Surveillance Radars Market Size, Share & Industry Growth Analysis Report by Application (Commercial, National Security, Defense & Space), Platform (Land, Airborne, Naval, Space), Frequency Band (HF, UHF & VHF; L; S; C; X; Ku; Ka; Multi-bands), Dimension, Component, Region (2020-2025)

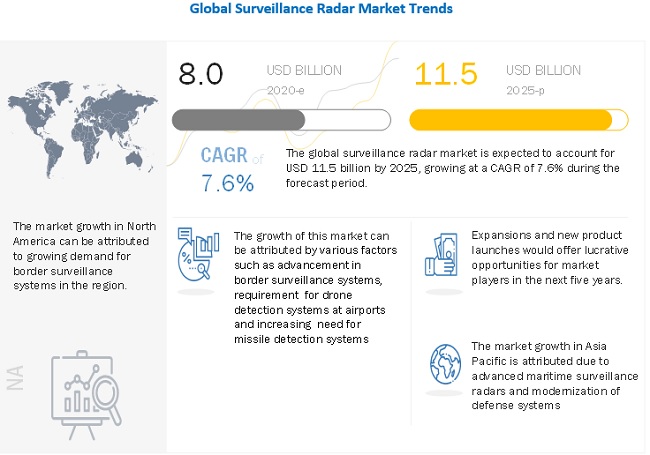

The Global Surveillance Radars Market size is projected to grow from USD 8.0 billion in 2020 to USD 11.5 billion by 2025, at a CAGR of 7.6% from 2020 to 2025. The Surveillance Radars Industry is driven by various factors, such as the advancement in border surveillance systems, ongoing military modernizations, demand for border surveillance, and the need for advanced air defense systems among others.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Surveillance Radars Market

The Surveillance Radars market includes major players Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Hensoldt (Germany), Israel Aerospace Industries Ltd. (Israel), and Leonardo S.p.A (Italy). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East & Africa, and South America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 could affect Surveillance Radar production and services by 3% ot 5% globally in 2020.

The rapid spread of COVID-19 in Europe, the US & Asia Pacific has led to a significant drop in demand for Surveillance Radars globally, with a corresponding reduction in revenues for various suppliers, service providers across all markets owing to late delivery, manufacturing shutdown, the limited staff at manufacturing facilities, and limited availability of equipment. As per industry experts, the global Surveillance Radar demand is anticipated to recover by 2023 fully.

Surveillance Radar Market Dynamics

Driver: Advancement in border surveillance systems

Border surveillance systems have evolved with time and are still undergoing major advancements, such as the use of autonomous drones and acoustic radar technology. Man-portable ground surveillance radars for border security have enabled various countries to secure their borders more efficiently. These surveillance radars are deployed in strategic locations to increase detection rates.

State-of-the-art surveillance radars with low false alarms have led countries with border disputes, drug trafficking problems, and illegal immigration to rely on these advanced radars to assist in border protection.

According to an article published by CNET in February 2019, the US government is considering a spending bill worth USD 100 million to fund the installation of border surveillance systems, such as fixed towers, remote video surveillance systems, and mobile surveillance systems, on its northern border.

Driver: Requirement for drone detection systems at airports

Drones pose a security threat to airports, aircraft, and passengers. Advancements in the drone stealth technology can further maximize the threat level as stealth drones could get past conventional surveillance radar systems. There have been incidents of unidentified drones flying within an airport’s restricted airspace over the past years, causing airports to ground all flights as a security measure, thus leading to economic losses for the airlines. For example, such an incident at Gatwick Airport (UK) in December 2018 compelled the airport to suspend all incoming and outgoing flights for over 24 hours. During the temporary shut-down, a total of 760 flights containing approximately 110,000 passengers were delayed. According to an article published by The Verge in December 2018, there have been 13 such incidents recorded across the US, Switzerland, Germany, Austria, New Zealand, and the UK.

Therefore, the need for surveillance radars with advanced drone detection capabilities is driving the surveillance radars market. Airspace security companies have suggested the use of a combination of radar, camera detection, radio frequency detection, and jamming technologies by airports to shut down illegal drone flights.

Opportunity: Increased investments in advanced surveillance technologies

There is an increasing demand from defense forces for technologically-advanced warfare systems. Governments worldwide are focused on the development of stealth aircraft, but, at the same time, they are also investing heavily in advanced surveillance systems to counter stealth technology.

Research is being conducted on technologies such as quantum radars and how they can be used for surveillance. According to an article published by China Daily in September 2018, quantum radars transmit subatomic particles, instead of radio waves, when searching for targets. They are not affected by radar-absorbent materials and low-signature designs. These radars are not fooled by traditional radar-jamming tactics and, hence, can be adopted in missile defense and space exploration in the future.

Therefore mentioned government investments are, therefore, expected to significantly contribute to the growth of the surveillance radars market during the forecast period.

Opportunity: Lightweight radars for aerial vehicles

The mounting of surveillance radars on helicopters and other such aerial vehicles is a relatively new phenomenon. There is a tremendous opportunity for manufacturers to innovate and design new radars for surveillance. Leonardo (Italy) has developed a multi-mode surveillance radar that electronically scans 360 degrees without the use of a rotating antenna. According to the company, the new product, named Osprey, is the world’s first lightweight e-scan system with no moving parts. The radar is attached to a helicopter and is currently in use by the Royal Norwegian Air Force and two undisclosed customers from the US.

Challenge: Regulatory challenges for sales to overseas customers

Defense companies need to comply with various rules and regulations laid down by their respective governments related to the sale of products and services. A non-compliance on any regulation could result in severe consequences, including the imposition of fines and penalties, termination of the whole contract, and civil or criminal investigations.

Reverse engineering of weapons and systems can enable terrorists to manufacture weapons equipped with advanced technologies, thus causing loss to lives and properties. To avoid such a scenario, various sanctions are placed on manufacturers to curtail the type and amount of technologies they can sell to foreign countries. Geopolitical unrest strains trade relations between countries. Some countries may impose trade restrictions on their domestic companies, forbidding them to export defense products to countries with whom they have ongoing disputes.

Challenge: Extreme weather conditions hampering the accuracy of surveillance radars

Collecting information in extreme weather conditions is a crucial factor for military operations. High dependency is placed on aerial applications to collect information on targets. However, intelligence gathering through the aerial platform is severely degraded in adverse weather conditions.

Ground-based surveillance radars face similar problems and cannot reliably detect targets when weather conditions are adverse. Therefore, in areas where extreme weather conditions exist, it is not possible to fully rely on surveillance radars for accurate information.

To know about the assumptions considered for the study, download the pdf brochure

Digital Signal Processors segment is expected to witness the largest market share during the forecast period

The surveillance radars market has been segmented based on component into antenna, transmitter, power amplifier, duplexer, receiver, display, digital signal processor, and stabilization system. Antennas are classified into parabolic, slotted waveguide, and scanned array, whereas transmitters are classified into microwave tube-based transmitter and solid-state. By Component, Digital Signal Processors is expected to have the largest market share during the forecasted period. Digital signal processor acts as a computer, which performs all the command and control operations by performing signal processing. Earlier, systems used analog signal processing techniques. The new digital signal processing uses high-end processors, such as Field Programmable Gated Array (FPGA), Graphics Processing Unit (GPU), and general-purpose processors.

3D segment is expected to witness the largest market share during the forecast period

The 3D is estimated to be the largest and fastest-growing segment in the Surveillance Radar market. T3D surveillance radars overcome the challenges faced by 2D radars. 3D radars use active electronically scanned arrays, with digital beamforming capabilities. These radars are critical for air defense, and for applications which require precise coordinates of a target to be gathered. Some 3D radars use stacked beams for surveillance. Digital beamforming technique has enabled 3D surveillance radars to become more advanced.

Saab AB (Sweden) offers portable 3D radars for short-range air surveillance. Giraffe 1X is a lightweight 3D radar, which can be integrated on multiple mobile platforms and can be used to track drones and provide a warning against incoming rocket, artillery, and mortar rounds. The radar is capable of classifying 100 different targets simultaneously.

