Supply Chain Security Market Size, Size, Growth & Latest Trends

Supply Chain Security Market by Hardware (IoT Sensors, RFID Tags & Readers, GPS Trackers), Software (Risk Management, Threat Intelligence, Blockchain-Based Solutions), Security Type (Data Locality & Protection, Fraud Prevention) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

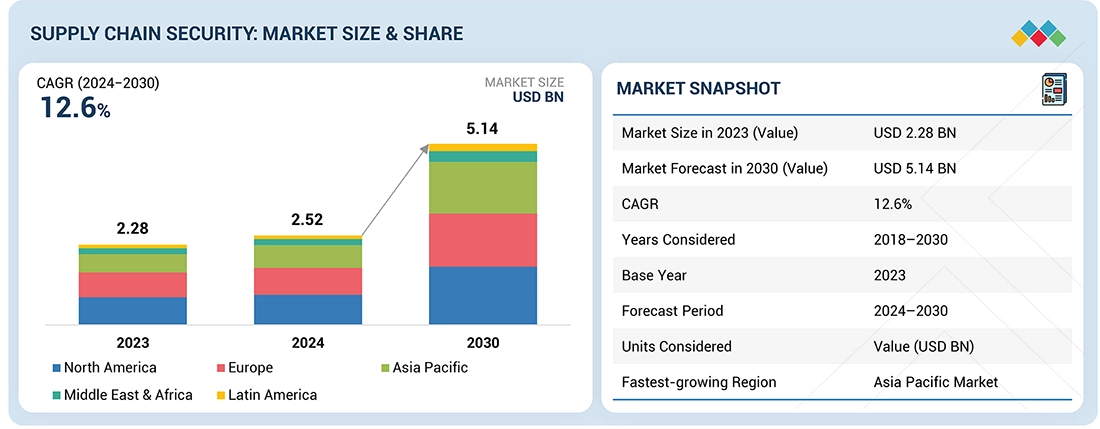

The global supply chain security market size is projected to grow from USD 2.52 billion in 2024 to USD 5.14 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 12.6% during the forecast period. The supply chain security market is driven by the growing need for transparency, as organizations seek end-to-end visibility to mitigate risks, ensure compliance, and build trust across global networks. At the same time, the upsurge and innovation in advanced technologies such as AI, blockchain, and IoT enhance real-time monitoring, threat detection, and data-driven decision-making.

