Warehouse Management System Market by Offering (Software, Services), Deployment (On-premises, Cloud-based), Tier (Advanced, Intermediate, Basic), End User (Automotive, E-commerce, Electricals & Electronics) and Region - Global Forecast to 2029

Warehouse Management System Market

Warehouse Management System Market and Top Companies

Manhattan Associates, Inc.

Manhattan Associates, Inc. develops, sells, and deploys advanced supply chain software solutions worldwide. The company sells its software licenses, services, and hardware products in three regions, namely, the Americas, EMEA, and APAC. Manhattan Associates, Inc. provides its supply chain software and WMS software solutions to various industries, including fashion retail; grocery, food & beverages; manufacturing; medical and pharmaceuticals; retail; wholesale; manufacturing; and third-party logistics. Manhattan Associates, Inc. offers its WMS software under Supply Chain Solutions. The company is a leading provider of innovative WMS software solutions and highly advanced supply chain solutions. Its flagship product Manhattan SCALE, which runs on Microsoft’s NET platform, is an ideal product for meeting distribution requirements and handling complex supply chain execution challenges. The product is a combination of various solutions, including warehouse management, labor management, trading partner management, supply chain intelligence, yard management, and transportation execution.

Blue Yonder Group, Inc.

Panasonic has acquired Blue Yonder Group, Inc. in September 2021. JDA Software changed its name to Blue Yonder Group, Inc. in February 2020. Blue Yonder Group, Inc. is one of the leading providers of end-to-end, integrated retail, multichannel, and supply chain planning and execution solutions. The company’s product offerings are classified under three categories—luminate planning, luminate retail, and luminate logistics. Blue Yonder Group, Inc. offers its solutions under the following product portfolios: luminate planning, luminate logistics, and omnichannel commerce. Warehouse management systems fall under the luminate logistics portfolio. Luminate logistics comprises functionalities such as space and inventory management, workforce management, in-store picking, replenishment, and order fulfillment. The company offers cloud-based WMS services, including implementation, optimization, performance, and upgrades.

HighJump (Körber)

HighJump (Körber) develops advanced supply chain solutions, including a suite of warehouse management, business integration, transportation management, and retail solutions. In August 2017, HighJump was acquired by Körber, which acts as a strategic and financial partner of HighJump. Its software solutions have applications in industries such as automotive and aerospace, food distribution and processing, retail, consumer packaged goods, beverages, craft brewing, health and wellness, third-party logistics, and wineries. HighJump (Körber) has been listed in Inbound Logistics’ 2019 Top 100 Logistics IT Providers. The company has offices in the US, Europe, and China, with more than 4,290 customers spread across more than 66 countries.The company offers end-to-end cloud WMS software services, which are managed by its infrastructure. HighJump (Körber)’s WMS software supports multi-client logistics operations. The software can be quickly implemented and configured as per customer requirements, and it has adaptability tools that provide seamless integration with leading ERP systems. The software is built on one common platform, resulting in easy adoption and efficient employee training.

Warehouse Management System Market and Top End-User Industry

3PL

The 3PL industry held the largest size of the WMS market in 2020. The 3PL industry is one of the primary drivers of the WMS market. Factors such as the growing need for efficient order management, increased outsourcing of logistics and transportation operations, and the globalization of supply chain networks has fueled the adoption of warehouse management systems in the 3PL industry. The trend of industrial automation has initiated most organizations to focus on the adoption of warehouse automation systems to achieve high operational efficiency and functional capabilities. The leading warehouse management system providers are focusing on the delivery of industry-specific customization in WMS that provides an end-to-end solution, allowing organizations to coordinate their procedures and inventory across their network.

Warehouse Management System Market and Top Deployment Type

ON PREMISES Based on deployment, the on-premise deployment held a larger share of the WMS market in 2020. Benefits offered by on-premise WMS include an increased degree of control over the servers and software installed at the location, enhanced security, and improved performance. On-premise WMS solutions are less dependent on the Internet and can be customized easily. However, a high cost is associated with the implementation of on-premise WMS as operators have to own all the related hardware components, along with the licenses of support software required to power WMS. APAC is a huge potential market as multinational companies have started setting up warehouses in this region. Therefore, there is an increased need for inventory management, which is boosting the growth of the on-premise WMS market.

