Food Colors Market Size, Share, Industry Growth, Trends Report by Type (Natural, Synthetic, and Nature-identical), Application (Food Products and Beverages), Source (Plants & Animals, Microorganisms, and Minerals & Chemicals), Form, Solubility and Region - Global Forecast to 2028

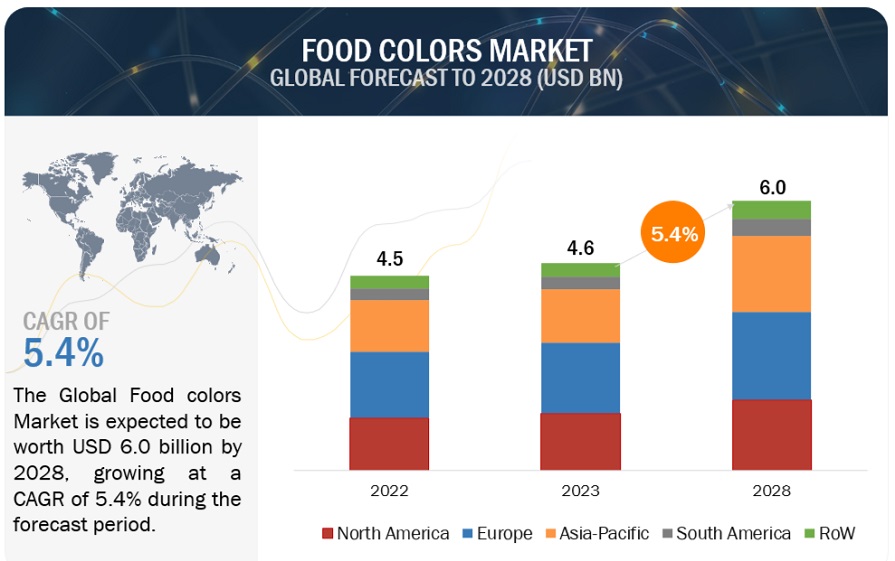

According to MarketsandMarkets, the food colors market is projected to reach USD 6.0 billion by 2028 from USD 4.6 billion in 2023, at a CAGR of 5.4% during the forecast. The increase in intake of processed food and beverages has motivated manufacturers into using attractive colors on their products to make them visually appealing enough to entice more customers and, thus, drive the demand for food colors globally. Additionally, the shift from artificial to natural coloring derived from fruits, vegetables, and spices is a growing trend in the food colors industry. Food coloring is another tool that enterprises use to differentiate their products in a crowded food and beverage industry where aesthetic visuals could impact in sales. Globalization of culinary trends requires authentic and varied food coloring.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Need to enhance product appeal among manufacturers

The need to enhance product appeal has become a key driving factor in the food colors market. With the popularity of social media sites like YouTube and Instagram, product differentiation is greatly influenced by aesthetics. Color is a vital tool for manufacturers as visually appealing products attract ever more consumers. Similarly, vibrant and colorful foods also excite children and promote eating. A study conducted by the International Food Information Council (IFIC) found that 64% of consumers give appearance a high priority when making purchases. In order to meet consumer expectations and differentiate themselves in a crowded market, manufacturers are driven to innovate with food colors due to the emphasis placed on visual appeal.

Restraints: Health hazards of synthetic colors

The health hazards associated with synthetic colors have significantly restrained the growth of the food colors market. Fears of possible hazards, such as children becoming hyperactive and other negative health impacts, have made consumers want safer, natural substitutes. This shift is particularly evident in legislative actions, such as the recent bill before the California Senate. This bill, which is anticipated to be voted on shortly, would prohibit six synthetic dyes from being used in K–12 public schools, as mentioned by New York Times article (August 2024). Although the FDA upheld the safety of nine synthetic dyes that were approved between 1963 and 1987, continuous discussions sparked by research connecting these dyes to behavioural problems in children have kept the market for synthetic colors under close observation, reducing their use in the food industry.

Opportunity: Innovative color extractions with use of new material resources

With new extraction methods and raw materials, color extraction innovations are reshaping the food color market. For instance, newer sources such as purple sweet potato and red cabbage offers vibrant, stable colors while providing antioxidant benefits. Furthermore, crocin, a naturally occurring yellow pigment derived from saffron, has gained attention as a possible health advantage. Various technological developments such as enzyme-assisted as well as ultrasound-assisted methods have also significantly increased the efficiency and yield of extraction processes, reduced processing times, and enhanced color stability. These developments fulfil consumer demands for natural, sustainable, and useful ingredients while assisting the food color industry's transition to cleaner labels and environmentally friendly production methods.

Challenge: Misperception about titanium dioxide among consumers

Misperceptions about titanium dioxide have had a major effect on the food colors market. As titanium dioxide can be carcinogenic when ingested in large quantities, there have been questions raised concerning its safety when used as a white pigment and opacity agent. In response to research indicating potential health hazards, the European Union banned titanium dioxide in food products in 2022. Food producers in Europe are now impacted and need to find substitute colorants. US FDA has not yet enacted a similar ban, creating a disparity that complicates product formulation for global manufacturers. The lack of consistency in regulations and consumer concerns regarding titanium dioxide pose challenges for food manufacturers when formulating products for a global market. This can have an impact on their approach to market strategy and the safety of their products.