KEY TAKEAWAYS

-

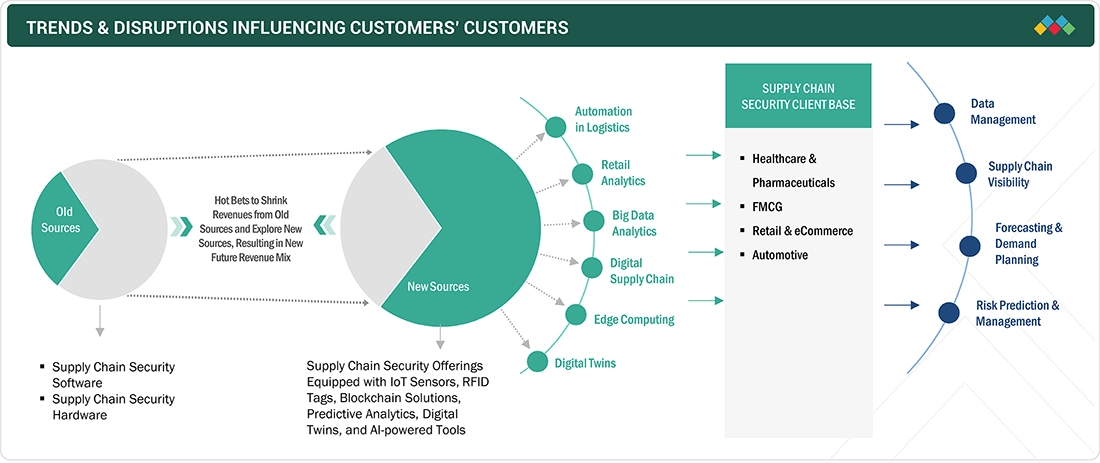

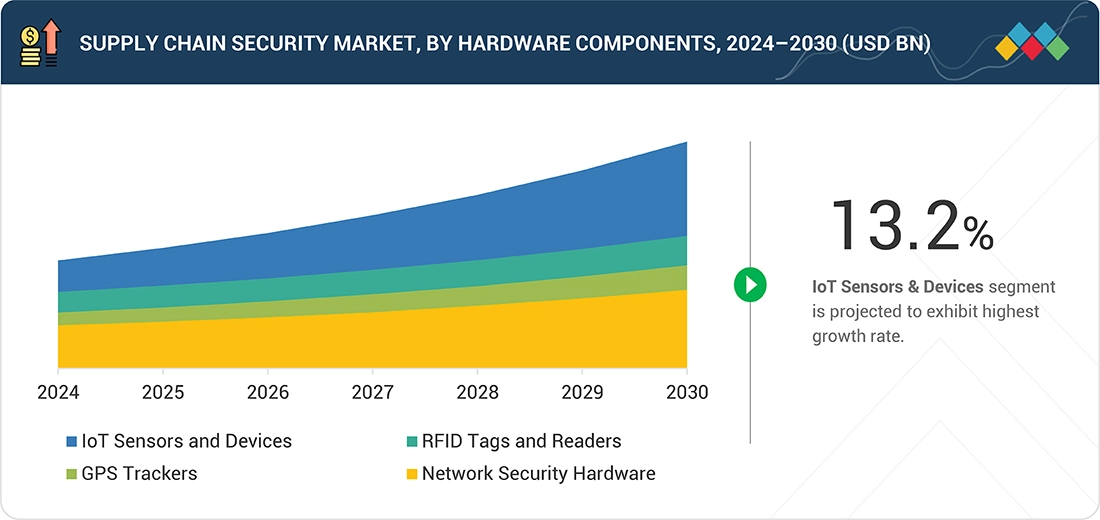

BY OFFERINGThe blockchain market is divided into hardware, software and services. IoT sensors and devices, risk management platforms, and managed services are the fastest-growing offerings in the supply chain security market. IoT hardware enables real-time tracking and anomaly detection, software platforms provide AI-driven risk assessment and compliance tools, while managed services offer continuous monitoring and expert support.

