Inertial Navigation Systems Market by Grade (Marine, Navigation, Tactical, Space, Commercial), Technology (Mechanical, Ring Laser, Fiber Optic, MEMS), Platform, End User (Commercial and Defence), Component and Region - Global Forecast to 2029

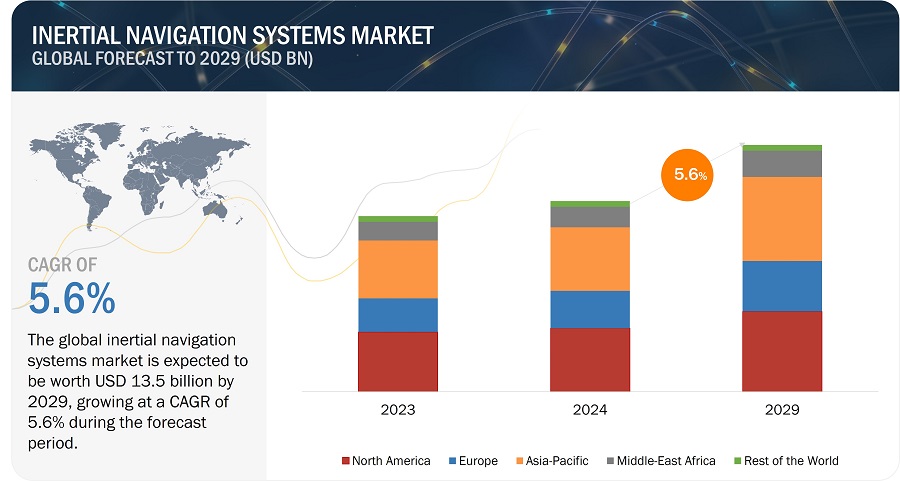

[270 Pages Report] The Inertial Navigation Systems Market is estimated to be USD 10.3 billion in 2024 and is projected to reach USD 13.5 billion by 2029, at a CAGR of 5.6% from 2024 to 2029. The market is driven by factors such as increasing industry demand, advancements in sensor technology, the rise of autonomous technologies, and the need for reliable navigation in GPS-denied environments.

Inertial Navigation Systems Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Inertial Navigation Systems Market Dynamics

Driver: Growing space exploration missions and Increasing procurement of commercial aircraft

Space exploration requires precise and reliable navigation technology to ensure the accurate positioning, orientation, and velocity of spacecraft and satellites. Advanced inertial navigation systems play a critical role in guiding space vehicles, enabling them to navigate complex trajectories and maintain stability in space environments. These systems utilize accelerometers, gyroscopes, and other sensors to provide continuous and accurate navigation data essential for the success of space missions. The ongoing evolution and growing scope of space exploration boosts the development and deployment of advanced inertial navigation systems. The increasing investment in space exploration by space agencies and private companies further raises the demand for inertial navigation systems to ensure functionality under extreme space conditions, such as high radiation levels, vacuum, and severe temperature fluctuations.

The increase in new commercial aircraft orders worldwide is one of the key factors driving the growth of the inertial navigation systems market. Inertial navigation systems play a significant role in aircraft by providing continuous, precise location and directional data crucial for flight control systems and navigation in areas where satellite navigation signals may be unavailable. The integration of GPS with inertial sensors to create hybrid systems enhances the efficiency of inertial navigation systems in commercial aviation. These hybrid systems offer improved accuracy and reliability, reducing the risk of signal loss or interference and enhancing safety and operational efficiency. The dependence on inertial navigation systems is especially crucial due to the rigorous safety and regulatory requirements in aviation. Increasing procurement of commercial aircraft and modernization of airlines drive the demand for advanced inertial navigation systems to ensure accurate navigation and safety.

Restraints: Complex integration of inertial navigation systems and High development costs

The complex integration of inertial navigation systems can be a significant market restraint. Integrating these systems into broader platforms involves extensive technical challenges due to the need to synchronize the inertial navigation systems with other navigational and operational systems such as GPS, radar, and avionics systems. The complexity of these systems increases particularly in advanced applications such as aerospace, defense, and autonomous vehicles, where high levels of accuracy and reliability are mandatory. This integration of inertial navigation systems requires advanced hardware architecture that can accommodate and process inputs from diverse sensors and advanced software algorithms that can execute sensor fusion effectively. Sensor fusion involves combining data from various sources to produce accurate and dependable navigation outputs.

