Blood Gas Analyzer Market Size, Growth, Share & Trends Analysis

Blood Gas Analyzer Market by Product (Consumables, Services), Type of Testing (PoC, Conventional), Sample (Arterial, Venous, Capillary Blood), Application (Respiratory, Emergency Care Management), End User (Hospitals, Clinics) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The blood gas analyzer market is estimated at USD 2.70 billion in 2025 and is projected to reach USD 3.38 billion by 2030, growing at a CAGR of 4.6% during the forecast period. Growth is being driven by the rising prevalence of chronic and acute diseases, increasing demand for rapid and accurate diagnostics, and continuous advancements in blood gas analyzer technology. The adoption of point-of-care testing in critical care, emergency, and respiratory management settings further supports market expansion. The growing focus on improving patient outcomes and optimizing clinical workflows encourages healthcare providers to invest in modern analyzers. Additionally, expanding healthcare infrastructure in developing regions presents new opportunities for market players to capture untapped demand.

KEY TAKEAWAYS

-

BY PRODUCTThe blood gas analyzer market is segmented by product into consumables, analyzers, and services. The consumables segment held the largest market share, driven by their recurring use in routine blood gas testing and the continuous demand from healthcare settings. The frequent replacement of cartridges, reagents, and sensors ensures steady revenue generation for this segment.

-

BY TYPE OF TESTINGThe market is categorized by type of testing into point-of-care testing and conventional testing. Point-of-care testing holds the largest share due to its ability to deliver rapid results directly at the patient’s bedside, supporting timely clinical decisions in critical care and emergency settings. The increasing focus on workflow efficiency and patient-centered care also fuels its growing adoption.

-

BY SAMPLE TYPEThe blood gas analyzer market is segmented by sample type into arterial blood, venous blood, and capillary blood. Arterial blood accounted for the largest share, as it provides the most accurate measurement of oxygenation, carbon dioxide levels, and pH balance. This makes it the preferred sample type for intensive care units and emergency departments.

-

BY APPLICATIONThe market is divided by application into critical care management, respiratory care, emergency care management, and other applications. Critical care management holds the largest share because patients in ICUs require frequent monitoring to manage life-threatening conditions. This high testing frequency drives substantial demand for blood gas analyzers in critical care settings.

-

BY END USERThe blood gas analyzer market is segmented by end users into hospitals and ASCs, Clinics, and other end users. Hospitals and ASCs accounted for the largest share due to their high patient throughput, complex care requirements, and need for advanced diagnostic equipment. Their preference for rapid and reliable testing solutions supports sustained market growth.

-

BY REGIONThe global blood gas analyzer market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these, the Asia Pacific region is projected to register the fastest growth over the forecast period. Steady GDP growth and rising disposable incomes in emerging economies have led to increased healthcare spending across a larger population. Additional factors driving growth include the rising prevalence of acute and chronic diseases, ongoing modernization of healthcare infrastructure, and wider adoption of advanced diagnostic technologies.

-

COMPETITIVE LANDSCAPEThe leading players in the global blood gas analyzer market include Danaher Corporation (US), Werfen S.A. (Spain), F. Hoffmann-La Roche Ltd. (Switzerland), Abbott Laboratories (US), and Siemens Healthineers AG (Germany). These companies have adopted organic and inorganic growth strategies, such as new product developments, product approvals, strategic partnerships, and expansions, to strengthen their market positions and cater to the increasing demand for rapid and accurate diagnostic solutions in critical care settings.

Due to several key factors, the blood gas analyzer market is poised for significant growth. The increasing prevalence of chronic and acute diseases, including respiratory, cardiovascular, and metabolic disorders, is driving the demand for rapid and accurate diagnostic testing. Technological advancements, such as multi-parameter analysis, automated calibration, and real-time data integration, have enhanced the efficiency and reliability of blood gas monitoring, supporting improved clinical decision-making. Additionally, the rising adoption of point-of-care testing, expanding healthcare infrastructure, and increased healthcare expenditure in developing regions further fuel market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The blood gas analyzer market is experiencing a significant transformation driven by emerging trends and technological innovations. Rising demand for rapid, point-of-care testing and continuous patient monitoring has extended the use of blood gas analyzers beyond conventional hospital laboratories to ICUs, emergency departments, and specialized clinics. Technological advancements such as automation, integrated data management systems, and connectivity with hospital information networks have improved diagnostic accuracy and streamlined patient care. Furthermore, the increasing prevalence of chronic respiratory and metabolic disorders, along with a growing number of critical care admissions, has heightened the need for advanced, multi-parameter analyzers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising incidence and prevalence of chronic and acute conditions