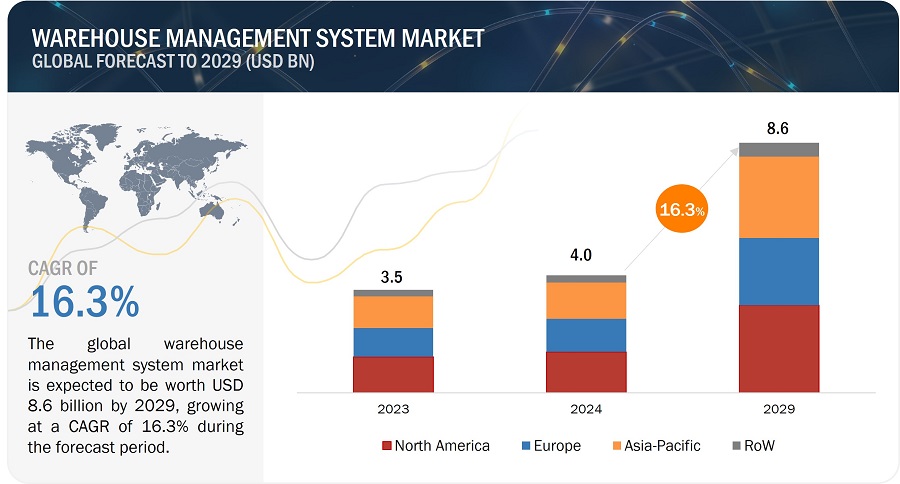

[315 Pages Report] The warehouse management system market to grow from USD 4.0 billion in 2024 and is expected to reach USD 8.6 billion by 2029, growing at a CAGR of 16.3% from 2024 to 2029. Factors Thriving e-commerce industry, growing preference for cloud-based warehouse management systems, increasing proliferation of businesses operating across multiple distribution channels, and rising focus on streamlining supply chain operations to enhance customer experience drives the warehouse management system market.

Warehouse Management System Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Warehouse Management System Market Dynamics

Driver: Rising focus on streamlining supply chain operations to enhance customer experience

Globalization has facilitated the expansion of business worldwide, leading to an increase in cross-border trading of goods and services. As a result, many companies are becoming multinational corporations and expanding their manufacturing and warehousing facilities globally. However, managing supply chain networks across borders comes with regulatory and localization complexities. Sharing information regarding products, suppliers, and workers has become a complex issue for warehouse operating companies with several facilities worldwide. Multinational companies with global warehousing facilities are constantly looking for advanced solutions to track their inventory. The dynamic nature of global supply chain networks has increased the need for adaptable warehousing solutions. Moreover, the management of high volumes of data generated from global supply chain operations poses a challenge for warehouse operating companies.

As international operations continue to grow, more and more product companies are turning to WMS solutions to help them plan, execute, and monitor the flow of goods across different geographies. Advanced WMS solutions can help companies streamline their supply chain networks by providing an integrated platform for the efficient flow of data and information. By implementing a WMS system, companies can improve their demand forecasting, make faster and more informed decisions, and process data related to the movement of goods in a more efficient manner.

In today's world, customers expect quick and accurate deliveries, and the speed and accuracy of order fulfillment play a crucial role in enhancing their overall experience with a brand. A well-implemented WMS can help businesses meet these expectations by automating processes, optimizing picking routes, and providing real-time visibility into inventory levels. This enables businesses to confidently promise and deliver fast, accurate shipments, which, in turn, leads to improved customer satisfaction and loyalty. Whether it is processing e-commerce orders swiftly or shipping products to retail locations promptly, a WMS that ensures efficient operations is a key driver in creating positive customer experiences and setting businesses apart in today's competitive market.

Restraint: High ownership cost of on-premises WMS, especially for SMEs

Small and mid-sized enterprises (SMEs) account for a major share of the global economy. Small and medium-sized enterprises (SMEs) may not have high revenues individually, but, collectively, they hold a significant market share and contribute considerably to the GDP and employment in any country. These enterprises are adopting new technologies to improve their supply chain and warehouse operations and boost productivity. However, the high implementation cost of high-end on-premises WMS solutions is limiting their adoption among SMEs. The constant requirement for hardware upgrades and maintenance costs of on-premises WMS is a significant disadvantage. Despite offering benefits such as higher efficiency and lower maintenance cost, implementing on-premises WMS solutions adds significant upfront costs, including hardware and software setup, testing, employee training, and technology support. SMEs typically do not have high finances available to invest in on-premises WMS solutions, which acts as a restraining factor for the growth of the on-premises warehouse management system market.

