The study involves four significant activities for estimating the size of the Ball valves market. Exhaustive secondary research has been conducted to collect information related to the market. The next step is to validate these findings and assumptions related to the market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the Ball valves market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications, articles by recognized authors; directories; and databases. The secondary data has been collected and analyzed to determine the overall market size, further validated through primary research.

Primary Research

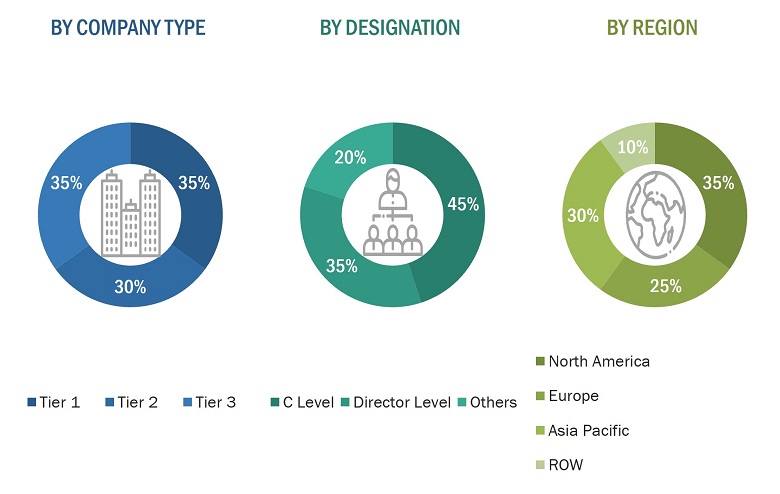

Extensive primary research has been conducted after gaining knowledge about the current scenario of the Ball valves market through secondary research. Several primary interviews have been conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been implemented to estimate and validate the size of the Ball valves market and other dependent submarkets listed in this report.

-

The key players in the industry and markets have been identified through extensive secondary research.

-

The supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Ball valves Market: Top-Down Approach

-

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

-

For calculating the Ball valves market segments, the market size obtained by implementing the bottom-up approach has been used to implement the top-down approach, which was later confirmed with the primary respondents across different regions.

-

The bottom-up approach has also been implemented for the data extracted from secondary research to validate the market size of various segments.

-

Each company’s market share has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the help of data triangulation and validation of data through primaries, the size of the overall Ball valves and each market have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments. The data was then triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

A valve is a mechanical device that regulates the flow of liquid or gas in a process stream. Ball valves are quarter-turn, straight-through valves and have a round closure element with matching rounded seats that permit uniform sealing stress. Ball valves are widely used in oil & gas, chemical, pharmaceutical, metal & mining, energy & power, and other industries for tight shutoff situations. Ball valves can be opened and closed quickly with a low-pressure drop, providing reliable leak protection, which is useful in gas applications. The major players of Ball Valves market includes Emerson Electric Co. (US), Flowserve Corporation (US), SLB (US), IMI (UK), Valmet (Finland), Crane Company (US), KITZ Corporation (Japan), Neway Valves Co. Ltd. (China), Spirax Sarco Limited (UK), Trillium Flow Technologies (US)..

Key Stakeholders

-

Original equipment manufacturers (OEMs)

-

Providers of technology solutions

-

Research institutes

-

Market research and consulting firms

-

Forums, alliances, and associations related to Ball valves

-

Technology investors

-

Governments and financial institutions

-

Analysts and strategic business planners

-

Existing end users and prospective ones

Report Objectives:

-

To describe and forecast the Ball valves market in terms of value based on Material, Type, Size, and Industry

-

To describe and forecast the Ball valves market size in terms of value for four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the Ball valves market

-

To provide a detailed overview of the supply chain of the ecosystem

-

To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

-

To analyze the probable impact of the recession on the market in the future

-

To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of market ranking/share and product portfolio.

-

To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the Ball valves market

Available Customization:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for this report:

-

Company Information: Detailed analysis and profiling of additional five market players

Trishul

Sep, 2017

We are launching a new indigenous valve, which has potential to disrupt the Ball valve/ gate valve industrial market. more specifically in pressure rating - class 1500 and above. we would like to understand the potential market for our product with respect to ball/gate valve. .

Laxman

Jan, 2018

I want Market forecast & opportunities in Ball valves upto 60 Inch size. Also need to know which type of Valve will have good market in future for pharmaceutical industry. .

STASI

Dec, 2022

is there a link or document that can provide the annual procurement for ball valves in the USA market ?.