-

Advancements in blood gas analyzer technology

Level

-

Unfavorable reimbursement policies

-

Complex operations and interpretation of data

Level

-

Growth opportunities in developing countries

-

Rising ICU and emergency department admissions

Level

-

Availability of refurbished analyzers

-

Lack of data analysis software

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advancements in blood gas analyzer technology

Advancements in blood gas technology are a key driver of market growth, as they have significantly improved the speed, accuracy, and convenience of patient monitoring. Modern analyzers now integrate real-time data connectivity, automated calibration, and multi-parameter testing, allowing clinicians to assess critical physiological parameters like blood gases, electrolytes, and metabolites more efficiently. These innovations enhance point-of-care testing capabilities, reduce the likelihood of errors, and support timely clinical decision-making in critical care, emergency, and respiratory management. As a result, healthcare providers are increasingly adopting advanced blood gas analyzers, fueling the expansion of the market.

Restraint: Unfavorable reimbursement policies

Unfavorable reimbursement policies remain a major restraint for the blood gas analyzer market, as they directly impact the affordability and adoption of these diagnostic devices. In many regions, reimbursement rates for blood gas tests are low or inconsistent, discouraging healthcare providers from upgrading to newer, more advanced analyzers. This is particularly critical for smaller clinics and outpatient facilities that operate under tight budgets and may prioritize tests with higher reimbursement potential. Additionally, restrictive insurance coverage or delays in reimbursement processing can limit patient access to frequent or routine blood gas testing, further restraining market expansion

Opportunity: Growth opportunities in developing countries

The growing demand for advanced healthcare solutions in developing markets presents a significant opportunity for the blood gas analyzer market. Increasing healthcare expenditure, expanding hospital infrastructure, and rising awareness of critical and chronic conditions are driving the adoption of modern diagnostic technologies in these regions. Moreover, governments and private healthcare providers are investing in upgrading laboratory facilities and point-of-care testing capabilities, creating a favorable environment for blood gas analyzers. With the rising prevalence of respiratory and cardiovascular diseases and the need for rapid and accurate diagnostics, developing markets offer substantial growth potential for manufacturers looking to expand their presence.

Challenge: Availability of refurbished analyzers

The availability of refurbished blood gas analyzers poses a notable challenge to market growth. Refurbished devices are often sold at lower prices than new analyzers, making them an attractive option for cost-conscious healthcare facilities, particularly in budget-constrained regions. This can limit the demand for new, technologically advanced analyzers, affecting manufacturers sales and profitability.

Blood Gas Analyzer Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers a range of blood gas analyzers, including compact point of care models such as the ABL90 FLEX PLUS for rapid results and the ABL9 blood gas analyzer | Enhanced diagnostic accuracy, streamlined workflow, and rapid results for critical care and emergency settings |

|

Offers blood gas analyzers through the GEM Premier line, providing automated testing of blood gases, electrolytes, and metabolites with integrated quality management | Reliable multi-parameter testing, improved patient monitoring, and efficient laboratory operations |

|

Provides blood gas analyzers, including the cobas b 221 and cobas b 123 POC systems to measure blood gases, electrolytes, and metabolites | Real-time patient monitoring, data-driven clinical decisions, and operational efficiency in hospitals and ICUs |

|

Manufactures portable blood gas analyzers with multi-parameter testing capabilities | Fast and accurate results, point-of-care convenience, and better management of critical and respiratory patients |

|

Provides automated blood gas analyzers, consumables, and point-of-care testing solutions | High throughput, reliable results, and enhanced workflow integration across hospital departments |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The blood gas analyzer market ecosystem comprises all key components and stakeholders in developing, distributing, and utilizing these devices. It includes products such as analyzers and consumables, as well as the different types of testing, sample types, applications, and end users. Manufacturers occupy a central role, managing activities from research and product development to optimization and market launch. Distributors, including third-party partners and e-commerce platforms, support the marketing and sale of blood gas analyzers. End users such as hospitals, ASCs, clinics, and other end users utilize these devices across various stages of patient diagnosis and monitoring, thereby completing the market ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Blood Gas Analyzer Market, By Product

By product, the blood gas analyzer market is segmented into consumables, analyzers, and services. Consumables hold the largest share, driven by their recurring usage in routine testing. Reagents, cartridges, and sensors are essential for every analysis, ensuring continuous demand. Analyzers themselves are increasingly equipped with advanced features to enhance accuracy and efficiency, while services including maintenance, calibration, and training support overall market growth.

