOUCH (US), Gaia (India), Softdel System (US), Mode: Green (New Jersey), CopperTree Analytics (Canada), Spaceti (Netherlands), Igor (US), eFACiLiTY (India), and Spacewell (Belgium). |

This research report categorizes the Smart Buildings market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Solutions

-

Safety and security management

- Access control system

- Video surveillance system

- Fire and life safety system

-

Energy management

- HVAC control system

- Lighting management system

-

Building infrastructure management

- Parking management system

- Smart Water Management system

- Elevator and escalator management system

-

Network management

- Wired technology

- Wireless technology

-

IWMS

- Operations and services management

- Real estate management

- Environment and energy management

- Facility management

- Capital project management

-

Safety and security management

-

Services

- Consulting

- Implementation

- Support and maintenance

By Building Type:

- Residential

- Commercial

- Industrial

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- Australia

- Rest of APAC

-

MEA

- United Arab Emirates

- Kingdom of Saudi Arabia

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In August 2022, Johnson Controls partnered with Microsoft Beijing Campus for its ongoing retrofit and optimization of building operations, achieving 27.9% energy savings and ensuring key equipment uptime to 98%

- In February 2022, Legrand partnered with URC, a leading provider of smart home automation and control systems, to expand Smart Home Control. Through this partnership, the companies will work hand-in-hand to provide seamless control of Legrand's Vantage lighting and climate systems.

- In January 2022, Johnson Controls completed the acquisition of FogHorn, the leading developer of Edge AI software for industrial and commercial Internet of Things (IoT) solutions. By pervasively integrating Foghorn's world-class Edge AI throughout Johnson Controls OpenBlue solution portfolio, it accelerated toward its vision of smart, autonomous buildings that continuously learn, adapt, and automatically respond to the needs of the environment and people.

- In September 2021, Legrand launched the Living Now design characterizes extreme purity of creation and the precision of its geometries to suit all homes. It can be installed to show its innovative potential with connected smart systems.

Frequently Asked Questions (FAQ):

How big is the Smart Buildings Market?

What is growth rate of the Smart Buildings Market?

What are the key trends affecting the global Smart Buildings Market?

Who are the key players in Smart Buildings Market?

Who will be the fastest growing region for Smart Buildings Market?

What are Smart Buildings?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 6 SMART BUILDINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

TABLE 2 PRIMARY INTERVIEWS

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL THE OFFERINGS IN THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE): MARKET

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 11 SMART BUILDINGS MARKET, 2019–2026 (USD MILLION)

FIGURE 12 TOP THREE LEADING SEGMENTS IN THE MARKET IN 2021

FIGURE 13 MARKET, REGIONAL AND COUNTRY-WISE SHARES, 2021

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 14 RISE IN ADOPTION OF IOT-ENABLED BUILDING MANAGEMENT SYSTEMS TO DRIVE MARKET GROWTH

4.2 MARKET, BY COMPONENT

FIGURE 15 SMART BUILDING SOLUTIONS TO LEAD MARKET GROWTH IN 2021

4.3 SMART BUILDING SOLUTIONS MARKET, BY TYPE

FIGURE 16 SAFETY AND SECURITY MANAGEMENT SOLUTIONS TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.4 SMART BUILDING SERVICES MARKET, BY TYPE

FIGURE 17 SMART BUILDING IMPLEMENTATION SERVICES TO ACCOUNT FOR THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

4.5 SMART BUILDINGS MARKET, BY BUILDING TYPE

FIGURE 18 COMMERCIAL SMART BUILDINGS TO LEAD MARKET BETWEEN 2021 AND 2026

4.6 MARKET, BY REGION

FIGURE 19 ASIA PACIFIC TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

4.7 MARKET, BY COUNTRY

FIGURE 20 CHINA AND JAPAN TO ACCOUNT FOR HIGH GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART BUILDINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Rise in adoption of IoT-enabled BMS