-

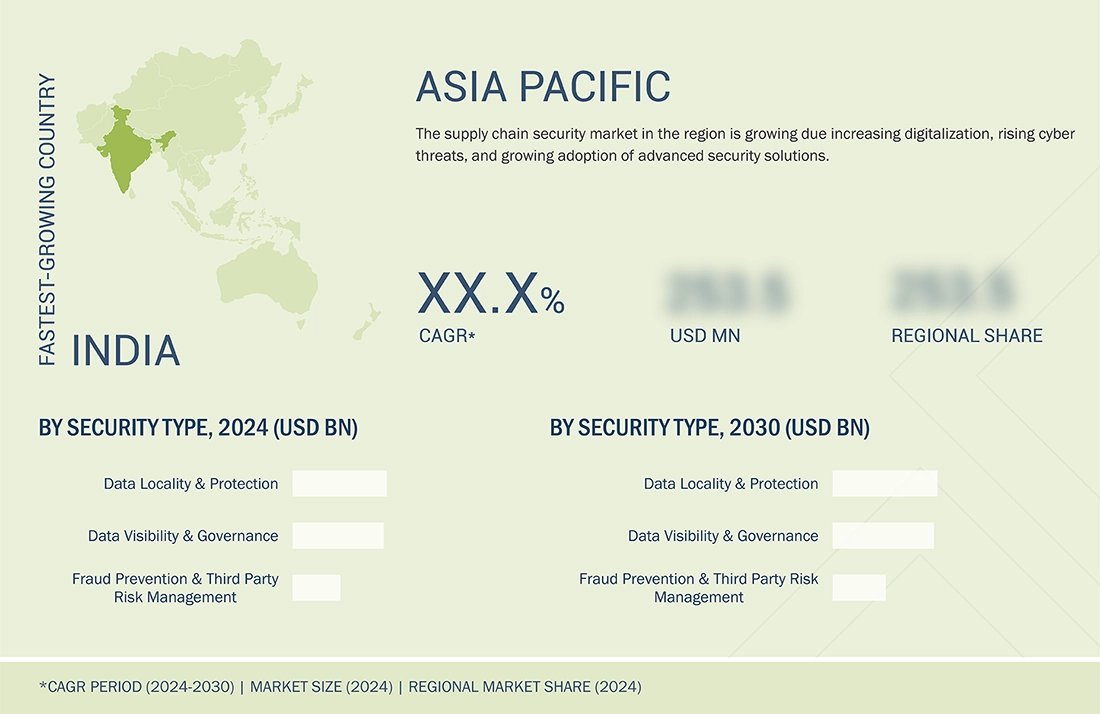

BY SECURITY TYPEData visibility and governance represent the fastest-growing security type, as enterprises prioritize transparency and control over sensitive supply chain data. Ensuring integrity, accessibility, and compliance with global standards, these solutions empower organizations to monitor transactions, detect anomalies, and maintain trust, addressing growing concerns of data breaches and cyber risks.

-

BY ORGANIZATION SIZESmall and medium-sized enterprises (SMEs) are the fastest-growing segment adopting supply chain security solutions, driven by rising cyber risks, cost-effective cloud platforms, and regulatory requirements. SMEs increasingly rely on scalable and affordable security tools to protect digital assets, enhance transparency, and strengthen competitiveness in globalized and interconnected supply chain networks.

-

BY APPLICATION AREARetail and ecommerce are the fastest-growing application areas for supply chain security, fueled by rising online transactions, digital platforms, and global distribution networks. These businesses face high risks of fraud, data breaches, and counterfeit goods, driving demand for advanced security solutions that ensure trust, transparency, and resilience in operations.

-

BY REGIONNorth America holds the largest market size in the supply chain security market due to its advanced infrastructure, high adoption of digital technologies, stringent regulatory standards, and presence of major global logistics and technology companies. In addition, Asia Pacific is the fastest-growing region, driven by rapid industrialization, expanding e-commerce, increasing cyber threats, and rising adoption of advanced security solutions across emerging economies seeking to enhance supply chain resilience and transparency.

-

COMPETITIVE LANDSCAPEKey players such as IBM, Emerson, Oracle, NXP Semiconductors, are expanding portfolios through acquisitions, AI/ML integration, and partnerships. Competition is intensifying between native supply chain security providers and broader enterprise ecosystems, with rising investments in managed services and solutions for faster adoption across industries.

The increasing emphasis on regulatory compliance and stringent government mandates further accelerates the adoption of supply chain security solutions. Organizations are compelled to implement robust security frameworks to safeguard sensitive data, maintain operational integrity, and avoid penalties. This regulatory pressure, combined with technological advancements and the demand for transparency, is shaping a more resilient and secure global supply chain ecosystem.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The supply chain security market is being reshaped by emerging trends and disruptions, including advanced technologies, increasing cyber threats, and evolving regulatory requirements. Organizations are prioritizing transparency, risk mitigation, and resilience, while innovations in AI, IoT, and blockchain are transforming how supply chains are monitored, managed, and secured globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidences of cyberattacks across supply chains

-

Growing need for supply chain transparency

Level

-

Budgetary constraints among small and emerging start-ups in developing economies

-

Shortage of skilled professionals

Level

-

Increasing loT devices in supply chain

-

Advancing risk prediction and management in supply chains

Level

-

Limited awareness about supply chain security among organizations

-

Third-party risks and insider threats

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Growing need for supply chain transparency

Organizations are increasingly prioritizing supply chain transparency to gain end-to-end visibility, enhance operational efficiency, and build stakeholder trust. Transparent supply chains help monitor product movement, ensure regulatory compliance, and quickly identify disruptions, making transparency a critical driver for adopting advanced supply chain security solutions across industries.