Blood Gas Analyzer Market, By Type of Testing

By type of testing, the market is divided into point-of-care testing and conventional laboratory testing. Point-of-care testing dominates due to its ability to provide rapid, on-site results, which are critical for timely clinical decision-making in ICUs, emergency departments, and specialized care units. The convenience and efficiency of point-of-care testing reduce turnaround time, streamline workflow, and improve patient outcomes, driving widespread adoption across healthcare facilities.

Blood Gas Analyzer Market, By Sample Type

By sample type, the market includes arterial, venous, and capillary blood. Arterial blood accounts for the largest share because it delivers the most accurate assessment of oxygenation, carbon dioxide levels, and pH balance. This precision is vital for critically ill patients in ICUs and emergency settings.

Blood Gas Analyzer Market, By Application

By application, the market is categorized into critical care management, respiratory care, emergency care management, and other applications. Critical care management holds the largest share due to the frequent monitoring required in ICUs, often multiple times daily, to manage severe conditions. Emergency care contributes significantly, as blood gas analyzers are used for rapid assessment before and after stabilization. In contrast, respiratory care testing is primarily conducted during routine check-ups or for chronic disease management, highlighting the versatile role of these analyzers.

Blood Gas Analyzer Market, By End User

By end user, the market includes hospitals & ASCs, Clinics, and other end users. Hospitals and ASCs dominate the market owing to high patient volumes, complex case management, and the adoption of advanced diagnostic technologies. Clinics and smaller healthcare facilities are increasingly incorporating blood gas analyzers as point-of-care testing becomes more affordable and accessible, enabling timely diagnostics in outpatient and specialized care settings.

REGION

North America to account for the largest share of the blood gas analyzer market during the forecast period

North America leads the blood gas analyzer market. It is expected to maintain strong growth, driven by well-established healthcare infrastructure, widespread use of point-of-care testing, and continuous advancements in analyzer technology. Increasing rates of chronic and acute diseases, coupled with significant healthcare investments, are further boosting the adoption of blood gas analyzers across the region.

Blood Gas Analyzer Market: COMPANY EVALUATION MATRIX

Danaher Corporation (Star) is a leading player in the blood gas analyzer market due to its comprehensive product portfolio, which includes advanced analyzers, consumables, and integrated point-of-care solutions. Its focus on technological innovation, high-quality diagnostics, and a global distribution network enables efficient workflow, rapid results, and strong adoption across hospitals and critical care settings.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.70 Billion |

| Market Forecast in 2030 (Value) | USD 3.38 Billion |

| Growth Rate | CAGR of 4.6% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Blood Gas Analyzer Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- April 2025 : F. Hoffmann-La Roche Ltd. (Switzerland) announced plans to invest USD 50 billion in the US over five years, further enhancing its strong presence in the country.

- July 2024 : Werfen S.A. (Spain) launched the GEM Premier 7000 with Intelligent Quality Management 3 (iQM3) after receiving 510(k) clearance from the US Food and Drug Administration. The GEM Premier 7000 with iQM3 is the first point-of-care (POC) system to offer hemolysis detection, enhancing the reliability of blood gas testing.

- May 2024 : Danaher Corporation (US) partnered with Etiometry (US), a clinical decision-support software provider, to improve decision-making and workflows in critical care. By integrating the Etiometry platform with Radiometer’s acute care diagnostics, clinicians can view blood gas results together with physiological parameters and other essential clinical data on a unified interface.

- October 2023 : Nova Biomedical (US) received 510(k) clearance from the US Food and Drug Administration (FDA) for the micro capillary sample mode on the Stat Profile Prime Plus Critical Care Analyzer.

- February 2023 : Siemens Healthineers AG (Germany) and Unilabs (Switzerland), a leading diagnostic services provider, have announced a multi-year agreement. As part of this agreement, Unilabs will enhance its laboratory infrastructure by investing in Siemens Healthineers’ advanced technology and acquiring over 400 laboratory analyzers.