By Anteena segment, active scanned array antennas subsegment is projected to lead the antennas segment of the surveillance radars market

Antennas are divided into parabolic, slotted waveguide, planer phased array, and scanned array. Scanned array antennas can be further divided into active and passive. The active scanned array antennas subsegment is projected to lead the antennas segment of the surveillance radars market from 2020 to 2025. This growth can be attributed to the rising demand for active scanned–array radars for border security.

The Ku-band segment is projected to witness a higher CAGR during the forecast period

Based on the frequency band, the Ku-band segment is projected to grow at the highest CAGR during the forecast period. Ka-bands provide a wide beam coverage and a higher throughput in comparison with lower bands. They suffer from rain fading, due to the absorption of electromagnetic waves by the rain. Blighter Surveillance Systems (UK) offers the Revolution 360 Radar, which uses Ku-band for the detection of targets. It operates in a fast-scan mode to achieve a full 360° coverage in 20 seconds.

In 2018, the US Army awarded a contract to the Raytheon Group for the development of a multi-mission radar system (KuFRS) based on Ku-band frequency. This radar system is capable of delivering precision firepower along with many other functions, including early detection of various threats.

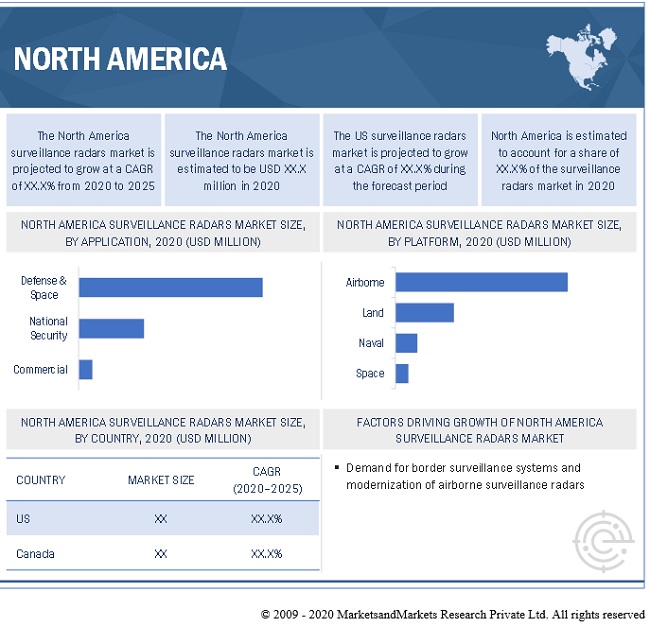

The North America market is projected to witness the highest market share from 2020 to 2025

The North America region of the Surveillance Radars market has the highest market share during the forecast period. The surveillance radars market in the North American region is expected to witness substantial growth during the forecast period due to the ongoing modernizations of aircraft, ships, border surveillance systems, among others. According to an article published in by The Intercept on 25th August 2019, the US Customs and Border Patrol (CBP) are planning to install 10 surveillance towers across the Arizona border under a USD 26 million contract with Elbit Systems (Israel). Cross-border conflicts, high illegal immigration rates, and drug trafficking have led to the US Homeland Security investing heavily in border security and detection systems. The US Customs and Border Protection has started installing surveillance towers across the Texas border.

To know about the assumptions considered for the study, download the pdf brochure

The Surveillance Radars market includes major players Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Hensoldt (Germany), Israel Aerospace Industries Ltd. (Israel), and Leonardo S.p.A (Italy).

Scope Of The Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 8.0 Billion |

|

Projected Market Size |

USD 11.5 Billion |

|

Growth Rate |

7.6% |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Application |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Hensoldt (Germany), Israel Aerospace Industries Ltd. (Israel), and Leonardo S.p.A (Italy). |

Surveillance Radars market by application

- Commercial

- Airspace Monitoring & Surveillance

- Airport Perimeter Security

- Critical Infrastructures

- Others

- National Security

- Border Surveillance

- Search & Rescue

- ISR

- Defense & Space

- Perimeter Security

- Isr & Battlefield Surveillance

- Military Space Assets & Hostile Satellites

- Air Defense

Surveillance Radars market by frequency band:

- HF/ VHF/UHF-bands

- L-bands

- S-bands

- C-bands

- X-bands

- Ku-bands

- Ka-bands

- Multi-band

Surveillance Radars market by component:

- Antennas

- Parabolic Reflector Antennas

- Slotted Waveguide Antennas

- Planar Phased Array Antennas

- Active Scanned Array Antennas

- Passive Scanned Array Antennas

- Transmitters

- Microwave Tube-Based Transmitters

- Solid-State Electronics

- Receivers

- Analog Receivers

- Digital Receivers

- Power Amplifiers

- Traveling Wave Tube Amplifiers (TWTA)

- Solid-State Power Amplifiers

- Gallium Arsenide (GAAS)

- Gallium Nitride (GAN)

- Duplexers

- Branch Type Duplexers

- Balanced Type Duplexers

- Circulator Duplexers

- Digital Signal Processor

- Stabilization System

- Circulator Duplexers

- Control Panels

- Graphic Panels

- Displays

- Other s

Surveillance Radars market by Waveform:

- Frequency modulated continuous wave (FMCW)

- Doppler

- Conventional Doppler Radar

- Pulse-Doppler Radar

- Ultrawide-band impulse

Surveillance Radars market by dimension:

- 2D

- 3D

- 4D

Surveillance Radars market by type:

- Battlefield Surveillance Radars

- Ground-Based Air Surveillance Radars

- Ground-based Space Surveillance Radars

- Coastal Surveillance Radars

- Airport Surveillance Radars

- Air to Ground Surveillance Radars

- Airborne Maritime Surveillance Radars

- Air-to-Air Surveillance Radars

- Shipborne Air Surveillance Radars

- Space-Based Synthetic Aperture Radars

Surveillance Radars market by platform:

- Land

- Fixed Installation

- Portable

- Naval

- Ships

- Unmanned Surface Vehicles

- Submarines

- Airborne

- Combact Aircraft

- Unmanned Aerial Vehicles

- Aerostats/Balloons

- Space

Surveillance Radars market by range:

- Short-Range surveillance radars

- Medium-Range surveillance radars

- Long-Range surveillance radars

- Very Short Range

- Very Long Range

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In November 2019, Leonardo received a contract to provide a RAT 31DL air defense radar system to the Royal Thai Air Force. The long-range radar is expected to be installed at a site in Samui to safeguard the country’s southern region.

- In July 2019, Lockheed Martin secured a contract worth USD 600 million from Northrop Grumman Corporation (US) for the supply of 24 APY-9 radars for the US Navy’s E-2D aircraft program.

- In March 2019, Raytheon secured a contract from an unnamed Middle Eastern nation for the supply of surveillance towers to help the nation secure its borders, military bases, and critical infrastructure.

- In January 2019, Hensoldt secured a contract worth USD 22.8 million from the Norwegian Coast Guard for the supply of the latest version of its TRS-3D naval radar and Monopulse Secondary Surveillance Radar (MSSR) 2000 I IFF system.

- In April 2019, Lockheed Martin and Raytheon (US) are jointly pursuing the US Federal Aviation Administration Spectrum Efficient National Surveillance Radar (SENSR) contract to modernize the US’ surveillance and air traffic control radars.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the Surveillance Radar market?

The Surveillance Radar market is expected to grow substantially owing to the increased demand for advancement in border surveillance systems has driven the market.

What are the key sustainability strategies adopted by leading players operating in the Surveillance Radar market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Surveillance Radar market. The major players Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Hensoldt (Germany), Israel Aerospace Industries Ltd. (Israel), and Leonardo S.p.A (Italy). these players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market further

What are the new emerging technologies and use cases disrupting the Surveillance RadarMarket?

Some of the major emerging technologies and use cases disrupting the market include broadband radar and multifunctional rf-systems and software defined radars.

Who are the key players and innovators in the ecosystem of the Surveillance Radar Market?

