Asset Integrity Management Market Size, Share & Industry Growth Analysis Report by Service Type (NDT, Risk-based Inspection, Corrosion Management, Pipeline Integrity, Hazard Identification, Structural Integrity Management, Reliability Availability and Maintainability) - Global Forecast to 2029

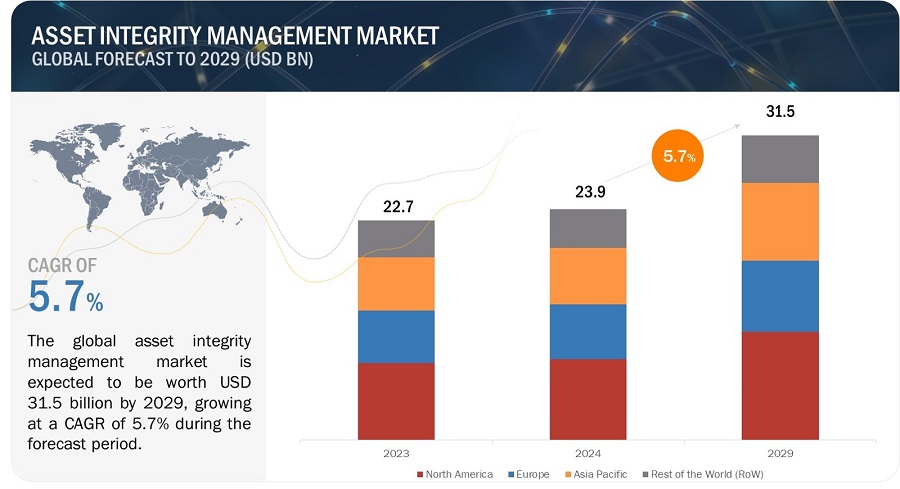

[259 Pages Report] The global asset integrity management market size is expected to be valued at USD 23.9 billion in 2024 and is projected to reach USD 31.5 billion by 2029; growing at a CAGR of 5.7% from 2024 to 2029.

The asset integrity management market is witnessing steady growth globally, driven by increasing emphasis on regulatory compliance, safety, and operational efficiency across industries. Factors such as aging infrastructure, stringent regulatory requirements, and technological advancements contribute to market expansion. Industries such as oil and gas, power generation, manufacturing, and aerospace are primary drivers of demand for asset integrity management solutions. Adopting digitalization and IoT technologies is also reshaping the market landscape, enabling real-time monitoring and predictive maintenance strategies. However, challenges such as high installation costs and the complexity of integration hinder widespread adoption.

Asset Integrity Management Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Asset Integrity Management Market Dynamics

Driver: Increasing need to maintain aging assets in risk-based industries

The increasing need to maintain aging assets in risk-based industries is a critical driver for asset integrity management. As infrastructure and equipment age, they become more susceptible to deterioration, posing heightened risks to operational reliability and safety. Effective asset integrity management is essential to mitigate risks and ensure regulatory compliance in industries such as oil and gas, petrochemicals, and power generation, where assets are subject to harsh operating conditions. The imperative to prolong asset lifespan and optimize performance necessitates proactive maintenance strategies, leveraging risk-based approaches to prioritize resources and interventions based on asset criticality and potential failure modes. As organizations strive to minimize downtime, enhance safety, and maximize asset value, the increasing focus on maintaining aging assets underscores the significance of asset integrity management solutions in risk-based industries.

Restraint: Complexity and high cost of system installation

The complexity and high installation cost are significant restraints in the asset integrity management market. Implementing asset integrity management systems often involves intricate integration processes, requiring expertise and resources, which can be time-consuming and costly for organizations. Additionally, the initial investment required for installation, including software, hardware, and training, presents financial barriers for some companies and significantly smaller enterprises with limited budgets. As a result, the complexity and expense associated with installation hinder the widespread adoption of asset integrity management solutions, particularly among organizations facing budget constraints or resource limitations.

