This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key market dynamics, key players, competitive landscape, industry trends, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Factiva, Bloomberg Businessweek, and D&B Hoovers), white papers, company house documents, investor presentations, annual reports, and SEC filings of companies. Secondary research was used to identify and collect information useful for the market-oriented, technical, extensive, and commercial study of the cardiac marker testing market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and recent developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

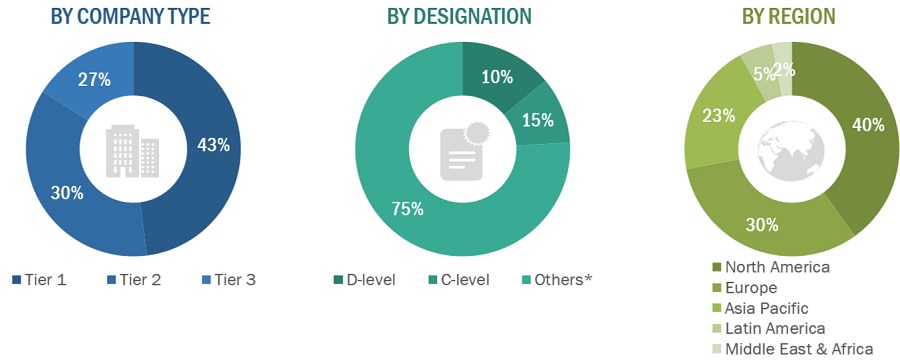

Comprehensive primary research was conducted following an initial understanding of the cardiac marker testing market from secondary research sources. Numerous primary interviews were carried out, encompassing perspectives from both demand (including research institutes, healthcare providers, hospital laboratories, and point-of-care testing facilities) and supply sides (involving developers, manufacturers, and distributors of cardiac marker testing products). The interviewees comprised industry experts from the in vitro diagnostics (IVD) sector, including CEOs, directors, sales heads, VPs and marketing managers from tier 1, 2, and 3 companies providing cardiac biomarker test kits and instruments globally.

Approximately 65% of the interviews were conducted with representatives from the supply side, while the remaining 35% were from the demand side. A rigorous primary research approach was employed to validate the report's contents and bridge any information gaps. Interviews were conducted through telephonic and email communications, where questionnaires were tailored and sent to primary participants based on their convenience.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