The key players in the Surveillance Radar market include Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Hensoldt (Germany), Israel Aerospace Industries Ltd. (Israel), and Leonardo S.p.A (Italy).

Which region is expected to hold the highest market share in theSurveillance Radar Market?

Surveillance Radar market in North America is projected to grow at the highest CAGR during the forecast period due to demand for Surveillance Radars in North America is being driven by the ongoing modernizations of aircraft, ships, border surveillance systems, among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKETS COVERED

1.3.1 REGIONAL SCOPE

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY & PRICING

TABLE 1 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 REPORT PROCESS FLOW

FIGURE 2 SURVEILLANCE RADARS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.2 MARKET DEFINITION & SCOPE

2.2.1 PRIMARY DATA

2.2.1.1 Key data from primary sources

2.2.1.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION & REGION

2.2.2 SEGMENT DEFINITIONS

2.2.2.1 Surveillance radars market, by application

2.2.2.2 Surveillance radar market, by frequency band

2.2.2.3 Surveillance radar market, by component

2.2.2.4 Surveillance radar market, by dimension

2.2.2.5 Surveillance radar market, by platform

2.2.2.6 Surveillance radar market, by range

2.2.2.7 Surveillance radar market, by waveform

2.2.2.8 Surveillance radars market, by type

2.3 MARKET SIZE ESTIMATION & METHODOLOGY

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.1 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.1.1 COVID-19 impact on the market analysis

2.4 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4.1 MARKET SIZING & FORECASTING

2.5 ASSUMPTIONS & ASSOCIATED RISKS

2.6 RISKS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 7 DEFENSE & SPACE SEGMENT PROJECTED TO LEAD SURVEILLANCE RADARS MARKET BY APPLICATION FROM 2020 TO 2025

FIGURE 8 X-BAND SEGMENT PROJECTED TO LEAD THE SURVEILLANCE RADAR MARKET BY FREQUENCY BAND FROM 2020 TO 2025

FIGURE 9 AIRBORNE SEGMENT PROJECTED TO LEAD THE SURVEILLANCE RADAR MARKET BY PLATFORM FROM 2020 TO 2025

FIGURE 10 DIGITAL SIGNAL PROCESSORS SEGMENT PROJECTED TO LEAD THE SURVEILLANCE RADARS MARKET BY COMPONENT FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE SURVEILLANCE RADARS MARKET

FIGURE 11 RISING DEMAND FOR BORDER SURVEILLANCE AND ONGOING MILITARY MODERNIZATION PROGRAMS ARE SOME OF THE MAJOR FACTORS DRIVING THE SURVEILLANCE RADARS MARKET

4.2 SURVEILLANCE RADARS MARKET IN NATIONAL SECURITY, BY TYPE

FIGURE 12 BORDER SURVEILLANCE SEGMENT PROJECTED TO LEAD THE SURVEILLANCE RADAR MARKET IN NATIONAL SECURITY FROM 2020 TO 2025

4.3 DEFENSE & SPACE SURVEILLANCE RADARS MARKET, BY TYPE

FIGURE 13 ISR & BATTLEFIELD SURVEILLANCE SEGMENT EXPECTED TO LEAD SURVEILLANCE RADAR MARKET IN DEFENSE & SPACE DURING FORECAST PERIOD

4.4 SURVEILLANCE RADARS MARKET FOR LAND, BY TYPE

FIGURE 14 PORTABLE SEGMENT PROJECTED TO LEAD THE SURVEILLANCE RADAR MARKET FOR LAND FROM 2020 TO 2025

4.5 SURVEILLANCE RADARS MARKET FOR NAVAL, BY TYPE

FIGURE 15 SHIPS SEGMENT PROJECTED TO LEAD THE SURVEILLANCE RADAR MARKET FOR NAVAL FROM 2019 TO 2025

4.6 SURVEILLANCE RADARS MARKET FOR AIRBORNE, BY TYPE

FIGURE 16 COMBAT AIRCRAFT SEGMENT IS EXPECTED TO LEAD THE SURVEILLANCE RADAR MARKET FOR AIRBORNE FROM 2019 TO 2025

4.7 SURVEILLANCE RADARS MARKET, BY REGION

FIGURE 17 SOUTH AMERICA IS PROJECTED TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 SURVEILLANCE RADARS MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Advancement in border surveillance systems

5.2.1.2 Requirement for drone detection systems at airports

5.2.1.3 Increasing need for missile detection systems

5.2.1.4 Advancement in radar technologies

5.2.1.5 Advancement in electronic warfare

5.2.2 OPPORTUNITIES

5.2.2.1 Increased investments in advanced surveillance technologies

5.2.2.2 Lightweight radars for aerial vehicles

5.2.3 CHALLENGES

5.2.3.1 Extreme weather conditions hampering the accuracy of surveillance radars

5.2.3.2 Regulatory challenges for sales to overseas customers

5.3 AVERAGE SELLING PRICE TREND

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS FOR SURVEILLANCE RADARS MARKET

5.5 ECOSYSTEM

FIGURE 20 ECOSYSTEM OF SURVEILLANCE RADARS

6 INDUSTRY TRENDS (Page No. - 66)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 BROADBAND RADAR AND MULTIFUNCTIONAL RF-SYSTEMS

6.2.2 SOFTWARE DEFINED RADARS

6.2.3 USE OF PASSIVE ELECTRONICALLY SCANNED ARRAY (PESA) RADARS

6.2.4 USE OF ACTIVE ELECTRONICALLY SCANNED ARRAY (AESA) RADARS

6.2.5 USE OF GALLIUM NITRIDE FOR FRONT-END COMPONENTS

6.2.6 DEVELOPMENT OF 3D RADARS

6.2.7 USE OF PHASED ARRAY ANTENNAS

6.2.8 LASER RADAR (LIDAR) TECHNOLOGY

6.2.9 QUANTUM RADARS

6.2.10 INVERSE SYNTHETIC APERTURE RADARS

6.3 COUNTRY-WISE IMPORT OF RADARS, 2017–2019 (USD THOUSAND)

6.4 COUNTRY-WISE EXPORT OF RADARS, 2017–2019 (USD THOUSAND)

6.5 CASE STUDY ANALYSIS

6.5.1 STEALTH TECHNOLOGY

6.5.2 DISRUPTIVE RADAR TECHNOLOGIES

6.6 INNOVATIONS & PATENT REGISTRATIONS

TABLE 2 INNOVATIONS & PATENT REGISTRATIONS, MARCH 2016–MAY 2019

7 SURVEILLANCE RADARS MARKET, BY TYPE (Page No. - 73)

7.1 INTRODUCTION

FIGURE 21 THE GROUND-BASED AIR SURVEILLANCE RADARS SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 3 SURVEILLANCE RADARS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 4 SURVEILLANCE RADAR MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