Restraint: Shortage of skilled professionals

The supply chain security market faces a significant restraint due to the shortage of skilled cybersecurity and logistics professionals. Limited expertise in implementing, monitoring, and managing advanced security solutions hinders adoption, delays deployment, and increases reliance on external providers, slowing market growth despite rising demand for secure and resilient supply chain operations.

Opportunity: Increasing loT devices in supply chain

The growing deployment of IoT devices presents a major opportunity in supply chain security. Connected sensors, trackers, and smart devices enable real-time monitoring, predictive analytics, and automated risk detection, allowing organizations to enhance visibility, reduce losses, and proactively manage threats, driving adoption of innovative security solutions across global supply networks.

Challenge: Third-party risks and insider threats

Third-party vendors and insider threats pose significant challenges to supply chain security. External suppliers and internal personnel can inadvertently or maliciously compromise sensitive data, disrupt operations, or introduce vulnerabilities. Addressing these risks requires robust monitoring, access controls, and comprehensive security frameworks, making risk management a critical yet complex challenge for organizations.

Supply Chain Security Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The company needed a solution to prioritize risks and reduce false positives, allowing the security team to focus on critical vulnerabilities. | Proactive risk mitigation, enhanced team efficiency, comprehensive risk visibility |

|

The company faced challenges such as temperature-controlled logistics failures, lack of real-time visibility, manual data upload delays, environmental concerns . | Enhanced supply chain security, cost and waste reduction, optimized logistics, increased customer satisfaction. |

|

Delays in shipment delivery, lack of real-time visibility for customers, security risks associated with cargo theft or unauthorized access during transit, reliance on drivers or third-party systems for tracking. | Enhanced visibility, improved security, operational efficiency, customer satisfaction, quick recovery from disruptions, business growth. |

|

Lack of real-time visibility, operational inefficiencies, risk identification and management, complex inventory management. | Enhanced risk management, improved inventory management, cost savings, increased efficiency and collaboration, reliability and scalability. |

|

Absence of real-time tracking and monitoring, limited ability to ensure the safe transportation of high-value electronics, Inability to provide accurate shipment updates, Risks of cargo theft, damage, and in-transit issues. | Enhanced shipment security, improved customer service, safer transportation, operational efficiency. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The supply chain security market ecosystem comprises hardware and software providers, technology vendors, service providers, and end-user industries working together to enhance supply chain resilience. It integrates hardware, software, and managed services, supported by regulatory bodies and industry standards, creating a collaborative environment that drives innovation, risk mitigation, and operational efficiency across global supply networks.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Supply Chain Security Market, By Hardware Components

IoT sensors and devices hold the largest market share in the hardware segment, providing real-time tracking, monitoring, and data collection across supply chains. Their ability to enhance operational visibility, detect anomalies, and improve efficiency makes them essential for organizations seeking secure, transparent, and well-managed logistics networks.

Supply Chain Security Market, By Software Solutions

Supply chain visibility tools are the largest software segment, enabling organizations to monitor operations, track shipments, and detect disruptions in real time. These tools support informed decision-making, risk management, and regulatory compliance, helping businesses maintain efficiency, transparency, and resilience across complex global supply chains.

Supply Chain Security Market, By Security Type

Data visibility and governance lead the market as the largest security type, focusing on monitoring, managing, and securing critical supply chain information. These solutions ensure data integrity, accessibility, and regulatory compliance, empowering organizations to mitigate risks, prevent breaches, and maintain operational trust across interconnected networks.

Supply Chain Security Market, By Organization Size

Large enterprises hold the largest market size due to their complex, global supply chains, substantial budgets, and stringent regulatory obligations. These organizations adopt advanced security solutions to manage risks, enhance visibility, and ensure compliance, driving significant investment in IoT devices, software platforms, and managed services to safeguard extensive operations.

Supply Chain Security Market, By Application Area

Healthcare and pharmaceuticals represent the largest application area, driven by the critical need to protect sensitive data, ensure product integrity, and comply with strict regulatory standards. Supply chain security solutions help monitor drug distribution, prevent counterfeiting, and maintain operational resilience, making this sector a major contributor to market demand.