Food Colors Market Ecosystem

Key players within this market consist of reputable and financially robust food colors product manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, cutting-edge technologies, and robust global sales and marketing networks.

Natural food colors, by type, accounted for the highest market share and is the fastest growing segment among food colors

Food colors market is dominated by the natural food colors. This growth is driven by rising consumer demand for organic as well as clean label products. Increasing health consciousness and concerns about synthetic dyes, which can cause allergic reactions, have further fueled this trend. The segment's growth is further propelled by advancements in biotechnology. For instance, DSM Venturing (Netherlands) led Phytolon, an Israeli startup focused on natural food colouring, to secure USD 14.5 million in Series A funding in July 2022. Precision fermentation is being used by Phytolon to create natural colorants, which could lead to scalable production and commercialization. Their technology aims to replace traditional agriculture-based methods with more sustainable practices, meeting the high demand for natural colors in markets such as the US and Europe.

Plants & Animal, by source, accounted for the highest market share and is the fastest growing segment among source segment during the study period.

The market for food colors is dominated by the plants & animals source, which is also expected to grow at the fastest rate as consumer demand for natural and clean-label products rises. Food manufacturers are searching for natural substitutes for synthetic dyes as consumers are becoming more cautious about their health. Animal-based colors such as carmine and plant-based colors like those derived from fruits, vegetables, and spices are becoming more and more popular due to their natural, vibrant colors and environmental friendliness. These alternatives are perceived as safer and more sustainable, driving market expansion and higher growth compared to mineral, chemical, and microorganism-based colors.

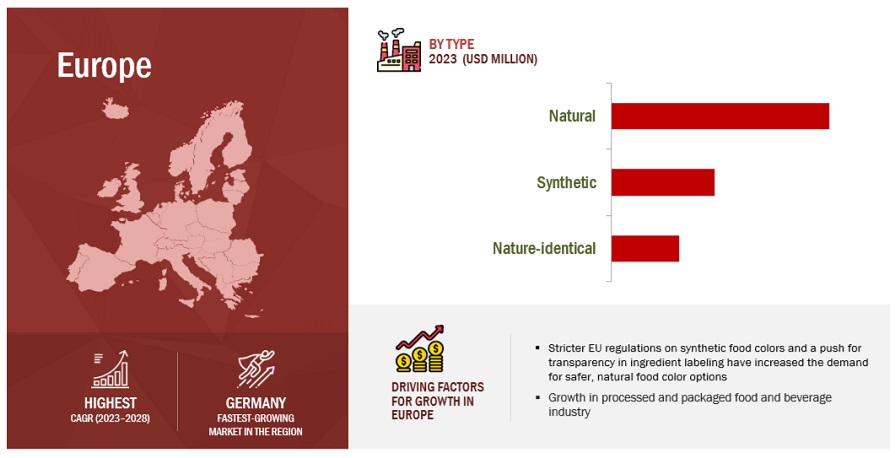

Europe accounted for the highest market share and is the fastest growing market for food colors among the regions.

Among the regions, Europe dominates the food colors market. The dynamic and diverse food and beverage industry in Europe is the primary reason for the high demand for food colors in the region. According to Eurostat, there were 291,000 food and beverage processing businesses in the EU in 2020, with 4.6 million employees and a GDP of USD 258.8 billion. Furthermore, in 2021, the average expenditure made by EU citizens on food, beverages, and catering services was USD 4101.6. This significant consumer spending suggests a high demand for processed food and beverages, which in turn supports the market for food colors. The region's inclination for natural food coloring and its stringent laws both support the market's expansion.

Key Market Players

The key players in the food colors market include ADM (US), International Flavors & Fragrances, Inc. (US), Sensient Technologies Corporation (US), DSM (Netherlands), Dohler Group (Germany), LycoRed (Israel), and Kalsec Inc. (US). These market participants are emphasizing the expansion of their footprint via acquisitions and new product launches. They maintain a robust presence in North America, Asia Pacific, Europe, South America, and RoW, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD Million) |

|

Segments Covered |

By Type, Source, Application, Form, Solubility, and Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies covered |

|

Target Audience

- Food color producers, suppliers, distributors, importers, and exporters

- Large-scale food and beverage ingredient manufacturers, processed food manufacturers, and research organizations

- Related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA, FSANZ, EUFIC government agencies & NGOs, and other regulatory bodies

- Food product consumers

- Regulatory bodies, including government agencies and NGOs

- Commercial research & development (R&D) institutions and financial institutions

- Government and research organizations

Food Colors Market:

-

By Type

-

Natural Colors

- Carmine

- Anthocyanins

- Caramel

- Annatto

- Carotenoids

- Chlorophyll

- Spirulina

- Other Natural Colors

-

Synthetic Colors

- Blue

- Red

- Yellow

- Green

- Amaranth

- Carmoisine

- Other Synthetic Colors

- Nature-Identical

-

Natural Colors

-

By Source

- Plants & Animals

- Minerals & Chemicals

- Microorganisms

-

By Form

- Liquid

- Powder

- Gel

-

By Solubility

- Dyes

- Lakes

-

By Application

-

Food Products

- Processed Food Products

- Bakery & Confectionery Products

- Meat, Poultry, and Seafood Products

- Oils & Fats

- Dairy Products

- Other Food Products

-

Beverages

- Juice & Juice Concentrates

- Functional Drinks

- Carbonated Soft Drinks

- Alcoholic Beverages

-

Food Products

-

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In July 2024, International Flavors & Fragrances Inc. (US) announced the expansion of its Shanghai Hongqiao Airport Business Park facility, creating the “Shanghai Creative Center.” This 16,000-square-meter site, International Flavors & Fragrances Inc.’s largest in Asia, aimed to enhance innovation across its portfolios.

