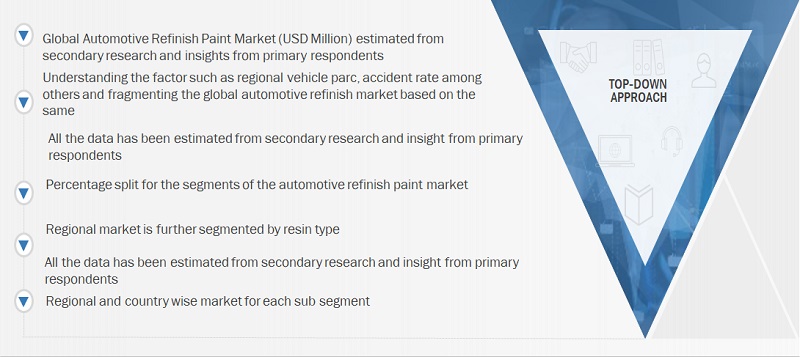

Various secondary sources, directories, and databases have been used to identify and collect information for an extensive study of the automotive paints market. The study involved four main activities in estimating the current size of the automotive paints market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as the paint types as well as the upcoming technologies and trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information useful for an extensive commercial study of the automotive paint market. Secondary sources include company annual reports/presentations, press releases, industry association publications [such as publications on vehicle sales, EEA (European Energy Agency), IEA (International Energy Agency), ACEA (European Automobile Manufacturers Association), T&E (Transport and Environment), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], Automotive paint related magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles. Additionally, secondary research has been carried out to understand the average cost of automotive paints consumed by vehicle type, and historic sales of vehicles.

Primary Research

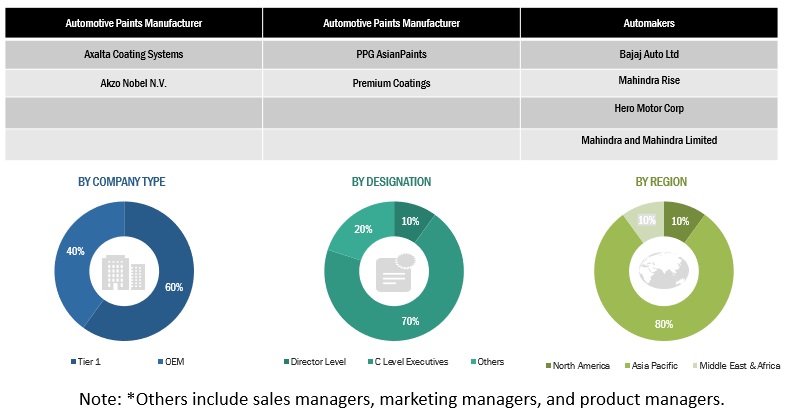

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as ICE vehicle and electric vehicle sales forecast, automotive paints market forecast, automotive paint regional penetration, future technology trends, and upcoming technologies for reducing the automotive painting. Data triangulation was then done with the information gathered from secondary research. Stakeholders from the demand as well as supply side have been interviewed to understand their views on the aforementioned points.

Primary interviews have been conducted with market experts from automotive paints manufacturers and automakers across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. A similar percentage of primary interviews have been conducted with the automotive paint providers and automotive paint technology providers, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert’s opinions, has led us to the findings as described in the remainder of this report.

Breakdown Of Primary Interviews: By Company Type & Designation

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

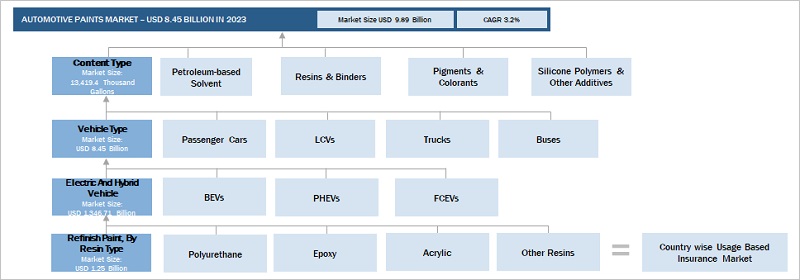

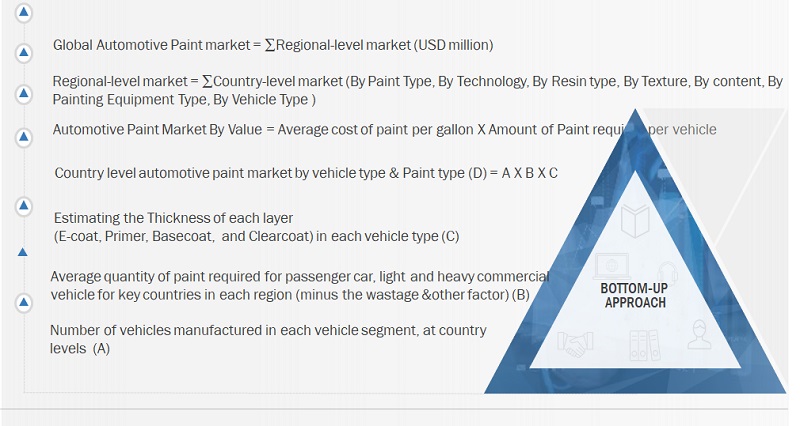

A detailed market estimation approach was followed to estimate and validate the value of the automotive paints market and other dependent submarkets, as mentioned below:

-

Key players in the automotive paints market were identified through secondary research, and their global market shares were determined through primary and secondary research.