The manufacturing and development of inertial navigation systems involves advanced and costly components such as gyroscopes and accelerometers, which are precision-engineered to deliver high accuracy and reliability. These components, particularly when based on ring laser gyroscopes (RLG) or fiber optics gyroscopes (FOG), are expensive due to the complex manufacturing processes and the high-quality materials required. The integration of these systems into platforms requires additional expenditure. This includes the cost of integrating hardware, calibrating sensors to ensure accuracy, and developing the necessary software algorithms for sensor fusion and error correction. The extensive testing and certification processes required to meet safety and regulatory standards further increase the initial cost of the system. Such high initial costs can be a barrier, especially for small and medium enterprises (SMEs) or industries where cost efficiency is a priority.

Opportunity: The trend of driverless cars and Innovations in sensor design and data processing algorithms

Driverless cars are robotic vehicles capable of traveling without human intervention. Advancements in sensor technology and machine learning are driving demand for commercial driverless vehicles. Companies such as Tesla, Google, Ford, and BMW are actively involved in developing driverless technology for commercial vehicles. Inertial navigation technologies, which use accelerometers and gyroscopes to calculate positional and directional data without reliance on external signals, are critical in ensuring the accuracy and reliability of navigation in autonomous vehicles. Driverless cars require advanced sensor fusion to integrate data from various sources for precise localization and navigation. Advanced inertial navigation systems can provide high integrity and continuous positioning capabilities, especially when GPS signals are unavailable or unreliable, such as in tunnels, urban canyons, or environments with significant electronic interference. These systems enhance the overall safety architecture of autonomous driving technologies by independently verifying vehicle position, velocity, and attitude.

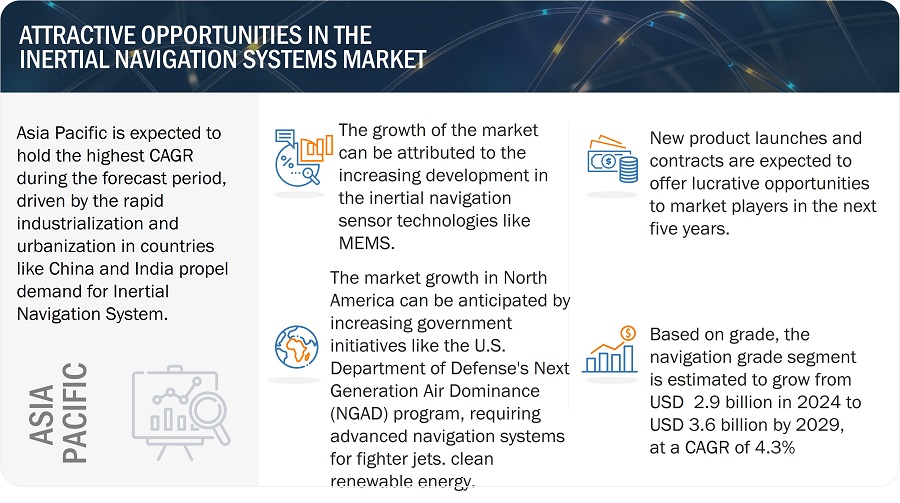

Technological advancements in sensor design, computational methods, and data integration technologies represent significant opportunities for the inertial navigation systems market. Key developments include improvements in MEMS technology, which have significantly reduced the size, cost, and power consumption of inertial sensors while enhancing performance. This makes inertial navigation systems more accessible for applications beyond traditional aerospace and defense sectors, extending into automotive, consumer electronics, and unmanned systems. Similarly, advancements in algorithmic techniques for sensor fusion and error correction increase the accuracy and reliability of inertial navigation system outputs. Techniques such as Kalman filtering and other advanced estimation methods effectively integrate inertial data with inputs from other navigation systems, including GPS, LIDAR, or visual odometry.