- In October 2022, Sensient Technologies Corporation (US) acquired Endemix Dogal Maddeler A.S., a Turkish natural colors and extracts company. This acquisition enhanced Sensient’s vertical integration and expanded its extraction and refining capabilities. It strengthened Sensient's natural color portfolio and improved its access to key botanical sources, bolstering its position in the food colors market and supporting the growing demand for natural and healthier products.

- In December 2021, Givaudan (Switzerland) completed its acquisition of DDW, The Color House (US), boosting its position as one of the largest global players in natural colors. The deal, which added USD 140 million in sales, expanded Givaudan’s capabilities in natural and caramel colors.

Frequently Asked Questions (FAQ):

What is the current size of the food colors market?

The food colors market is estimated at USD 4.6 billion in 2023 and is projected to reach USD 6.0 billion by 2028, at a CAGR of 5.4% from 2023 to 2028.

Which are the key players in the market, and how intense is the competition?

The key players in the food colors market include ADM (US), International Flavors & Fragrances, Inc. (US), Sensient Technologies Corporation (US), DSM (Netherlands), Dohler Group (Germany), LycoRed (Israel), and Kalsec Inc. (US).

The food colors market witnesses increased scope for growth. The market is seeing an increase in the number of new product launches, acquisitions, and new expansions. Moreover, the companies involved in manufacturing food colors products are investing a considerable proportion of their revenues in research and development activities.

Which region is projected to account for the largest share of the food colors market?

The European market is expected to dominate during the forecast period. The increased demand for food colors in the European region is driven by stringent regulatory standards, consumer preference for natural and clean-label ingredients, and the rise in premium and health-conscious products. Additionally, Europe’s rigorous regulations on synthetic dyes have spurred growth in natural and nature-identical colors categories.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the factors driving the food colors market?

The demand for food colors is primarily driven by increase in demand for natural and clean-label products, need to enhance product appeal among manufacturers, and technological advancements & growing R&D activities. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in demand for natural and clean-label products- Need to enhance product appeal among manufacturers- Growing trade, investment, and expenditure in processed food & beverages market- Technological advancements and growth in R&D activities- Increase in consumer preference for organic productsRESTRAINTS- Health hazards of synthetic colorants- Stringent regulations on use of colors in food applications- Low stability and high cost of natural colorsOPPORTUNITIES- Innovative color extractions with use of new raw material sources- Increase in ventures undertaken by manufacturers in Asia Pacific and South America- Safety reassessment of synthetic food colors- Launching of advanced products by manufacturers- Consumer willingness to pay more for natural colorsCHALLENGES- Consumer preference for natural food colors due to labeling mandates for E numbers- Misperception about titanium dioxide among consumers

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH & PRODUCT DEVELOPMENTSOURCING & PRODUCTIONMARKETING & SALES AND LOGISTICS

-

6.3 TECHNOLOGY ANALYSISMICROENCAPSULATION TECHNOLOGYNON-THERMAL TREATMENTS: HPP & PEF ENHANCE COLOR RETENTIONOTHER TECHNOLOGIES

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

-

6.5 ECOSYSTEM MAPPING: FOOD COLORS MARKETDEMAND-SIDE ECOSYSTEMSUPPLY-SIDE ECOSYSTEM

- 6.6 TRENDS IMPACTING CUSTOMERS’ BUSINESS

-

6.7 PATENT ANALYSIS

- 6.8 TRADE DATA

- 6.9 KEY CONFERENCES & EVENTS

-

6.10 PORTER’S FIVE FORCES ANALYSISDEGREE OF COMPETITIONBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT FROM SUBSTITUTESTHREAT FROM NEW ENTRANTS

-

6.11 CASE STUDIESALLERGEN SENSORS FOR CONSUMERSSENSORY EXPERIENCE TO REMAIN KEY PRIORITY FOR CONSUMERS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY BUYING CRITERIA

-

6.13 TRADE AND REGULATORY LANDSCAPEMEXICO- Mexican Food RegulationsBRAZIL- Brazilian Health Regulatory Agency (ANVISA)- Brazilian Food Regulations and StandardsARGENTINA- The Argentina Food Safety ActREST OF SOUTH AMERICAEUROPE- Food and Agricultural Import Regulations and Standards (Berlin, Germany)- Food and Agriculture Imports Regulations and Standards (France)- ItalyCHINAINDIAJAPAN- Japanese Ministry of Health, Labour and Welfare- Japan Food Chemical Research Foundation (JFCRF)SOUTH KOREA- Ministry of Food and Drug Safety (MFDS)AUSTRALIA & NEW ZEALAND- Australia New Zealand Food Standards Code - Standard 1.3.1 - Food AdditivesMIDDLE EAST- Food, Agricultural, and Water Import Regulations, and Standards - Dubai, United Arab Emirates