REGION

Asia Pacific to be the fastest-growing region in the global supply chain security market during the forecast period.

Asia Pacific is the fastest-growing region in the supply chain security market due to rapid industrialization, expanding e-commerce, rising cyber threats, and increasing adoption of advanced technologies like IoT, AI, and blockchain, enabling organizations across emerging economies to enhance supply chain visibility, resilience, and operational efficiency.

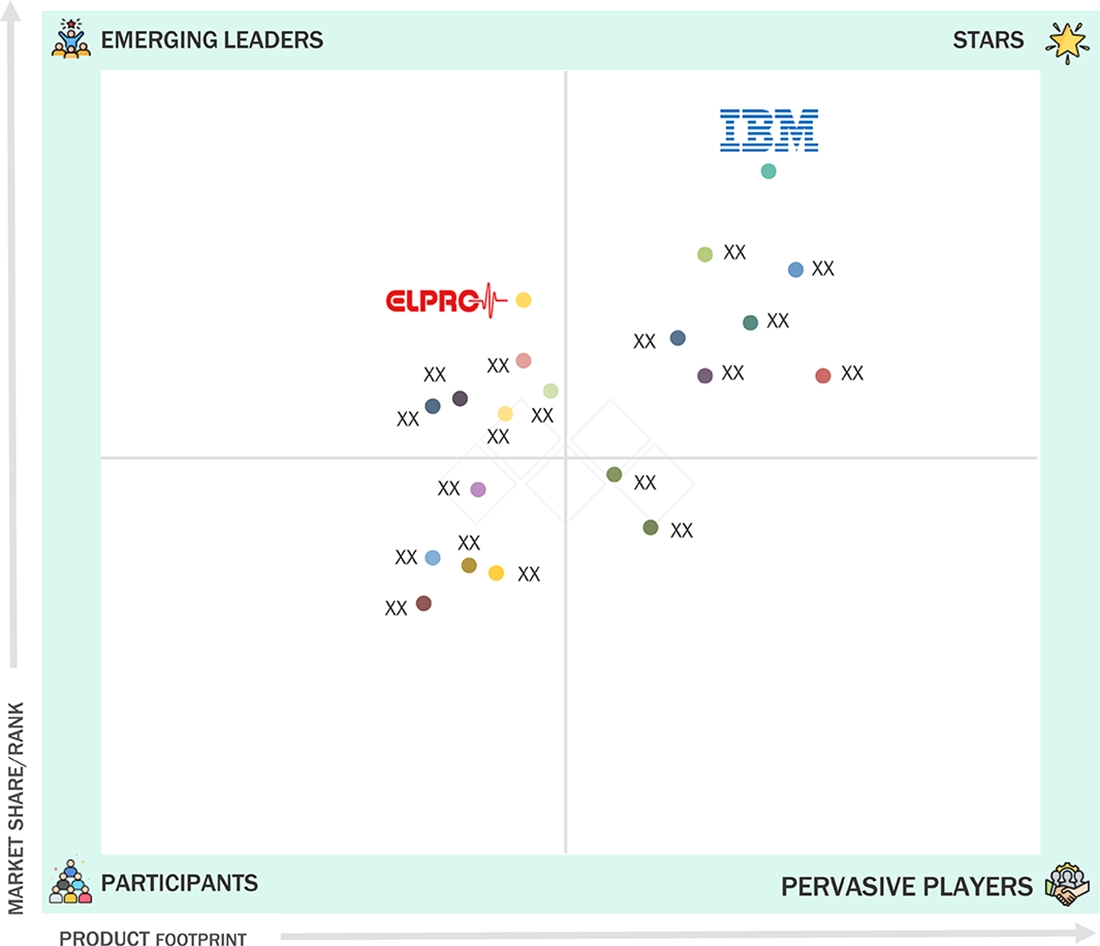

Supply Chain Security Market: COMPANY EVALUATION MATRIX

In the supply chain security market matrix, IBM (Star) leads due to its comprehensive portfolio of AI-driven risk management, blockchain solutions, and global expertise, while Elpro (Emerging Player) leverages innovative IoT devices and niche solutions to capture growth in specialized supply chain segments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | 2.28 billion |

| Market Forecast in 2030 (value) | 5.14 billion |

| Growth Rate | CAGR of 12.6% from 2024-2030 |

| Years Considered | 2018–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Billion/Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, Latin America |

