Carotenoids Market by Type (Astaxanthin, Beta-Carotene, Lutein, Lycopene, Canthaxanthin, Zeaxanthin), Formulations (Oil Suspension, Powder, Beadlet, and Emulsion), Source (Natural And Synthetic), Application and Region - Global Forecast to 2029

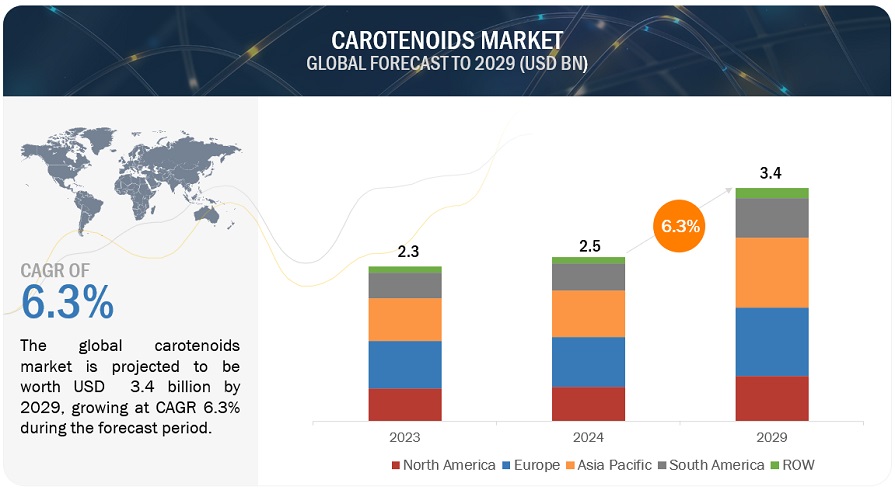

[337 Pages Report] According to MarketsandMarkets, the Carotenoids market is projected to reach USD 3.4 billion by 2029 from USD 2.5 billion by 2024, at a CAGR of 6.3% during the forecast period in terms of value. Demand for dietary supplements is increasing, leading to higher consumption of natural Carotenoids. There is a growing need for sustainable, natural, clean label, natural carotenoids contributing to market expansion. Changing dietary preferences and the awareness of health and wellness further propel market growth. Overall, these trends highlight the growing significance and adoption of Carotenoids.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Incresed use of natural carotenoids as food and beverage colorant.

The shift towards natural and clean label ingredients in the food industry has spurred increased utilization of natural carotenoids as food colorants. Carotenoids, found in fruits, vegetables, and algae, serve as appealing substitutes to synthetic colors due to their perceived health benefits and clean label appeal. Consumers seek products with recognizable, natural ingredients like beta-carotene, lycopene, and astaxanthin, which not only provide vibrant colors but also offer antioxidant properties. With a growing demand for natural ingredients and a preference for brightly colored foods, food manufacturers must prioritize understanding these trends to effectively meet consumer expectations and influence purchasing decisions. Consequently, incorporating natural carotenoid extracts across dairy, bakery, confectionery, beverages, and snacks enables versatile color applications in response to evolving consumer preferences.

Restraint: Risk with high doses of carotenoids as dietary supplements

High doses of carotenoids pose several risks, as indicated by clinical trials from Ohio State University. Large doses of beta-carotene can inhibit some functions of Vitamin A critical for vision, bone, skin, immune, and heart health. Heavy beta-carotene supplementation has been linked to a higher lung cancer risk, particularly in chain smokers. Intake exceeding 50,000 IU of beta-carotene may reduce blood levels of lutein, lycopene, and other carotenoids. Additionally, combining beta-carotene with selenium, vitamin C, and vitamin E might decrease the effectiveness of cholesterol-lowering medications. These findings from trials like the Alpha Tocopherol Beta-Carotene (ATBC) cancer prevention trial in Finland underscore the need for caution in using carotenoids extensively in food and beverage applications.