- 7.1 INTRODUCTION

-

7.2 NATURAL COLORSINCREASE IN FOOD QUALITY AND SAFETY AWARENESS AMONG CONSUMERSCARMINEANTHOCYANINSCARAMELANNATTOCAROTENOIDSCHLOROPHYLLSPIRULINAOTHER NATURAL COLORS

-

7.3 SYNTHETICHIGH ADOPTION AND EXTENSIVE COLOR PALETTE OFFERED BY SYNTHETIC COLORSBLUEREDYELLOWGREENAMARANTHCARMOISINEOTHER SYNTHETIC COLORS

-

7.4 NATURE-IDENTICALLOW HEALTH IMPACT OF NATURE-IDENTICAL COLORS AND COST-EFFECTIVENESS OVER NATURAL COLORS

- 8.1 INTRODUCTION

-

8.2 PLANTS & ANIMALSINCREASE IN CONSUMER DEMAND FOR NATURAL INGREDIENTS AND SUSTAINABLE, ETHICAL PRODUCTION METHODS

-

8.3 MINERALS & CHEMICALSPETROLEUM, PETROCHEMICALS, AND MINERAL COMPOUNDS USED IN FOOD AND PHARMACEUTICAL INDUSTRIES

-

8.4 MICROORGANISMSPROMISING ALTERNATIVE TO SYNTHETIC FOOD COLORANTS

- 9.1 INTRODUCTION

-

9.2 LIQUIDEASE OF USE AND INCREASE IN APPLICATION FOR FURTHER BLENDING AND FORMULATION OF NEW FOOD COLORS

-

9.3 POWDERDIVERSE COLOR PROFILE FACILITATED BY POWDERED COLORS

-

9.4 GELLONGER SHELF LIFE AND WIDE COLOR PALETTE OFFERED IN GEL FORM

- 10.1 INTRODUCTION

-

10.2 DYESHIGH GROWTH OF FOOD & BEVERAGE INDUSTRY AND GLOBAL DEMAND FOR NATURAL FOOD INGREDIENTS

-

10.3 LAKESINCREASED APPLICABILITY OF LAKES IN DYNAMIC BAKERY AND CONFECTIONERY INDUSTRY

- 11.1 INTRODUCTION

-

11.2 FOOD PRODUCTSRAPID GROWTH OF FOOD SECTORS GLOBALLYPROCESSED FOOD PRODUCTSBAKERY & CONFECTIONERY PRODUCTSMEAT, POULTRY, AND SEAFOODOILS & FATSDAIRY PRODUCTSOTHER FOOD PRODUCTS

-

11.3 BEVERAGESAVAILABILITY OF NEW, REFRESHING, AND HEALTHIER JUICES AND BEVERAGESJUICE & JUICE CONCENTRATESFUNCTIONAL DRINKSCARBONATED SOFT DRINKSALCOHOLIC BEVERAGES

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Presence of key players and well-established food & beverage industriesCANADA- Increase in consumer preference for clean-label food products to encourage natural food colorsMEXICO- High demand for natural food colors

-

12.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- High growth of chemicals and processed foods manufacturing sectorsUK- Steady rise in food & beverage processing sector along with high demand for natural ingredientsFRANCE- Rise in preference for ready-to-eat meals with premium ingredients during pandemicITALY- Slowly rising expenditure on food in Italy due to changing lifestylesSPAIN- Well-established processed food sector demanding high-quality food colorsREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Increase in chemical production and exportsINDIA- Rise in local food color manufacturers and domestic consumption of processed foodsJAPAN- Increase in demand for natural food colorsAUSTRALIA & NEW ZEALAND- Rise in demand for organic and natural food productsSOUTH KOREA- Robust food processing industries in South KoreaREST OF ASIA PACIFIC

-

12.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Increase in presence of key food retailers and growth of food processing industriesARGENTINA- Growth of food processing sectorREST OF SOUTH AMERICA

-

12.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISSOUTH AFRICA- Growth of food & beverage industry to offer attractive investment opportunitiesMIDDLE EAST- Gradual growth in food & beverage sector in this regionREST OF AFRICA

- 13.1 OVERVIEW

- 13.2 REVENUE ANALYSIS OF KEY PLAYERS

- 13.3 MARKET SHARE ANALYSIS

- 13.4 STRATEGIES OF TOP FOUR PLAYERS

-

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSPRODUCT FOOTPRINT

-

13.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

-

13.7 NEW PRODUCT LAUNCHES AND DEALSNEW PRODUCT LAUNCHES

-

14.1 KEY PLAYERSARCHER DANIELS MIDLAND COMPANY- Business overview- Products offered- Recent developments- MnM viewINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products offered- Recent developments- MnM viewSENSIENT TECHNOLOGIES CORPORATION- Business overview- Products offered- Recent developments- MnM viewDSM- Business overview- Products offered- Recent developments- MnM viewNATUREX- Business overview- Products offered- Recent developments- MnM viewDDW- Business overview- Products offered- Recent developments- MnM viewDÖHLER GROUP- Business overview- Products offered- Recent developments- MnM viewFIORIO COLORI- Business overview- Products offered- Recent developments- MnM viewLYCORED- Business overview- Products offered- MnM viewKALSEC INC.- Business overview- Products offered- Recent developments- MnM viewALLIANCE ORGANICS LLP- Business overview- Products offered- Recent developments- MnM viewHORIZON SPECIALITIES LTD.- Business overview- Products offered- Recent developments- MnM viewSUN FOOD TECH PVT. LTD.- Business overview- Products offered- Recent developments- MnM viewSAN-EI GEN F.F.I., INC.- Business overview- Products offered- Recent developments- MnM view