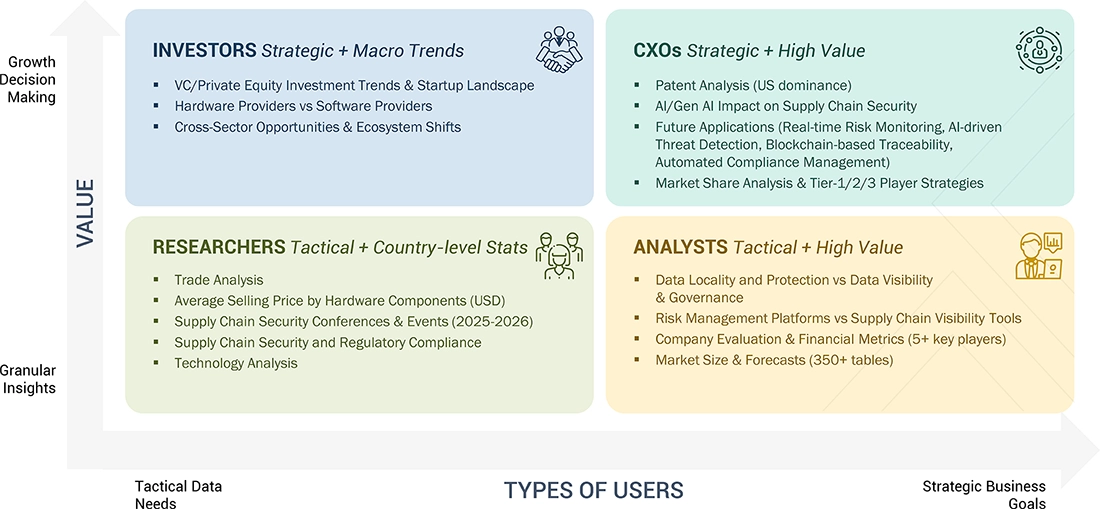

WHAT IS IN IT FOR YOU: Supply Chain Security Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Product Analysis: Product Matrix, which gives a detailed comparison of the product portfolio of each company | Improved clarity on competitive positioning and product strengths to drive informed decision- making. |

| Leading Service Provider (EU) | Company Information: Detailed analysis and profiling of additional market players (up to 5) | Comprehensive insights into market landscape and opportunities for strategic collaborations. |

RECENT DEVELOPMENTS

- October 2024 : Emerson expanded its Ovation Automation Platform with enhanced cybersecurity capabilities in partnership with Nozomi Networks. This enhancement improves the security of power and water supply chains by integrating advanced OT and loT security solutions, ensuring greater resilience and operational visibility.

- September 2024 : Oracle announced new user experience enhancements within Oracle Fusion Cloud SCM, leveraging Al to increase workforce productivity, expand visibility, accelerate processes, and prioritize actions to drive results, enhancing supply chain security.

- November 2023 : Sensitech launched a cloud-based solution within the SensiWatch platform to monitor outbound shipments in real-time, extending cold chain visibility to the last mile. This innovation ensures the quality of perishable goods by providing continuous cargo monitoring from distribution centers to final destinations.

- July 2023 : IBM collaborated with The National Association of Boards of Pharmacy (NABP) to launch Pulse by NABP. This digital platform enhances transparency and safety in the US drug supply chain. Pulse helps bring visibility to the drug supply chain and also helps safeguard patients from forged or substandard prescription medications.