-

The research methodology included the study of annual and quarterly financial reports and regulatory filings of major market players (public) as well as interviews with industry experts for detailed market insights.

-

All industry-level penetration rates, percentage shares, splits, and breakdowns for the automotive paints market were determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

-

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Paints Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Paints Market: Top-Down Approach

The top-down approach has been used to estimate and validate the size of the automotive paints market, by paint. The market share of each technology was derived at regional level through secondary research & insights from industry experts. Further, market was segmented based on market share for each paint type at regional level. The similar approach is used in, technology type, resin type, texture type, content type, and paint equipment type.

Bottom-Up Approach Automotive Paints By Technology At Regional Level

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends.

Market Definition

Automotive paint is a coating that provides an aesthetic appearance to the vehicle’s exterior body and protects it from external factors, such as rain, dust, and chemicals. Hence, the exterior paint is an integral part of the automotive industry. The demand for automotive paints is directly proportional to vehicle production and demand in the automotive industry.

Stakeholders

-

Manufacturers of various types of automotive paints

-

Raw material suppliers to automotive paint manufacturers

-

Manufacturers of automotive coating technologies

-

Dealers and distributors of automotive paints

-

Automotive original equipment manufacturers (OEMs)

-

Automobile industry as an end-user industry

-

Regional manufacturer associations and automobile associations

-

Government’s national and regional environmental regulatory agencies or organizations

Report Objectives

-

To define, describe, and forecast the automotive paints market, in terms of value

(USD million), based on the following segments:

-

By Paint Type [Electrocoat, Basecoat, Primer, Clearcoat]

-

By Technology Type [Solvant Borne, Waterborne, Powder Coating]

-

By Resin Type [Polyurethane, Epoxy, Acrylic, Other Resins]

-

By Texture Type [Solid, Metallic, Matte, Pearlescent, Solar reflective]

-

By Electric and Hybrid Vehicle Type [HEV, PHEV, FCEV]

-

By Vehicle Type [Passenger cars, LCV, Trucks, Buses]

-

By Content Type [E-coat, Solvent-Borne Basecoat, Solvent-Borne Clearcoat, Waterborne Basecoat, Waterborne Clearcoat]

-

By Refinish Paints [Polyurethane, Epoxy, Acrylic, Other Resins]

-

By Painting Equipment type [Airless Spray Gun, Electrostatic Spray Gun]

-

By Region (Asia Pacific, Europe, North America, and RoW)

-

To understand the market dynamics (drivers, restraints, opportunities, and challenges) and conduct patent analysis, case study analysis, supply chain analysis, regulatory analysis, and ecosystem analysis.

-

To understand the dynamics of the market players and distinguish them into stars, emerging leaders, pervasive players, and participants according to their product portfolio strength and business strategies.

-

To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market.

-

To understand the dynamics of competitors and distinguish them into stars, emerging leaders, pervasive players, and participants per the strength of their product portfolio and business strategies.

-

To analyze recent developments, such as agreements/partnerships/collaborations, joint ventures/mergers and acquisitions, geographic expansions, and product developments of key players in the automotive paints market.

-

To identify innovations and patents by assessing the intellectual property (IP) landscape for any particular product or technology.

-

To understand the general impact of the recession on the automotive paints market and how it will affect the overall economy of the country or region.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Automotive Electric And Hybrid Paint Market By Country And Vehicle Type

Additional Companies Profiled (Business Profile, Recent Developments, And Mnm Views)

Note: This will be further segmented by region.

srinivasa

Sep, 2021

What is the percentage volume of matt finish vehicles across the globe as of today.

User

Nov, 2019

I am looking to make contact with a paint manufacturer to supply my company with OEM alloy wheel base coats as well as powder primers. If you could recommend a company we could contact would be much appreciated. If you require further information on our requirements please feel to cont me by above email or telephone. Thank you for your time.

User

Nov, 2019

More interested in Paints market in India - Architechural, Industrial, Automotive OEM / Refinish and Wood Coatings.

User

Nov, 2019

Do you have a specific passage about primers? Is there any emphasis on conductive primers? Looking forward to hearing from you ASAP..

User

Nov, 2019

Automotive OEM paints but paints in general as well. In Indian, SEA, Taiwan, China, South Africa, Zimbabwe.

User

Nov, 2019

My group and I are studying self-healing paint for a design class. A part of the project is study the market for all automobile paints, and this report seems to be exactly what we were searching for, though we could not find..

User

Nov, 2019

Automotive paint market, paint and equipment technologies, transfer efficiency,powder, bi-funtional coat, paint process, new paint process.

User

Nov, 2019

I am working in automotive interiors design and development from past 6 years. I am intereseted to know the paint details as I often come accorss it as I work to support aquisition activities..

User

Nov, 2019

Does the report contain a review/comment on the manufacturing strategies of the major coatings producers in addressing their end markets?.

User

Jul, 2019

looking to do a marketing research assignment on automotive paints in general, and specifically the target market for certain paint types.

Akshit

Jun, 2019

we are looking to optimize our technology for automotive paint lines and looking for help to understand the market size.