FIGURE 22 GLOBAL GROWTH IN IOT DEPLOYMENTS FOR COMMERCIAL REAL ESTATE, 2015—2020

5.2.1.2 Increase in awareness of space utilization

FIGURE 23 AVERAGE OFFICE VACANCY RATE ACROSS OFFICE/ADMIN SPACE, 2017–2019

FIGURE 24 BUSINESS CASES FOR SPACE MANAGEMENT IN SMART BUILDINGS

5.2.1.3 Increase in industry standards and regulations

5.2.1.4 Increased demand for energy-efficient systems

5.2.2 RESTRAINTS

5.2.2.1 Lack of cooperation among standard bodies

5.2.2.2 High cost of implementation

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of the 5G technology

TABLE 4 PROJECTED PENETRATION OF 5G IN SOUTHEAST ASIA BY 2025

5.2.3.2 Rise in the smart city trend

5.2.3.3 Government initiatives and incentives

5.2.4 CHALLENGES

5.2.4.1 Lack of technology alignment and skilled professionals

5.2.4.2 Rise in privacy and security concerns due to IoT-enabled devices

5.3 INDUSTRY TRENDS

5.3.1 SMART BUILDINGS MARKET: ECOSYSTEM

FIGURE 25 SMART BUILDINGS ECOSYSTEM

TABLE 5 MARKET: ECOSYSTEM

5.3.2 MARKET: SUPPLY CHAIN ANALYSIS

FIGURE 26 SUPPLY CHAIN

5.3.3 MARKET: REGULATIONS

5.3.3.1 BACnet—Data Communication Protocol for Building Automation and Control Networks

5.3.3.2 KnX

5.3.3.3 Digital addressable lighting interface

5.3.3.4 General data protection regulation

5.3.3.5 Modbus

5.3.3.6 Cloud Standard Customer Council

5.3.4 SMART BUILDINGS MARKET: PATENT ANALYSIS

5.3.4.1 Methodology

5.3.4.2 Document Types of Patents

TABLE 6 PATENTS FILED, 2019–2021

5.3.4.3 Innovation And Patent Applications

FIGURE 27 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2019–2021

5.3.4.4 Top applicants

FIGURE 28 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2021

TABLE 7 US: TOP TEN PATENT OWNERS IN THE MARKET, 2019–2021

5.3.5 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE MARKET

FIGURE 29 SMART BUILDINGS MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.3.6 MARKET: PRICING ANALYSIS

TABLE 8 SMART BUILDING SOLUTION/SOFTWARE PRICING ANALYSIS

5.3.7 MARKET: PORTER’S FIVE FORCES

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS OF MARKET

5.3.8 CASE STUDIES

5.3.9 IMPACT OF DISRUPTIVE TECHNOLOGIES

5.3.9.1 Internet of Things

5.3.9.2 Artificial Intelligence and Machine Learning

5.3.9.3 Building Information Modeling

5.3.9.4 Cloud Computing

5.3.9.5 Big Data Analytics

5.3.10 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 9 SMART BUILDINGS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.4 COVID-19 MARKET OUTLOOK FOR THE MARKET

TABLE 10 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 11 SMART BUILDING SOLUTIONS: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.4.1 CUMULATIVE GROWTH ANALYSIS

TABLE 12 MARKET: CUMULATIVE GROWTH ANALYSIS

6 SMART BUILDINGS MARKET, BY COMPONENT (Page No. - 77)

6.1 INTRODUCTION

FIGURE 31 SMART BUILDING SOLUTIONS TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 14 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

6.2.1 NEED TO OPTIMIZE THE CAPABILITY BUILDING EQUIPMENT AND SYSTEMS DRIVES THE DEMAND FOR SMART BUILDING SOLUTIONS

6.2.2 SOLUTIONS: MARKET DRIVERS

6.2.3 SOLUTIONS: COVID-19 IMPACT

TABLE 15 SMART BUILDING SOLUTIONS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 SMART BUILDING SOLUTIONS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: SMART BUILDINGS MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

TABLE 17 SMART BUILDING SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 SMART BUILDING SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

FIGURE 32 IMPLEMENTATION SERVICES TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 19 SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 20 SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

6.3.3 CONSULTING

6.3.3.1 Need for awareness of the compliance requirements of smart buildings drives the need for consulting services

TABLE 21 SMART BUILDING CONSULTING SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 SMART BUILDING CONSULTING SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.4 IMPLEMENTATION

6.3.4.1 Need for efficiency and sustainability by installing intelligent systems drives the demand for implementation services

TABLE 23 SMART BUILDING IMPLEMENTATION SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 SMART BUILDING IMPLEMENTATION SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.5 SUPPORT AND MAINTENANCE

6.3.5.1 Regular assessment of building assets ensures asset uptime and enhancing asset life cycle

TABLE 25 SMART BUILDING SUPPORT AND MAINTENANCE SERVICES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 SMART BUILDING SUPPORT AND MAINTENANCE SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 SMART BUILDINGS MARKET, BY SOLUTION (Page No. - 86)

7.1 INTRODUCTION

7.1.1 SOLUTIONS: COVID-19 IMPACT

FIGURE 33 SAFETY AND SECURITY MANAGEMENT SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 27 SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 28 SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.1.2 BUILDING INFRASTRUCTURE MANAGEMENT

7.1.2.1 Digital and technological disruptions drive the demand for futuristic building infrastructure

7.1.2.2 Building infrastructure management: Smart buildings market drivers

TABLE 29 SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 31 SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 32 SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.1.2.3 Parking management system

TABLE 33 SMART BUILDING PARKING MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 SMART BUILDING PARKING MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.1.2.4 Smart water management system

TABLE 35 SMART BUILDING WATER MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 SMART WATER MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.1.2.5 Elevators and escalators management system

