Cloud Analytics Market by Offering ((Solutions (Advanced Analytics, Cloud Bl Tools), Deployment Mode (Public, Private, Hybrid)), Services), Data Type, Data Processing (Real-Time Analytics, Batch Analytics), Vertical and Region - Global Forecast to 2029

Cloud Analytics Market Worldwide - Size, Share & Growth

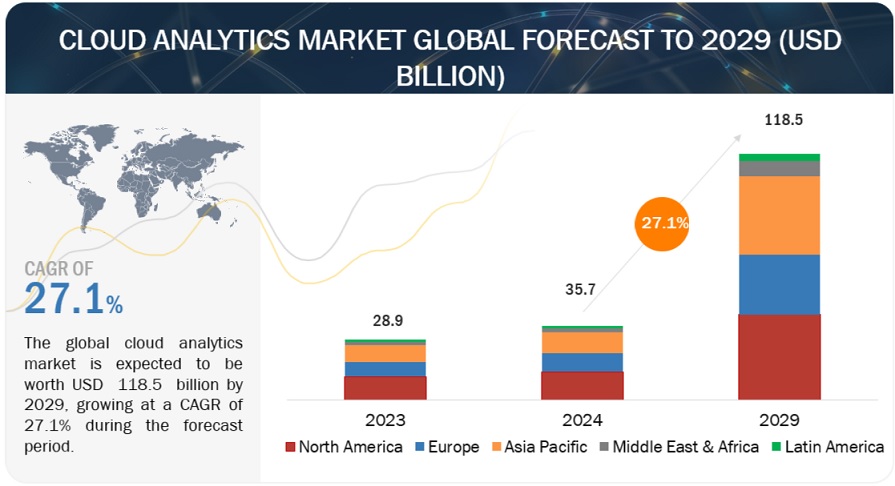

[342 Pages Report] The global cloud analytics market is projected to grow from USD 35.7 billion in 2024 to USD 118.5 billion in 2029, at a CAGR of 27.1% during the forecast period. In today's digital landscape, the surge in data volume underscores the urgent requirement for advanced analytics solutions capable of efficiently processing, analyzing, and interpreting vast datasets. Cloud analytics emerges as a scalable and cost-effective solution to address these needs, unleashing the complete potential of data and empowering businesses to embrace data-driven decision-making. Its appeal lies in leveraging sophisticated analytical algorithms on cloud-stored data, offering businesses a competitive edge. By amalgamating data from diverse sources and transforming structured, semi-structured, and unstructured data into human-readable formats, cloud-based analytics provides a comprehensive perspective, enhancing forecasting and decision-making. This capacity to derive novel insights from varied data sources elevates overall business operations, enabling enterprises to better fulfill customer requirements and drive success.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Exponential rise of unstructured data

The exponential surge in unstructured data rapidly reshapes the digital landscape, encouraging organizations to embrace robust analytics solutions to navigate this complexity effectively. With projections indicating that unstructured data will dominate the data landscape by 2025, the urgency to harness its potential has never been more pronounced. Cloud analytics emerges as a pivotal solution, offering a versatile platform for businesses to harness diverse data streams and extract actionable insights swiftly. This imperative is further fueled by the escalating demand for data-driven decision-making in the digital age.

Cloud-based analytics solutions are indispensable assets, empowering enterprises to optimize operational efficiency, enhance customer experiences, expedite digital transformation initiatives, and bolster network security measures. As businesses strive to stay ahead in dynamic market environments, the ability to pivot swiftly based on data-driven insights becomes paramount. Consequently, the cloud analytics market stands poised for substantial expansion, with cloud-based storage and analytical tools pivotal in driving innovation, revenue growth, and securing competitive advantages amidst evolving business landscapes. In this paradigm, rising unstructured data and cloud analytics convergence presents unprecedented opportunities for organizations to thrive in an increasingly data-centric world.

