Cell Culture Market Size, Growth, Share & Trends Analysis

Cell Culture Market by Product (Consumables (Media, Sera, Reagent, Vessels (Roller bottle, Flask, Cell Factory)), Equipment (Bioreactors, Centrifuges, Filtration, Incubators, Freezers)), Application (mAbs, Vaccines, CGT), End User - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global cell culture market, valued at US$27.92 billion in 2024, stood at US$29.76 billion in 2025 and is projected to advance at a resilient CAGR of 11.2% from 2025 to 2030, culminating in a forecasted valuation of US$50.69 billion by the end of the period. The growth of the cell culture market is driven by the increasing support and funding from government and private organizations for cell-based research and growing popularity of monoclonal antibodies & biosimilars.

KEY TAKEAWAYS

-

BY REGIONIn 2024, North America is expected to hold the largest market share of 39.8%, supported by the rising approvals of cell-culture-

-

BY PRODUCTIn 2024, the consumables segment accounted for 73.6% of the cell culture market, driven by the repeated purchase of consumable and rising research for funding.

-

BY APPLICATIONThe biopharmaceutical production segment is expected to grow at the highest CAGR of 12.3% during the forecast period.

-

BY END USERIn 2024, pharmaceutical and biotechnology companies accounted for the largest share of the cell culture market, due to their extensive use of cell culture systems in biologics manufacturing.

-

COMPETITIVE LANDSCAPEThermo Fisher Scientific Inc., Merck KGaA, Danaher Corporation, Sartorius AG, and Corning Incorporated are dominant companies in this market.

The cell culture market is witnessing steady growth, driven by increasing funding and support for cell-based research and the emergence of advanced cell culture technologies. Rising adoption of single-use systems and the growing popularity of monoclonal antibodies, biosimilars, and advanced therapy medicinal products are driving demand. Additionally, frequent product launches and the increasing incidence of infectious diseases are further boosting market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Key trends and disruptions shaping the cell culture market include the rising adoption of 3D cell culture and organ-on-chip technologies, which enable more physiologically relevant models and accelerate drug discovery. The increasing shift toward serum-free and chemically defined media is enhancing reproducibility and reducing the risk of contamination. Additionally, the growing demand for biopharmaceuticals and personalized medicine is driving the need for higher throughput and automation in cell culture workflows, while sustainability pressures are prompting the development of eco-friendly consumables and processes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing support and funding for cell-based research

-

Emerging cell culture technologies

Level

-

High cost of cell biology research

-

Limitations in producing high density cell cultures

Level

-

Rising demand for 3D cell culture

-

Increasing focus on next-generation therapeutics

Level

-

Disposal of plastic consumables

-

Ethical concerns related to cell usage

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing support and funding for cell-based research

Cell culture is used to develop biological products for treating various diseases, such as cancer and cardiovascular conditions. Globally, major research and development activities are underway to create new and innovative cell therapy products, funded by both government and private organizations. For example, in June 2025, Celltrio (US), a life sciences company, secured USD 15 million in funding led by Premier Partners to accelerate the global commercialization of RoboCell, its flagship automated platform for sterile cell culturing and cell therapy manufacturing. Additionally, in May 2025, the Maryland Stem Cell Research Commission (US) announced grants exceeding USD 18 million to support cutting-edge stem cell and regenerative medicine research across Maryland.

Restraint:High cost of cell biology research

Cell biology research is an expensive process, requiring advanced laboratory equipment, specialized reagents, and skilled personnel. These high costs directly impact the adoption of microcarrier-based technologies for large-scale cell culture and production, as they add to the overall expenditure of R&D projects. Researchers and small-scale pharmaceutical & biotechnology companies may face budget constraints and prioritization of funds, which can limit their capacity to invest in microcarrier-based systems.

Opportunity: Rising demand for 3D Cell Culture

3D cell cultures are becoming more popular than 2D cell cultures for several reasons. 2D cell culture methods involve growing cells on flat surfaces as monolayers. However, these cells only adhere to the surface of the culture vessel and attach mainly at the edges. This restricts their ability to simulate a true 3D environment. Researchers have developed 3D cell cultures to address these limitations. These cultures have been shown to be effective in various studies of basic biological processes, such as monitoring cell number, assessing cell viability, observing cell proliferation, and examining cell structure. Additionally, 3D cell cultures offer greater stability and longer lifespans compared to 2D cultures.

Challenge: Disposal of plastic consumables

Cell culture is a flexible research method. However, it depends heavily on plastic consumables, which generate large amounts of plastic waste annually, negatively impacting the environment. Additionally, biopharmaceutical companies are increasingly using single-use bioprocessing systems and consumables because of their benefits, such as lower costs, faster process development, and reduced capital investment. They also help cut utility and water expenses during cleaning, sterilization, and batch changeover. Nevertheless, the disposal of solid waste from this technology raises serious environmental concerns.