TABLE 37 SMART BUILDING ELEVATORS AND ESCALATORS MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 SMART BUILDING ELEVATORS AND ESCALATORS MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.1.3 SAFETY AND SECURITY MANAGEMENT

7.1.3.1 Safety and security management solutions help enterprises achieve increased business productivity and risk management

7.1.3.2 Safety and security management: Smart buildings market drivers

TABLE 39 SMART BUILDING SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 SMART BUILDING SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 41 SMART BUILDING SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 42 SMART BUILDING SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.1.3.3 Access control system

TABLE 43 SMART BUILDING ACCESS CONTROL SYSTEM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 SMART BUILDING ACCESS CONTROL SYSTEM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.1.3.4 Video surveillance system

TABLE 45 SMART BUILDING VIDEO SURVEILLANCE SYSTEM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 SMART BUILDING VIDEO SURVEILLANCE SYSTEM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.1.3.5 Fire and life safety system

TABLE 47 SMART BUILDING FIRE AND LIFE SAFETY SYSTEM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 SMART BUILDING FIRE AND LIFE SAFETY SYSTEM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.1.4 ENERGY MANAGEMENT

7.1.4.1 Buildings are becoming more sustainable and energy-efficient through the optimization of infrastructure

7.1.4.2 Energy management: Smart buildings market drivers

TABLE 49 SMART BUILDING ENERGY MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 SMART BUILDING ENERGY MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 SMART BUILDING ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 52 SMART BUILDING ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.1.4.3 HVAC control system

TABLE 53 SMART BUILDING HVAC CONTROL SYSTEM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 SMART BUILDING HVAC CONTROL SYSTEM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.1.4.4 Lighting management system

TABLE 55 SMART BUILDING LIGHTING MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 SMART BUILDING LIGHTING MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.1.5 NETWORK MANAGEMENT

7.1.5.1 High-performance network management solutions play a crucial role in increasing bandwidth and eliminating network downtime

7.1.5.2 Network management: Smart buildings market drivers

TABLE 57 SMART BUILDING NETWORK MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 SMART BUILDING NETWORK MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 59 SMART BUILDING NETWORK MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 60 SMART BUILDING NETWORK MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.1.5.3 Wired technology

TABLE 61 MAJOR WIRED COMMUNICATION PROTOCOLS FOR SMART BUILDINGS

7.1.5.4 Wireless technology

TABLE 62 MAJOR WIRELESS COMMUNICATION TECHNOLOGY FOR SMART BUILDING

7.1.6 INTEGRATED WORKPLACE MANAGEMENT SYSTEM

7.1.6.1 IWMS provides an extensive range of facility management tools under a single, unified software platform

7.1.6.2 Integrated workplace management system: Smart buildings market drivers

TABLE 63 SMART BUILDING INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 SMART BUILDING INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 65 SMART BUILDING INTEGRATED WORKPLACE MANAGEMENT SYSTEM MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 66 SMART BUILDING INTEGRATED WORKPLACE MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.1.6.3 Operations and services management

7.1.6.4 Real estate management

7.1.6.5 Environmental and energy management

7.1.6.6 Facility management

7.1.6.7 Capital project management

8 SMART BUILDINGS MARKET, BY BUILDING TYPE (Page No. - 110)

8.1 INTRODUCTION

FIGURE 34 COMMERCIAL SMART BUILDINGS TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 67 MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 68 MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

8.2 RESIDENTIAL

8.2.1 DIGITAL SOLUTIONS PROVIDE REAL-TIME MONITORING OF PHYSICAL PARAMETERS TO ENSURE OCCUPANT COMFORT AND HEALTHIER SPACE

8.2.2 RESIDENTIAL: MARKET DRIVERS

8.2.3 RESIDENTIAL: COVID-19 IMPACT

TABLE 69 RESIDENTIAL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 RESIDENTIAL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 COMMERCIAL

8.3.1 SMART BUILDING SOLUTIONS ASSIST IN OBSERVING AND OPTIMIZING OPERATIONS, INVENTORIES, AND COORDINATION

8.3.2 COMMERCIAL: SMART BUILDINGS MARKET DRIVERS

8.3.3 COMMERCIAL: COVID-19 IMPACT

TABLE 71 COMMERCIAL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 COMMERCIAL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 INDUSTRIAL

8.4.1 INDUSTRIES CAN REDUCE EMISSIONS TO ACHIEVE SUSTAINABILITY GOALS USING SMART BUILDING SOLUTIONS

8.4.2 INDUSTRIAL: MARKET DRIVERS

8.4.3 INDUSTRIAL: COVID-19 IMPACT

TABLE 73 INDUSTRIAL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 INDUSTRIAL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 SMART BUILDINGS MARKET, BY REGION (Page No. - 117)

9.1 INTRODUCTION

FIGURE 35 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 75 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: MARKET DRIVERS