Restraint: Discrepancy among data sources impedes the advancement of cloud analytics

The growth of the cloud analytics market faces a substantial restraint due to the presence of data silos and a fragmented data landscape within organizations. These impediments obstruct the smooth data flow crucial for effective cloud analytics deployment. Data silos, isolated datasets inaccessible to other parts of the business, and a fragmented data landscape scattered across different systems complicate data aggregation and analysis. Consequently, organizations encounter challenges deriving comprehensive insights from disparate data sources, limiting the effectiveness of cloud analytics solutions. This hinders efficient data processing, analysis, and decision-making processes. The inability to integrate and harmonize data across various sources constrains the capability of cloud analytics solutions to deliver comprehensive and actionable insights. Thus, organizations struggle to realize the full potential of cloud analytics, including real-time insights, predictive analytics, and data-driven decision-making, ultimately restraining the market’s growth.

Opportunity: Empowering cloud analytics through SDN-enabled network integration

Integrating network infrastructures with Software-Defined Networking (SDN) presents a significant opportunity to expand the cloud analytics market. By allowing centralized control and programmable network configurations, SDN enhances network management, scalability, and efficiency, facilitating seamless integration with cloud environments. SDN streamlines network operations, augments visibility, and bolsters security protocols by decoupling the control plane from the data plane and utilizing software controllers. This integration empowers organizations to manage network resources efficiently, rapidly provision services, and adapt to evolving demands, as well as critical capabilities for cloud analytics applications reliant on real-time data processing and insights. Moreover, SDN’s compatibility with cloud environments ensures that applications hosted on-premises and in the cloud can operate seamlessly on the software-defined network, providing a unified platform for monitoring and managing network operations. The readiness of SDN solutions for integration further enables seamless connectivity with various enterprise components, enhancing overall network performance and control. These advancements in network infrastructure pave the way for organizations to leverage advanced analytics capabilities effectively, driving innovation in cloud-based services and fueling the growth of the cloud analytics mark.

Challenge: Rise in need for training and upskilling to address knowledge gap

The growth of the cloud analytics market faces a significant challenge stemming from the limited understanding of advanced analytics concepts among businesses and individuals. This deficiency in expertise hampers the effective utilization of advanced analytics solutions and services, which are integral to maximizing the potential of cloud analytics tools. Despite projections indicating substantial market growth driven by big data adoption and the demand for fraud prevention during the pandemic, the lack of advanced analytics knowledge could impede this progress. To mitigate this challenge, investments in training and upskilling initiatives are crucial for empowering workforce capabilities. Moreover, cloud analytics providers can simplify user interfaces and tools to enhance accessibility and usability for a wider audience. By addressing this knowledge gap, businesses can unlock the full potential of cloud analytics, enabling informed decision-making and driving overall market growth.