7.2 BATTLEFIELD SURVEILLANCE RADARS

7.2.1 INCREASE IN THE DEVELOPMENT AND PROCUREMENT OF MISSILE AND AIR-DEFENSE SYSTEMS ACROSS COUNTRIES FUEL THIS SEGMENT

7.3 GROUND-BASED AIR SURVEILLANCE RADARS

7.3.1 AVAILABILITY OF COST-EFFICIENT UNMANNED AERIAL VEHICLE (UAVS) FOR AIRBORNE SURVEILLANCE DRIVE THIS SEGMENT

7.4 GROUND-BASED SPACE SURVEILLANCE RADARS

7.4.1 AVAILABILITY OF ADVANCED LONG-RANGE AIRBORNE SITUATIONAL AWARENESS SYSTEMS

7.5 COASTAL SURVEILLANCE RADARS

7.5.1 COASTAL RADARS CAN DETECT ADVERSE EFFECTS OF CRITICAL WEATHER CONDITIONS

7.6 AIRPORT SURVEILLANCE RADARS

7.6.1 INCREASING NEED FOR THE ADVANCED SITUATIONAL AWARENESS AND INFORMATION DISSEMINATION ABILITIES

7.7 AIR-TO-GROUND SURVEILLANCE RADARS

7.7.1 TECHNOLOGICAL ADVANCEMENTS IN MULTI BAND SPECTRUM CAPABILITY

7.8 AIRBORNE MARITIME SURVEILLANCE RADARS

7.8.1 GEOPOLITICAL ISSUES AND INVESTMENTS IN NAVAL RADAR TECHNOLOGY

7.9 AIR-TO-AIR SURVEILLANCE RADARS

7.9.1 INCREASING NEED FOR SITUATIONAL AWARENESS DRIVE THE DEMAND FOR THESE RADARS

7.10 SHIPBORNE SURVEILLANCE RADARS

7.10.1 INCREASING GEOPOLITICAL CONCERNS IN ASIA PACIFIC AND MIDDLE EAST

7.11 SPACE-BASED SYNTHETIC APERTURE RADARS

7.11.1 INCREASING USE OF SYNTHETIC APERTURE RADARS FOR PROVING SITUATIONAL AWARENESS

8 SURVEILLANCE RADARS MARKET, BY RANGE (Page No. - 78)

8.1 INTRODUCTION

FIGURE 22 VERY LONG RANGE SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

TABLE 5 SURVEILLANCE RADARS MARKET, BY RANGE, 2017–2019 (USD MILLION)

TABLE 6 SURVEILLANCE RADAR MARKET, BY RANGE, 2020–2025 (USD MILLION)

8.2 LONG-RANGE SURVEILLANCE RADARS

8.2.1 LONG RANGE RADARS ARE USED FOR LONG-DISTANCE TRACKING AND ACCURATE LOCATION

TABLE 7 LONG RANGE SURVEILLANCE RADARS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 8 LONG RANGE SURVEILLANCE RADAR MARKET, BY REGION, 2020–2025 (USD MILLION)

8.3 VERY LONG RANGE

8.3.1 VERY LONG RANGE RADARS ARE USED TO TRACK BALLISTIC MISSILES, AIR-BREATHING TARGETS, AND SATELLITES

TABLE 9 VERY LONG RANGE SURVEILLANCE RADARS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 10 VERY LONG RANGE SURVEILLANCE RADAR MARKET, BY REGION, 2020–2025 (USD MILLION)

8.4 MEDIUM-RANGE SURVEILLANCE RADARS

8.4.1 MEDIUM RANGE RADARS ARE USED ACROSS MILITARY APPLICATIONS

TABLE 11 MEDIUM RANGE SURVEILLANCE RADARS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 12 MEDIUM RANGE SURVEILLANCE RADAR MARKET, BY REGION, 2020–2025 (USD MILLION)

8.5 SHORT-RANGE SURVEILLANCE RADARS

8.5.1 SHORT RANGE RADARS ARE USED PRIMARILY IN COMMERCIAL APPLICATIONS OR MAN-PORTABLE RECONNAISSANCE MISSIONS

TABLE 13 SHORT RANGE SURVEILLANCE RADARS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 14 SHORT RANGE SURVEILLANCE RADAR MARKET, BY REGION, 2020–2025 (USD MILLION)

8.6 VERY SHORT RANGE

8.6.1 VERY SHORT RANGE RADARS ARE MOSTLY PREFERRED TO PROTECT CONVOYS OR WARM AND SHIELD LAND OPERATIONS FROM FLYING THREATS

TABLE 15 VERY SHORT RANGE SURVEILLANCE RADARS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 16 VERY SHORT RANGE SURVEILLANCE RADAR MARKET, BY REGION, 2020–2025 (USD MILLION)

9 SURVEILLANCE RADARS MARKET, BY PLATFORM (Page No. - 86)

9.1 INTRODUCTION

FIGURE 23 THE AIRBORNE SEGMENT PROJECTED TO LEAD SURVEILLANCE RADARS MARKET DURING THE FORECAST PERIOD

TABLE 17 SURVEILLANCE RADAR MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 18 SURVEILLANCE RADAR MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

9.2 LAND

TABLE 19 SURVEILLANCE RADAR MARKET FOR LAND, BY REGION, 2017–2019 (USD MILLION)

TABLE 20 SURVEILLANCE RADARS MARKET FOR LAND, BY REGION, 2020–2025 (USD MILLION)

TABLE 21 SURVEILLANCE RADAR MARKET FOR LAND, BY TYPE, 2017–2019 (USD MILLION)

TABLE 22 SURVEILLANCE RADAR MARKET FOR LAND, BY TYPE, 2020–2025 (USD MILLION)

9.2.1 FIXED INSTALLATION

9.2.1.1 Increasing use for border surveillance

TABLE 23 FIXED INSTALLATION SURVEILLANCE RADARS MARKET FOR LAND, BY TYPE, 2017–2019 (USD MILLION)

TABLE 24 FIXED INSTALLATION SURVEILLANCE RADAR MARKET FOR LAND, BY TYPE, 2020–2025 (USD MILLION)

9.2.2 PORTABLE

9.2.2.1 Increasing demand for lightweight portable surveillance radars

TABLE 25 PORTABLE SURVEILLANCE RADARS MARKET FOR LAND, BY TYPE, 2017–2019 (USD MILLION)

TABLE 26 PORTABLE SURVEILLANCE RADAR MARKET FOR LAND, BY TYPE, 2020–2025 (USD MILLION)

9.3 NAVAL

9.3.1 SHIPS

9.3.1.1 Increasing need for coastal and marine surveillance radars

9.3.2 UNMANNED SURFACE VEHICLES

9.3.2.1 Rising demand for maritime security

9.3.3 SUBMARINES

9.3.3.1 Increasing investments for maritime surveillance

TABLE 27 SURVEILLANCE RADAR MARKET FOR NAVAL, BY TYPE, 2017–2019 (USD MILLION)

TABLE 28 SURVEILLANCE RADAR MARKET FOR NAVAL, BY TYPE, 2020–2025 (USD MILLION)

TABLE 29 SURVEILLANCE RADAR MARKET FOR NAVAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 30 SURVEILLANCE RADARS MARKET FOR NAVAL, BY REGION, 2020–2025 (USD MILLION)

9.4 AIRBORNE

9.4.1 COMBAT AIRCRAFT

9.4.1.1 Adoption of surveillance radars for defense and national security

9.4.2 UNMANNED AERIAL VEHICLES (UAV)

9.4.2.1 Rapid Technological Advancements

9.4.3 AEROSTATS/BALLOONS

9.4.3.1 Need for surveillance to monitor border disputes and drug trafficking

TABLE 31 SURVEILLANCE RADAR MARKET FOR AIRBORNE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 32 SURVEILLANCE RADAR MARKET FOR AIRBORNE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 33 SURVEILLANCE RADAR MARKET FOR AIRBORNE, BY REGION, 2017–2019 (USD MILLION)

TABLE 34 SURVEILLANCE RADARS MARKET FOR AIRBORNE, BY REGION, 2020–2025 (USD MILLION)

9.5 SPACE

9.5.1 INCREASING DEMAND FOR ENHANCED IMAGING TECHNOLOGY

TABLE 35 SURVEILLANCE RADAR MARKET FOR SPACE, BY REGION, 2017–2019 (USD MILLION)

TABLE 36 SURVEILLANCE RADAR MARKET FOR SPACE, BY REGION, 2020–2025 (USD MILLION)

10 SURVEILLANCE RADARS MARKET, BY APPLICATION (Page No. - 96)

10.1 INTRODUCTION

FIGURE 24 THE DEFENSE & SPACE SEGMENT IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 37 SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 38 SURVEILLANCE RADAR MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

10.2 COMMERCIAL

10.2.1 AIRSPACE MONITORING & SURVEILLANCE

10.2.1.1 Ongoing modernization of airspace monitoring radars

10.2.2 AIRPORT PERIMETER SECURITY

10.2.2.1 Global requirement for drone detection radars

10.2.3 CRITICAL INFRASTRUCTURES

10.2.3.1 Need for intruder detection systems at ports & harbors

10.2.4 OTHERS

TABLE 39 SURVEILLANCE RADARS MARKET IN COMMERCIAL, BY TYPE, 2017–2019 (USD MILLION)