9.2.2 NORTH AMERICA: COVID-19 IMPACT

9.2.3 NORTH AMERICA: REGULATORY NORMS

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 77 NORTH AMERICA: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 84 NORTH AMERICA: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.2.4 UNITED STATES

9.2.4.1 Government initiatives and awareness plans for energy-efficient and cost-effective smart buildings to drive market growth in the US

TABLE 93 UNITED STATES: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 95 UNITED STATES: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 96 UNITED STATES: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 97 UNITED STATES: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 98 UNITED STATES: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 100 UNITED STATES: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

9.2.5 CANADA

9.2.5.1 Use of smart technologies and smart building solutions and services to drive market growth in Canada

TABLE 101 CANADA: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 102 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 103 CANADA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 CANADA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 CANADA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 106 CANADA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 107 CANADA: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 108 CANADA: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: MARKET DRIVERS

9.3.2 EUROPE: COVID-19 IMPACT

9.3.3 EUROPE: REGULATORY NORMS

TABLE 109 EUROPE: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 111 EUROPE: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 112 EUROPE: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 113 EUROPE: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 114 EUROPE: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 115 EUROPE: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 116 EUROPE: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 117 EUROPE: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 118 EUROPE: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 119 EUROPE: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 120 EUROPE: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.3.4 UNITED KINGDOM

9.3.4.1 Government initiatives to improve energy performance and create employment opportunities to drive market growth in the UK

TABLE 125 UNITED KINGDOM: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 126 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 127 UNITED KINGDOM: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 128 UNITED KINGDOM: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 129 UNITED KINGDOM: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 130 UNITED KINGDOM: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 131 UNITED KINGDOM: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 132 UNITED KINGDOM: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

9.3.5 GERMANY

9.3.5.1 Rise in demand for HVAC and lighting control systems to boost the growth of the smart buildings market in Germany

TABLE 133 GERMANY: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 134 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 135 GERMANY: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 136 GERMANY: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 137 GERMANY: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 138 GERMANY: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 139 GERMANY: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 140 GERMANY: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: MARKET DRIVERS

9.4.2 ASIA PACIFIC: COVID-19 IMPACT

9.4.3 ASIA PACIFIC: REGULATORY NORMS

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 141 ASIA PACIFIC: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 144 ASIA PACIFIC: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 146 ASIA PACIFIC: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 148 ASIA PACIFIC: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 150 ASIA PACIFIC: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 152 ASIA PACIFIC: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.4.4 CHINA

9.4.4.1 Rapid urbanization and modernization pressure the construction industry to work faster and on newer designs

TABLE 157 CHINA: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 158 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 159 CHINA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 160 CHINA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 161 CHINA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 162 CHINA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 163 CHINA: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 164 CHINA: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

9.4.5 JAPAN

9.4.5.1 Active government support and rapid growing construction sector to drive the market growth in Japan

9.4.6 AUSTRALIA

9.4.6.1 Investment in smart buildings by government and property owners to drive the market growth in Australia

9.4.7 REST OF ASIA PACIFIC

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: SMART BUILDINGS MARKET DRIVERS

9.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

9.5.3 MIDDLE EAST AND AFRICA: REGULATORY NORMS

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.5.4 UNITED ARAB EMIRATES

9.5.4.1 Shifting focus from oil to construction activities increased domestic and foreign investments in the commercial sector in the UAE

TABLE 181 UNITED ARAB EMIRATES: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 182 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 183 UNITED ARAB EMIRATES: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 184 UNITED ARAB EMIRATES: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 185 UNITED ARAB EMIRATES: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 186 UNITED ARAB EMIRATES: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 187 UNITED ARAB EMIRATES: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 188 UNITED ARAB EMIRATES: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

9.5.5 KINGDOM OF SAUDI ARABIA

9.5.5.1 Development of commercial projects and refurbishment of existing buildings to drive the market growth in the KSA

9.5.6 REST OF THE MIDDLE EAST AND AFRICA

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: SMART BUILDINGS MARKET DRIVERS

9.6.2 LATIN AMERICA: COVID-19 IMPACT

9.6.3 LATIN AMERICA: REGULATORY NORMS

TABLE 189 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 191 LATIN AMERICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 192 LATIN AMERICA: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 193 LATIN AMERICA: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 194 LATIN AMERICA: SMART BUILDING INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 195 LATIN AMERICA: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 196 LATIN AMERICA: SMART BUILDINGS SAFETY AND SECURITY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 197 LATIN AMERICA: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 198 LATIN AMERICA: SMART BUILDINGS ENERGY MANAGEMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 199 LATIN AMERICA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 200 LATIN AMERICA: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.6.4 BRAZIL

9.6.4.1 Need for sustainable and efficient infrastructure with reduced energy consumption to drive the market growth in this region