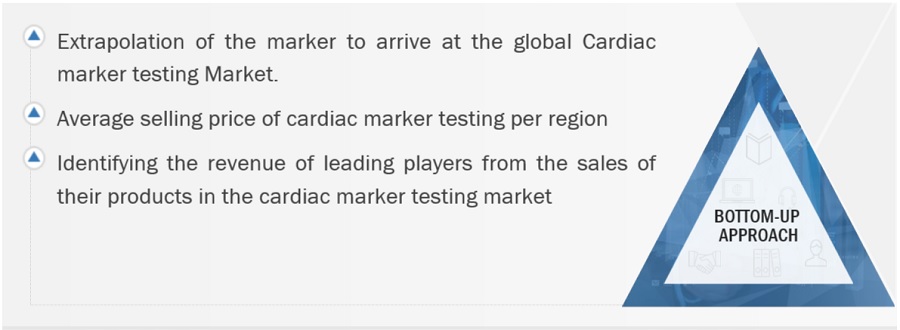

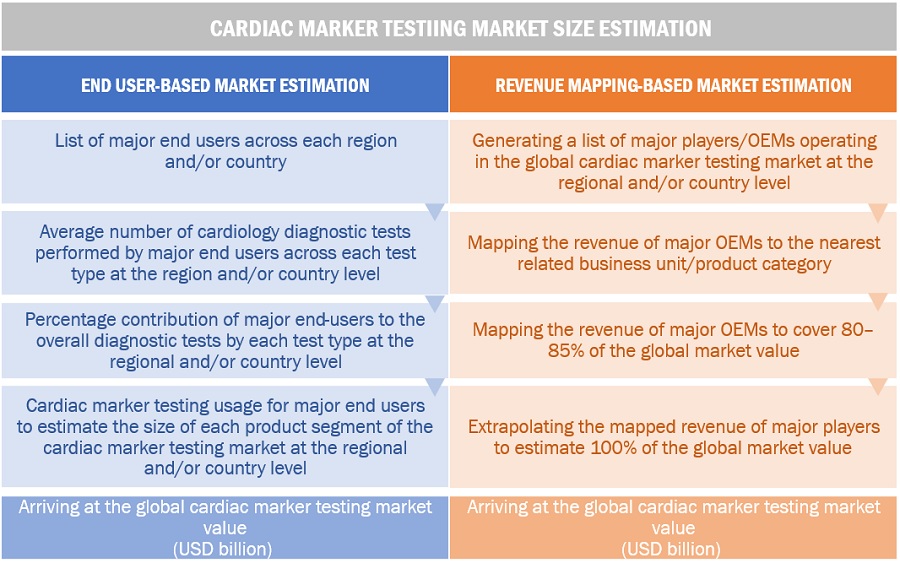

In this report, the global cardiac marker testing market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the cardiac marker testing business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as directors, CEOs, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

-

Generating a list of major global players operating in the cardiac marker testing market

-

Mapping annual revenues generated by major global players from the cardiac marker testing market segment (or nearest reported product category/ business unit)

-

Revenue mapping of key players to cover a major share of the global market, as of 2022

-

Extrapolating the global value of the cardiac marker testing industry

Global cardiac marker testing market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

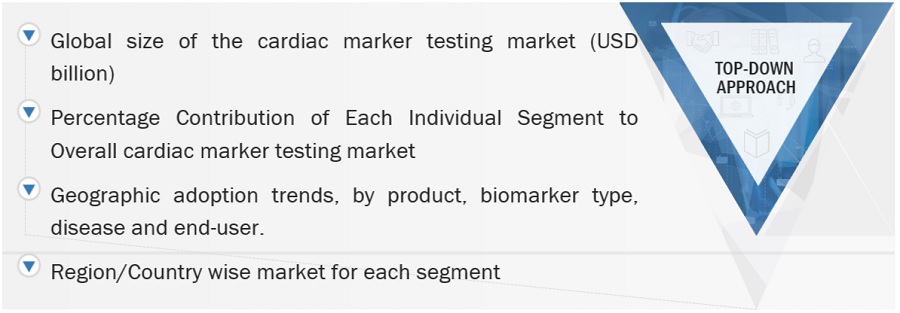

Global cardiac marker testing market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global cardiac marker testing market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the cardiac marker testing market was validated using both top-down and bottom-up approaches.

Market Definition

Cardiac marker testing encompasses a suite of medical diagnostic examinations designed to analyze specific biomolecules, termed cardiac markers, within the bloodstream. These markers, including enzymes, hormones, and proteins, are released when the heart sustains damage or stress, typically in the context of conditions like heart attacks or cardiovascular diseases.

These tests play a crucial role in diagnosing a range of cardiac ailments, gauging the seriousness of cardiac incidents, monitoring patients afflicted with heart conditions, and evaluating the efficacy of treatments. Cardiac marker testing empowers healthcare professionals with accurate and timely diagnostic information, facilitating precise medical interventions and enhancing overall patient outcomes.

Key Stakeholders

-

Product manufacturers, distributors, and suppliers

-

Diagnostic laboratories and point-of-care testing centers

-

Research laboratories and CROs

-

Ambulatory testing centers

-

Contract testing laboratories

-

Academic universities and medical research centers

-

Research and development (R&D) centers

-

Market research and consulting firms

Objectives of the Study

-

To define, describe, and forecast the cardiac marker testing market based on product, procedure, biomarker type, diseases, end user, and region.

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market.

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

-

To profile the key market players and comprehensively analyze their market shares and core competencies.

-

To forecast the revenue of the market segments with respect to five main regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), the Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa.

-

To track and analyze competitive developments such as new product launches and approvals; agreements, expansions, acquisitions, partnerships; and collaborations in the cardiac marker testing market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global cardiac marker testing market report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies.

Company Information

-

Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

-

Further breakdown of the Rest of Europe cardiac marker testing market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

-

Further breakdown of the Rest of Asia Pacific cardiac marker testing market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

-

Further breakdown of the Rest of the world cardiac marker testing market into Latin America, MEA, and Africa

Growth opportunities and latent adjacency in Cardiac Marker Testing Market