-

14.2 OTHER PLAYERSPHARMOGANA GMBHCHROMATECH INCORPORATEDSUNRISE GREENFOODPROQUIMACEXBERRYAJANTA CHEMICAL INDUSTRIES

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

-

15.3 FOOD FLAVORS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.4 NATURAL COLORS & FLAVORS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- TABLE 4 FOOD COLORS MARKET SNAPSHOT, BY TYPE, 2023 VS. 2028

- TABLE 5 NATURAL COLORING AGENTS AND THEIR HEALTH BENEFITS

- TABLE 6 USE OF FOOD COLORS TO ENHANCE PRODUCT APPEAL

- TABLE 7 SYNTHETIC FOOD COLORS AND THEIR HEALTH HAZARDS

- TABLE 8 COLORING FOOD, NUTRIENTS, AND HEALTH BENEFITS

- TABLE 9 E NUMBERS OF FOOD COLORS

- TABLE 10 FOOD COLORS MARKET: AVERAGE SELLING PRICES, BY TYPE, 2022 (USD/KG)

- TABLE 11 FOOD COLORS MARKET: AVERAGE SELLING PRICES, BY REGION, 2022 (USD/KG)

- TABLE 12 FOOD COLORS MARKET: ECOSYSTEM MAPPING

- TABLE 13 PATENTS PERTAINING TO FOOD COLORS, 2020–2022

- TABLE 14 IMPORT AND EXPORT VALUE OF FOOD COLORS, BY COUNTRY, 2021 (USD MILLION)

- TABLE 15 IMPORT AND EXPORT VOLUME OF FOOD COLORS, BY COUNTRY, 2021 (KG)

- TABLE 16 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 17 FOOD COLORS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD COLOR TYPES

- TABLE 19 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 21 FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 22 FOOD COLORS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 23 FOOD COLORS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 24 NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 25 NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 26 SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 27 SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 28 COMMONLY USED EXEMPT COLORS & THEIR APPLICATIONS

- TABLE 29 NATURAL FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 NATURAL FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 NATURAL FOOD COLORS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 32 NATURAL FOOD COLORS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 33 CARMINE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 CARMINE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 ANTHOCYANINS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 ANTHOCYANINS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 CARAMEL MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 CARAMEL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 ANNATTO MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 ANNATTO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 CAROTENOIDS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 CAROTENOIDS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 CHLOROPHYLL MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 CHLOROPHYLL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 SPIRULINA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 SPIRULINA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 OTHER NATURAL FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 OTHER NATURAL FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 E NUMBER OF COLORS

- TABLE 50 SYNTHETIC COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 SYNTHETIC COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 SYNTHETIC COLORS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 53 SYNTHETIC COLORS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 54 BLUE FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 BLUE FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 RED FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 RED FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 YELLOW FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 YELLOW FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 GREEN FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 GREEN FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 AMARANTH MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 AMARANTH MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 CARMOISINE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 CARMOISINE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 OTHER SYNTHETIC FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 OTHER SYNTHETIC FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 NATURE-IDENTICAL FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 NATURE-IDENTICAL FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 NATURE-IDENTICAL FOOD COLORS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 71 NATURE-IDENTICAL FOOD COLORS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 72 FOOD COLORS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 73 FOOD COLORS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 74 FOOD COLORS MARKET, BY SOURCE, 2019–2022 (KT)

- TABLE 75 FOOD COLORS MARKET, BY SOURCE, 2023–2028 (KT)

- TABLE 76 PLANT & ANIMAL SOURCES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 PLANT & ANIMAL SOURCES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 MINERAL & CHEMICAL SOURCES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 MINERAL & CHEMICAL SOURCES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 MICROORGANISM SOURCES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 MICROORGANISM SOURCES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 FOOD COLORS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 83 FOOD COLORS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 84 LIQUID FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 LIQUID FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 POWDER-BASED FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 POWDER-BASED FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 GEL-BASED FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 GEL-BASED FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 FOOD COLORS MARKET, BY SOLUBILITY, 2019–2022 (USD MILLION)

- TABLE 91 FOOD COLORS MARKET, BY SOLUBILITY, 2023–2028 (USD MILLION)

- TABLE 92 EU: APPROVED LAKES COLORS

- TABLE 93 FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 96 FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 PROCESSED FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 102 PROCESSED FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 BAKERY & CONFECTIONERY APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 BAKERY & CONFECTIONERY APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 MEAT, POULTRY, AND SEAFOOD APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 106 MEAT, POULTRY, AND SEAFOOD APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 OIL & FAT APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 108 OIL & FAT APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 DAIRY PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 110 DAIRY PRODUCT APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 OTHER FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 112 OTHER FOOD PRODUCT APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 113 BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 114 BEVERAGE APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 JUICE & JUICE CONCENTRATE APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 116 JUICE & JUICE CONCENTRATE APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 117 FUNCTIONAL DRINK APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 118 FUNCTIONAL DRINK APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 FOOD COLOR TYPES USED IN SOFT DRINKS