TABLE 205 BRAZIL: SMART BUILDINGS MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 206 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 207 BRAZIL: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 208 BRAZIL: SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 209 BRAZIL: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 210 BRAZIL: SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 211 BRAZIL: MARKET SIZE, BY BUILDING TYPE, 2017–2020 (USD MILLION)

TABLE 212 BRAZIL: MARKET SIZE, BY BUILDING TYPE, 2021–2026 (USD MILLION)

9.6.5 MEXICO

9.6.5.1 Highest concentration of LEED buildings and significant shift toward green building and sustainability to drive the market growth in Mexico

9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 173)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES

TABLE 213 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE SMART BUILDINGS MARKET

10.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 214 MARKET: DEGREE OF COMPETITION

10.4 REVENUE ANALYSIS

FIGURE 38 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018–2020 (USD MILLION)

10.5 KEY COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 39 KEY SMART BUILDING MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

10.6 COMPETITIVE BENCHMARKING

TABLE 215 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

TABLE 216 MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

TABLE 217 SMART BUILDINGS MARKET: DETAILED LIST OF KEY STARTUP/SMES

10.7 STARTUP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 40 STARTUP/SME SMART BUILDING MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES

TABLE 218 PRODUCT LAUNCHES, SEPTEMBER 2019–APRIL 2021

10.8.2 DEALS

TABLE 219 DEALS, APRIL 2020–JANUARY 2022

10.8.3 OTHERS

TABLE 220 OTHERS, SEPTEMBER 2019–MAY 2021

11 COMPANY PROFILES (Page No. - 186)

11.1 MAJOR PLAYERS

(Business Overview, Products offered, Response to COVID-19, Recent Developments, MnM View)*

11.1.1 CISCO

TABLE 221 CISCO: BUSINESS OVERVIEW

FIGURE 41 CISCO: FINANCIAL OVERVIEW

TABLE 222 CISCO: PRODUCTS OFFERED

TABLE 223 CISCO: PRODUCT LAUNCHES

TABLE 224 CISCO: DEALS

TABLE 225 CISCO: OTHERS

11.1.2 IBM

TABLE 226 IBM: BUSINESS OVERVIEW

FIGURE 42 IBM: FINANCIAL OVERVIEW

TABLE 227 IBM: PRODUCTS OFFERED

TABLE 228 IBM: PRODUCT LAUNCHES

TABLE 229 IBM: DEALS

11.1.3 HONEYWELL

TABLE 230 HONEYWELL: BUSINESS OVERVIEW

FIGURE 43 HONEYWELL: FINANCIAL OVERVIEW

TABLE 231 HONEYWELL: PRODUCTS OFFERED

TABLE 232 HONEYWELL: PRODUCT LAUNCHES

TABLE 233 HONEYWELL: DEALS

11.1.4 SIEMENS

TABLE 234 SIEMENS: BUSINESS OVERVIEW

FIGURE 44 SIEMENS: FINANCIAL OVERVIEW

TABLE 235 SIEMENS: PRODUCTS OFFERED

TABLE 236 SIEMENS: PRODUCT LAUNCHES

TABLE 237 SIEMENS: DEALS

11.1.5 JOHNSON CONTROLS

TABLE 238 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 45 JOHNSON CONTROLS: FINANCIAL OVERVIEW

TABLE 239 JOHNSON CONTROLS: PRODUCTS OFFERED

TABLE 240 JOHNSON CONTROLS: PRODUCT LAUNCHES

TABLE 241 JOHNSON CONTROLS: DEALS

11.1.6 HUAWEI

TABLE 242 HUAWEI: BUSINESS OVERVIEW

FIGURE 46 HUAWEI: FINANCIAL OVERVIEW

TABLE 243 HUAWEI: PRODUCTS OFFERED

TABLE 244 HUAWEI: PRODUCT LAUNCHES

TABLE 245 HUAWEI: DEALS

11.1.7 INTEL

TABLE 246 INTEL: BUSINESS OVERVIEW

FIGURE 47 INTEL: FINANCIAL OVERVIEW

11.1.7.2 Products offered

TABLE 247 INTEL: PRODUCTS OFFERED

11.1.7.3 Recent developments

TABLE 248 INTEL: PRODUCT LAUNCHES

TABLE 249 INTEL: DEALS

TABLE 250 INTEL: OTHERS

11.1.8 PTC

TABLE 251 PTC: BUSINESS OVERVIEW

FIGURE 48 PTC: FINANCIAL OVERVIEW

TABLE 252 PTC: PRODUCTS OFFERED

TABLE 253 PTC: PRODUCT LAUNCHES

TABLE 254 PTC: DEALS

11.1.9 ABB

TABLE 255 ABB: BUSINESS OVERVIEW

FIGURE 49 ABB: FINANCIAL OVERVIEW

TABLE 256 ABB: PRODUCTS OFFERED

TABLE 257 ABB: PRODUCT LAUNCHES

TABLE 258 ABB: DEALS

11.1.10 HITACHI

TABLE 260 HITACHI: PRODUCTS OFFERED

TABLE 261 HITACHI: PRODUCT LAUNCHES

TABLE 262 HITACHI: DEALS

TABLE 263 HITACHI: OTHERS

11.1.11 SCHNEIDER ELECTRIC

TABLE 264 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 51 SCHNEIDER ELECTRIC: FINANCIAL OVERVIEW

TABLE 265 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 266 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 267 SCHNEIDER ELECTRIC: DEALS