Opportunity: Expansion of the power sector in emerging economies

Expanding the power sector in emerging nations presents a significant asset integrity management market opportunity. As developing countries undergo rapid industrialization and urbanization, there is a growing demand for reliable and efficient power generation and distribution infrastructure. This expansion necessitates robust asset integrity management practices to ensure the reliability, safety, and regulatory compliance of critical assets such as power plants, transmission lines, and substations. Additionally, emerging economies often lack established asset management frameworks, creating opportunities for asset integrity management providers to offer tailored solutions and expertise to support the development and optimization of power infrastructure in these regions. Asset integrity management companies can leverage growth opportunities and expand their market presence by capitalizing on expanding the power sector in emerging nations.

Challenge: Harsh weather conditions to challenge inspection and monitoring of assets

The challenge of harsh weather conditions poses significant obstacles to inspecting and monitoring assets in the asset integrity management market. In industries such as oil and gas, offshore wind, and maritime, assets are often located in environments characterized by extreme temperatures, high winds, corrosive saltwater, and other adverse weather conditions. These conditions increase the risk of asset degradation and pose challenges for inspection and monitoring activities, as they can impede access to assets and compromise the effectiveness of monitoring equipment. As a result, asset integrity management providers must develop robust strategies and technologies capable of withstanding harsh weather conditions while ensuring accurate and reliable asset assessment to mitigate risks and ensure operational reliability and safety.

Asset Integrity Management Market Ecosystem

The asset integrity management market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include SGS Société Générale de Surveillance SA. (Switzerland), Bureau Veritas (France), TechnipFMC plc (UK), John Wood Group PLC (UK), Fluor Corporation (US) and Baker Hughes Company (US) among others.

The Non-destructive testing (NDT) inspection segment by service type is expected to account for the largest asset integrity management market share during the forecast period.

Non-destructive testing (NDT) inspection is expected to dominate the market share during the forecast period due to its critical role in ensuring industrial assets' safety, reliability, and compliance across various sectors. Unlike traditional testing methods that require dismantling or damaging the material being inspected, NDT techniques allow for thorough examination without causing harm, making it a preferred choice for asset evaluation. Its versatility enables the detection of flaws, defects, or weaknesses in materials, welds, and components, providing valuable insights into asset condition without disrupting operations. As industries increasingly prioritize safety, regulatory compliance, and operational efficiency, the demand for NDT inspection services continues to surge, solidifying its position as the leading service type in the asset integrity management market.

The power industry in asset inetegrity management is to hold the largest market share during the forecast period.

The power industry is expected to have the highest market share in the upcoming years due to several reasons. As renewable energy sources are becoming more popular, there's a need for strong asset management to ensure reliability and efficiency. Also, since power infrastructure is aging globally, there's a growing demand for monitoring and maintenance solutions to comply with regulations and reduce risks. Additionally, the increasing need for electricity, especially in emerging economies, leads to investments in power infrastructure, further boosting demand for asset management services. Moreover, the industry's adoption of digitalization and smart grid technologies requires advanced monitoring and maintenance solutions, solidifying its position in the asset management market.

Based on plant location offshore oil & gas segment to hold the highest growth rate in the asset integrity management market.

The offshore sub-segment within the oil and gas industry is projected to witness the highest CAGR in the market due to various factors. Offshore facilities, including platforms and subsea infrastructure, face unique challenges such as corrosion and extreme environmental conditions, necessitating robust asset integrity management practices. With increasing global energy demand, there's a growing focus on exploring offshore reserves in deeper waters, driving the demand for advanced asset integrity management solutions. Stringent regulatory requirements governing offshore operations further emphasize the need for effective asset management practices. Additionally, the industry's commitment to risk mitigation and operational efficiency reinforces the importance of asset integrity management in the offshore sector, contributing to its anticipated high CAGR in the market.