TABLE 40 MARKET IN COMMERCIAL, BY TYPE, 2020–2025 (USD MILLION)

TABLE 41 MARKET IN COMMERCIAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 42 MARKET IN COMMERCIAL, BY REGION, 2020–2025 (USD MILLION)

10.3 NATIONAL SECURITY

10.3.1 BORDER SURVEILLANCE

10.3.1.1 Upgradation to autonomous border surveillance systems

10.3.2 SEARCH & RESCUE

10.3.2.1 Integration of radars with EO/IR systems

10.3.3 ISR

10.3.3.1 Requirement of actionable intelligence for safety

TABLE 43 SURVEILLANCE RADARS MARKET IN NATIONAL SECURITY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 44 MARKET IN NATIONAL SECURITY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 45 MARKET IN NATIONAL SECURITY, BY REGION, 2017–2019 (USD MILLION)

TABLE 46 MARKET IN NATIONAL SECURITY, BY REGION, 2020–2025 (USD MILLION)

10.4 DEFENSE & SPACE

10.4.1 PERIMETER SECURITY

10.4.1.1 Need for early warning systems

10.4.2 ISR & BATTLEFIELD SURVEILLANCE

10.4.2.1 Use of surveillance drones to gather intelligence

10.4.3 MILITARY SPACE ASSETS & HOSTILE SATELLITES

10.4.3.1 Need for military satellites to protect assets

10.4.4 AIR DEFENSE

10.4.4.1 Need for ballistic missile defense systems

TABLE 47 SURVEILLANCE RADARS MARKET IN DEFENSE & SPACE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 48 SURVEILLANCE RADAR MARKET IN DEFENSE & SPACE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 49 SURVEILLANCE RADAR MARKET IN DEFENSE & SPACE, BY REGION, 2017–2019 (USD MILLION)

TABLE 50 SURVEILLANCE RADAR MARKET IN DEFENSE & SPACE, BY REGION, 2020–2025 (USD MILLION)

11 SURVEILLANCE RADARS MARKET, BY FREQUENCY BAND (Page No. - 105)

11.1 INTRODUCTION

FIGURE 25 THE KU-BAND IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 51 SURVEILLANCE RADARS MARKET SIZE, BY FREQUENCY BAND, 2017–2019 (USD MILLION)

TABLE 52 SURVEILLANCE RADAR MARKET SIZE, BY FREQUENCY BAND, 2020–2025 (USD MILLION)

TABLE 53 FREQUENCY BANDS OF SURVEILLANCE RADARS

11.2 HF/UHF/VHF-BANDS

11.2.1 INCREASING USE IN EARLY-WARNING SYSTEMS

TABLE 54 SURVEILLANCE RADARS MARKET IN HF/UHF/VHF-BANDS, BY REGION, 2017–2019 (USD MILLION)

TABLE 55 SURVEILLANCE RADAR MARKET IN HF/UHF/VHF-BANDS, BY REGION, 2020–2025 (USD MILLION)

11.3 L-BAND

11.3.1 MAJOR APPLICATIONS IN ASSET TRACKING

TABLE 56 SURVEILLANCE RADARS MARKET IN L-BANDS, BY REGION, 2017–2019 (USD MILLION)

TABLE 57 SURVEILLANCE RADAR MARKET IN L-BANDS, BY REGION, 2020–2025 (USD MILLION)

11.4 S-BAND

11.4.1 WIDELY USED ON SHIPS FOR SURVEILLANCE

TABLE 58 SURVEILLANCE RADARS MARKET IN S-BANDS, BY REGION, 2017–2019 (USD MILLION)

TABLE 59 SURVEILLANCE RADAR MARKET S-BANDS, BY REGION, 2020–2025 (USD MILLION)

11.5 C-BAND

11.5.1 INCREASING NEED TO TRACK SATELLITES

TABLE 60 SURVEILLANCE RADARS MARKET IN C-BANDS, BY REGION, 2017–2019 (USD MILLION)

TABLE 61 SURVEILLANCE RADAR MARKET IN C-BANDS, BY REGION, 2020–2025 (USD MILLION)

11.6 X-BAND

11.6.1 EXTENSIVELY USED IN MILITARY APPLICATIONS

TABLE 62 SURVEILLANCE RADARS MARKET IN X-BANDS, BY REGION, 2017–2019 (USD MILLION)

TABLE 63 SURVEILLANCE RADAR MARKET IN X-BANDS, BY REGION, 2020–2025 (USD MILLION)

11.7 KU-BAND

11.7.1 KU-BANDS PROVIDE WIDE BEAM COVERAGE AND HIGHER THROUGHPUT IN COMPARISON WITH LOWER BANDS

TABLE 64 SURVEILLANCE RADARS MARKET IN KU-BANDS, BY REGION, 2017–2019 (USD MILLION)

TABLE 65 SURVEILLANCE RADAR MARKET IN KU-BANDS, BY REGION, 2020–2025 (USD MILLION)

11.8 KA-BAND

11.8.1 KA-BAND TRANSMIT DATA AT A HIGHER RATE AS COMPARED TO KU-BANDS

TABLE 66 SURVEILLANCE RADARS MARKET KA-BANDS, BY REGION, 2017–2019 (USD MILLION)

TABLE 67 SURVEILLANCE RADAR MARKET IN KA-BANDS, BY REGION, 2020–2025 (USD MILLION)

11.9 MULTI-BAND

11.9.1 MULTI-BAND RADARS ARE USED FOR COHERENT DETECTION AND TRACKING OF MOVING TARGET OBJECTS

TABLE 68 SURVEILLANCE RADARS MARKET IN MULTI-BANDS, BY REGION, 2017–2019 (USD MILLION)

TABLE 69 SURVEILLANCE RADAR MARKET IN MULTI-BANDS, BY REGION, 2020–2025 (USD MILLION)

12 SURVEILLANCE RADARS MARKET, BY WAVEFORM (Page No. - 116)

12.1 INTRODUCTION

FIGURE 26 FMCW SEGMENT PROJECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD AS COMPARED TO DOPPLER SEGMENT

TABLE 70 SURVEILLANCE RADARS MARKET, BY WAVEFORM, 2017–2019 (USD MILLION)

TABLE 71 MARKET, BY WAVEFORM, 2020–2025 (USD MILLION)

12.2 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW)

12.2.1 INCREASED DEPENDENCY ON LOW POWER TRANSMISSION DEVICES DRIVE THIS SEGMENT

12.3 DOPPLER

TABLE 72 DOPPLER: SURVEILLANCE RADARS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 73 DOPPLER: MARKET, BY TYPE, 2020–2025 (USD MILLION)

12.3.1 CONVENTIONAL DOPPLER RADAR

12.3.1.1 Conventional Doppler radars are used to monitor weather conditions

12.3.2 PULSE-DOPPLER RADAR

12.3.2.1 Pulse-Doppler combines the features of pulse radars and continuous-wave radars

12.4 ULTRA-WIDEBAND IMPULSE

12.4.1 DEMAND FOR HUMAN DETECTION BEHIND OBSTACLES FOR SURVEILLANCE AND SECURITY DRIVES THE MARKET

13 SURVEILLANCE RADARS MARKET, BY COMPONENT (Page No. - 121)

13.1 INTRODUCTION

FIGURE 27 DIGITAL SIGNAL PROCESSORS SEGMENT ESTIMATED TO LEAD SURVEILLANCE RADAR MARKET DURING FORECAST PERIOD

TABLE 74 SURVEILLANCE RADARS MARKET, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 75 MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

13.2 ANTENNAS

TABLE 76 ANTENNAS IN SURVEILLANCE RADARS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 77 ANTENNAS IN MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 78 ANTENNAS IN MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 79 ANTENNAS IN MARKET, BY REGION, 2020–2025 (USD MILLION)

