Cloud ITSM Market by Offering (Solutions (Change & Configuration Management, Operations & Performance Management), and Services), Deployment Mode (Public, Private, Hybrid Cloud), Organization Size, Vertical and Region - Global Forecast to 2029

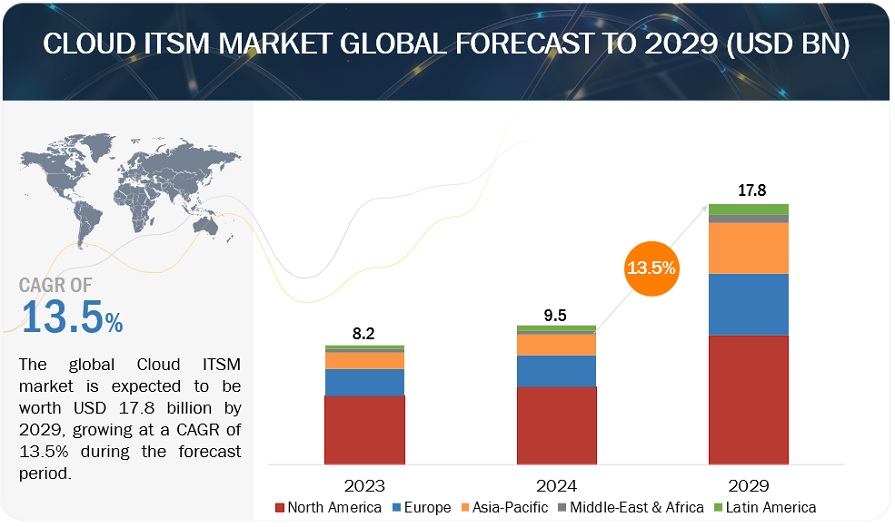

[326 Pages Report] The Cloud ITSM market size is expected to grow from USD 9.5 billion in 2024 to USD 17.8 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 13.5% during the forecast period. The impact of the recession on the market is covered throughout the report. Cloud ITSM streamlines business operations across industries by offering scalable and cost-effective solutions for managing IT services. It enhances efficiency and customer service, allowing businesses to stay competitive and agile in a rapidly evolving digital landscape.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Global Cloud ITSM Market

The global economy significantly influences all markets, including the Cloud ITSM market. This research study considers macroeconomic factors such as economic collapses, recessions, and the impact of COVID-19 when forecasting market size. Global institutions like the International Monetary Fund, World Bank, OECD, and central banks are lowering growth estimates due to high inflation and slowing economic activity. Unemployment rates have remained relatively stable recently, with 3.5% in the US, 6.6% in the eurozone (a record low), 6.4% in India, and 8.7% in Brazil. According to a comprehensive new study by the World Bank, the world may be on the brink of a global recession in 2023, potentially causing lasting harm to emerging markets and developing economies. Organizations typically tighten their budgets during recessions, reducing spending on IT initiatives, including cloud ITSM solutions. ITSM vendors may find it challenging to sell higher-cost solutions, leading organizations to prioritize cost-effective ITSM options. Cost optimization becomes critical as organizations seek to maximize IT operational efficiency during economic downturns. Cloud ITSM solutions that offer automation, efficiency improvements, and cost savings will likely become more attractive. Organizations aim for operational efficiency to navigate financial challenges. Cloud ITSM solutions that enhance workflow automation, incident resolution, and resource utilization may see increased demand. During a recession, organizations prioritize essential business functions, sustaining demand for cloud ITSM solutions that support critical IT services such as incident resolution, service request management, and security. Cloud-based ITSM solutions may experience increased adoption as organizations seek flexibility and cost-effectiveness. Subscription-based models and reduced infrastructure requirements make cloud solutions more appealing than traditional on-premises.

