Hearth Market by Fuel Type (Electricity, Gas, Wood, Pellet), Product (Fireplaces, Stoves, Inserts), Ignition Type (Electronic Ignition, Standing Pilot Ignition), Placement, Design Vent Availability, Application and Region - Global Forecast to 2029

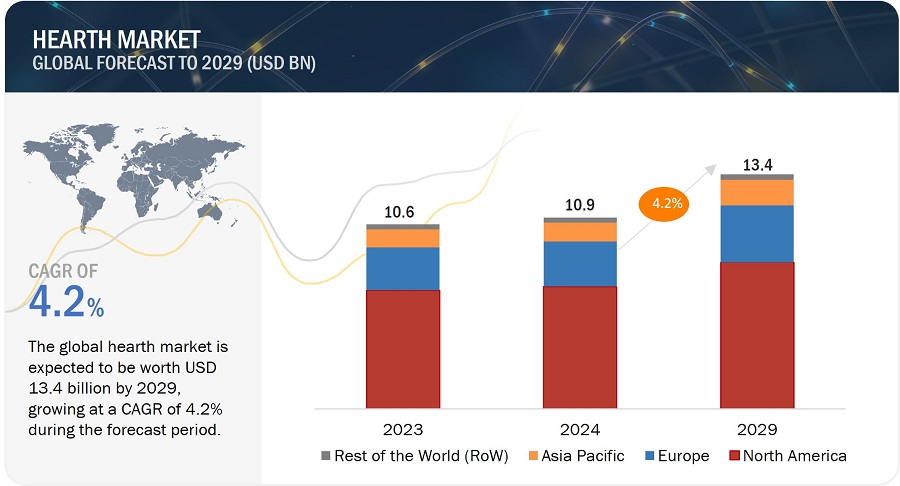

[224 Pages Report] The global hearth market size is estimated to be worth USD 10.9 billion in 2024 and is projected to reach USD 13.4 billion by 2029, at a CAGR of 4.2% during the forecast period. Increasing adoption of hearth products in commercial and hospitality sectors, surging deployment of hearths in outdoor spaces are some of the major factors driving the market growth globally.

Hearth Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Hearth Market Dynamics

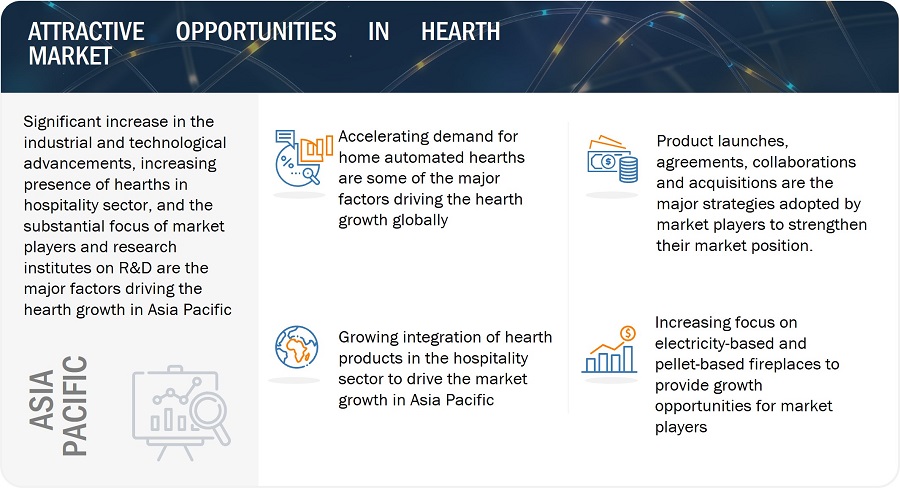

Driver: Growing adoption of home automation

The increasing demand for home automation is propelled by consumers' desire for convenience, control, and enhanced living experiences within their homes. Integrated hearth products with home automation systems empower users to remotely manage heating settings, schedule operation times, and monitor energy usage via smartphones or other smart devices. Manufacturers embracing advanced home automation capabilities gain a competitive edge. By leveraging the rising demand for home automation, they can distinguish their products in the market, appealing to a broader consumer base.