CELL CULTURE MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Collaborated with Universitat Autònoma de Barcelona to optimize cell culture media for CHO-S cells, enhancing protein productivity | Achieved a 1.7-fold increase in monoclonal antibody productivity, demonstrating the impact of media optimization on cell culture efficiency |

|

Implemented Cytiva Xcellerex Disposable Reactors (XDR) for mAb and bispecific antibody production | Demonstrated that XDR bioreactors can be used effectively for antibody production | The System met all benchmarks for viable cell density, viability, integral viable cell count (IVC), and titer | Real-time CO2 monitoring proved effective, allowing the maintenance of optimal culture conditions |

|

Growing NS0 cells in disposable bioreactors for clinical trial production | Process scale-up in single-use systems was confirmed at 50 L and 250 L scale | GMP manufacturing was conducted at 2,000 L scale in single-use bioreactors | The 1st biological drug manufactured in China for global clinical trials was successfully produced by WuXi Biologics’ manufacturing site in Wuxi city |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cell culture market ecosystem comprises raw material suppliers, cell culture product manufacturers, and end users such as pharmaceutical and biotechnology companies, research & academic institutes, hospitals & diagnostic laboratories, CROs, and cell banks. Cell culture product manufacturers provide consumables, including media, reagents, sera, vessels, and accessories, as well as equipment such as bioreactors, storage equipment, and other equipment.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cell Culture Market, By Product

As of 2024, the consumables segment dominates the cell culture market as these products are essential for routine operations and are required in large volumes for every experimental or production cycle. Continuous advancements in media formulations and reagents have improved cell yield and consistency, increasing dependence on high-quality consumables. Furthermore, the growing shift toward single-use culture systems has amplified recurring demand, making consumables a key revenue driver in the market.

Cell Culture Market, By Application

The biopharmaceutical production segment accounts for the largest share of the market owing to the expanding global demand for biologics and the increased adoption of mammalian cell culture systems in large-scale drug manufacturing. Enhanced focus on process optimization, scalability, and regulatory compliance has further accelerated the use of cell culture in production workflows. Additionally, rising investments in capacity expansion and contract manufacturing for biologics strengthen this segment’s leadership.

Cell Culture Market, By End User

In 2024, pharmaceutical & biotechnology companies held the largest market share in the global cell culture market, owing to growing demand for biopharmaceuticals and personalized medicine, advancements in cell-based therapies and regenerative medicine, and the need for scalable and cost-effective production methods.

REGION

Asia Pacific to be fastest-growing region in global cell culture market during forecast period

The Asia Pacific cell culture market is expected to register the highest CAGR during the forecast period, driven by increasing investments in biopharmaceutical R&D and expanding manufacturing capabilities across countries like China, India, South Korea, and Japan. Growing government support for the development of advanced therapies and rising demand for vaccines and biosimilars are further propelling regional growth. Additionally, the presence of cost-effective production infrastructure and the expansion of multinational biopharma companies in the region are enhancing market potential.

CELL CULTURE MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMPANY EVALUATION MATRIX

In the cell culture market matrix, Thermo Fisher Scientific Inc. (Star) leads with a strong market share, extensive product footprint, and broad application coverage across biopharmaceutical, research, and clinical segments. Its comprehensive presence across consumables, instruments reinforces its leadership position. FUJIFILM Holdings Corporation (Emerging Leader) is rapidly expanding cell culture capabilities supported by both organic R&D initiatives, product launched and strategic acquisitions. The company’s growing global footprint and strengthening market rank indicate its increasing influence and potential to transition into a leading position in the coming years.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific Inc. (US)

- Danaher Corporation (US)

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Corning Incorporated (US)

- FUJIFILM Holdings Corporation (Japan)

- BD (US)

- Eppendorf SE (Germany)

- Lonza (Switzerland)

- Getinge AB (Sweden)

- Agilent Technologies, Inc. (US)

- HiMedia Laboratories (India)

- Miltenyi Biotec (Germany)

- STEMCELL Technologies (Canada)

- Solida Biotech GmbH (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 27.92 Billion |

| Market Forecast in 2030 (Value) | USD 50.69 Billion |

| Growth Rate | CAGR of 11.2% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

WHAT IS IN IT FOR YOU: CELL CULTURE MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Cell Culture Consumables Market |

|

|

| Global 3D Cell Culture Vessels Market Opportunity Assessment and Competitive Analysis |

|

|

RECENT DEVELOPMENTS

- May 2025 : BD launched a cell analyzer BD FACSDiscover A8 Cell Analyzer featuring spectral and real-time cell imaging technologies.