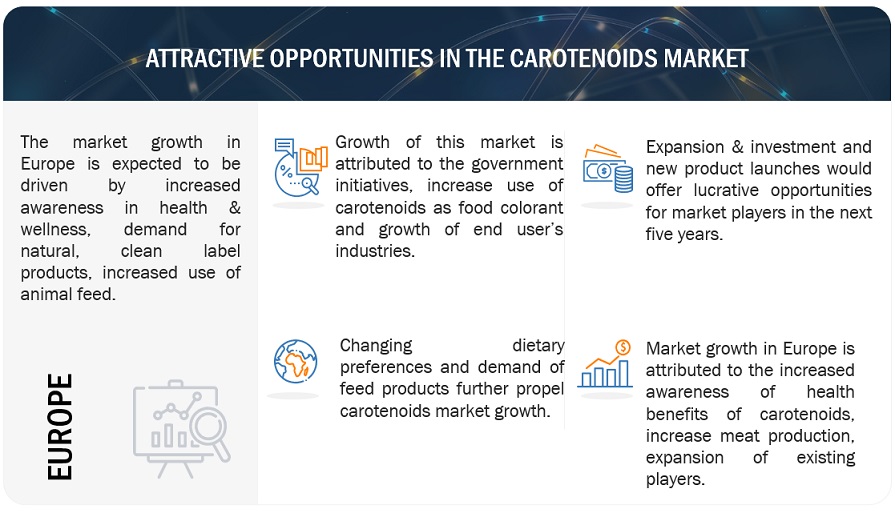

Opportunity: Increased opportunity for expansion into high-growth potential markets, including developing countries in the Asia Pacific and South America regions

Currently, Europe is poised to lead the carotenoids market, yet the Asia Pacific region anticipates sustained demand growth due to expanding markets for dietary supplements and food and beverages. Increasing awareness of carotenoids' benefits is expected to fuel demand in Asia Pacific and South America. Additionally, the burgeoning animal feed segment in Asia Pacific is projected to drive market expansion. According to the 2024 Alltech report, Latin America has demonstrated consistent growth over the past decade, driven by robust monogastric exports and expanding aqua and pet markets. With China, India, and Japan among the top feed-producing countries, the region's accelerating use of carotenoids in animal feed is forecasted to propel overall market growth.

Challenge: Challenges in achieving the necessary quality standards.

The prevalence of adulteration poses a significant challenge to maintaining carotenoid quality, endangering animals, humans, and the environment. Adulterated carotenoids, increasingly found in North America, can be hazardous, even fatal, when consumed excessively. Synthetic astaxanthin, prevalent in the US market, is typically derived from petrochemicals or genetically modified yeast, posing health risks. To counter this, manufacturers are shifting towards natural sources for carotenoid production, yet the limited adoption of natural alternatives may impede overall market growth. Moreover, heightened competition, particularly in burgeoning Asian Pacific and South American markets, has led to an influx of smaller regional players, potentially compromising carotenoid quality.