11.1.12 TELIT

TABLE 268 TELIT: BUSINESS OVERVIEW

FIGURE 52 TELIT: FINANCIAL OVERVIEW

TABLE 269 TELIT: PRODUCTS OFFERED

TABLE 270 TELIT: PRODUCT LAUNCHES

TABLE 271 TELIT: DEALS

11.1.13 LEGRAND

TABLE 272 LEGRAND: BUSINESS OVERVIEW

FIGURE 53 LEGRAND: FINANCIAL OVERVIEW

TABLE 273 LEGRAND: PRODUCTS OFFERED

TABLE 274 LEGRAND: PRODUCT LAUNCHES

TABLE 275 LEGRAND: DEALS

11.1.14 BOSCH

TABLE 276 BOSCH: BUSINESS OVERVIEW

FIGURE 54 BOSCH: FINANCIAL OVERVIEW

TABLE 277 BOSCH: PRODUCTS OFFERED

TABLE 278 BOSCH: PRODUCT LAUNCHES

TABLE 279 BOSCH: DEALS

*Details on Business Overview, Products offered &, Key Insights, Response to COVID-19, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.2 STARTUPS/SMES

11.2.1 KMC CONTROLS

11.2.2 VERDIGRIS TECHNOLOGIES

11.2.3 AQUICORE

11.2.4 75F

11.2.5 BUILDINGIQ

11.2.6 ENTOUCH

11.2.7 GAIA

11.2.8 SOFTDEL

11.2.9 MODE: GREEN

11.2.10 COPPERTREE ANALYTICS

11.2.11 SPACETI

11.2.12 IGOR

11.2.13 EFACILITY

11.2.14 SPACEWELL

12 ADJACENT/RELATED MARKETS (Page No. - 272)

12.1 SMART CITIES MARKET

12.1.1 MARKET DEFINITION

12.1.2 MARKET OVERVIEW

12.1.3 SMART CITIES MARKET, BY FOCUS AREA

TABLE 280 SMART CITIES MARKET SIZE, BY FOCUS AREA, 2016–2020 (USD BILLION)

TABLE 281 SMART CITIES MARKET SIZE, BY FOCUS AREA, 2021–2026 (USD BILLION)

12.1.4 SMART TRANSPORTATION MARKET, BY COMPONENT

TABLE 282 SMART TRANSPORTATION MARKET SIZE, BY COMPONENT, 2016–2020 (USD BILLION)

TABLE 283 SMART TRANSPORTATION MARKET SIZE, BY COMPONENT, 2021–2026 (USD BILLION)

TABLE 284 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 285 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 286 SMART TRANSPORTATION MARKET SIZE, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 287 SMART TRANSPORTATION MARKET SIZE, BY SERVICE, 2021–2026 (USD BILLION)

12.1.5 SMART TRANSPORTATION MARKET, BY TYPE

TABLE 288 SMART TRANSPORTATION MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 289 SMART TRANSPORTATION MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

12.1.6 SMART BUILDINGS MARKET, BY SOLUTION

TABLE 290 SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 291 SMART BUILDING SOLUTIONS MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

12.1.7 MARKET, BY SERVICE

TABLE 292 SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 293 SMART BUILDING SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

12.1.8 SMART UTILITIES MARKET, BY COMPONENT

TABLE 294 SMART UTILITIES MARKET SIZE, BY COMPONENT, 2016–2020 (USD BILLION)

TABLE 295 SMART UTILITIES MARKET SIZE, BY COMPONENT, 2021–2026 (USD BILLION)

TABLE 296 SMART UTILITIES MARKET SIZE, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 297 SMART UTILITIES MARKET SIZE, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 298 SMART UTILITIES MARKET SIZE, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 299 SMART UTILITIES MARKET SIZE, BY SERVICE, 2021–2026 (USD BILLION)

12.1.9 SMART UTILITIES MARKET, BY TYPE

TABLE 300 SMART UTILITIES MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 301 SMART UTILITIES MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

12.1.10 SMART CITIZEN SERVICES MARKET, BY TYPE

TABLE 302 SMART CITIZEN SERVICES MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 303 SMART CITIZEN SERVICES MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

12.2 FACILITY MANAGEMENT MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.3 FACILITY MANAGEMENT MARKET, BY COMPONENT

