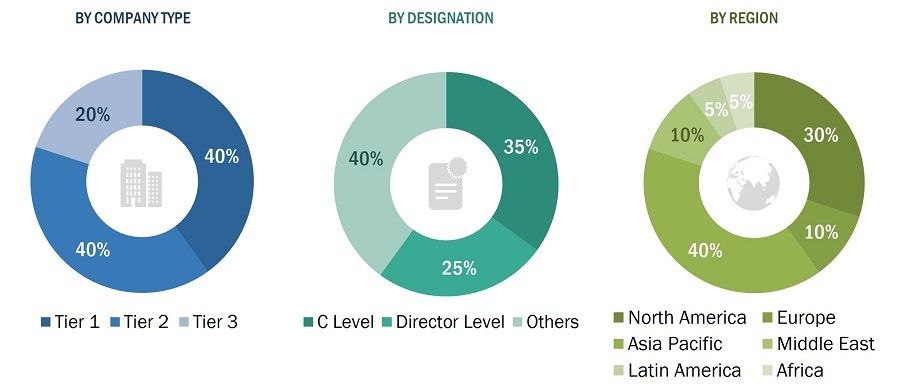

This research study involved the extensive use of secondary sources including directories, databases of articles, journals on aircraft seating, in-flight entertainment & connectivity systems, cabin lighting, galley equipment, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the aircraft cabin interiors market. Primary sources included several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the aircraft cabin interiors industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess the prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the aircraft cabin interiors market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturers' associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the aircraft cabin interiors industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

Extensive Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the aircraft cabin interiors market. Several primary interviews were conducted with market experts from both the demand and supply sides across major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. Primary sources from the supply side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the aircraft cabin interiors market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Key players in the market were identified through secondary research with their market shares in their respective regions determined through primary research. This entire procedure included the study of annual and financial reports of the top market players and in-depth interviews of industry leaders such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives for key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data was consolidated, added with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

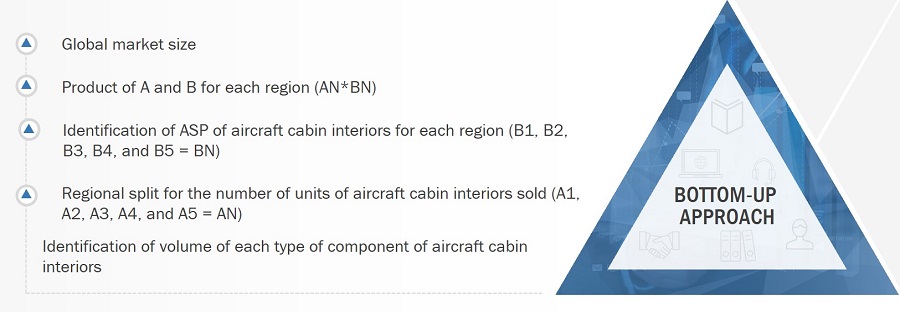

Bottom-Up Approach

The The bottom-up approach was employed to determine the overall size of the aircraft cabin interiors market. Calculations for the OEM market relied on global new aircraft manufacturing and deliveries and, based on that, the number of cabin interior components required for each aircraft, while the aftermarket and MRO services market estimations were based on regional fleet sizes for each country, for which demand for new aircraft cabin interiors and repair services was calculated. The summation of the above markets for all regions has led to the overall size of the aircraft cabin interiors market.

The bottom-up approach was also implemented to extract secondary research data to validate different market segments' revenues. With the data triangulation procedure and data validation through primaries, the overall sizes of the aircraft cabin interiors market from the revenues of key players and their shares in the market and each market segment were determined and confirmed in this study.

Aircraft Cabin Interiors Market: Bottom-Up Approach

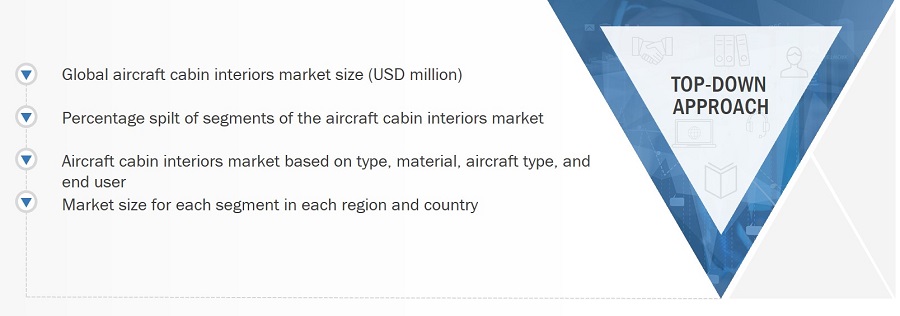

Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in market segmentation) through percentage splits based on secondary and primary research.

For calculating the sizes of specific market segments, the most appropriate and immediate parent market size was used to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

Market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the sizes of the parent market and each individual market were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Aircraft Cabin Interiors Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, market breakdown & data triangulation procedures explained below were implemented, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

The Aircraft cabin interiors refer to the components and design elements that make up the interior of an aircraft, which includes, Seats (economy, business, first class), Galleys and lavatories, Lighting systems, In-flight entertainment and connectivity (IFEC) systems, Overhead bins and storage compartments, Sidewall and ceiling panels, Carpets and soft furnishings, Bulkheads and partitions. The designing of aircraft cabin interiors is a complex process that involves balancing passenger comfort, safety regulations, weight and space constraints, and aesthetics. Cabin interiors are designed to provide a comfortable and enjoyable experience for passengers while meeting strict safety standards set by aviation authorities like the FAA and EASA.

Key Stakeholders

Various stakeholders of the market are listed below:

-

Airlines

-

Cabin Interior Providers

-

Aircraft Manufacturers

-

Regulatory Bodies

-

Technology Providers

-

Content Providers

-

Investors

-

Passengers

Report Objectives

-

To define, describe, segment, and forecast the size of the aircraft cabin interiors market based on platform, end user, type, material, and region

-

To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

-

To understand the structure of the aircraft cabin interiors market by identifying its various segments and subsegments

-

To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the market.

-

To provide an overview of the tariff and regulatory landscape for the adoption of aircraft cabin interiors across regions

-

To forecast the size of market segments across North America, Europe, Asia Pacific, Middle East, Latin America and Africa along with major countries in each region

-

To analyze the demand- and supply-side indicators of the aircraft cabin interiors market and provide a factor analysis for the same

-

To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

-

To analyze opportunities in the market for stakeholders by identifying key market trends

-

To profile key market players and comprehensively analyze their market share and core competencies2

-

To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers and acquisitions, partnerships, agreements, and product developments in the aircraft cabin interiors market.

-

To identify detailed financial positions, key products, and unique selling points of leading companies in the market

1. Micromarkets are further segments and subsegments of the aircraft cabin interiors market.

2. Core competencies of companies were captured in terms of their key developments and strategies adopted to sustain their position in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

-

Further breakdown of the market segments at the country level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Anant

Feb, 2019

I am interested in market research in aircraft interiors, in particular, various cabin systems-e.g. lighting, seats, galleys, overhead bins, and lavatories, among others..

Meinda

Apr, 2019

We need secondary data on the Cabin Market. We need to analyze the in-depth marketing intelligence of the Aircraft Cabin Market in the world..