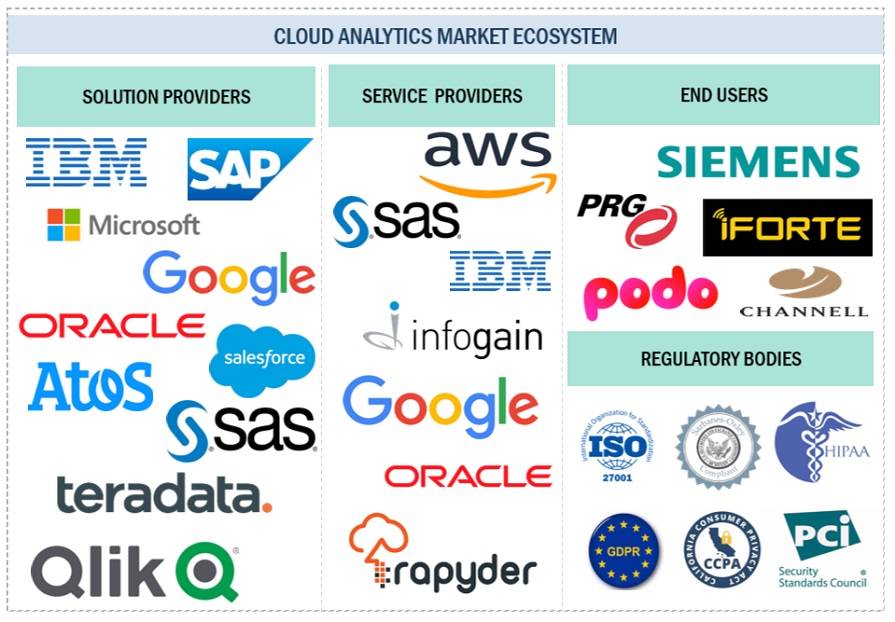

Cloud Analytics Market Ecosystem

The ecosystem comprises cloud analytics solution providers, service providers, end-users, and government & regulatory bodies. This segmented ecosystem works collaboratively to drive the transition toward more efficient workflows and output generation, leveraging technology and data to achieve goals.

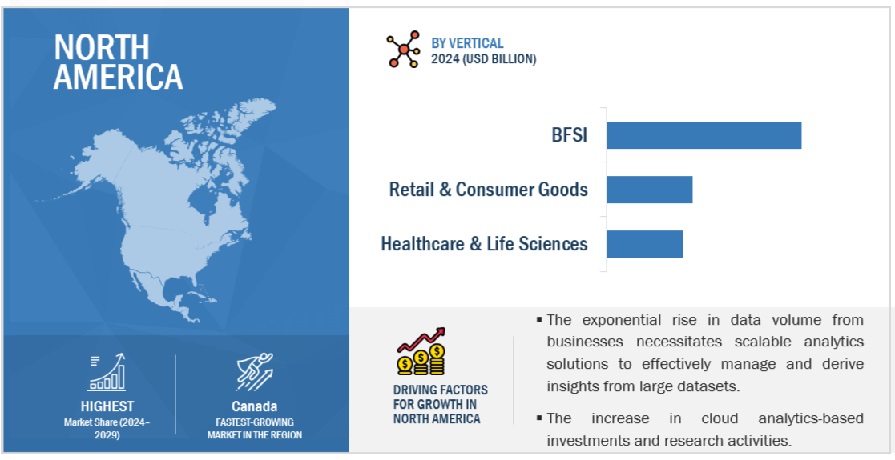

By vertical, BFSI segment accounts for the largest market size during the forecast period.

The BFSI sector dominates cloud analytics due to its data-intensive nature and stringent regulatory requirements. Cloud analytics offer scalability, cost-effectiveness, and agility, allowing BFSI companies to efficiently manage vast amounts of data while ensuring compliance. Moreover, the sector's constant need for real-time insights to mitigate risks, detect fraud, personalize customer experiences, and optimize operations aligns perfectly with the capabilities of cloud analytics platforms. Additionally, the increasing adoption of AI and machine learning in BFSI further enhances the value proposition of cloud analytics by enabling predictive analytics and automated decision-making. As a result, BFSI firms leverage cloud analytics to gain competitive advantages, improve customer satisfaction, and drive innovation, making it the largest beneficiary of cloud analytics solutions.

By data processing, the batch analytics segment is projected to grow at the highest CAGR during the forecast period.

In cloud analytics market, batch analytics has experienced significant growth as a data processing method. Leveraging the scalability and flexibility of cloud infrastructure, batch analytics efficiently processes large volumes of data in scheduled batches. This approach allows businesses to analyze historical data, identify trends, and extract valuable insights for strategic decision-making. Moreover, advancements in cloud technologies have enhanced the speed and cost-effectiveness of batch analytics, making it increasingly attractive for businesses across various industries. With the rising demand for data-driven insights, the batch analytics market within cloud analytics is poised for further expansion. Its ability to handle massive datasets, coupled with the scalability of cloud platforms, ensures its continued prominence in driving actionable intelligence and empowering organizations to stay competitive in today's data-driven era.

North America to account for the largest market size during the forecast period.