TABLE 304 FACILITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 305 FACILITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 306 FACILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2016–2020 (USD MILLION)

TABLE 307 FACILITY MANAGEMENT MARKET SIZE, BY SOLUTION, 2021–2026 (USD MILLION)

TABLE 308 FACILITY MANAGEMENT MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 309 FACILITY MANAGEMENT MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

12.2.4 FACILITY MANAGEMENT MARKET, BY DEPLOYMENT TYPE

TABLE 310 FACILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 311 FACILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

12.2.5 FACILITY MANAGEMENT MARKET, BY ORGANIZATION SIZE

TABLE 312 FACILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 313 FACILITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

12.2.6 FACILITY MANAGEMENT MARKET, BY VERTICAL

TABLE 314 FACILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 315 FACILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

12.2.7 FACILITY MANAGEMENT MARKET, BY REGION

TABLE 316 FACILITY MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 317 FACILITY MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.3 BUILDING ANALYTICS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 BUILDING ANALYTICS MARKET, BY APPLICATION

TABLE 318 BUILDING ANALYTICS MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

12.3.4 BUILDING ANALYTICS MARKET, BY OFFERING

TABLE 319 BUILDING ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 320 BUILDING ANALYTICS SOFTWARE MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 321 BUILDING ANALYTIC SERVICES MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 322 BUILDING ANALYTIC SERVICES MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

TABLE 323 MANAGED SERVICES MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 324 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 325 PROFESSIONAL SERVICES MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

12.3.5 BUILDING ANALYTICS MARKET, BY DEPLOYMENT MODE

TABLE 326 BUILDING ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2016–2023 (USD MILLION)

TABLE 327 ON-PREMISE BUILDING ANALYTICS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 328 CLOUD BUILDING ANALYTICS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

12.3.6 BUILDING ANALYTICS MARKET, BY BUILDING TYPE

TABLE 329 BUILDING ANALYTICS MARKET SIZE, BY BUILDING TYPE, 2016–2023 (USD MILLION)

12.3.7 BUILDING ANALYTICS MARKET, BY REGION

TABLE 330 BUILDING ANALYTICS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

13 APPENDIX (Page No. - 295)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

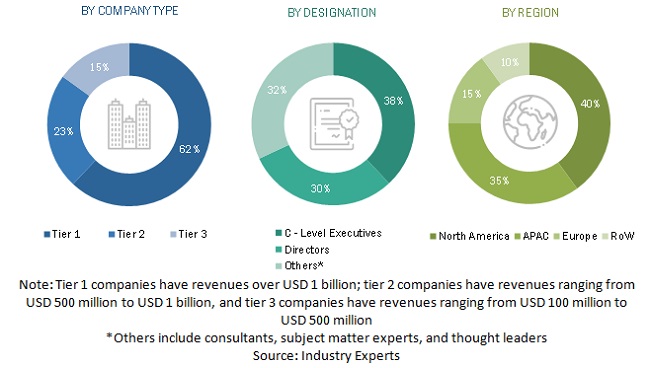

The study involved four major activities in estimating the current size of the Smart Buildings market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. These secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Primary Research

Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Smart Buildings market. The primary sources from the demand side included Smart Buildings end users, network administrators/consultants/specialists, Chief Information Officers (CIOs) and subject-matter experts from enterprises and government associations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global Smart Buildings market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

In the bottom-up approach, the key companies offering Smart Buildings solutions and services were identified. After confirming these companies through primary interviews with industry experts, their total revenue was estimated through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenue of these companies from Business Units (BUs) that offer Smart Buildings was identified through similar sources. Then through primaries, the data on revenue generated through specific Smart Buildings components was collected.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the size of the Smart Buildings market by Component (solution, and services), building types, and regions, and analyze various macro and microeconomic factors that affect the market growth during the forecast period.

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and the Latin America.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To analyze the impact of COVID-19 on the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the Smart Buildings market.

- To profile key market players, including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and provide a detailed competitive landscape of the market.

- To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market.

Intelligent Building Market & Its impact on Smart Buildings Market:

Intelligent Building Market and Smart Buildings Market are closely related as they both refer to the use of technology to improve the efficiency and functionality of buildings. The terms are often used interchangeably, although some experts may draw distinctions between them.

Intelligent Building typically refers to the integration of various building systems, such as HVAC, lighting, security, and energy management, into a single, centralized control system that can be managed and monitored in real-time. This centralized system can leverage advanced analytics and automation to optimize building performance, reduce energy consumption, and improve occupant comfort and safety.

Smart Buildings, on the other hand, is a broader term that encompasses the use of various technologies, such as IoT sensors, data analytics, and machine learning, to optimize building performance and enhance the occupant experience. Smart Buildings can include Intelligent Building systems, but they can also include other technologies such as smart parking, indoor navigation, and mobile apps for building occupants.

