Intelligent Building Automation Technologies Market

Intelligent Building Automation Technologies Market by Solution (Facility Management, Security & Access Control, Energy Management, Fire Detection & Prevention), Technology (Sensors, Actuators, Connectivity, Computing) - Global Forecast to 2028

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global intelligent building automation technologies market is estimated to reach USD 108.45 billion in 2025 and is projected to grow to USD 201.02 billion by 2030, registering a CAGR of 13.1% during the forecast period. Market growth is supported by rising investment in digitally managed buildings across commercial, residential, and public infrastructure. Growth is being shaped by the increasing complexity of building operations, where energy use, occupant comfort, safety, and regulatory compliance must be managed simultaneously.

KEY TAKEAWAYS

-

By OfferingThe services segment is expected to register the highest CAGR of 14.7%.

-

By TechnologyBy Technology, the Computing technology segment is projected to grow at the fastest rate from 2025 to 2030.

-

By End UserBy End User, the industrial segment is expected to dominate the market.

-

By RegionAsia Pacific to the fastest growing region in the global intilligent building automation technologies market

-

Competitive LandscapeHoneywell, Johnson Controls, Siemens AG, Schneider Electric were identified as some of the star players in the building automation technologies market, given their strong market share and product footprint.

-

Competitive Landscape Startup/SMEsCurrent Lighting Solution, KMC Controls, Softdel have distinguished themselves among startups and SMEs in the building automation technologies Market

Building automation platforms are being adopted to centralize monitoring and control across these systems. By collecting real-time operational data and enabling coordinated system responses, automation technologies help reduce manual intervention and improve consistency across facilities. As building portfolios expand across regions and usage patterns become more variable, centralized automation is becoming a foundational requirement. Intelligent building automation is therefore moving from a supporting technology to a core element of modern facility operations and long-term asset management strategies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The intelligent building automation market is shifting from hardware-centric deployments toward software-driven platforms that support continuous monitoring and optimization. Earlier automation systems focused on local control and scheduled operation. Current systems emphasize real-time analytics, remote management, and adaptive control based on occupancy and environmental conditions. This shift is changing how automation value is measured, from installation completion to ongoing performance outcomes. Automation technologies are now being considered earlier in building design, renovation, and portfolio planning. As a result, automation platforms are becoming embedded into broader digital building strategies rather than treated as standalone control upgrades.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Demand for Energy-Efficient and Compliant Buildings

-

Sustainability and Energy Reporting Requirements

Level

-

Fragmented Legacy Building Infrastructure

-

High Integration and Retrofit Complexity

Level

-

Data-Driven Facility Optimization

-

Smart Retrofit and Building Modernization Projects

Level

-

Data Security and System Reliability

-

Skilled Workforce and Operational Readiness

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Demand for Energy-Efficient and Compliant Buildings

Energy performance has moved from a long-term consideration to a routine operational requirement for many buildings. In several regions, regulations around energy use, emissions disclosure, and indoor environmental conditions are being tightened or more actively enforced. Building owners are now expected to track consumption in greater detail and show evidence of ongoing control rather than one-time compliance. In practice, this is difficult to manage through manual checks or static control systems. Intelligent building automation is increasingly used to bring energy-related systems under a single operational framework. Heating, ventilation, air conditioning, lighting, and related systems can be adjusted based on occupancy levels, time schedules, and external conditions. This allows operators to maintain acceptable performance levels while reducing avoidable energy use. As energy costs remain unpredictable and reporting requirements expand, automation is being adopted as a practical tool for maintaining operational control rather than as a discretionary technology investment.

Restraint: Fragmented Legacy Building Infrastructure

Many commercial and institutional buildings operate with equipment installed over long time periods, often from different vendors and based on proprietary control logic. These systems were not designed for interoperability or centralized management. Integrating modern automation platforms into such environments requires hardware replacement, controller upgrades, or additional middleware. Each step adds cost and complexity. In buildings where documentation is limited or systems have been modified repeatedly, integration work becomes harder to plan and execute. This is especially common in multi-building portfolios with varying construction timelines. As a result, automation projects are frequently implemented in phases or restricted to selected subsystems. Until legacy infrastructure is addressed more broadly, it continues to slow the pace and scale of intelligent building automation deployment.