Challenges: Calibration and alignment issues

Calibration and alignment issues are significant challenges in the market for inertial navigation systems. These systems rely on precise measurements from accelerometers and gyroscopes to determine position, orientation, and velocity without external references. However, the accuracy of these measurements depends on the proper calibration and alignment of the sensors with respect to the vehicle or platform’s reference frame. Misalignment or improper calibration can lead to errors in the computed position and orientation data, which accumulate over time, leading to drift. This drift is particularly problematic in applications requiring high precision over extended periods or in environments where GPS updates are unavailable to correct inertial errors. The calibration process is complex and must be repeatedly conducted over the lifecycle of the device to ensure accuracy, as sensor performance can degrade due to environmental factors such as temperature fluctuations, mechanical stress, and aging. Alignment must also be accurately managed during the installation and operational phases to ensure the sensors maintain their orientation relative to the navigational frame of reference. These calibration and alignment challenges impose additional costs and technical barriers, potentially limiting the deployment of inertial navigation systems in applications where cost-efficiency and maintenance simplicity are prominent.

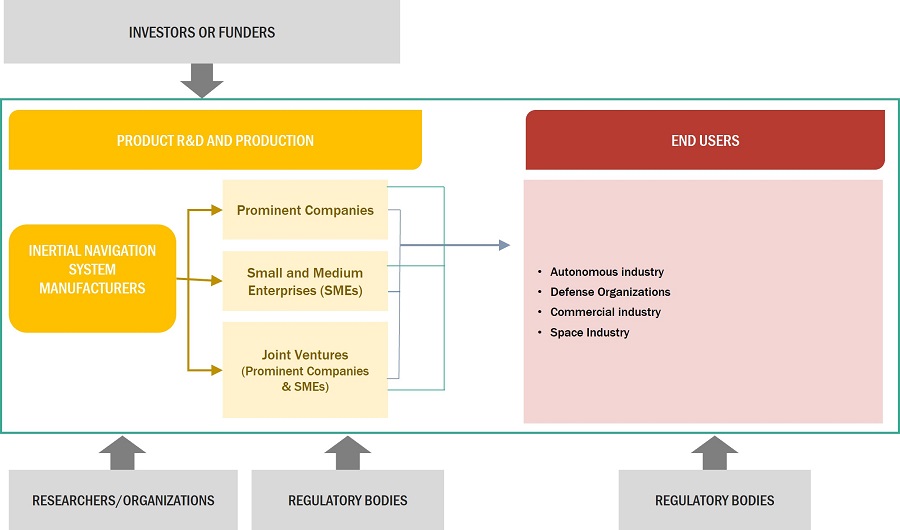

Inertial Navigation Systems Market Ecosystem

In the inertial navigation systems market ecosystem, key stakeholders range from manufacturers and suppliers of inertial navigation systems to end consumers. Influential forces shaping the industry include investors, funders, academic researchers, integrators, service providers, and licensing authorities. This intricate network of participants collaboratively drives market dynamics, innovation, and strategic decisions, highlighting the complexity and vitality of the inertial navigation systems sector.