The Intelligent Building market is poised to have a significant impact on the Smart Buildings market, as it represents a key component of the overall Smart Buildings ecosystem. Intelligent Buildings, which refer to the integration of various building systems into a single, centralized control system, can help to optimize building performance, reduce energy consumption, and improve occupant comfort and safety. This, in turn, can drive the adoption of Smart Buildings technologies, which are designed to enhance the overall functionality and efficiency of buildings.

Futuristic growth use-cases of Intelligent Building Market:

- Energy Management: Intelligent Building systems can help to optimize energy consumption by integrating various building systems, such as lighting, HVAC, and energy storage, into a single, centralized control system. This can help to reduce energy waste and lower energy costs.

- Predictive Maintenance: By leveraging advanced analytics and machine learning algorithms, Intelligent Building systems can predict when building equipment is likely to fail and schedule maintenance proactively. This can help to reduce downtime and extend the lifespan of building equipment.

- Occupant Comfort and Safety: Intelligent Building systems can monitor and adjust building conditions, such as temperature, lighting, and air quality, to ensure optimal comfort for occupants. They can also monitor building security and safety systems to detect potential threats and alert building managers in real-time.

- Space Optimization: Intelligent Building systems can monitor space usage and occupancy patterns to optimize space utilization and improve the overall efficiency of buildings. This can help to reduce costs associated with unused or underutilized space.

- Integration with Smart City Infrastructure: Intelligent Building systems can be integrated with smart city infrastructure, such as public transportation and energy grids, to optimize building operations and reduce energy consumption. This can help to create a more sustainable and connected urban environment.

Overall, the Intelligent Building Market is expected to play a key role in the development of smart cities and the transition to a more sustainable and efficient built environment.

Some of the top companies in Intelligent Building Market are Siemens AG, Honeywell International, Schneider Electric SE, Johnson Controls International plc, United Technologies Corporation, Cisco Systems, IBM Corporation, ABB, Legrand SA, Carrier Corporation.

New business opportunities in Intelligent Building Market:

- Integrated Building Management Systems (IBMS): IBMS is a system that integrates all building automation systems into one centralized platform, providing a holistic view of the building's performance. The IBMS market is expected to grow due to the increasing demand for energy-efficient and sustainable buildings.

- Smart Lighting Systems: Smart lighting systems use sensors and controls to adjust lighting levels based on occupancy and natural light availability. The market for smart lighting systems is expected to grow due to the increasing demand for energy-efficient and cost-effective lighting solutions.

- Energy Management Systems: Energy management systems are used to monitor, control, and optimize energy consumption in buildings. The market for energy management systems is expected to grow due to the increasing demand for energy-efficient buildings and the need to reduce carbon emissions.

- Building Analytics: Building analytics uses data analytics to optimize building performance and reduce energy consumption. The market for building analytics is expected to grow due to the increasing demand for energy-efficient buildings and the need to reduce operational costs.

- Internet of Things (IoT) in Building Automation: IoT is being integrated into building automation systems, allowing for remote monitoring and control of building systems. The market for IoT in building automation is expected to grow due to the increasing demand for smart buildings and the need for real-time monitoring and control of building systems.

- Building Information Modeling (BIM): BIM is a digital representation of a building that allows for improved collaboration and communication between building stakeholders. The market for BIM is expected to grow due to the increasing demand for sustainable and energy-efficient buildings.

Overall, the Intelligent Building Market presents a range of new business opportunities, including integrated building management systems, smart lighting systems, energy management systems, building analytics, IoT in building automation, and building information modeling.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Buildings Market

Insights about the report on type of smart buildings in whcih market for open integrated platform vendors

Understand the dymanics and market trends of applications such as Solar Energy, particularly being in a tropical country.

Market potential of Smart building within the Commercial building Plumbing and Water segment

understand the market dymnaics by Networking Technology especially in "wireless Technology" and market by Application especially in "Commercial Buildings".

Understanding the role of sensors that are used in smart and connected buildings.

Understand the SWOT analysis of vendors and insights about the BAS, BEMS, BCS in LATAM market.

Understand the SWOT analysis of vendors and insights about the BAS, BEMS, BCS in LATAM market.

Insights on Wireless Technology by Type such as ZigBee, Z-Wave and EnOcean.

Understand the SWOT analysis of vendors and insights about the BAS, BEMS, BCS in LATAM market.

Market potential from 2013 to 2018.

Scope and defination of various segments such as Building energy management system, Physical security system, Building communication systems, Plumbing and water management system, Parking management systems, Elevators and escalators management system.

Understanding the market potential of Smart building along with trends, forecasts by countries in Europe (with a specific focus on France).

Market potential of smart buildimng market in Finland and Nordics countries.

Understanding about Energy Management for a customer with several buildings and integrated with security systems

Recent growth factors and market size specific to MEA Region for Smart Buildings Market

Understanding the market potential of smart buildings