Opportunity: Data-Driven Facility Optimization

Intelligent building automation systems generate continuous streams of operational data related to energy usage, equipment health, occupancy behavior, and environmental conditions. This data creates opportunities to move beyond reactive maintenance and static scheduling toward predictive and performance-based facility management. Advanced analytics can identify inefficiencies, forecast equipment failures, and support informed capital planning decisions. Building owners are increasingly interested in solutions that convert operational data into actionable insights rather than simple alerts. This shift supports demand for platforms that integrate analytics, visualization, and decision-support tools. As portfolios expand and buildings are operated as long-term assets, data-driven optimization represents a clear growth opportunity for automation providers that can demonstrate measurable operational and cost benefits.

Challenge: Data Security and System Reliability

As building systems become more connected and remotely managed, security and data governance requirements are becoming harder to manage. Automation platforms now interact with enterprise networks, cloud services, and third-party applications, which increases exposure to potential cyber risks. In parallel, building data is often subject to regional data protection and security rules, especially in sectors such as healthcare, government, and critical infrastructure. Maintaining stable system operation while controlling access rights, managing software updates, and protecting data integrity adds operational burden. Any system disruption can have direct implications for occupant safety and building performance. As portfolios grow in size or geographic spread, balancing connectivity, performance, and security remains an ongoing challenge rather than a one-time configuration task.

INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Siemens deployed its Desigo building automation platform across international airports in Europe and Asia to centrally manage heating, ventilation, air conditioning (HVAC), lighting, fire safety, and energy systems. The solution integrated data from multiple terminals and legacy systems, enabling real-time monitoring and automated control based on occupancy and operating schedules. | Reduced energy consumption | Improved system reliability | Centralized building operations | Enhanced passenger comfort |

|

Schneider Electric implemented its EcoStruxure Building platform for large commercial office campuses and hospitals in North America. The solution connected building management systems, power monitoring, and energy analytics to optimize HVAC performance and support sustainability targets while maintaining strict indoor air quality standards. | Lower operating costs | Improved energy efficiency | Compliance with sustainability regulations | Better indoor environmental quality |

|

Honeywell deployed its Building Management Solutions in healthcare and public infrastructure facilities to automate climate control, security access, and life-safety systems. The platform enabled predictive maintenance and remote system management, reducing reliance on manual inspections and on-site interventions. | Reduced downtime | Faster fault detection | Improved occupant safety | Lower maintenance costs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The intelligent building automation ecosystem includes several groups that support system delivery and ongoing operation. Platform vendors provide automation software, controllers, and analytics tools used to manage core building systems, including heating, ventilation, air conditioning, lighting, and energy monitoring. Hardware suppliers deliver sensors and control devices that capture operational data from buildings. Service providers and system integrators handle installation, configuration, and maintenance, particularly in complex or multi-site environments. Integration becomes more demanding when automation platforms must work with older infrastructure or vendor-specific control logic. In addition, energy efficiency, safety, and environmental regulations influence how systems are designed and deployed across different building types.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Intelligent Building Automation Technologies Market, By Offering

The solutions segment represents the largest share of the intelligent building automation market because it supports routine building operations. Software platforms bring together data from sensors, control devices, and building subsystems into a common operating view. This setup allows facility teams to observe system conditions, make adjustments, and address issues without constant manual input. In practice, solution platforms are often chosen over standalone hardware since they provide visibility across multiple buildings rather than a single site. They also tend to accommodate operational changes more easily as usage patterns evolve. Adoption is strongest in commercial offices, healthcare facilities, data centers, and large institutional buildings, where coordination and reporting requirements are more demanding. As automation programs expand beyond isolated upgrades, spending is increasingly directed toward solution platforms that can support portfolio-level deployment and ongoing management.

Intelligent Building Automation Technologies Market, By Technology

Energy management sensors are expected to grow faster than other components of intelligent building automation systems during the forecast period. These sensors collect operational data related to electricity use, space occupancy, equipment runtime, and indoor conditions as buildings are used day to day. Instead of relying on fixed schedules, building systems can adjust based on observed patterns. Adoption is increasing in both new construction and retrofit projects, where sensors are added to address gaps in performance monitoring. In older facilities, falling device prices and improved wireless connectivity have reduced installation constraints. As monitoring expectations expand and reporting requirements become more frequent, energy management sensors are being treated as a core data source within automation systems rather than an optional enhancement.