- April 2025 : Sartorius acquired MatTek, a leading developer and manufacturer of 3D microtissue models, from BICO Group AB (Sweden). This acquisition will advance Sartorius’ cell culture portfolio.

- April 2025 : Thermo Fisher Scientific Inc. opened the Advanced Therapies Collaboration Center (ATxCC) in Carlsbad, Calif. This advanced facility is designed to accelerate the development and commercialization of cell therapies.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global cell culture market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the cell culture market. The secondary sources used for this study include World Health Organization (WHO), Food and Drug Administration, American Society for Cell Biology (ASCB), National Institutes of Health (NIH), International Society for Cell & Gene Therapy (ISCT), American Society for Gene and Cell Therapy (ASGCT), Centers of Disease Control and Prevention (CDC), International Serum Industry Association (ISIA), Pharmaceutical Research and Manufacturers of America (PhRMA), International Society for Vaccines (ISV), International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), the Society for In Vitro Biology (SIVB), Japan Agency for Medical Research and Development, European Federation of Pharmaceutical Industries and Associations (EFPIA), American Type Culture Collection (ATCC), and the Alliance for Regenerative Medicine (ARM); corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; press releases; trade, business, professional associations and among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

After acquiring foundational knowledge about the global cell culture market through secondary research, extensive primary research was conducted. Multiple interviews were held with market experts from the demand side, including representatives from pharmaceutical and biopharmaceutical companies, hospitals & diagnostic laboratories, research & academic institutes, and CROs. Additionally, experts from the supply side were interviewed, including C-level and D-level executives, product managers, and marketing and sales managers from key manufacturers, distributors, and channel partners.

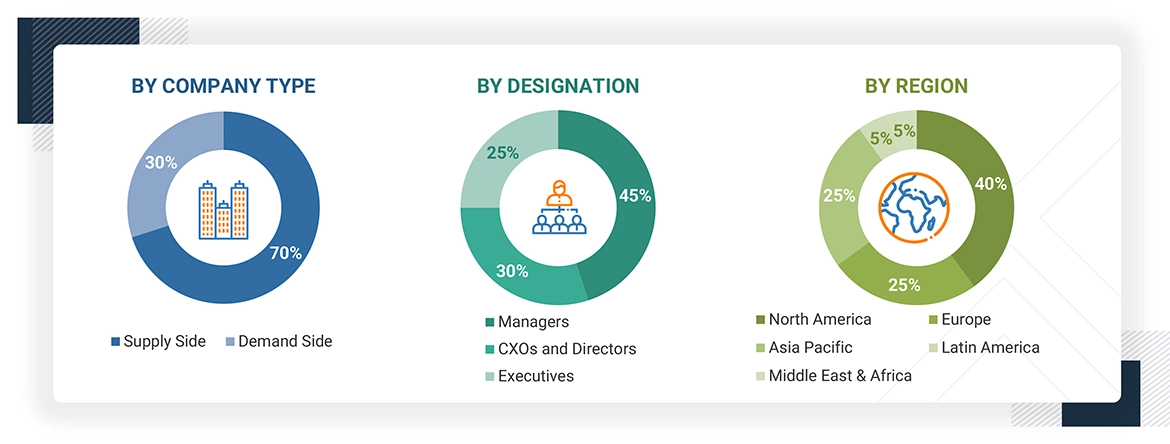

These interviews spanned five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Approximately 70% of the primary interviews were conducted with supply-side participants, while the remaining 30% were with demand-side participants. The primary data was collected through various methods, including questionnaires, emails, online surveys, personal interviews, and telephone interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cell culture market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Bottom-up Approach and Top-down Approach

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Cell culture refers to removing cells from an animal or plant and their subsequent growth in an artificial environment under controlled conditions. It is a process of growing cells outside their natural environment, typically in a laboratory setting. This technique allows researchers to study cells in a controlled environment, providing insights into their behavior, growth, metabolism, and response to various stimuli.

Stakeholders

- Cell Culture Equipment and Reagents Manufacturers

- Analytical and Life Science Instrumentation Companies

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Life Science Companies

- Venture Capitalists and Investors

- Government Organizations

- Private Research Firms

- Contract Research Organizations (CROs)

- Hospitals and Diagnostic Laboratories

- Cell Banks

Report Objectives

- To define, describe, and forecast the global cell culture market based on the product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contributions to the overall cell culture market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to six main regions, namely, North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, and R&D activities in the cell culture market

- To benchmark players within the cell culture market using the ‘Company Evaluation Matrix’ framework, which analyzes market players based on various parameters within the broad categories of business and product strategy

Key Questions Addressed by the Report

How is the preference for sustainable and animal-free components shaping the cell culture market?