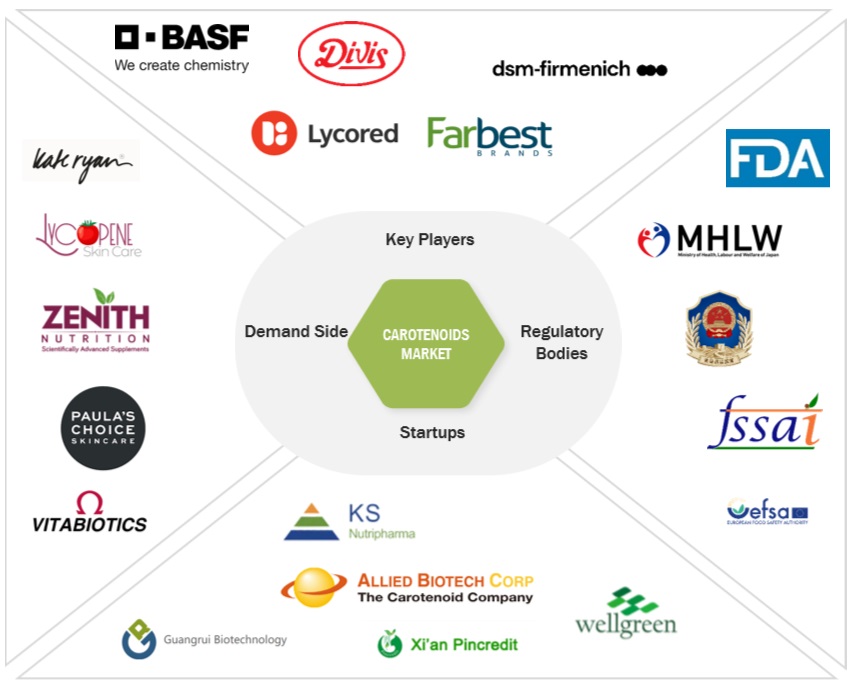

Carotenoids Market Ecosystem

Key players within this market consist of reputable and financially robust Carotenoids manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, cutting-edge technologies, and robust global sales and marketing networks. Prominent companies in this market are DSM (Netherlands), BASF SE (Germany), Cyanotech Corporation (US), Givaudan (Switzerland), ADM (US), NHU (China), Divi's Laboratories Limited (India), Allied Biotech Corporation (Taiwan), Lycored (US), Kemin Industries, Inc. (US), Fuji Chemical Industries Co., Ltd. (Japan), EW Nutrition (Germany), Döhler GmbH (Germany), ExcelVite (Malaysia) and Farbest Brands (US).

In by source segment, synthetic segment holds the largest market share in the Carotenoids Market.

The synthetic segment holds the highest market share in the carotenoids industry for several reasons. Firstly, synthetic carotenoids offer cost advantages over natural counterparts, making them economically attractive for manufacturers. Secondly, synthetic carotenoids provide consistent color and performance characteristics, ensuring uniformity in product formulations. Additionally, advancements in synthetic chemistry have led to the development of high-quality synthetic carotenoids with improved stability and functionality, further driving their demand across various industries such as food, beverages, cosmetics, and pharmaceuticals.

In by application segment, food & beverage segment is expected to grow at highest CAGR during the forecast period.

The food and beverage segment in the carotenoid market is witnessing the highest growth rate due to several key drivers. Firstly, increasing consumer demand for natural and healthy food additives drives the incorporation of carotenoids as natural colorants and functional ingredients. Secondly, growing awareness of the health benefits associated with carotenoids, such as antioxidant properties and potential disease prevention, fuels their utilization in a wide range of food and beverage products. Additionally, the rise in innovative product development and the introduction of clean-label products further stimulate market growth in this segment, catering to evolving consumer preferences for natural and nutritious food options.

The beadlet segment is expected to grow at the highest CAGR during the forecast period.

The beadlet segment is experiencing the highest growth rate in the carotenoid market due to several key factors. Firstly, beadlets offer enhanced stability and ease of handling, making them preferred for formulation in various applications such as dietary supplements, food, and beverages. Secondly, advancements in encapsulation technologies have led to the development of beadlets with improved bioavailability, ensuring efficient delivery of carotenoids to the body. Thirdly, increasing consumer demand for clean-label and natural products drives the adoption of beadlet formulations, which often use natural ingredients and avoid synthetic additives. Additionally, the versatility and convenience of beadlets make them a preferred choice for manufacturers seeking innovative solutions in the carotenoid market.

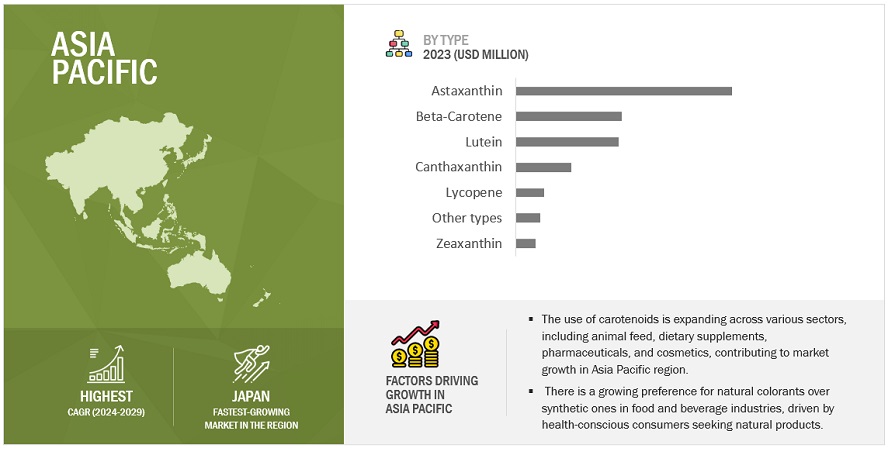

The Asia Pacific region is expected to grow at the highest CAGR in the Carotenoids Market during the forecast period.