REGION

Asia Pacific to be fastest-growing region in global intelligent building automation technology market during forecast period

Asia Pacific is expected to see continued growth in intelligent building automation adoption during the forecast period. Urban expansion and infrastructure development are increasing the number and scale of commercial building projects across both emerging and developed economies. Investment activity in smart city programs, healthcare facilities, and transport infrastructure is also contributing to demand for automated building systems. At the same time, rising energy consumption and policy-driven efficiency targets are influencing how new buildings are designed and operated. In response, enterprises and property developers across the region are adopting centralized building management platforms to improve operational oversight and manage long-term operating costs more consistently across portfolios.

INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET: COMPANY EVALUATION MATRIX

In the intelligent building automation technologies market matrix, Honeywell (Star) holds a leading position, supported by its broad automation portfolio, strong systems integration capabilities, and large installed base across commercial and institutional buildings. Carrier Global Corporation (Emerging Leader) is expanding its position through integrated HVAC automation and digital controls, showing potential to move upward as demand grows for energy-efficient and performance-driven building operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Honeywell International Inc. (US)

- Johnson Controls International PLC (US)

- Siemens AG (Germany)

- Schneider Electric SE (France)

- ABB Ltd. (Switzerland)

- Eaton Corporation (US)

- Trane Technologies plc (Ireland)

- Carrier Global Corporation (US)

- Rockwell Automation

- Inc. (US)

- Azbil Corporation (Japan)

- Ingersoll Rand (US)

- Emerson Electric co. (US)

- Robert Bosch GmbH (Germany)

- Hubbell Incorporated (US)

- Lutron Electronics Company (US)

- Cisco Systems

- Inc. (US)

- Cushman & Wakefield plc (US)

- Jones Lang LaSalle Incorporated (US)

- CBRE Group

- Inc. (US)

- Current Lighting Solutions

- LLC (US)

- Verdigris Technologies

- Inc. (US)

- 75F (US)

- BuildingIQ (US)

- KMC Controls (US)

- Spaceti (Netherlands)

- eFACiLiTY (India)

- Softdel (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 108.45 Billion |

| Market Forecast in 2030 (Value) | USD 201.02 Billion |

| Growth Rate | CAGR of 13.1% from 2025-2030 |

| Years Considered | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa and Latin America |

WHAT IS IN IT FOR YOU: INTELLIGENT BUILDING AUTOMATION TECHNOLOGIES MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) | Regional Analysis: • Further breakdown of the North American intelligent building automation technologies market • Further breakdown of the European intelligent building automation technologies market • Further breakdown of the Asia Pacific intelligent building automation technologies market • Further breakdown of the Middle Eastern & African intelligent building automation technologies market • Further breakdown of the Latin American intelligent building automation technologies market | • Identifies high-growth regional opportunities, enabling tailored market entry strategies. • Optimizes resource allocation and investment based on region-specific demand and trends. |

| Company Information | Detailed analysis and profiling of additional market players (up to 5) | • Broadens competitive insights, helping clients make informed strategic and investment decisions. • Reveals market gaps and opportunities, supporting differentiation and targeted growth initiatives. |

RECENT DEVELOPMENTS

- January 2025 : Trane Technologies acquired BrainBox AI, integrating the company's autonomous HVAC controls and generative AI technology. BrainBox AI's deep learning algorithms cut building energy use by up to 25% and GHG emissions by up to 40%. The deal enhances Trane's smart building portfolio through their prior collaboration on AI-driven building management.

- July 2025 : Honeywell acquired Li-ion Tamer, to enhance fire detection for lithium-ion batteries in its Building Automation portfolio. The technology detects battery off-gassing up to 30 minutes before thermal runaway, serving data centers and energy storage. This tuck-in acquisition strengthens Honeywell's fire safety solutions amid rising li-ion battery demand across sectors.

- May 2025 : ABB introduced its Smart EMS platform, targeting residential energy optimization. The system gives homeowners real-time control over consumption patterns, helping cut utility bills through automated load balancing and renewable integration.

- May 2025 : Carrier Global Corporation committed USD 1 billion over five years, for U.S.-based manufacturing upgrades, R&D expansion, and workforce development. The investment supports intelligent climate solutions amid growing demand for energy-efficient building systems.

