Fatty Amines Market

Fatty Amines Market by Type (Primary, Secondary, Tertiary), End Use (Agrochemicals, Oilfield Chemicals, Chemical Processing, Water Treatment, Asphalt Additives, Personal Care), Function, Carbon Chain Length, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global fatty amines market is projected to grow from USD 3.60 billion in 2025 to USD 4.97 billion by 2030, at a CAGR of 6.7% during the forecast period. The global fatty amines market is growing steadily, driven by increasing demand across various industries. Derived from natural fats and oils, fatty amines are valued for their low toxicity and excellent surface activity. They are widely used as emulsifiers and adjuvants in agriculture, as well as flocculants and corrosion inhibitors in water treatment. Their role in personal and home care products as conditioning and emulsifying agents continues to expand with the shift toward natural formulations. Additionally, the oil and gas sector relies on them for demulsification and corrosion control.

KEY TAKEAWAYS

-

BY TYPEThe Types include Primary, Secondary, and Tertiary

-

BY FUNCTIONThe Functions include Emulsifiers, Flotation Agents, Anti-Caking Agents, Dispersants, Corrosion Inhibitors, Chemical Intermediates, and Others

-

BY END-USE INDUSTRYThe End-use includes Agrochemicals, Oilfield Chemicals, Chemical Processing, Water Treatment, Asphalt Additives, Personal Care, and Others

-

BY CARBON CHAIN LENGTHThe Carbon chain Length includes C8-C10, C12-C14, C16-C18, and C20+

-

BY REGIONThe Fatty Amines Market covers Europe, North America, Asia Pacific, South America, and Middle East & Africa.

-

COMPETITIVE LANDSCAPEArkema (France), Evonik Industries AG (Germany), Kao Corporation (Japan), Procter & Gamble (US), BASF (Germany), and Nouryon (Netherlands) are the key players with distribution networks spread across Asia Pacific, North America, Middle East & Africa, South America, and Europe. These companies are vital in their domestic regions and explore geographic diversification alternatives to grow their businesses. They focus on increasing their market share through expansions and enhancing their product portfolios.

The global fatty amines market is expanding, driven by their wide-ranging applications across key industries. In agrochemicals, they are vital for formulating herbicides and pesticides that enhance crop yields and meet rising food demand. The water treatment industry depends on fatty amines as corrosion inhibitors and flocculants to ensure clean and safe water amid growing scarcity and stricter regulations. In personal care, the shift toward sulfate-free and bio-based products has boosted their use in shampoos, conditioners, and skincare formulations. The oilfield sector benefits from their corrosion protection and emulsion-stabilizing properties, while industries such as asphalt additives and chemical processing use them as effective surfactants and performance enhancers.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The fatty amines market is experiencing rapid growth, propelled by rising demand for personal care products, agrochemicals, water treatment, and specialty industrial applications. The fatty amines are used as emulsifiers, flotation agents, corrosion inhibitors, and other functions. The market is further reinforced by investments in research and development to optimize production, support compliance, and deliver high-performance chemical additives aligned with global sustainability trends.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for fatty amines in various end-use industries

Level

-

Fluctuations in raw material prices

Level

-

Surging demand for bio-based coating additives

Level

-

Environmental concerns regarding ammonia as by-product

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand of fatty amines in various end-use industries

The fatty amines market globally is expanding rapidly to pace across important end-uses of agrochemicals, water treatment, personal care, and oilfield chemicals driven by demand. In agriculture, fatty amines are becoming important as sustainable adjuvants and emulsifiers in alignment with a global shift to sustainable crop protection and growing eco-friendly chemicals. A policy push for sustainable farming in Europe and the introduction of bio-based agricultural products is driving innovation in the formulation of agrochemicals. Strong public sector funding of agricultural research and development and a focus on environmental sustainability to build resilience further align fatty amines with the principles of green chemistry. Regarding water treatment, the market is benefitting from new standards of quality, and national clean water initiatives are driving the use of biodegradable agents to treat wastewater. Regulatory trends in North America and Asia are intended to integrate "low toxicity" and environmentally compatible compounds. In personal care, the consumer preference for natural/non-toxic ingredients is changing the formulation, and regulatory frameworks increasingly favor plant-derived/safe-to-use chemicals. Fatty amines are emerging as key enablers of sustainable product innovation across all three sectors. A converging theme of the policy of sustainability and market submission of sustainability as an efficient solution to consumer chemicals continues to provide strength to the market.