The carotenoid market in the Asia-Pacific region is experiencing the highest growth rate due to several key factors. Firstly, rising consumer awareness of health and wellness, coupled with changing dietary preferences towards natural and functional ingredients, drives the demand for carotenoids in food, beverages, and dietary supplements. Secondly, rapid urbanization and increasing disposable incomes in emerging economies fuel the expansion of the food and beverage industry, creating opportunities for carotenoid manufacturers. Additionally, the growing prevalence of chronic diseases and aging populations amplify the demand for carotenoids, known for their antioxidant properties and health benefits, further propelling market growth in the region.

Key Market Players

The key players in the market include BASF SE (Germany), DSM (Netherlands), Cyanotech Corporation (US), Givaudan (Switzerland), ADM (US), NHU (China), Divi's Laboratories Limited (India), Allied Biotech Corporation (Taiwan), Lycored (US), Kemin Industries, Inc. (US), Fuji Chemical Industries Co., Ltd. (Japan), EW Nutrition (Germany), Döhler GmbH (Germany), ExcelVite (Malaysia) and Farbest Brands (US). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, Formulation, Application, Source and Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, Middle East and Africa |

|

Companies studied |

|

This research report categorizes the carotenoids market based on type, formulation, application, source and region.

Target Audience

- Carotenoids traders, retailers, and distributors.

- Carotenoids manufacturers & suppliers.

- Related government authorities, commercial research & development (R&D) institutions.

- Regulatory bodies, including government agencies and NGOs.

- Commercial research & development (R&D) institutions and financial institutions.

- Government and research organizations.

- Venture capitalists and investors.

- Technology providers to Carotenoids and Carotenoids companies.

- Associations and industry bodies.

Carotenoids Market:

By Type

- Astaxanthin

- Beta-Carotene

- Lutein

- Lycopene

- Canthaxanthin

- Zeaxanthin

- Other Types

By Formulation

- Oil Suspension

- Powder

- Beadlet

- Emulsion

By Application

- Food & Beverage

- Feed

- Pharmaceuticals

- Dietary Supplement

- Cosmetics

By Source

- Natural

- Synthetic

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East

- Africa

Recent Developments

- In March, 2023, ADM (US) revealed the signing of a joint venture agreement with Marel (Netherlands), a leading provider of cutting-edge food processing solutions. This partnership aimed to establish an innovation center at the prestigious Wageningen Campus in the Netherlands, renowned as the epicenter of the nation's food valley. Tailored to foster collaboration among food manufacturers, food scientists, extrusion specialists, and culinary professionals, this strategic initiative is poised to bolster ADM's market expansion efforts and facilitate research and development in its carotenoid segments.

- In May 2022, Divi's Laboratories Limited (India) and Algalif (Iceland) announced a collaboration to develop highly concentrated beadlets of sustainable natural astaxanthin. Leveraging Algalif's production process in Iceland, which utilizes renewable energy and yields premium astaxanthin oleoresin sourced from microalgae, the partnership aims to enhance Divi's Laboratories Limited's capabilities and product offerings in the carotenoid segment.

- In December 2021, Givaudan (Switzerland) finalized the acquisition of DDW, the Color House (US), a prominent natural color-based company. This acquisition is poised to enable Givaudan to enhance its portfolio of natural food color products and facilitate market expansion.

Frequently Asked Questions (FAQ):

Which are the major companies in the carotenoids market? What are their major strategies to strengthen their market presence?

The key players in the market include DSM (Netherlands), BASF SE (Germany), Cyanotech Corporation (US), Givaudan (Switzerland), ADM (US), NHU (China), Divi's Laboratories Limited (India), Allied Biotech Corporation (Taiwan), Lycored (US), Kemin Industries, Inc. (US), Fuji Chemical Industries Co., Ltd. (Japan), EW Nutrition (Germany), Döhler GmbH (Germany), ExcelVite (Malaysia) and Farbest Brands (US). These players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

What are the drivers and opportunities for the carotenoids market?

The carotenoids market is driven by increasing consumer awareness of health benefits, demand for natural food additives, and growth in dietary supplement usage. Opportunities abound in expanding applications in food, pharmaceuticals, cosmetics, and animal feed sectors. Rising preference for clean-label products and the search for natural colorants propel market growth. Technological advancements in extraction, formulation, and delivery systems further augment opportunities. Additionally, the surge in research and development activities to enhance carotenoid bioavailability and functionality opens avenues for innovation. Emerging markets in Asia-Pacific present lucrative opportunities for market expansion, fostering industry growth and diversification.