Opportunity: Integration of video AI technology into WMS

The integration of video AI technology into WMS software presents a compelling opportunity for significant market growth. Video AI enhances WMS capabilities by providing real-time visibility into warehouse operations through intelligent video analysis. This innovation allows for the seamless monitoring of inventory, personnel, and equipment movements, thereby optimizing operational efficiency. Video AI WMS software empowers businesses to make data-driven decisions swiftly, reducing errors and improving overall productivity.

Moreover, the market growth potential of video AI-powered WMS software is further amplified by its ability to enhance security measures within warehouses. With advanced video analytics, WMS can detect anomalies, unauthorized access, or potential hazards in real time, enabling proactive responses to security threats. This comprehensive approach to warehouse security not only mitigates risks but also fosters a safer working environment. Businesses across various industries are increasingly recognizing the value of such integrated solutions, creating a burgeoning market demand.

Furthermore, the incorporation of video AI into WMS software opens doors to predictive analytics and machine learning applications. By analyzing historical data from video feeds, WMS can forecast trends, optimize workflows, and predict inventory demands with higher accuracy. This predictive capability not only streamlines operations but also reduces costs associated with overstocking or stockouts. As businesses seek to stay competitive in an evolving market landscape, the advanced insights provided by video AI-integrated WMS software provide significant opportunities for market growth. Some major companies that provide video AI technology to deploy in WMS are Awiros (India), Resolute Partners (US), and SCYLLA TECHNOLOGIES INC. (US)

Challenge: Necessity for consistent software updates and security

Modern-day consumers are adopting newer technologies and demanding increased convenience from product companies. The dynamic ecosystem of the supply chain industry constantly challenges warehousing companies to keep up with technological advancements and evolving consumer demands. Software may have loopholes pertaining to security issues. It is important to regularly update software solutions to fix errors, enhance features, improve compatibility, and maintain speed. Software systems are vulnerable to cyber threats and require regular updates with newer technologies to protect the stored data. To keep up with consumer demands, tackle security issues, and boost productivity and efficiency of order fulfillment, companies are required to constantly upgrade and scale their existing WMS software. Upgrading security systems and firewalls is necessary to protect against threats from cyber criminals and maintain a competitive edge in the market.

Warehouse Management System Market Ecosystem

The warehouse management system market is competitive. It is marked by the presence of a prominent players, such as Manhattan Associates (US), Blue Yonder Group, Inc. (US), Körber AG (Germany), Oracle (US), and SAP (Germany). These companies have created a competitive ecosystem by focusing on partnership, collaboration, and acquisition to achieve competitive advantage.

Services segment to grow at the fastest CAGR during the forecast period.

The complexity of modern supply chains, amplified by globalization and e-commerce, necessitates expert services such as installation, testing, and customization to ensure seamless integration of WMS software. Moreover, the adoption of Industry 4.0 technologies like IoT and automation fuels the need for services like maintenance and software updates, as businesses seek to optimize warehouse operations with real-time data and advanced features. Also, the competitive landscape and focus on operational efficiency propel the requirement for training and consultation services to empower businesses with the knowledge and strategies needed to maximize the benefits of WMS solutions. These factors collectively contribute to the increasing demand for comprehensive WMS services, reflecting the evolving needs of businesses striving to enhance productivity and customer satisfaction in their logistics and supply chain operations. Key companies that provide WMS services are Manhattan Associates (US), Blue Yonder Group, Inc. (US), Körber AG (Germany), Oracle (US), SAP (Germany), and Infor (US).

On-premises segment to dominate the market during the forecast period.

On-premise WMS software is installed in on-premise servers to provide the necessary computing power. It is set up at any warehouse location. Benefits offered by on-premise WMS include increased control over the servers and software installed at the location, enhanced security, and improved performance. However, a high cost is associated with implementing on-premise WMS as operators have to own all the related hardware components and the licenses of support software required to power WMS. Moreover, on-premise WMS adds a significant upfront cost in the form of dedicated IT personnel maintenance and periodic data backup performances.

3PL segment to dominate market during forecast period.