- January 2023 : Cisco Hong Kong and Neuron Digital Group forged a strategic partnership to expedite the development of smart buildings and properties in Hong Kong.

Table of Contents

Methodology

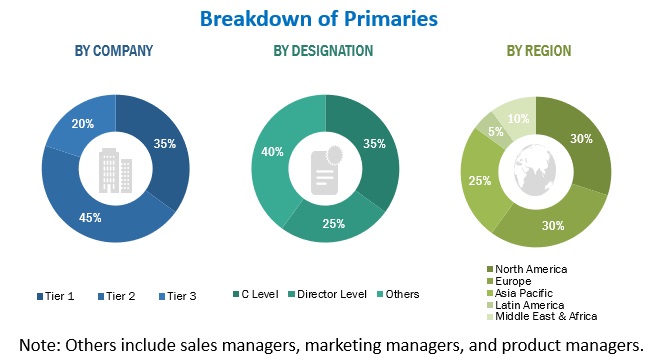

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the intelligent building automation technologies market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering intelligent building automation solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources, as well as by analyzing their product portfolios in the ecosystem of the intelligent building automation technologies market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as Intelligent Buildings and Green Homes (IBGH) Conferences, the International Building Performance Simulation Association (IBPSA) Conference, Automation in Construction and Robotics (AECR) Conference have been referred to for identifying and collecting information for this study on the intelligent building automation technologies market. The secondary sources included annual reports, press releases investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that have been further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from intelligent building automation technologies solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using intelligent building automation technologies solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of intelligent building automation technologies solutions which would impact the overall building automation market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

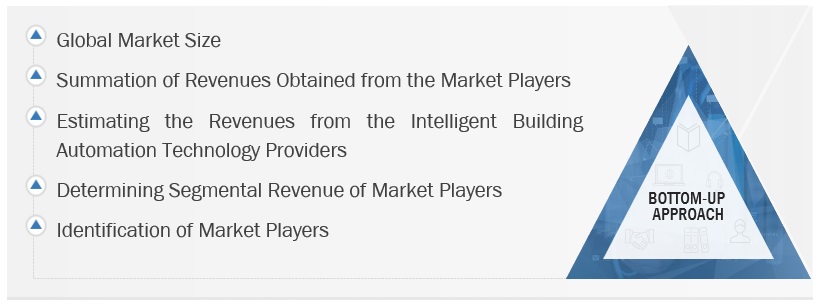

Multiple approaches were adopted to estimate and forecast the size of the intelligent building automation technologies market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of intelligent building automation technologies offerings.

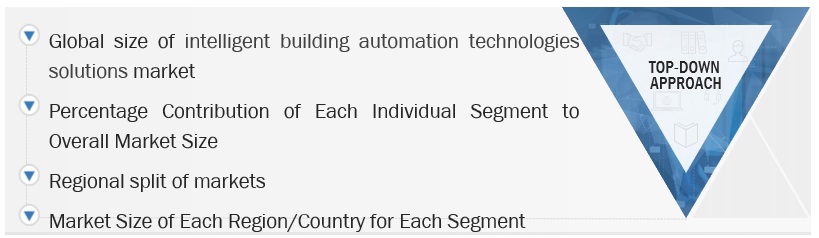

Both top-down and bottom-up approaches were used to estimate and validate the total size of the intelligent building automation technologies market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size, the intelligent building automation technologies market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

According to Cisco, building automation is defined as the usage of automation and control systems for monitoring and controlling building wide systems, such as HVAC, lighting, alarms, and security access and cameras. Smart building is created by converging these systems into a single IT-managed network infrastructure.

Building automation uses a wide range of technologies for collecting information and improving building operations. Smart building designs are integrated with core systems such as lighting, business security cameras, alarms, sensors and control systems to develop efficient buildings and thereby reduce costs for residents and increase safety.

Key Stakeholders

- Building Owners and Facility Managers

- IT Departments

- Building Automation System (BAS) Providers

- System Integrators (SIs)

- Energy Providers

- Government Agencies

- Investment Firms

- Intelligent Building Automation Technologies Alliances/Groups

Report Objectives

- To determine, segment, and forecast the intelligent building automation technologies market by offering, technology, end use, and region in terms of value

- To forecast the size of the market segments with respect to 5 main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Intelligent Building Automation Technologies Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Intelligent Building Automation Technologies Market