13.2.1 PARABOLIC REFLECTOR ANTENNAS

13.2.1.1 High signal gain and directivity at narrow bandwidths drive the demand for these antennas

13.2.2 SLOTTED WAVEGUIDE ANTENNAS

13.2.2.1 Increasing demand for lightweight, portable surveillance radars fuel this segment

13.2.3 PLANAR PHASED ARRAY ANTENNAS

13.2.3.1 Growing adoption of tactical defense radar systems propel the demand for these antennas

13.2.4 ACTIVE SCANNED ARRAY ANTENNAS

13.2.4.1 Increasing demand for reliable and efficient surveillance radars fuel this segment

13.2.5 PASSIVE SCANNED ARRAY ANTENNAS

13.2.5.1 The ability to can track multiple targets drive the demand for passive scanned array antennas

13.3 TRANSMITTERS

TABLE 80 TRANSMITTERS IN SURVEILLANCE RADARS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 81 TRANSMITTERS IN MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 82 TRANSMITTERS IN MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 83 TRANSMITTERS IN MARKET, BY REGION, 2020–2025 (USD MILLION)

13.3.1 MICROWAVE TUBE-BASED TRANSMITTERS

13.3.1.1 Ability to transmit high-power microwaves make these transmitters used in radars

13.3.2 SOLID-STATE ELECTRONICS

13.3.2.1 These transmitters are preferred for a reliable mode of signal transmission in critical weather conditions

13.4 RECEIVERS

TABLE 84 RECEIVERS IN SURVEILLANCE RADARS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 85 RECEIVERS IN MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 86 RECEIVERS IN MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 87 RECEIVERS IN MARKET, BY REGION, 2020–2025 (USD MILLION)

13.4.1 ANALOG RECEIVERS

13.4.1.1 Several advantages offered by digital receivers make analog receivers less preferred

13.4.2 DIGITAL RECEIVERS

13.4.2.1 These receivers are easy to design, are compact and reliable when compared with analog receivers

13.5 POWER AMPLIFIERS

TABLE 88 POWER AMPLIFIERS IN SURVEILLANCE RADARS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 89 POWER AMPLIFIERS IN MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 90 POWER AMPLIFIERS IN MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 91 POWER AMPLIFIERS IN MARKET, BY REGION, 2020–2025 (USD MILLION)

13.5.1 TRAVELING WAVE TUBE AMPLIFIERS (TWTA)

13.5.1.1 Demand for large bandwidth capable radars drive this segment

13.5.2 SOLID-STATE POWER AMPLIFIERS

13.5.2.1 These amplifiers are used for applications that require narrow bandwidth and less voltage

TABLE 92 SOLID-STATE POWER AMPLIFIERS IN SURVEILLANCE RADARS MARKET, BY TYPE, 2017–2019(USD MILLION)

TABLE 93 SOLID-STATE POWER AMPLIFIERS IN MARKET, BY TYPE, 2020–2025 (USD MILLION)

13.5.2.2 GALLIUM ARSENIDE (GAAS)

13.5.2.2.1 Growing demand for low power consuming electronic warfare systems is driving this segment

13.5.2.3 GALLIUM NITRIDE (GAN)

13.5.2.3.1 GaN-based power amplifiers primarily operate in micrometer and millimeter-wave range

13.5.2.3.1.1 GALLIUM NITRIDE ON SILICON CARBIDE (GAN-ON-SIC)

13.5.2.3.1.2 GALLIUM NITRIDE HIGH POWER AMPLIFIERS (GAN HPA)

13.6 DUPLEXERS

13.6.1 GROWING DEMAND FOR COMPACT DUPLEXERS DRIVE THIS SEGMENT

TABLE 94 DUPLEXERS IN SURVEILLANCE RADARS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 95 DUPLEXERS IN SURVEILLANCE RADAR MARKET, BY TYPE, 2020–2025 (USD MILLION)

13.6.2 BRANCH TYPE DUPLEXERS

13.6.3 BALANCED TYPE DUPLEXERS

13.6.4 CIRCULATOR DUPLEXERS

13.7 DIGITAL SIGNAL PROCESSORS

13.7.1 INCREASING USE OF FPGA AND GPU TO DRIVE DIGITAL SIGNAL PROCESSORS SEGMENT

TABLE 96 DIGITAL SIGNAL PROCESSORS IN SURVEILLANCE RADARS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 97 DIGITAL SIGNAL PROCESSORS IN SURVEILLANCE RADAR MARKET, BY REGION, 2020–2025 (USD MILLION)

13.8 STABILIZATION SYSTEM

13.8.1 GROWING DEMAND FOR 360-DEGREE FULL ROTATIONAL RADAR SYSTEMS

13.9 GRAPHICAL USER INTERFACES

13.9.1 GROWING DEMAND FOR INTERACTIVE CONTROL PANEL

13.9.1.1 Control panels

13.9.1.2 Graphic panels

13.9.1.3 Displays

13.9.1.4 Others

14 SURVEILLANCE RADARS MARKET, BY DIMENSION (Page No. - 137)

14.1 INTRODUCTION

FIGURE 28 THE 3D SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 98 SURVEILLANCE RADARS MARKET SIZE, BY DIMENSION, 2017–2019 (USD MILLION)

TABLE 99 SURVEILLANCE RADAR MARKET SIZE, BY DIMENSION, 2020–2025 (USD MILLION)

14.2 2D

14.2.1 EXTENSIVELY USED IN AIR TRAFFIC MONITORING

14.3 3D

14.3.1 WIDELY USED IN AIR DEFENSE SYSTEMS

14.4 4D

14.4.1 INCREASINGLY USED IN AUTONOMOUS VEHICLES

15 SURVEILLANCE RADARS MARKET, BY REGION (Page No. - 140)

15.1 INTRODUCTION

FIGURE 29 SURVEILLANCE RADARS MARKET SNAPSHOT

TABLE 100 COVID-19 IMPACT (OPTIMISTIC SCENARIO) ON SURVEILLANCE RADARS MARKET, BY REGION,2017–2019 (USD MILLION)

TABLE 101 COVID-19 IMPACT (OPTIMISTIC SCENARIO) ON SURVEILLANCE RADAR MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 102 COVID-19 IMPACT (PESSIMISTIC SCENARIO) ON SURVEILLANCE RADAR MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 103 COVID-19 IMPACT (PESSIMISTIC SCENARIO) ON SURVEILLANCE RADAR MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 104 COVID-19 IMPACT (REALISTIC SCENARIO) ON SURVEILLANCE RADAR MARKET, BY REGION,2017–2019 (USD MILLION)

TABLE 105 COVID-19 IMPACT (REALISTIC SCENARIO) ON SURVEILLANCE RADAR MARKET, BY REGION,2020–2025 (USD MILLION)

15.2 NORTH AMERICA

15.2.1 COVID-19 IMPACT ON NORTH AMERICA

15.2.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 30 NORTH AMERICA SURVEILLANCE RADARS MARKET SNAPSHOT

TABLE 106 NORTH AMERICA MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 107 NORTH AMERICA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 108 NORTH AMERICA MARKET SIZE, BY FREQUENCY BAND, 2017–2019 (USD MILLION)

TABLE 109 NORTH AMERICA MARKET SIZE, BY FREQUENCY BAND, 2020–2025 (USD MILLION)

TABLE 110 NORTH AMERICA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 111 NORTH AMERICA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 112 NORTH AMERICA MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 113 NORTH AMERICA MARKET SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 114 NORTH AMERICA MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 115 NORTH AMERICA SURVEILLANCE RADARS MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 116 NORTH AMERICA MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 117 NORTH AMERICA MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.2.3 US

15.2.3.1 Growing demand for border surveillance systems

TABLE 118 US SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 119 US MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 120 US MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 121 US MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.2.4 CANADA

15.2.4.1 Ongoing modernization of airborne surveillance radars

TABLE 122 CANADA SURVEILLANCE RADAR MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 123 CANADA SURVEILLANCE RADAR MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 124 CANADA SURVEILLANCE RADAR MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 125 CANADA SURVEILLANCE RADAR MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.3 EUROPE