The 3PL industry held the largest size of the warehouse management system market in 2023. The 3PL industry is one of the primary drivers of the warehouse management system market. Factors such as the increasing demand for streamlined order management, rising outsourcing of logistics and transportation operations, and the expanding global supply chain networks have all contributed to the widespread adoption of warehouse management systems within the 3PL sector. With the advent of industrial automation, many organizations are prioritizing the implementation of warehouse automation systems to enhance operational efficiency and capabilities. Providers of warehouse management systems are concentrating on offering tailored solutions catering to specific industries, enabling organizations to synchronize their processes and inventory management across their networks.

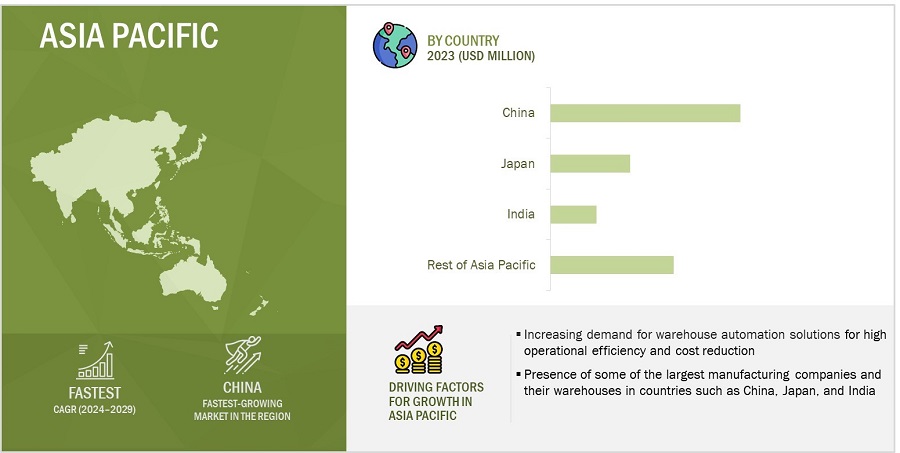

Asia Pacific to grow at the fastest CAGR during the forecast period.

Asia Pacific is the fastest-growing market for warehouse management systems. This growth is fueled by the increasing need for automation among businesses, growing economic activities, and the rising e-commerce industry in the country, supported by high internet penetration rates. In China and India, the growth of the WMS market is supported by increasing demand for end-use goods driven by rising purchasing power among consumers. This demand is fueling the adoption of WMS to ensure efficient handling and delivery of products.

Government initiatives in China and India are also crucial in supporting the WMS market's growth. In China, initiatives like the "Made in China 2025" plan, which focuses on upgrading the country's manufacturing capabilities through technology adoption, are driving the adoption of advanced technologies like WMS in the manufacturing sector. Similarly, in India, initiatives such as "Make in India" and the push for digital transformation are encouraging businesses to invest in technologies like WMS to enhance their operational efficiency and competitiveness.

Warehouse Management System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The warehouse management system companies is dominated by globally established players such Manhattan Associates (US), Blue Yonder Group, Inc. (US), Körber AG (Germany), Oracle (US), SAP (Germany), Infor (US). Microsoft (US), IBM (US), Tecsys Inc. (Canada), and Ehrhardt Partner Group (Germany). These players have adopted product launches/developments, partnerships, collaborations, and acquisitions for growth in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Offering, By Deployment, By Tier, and By End User |

|

Region covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies covered |

The key players in the warehouse management system market are Manhattan Associates (US), Blue Yonder Group, Inc. (US), Körber AG (Germany), Oracle (US), SAP (Germany), Infor (US). Microsoft (US), Reply (Italy), PTC Inc. (US), IBM (US), Ehrhardt Partner Group (Germany), Mecalux, S.A. (Spain), Dematic (US), SSI SCHAEFER Group (Germany), Tecsys Inc. (Canada), Epicor Software Corporation (US), Extensiv (US), Datapel Systems (Australia), Generix Group (France), ecovium Holding GmbH (Germany), Made4net (US), Microlistics (Australia), Softeon (US), Synergy Logistics Ltd. (UK), and Vinculum Solutions Pvt. Ltd. (India) |

Warehouse Management System Market Highlights

The study categorizes the warehouse management system market based on Offering, Deployment, Tier, End User, and Region.