Restraint: High installation and maintenance costs of hearths

The hearth market faces significant challenges due to the burdensome costs associated with both installation and ongoing maintenance. These hurdles impede market growth and consumer adoption of hearths and fireplaces, despite their benefits in providing warmth and ambiance to homes. High upfront costs constitute a major obstacle for consumers considering hearth installations. From purchasing the equipment to hiring professional installers and ensuring compliance with building codes, the initial investment can be substantial.

Opportunity: Rising interest in hearth products within the hospitality industry

The hospitality industry is experiencing a rise in demand for hearths, which are used to improve guest satisfaction, extending outdoor dining, and socializing seasons and maximizing revenue opportunities for hospitality businesses. Outdoor hearth products enable the creation of versatile event spaces for weddings, corporate gatherings, and social events, generating additional revenue streams and offering guests unique and memorable experiences. The emphasis on sustainability and energy efficiency in the hospitality sector further enhances the appeal of hearth products that utilize eco-friendly fuels and technologies. By leveraging these features, hotels and resorts can attract environmentally conscious guests and enhance their green credentials, aligning with evolving consumer preferences for sustainable accommodation options.

Challenge: Competition from alternative heating solutions

Competition from alternative heating solutions presents a significant challenge to traditional hearth products like fireplaces, stoves, and inserts. HVAC systems, heat pumps, and radiant floor heating are among the alternatives impacting the demand for traditional hearth products. These alternative solutions diminish the demand for traditional hearth products, especially in new construction and home renovation projects. Consumers prioritize the convenience, energy efficiency, and versatility offered by alternatives, while builders may opt for integrated systems that align with modern design trends. However, traditional hearth products maintain niche appeal for ambiance, aesthetics, and nostalgic charm. In regions with access to affordable fuel sources, they remain popular for cost-effectiveness and backup heating capabilities during emergencies.

Hearth Ecosystem

The prominent players in the hearth market are HNI Corp. (US), Glen Dimplex (Ireland), Napoleon (Canada), Travis Industries, Inc. (US), and HPC Fire Inspired (US). These companies perform organic and inorganic growth strategies to expand themselves globally by providing advanced products of hearths.

Vented hearth segment is projected at the highest CAGR in the hearth market during the forecast period.

Unvented hearths have a lower market share primarily due to concerns about indoor air quality, as unvented hearths release combustion by-products directly into the living space. Despite the lower initial cost and easier installation, the potential health risks and regulatory challenges associated with unvented hearths make them less favorable among consumers. Key factors for growth of vented hearths include their ability to effectively channel combustion gases outside, which enhances indoor air quality, their efficiency in heating larger spaces, and their compliance with stringent safety and environmental regulations.

Gas- based fuel type accounts for the second highest CAGR of the hearth market during the forecast period.

Gas fireplaces and stoves are favored for their efficiency, convenience, and clean-burning characteristics. Known for providing a consistent and controllable heat source at the push of a button, these units can be fueled by either natural gas or propane. Modern gas hearths emit zero smoke, venting waste gases outside and improving indoor air quality. Electric- based hearths have become increasingly popular due to their highly energy-efficiency, ease of installation, ventless system, cost saving and offering ambiance. The use of wood as a fuel type is experiencing a decline. The growing demand for pellets highlights a shift towards more sustainable and efficient heating options globally.

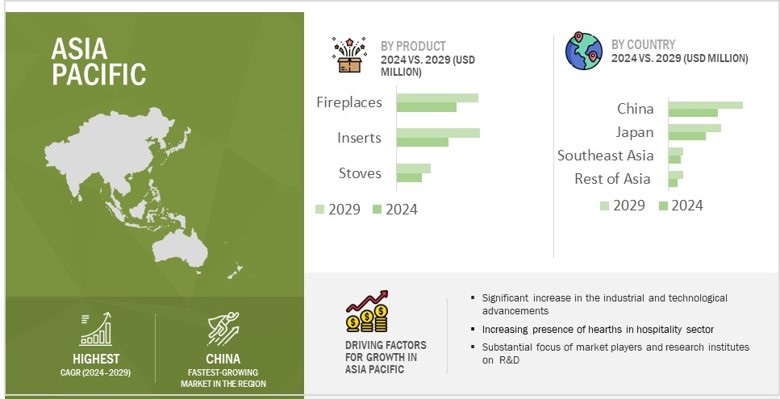

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The Asia Pacific market is expected to register the highest CAGR during the forecast period. The increasing integration of hearth products in the hospitality segment is primarily fueling the market growth in Asia Pacific. The rising adoption of the hearth market in varying demands, preferences, and economic condition that influence market dynamics. Europe is also expected to drive the growth of hearth products. North America has a high prevalence of fireplaces and stoves in both residential and commercial properties, holding the largest market share. The hearth market is growing steadily in regions like South America, and the Middle East & Africa.