Cloud ITSM Market Dynamics

Driver: Cloud ITSM provides users access to IT services from anywhere, providing greater flexibility for the remote workforce

The accessibility and flexibility offered by Cloud ITSM solutions are significant driving factors for its adoption in the market. By leveraging cloud-based ITSM platforms, users can access IT services from any location with an internet connection, facilitating remote work and accommodating mobile employees effectively. This accessibility eliminates the constraints of physical office spaces, allowing organizations to embrace flexible work arrangements and support distributed teams seamlessly. Moreover, cloud-based ITSM solutions enable users to access critical IT resources and tools on various devices, including laptops, smartphones, and tablets, enhancing productivity and collaboration across the workforce. The ability to provide IT services remotely and cater to the evolving needs of a modern, mobile workforce positions Cloud ITSM as a critical enabler of flexibility, agility, and productivity in today's digital workplace landscape, thereby driving its adoption and growth in the market.

Restraints: Concerns on adoption of Cloud ITSM solutions owing to data security and privacy breaches

Security concerns pose a significant limiting factor for the Cloud ITSM market. Many organizations hesitate to adopt cloud ITSM solutions due to fears of data security and privacy breaches. The potential risks of storing sensitive information off-premises and relying on third-party providers for security measures can deter adoption. Additionally, concerns about compliance with regulatory requirements and industry standards further contribute to organizations' reluctance to migrate ITSM operations to the cloud. Addressing these security concerns through robust encryption, access controls, and compliance certifications is crucial for cloud ITSM vendors to gain the trust of organizations and drive broader adoption in the market.

Opportunities: Leveraging AI and automation technologies within Cloud ITSM opens avenues for innovation and growth

Integrating artificial intelligence (AI) and automation technologies into Cloud ITSM offers a significant opportunity for growth, innovation, and market expansion. Organizations can streamline IT processes, improve operational efficiency, and enhance user experiences by leveraging AI-driven insights and automation capabilities. AI-powered features such as predictive analytics can anticipate IT issues before they occur, enabling proactive problem resolution and minimizing downtime. Automation of routine tasks further accelerates workflows, allowing IT teams to focus on strategic initiatives. Additionally, AI-driven chatbots can provide instant support to users, enhancing overall service delivery. As businesses increasingly recognize the value of AI and automation in ITSM, there is immense potential for Cloud ITSM providers to differentiate their offerings, drive innovation, and capture market share. By embracing these technologies, providers can position themselves for sustained growth and competitiveness in the evolving ITSM landscape

Challenges: Challenges due to downtime and service interruptions

Cloud ITSM services are susceptible to downtime and service interruptions due to various factors such as network outages, server failures, or cyberattacks. These disruptions can impact business operations, productivity, and customer satisfaction, leading to financial losses and reputational damage for service providers and clients. Cloud ITSM services rely on cloud infrastructure and networks to deliver IT services and support to organizations. However, these services are vulnerable to downtime and interruptions caused by network outages, server failures, and cyberattacks. Network Outages are disruptions in network connectivity that occur due to issues with internet service providers, hardware failures, or configuration errors. When network connectivity is lost, users may be unable to access cloud ITSM platforms, leading to service disruptions. Cloud ITSM services depend on servers hosted in data centers to store and process data. Server failures, whether due to hardware malfunctions or software errors, can result in downtime and impact the availability of IT services. Cloud ITSM platforms are prime targets for cyberattacks, including Distributed Denial of Service (DDoS) attacks, ransomware, and data breaches. These attacks can compromise data confidentiality, integrity, and availability, disrupting IT services and causing financial and reputational harm to service providers and their clients.