- TABLE 120 CARBONATED SOFT DRINK APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 121 CARBONATED SOFT DRINK APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 122 ALCOHOLIC BEVERAGE APPLICATIONS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 123 ALCOHOLIC BEVERAGE APPLICATIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 124 FOOD COLORS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 125 FOOD COLORS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 126 FOOD COLORS MARKET, BY REGION, 2019–2022 (KT)

- TABLE 127 FOOD COLORS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 128 NORTH AMERICA: FOOD COLORS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: FOOD COLORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 131 NORTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 133 NORTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 134 NORTH AMERICA: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: FOOD COLORS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: FOOD COLORS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: FOOD COLORS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: FOOD COLORS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 US: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 149 US: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 150 US: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 151 US: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 CANADA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 153 CANADA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 154 CANADA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 155 CANADA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 156 MEXICO: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 157 MEXICO: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 MEXICO: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 159 MEXICO: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 EUROPE: FOOD COLORS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 161 EUROPE: FOOD COLORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 162 EUROPE: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 163 EUROPE: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 164 EUROPE: FOOD COLORS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 165 EUROPE: FOOD COLORS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 166 EUROPE: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 167 EUROPE: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 168 EUROPE: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 169 EUROPE: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 170 EUROPE: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 171 EUROPE: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 172 EUROPE: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 173 EUROPE: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 174 EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 175 EUROPE: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 176 EUROPE: FOOD COLORS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 177 EUROPE: FOOD COLORS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 178 EUROPE: FOOD COLORS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 179 EUROPE: FOOD COLORS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 180 GERMANY: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 181 GERMANY: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 182 GERMANY: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 183 GERMANY: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 184 UK: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 185 UK: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 186 UK: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 187 UK: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 188 FRANCE: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 189 FRANCE: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 190 FRANCE: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 191 FRANCE: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 192 ITALY: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 193 ITALY: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 194 ITALY: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 195 ITALY: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 196 SPAIN: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 197 SPAIN: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 198 SPAIN: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 199 SPAIN: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 200 REST OF EUROPE: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 201 REST OF EUROPE: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 202 REST OF EUROPE: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 203 REST OF EUROPE: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 204 ASIA PACIFIC: FOOD COLORS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 205 ASIA PACIFIC: FOOD COLORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 206 ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 207 ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 208 ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 209 ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 210 ASIA PACIFIC: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 211 ASIA PACIFIC: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 213 ASIA PACIFIC: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 215 ASIA PACIFIC: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 217 ASIA PACIFIC: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 219 ASIA PACIFIC: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 220 ASIA PACIFIC: FOOD COLORS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 221 ASIA PACIFIC: FOOD COLORS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 222 ASIA PACIFIC: FOOD COLORS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 223 ASIA PACIFIC: FOOD COLORS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 224 CHINA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 225 CHINA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 226 CHINA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 227 CHINA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 228 INDIA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 229 INDIA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 230 INDIA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 231 INDIA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 232 JAPAN: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 233 JAPAN: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 234 JAPAN: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 235 JAPAN: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 236 AUSTRALIA & NEW ZEALAND: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 237 AUSTRALIA & NEW ZEALAND: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 238 AUSTRALIA & NEW ZEALAND: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 239 AUSTRALIA & NEW ZEALAND: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 240 SOUTH KOREA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 241 SOUTH KOREA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 242 SOUTH KOREA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 243 SOUTH KOREA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 248 SOUTH AMERICA: FOOD COLORS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 249 SOUTH AMERICA: FOOD COLORS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 250 SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 251 SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 252 SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 253 SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 254 SOUTH AMERICA: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 255 SOUTH AMERICA: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 256 SOUTH AMERICA: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 257 SOUTH AMERICA: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 258 SOUTH AMERICA: FOOD COLORS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 259 SOUTH AMERICA: FOOD COLORS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 260 SOUTH AMERICA: FOOD COLORS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 261 SOUTH AMERICA: FOOD COLORS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 262 SOUTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 263 SOUTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 264 SOUTH AMERICA: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 265 SOUTH AMERICA: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 266 SOUTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 267 SOUTH AMERICA: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 268 BRAZIL: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 269 BRAZIL: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 270 BRAZIL: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 271 BRAZIL: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 272 ARGENTINA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 273 ARGENTINA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 274 ARGENTINA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 275 ARGENTINA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 276 REST OF SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 277 REST OF SOUTH AMERICA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 278 REST OF SOUTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 279 REST OF SOUTH AMERICA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 280 ROW: FOOD COLORS MARKET, BY COUNTRY/REGION, 2019–2022 (USD MILLION)

- TABLE 281 ROW: FOOD COLORS MARKET, BY COUNTRY/REGION, 2023–2028 (USD MILLION)

- TABLE 282 ROW: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 283 ROW: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 284 ROW: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 285 ROW: NATURAL FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 286 ROW: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 287 ROW: SYNTHETIC FOOD COLORS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 288 ROW: FOOD COLORS MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 289 ROW: FOOD COLORS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 290 ROW: FOOD COLORS MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 291 ROW: FOOD COLORS MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 292 ROW: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 293 ROW: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 294 ROW: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 295 ROW: FOOD PRODUCT APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 296 ROW: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2019–2022 (USD MILLION)