Hearth Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Hearth Companies - Key Market Players:

The major players in the hearth companies are HNI Corp. (US), Glen Dimplex (Ireland), Napoleon (Canada), Travis Industries, Inc. (US), and HPC Fire Inspired (US). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and expansions to strengthen their position in the market.

Hearth Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 10.9 billion in 2024 |

| Projected Market Size | USD 13.4 billion by 2029 |

| Growth Rate | CAGR of 4.2% |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million or Billion), Volume (Million Units) |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

The major players in the hearth market are HNI Corp. (US), Glen Dimplex (Ireland), Napoleon (Canada), Travis Industries Inc. (US), HPC Fire Inspired (US), Jøtul (Norway), Montigo (Canada), Stove Builder International (Canada), Innovative Hearth Products (US) and Empire Comfort Systems (US). |

Hearth Market Highlights

The study segments the heart market based on product type, fuel type, placement, design, ignition type, vent availability application, fireplace type, material, and region at the regional and global level.

|

Segment |

Subsegment |

|

By Product Type |

|

|

By Fuel Type |

|

|

By Placement |

|

|

By Design |

|

|

By Ignition Type |

|

|

By Vent Availability |

|

|

By Application |

|

|

By Fireplace Type |

|

|

By Material |

|

|

By Region |

|

Recent Developments in Hearth Industry :

- In March 2023, the company acquired Kimball International, Inc. (US) to diversify its business by adding a new segment, expanding its product range, customizing its go-to-market strategies, and enhancing its manufacturing capabilities.

- In February 2023, the company launched Clutha ULEB, a product under Masport brand, that represents a category of ultra- low emission burners.

- In February 2022, the company launches Stylus Cara Elite- electric fireplace that operates on mobile devices through the Napoleon Home IoT software.

- In 2003, HPC Fire Inspired expanded its offerings with the introduction of Outdoor Fire Products, starting with the manufacturing of fire rings.

- In March 2020 the company launched the innovative Universal Gas Orifice, capable of accommodating both Natural Gas (NG) and Liquid Propane (LP) with a single orifice, a versatile solution enables seamless conversion between the two gases directly onsite, eliminating the need for disassembly.

Frequently Asked Questions (FAQs):

What is the current size of the global hearth market?

The hearth market is estimated to be worth USD 10.9 billion in 2024 and is projected to reach USD 13.4 billion by 2029, at a CAGR of 4.2% during the forecast period. The growing integration of hearths in the hospitality sector is a major factor driving the growth of the hearth market globally. Moreover, increasing demand for outdoor hearths, aesthetically pleasing designs, and advancements in technology are also key factors contributing to the market growth globally.

Who are the winners in the global hearth market?

Companies such as HNI Corp. (US), Glen Dimplex (Ireland), Napoleon (Canada), Travis Industries, Inc. (US), and HPC Fire Inspired (US), fall under the winners category.

Which region is expected to hold the highest market share?

North America is expected to dominate the hearth market during forecast period. The presence of established several semiconductor manufacturing companies such as HNI Corp. (US), Napoleon (Canada), Travis Industries, Inc. (US), and HPC Fire Inspired (US), increasing integration in residential, commercial and hospitality sectors, government-led initiatives for environmental protection, huge consumer base are the major factors driving the market growth in North America.