Which region is expected to hold the highest market share?

Europe holds the highest market share in the carotenoid market due to several factors. Firstly, stringent regulations on synthetic food additives drive the demand for natural alternatives, boosting the consumption of carotenoids in food and beverage applications. Secondly, increasing consumer awareness of health and wellness drives the demand for dietary supplements enriched with carotenoids. Thirdly, the presence of key market players and robust R&D activities contribute to product innovation and market growth. Moreover, Europe's strong food processing industry and growing demand for natural colorants in cosmetics and pharmaceuticals further fuel market expansion, consolidating Europe's position as a leading market for carotenoids.

What are the key technology trends prevailing in the carotenoids market?

Advancements in biotechnology have led to the development of Carotenoids derived from natural sources such as microbes and plants, animals. Several key technologies prevail in the carotenoids market, facilitating their extraction, formulation, and application across various industries. Extraction Technologies such as solvent extraction, supercritical fluid extraction, and enzymatic extraction are employed to isolate carotenoids from natural sources like fruits, vegetables, and microorganisms. Encapsulation technologies, including spray drying, coacervation, and fluid bed coating, are used to formulate carotenoids into stable delivery systems such as beadlets, microencapsulates, and emulsions, ensuring their protection and enhanced bioavailability. Chemical synthesis and biotechnological methods, such as fermentation using genetically engineered microorganisms, enable the production of carotenoids like astaxanthin and canthaxanthin at commercial scales, providing cost-effective alternatives to natural sources. In 2021, Kuehnle AgroSystems (KAS), an algae technology firm, unveiled a novel fermentation technique and gained patent utilizing the microalga Haematococcus pluvialis for natural astaxanthin production. Nanoparticle-based delivery systems enable improved solubility, stability, and targeted delivery of carotenoids, enhancing their efficacy in food, pharmaceuticals, and cosmetics. Analytical Techniques: Advanced analytical techniques like high-performance liquid chromatography (HPLC), mass spectrometry (MS), and nuclear magnetic resonance (NMR) spectroscopy are utilized for qualitative and quantitative analysis of carotenoids, ensuring product quality and regulatory compliance.

These technologies collectively drive innovation and advancement in the carotenoids market, expanding their applications and meeting the evolving needs of industries and consumers alike.

What total CAGR is expected to be recorded for the carotenoids market from 2024 to 2029?

The CAGR is expected to be 6.3% from 2024-2029. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