Table of Contents

Methodology

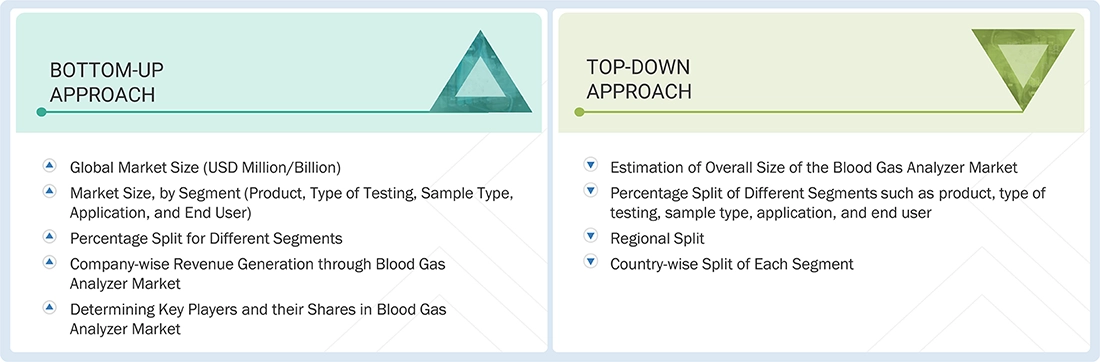

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, restraints, challenges, and key player strategies. To track company developments such as acquisitions, product launches, expansions, agreements, and partnerships of the leading players, the competitive landscape, and market players are analyzed on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

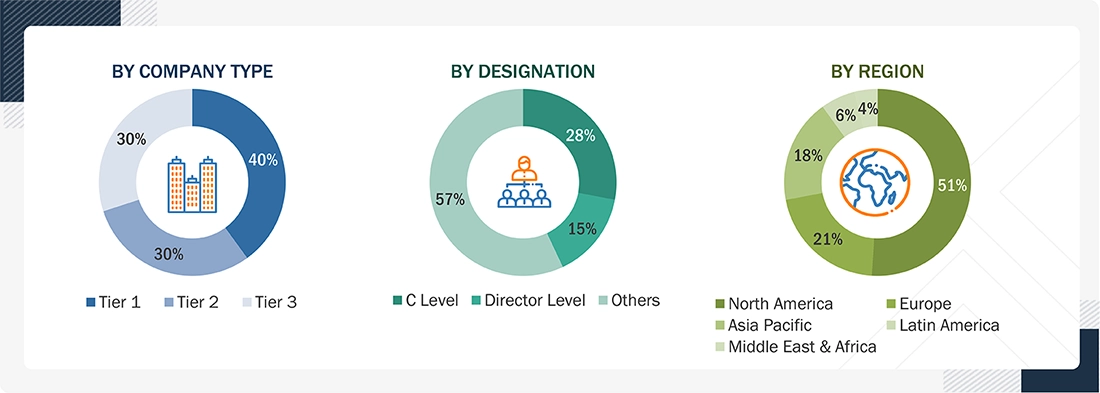

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024 Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION |

|---|---|

| Danaher | Product Manager |

| Transasia Bio-Medicals | Sales Executive |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the blood gas analyzer have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Blood gas analyzers are widely used in blood testing to test various blood parameters, such as oxygen concentration, hydrogen ions, electrolytes, and partial pressure of carbon dioxide (pC02) and oxygen (p02). The concentrations of oxygen, carbon dioxide, and other electrolytes, along with the pH, are indicators for diabetes, blood vessel hemorrhage, drug overdose, shock, and other conditions.

Stakeholders

- Manufacturers & Distributors of Blood Gas Analyzers

- IVD Companies

- Hospitals & ASCs

- Clinics

- Clinical Labs

- Research Institutes

- Point of Care Settings

- Market Research & Consulting Firms

- Government Associations

- Venture Capitalists & Investors

Report Objectives

- To define, describe, segment, and forecast the global blood gas analyzer by product, type of testing, sample type, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall blood gas analyzer market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the blood gas analyzer using the Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Blood Gas Analyzer Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Blood Gas Analyzer Market

Lab

Apr, 2019

Thanks for sharing information about Electrolyte Analyzer Market this article is very use full for me..