Restraints: Fluctuation in raw material prices

The volatile situation that is plaguing the fatty amines market today has to do with prices of raw materials being highly unpredictable. Most fatty amines come from natural sources such as palm oil, tallow, and coconut oil sources that are affected by weather patterns, political developments, and policy changes in the exporting countries. This triggered some immediate ripple effects on the global market, which stressed supply chains and increased costs for manufacturers allied to palm-based ingredients. High price fluctuations heavily pressurize production costs and profit margins. Particularly smaller manufacturers feel this strain more acutely as they usually do not have access to multiple suppliers or long-term contracts that provide cushioning against such shocks. Those without strong supply chain diversification or strategic procurement practices are left highly vulnerable to market volatility. The result is uncertainty in the business environment that comes in the way of future expansion or investment planning uphill task in developing environments. Thus, in summary, unstable feedstock pricing remains an overarching limitation for any consistent growth and long-term competitiveness in the fatty amines market.

Opportunity: Surge in demand for bio-based coatings

Emerging Sustainable and Eco-Friendly Solutions have a lot to offer to the fatty amines market, especially in terms of bio-based coatings. Tightened regulations around emissions and chemical usage the world over have heightened the interest in alternatives, which would give high performance while being conscious of the impact on the environment. Fatty amines, especially in their ethoxylated and alkyl-modified forms, are taking root as promising high-value components in the formulation of modern coatings. They play multiple roles in dispersion improvement and adhesion, but also film strength and durability-enhancing solutions. Their value in waterborne and solvent-free systems is highly relevant as the industry shifts away from traditional solvent-hogging products. In Europe, for instance, recent legislation leads towards a huge cut in VOC emissions by the end of this decade, thus activating curiosity among manufacturers to focus instead on plant-based and biodegradable inputs. Industry experts are already responding. A big chemical firm has instituted a certified process that associates sustainable palm oil in its coating ingredients, thus reducing the carbon footprint. Recently, by a well-known coatings firm, a new wood finish product was made with a noteworthily high percentage of bio-based content.

Challenge: Environmental concerns regarding ammonia as a by-product

One of the challenges the fatty amines market faces is the environmental concerns posed by the ammonia byproducts. Ammonia is an important intermediary in the production process and often comes out as a waste. If adequately disposed of, ammonia can become a great pollutant. It can adversely affect health when it floats in the air, causing respiratory disorders. For instance, in Zhejiang province, authorities have started imposing stricter emission standards on plants which pressure several plants to upgrade their systems or close temporarily due to non-compliance. It leads to pollution in the air and can cause harmful algal blooms and very unhealthy aquatic ecosystems when it gets into water bodies. It also poses hazard risks to soil health. Spill/leak would have long-term effects on biodiversity and fertility. Most of the regulatory agencies worldwide, for example, to mention a few, the U.S. Environmental Protection and the European Union have imposed stricter rules that entailed companies controlling and monitoring their emissions. This has become the hallmark of innovation whereby manufacturers introduce advanced methods such as closed-loop systems, high-efficiency scrubbers, etc., to reduce environmental impacts as well as keep pace with ever-changing compliance standards.