- TABLE 297 ROW: BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

- TABLE 298 SOUTH AFRICA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 299 SOUTH AFRICA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 300 SOUTH AFRICA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 301 SOUTH AFRICA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 302 MIDDLE EAST: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 303 MIDDLE EAST: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 304 MIDDLE EAST: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 305 MIDDLE EAST: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 306 REST OF AFRICA: FOOD COLORS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 307 REST OF AFRICA: FOOD COLORS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 308 REST OF AFRICA: FOOD COLORS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 309 REST OF AFRICA: FOOD COLORS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 310 FOOD COLORS MARKET: DEGREE OF COMPETITION

- TABLE 311 FOOD COLORS MARKET: KEY PLAYER STRATEGIES

- TABLE 312 KEY COMPANY FOOTPRINT, BY TYPE

- TABLE 313 KEY COMPANY FOOTPRINT, BY SOURCE

- TABLE 314 KEY COMPANY FOOTPRINT, BY FORM

- TABLE 315 KEY COMPANY FOOTPRINT, BY APPLICATION

- TABLE 316 KEY COMPANY FOOTPRINT, BY REGION

- TABLE 317 OVERALL KEY COMPANY FOOTPRINT

- TABLE 318 FOOD COLORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 319 STARTUP/SME COMPANY FOOTPRINT, BY TYPE

- TABLE 320 STARTUP/SME COMPANY FOOTPRINT, BY SOURCE

- TABLE 321 STARTUP/SME COMPANY FOOTPRINT, BY FORM

- TABLE 322 STARTUP/SME COMPANY FOOTPRINT, BY SOLUBILITY

- TABLE 323 STARTUP/SME COMPANY FOOTPRINT, BY APPLICATION

- TABLE 324 STARTUP/SME COMPANY FOOTPRINT, BY REGION

- TABLE 325 OVERALL STARTUP/SME COMPANY FOOTPRINT

- TABLE 326 FOOD COLORS MARKET: NEW PRODUCT LAUNCHES, JANUARY 2019–JANUARY 2023

- TABLE 327 FOOD COLORS MARKET: DEALS, OCTOBER 2019–OCTOBER 2022

- TABLE 328 ADM: BUSINESS OVERVIEW

- TABLE 329 ADM: PRODUCTS OFFERED

- TABLE 330 ADM: PRODUCT LAUNCHES

- TABLE 331 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- TABLE 332 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS OFFERED

- TABLE 333 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHER DEVELOPMENTS

- TABLE 334 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 335 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- TABLE 336 SENSIENT TECHNOLOGIES CORPORATION: DEALS

- TABLE 337 DSM: BUSINESS OVERVIEW

- TABLE 338 DSM: PRODUCTS OFFERED

- TABLE 339 NATUREX: BUSINESS OVERVIEW

- TABLE 340 NATUREX: PRODUCTS OFFERED

- TABLE 341 NATUREX: NEW PRODUCT LAUNCHES

- TABLE 342 DDW: BUSINESS OVERVIEW

- TABLE 343 DDW: PRODUCTS OFFERED

- TABLE 344 DDW: DEALS

- TABLE 345 DÖHLER GROUP: BUSINESS OVERVIEW

- TABLE 346 DÖHLER GROUP: PRODUCTS OFFERED

- TABLE 347 FIORIO COLORI: BUSINESS OVERVIEW

- TABLE 348 FIORIO COLORI: PRODUCTS OFFERED

- TABLE 349 LYCORED: BUSINESS OVERVIEW

- TABLE 350 LYCORED: PRODUCTS OFFERED

- TABLE 351 LYCORED: OTHER DEVELOPMENTS

- TABLE 352 KALSEC INC.: BUSINESS OVERVIEW

- TABLE 353 KALSEC INC.: PRODUCTS OFFERED

- TABLE 354 ALLIANCE ORGANICS LLP: BUSINESS OVERVIEW

- TABLE 355 ALLIANCE ORGANICS LLP: PRODUCTS OFFERED

- TABLE 356 HORIZON SPECIALITIES LTD.: BUSINESS OVERVIEW

- TABLE 357 HORIZON SPECIALITIES LTD.: PRODUCTS OFFERED

- TABLE 358 SUN FOOD TECH PVT. LTD.: BUSINESS OVERVIEW

- TABLE 359 SUN FOOD TECH PVT. LTD.: PRODUCTS OFFERED

- TABLE 360 SAN-EI GEN F.F.I., INC.: BUSINESS OVERVIEW

- TABLE 361 SAN-EI GEN F.F.I., INC.: PRODUCTS OFFERED

- TABLE 362 SAN-EI GEN F.F.I., INC.: PRODUCT LAUNCHES

- TABLE 363 ADJACENT MARKETS TO FOOD COLORS

- TABLE 364 FLAVORS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 365 FLAVORS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 366 NATURAL FOOD COLORS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

- FIGURE 1 FOOD COLORS MARKET SEGMENTATION

- FIGURE 2 REGIONAL SEGMENTATION

- FIGURE 3 FOOD COLORS MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 FOOD COLORS MARKET SIZE ESTIMATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 SUPPLY-SIDE ANALYSIS

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 GLOBAL INFLATION RATE, 2011—2021

- FIGURE 11 GLOBAL GROSS DOMESTIC PRODUCT: 2011–2021 (USD TRILLION)