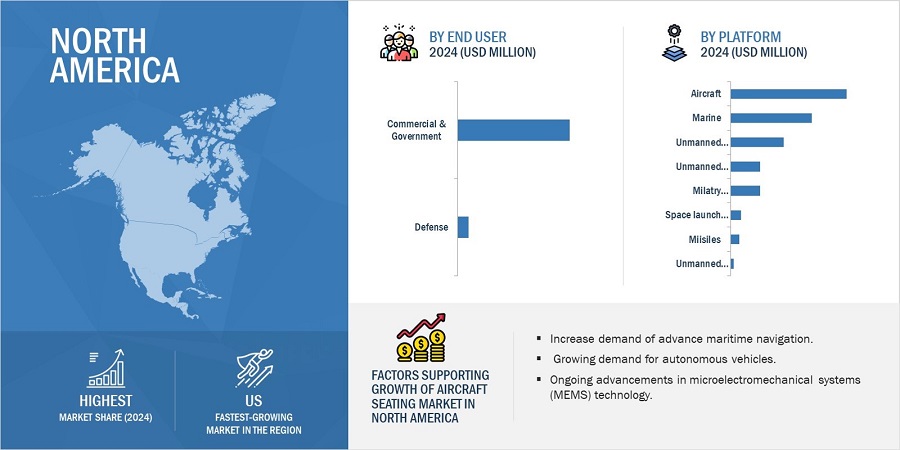

Based on the platform, the aircraft segment is estimated to lead the inertial navigation systems market in 2024

Based on the platform, the inertial navigation systems market has been segmented broadly into Aircraft, Missiles, Marine, Space launch Vehicles, Military Armored Vehicles, Unmanned Aerial Vehicles, Unmanned Ground Vehicles, Unmanned Marine Vehicles. Here aircraft is leading this segment in 2024. The aircraft segment in inertial navigation systems is the increasing demand for precise navigation solutions in aviation. Aircraft rely heavily on accurate inertial navigation systems for safe and efficient navigation, especially during flights where GPS signals may be unreliable or unavailable. The growing air traffic and expansion of commercial aviation further drive the need for advanced navigation systems.

Based on the end user, the Defense segment is estimated to lead the inertial navigation systems market in 2024

Based on the end user, the inertial navigation systems market has been segmented broadly into commercial & government and defense. Here defense is leading this segment in 2024. Defense agencies rely heavily on precise INS for various critical tasks like missile guidance, reconnaissance, and navigating challenging environments. As modern warfare becomes more complex, the need for reliable navigation systems in GPS-denied areas becomes paramount. As defense budgets allocate resources to enhance navigation capabilities, the INS market experiences sustained growth within the defense sector.

Based on the technology, the ring laser gyro segment is estimated to lead the inertial navigation systems market in 2024

Based on the technology, the inertial navigation systems market has been segmented broadly Mechanical Gyro, Ring Laser Gyro, Fiber Optic Gyro, Microelectromechanical Systems, Others (HRG). Here ring laser gyro is leading this segment in 2024. Ring laser gyros offer exceptionally accurate measurements of rotation rates, making them indispensable in inertial navigation systems for ensuring precise navigation. Their robust design and immunity to external factors make them ideal for use in diverse environments, including aerospace, maritime, and defense applications. Furthermore, ongoing research and development efforts aimed at enhancing the performance and efficiency of ring laser gyro technology contribute to its continued adoption in the inertial navigation systems market.

Based on the components, the accelerometers segment is estimated to lead the inertial navigation systems market in 2024

Based on the components, the inertial navigation systems market has been segmented broadly into accelerometers, gyroscopes, and algorithms & processors. Here accelerometers are leading this segment in 2024. The accelerometers segment in the inertial navigation systems market is primarily driven by factor such as the increasing demand for accurate motion sensing technology. Accelerometers play a crucial role in INS by detecting changes in velocity and acceleration, which are essential for calculating precise position and orientation data. The expanding applications of inertial navigation systems across various industries, including aviation, maritime, and defense, drive the need for high-performance accelerometers. Additionally, advancements in sensor technology, such as improved sensitivity and reduced size, further fuel the growth of accelerometers in the inertial navigation systems market. As industries continue to prioritize precise navigation solutions, accelerometers emerge as a key component driving the growth and innovation within the inertial navigation systems market.

The North America market is projected to have the largest share in 2024 in the inertial navigation systems market

Inertial Navigation Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Based on region, the inertial navigation systems market has been segmented into North America, Europe, Asia Pacific the Middle East, and the Rest of the world. The North American inertial navigation systems market covers the US and Canada. The region is experiencing significant growth, driven by several factors. Increasing demand from military applications, particularly in defense platforms such as aircraft, missiles, and submarines, creates a need for advanced inertial navigation systems for navigation, guidance, and targeting. The aerospace industry's demand for precise and dependable navigation systems in commercial and military aircraft further boosts market expansion, leveraging the expertise of leading aerospace companies such as Teledyne Technologies Inc. (US), Collins Aerospace (US), and Northrop Grumman(US).