Fatty Amines Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops bio-based ethoxylated fatty amines used as emulsifiers, dispersing agents, and corrosion inhibitors across industrial and consumer applications. | Enhances product stability, sustainability, and performance while offering customized solutions through advanced R&D and localized production. |

|

Develops primary, secondary, and tertiary fatty amines under the brands ACETAMIN, DIAMIN, and FARMIN, serving industries such as asphalt, pigments, fertilizers, and emulsifiers. | Enhances surface performance, provides corrosion resistance, and improves formulation stability in diverse industrial and household applications. |

|

Provides tertiary fatty amine products. These amines are primarily used as intermediates in producing cationic surfactants and as quaternaries for biocides. | Used in agriculture, personal care, and household products applications. |

|

Manufactures primary amines like N-Octylamine and Octylamine BMBCert for biocides, lubricants, greases, marine, and wood coating formulations. | Used as a building block for biocides subsequently utilized in marine and wood coating formulations. It is also used as a corrosion inhibitor in lubricants and greases. |

|

Evonik manufactures fatty amines such as ADOGEN 140, ADOGEN 170, and VARONIC T 205, designed for applications like surfactants, flotation agents, emulsifiers, anticorrosive agents, and chemical intermediates. | Evonik’s fatty amines provide superior surface activity, anticaking, dispersion, and anticorrosion performance, supporting high-quality chemical processing and product stability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The fatty amines market ecosystem consists of raw material suppliers, manufacturers, and end users. Prominent companies in this market include well-established and financially stable manufacturers of fatty amines. These companies have been operating in the market for several years and possess diversified product portfolios and strong global sales and marketing networks. Prominent companies in this market include Arkema (France), Evonik Industries AG (Germany), Kao Corporation (Japan), and among others

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fatty Amines Market, By End-use

Water treatment has quickly become the most dynamic segment and fastest-growing end-use area for the global fatty amine market. This has been prompted by the increasing global trend toward sustainable water management and the growing need for remediation of water deterioration due to increasing industrial activities. Fatty amines are the key to modern water treatment technologies as they are functionally very versatile. They are important agents in coagulation, flocculation, corrosion inhibition, and emulsification. They are becoming increasingly important in enhancing the efficiencies of municipal and industrial wastewater treatment systems, especially in water-stressed areas or those focused on a circular water economy. Governments and regulatory bodies worldwide have come up with tighter discharge norms and quality standards for treated water so that facilities will be pushed to spend on treatment chemicals that are high-performance and eco-friendly. Fatty amines are becoming an option in advanced treatments, as they have the unique functionality to target a variety of contaminants. Besides, the growing demand in rural and remote areas for decentralized and modular water treatment has even higher applicative potential. Fatty amines are very likely to be among the key players in the transforming world of water treatment where industries as well as municipalities are concerned with cheap and sustainable methods of achieving compliance standards and protecting natural resources.

Fatty Amines Market, By Type

Tertiary fatty amines represent the fastest-growing segment in the global fatty amines market, propelled by their multifunctionality and rising adoption across a diverse set of high-growth industries. Tertiary fatty amines are essential building blocks in the synthesis of quaternary ammonium compounds, which are most typically found as cationic surfactants in personal care, fabric softeners, disinfectants, and industrial cleaners. Increased focus on hygiene and antiviral efficacy has no doubt driven the demand for quaternary ammonium compounds, and therefore, tertiary fatty amines. Tertiary fatty amines are also rapidly gaining relevance in oil and gas as corrosion inhibitors, emulsifiers, and wetting agents in drilling fluids, especially with resurgent energy exploration and production. In addition, in the coating and chemical processing industries, tertiary fatty amines are highly regarded as catalysts or hardeners in polyurethane foams, and as epoxy resins curing agents. Tertiary fatty amines have enormous potential for utilization in new applications such as electrostatic coatings, agricultural adjuvants, pesticide carriers, and water treatment. As the market for specialty surfactants continues to grow from both developed and developing regions, tertiary fatty amines are certain to be a significant factor in continued growth.