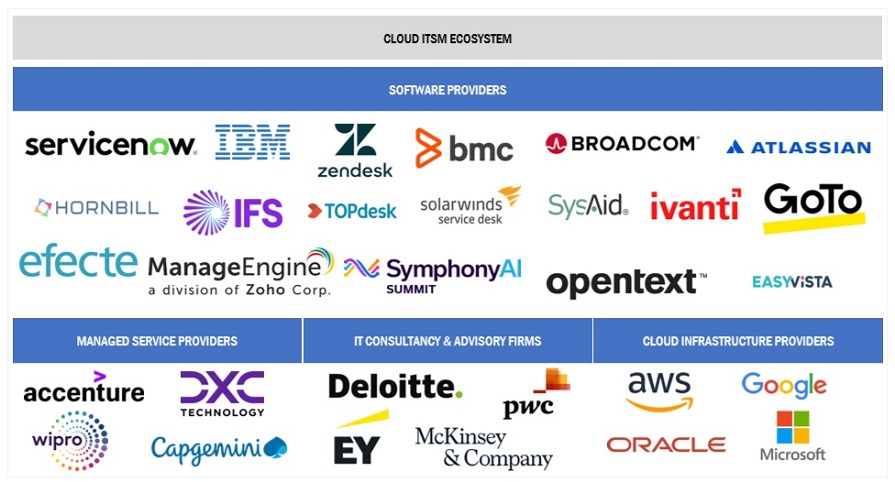

Cloud ITSM Market Ecosystem

Based on Solutions, Operations & Performance Management will hold the largest market share in the Cloud ITSM market during the forecast period.

Operations and Performance Management solutions leverage the scalability and flexibility of cloud technology to provide comprehensive oversight and control over IT operations. By integrating advanced monitoring tools, real-time analytics, and automated workflows, cloud-based ITSM platforms enable proactive management of IT services. This allows for the early detection and resolution of issues, minimizing downtime and improving overall service performance. Performance management features, such as continuous performance monitoring, benchmarking, and reporting, ensure that IT services consistently meet or exceed predefined standards. Moreover, these solutions' AI and machine learning capabilities help in predictive analysis and resource optimization, further enhancing operational resilience and efficiency. Consequently, Cloud ITSM Operations and Performance Management solutions empower organizations to deliver reliable, high-quality IT services that align with business objectives and improve user satisfaction.

Based on Organization Size, the SME segment will record a higher CAGR in the Cloud ITSM market during the forecast period.

Over the forecast period, small and medium-sized enterprises (SMEs) will see the highest growth in the cloud IT Service Management (ITSM) market. This rapid expansion is fueled by SMEs appreciating the many advantages of cloud ITSM solutions, like cost savings, scalability, and enhanced service management. These tools allow SMEs to streamline their operations, boost customer service, and stay competitive without significant investments in traditional IT infrastructure. As SMEs increasingly embrace digital transformation, their adoption of cloud ITSM is expected to grow swiftly, making them important contributors to the market's growth.

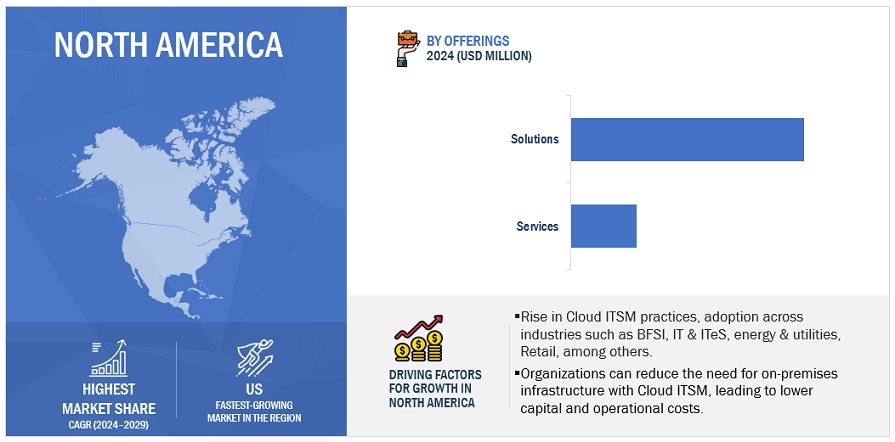

North America is estimated to hold the largest Cloud ITSM market share during the forecasted period.