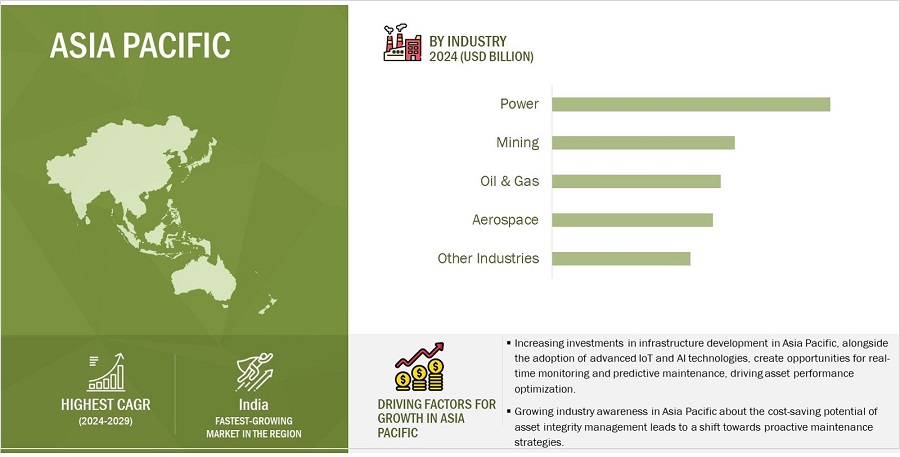

The asset integrity management market in the Asia Pacific region will exhibit the highest CAGR during the forecast period.

Asia Pacific is anticipated to demonstrate the highest CAGR in the market due to several key factors. The region's rapid industrialization and infrastructure development are fueling demand for reliable asset integrity management solutions to ensure operational safety and reliability across diverse sectors. Furthermore, the rising adoption of advanced technologies like IoT and AI in industries such as oil and gas, manufacturing, and power generation presents opportunities for real-time monitoring and predictive maintenance, driving further growth in the market. Moreover, the expanding energy demand in emerging economies within Asia Pacific and investments in renewable energy sources stimulate the need for comprehensive asset integrity management services. Lastly, stringent regulatory requirements and a growing awareness of the importance of asset optimization and safety contribute to the region's expected high CAGR in the asset integrity management market.

Asset Integrity Management Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The asset integrity management companies is dominated by players such as SGS Société Générale de Surveillance SA. (Switzerland), Bureau Veritas (France), TechnipFMC plc (UK), John Wood Group PLC (UK), Fluor Corporation (US) and Baker Hughes Company (US) and others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Estimated Market Size | USD 23.9 billion in 2024 |

| Projected Market Size | USD 31.5 billion by 2029 |

| Asset Integrity Management Market Growth Rate | CAGR of 5.7% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Thousand/Million/Billion) |

|

Segments Covered |

By Service Type, By Industry |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the world (RoW) |

|

Companies covered |

The major market players include SGS Société Générale de Surveillance SA. (Switzerland), Bureau Veritas (France), TechnipFMC plc (UK), John Wood Group PLC (UK), Fluor Corporation (US), Baker Hughes Company (US), (Total of 25 players are profiled) |

Asset Integrity Management Highlights

The study categorizes the asset integrity management market based on the following segments:

|

Segment |

Subsegment |

|

By Service Type |

|

|

By Industry |

|

|

By Region |

|

Recent Developments

- In October 2023, Applus+ in Italy secures a 3-year Master Agreement for inspection and expediting services with a key Oil & Gas industry player, covering global operations. The agreement involves Applus+ professionals supporting the client, specializing in oil and gas drilling and production solutions. Additionally, Applus+ will provide asset integrity services to ensure compliance with regulatory and voluntary standards for enhanced safety and performance.

- In May 2023, Fluor Corporation's subsidiary, Stork, secures a five-year contract with Harbour Energy, extending asset integrity services in the North Sea for the AELE hub (Armada, Everest, Lomond, and Erskine) and expanding services to Solan, the J-Area, and the Great Britannia Area. This partnership reinforces Stork's commitment to providing comprehensive asset integrity services in the offshore oil and gas industry.