What are the major drivers and opportunities related to hearth market?

rising demand for home automation, growing interest in visually pleasing fireplaces, increasing use of hearths in and around houses to combat cold weather, customizing hearth designs offers an abundance of options, increasing awareness of climate change and environment sustainability, rising interest in hearth products within the hospitality sector, updating outdates space heating systems, and technological advancements are some of the major drivers and opportunities for hearth market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and expansions to strengthen their position in the hearth market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

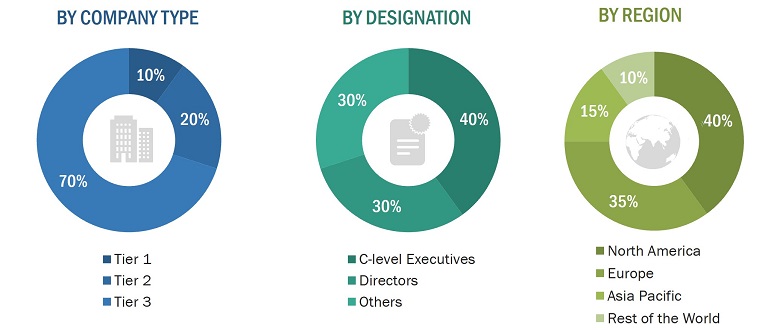

The research study involved 4 major activities in estimating the size of the hearth market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the hearth ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches have been used, along with data triangulation methods, to estimate and validate the size of the hearth market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying stakeholders in the hearth market that influence the entire market, along with participants across the value chain.

- Analyzing major manufacturers of hearth products and studying their product portfolios

- Analyzing trends related to the adoption of hearth products

- Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, and acquisitions as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of hearth market

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall hearth market has been divided into several segments and subsegments. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

A hearth is the floor of a fireplace extending into a room, serving both functional and decorative purposes in homes. Made from durable, non-combustible materials like brick, stone, tile, or concrete, hearths withstand heat and prevent fire hazards. The hearth market encompasses products and services related to home heating appliances, such as fireplaces, stoves, inserts, and accessories. This includes traditional wood-burning, gas, electric, and ethanol fireplaces, as well as wood, pellet, gas, and electric stoves. Additionally, the market covers outdoor heating solutions like fire pits and patio heaters, and services like installation, maintenance, and chimney cleaning. Catering to residential and commercial customers, the hearth market combines efficient heating solutions with aesthetic enhancements. Influenced by energy efficiency trends, environmental regulations, and consumer preferences, the market is segmented by fuel type, product type, application, design, placement, material, and region. Demand is driven by weather conditions, energy costs, and the housing market, with the residential sector being the primary contributor.

Stakeholders

- Homeowners

- Builders and Contractors

- Interior Designers

- Retailers

- Hearth Product Manufacturers

- Raw Material Suppliers

- System Integration Providers

- Technology Solution Providers

- Distributors and Resellers

- Service Providers

- Regulatory Bodies

- Research and Development Institutes

- End Users

The main objectives of this study are as follows:

- Define, analyze, and forecast the hearth market, in terms of value, based on products, placement, design, ignition type, vent availability, application, fireplace type and material

- Define, analyze, and forecast the hearth market, in terms of volume, based on fuel type

- Forecast the market size for various segments with respect to 4 main regions: North America, Europe, Asia Pacific, and Rest of the World

- Provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the hearth market

- Study the complete value chain and related industry segments for the hearth market

- Strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze trends and disruptions; pricing trends; patents and innovations; trade data (export and import data); regulatory environment; Porter’s five forces analysis; case studies; key stakeholders & buying criteria; technology trends; the market ecosystem; and key conferences and events related to the hearth market

- Analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- Strategically profile the key players and comprehensively analyze their market position in terms of revenue, market share and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as product launches/developments, expansions, acquisitions, partnerships, collaborations, agreements, and research and development (R&D) activities carried out by players in the hearth market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hearth Market

The hearth market is driven by factors such as growing need for space heating products due to extremely cold climatic conditions in certain regions and increasing interest in esthetic home decor products among customers. What are different assumptions included for market data forecast?

Japan and China are two big market in Asia Pacific for this market. What kind of data have been provided for APAC countries in this study?

I am interested specifically into the Japanese market for this research.

Did you outline market size in USD from the end consumer perspective or from the Manufacturer selling price? Meaning in most cases the manufacturer sells to a distributor or retailer (which you refer to your report) and then ultimately to a consumer (obviously with mark-up at each level). Can you share details on your reserach methodology.

How you compiled the data, did it include the venting/chimney cost as well or just the manufactured appliance (gas stove, wood stove, etc.?)