Fatty Amines Market, By Function

Corrosion inhibitors are the fastest-growing market segment functionally in fatty amines owing to the need for protecting critical metal infrastructures in corrosive industrial environments. Fatty amines such as ethoxylates and alkoxylates are turning out to be extremely effective organic corrosion inhibitors because they form slightly protective hydrophobic films on the surfaces of metals, especially under acidic salty conditions. This is very important where carbon steel pipelines and apparatus are regularly exposed to such aggressive agents as hydrochloric acid, in the oil and gas sector. This increases the trend in extending the life of aging infrastructure and increasing investments in industrial maintenance and integrity management, which is driving the demand for high-efficiency and long-lasting corrosion inhibitors. The increasing emphasis on sustainability and reliability in operations by different industries in power generation, marine, water treatment, and chemical processing has further accelerated the market penetration of fatty amine-based corrosion inhibitors into an important and fast-growing application area within the global fatty amines market.

REGION

South Aamerica is to be fastest-growing region in global fatty amines market during forecast period

The fatty amines market in South America is poised to have the highest CAGR growth rate throughout the forecast period. The promise of fatty amines is owing to continued strong industrial development and growing end-use sectors. These aspects lay major impetus based on the strong agriculture base in the region complemented by infrastructural development activities as well as a rising emphasis on environmental management. Brazil, Argentina, Colombia, and The Rest of South America are among the other countries that are contributing to this momentum. Increasing demand and consumption of fatty amines in the agricultural sector will be well helped by strong crop cultivation for the manufacture of agrochemicals. Furthermore, with investments in wastewater treatment facilities and stricter environmental regulations, demand is being intensified for fatty amines, which are used as primary compounds for corrosion control and water purification. Several end-use applications increasingly adopt fatty amines because of the diverse economic activities in the region and modernization efforts in agricultural as well as industrial practices.

Fatty Amines Market: COMPANY EVALUATION MATRIX

In the fatty amines market matrix, Arkema (Star) is a strong global specialty chemicals leader backed by advanced R&D capabilities, sustainable innovation, and a robust integrated supply chain. By leveraging its bio-based and performance materials expertise, Arkema delivers high-value fatty amines for key markets such as agrochemicals, personal care, and water treatment. Huntsman International LLC (Emerging Leader) is gaining visibility with its specialty amines for alkalinity control and corrosion inhibitors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.40 BN |

| Market Forecast in 2030 (value) | USD 4.97 BN |

| Growth Rate | CAGR 6.7% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD MN), Volume (Kiloton) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | Europe, North America, Asia Pacific, South America, and Middle East & Africa. |

WHAT IS IN IT FOR YOU: Fatty Amines Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Personal Care/Cosmetics Manufacturer | Benchmarking of fatty amine-based emulsifiers and conditioners, assessment of alternative non-toxic formulations | Improves product gentleness, enhances conditioning performance, and boosts appeal to health-conscious consumers |

| Agrochemical Producer | Evaluation of amine-based adjuvants for crop protection, customization for compatibility with specific pesticides | Optimizes pesticide efficacy, supports regulatory compliance, and creates differentiated product lines |

| Water Treatment Chemical Supplier | Technology benchmarking of fatty amines for wastewater treatment, supply chain mapping for sustainable sourcing | Enhances treatment effectiveness, strengthens ESG positioning, and ensures continuity of compliant supply |

| Home & Fabric Care Brand | Mapping amine derivatives for softeners and antistatic benefits, lifecycle analysis for biodegradable formulations | Increases fabric/hair softness and antistatic effect, supports sustainability and market differentiation |

| Industrial Lubricant/Grease Producer | Assessment of fatty amine corrosion inhibitors, comparison with synthetic alternatives, supply security analysis | Improves metal surface protection, reduces wear, and supports long-term durability and client trust |

RECENT DEVELOPMENTS

- November 2024 : this expansion is a strategic investment in the double-digit million-euro range, enabling Evonik to broaden its amine portfolio by leveraging cost-effective raw materials. By scaling up production in China, the company enhances its competitiveness, improves market efficiency, and optimizes its global production network. This initiative supports future market growth and aligns with Evonik’s global amine strategy, reinforcing its commitment to product differentiation and innovation.