Key Market Players

Major players in the inertial navigation systems companies include Safran Electronics & Defense (France), Northrop Grumman (US), Teledyne Technologies Inc. (US), Collins Aerospace (US), Honeywell Inertnational Inc. (US) to enhance their presence in the market. The report covers various industry trends and new technological innovations in the inertial navigation systems market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By Platform, Component, Technology, Grade and End User |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, and Rest of the World |

|

Companies covered |

Safran Electronics & Defense (France), Northrop Grumman (US), Teledyne Technologies Inc. (US), Collins Aerospace (US), Honeywell International Inc. (US), Thales (France), General Electric Company (US), Trimble Inc. (US), L3Harris Technologies, Inc. (US), EXAIL Technologies (France), MEMSIC Semiconductor Co., Ltd. (China), Israel Aerospace Industries Ltd. (Israel), EMCORE Corporation (US). |

Inertial Navigation Systems Market Highlights

This research report categorizes the inertial navigation systems markets based on Platform, Component, Technology, Grade and End User.

|

Segment |

Subsegment |

|

By Platform |

|

|

By Component |

|

|

By Technology |

|

|

By Grade |

|

|

By End User |

|

|

By Region |

|

Recent Developments

- In June 2023, Wisk Aero (US), a leading advanced air mobility (AAM) company, entered into a contract with Safran Electronics & Defense to supply SkyNaute inertial navigation systems for its Generation 6 autonomous, all-electric air taxi.

- In December 2023, Northrop Grumman secured a contract to procure 12 items to support the WSN-7 ship’s inertial navigation system. The contract was awarded by the Naval Supply Systems Command Weapon Systems Support (US). The deal was valued at USD 12.5 million and is expected to be completed by June 2028.

Frequently Asked Questions (FAQs) Addressed by the Report:

What are the drivers and opportunities for the Inertial Navigation Systems market?

The trend of driverless cars, increasing deployment of Unmanned marine vehicles and innovations in sensor design and data processing algorithms are some of the drivers for the Inertial Navigation Systems market.

Which region is expected to hold the largest share in the next five years?

The market in the Asia Pacific region is projected to account for the largest share from 2024 to 2029, showcasing strong demand for Inertial navigation systems solutions in the region

What is the CAGR of the Inertial Navigation Systems Market?

The CAGR of the Inertial Navigation Systems Market is 5.6%

Which segment shows the highest CAGR of the Inertial Navigation Systems Market?

The Fiber Optic Gyro (FOG) by Technology shows the highest growth rate during the forecasted year for the Inertial Navigation Systems Market.

Which are the major companies in the Inertial Navigation Systems market? What are their major strategies to strengthen their market presence?

Some of the key players in the Inertial Navigation Systems market are Safran Electronics & Defense (France), Northrop Grumman (US), Teledyne Technologies Inc. (US), Collins Aerospace (US), Honeywell Inertnational Inc. (US), and among others, are the key providers that secured Inertial Navigation Systems contracts in the last few years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

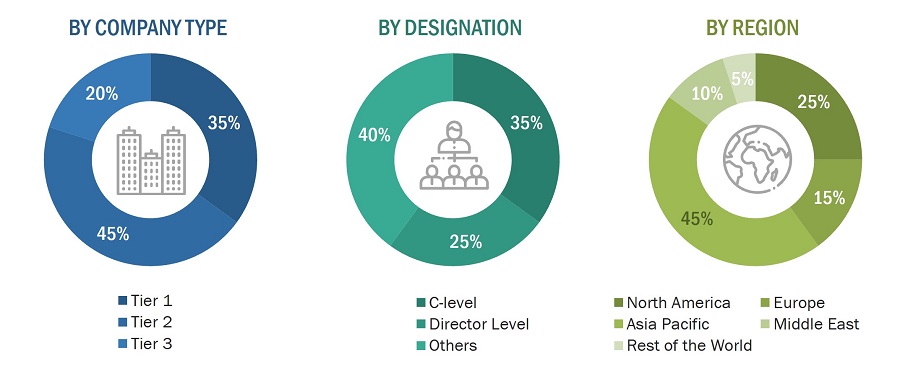

This research study on the inertial navigation systems market involved the extensive use of secondary sources, directories, and databases, such as TradeMap, lens.org, and UNCTAD, to identify and collect information on the relevant market. Primary sources included experts from core and related industries, as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information, as well as assess the growth prospects of the market during the forecast period.