Throughout the forecasted period, North America is expected to maintain its leadership in the cloud IT Service Management (ITSM) market, securing the largest market share. This dominance stems from various factors, including the widespread adoption of cloud technologies, the presence of top-tier IT service management vendors, and a robust technological infrastructure. Furthermore, North American enterprises prioritize innovation and efficiency, fueling the demand for sophisticated ITSM solutions. Their proactive approach to digital transformation and emphasis on operational agility further bolster their standing in the cloud ITSM market. With a solid commitment to harnessing state-of-the-art technologies to streamline business processes, North America is positioned to spearhead the evolution of cloud ITSM adoption and implementation.

Key market players

The Cloud ITSM market is dominated by startups as well as established companies such as ServiceNow (US), BMC Software (US), Broadcom (US), ManageEngine (US), and Ivanti (US), among others. These vendors have a large customer base, a strong geographic footprint, and organized distribution channels. They incorporate organic and inorganic growth strategies, including product launches, deals, and business expansions, boosting revenue generation.

The study includes an in-depth competitive analysis of these critical Cloud ITSM market players with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Deployment Mode, Organization Size, and Vertical |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

ServiceNow (US), BMC Software (US), Broadcom (US), ManageEngine (US), Ivanti (US), Zendesk (US), Freshworks (US), SolarWinds (US), Atlassian (Australia), OpenText (US), Microsoft (US), IBM (US), GOTO (US), IFS (Sweden), SymphonyAI Summit (US), Efecte (Finland), EasyVista (US), ITarian (US), SysAid Technologies (Israel), InvGate (Argentina), Alemba (UK), Hornbill (UK), NinjaOne (US), HaloITSM (US), Aisera (US), 4ME (US), TOPdesk (Netherlands), TeamDynamix (US) |

This research report categorizes the Cloud ITSM market to forecast revenue and analyze trends in each of the following submarkets:

Based on Offering:

-

Solutions

- Service Portfolio Management

- Configuration & Change Management

- Service Desk Software

- Operations & Performance Management

- Dashboard, Reporting & Analytics

-

Services

- Professional services

- Managed services

Based on Deployment Mode:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on Organization Size:

- SMEs

- Large Enterprises

Based on Verticals:

- BFSI

- Telecommunications

- IT & ITeS

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Healthcare & Life Sciences

- Education

- Other Verticals

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

-

Gulf Cooperation Council (GCC)

- UAE

- Saudi Arabia

- Rest of GCC

- South Africa

- Rest of the Middle East & Africa

-

Gulf Cooperation Council (GCC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2024, At the Relate global conference, Zendesk unveiled a collaboration with Amazon Web Services (AWS) and Anthropic to enhance AI capabilities. By leveraging Amazon Bedrock and Anthropic's Claude 3 model family, Zendesk aims to provide faster, more accurate AI features. This partnership enables businesses to deliver personalized customer experiences, empower agents with AI tools, and improve customer satisfaction through intelligent, empathetic support.

- In February 2024, ServiceNow and NVIDIA expanded their partnership to introduce telco-specific generative AI solutions, enhancing service experiences. Built on the Now Platform, Now Assist for Telecommunications Service Management leverages NVIDIA AI to boost productivity, speed up resolution times, and improve customer service. This collaboration aims to help telcos reduce costs, uncover new business opportunities, and drive industry-wide transformation.

- In February 2024, Amdocs and BMC announced a strategic alliance to enhance digital operations in telecommunications and financial services. This partnership leverages Amdocs' IT and network expertise with BMC's automation solutions to drive growth and efficiency. Together, they will offer integrated services, including generative AI, to accelerate innovation and operational excellence for global customers.

- In November 2023, ServiceNow introduced enhancements in its Now Assist generative AI portfolio with new capabilities to improve experiences and increase efficiency. With this, Now Assist in Virtual Agent, flow generation, and Now Assist for Field Service Management (FSM) will be the newest sophisticated Generative AI technologies to be embedded into the ServiceNow Platform.

- In November 2023, BMC software introduced generative AI capabilities in the Helix Service Management solution, enhancing security measures and providing AI-driven insights. Recognized as a leader in enterprise service management and AIOps, BMC Helix offers resolution insights, unified workflows for security and operations teams, industry-specific templates, and broader low code/no code platform capabilities. These innovations underscore BMC's commitment to driving meaningful innovation and helping organizations achieve autonomy in the digital landscape.