- In March 2023, Baker Hughes and BP p.l.c. are collaborating to refine further and develop CordantTM, an integrated suite of solutions for asset performance management and process optimization, emphasizing asset integrity management. This collaboration aims to leverage technology and expertise to enhance the reliability and efficiency of energy infrastructure while minimizing risks associated with asset integrity.

- In January 2023, Bureau Veritas officially opened its new regional headquarters in Riyadh, solidifying its 30-year presence in Saudi Arabia and emphasizing its dedication to the Middle East's growth, especially in Saudi Arabia and the UAE. The new regional headquarters in Riyadh positions Bureau Veritas to enhance its asset integrity portfolio, facilitating further expansion and development opportunities in the Middle East.

- In March 2022, Baker Hughes collaborated with C3.ai, Inc., Accenture, and Microsoft, aiming to develop industrial asset management (IAM) solutions leveraging digital technologies to enhance safety, efficiency, and emissions profiles of physical assets in the energy and industrial sectors. This collaboration focuses on optimizing plant equipment, operational processes, and business operations, ultimately contributing to improved uptime, flexibility, capital planning, and energy efficiency management, thereby enhancing asset integrity management practices.

Frequently Asked Questions(FAQs):

What are the asset integrity management market's major driving factors and opportunities?

The increasing focus on regulatory compliance drives demand for asset integrity management, while offering opportunities for market expansion. Industries strive to mitigate risks and ensure safety, fostering the adoption of robust asset monitoring and maintenance solutions. This dual emphasis on compliance and risk mitigation presents significant growth potential for asset integrity management providers in various sectors. Leveraging regulatory requirements as catalysts for innovation and operational excellence enhances market competitiveness and profitability.

Which region is expected to hold the highest market share?

North America is poised to hold the highest market share during the forecast period due to its dense concentration of key industries such as oil and gas, manufacturing, and aerospace, necessitating robust asset integrity management practices. Additionally, the region benefits from advanced technological capabilities and a strong regulatory framework, driving the adoption of sophisticated asset monitoring and maintenance solutions.

Who are the leading players in the global asset integrity management market?

Companies such as SGS Société Générale de Surveillance SA. (Switzerland), Bureau Veritas (France), TechnipFMC plc (UK), John Wood Group PLC (UK), Fluor Corporation (US) and Baker Hughes Company (US) are the leading players in the market. Moreover, these companies rely on several strategies, including new product/service launches and developments, collaborations, partnerships, and acquisitions. Such methods give these companies an edge over other players in the market.

What are some of the technological advancements in the market?

Some technology advancements in the asset integrity management market include adopting IoT devices for real-time monitoring, using predictive analytics for proactive maintenance, and implementing drone technology for remote inspections. These advancements enhance asset performance, minimize downtime, and improve operational efficiency by enabling data-driven decision-making and early detection of potential issues.

What is the size of the global asset integrity management market?

The global asset integrity management market was valued at USD 23.9 billion in 2024 and is anticipated to reach USD 31.5 billion at a CAGR of 5.7% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

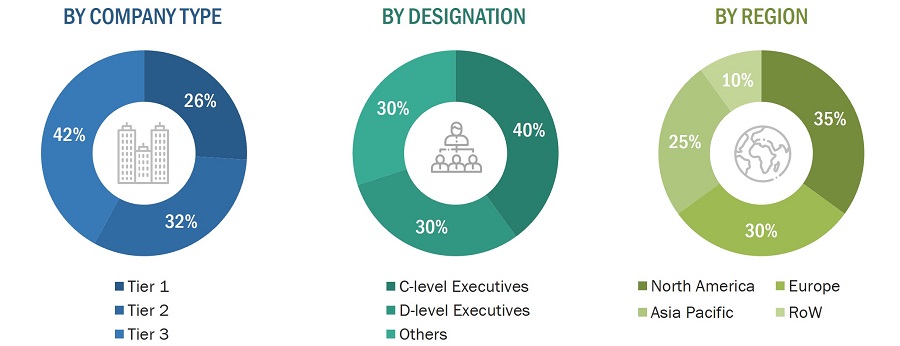

The study involved four major activities in estimating the current size of the asset integrity management market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

|

Source |

Web Link |

|

American Society of Mechanical Engineers (ASME) |

|

|

Occupational Safety and Health Administration (OSHA) |

|

|

International Energy Agency (IEA) |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the asset integrity management market through secondary research. Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