Secondary Research

The market share of companies offering inertial navigation systems was arrived at based on the secondary data available through paid and unpaid sources, as well as by analyzing the product portfolios of major companies and rating them based on their performance and quality.

In the secondary research process, corporate filings, such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; articles by recognized authors; directories; and databases were used to identify and collect information for this study. Secondary research was mainly used to obtain key information about the industry’s current scenario and to identify the key players by various products, market classifications, and segmentation according to their offerings and industry trends related to platform, component, technology, grade, end-user, and region segments and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts such as vice presidents (VPs); directors from business development, marketing, and product development/innovation teams; industry experts; INS manufacturers; and key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

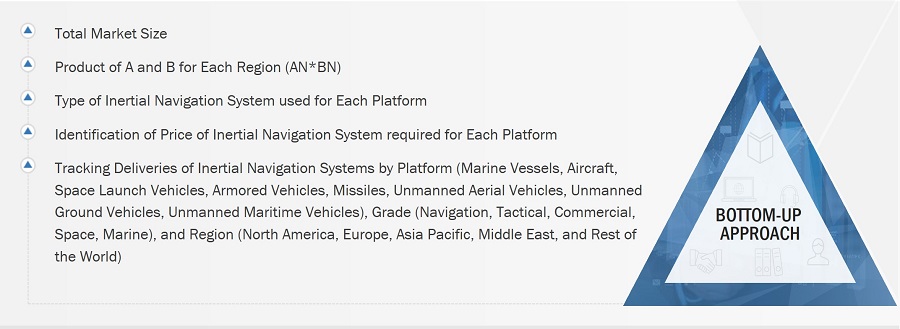

Market Size Estimation

- Both top-down and bottom-up approaches were used to estimate and validate the size of the inertial navigation systems market.

- Key players in the inertial navigation system market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the inertial navigation systems market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the inertial navigation systems market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-Up Approach

Market size estimation methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

An inertial navigation system evaluates inputs from accelerometers and gyroscopes to track the position and orientation of an object relative to its starting point and velocity. These systems are utilized across airborne, ground, and naval platforms. Position, velocity, and orientation are essential parameters of navigation systems. Most navigation systems, such as the global positioning system (GPS), do not provide real-time details on the above-mentioned parameters. The deployment of GPS across various platforms depends on its signal strength and the equipment’s location. Additionally, precise, and reliable navigation inputs are required to ensure the efficient functioning of GPS and other satellite communication and airborne equipment. Inertial navigation systems provide these details with the desired accuracy and reliability.

Stakeholders

Various stakeholders of the market are listed below:

- Inertial Navigation System Manufacturers

- Inertial Navigation System Wholesalers, Retailers, and Distributors

- System Integrators

- Technology Providers

- Sensor Manufacturers

- Raw Material Suppliers

- Aircraft Regulatory Bodies

Report Objectives

- To define, describe, segment, and forecast the size of the inertial navigation systems market based on platform, component, technology, grade, end user, and region

- To forecast the size of market segments with respect to five regions, namely North America, Europe, Asia Pacific, the Middle East, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

- To analyze the degree of competition in the market by identifying key growth strategies, such as product launches, contracts, and partnerships, adopted by leading market players

1. Micromarkets are defined as further segments and subsegments of the inertial navigation systems market included in the report.

2. Core competencies of the companies have been captured in terms of key developments and strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Inertial Navigation Systems Market

Hi Team, I am interested in buying market research on inertial navigation and gyrocompass for a naval or maritime small carrier like UUV, UAV, USV. Thanks, Hortense BASTIE.