In North America, the embrace of cloud analytics is swiftly becoming a defining feature of progressive businesses seeking to optimize their operations and gain competitive advantage. This trend is fueled by the unparalleled scalability, flexibility, and cost-efficiency offered by cloud-based analytics solutions. By leveraging the vast computational power and storage capabilities of the cloud, organizations can seamlessly analyze vast volumes of data in real-time, uncovering valuable insights that drive informed decision-making. Moreover, the accessibility of cloud analytics platforms empowers businesses of all sizes to harness the power of advanced analytics without the need for significant upfront investments in infrastructure or specialized talent. As a result, industries across North America are increasingly integrating cloud analytics into their workflows, unlocking new opportunities for innovation, efficiency, and growth in the digital age.

Key Market Players

The major cloud analytics solution and service providers include IBM (US), SAS Institute (US), Oracle (US), Google (US), Microsoft (US), Teradata (US), Salesforce (US), AWS (US), NetApp (US), Qilk (US), Sisense (US), SAP (Germany), Atos (France), Altair (US), Microstrategy (US), Tibco Software (US), Hexaware Technologies (India), Zoho (India), Rackspace Technology (US), Splunk (US), Cloudera (US), Domo (US), Hewlett Packard Enterprise (US), Incorta (US), Tellius (US), Rapyder (US), Hitachi Vantara (US), Board International (Switzerland), Ridge (Israel), Jaspersoft (US), Yellowfin (Australia), Deonodo (US), GoodData (US), Thoughtspot (US), and Infogain (US). These companies have used organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the cloud analytics market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Offering, Data Type, Data Processing, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), SAS Institute (US), Oracle (US), Google (US), Microsoft (US), Teradata (US), Salesforce (US), AWS (US), NetApp (US), Qilk (US), Sisense (US), SAP (Germany), Atos (France), Altair (US), Microstrategy (US), Tibco Software (US), Hexaware Technologies (India), Zoho (India), Rackspace Technology (US), Splunk (US), Cloudera (US), Domo (US), Hewlett Packard Enterprise (US), Incorta (US), Tellius (US), Rapyder (US), Hitachi Vantara (US), Board International (Switzerland), Ridge (Israel), Jaspersoft (US), Yellowfin (Australia), Deonodo (US), GoodData (US), Thoughtspot (US), and Infogain (US) |

This research report categorizes the cloud analytics market based on Offering, Data Type, Data Processing, Vertical, and Region.

Offering:

-

Solution

-

By type

-

Cloud BI Tools

- Data Warehouses

- Data Discovery & Exploration

- Data Visualization

- Complex Event Processing

- Data Integration Tools

- Reporting and OLAP Tools

- Enterprise Information Management

- Enterprise Performance Mangement

- Governance, Risk, and Compliance

-

Advanced Analytics

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

-

Cloud BI Tools

-

By Integration level

- Embedded

- Standalone

-

By Deployment Mode

- Public

- Private

- Hybrid

-

By type

-

Services

-

Professional Services

- Consulting Services

- Deployment & Integration

- System & Maintenance

-

Professional Services

- Managed Services

By Data Type:

- Structured

- Unstructured

By Data Processing:

- Real-Time Analytics

- Batch Analytics

By Verticals:

- BFSI

- Retail & Consumer goods

- Healthcare & Life sciences

- Telecommunications

- Education

- Automotive

- Manufacturing

- Transporatation & Logistics

- Government & Defense

- Other verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- ANZ

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- Qatar

- Egypt

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In January 2024, Salesforce unveiled fresh Commerce Cloud tools leveraging generative AI and data-driven insights, enhancing every customer interaction for heightened loyalty and revenue growth.

- In February 2024, IBM and Wipro strengthened their collaboration to offer clients expanded AI services and support. This collaboration aims to utilize AI technologies to tackle various business challenges and foster innovation across industries.

- In June 2023, Salesforce and Google formed a partnership. The partnership between Salesforce and Google focuses on integrating Google's AI capabilities into Salesforce's products, enhancing their analytics offerings.