Frequently Asked Questions (FAQ):

What is the projected market value of the Cloud ITSM market?

The global Cloud ITSM market is expected to grow from USD 9.5 billion in 2024 to USD 17.8 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 13.5% during the forecast period.

Which region has the highest CAGR in the Cloud ITSM Market?

The Asia Pacific region has the highest Cloud ITSM Market CAGR.

Which Offering holds the more significant market share during the forecast period?

The Solution segment is forecasted to hold the largest market share in the Cloud ITSM Market.

Which are the major vendors in the Cloud ITSM Market?

ServiceNow, BMC Software, Broadcom, and ManageEngine are prominent in the Cloud ITSM market.

What are some of the drivers in the Cloud ITSM Market?

Increased demand for scalable and cost-effective IT service management solutions, coupled with the growing adoption of cloud technologies across industries, drives the growth of the cloud ITSM market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

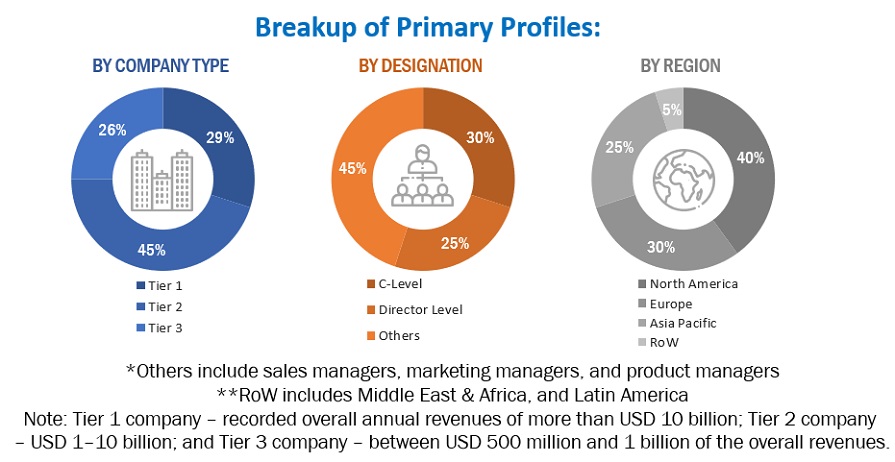

This research study involved extensive secondary sources, directories, and databases, such as Bloomberg BusinessWeek, EconoTimes, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the Cloud ITSM market. The global Cloud ITSM market size is obtained by evaluating its penetration among the major vendors and their components in this market. A few startups and private companies were interviewed to gain better visibility and in-depth knowledge of the market across regions. In addition, a few government associations, public sources, conferences, webinars, journals, magazines, articles, and MarketsandMarkets internal repositories were referred to arrive at the actual market size.

The primary sources were mainly the industry experts from the core and related industries and preferred system developers, service providers, system integrators, resellers, partners, standards, and certification organizations from companies and organizations related to various segments of the Cloud ITSM industry's value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess the prospects.

Secondary Research

The market size of the company component Cloud ITSM and services was determined based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on Cloud ITSM was extracted from the respective sources. Secondary research was mainly used to obtain the critical information related to the industry's value chain and supply chain to identify the key players based on solutions, services, market classification, and segmentation according to components of the major players, industry trends related to components, users, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Cloud ITSM vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various trends related to technology, components, end users, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use, which would affect the overall Cloud ITSM market.