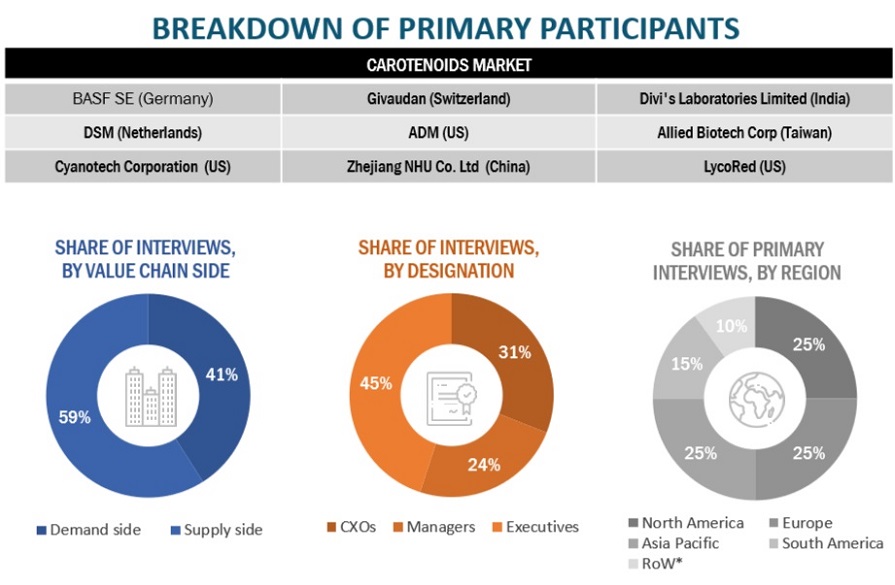

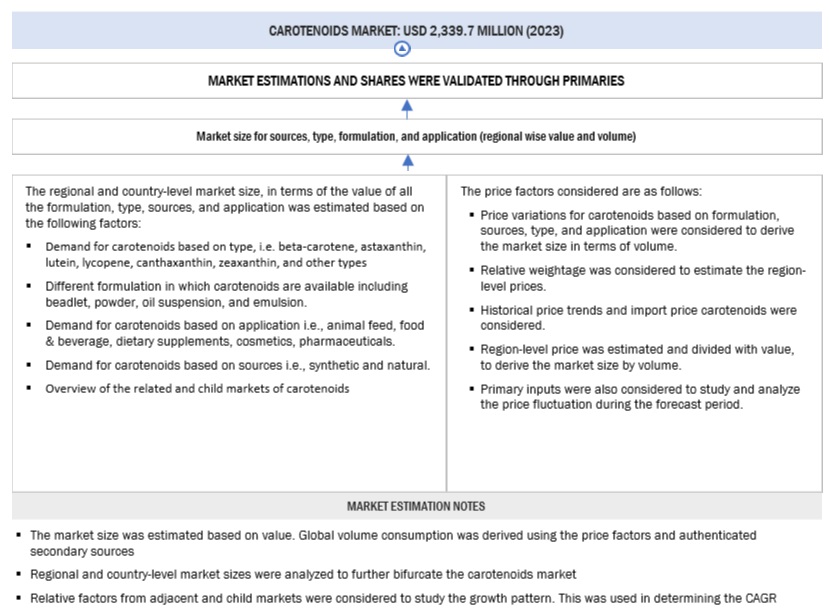

The study involved four major activities in estimating the current size of the carotenoids market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the carotenoids market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the carotenoids market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the carotenoids market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, formulation, application, source, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the carotenoids market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- Primary and secondary research determined the industry’s value chain and market size.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The following figure provides an illustrative representation of the complete market size estimation process implemented in this research study for an overall estimation of the carotenoids market in a consolidated format.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Global Carotenoids Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Carotenoids Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall carotenoids market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to European Feed Additives Manufacturers Association (FEFANA):

Carotenoids are naturally transpiring pigments predominantly accountable for the array of yellow to red hues observed in flora, fauna, fungi, avifauna, and aquatic organisms such as fish flesh, the cuticle of crustaceans, or insects. For instance, the yellow-orange hue of carrots arises from one of the most recognizable carotenoids and a precursor of vitamin A, β-carotene, from which the nomenclature of this entire category of innate pigments originates.

Key Stakeholders

- Supply-Side: Carotenoids Producers, Suppliers, Distributors, Importers, and Exporters

- Demand Side: Feed Industry, Food & Beverage Industry, Dietary Supplement Industry, Pharmaceutical Industry, Cosmetics Industry and Researchers

- Government, Research Organizations, and Institutions

- World Health Organization (WHO)

- Food and Drug Administration (FDA)

- Food and Agriculture Organization (FAO)

- Food Additives and Ingredients Association (FAIA)

- Food Processing Suppliers Association (FPSA)

- Institute of Food and Agricultural Sciences (IFAS)

- Association of Nutrition & Foodservice Professionals (ANFP)

- Natural Products Association (NPS)

- Department of Environment Food and Rural Affairs (DEFRA)

- US Department of Agriculture (USDA)

- European Food Safety Association (EFSA)

- Commercial Research & Development (R&D) Institutions and Financial Institutions

Report Objectives

Market Intelligence

- To determine and project the size of the carotenoids market with respect to the type, formulation, application, source and region, over five years, ranging from 2024 to 2029.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- To analyze the demand-side factors based on the following:

- Impact of macro-and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

Competitive Intelligence

- Identifying and profiling the key players in the carotenoids market

- Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies players across the country adopt.

- Providing insights on key product innovations and investments in the carotenoids market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into the UK, Turkey, Switzerland, Belgium, Ukraine and other EU & non-EU countries.

- Further breakdown of the Rest of Asia Pacific into South Korea, Kazakhstan, Vietnam and other Asian countries

- Further breakdown of the Rest of South America into Uruguay, Venezuela, Colombia and other South American countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Carotenoids Market