- In May 2023, Microsoft launched Microsoft Fabric Data Analytics which is a cutting-edge platform tailored for the AI era, facilitating seamless integration of analytics and AI capabilities into data processing workflows. It streamlines data ingestion, preparation, and analysis, enabling organizations to derive actionable insights efficiently.

- In August 2022, Teradata introduced VantageCloud Lake, a cloud-native service designed to simplify data lakes for businesses, enabling seamless management and analytics of vast data sets.

Frequently Asked Questions (FAQ):

What is Cloud analytics?

Cloud analytics refers to the process of analyzing data stored in cloud platforms or utilizing cloud-based tools and resources to perform data analysis. It enables organizations to gain insights, make data-driven decisions, and derive value from large datasets without needing to invest in on-premises infrastructure.

Which region is expected to hold the highest share in the cloud analytics market?

North America leads the cloud analytics market with its strong economy, advanced technological infrastructure, and supportive regulatory framework, which stimulate innovation and expansion in cloud analytics.

Which key verticals adopt cloud analytics solutions, and services?

Key verticals adopting cloud analytics software and services include BFSI, retail & consumer goods, healthcare & life sciences, telecommunications, automotive, education, transportation & logistics, manufacturing, government & defense, and other verticals.

Which are the key drivers supporting the market growth for cloud analytics market?

The key drivers supporting the market growth for cloud analytics include the exponential rise of unstructured data, and the rise in digitalization trends.

Who are the key vendors in the market of cloud analytics market?

The key vendors in the global cloud analytics market include IBM (US), SAS Institute (US), Oracle (US), Google (US), Microsoft (US), Teradata (US), Salesforce (US), AWS (US), NetApp (US), Qilk (US), Sisense (US), SAP (Germany), Atos (France), Altair (US), Microstrategy (US), Tibco Software (US), Hexaware Technologies (India), Zoho (India), Rackspace Technology (US), Splunk (US), Cloudera (US), Domo (US), Hewlett Packard Enterprise (US), Incorta (US), Tellius (US), Rapyder (US), Hitachi Vantara (US), Board International (Switzerland), Ridge (Israel), Jaspersoft (US), Yellowfin (Australia), Deonodo (US), GoodData (US), Thoughtspot (US), and Infogain (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