- September 2022 : Global Amines successfully commenced operations at its new fatty amines production plant in Surabaya, Indonesia. This expansion strengthens the company’s ability to supply fatty amines to customers across Southeast Asia and global markets, complementing its existing production facilities in China, Europe, and the Americas.

- February 2022 : Eastman's care additives business announced the completion of a significant expansion of its tertiary amine capacity, primarily DIMLA 1214, at both its Ghent, Belgium, and Pace, Florida, manufacturing sites. The Ghent expansion led to an increase in capacity, while the Pace expansion improved production flow, making it the world's largest tertiary amine unit.

- August 2021 : Huntsman Corporation announced plans for its Performance Products division to expand its manufacturing facility in Petfurdo, Hungary, to address the rising demand for polyurethane catalysts and specialty amines. This multi-million-dollar investment was completed in 2023. The brownfield expansion aims to enhance Huntsman’s global production capacity while offering greater flexibility and advanced technologies for the polyurethane, coatings, metalworking, and electronics industries.

Table of Contents

Methodology

The research methodology for assessing the current market size of fatty amines involved four key stages. Initially, comprehensive secondary research was conducted to collect relevant data on the fatty amines market and related peer and parent markets. This was followed by primary research, wherein findings, assumptions, and market estimations were validated through interviews and consultations with industry experts across the fatty amines value chain.

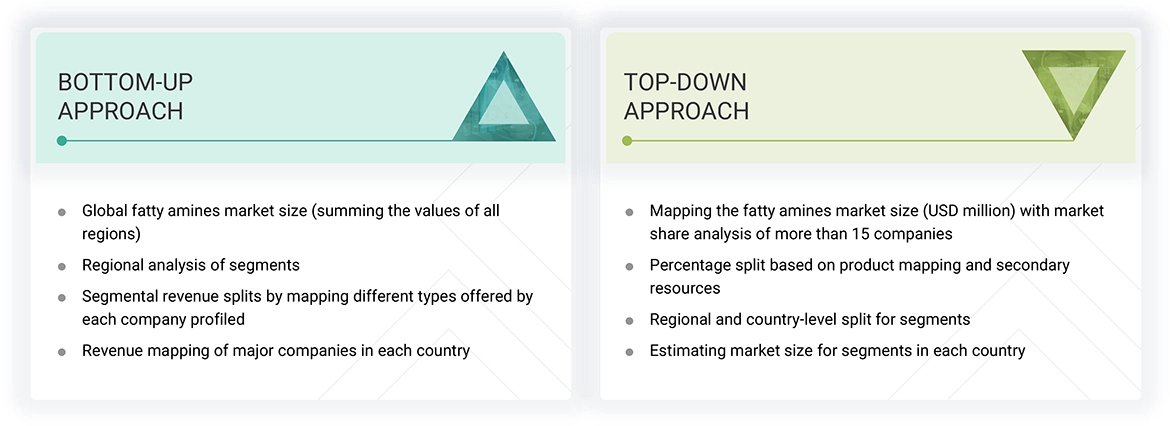

To determine the overall market size, top-down and bottom-up approaches were utilized. Finally, market segmentation analysis and data triangulation techniques were applied to refine and validate the size and scope of individual market segments and sub-segments, ensuring accuracy and reliability in the final assessment.