Table of Contents

Methodology

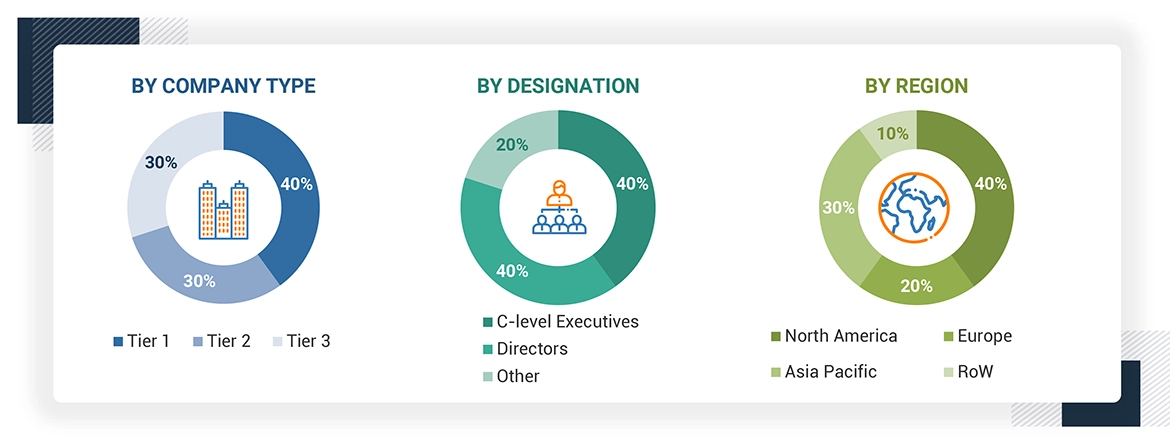

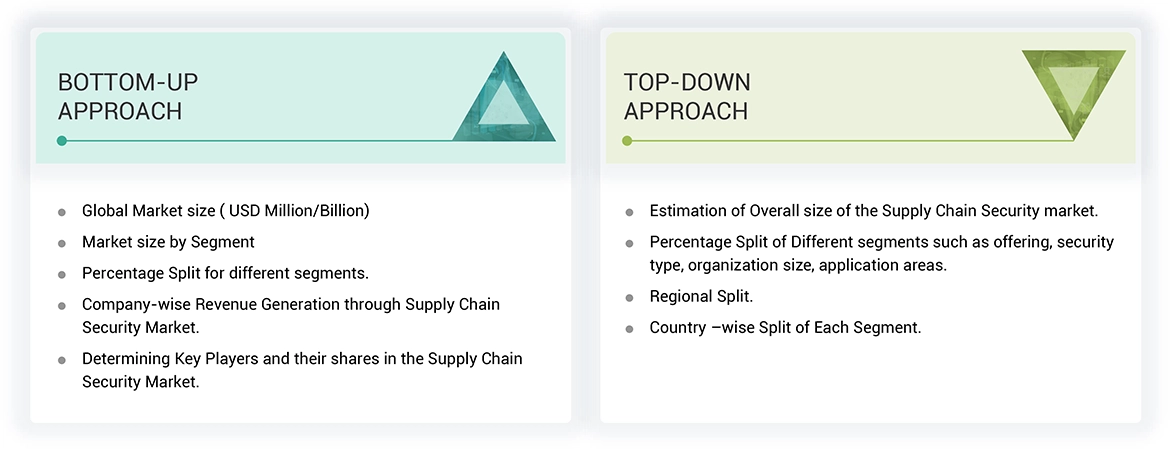

Secondary research was conducted to collect information useful for this technical, market-oriented, and commercial study of the global supply chain security market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the supply chain security market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included supply chain security news, supply chain security foundations, annual reports, press releases, investor presentations of supply chain security vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the supply chain security market were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing supply chain security solutions, tools and applications, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research helped identify and validate the segmentation types, industry trends, key players, a competitive landscape of supply chain security services, tools, and applications offered by several market vendors, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the bottom-up and top-down approaches and several data triangulation methods were extensively used to estimate and forecast the overall market segments and subsegments listed in this report. An extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: Other levels include sales, marketing, and product managers.