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Deployment: |

|

|

By End User: |

|

|

By Region: |

|

Recent Developments

- In February 2024, Blue Yonder, Inc. (US) acquired Flexis AG (Germany), a leader in manufacturing and supply chain planning technology, to enhance its offerings for automotive and industrial customers. This acquisition strengthened Blue Yonder's capabilities in production optimization and transportation planning, providing solutions for complex production facilities and network structures in the evolving automotive industry.

- In November 2023, SAP (Germany) introduced an update for its SAP Extended Warehouse Management (EWM) which included the integration of SAP Transportation Management to support production warehousing and offer usability enhancements. Some key features include advanced shipping and receiving, defect processing, KANBAN, manufacturing execution system integration, delivery split, radio frequency (RF) improvements, extensibility updates, and user experience (UX) enhancements such as goods movement short text and warehouse monitor upgrades.

- In March 2023, Raymour & Flanigan (US), a major furniture retailer, chose Körber AG (Germany) to enhance its end customer experience. Utilizing Körber's warehouse management system (WMS), Raymour & Flanigan aims to improve efficiency, accuracy, and customer satisfaction. This also allowed Körber to demonstrate its advanced WMS technologies and position itself as a go-to provider for businesses seeking to modernize its warehouse operations.

Frequently Asked Questions (FAQs):

Which are the major companies in the warehouse management system market? What are their major strategies to strengthen their market presence?

Manhattan Associates (US), Blue Yonder Group, Inc. (US), Körber AG (Germany), Oracle (US), and SAP (Germany), are some of the major companies operating in the warehouse management system market. Partnerships, and acquisitions were the key strategies these companies adopted to strengthen their warehouse management system market presence.

What are the drivers for the warehouse management system market?

Drivers for the warehouse management system market are:.

- Thriving e-commerce industry

- Growing preference for cloud-based warehouse management systems

- Increasing proliferation of businesses operating across multiple distribution channels

- Rising focus on streamlining supply chain operations to enhance customer experience

What are the challenges in the warehouse management system market?

Ensuring scalability to support business growth, Lack of awareness leading to lower adoption rate of WMS technology among small-scale companies, and Necessity for consistent software updates and security are among the challenges faced by the warehouse management system market.

What are the functions of warehouse management systems?

Receiving and putaway, slotting, inventory control, picking, workforce and task management, shipping, and yard and dock management are a few of the key funcations of warehouse management systems

What is the total CAGR expected to be recorded for the warehouse management system market from 2024 to 2029?

The CAGR is expected to record a CAGR of 16.3% from 2024-2029.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

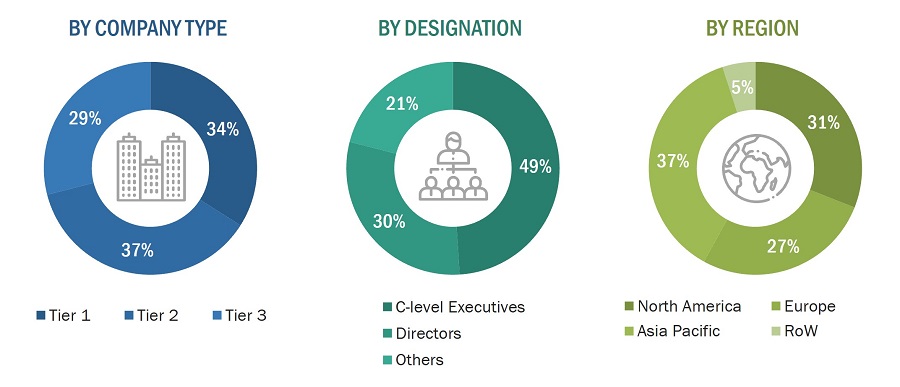

The study involved four major activities in estimating the size of the warehouse management system market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources were referred to in the secondary research process to identify and collect information pertinent to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases. Secondary research has been mainly carried out to obtain key information about the supply chain of the warehouse management system industry, the value chain of the market, the total pool of the key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources, from both supply and demand sides, were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, SMEs, consultants, and related key executives from the major companies and organizations operating in the warehouse management system market.

After the complete market engineering process (which includes market statistics calculations, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical market numbers.

Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the warehouse management system market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying verticals that are either using or will use warehouse management systems.

- Tracking leading companies and system integrators operating across various industries.