Secondary Research

The research approach employed to assess and project the fatty amines market is initiated by collecting revenue data from prominent suppliers using secondary research. During the secondary research, many secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The fatty amines market comprises several stakeholders in the supply chain, such as manufacturers, suppliers, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of various industries, including agrochemicals, oilfield chemicals, chemical processing, water treatment, asphalt additives, and personal care. Advancements in technology characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

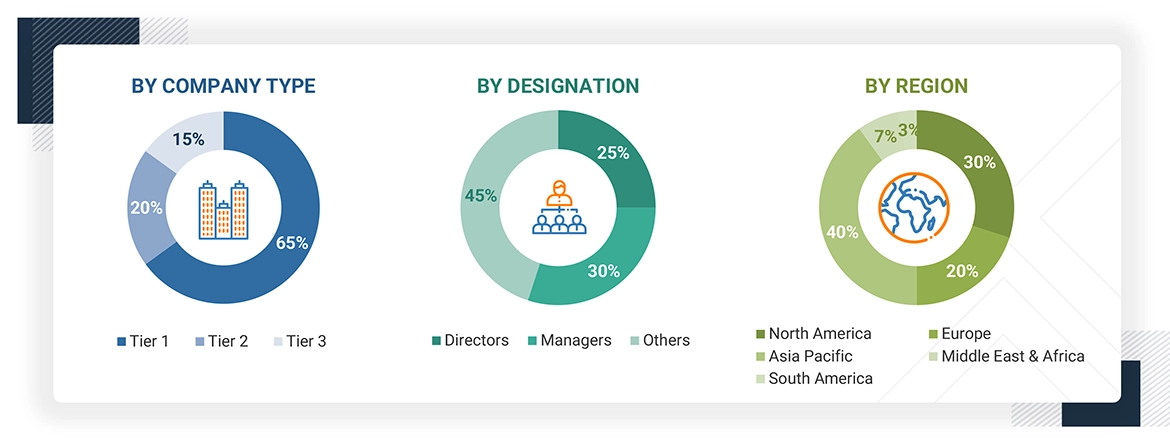

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the fatty amines market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the fatty amines market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that impact the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Fatty Amines Market Size: Bottom-up and Top-down Approaches

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Fatty amines are classified as oleochemicals comprising hydrocarbon chains with eight or more carbon atoms bonded to an amine group. They are primarily produced from fatty acids derived from natural sources such as seed oils—including palm oil, crude tall oil, palm kernel oil, and soybean oil—and can also be synthesized from fatty alcohols.

This global market study examines three main types of fatty amines: primary, secondary, and tertiary. The production of each type is influenced by reaction conditions such as temperature, ammonia pressure, and catalyst selection. Fatty amines serve various functional roles, including emulsifiers, flotation agents, anti-caking agents, dispersants, corrosion inhibitors, and chemical intermediates. Their diverse functionality supports applications across several key industries, including agrochemicals, personal care, oilfield chemicals, chemical processing, asphalt additives, and water treatment—each analyzed in detail in this report.

Stakeholders

- Fatty amine manufacturers

- Fatty amine suppliers

- Fatty amine traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Government and research organizations

- Consulting companies/consultants in the chemicals & materials industry

- Industry associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, governments, investment banks, venture capitalists, and private equity firms

Report Objectives

- To define, describe, and forecast the size of the global fatty amines market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global fatty amines market

- To analyze and forecast the size of various segments of the fatty amines market based on five major regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as expansions, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the critical driver for the fatty amines market?

The growth of the fatty amines market can be driven by their growing demand in various industries and sectors.

Which region is expected to register the highest CAGR in the fatty amines market during the forecast period?

The fatty amines market in South America is estimated to register the highest CAGR during the forecast period.

What is the primary end-use industry of fatty amines?

Agrochemicals is the major end-use industry for fatty amines.

Who are the major players in the fatty amines market?

Key players include Arkema (France), Evonik Industries AG (Germany), Kao Corporation (Japan), Procter & Gamble (US), BASF (Germany), and Nouryon (Netherlands).

What is expected to be the CAGR of the fatty amines market from 2025 to 2030?

The market is expected to record a CAGR of 6.7% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fatty Amines Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Fatty Amines Market

Stephanie

Jul, 2022

Need report on Fatty Amines Market by Region.