15.3.1 COVID-19 IMPACT ON EUROPE

15.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 31 EUROPE SURVEILLANCE RADARS MARKET SNAPSHOT

TABLE 126 EUROPE MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 127 EUROPE MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 128 EUROPE MARKET SIZE, BY FREQUENCY BAND, 2017–2019 (USD MILLION)

TABLE 129 EUROPE MARKET SIZE, BY FREQUENCY BAND, 2020–2025 (USD MILLION)

TABLE 130 EUROPE MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 131 EUROPE MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 132 EUROPE MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 133 EUROPE MARKET SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 134 EUROPE MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 135 EUROPE MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 136 EUROPE MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 137 EUROPE SURVEILLANCE RADARS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.3.3 RUSSIA

15.3.3.1 Ongoing upgradation of long-range surveillance radars

TABLE 138 RUSSIA SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 139 RUSSIA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 140 RUSSIA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 141 RUSSIA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.3.4 GERMANY

15.3.4.1 Demand for air surveillance radars from Ministry of Defense

TABLE 142 GERMANY SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 143 GERMANY MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 144 GERMANY MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 145 GERMANY MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.3.5 UK

15.3.5.1 Advancements in the field of military automation

TABLE 146 UK SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 147 UK MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 148 UK MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 149 UK MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.3.6 ITALY

15.3.6.1 Need for advanced air defense systems

TABLE 150 ITALY SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 151 ITALY MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 152 ITALY MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 153 ITALY MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.3.7 FRANCE

15.3.7.1 Demand for coastal surveillance radars

TABLE 154 FRANCE SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 155 FRANCE MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 156 FRANCE MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 157 FRANCE MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.4 ASIA PACIFIC

15.4.1 COVID-19 IMPACT ON ASIA PACIFIC

15.4.2 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 32 ASIA PACIFIC SURVEILLANCE RADARS MARKET SNAPSHOT

TABLE 158 ASIA PACIFIC MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 159 ASIA PACIFIC MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 160 ASIA PACIFIC MARKET SIZE, BY FREQUENCY BAND, 2017–2019 (USD MILLION)

TABLE 161 ASIA PACIFIC MARKET SIZE, BY FREQUENCY BAND, 2020–2025 (USD MILLION)

TABLE 162 ASIA PACIFIC MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 163 ASIA PACIFIC MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 164 ASIA PACIFIC MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 165 ASIA PACIFIC MARKET SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 166 ASIA PACIFIC MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 167 ASIA PACIFIC MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 168 ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 169 ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.4.3 CHINA

15.4.3.1 Development of advanced maritime surveillance radars

TABLE 170 CHINA SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 171 CHINA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 172 CHINA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 173 CHINA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.4.4 AUSTRALIA

15.4.4.1 Demand for modern naval radars with advanced technologies

TABLE 174 AUSTRALIA SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 175 AUSTRALIA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 176 AUSTRALIA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 177 AUSTRALIA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.4.5 INDIA

15.4.5.1 Ongoing modernization of the Indian navy

TABLE 178 INDIA SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 179 INDIA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 180 INDIA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 181 INDIA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.4.6 JAPAN

15.4.6.1 Need for anti-ballistic missile systems

TABLE 182 JAPAN SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 183 JAPAN MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 184 JAPAN MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 185 JAPAN MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.4.7 SOUTH KOREA

15.4.7.1 Need for advanced radars to detect stealth aircraft

TABLE 186 SOUTH KOREA SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 187 SOUTH KOREA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 188 SOUTH KOREA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 189 SOUTH KOREA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.5 MIDDLE EAST & AFRICA

15.5.1 PESTLE ANALYSIS: MIDDLE EAST

TABLE 190 MIDDLE EAST & AFRICA SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA MARKET SIZE, BY FREQUENCY BAND, 2017–2019 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA MARKET SIZE, BY FREQUENCY BAND, 2020–2025 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA SURVEILLANCE RADARS MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA MARKET SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.5.2 SAUDI ARABIA

15.5.2.1 Ongoing military modernizations

TABLE 202 SAUDI ARABIA SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 203 SAUDI ARABIA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 204 SAUDI ARABIA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 205 SAUDI ARABIA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.5.3 ISRAEL

15.5.3.1 Development of new and improved radar technologies

TABLE 206 ISRAEL SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 207 ISRAEL MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 208 ISRAEL MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 209 ISRAEL MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.5.4 TURKEY

15.5.4.1 Installation of advanced coastal surveillance radars

TABLE 210 TURKEY SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 211 TURKEY MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 212 TURKEY MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 213 TURKEY MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.5.5 SOUTH AFRICA

15.5.5.1 Need for radars for border surveillance

TABLE 214 SOUTH AFRICA SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 215 SOUTH AFRICA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 216 SOUTH AFRICA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 217 SOUTH AFRICA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

15.6 SOUTH AMERICA

15.6.1 ONGOING MILITARY MODERNIZATIONS IN BRAZIL AND MEXICO

TABLE 218 SOUTH AMERICA SURVEILLANCE RADARS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 219 SOUTH AMERICA MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 220 SOUTH AMERICA MARKET SIZE, BY FREQUENCY BAND, 2017–2019 (USD MILLION)

TABLE 221 SOUTH AMERICA MARKET SIZE, BY FREQUENCY BAND, 2020–2025 (USD MILLION)

TABLE 222 SOUTH AMERICA MARKET SIZE, BY PLATFORM, 2017–2019 (USD MILLION)

TABLE 223 SOUTH AMERICA MARKET SIZE, BY PLATFORM, 2020–2025 (USD MILLION)

TABLE 224 SOUTH AMERICA MARKET SIZE, BY RANGE, 2017–2019 (USD MILLION)

TABLE 225 SOUTH AMERICA MARKET SIZE, BY RANGE, 2020–2025 (USD MILLION)

TABLE 226 SOUTH AMERICA MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 227 SOUTH AMERICA MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 194)

16.1 INTRODUCTION

FIGURE 33 MARKET EVALUATION FRAMEWORK: CONTRACTS IS A KEY STRATEGY ADOPTED BY MARKET PLAYERS

16.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2019

FIGURE 34 RANK ANALYSIS OF KEY PLAYERS IN THE SURVEILLANCE RADARS MARKET, 2019

16.3 MARKET SHARE ANALYSIS OF KEY MARKET PLAYERS, 2019

FIGURE 35 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN THE SURVEILLANCE RADARS MARKET, 2019

16.4 REVENUE SHARE ANALYSIS OF TOP 4 MARKET PLAYERS, 2019

FIGURE 36 REVENUE SHARE ANALYSIS OF TOP 4 PLAYERS IN THE SURVEILLANCE RADARS MARKET, 2019

16.5 COMPETITIVE SCENARIO

16.5.1 NEW PRODUCT LAUNCHES, MERGERS & ACQUISITION

TABLE 228 NEW PRODUCT LAUNCHES, DECEMBER 2015–MAY 2020

16.5.2 CONTRACTS

TABLE 229 CONTRACTS, DECEMBER 2015–NOVEMBER 2019

16.5.3 PARTNERSHIPS & AGREEMENTS

TABLE 230 PARTNERSHIPS & AGREEMENTS, DECEMBER 2015–NOVEMBER 2019

17 COMPANY EVALUATION AND COMPANY PROFILES (Page No. - 201)

17.1 OVERVIEW

17.2 COMPANY EVALUATION MATRIX DEFINITION AND METHODOLOGY

17.2.1 STAR

17.2.2 EMERGING LEADERS

17.2.3 PERVASIVE

17.2.4 EMERGING COMPANIES

FIGURE 37 SURVEILLANCE RADARS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

17.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 38 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SURVEILLANCE RADARS MARKET

17.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 39 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN SURVEILLANCE RADARS MARKET