- FIGURE 12 GLOBAL FOOD INGREDIENTS MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST

- FIGURE 13 RECESSION INDICATORS AND THEIR IMPACT ON FOOD COLORS MARKET

- FIGURE 14 GLOBAL FOOD COLORS MARKET: PREVIOUS FORECAST VS. RECESSION IMPACT FORECAST

- FIGURE 15 FOOD COLORS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 FOOD COLORS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 FOOD COLORS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 FOOD COLORS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 19 FOOD COLORS MARKET SHARE (VALUE), BY REGION, 2023

- FIGURE 20 RISE IN DEMAND FOR NATURAL FOOD COLORS DUE TO INCREASED CONSUMER AWARENESS

- FIGURE 21 CHINA TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2023

- FIGURE 22 NATURAL FOOD COLORS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 APPLICATION IN FOOD PRODUCTS TO DOMINATE OVER BEVERAGES DURING FORECAST PERIOD

- FIGURE 24 LIQUID COLORS TO REMAIN LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 25 FOOD DYES TO DWARF FOOD LAKES SEGMENT DURING FORECAST PERIOD

- FIGURE 26 ASIA PACIFIC COUNTRIES TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 27 MARKET DYNAMICS: FOOD COLORS MARKET

- FIGURE 28 US: FACTORS DRIVING GROWTH OF CLEAN-LABEL PURCHASES, 2021

- FIGURE 29 TRENDS IN FMCG REVENUES, 2016–2020 (USD BILLION)

- FIGURE 30 ORGANIC FOOD & BEVERAGES MARKET, 2021 (USD BILLION)

- FIGURE 31 TOP FIVE COUNTRIES WITH LARGEST NUMBER OF ORGANIC PRODUCERS, 2020 (MILLION)

- FIGURE 32 VALUE CHAIN ANALYSIS: SOURCING AND PRODUCTION OF FOOD COLORS TO BE KEY CONTRIBUTORS

- FIGURE 33 FOOD COLORS MARKET ECOSYSTEM

- FIGURE 34 FOOD COLORS MARKET: TRENDS IMPACTING BUYERS

- FIGURE 35 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2022

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FOOD COLOR TYPES

- FIGURE 37 KEY BUYING CRITERIA FOR TYPES OF FOOD COLORS

- FIGURE 38 FOOD COLORS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 39 CARMINE TO LEAD AMONG NATURAL COLORS MARKET THROUGH 2028 (USD MILLION)

- FIGURE 40 FOOD COLORS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 41 LIQUID FORM TO BE LARGEST AMONG FORMS DURING FORECAST PERIOD

- FIGURE 42 FOOD COLORS MARKET, BY SOLUBILITY, 2023 VS. 2028 (USD MILLION)

- FIGURE 43 FOOD COLORS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 44 COLORS IN PROCESSED FOOD TO DOMINATE AMONG FOOD PRODUCTS THROUGH 2028

- FIGURE 45 US TO ACCOUNT FOR LARGEST SHARE IN FOOD COLORS MARKET, 2023

- FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 47 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2019–2021 (USD BILLION)

- FIGURE 48 FOOD COLORS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 49 FOOD COLORS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 50 ADM: COMPANY SNAPSHOT

- FIGURE 51 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 52 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 DSM: COMPANY SNAPSHOT

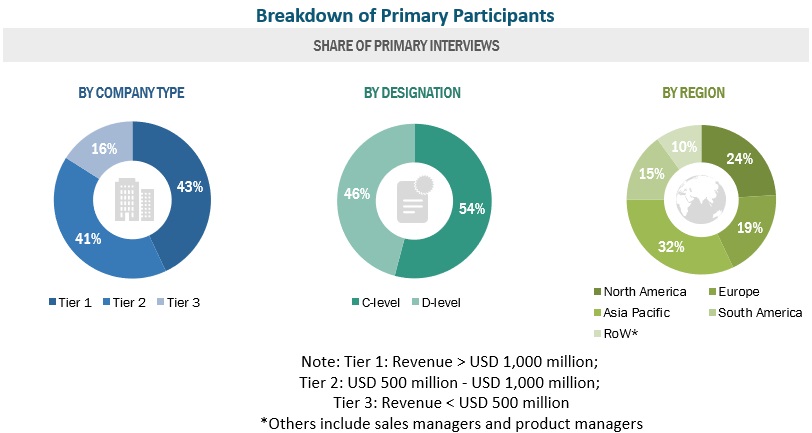

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the food colors market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the food colors market.

To know about the assumptions considered for the study, download the pdf brochure

Food Colors Market Report Objectives

- Determining and projecting the food colors market size with respect to type, source, application, form solubility, and region, over a five-year period, ranging from 2023 to 2028

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Impact of macro- and microeconomic factors on the market

- Impact of recession on the global market

- Shifts in demand patterns across different subsegments and regions

- Identifying and profiling the key market players in the market

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis of the Food Colors Market

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into the Netherlands, Poland, Belgium, Sweden, and other EU & non-EU countries

- Further breakdown of the Rest of Asia Pacific into Indonesia, Malaysia, Thailand, the Philippines, Bangladesh, Singapore, and Vietnam.

- Further breakdown of South America into Chile, Uruguay, and Peru.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Food Colors Market