Tier 1 companies receive revenues higher than USD 10 billion; Tier 2 companies' revenues range

between USD 1 and 10 billion; and Tier 3 companies' revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts and MarketandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the supply chain security market's size and various other dependent sub-segments in the overall supply chain security market. The research methodology used to estimate the market size includes the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the WCM market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of product type, deployment mode, architecture, and end user. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Supply Chain Security Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

A supply chain security system combines traditional supply chain management practices with security measures and focuses on the risk management of external suppliers, vendors, logistics, and transportation. Supply chain security activities aim to enhance the security/ protection of the supply chain from terrorism, piracy, and theft. Supply chain security solutions help businesses identify, analyze, and mitigate supply chain risks with real-time visibility and transparency. This, in turn, helps businesses make faster, accurate, and informed decisions.

Stakeholders

- Chief Technology and Data Officers

- Supply Chain Security Service Professionals

- Business Analysts

- Information Technology (IT) Professionals

- Investors and Venture Capitalists

- Third-party Providers

- Consultants/Consultancies/Advisory Firms

- Product Designers/Computer-aided Software Engineers

- System Integrators

- Value-added Resellers (VARs)

Report Objectives

- To describe and forecast the global supply chain security market based on offering, security type, organization size, application areas, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Middle East & Africa, Asia Pacific and Latin America.

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market.

- To profile the key players and comprehensively analyze their market sizes and core competencies.

- To track and analyze competitive developments such as product enhancements and new product launches, acquisitions, and partnerships and collaborations in the market globally.

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further breakup of the Asia Pacific market into countries contributes to the rest of the regional market size.

- Further breakup of the North American market into countries contributes to the rest of the regional market size.

- Further breakup of the Latin American market into countries contributes to the rest of the regional market size.

- Further breakup of the Middle East & African market into countries contributing to the rest of the regional market size

- Further breakup of the European market into countries contributes to the rest of the regional market size.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

How have Trump tariffs affected global supply chain costs?

The tariffs imposed during the Trump administration increased costs for businesses relying on imported materials. Companies faced higher expenses for raw materials and finished goods, forcing them to reassess supplier relationships and sourcing strategies. Many firms shifted supply chains to avoid tariffs, but this often led to longer lead times and operational disruptions. The added financial pressure squeezed profit margins, particularly for industries dependent on cross-border trade.

What are the opportunities in the global Supply Chain Security market?

Rapid growth in the Commerce sector, advancement in risk prediction and management for supply chains, and increasing adoption of IoT devices create opportunities for the suply chain security market.

What is the definition of the supply chain security market?

According to MarketsandMarkets, a supply chain security system combines traditional supply chain management practices with security measures and focuses on managing external suppliers, vendors, logistics, and transportation risks. Supply chain security activities aim to enhance the security/ protection of the supply chain from terrorism, piracy, and theft. With real-time visibility and transparency, supply chain security solutions help businesses identify, analyze, and mitigate supply chain risks. This, in turn, helps businesses make faster, more accurate, and more informed decisions.

Which region is expected to show the highest supply chain security market share?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors include IBM (US), Emerson (US), Oracle (US), NXP Semiconductors (Netherlands), Testo (Germany), ORBCOMM (US), Sensitech (US), Elpro (Switzerland), Rotronic (Switzerland), Berlinger & Co (Switzerland), Monnit (US), Cold Chain Technologies (US), LogTag Recorders (New Zealand), Dickson (US) and Signatrol (UK)

What is the current size of the global supply chain security market?

The global Supply Chain Security market size is projected to grow from USD 2.52 billion in 2024 to USD 5.14 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 12.6% during the forecast period.

What are the main drivers of growth in the supply chain security market?

The main drivers are rising cyberattacks and data breaches, strict regulatory requirements, rapid e-commerce growth, and the adoption of advanced technologies like AI, IoT, and blockchain for real-time monitoring and risk management.

What is the estimated annual growth rate of the supply chain security market in North America over the projected period?

The North America supply chain security market is expected to grow at a compound annual growth rate of 11.5% during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Supply Chain Security Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Supply Chain Security Market