To know about the assumptions considered for the study, download the pdf brochure

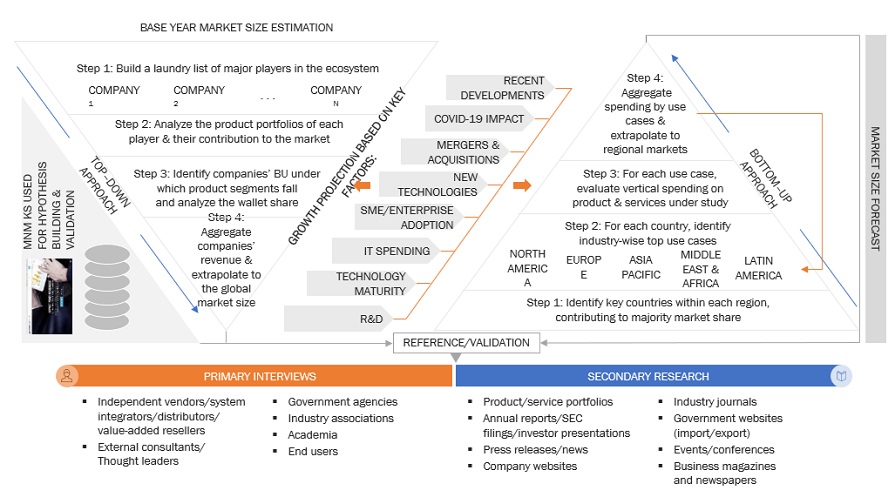

Market Size Estimation

This report section highlights different methods to determine the Cloud ITSM market size. The research method involved the use of top-down and bottom-up approaches.

The top-down and bottom-up approaches were used to estimate and validate the size of the Cloud ITSM market and the size of various dependent subsegments. The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

- All possible parameters affecting the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed input and analysis from MarketsandMarkets.

Top-down approach

The top-down approach prepared an exhaustive list of all vendors' offerings in the Cloud ITSM market. The revenue contribution for all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its components. The aggregate of all companies' revenues was extrapolated to reach the overall market size. Each subsegment was further studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included obtaining critical insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. The Cloud ITSM market was derived from adopting Cloud ITSM solutions by different verticals. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Bottom-up approach

The bottom-up approach identified the adoption trend of Cloud ITSM in major countries and regions, contributing to most of the market share. The adoption trend of Cloud ITSM and different use cases concerning their business segments were identified and extrapolated for cross-validation. Weightage was given to the use cases identified in other areas for the calculation. An exhaustive list of all vendors' component solutions and services in the Cloud ITSM market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with Cloud ITSM components were considered to evaluate the market size. Each vendor was evaluated based on its components across user types. The aggregate of all companies' revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration.

Based on these numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the Cloud ITSM market's regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of foremost Cloud ITSM solutions and service providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, this study determined and confirmed the exact values of the overall Cloud ITSM market size and its segments' market size.

Cloud ITSM market: Top-down and Bottom-Up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was divided into several segments and subsegments using the previously described market size estimation procedures once the overall market size was determined. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines Cloud ITSM as "the provision and utilization of cloud-based software solutions, platforms, and services designed to manage and optimize the delivery of IT services within organizations. Cloud ITSM solutions typically include service portfolio management, configuration & change management, service desk software, operations & performance management, dashboard, reporting, and analytics, and other Information Technology Infrastructure Library (ITIL) processes delivered via cloud computing infrastructure. This market addresses the growing demand for scalable, flexible, and cost-effective ITSM solutions that leverage the benefits of cloud technology, such as on-demand access, elasticity, scalability, and reduced upfront investment in hardware and software infrastructure."

Key Stakeholders

- Cloud ITSM solution providers

- IT Professionals and Administrators

- Cloud Service Providers (CSPs)

- Consulting Service Providers

- Original Equipment Manufacturers (OEM)

- Regulatory Bodies and Compliance Organizations

- System Integrators (SIs)

- Value-added Resellers (VARs)

- Industry Analysts and Research Firms

- End-Users and Customers

Report Objectives

- To define, describe, and forecast the global cloud ITSM market based on offering, deployment mode, organization size, vertical, and region.

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets for growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the cloud ITSM market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product developments, and partnerships & collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the European market into countries contributing 42.5% to the regional market size

- Further breakup of the Asia Pacific market into countries contributing 20.9% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 33.2% to the regional market size

- Further breakup of the Latin American market into countries contributing 33.6% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Cloud ITSM Market