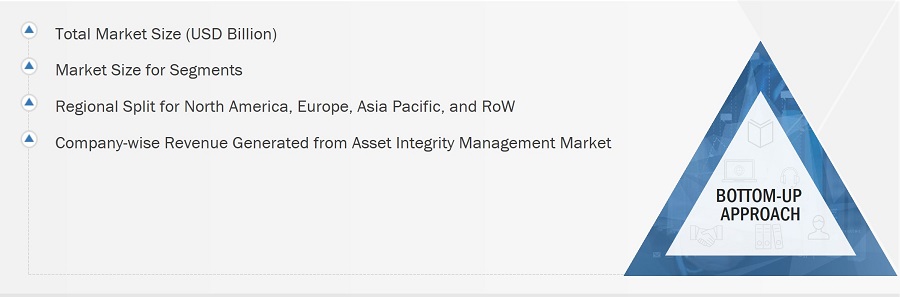

Bottom-Up Approach

The bottom-up approach was used to determine the overall size of the asset integrity management market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying entities in the asset integrity value chain influencing the entire asset integrity management industry

- Analyzing each entity, along with related major companies

- Identifying technology providers for the implementation of products

- Estimating the market for asset integrity management end users

- Tracking ongoing and upcoming implementation of asset integrity management service developments by various companies and forecasting the market based on these developments and other critical parameters

- Arriving at the market size by analyzing asset integrity management companies based on their countries and then combining it to get the market estimate by region

- Verifying estimates and crosschecking them through a discussion with key opinion leaders, including chief experience officers (CXOs), directors, and operation managers

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach has been implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share has been estimated to verify the revenue shares used earlier in the top-down approach. This study has determined and confirmed the overall parent market and individual market sizes by the data triangulation method and data validation through primaries. The data triangulation method in this study is explained in the next section.

- Focusing initially on topline investments by market players in the asset integrity management ecosystem

- Calculating the market size based on the revenue generated by market players through the sales of asset integrity management

- Mapping the use of asset integrity management in different applications

- Building and developing the information related to the revenue generated by market players through key products

- Estimating the geographic split using secondary sources considering factors such as the number of players in a specific country and region, the role of major players in developing innovative products, and adoption and penetration rates for various methods and end-user industries in a particular country

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Asset Integrity Management (AIM) refers to a systematic approach that ensures the reliability, safety, and performance of critical assets throughout their operational lifecycle. It involves comprehensive strategies and practices aimed at assessing, monitoring, and maintaining the integrity of assets such as infrastructure, equipment, and facilities. By implementing risk-based inspection, non-destructive testing, corrosion management, and other techniques, AIM aims to mitigate operational risks, enhance asset lifespan, comply with regulatory requirements, and optimize asset performance and reliability, ultimately contributing to the overall operational efficiency and sustainability of industries such as oil and gas, power generation, and manufacturing.

Key Stakeholders

- Oil and Gas Refinery Companies

- Asset Integrity Management Service Providers

- Asset Integrity Software Developers

- Asset Integrity Management Consultants

- Research Organizations and Consulting Companies

- Technology Investors

- Technology Standard Organizations, Forums, Alliances, and Associations

Report Objectives

- To describe and forecast the asset integrity management market in terms of value by service type, industry, and region

- To forecast the market, in terms of value, for various segments concerning four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the asset integrity management market

- To analyze the micromarkets1 concerning individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the asset integrity management landscape

- To strategically analyze the regulatory landscape, tariff, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the asset integrity management market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as partnerships and joint ventures, mergers and acquisitions, product/service developments, expansions, and research and development, in the asset integrity management market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the asset integrity management market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the asset integrity management market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Asset Integrity Management Market