There’s a growing shift toward serum-free, chemically defined media and single use technologies, driven by regulatory pressure, reproducibility issues, risk of contamination and ethical sourcing concerns. Adoption is particularly strong in Europe, where more than 40% of manufacturers reports transitioning to animal-free alternatives.

How is continuous manufacturing transforming the cell culture industry?

Continuous biomanufacturing is enabling real-time process monitoring, higher yields, and smaller facility footprints. In upstream cell culture, continuous perfusion systems are gaining traction and can improve productivity by 2–3x compared to traditional fed-batch processes.

How are automation and digitalization transforming cell culture workflows?

Integration of automated culture systems and AI-driven cell monitoring solutions used for media optimization, real-time cell monitoring, and predictive analytics is improving reproducibility and reducing manual error, with up to 30-40% efficiency gains in high-throughput labs.

How is the market being reshaped by the rise in advanced therapies (ATMPs)?

Cell and gene therapies are transforming the cell culture market landscape, with over 4,400 gene, cell and RNA-based therapies in development globally. This has pushed demand for GMP-grade media, automated systems, and closed bioprocessing platforms.

How is the shift towards 3D cell culture systems impacting R&D and preclinical testing?

3D cultures and organoids are gaining traction, especially in oncology, neurology, and toxicity testing reducing drug attrition rates and offering more physiologically relevant data than 2D cultures.

What are the primary supply chain concerns impacting the market today?

The industry is facing price volatility and procurement delays, especially for high-grade FBS, recombinant proteins, and lab plastics, urging firms to diversify suppliers and invest in supply chain resilience. Companies are responding by diversifying suppliers, expanding regional manufacturing, investing in in-house production, and using AI-based forecasting to improve resilience and reduce dependency on global supply chains.

What are the key pain points for companies scaling up from R&D to GMP manufacturing?

Key challenges include scaling adherent cells, ensuring batch-to-batch consistency, and adapting to closed, automated systems—especially for companies moving from research-grade reagents to clinical-grade platforms. To address this, they’re adopting closed, automated bioreactor systems, using pre-validated GMP media, and partnering with CDMOs for tech transfer and regulatory support.

Which government programs are actively investing in local cell culture manufacturing capacity?

Governments in China, Singapore, and India have launched biotech funds and incentives—e.g., China’s 14th Five-Year Plan, which includes $10B+ allocated to biomanufacturing infrastructure, boosting local cell culture production. Similarly, initiatives like India’s Biotechnology Industry Research Assistance Council (BIRAC) are accelerating biotech capacity, directly boosting media and reagent demand.

How will the 2025 US tariffs on Chinese biotech goods impact the cell culture supply chain?

Starting 2025, the US plans to impose 25% tariffs on certain Chinese-origin biologics and biomanufacturing equipment, including lab-grade media, reagents, plastics, and filtration units likely leading to 5–15% cost inflation for US-based manufacturers relying on Chinese imports. Firms are diversifying suppliers, localizing production of media and consumables, and entering strategic partnerships with domestic and EU-based vendors to secure critical raw materials and maintain compliance.

Are any regional disparities emerging in access to high-quality cell culture inputs?

Yes. Africa, LATAM, and parts of Southeast Asia face challenges accessing high-quality media and reagents due to import dependency, limited local suppliers, and regulatory bottlenecks highlighting a need for regional manufacturing hubs. To overcome this, companies and governments are investing in local production facilities, forming regional supply partnerships to improve access and self-sufficiency.

How are companies differentiating through product innovation in 2024–2025?

Companies are launching custom media formulations, 3D culture platforms, and closed single-use bioreactor systems. Recent launches such as Thermo Fisher’s Gibco CTS media line, Nucleus Biologics’s NB-KUL DF, a DMSO-free, chemically defined cryomedia target consistent performance in cell therapy and protein expression, respectively.

What recent strategic moves are shaping competition in the cell culture industry?

In the past 2 years, leading players have made multiple acquisitions (e.g., Sartorius acquiring Albumedix, Thermo Fisher acquiring PeproTech) and expanded GMP-grade media facilities to strengthen biologics and cell therapy manufacturing offerings. In 2024, Fujifilm invested $1.2 billion in its large-scale cell culture CDMO facility in North Carolina

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cell Culture Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Cell Culture Market

Alan

Mar, 2022

Which market size estimation methodologies are adopted to study the Global Cell Culture Market?.

Juan

Mar, 2022

How much percent share, does each segment holds, of the Global Cell Culture Market?.

Wayne

Mar, 2022

What are the growth opportunities in the Global Cell Culture Market across different geographies?.