17.5 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

17.5.1 ASELSAN A.ª.

FIGURE 40 ASELSAN A.ª.: COMPANY SNAPSHOT

17.5.2 BLIGHTER SURVEILLANCE SYSTEMS LTD.

17.5.3 DETECT, INC.

17.5.4 NORTHROP GRUMMAN CORPORATION

FIGURE 41 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

17.5.5 ELBIT SYSTEMS LTD.

FIGURE 42 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

17.5.6 FLIR SYSTEMS, INC.

FIGURE 43 FLIR SYSTEMS, INC.: COMPANY SNAPSHOT

17.5.7 GEM ELETTRONICA

17.5.8 L3HARRIS TECHNOLOGIES

FIGURE 44 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

17.5.9 ISRAEL AEROSPACE INDUSTRIES LTD.

FIGURE 45 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

17.5.10 LEONARDO S.P.A

FIGURE 46 LEONARDO S.P.A: COMPANY SNAPSHOT

17.5.11 LOCKHEED MARTIN CORPORATION

FIGURE 47 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

17.5.12 HENSOLDT

17.5.13 RAYTHEON COMPANY

FIGURE 48 RAYTHEON COMPANY: COMPANY SNAPSHOT

17.5.14 SAAB AB

FIGURE 49 SAAB AB: COMPANY SNAPSHOT

17.5.15 TERMA A/S

17.5.16 THALES GROUP

FIGURE 50 THALES GROUP: COMPANY SNAPSHOT

17.5.17 HONEYWELL INC.

FIGURE 51 HONEYWELL INC.: COMPANY SNAPSHOT

17.5.18 L&T DEFENCE

FIGURE 52 L&T DEFENCE: COMPANY SNAPSHOT

17.5.19 SRC, INC.

17.5.20 BAE SYSTEMS

FIGURE 53 BAE SYSTEMS.: COMPANY SNAPSHOT

17.5.21 REUTECH RADAR SYSTEMS

17.5.22 EASAT RADAR SYSTEMS LIMITED

17.5.23 INDRA COMPANY

FIGURE 54 INDRA COMPANY: COMPANY SNAPSHOT

17.5.24 JAPAN RADIO CO., LTD.

FIGURE 55 JAPAN RADIO CO., LTD.: COMPANY SNAPSHOT

17.5.25 ACCIPITER RADAR

17.5.26 RAYMARINE

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

18 SURVEILLANCE RADARS ADJACENT MARKET (Page No. - 256)

18.1 INTRODUCTION

18.2 MILITARY RADARS MARKET, BY END USER

FIGURE 56 NAVY SEGMENT PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 231 MILITARY RADARS MARKET, BY END USER, 2018-2025 (USD MILLION)

18.3 NAVY

TABLE 232 MILITARY RADARS MARKET FOR NAVY, BY END USER, 2018-2025 (USD MILLION)

18.3.1 VESSEL-BASED RADARS

18.3.1.1 Increasing demand for coastal surveillance across geographies drive this segment

TABLE 233 NAVY: VESSEL-BASED RADARS MARKET, BY REGION, 2018-2025 (USD MILLION)

18.3.2 AIRBORNE RADARS

18.3.2.1 Increased need for miniaturized and compact radar systems drive this segment

TABLE 234 NAVY: AIRBORNE RADARS MARKET, BY REGION, 2018-2025 (USD MILLION)

18.3.3 COASTAL SECURITY RADARS

18.3.3.1 Coastal security radars are used for coastal surveillance for and port security

TABLE 235 NAVY: COASTAL SECURITY RADARS MARKET, BY REGION, 2018-2025 (USD MILLION)

18.4 ARMY

TABLE 236 MILITARY RADARS MARKET FOR ARMY, BY END USER, 2018-2025 (USD MILLION)

18.4.1 AIRBORNE RADARS

18.4.1.1 Increasing need for the advanced situational awareness and information dissemination abilities drive this segment

TABLE 237 ARMY: AIRBORNE RADARS MARKET, BY REGION, 2018-2025 (USD MILLION)

18.4.2 LAND RADARS

18.4.2.1 Increase in the development and procurement of missile and air-defense systems across countries fuel this segment

TABLE 238 ARMY: LAND RADARS MARKET, BY REGION, 2018-2025 (USD MILLION)

18.4.3 OVER THE HORIZON RADARS

18.4.4 MISSILE AND GUNFIRE CONTROL RADARS

18.4.5 PERIMETER SURVEILLANCE RADARS

18.4.6 LONG RANGE SURVEILLANCE RADARS

18.5 AIRFORCE

TABLE 239 MILITARY RADARS MARKET FOR AIRFORCE, BY END USER, 2018-2025 (USD MILLION)

18.5.1 AIRBORNE RADARS

18.5.1.1 Airborne radars are preferred in border protection applications

TABLE 240 AIRFORCE: AIRBORNE RADARS MARKET, BY REGION, 2018-2025 (USD MILLION)

18.5.2 LAND RADARS

18.5.2.1 Advancements in 4D imaging and signal processing techniques drive this segment

TABLE 241 AIRFORCE: LAND RADARS MARKET, BY REGION, 2018-2025 (USD MILLION)

18.5.3 PRECISION APPROACH RADAR

18.5.4 SURFACE MOVEMENT RADARS

18.5.5 WEATHER NAVIGATION RADARS

18.6 SPACE

TABLE 242 MILITARY RADARS MARKET FOR SPACE, BY REGION, 2018-2025 (USD MILLION)

18.6.1 SEARCH AND DETECTION RADARS

18.6.1.1 Increased demand for three-dimensional imaging of the target will drive the market

19 APPENDIX (Page No. - 266)

19.1 DISCUSSION GUIDE

19.2 KNOWLEDGE STORE: MARKETSANDMARKETS™ SUBSCRIPTION PORTAL

19.3 AVAILABLE CUSTOMIZATIONS

19.4 RELATED REPORTS

19.5 AUTHOR DETAILS

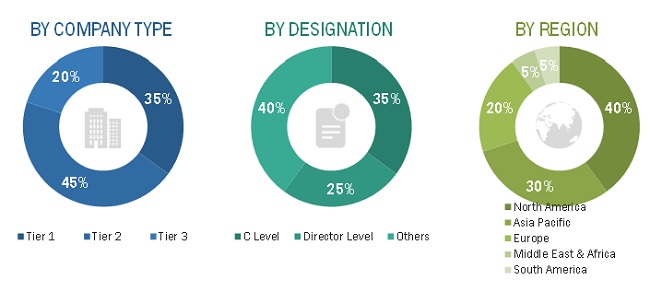

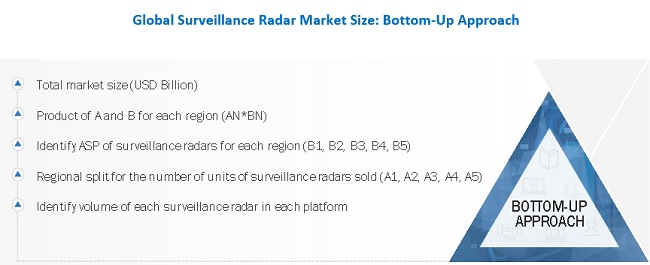

The study involved four major activities in estimating the current size of the surveillance radar market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Statista, SIPRI report, World Bank, Global Firepower, Factiva, Bloomberg, BusinessWeek, SEC filings, annual reports, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the surveillance radar Market.

Primary Research

The surveillance radar market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, service providers and system integrators in its supply chain. The demand side of this market is characterized by various end-users such as commercial, government & Defense organizations of different countries. The supply side is characterized by technologically advanced surveillance radar, advanced components, and architecture systems for surveillance radar market catering to various applications. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the surveillance radar market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the surveillance radar market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the surveillance radar market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the surveillance radar market.

Report Objectives

- To define, describe, and forecast the size of the surveillance radar market based on Application, Platform ,Frequency Band , Dimension, Waveform, Range, Type, Component and region

- To forecast the size of the various segments of the surveillance radar market based on six regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with key countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as new product developments, contracts, partnerships, mergers, product enhancements, and collaborations adopted by key players in the market

- To identify the detailed financial position, key products, unique selling points, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies2

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the surveillance radar market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the surveillance radar market

Growth opportunities and latent adjacency in Surveillance Radars Market