- Deriving the size of the warehouse management system market through the data sanity method; analyzing revenues of more than 25 key providers through their annual reports and press releases and summing them up to estimate the overall market size.

- Conducting multiple discussions with key opinion leaders to understand the demand for warehouse management systems and analyzing the break-up of the scope of work carried out by each major company

- Carrying out the market trend analysis to obtain the CAGR of the warehouse management system market by understanding the industry penetration rate and analyzing the demand and supply of warehouse management systems in different industries

- Assigning a percentage to the overall revenue or, in a few cases, to each company's segmental revenues to derive their revenues from the sale of warehouse management systems. This percentage for each company has been assigned based on their product portfolios.

- Verifying and crosschecking estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operation managers, and with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, white papers, and databases

- Tracking the ongoing and identifying the upcoming warehouse management system market implementation projects by companies and forecasting the market size based on these developments and other critical parameters

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall size of the warehouse management system market from the market size estimation processes explained above, the total market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data have been triangulated by studying various factors and trends. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

A warehouse management system (WMS) is a software application that helps manage warehouse operations most efficiently and productively. Functions of these systems include inventory control, labor management, yard management, and dock management, among others. A WMS can be deployed on-premises or can be accessed through cloud servers maintained by WMS vendors.

Stakeholders

- Associations, forums, and alliances related to warehouse management systems

- End users from industries such as 3PL, e-commerce, automotive, chemicals, food & beverages, metals & machinery, and electricals & electronics

- Manufacturers of material handling systems, such as robots, AGVs, ASRS, cranes, and conveyors and sortation systems

- Research organizations and consulting companies

- System integrators

- Venture capitalists and private equity firms

- Warehouse management system software designers and developers

- Warehouse management system service providers

- Cloud service providers

- Market research and consulting firms

Research Objectives

- To describe and forecast the warehouse management system market, in terms of value, by offering, deployment, tier, end user, and region

- To forecast the warehouse management system market size, in terms of value, for various segments with respect to four main regions—North America, Europe, Asia Pacific, and RoW.

- To provide a detailed overview of the functions of warehouse management systems

- To offer a detailed overview of different hardware components (material handling equipment) integrated with WMS software

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To give detailed information regarding the major factors influencing the growth of the warehouse management system market (drivers, restraints, opportunities, and challenges)

- To analyze the market ecosystem, trends/disruptions impacting customers' businesses, technology analysis, pricing analysis, Porter's five forces analysis, key stakeholders & buying criteria, case study analysis, trade analysis, patent analysis, key conferences & events, investment & funding scenario; and tariff & regulations related to the warehouse management system market

- To analyze opportunities for stakeholders in the warehouse management system market by identifying high-growth segments

- To provide a detailed overview of the supply chain of the WMS ecosystem

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive growth strategies such as product launches, acquisitions, expansions, contracts, and partnerships in the warehouse management system market

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Warehouse Management System Market

Nice brief, as already mentioned as question below: the potential of ECommerce growth is not even represented in your numbers, keeping in mind that only the biggest of companies can afford the mentioned solutions, no the average merchant that has 5-20 people inside his warehouse. Imagine what the real market size and potential is in fact.Best regards, Thomas Kircheis, PULPO WMS

The e-commerce industry is expected to grow at a high rate owing to the increasing number of online shoppers. The e-commerce sales in APAC is predicted to be the twice the size of Western Europe and North America combined in 2020. Have you covered the impact of e-commerce industry on the WMS market in your study?

Implementation cost of high-end on-premise WMS solutions is high, which is limiting its adoption in many small and midsized enterprises. Does your report covers the cost analysis and its impact on the growth of WMS market?

Multinational companies with warehousing facilities across the world are constantly looking for advanced solutions to instantly track their inventory. The dynamic nature of the global supply chain networks has increased the need for adaptable warehousing solutions. Have you considered this factor while studying the global spread of the WMS market?

Cloud computing is transforming operational activities of a warehouse and supply chain management. We would like to understand the impact of cloud computing on WMS market across the world.

Businesses today need to face challenges related to seasonal changes, price changes, fashion changes, and competitive product launches to remain competitive in the market. Thus, they need different types of forecasting models to fulfill customer orders on-time and provide them with a prediction of short- and long-term prices. Have you considered the forecasting models in this study?