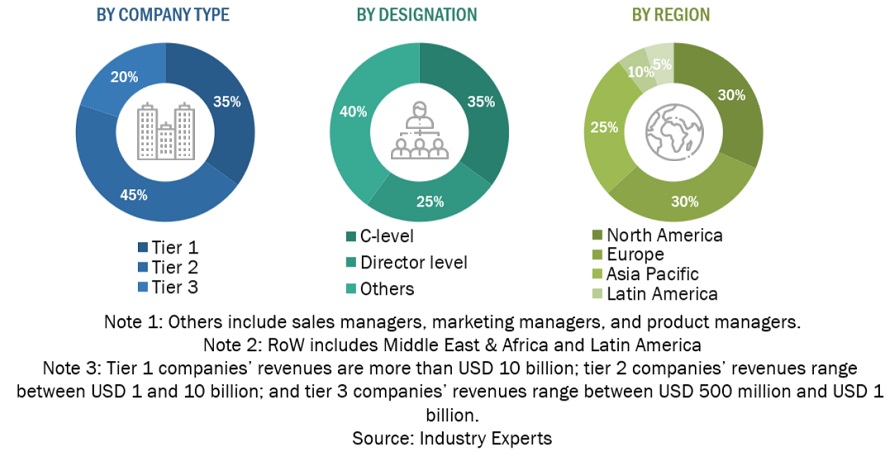

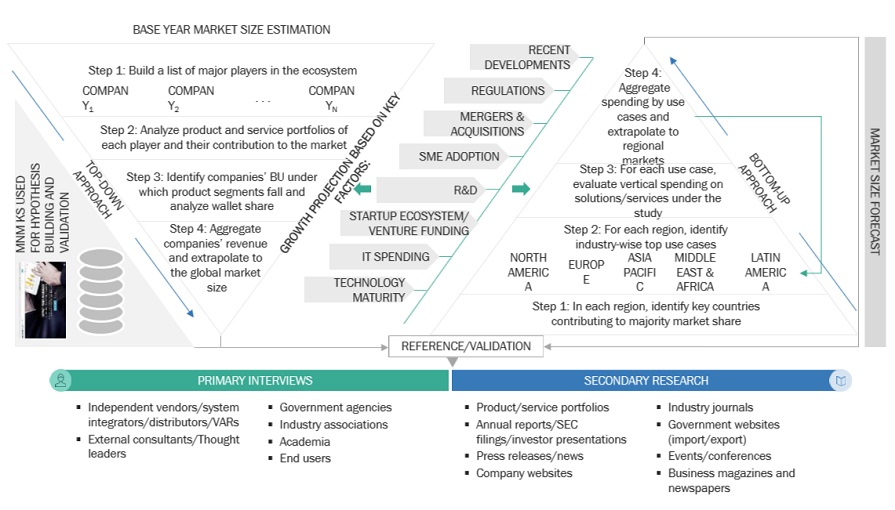

The research study for the cloud analytics market involved extensive secondary sources, directories, and several journals. Primary sources were mainly industry experts from the core and related industries, preferred cloud analytics solutions providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of companies offering cloud analytics solutions and services was determined based on secondary data from paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites. Additionally, cloud analytics spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to offering, data type, data processing, vertical, and region, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and cloud analytics expertise; related key executives from cloud analytics solutions vendors, System Integrators (SIs), professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using cloud analytics, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of cloud analytics solutions and services which would impact the overall cloud analytics market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the cloud analytics market. The first approach involves estimating the market size by summating companies’ revenue generated through the sale of solutions and services.

Market Size Estimation Methodology-Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the cloud analytics market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of offering, data type, data processing, vertical, and region. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of cloud analytics offerings among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of cloud analytics solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in the different areas for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the cloud analytics market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major cloud analytics solutions providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall cloud analytics market size and segments’ size were determined and confirmed using the study.

Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

According to ThoughtSpot, Cloud analytics involves the process of scrutinizing data within a cloud-based data platform to unveil actionable business insights. This analytical approach empowers users to delve into extensive datasets stored in the cloud, revealing pertinent trends and patterns, forecasting outcomes, enhancing decision-making processes, and ultimately catalyzing business advancement.

Cloud analytics transfers data analysis tasks to a public or private cloud, it enables the processing of vast and complex datasets using algorithms and cloud tech, delivering actionable business insights. This involves applying analytic algorithms in the cloud to data stored there. Cloud analytics combines scalable computing with analytic software to uncover patterns and insights. Cloud analytics platforms are attractive to businesses due to their swift and cost-efficient deployment sans internal expertise. Additionally, it offer scalability, aligning seamlessly with evolving business needs, making them an attractive option for organizations seeking agile and adaptable solutions.

Stakeholders

- Cloud Analytics Market Solutions Providers

- Cloud Analytics Market Service Providers

- End-user Industries

- System Integrators (SIs)

- Managed Service Providers (MSPs)

- Business Intelligence Solution Providers

- Technology Providers

- Value-added Resellers (VARs)

- Government And Regulatory Bodies

Report Objectives

- To define, describe, and predict the cloud analytics market by offering, data type, data processing, vertical, and region

- To describe and forecast the cloud analytics market, in terms of value, by region—North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall cloud analytics market

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as joint ventures, mergers and acquisitions, product developments, and ongoing research and development (R&D) in the cloud analytics market

- To provide the illustrative segmentation, analysis, and projection of the main regional markets

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American Cloud Analytics Market

- Further breakup of the European Cloud Analytics Market

- Further breakup of the Asia Pacific Cloud Analytics Market

- Further breakup of the Middle East & Africa Cloud Analytics Market

- Further breakup of the Latin America Cloud Analytics Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Cloud Analytics Market

Require qualitative and quantitative insights into cloud analytics, cloud based CRM, and social CRM

Understanding of the cloud analytics market.