Commercial Refrigeration Market

Commercial Refrigeration Market By Product Type, Refrigerant Type (HCFCs, HFCs, HFO, Isobutane, Propane, Ammonia, Carbon Dioxide), Application, End Use (Supermarkets & Hypermarkets, Hotels & Restaurants), Door Type, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

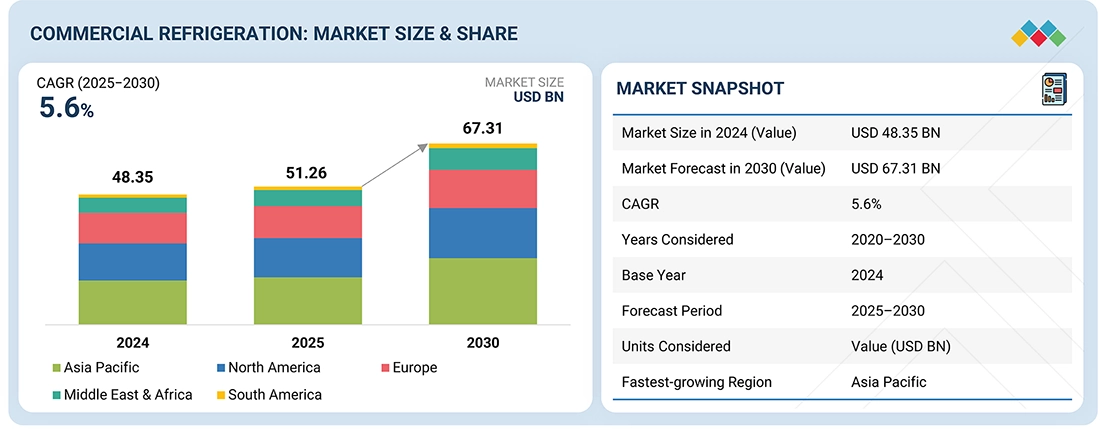

The global commercial refrigeration market is projected to grow from USD 51.26 billion in 2025 to USD 67.31 billion by 2030, at a CAGR of 5.6% during the forecast period. The commercial refrigeration market in North America is expected to show a considerable increase in the future, mostly due to the introduction of new technologies, growth of cold chain logistics, and a higher demand for energy-efficient systems. The already established food retail sector of the region, along with the trend of frozen and packaged foods acceptance, keeps the requirement for advanced refrigeration solutions going. Besides, government regulations for higher food safety and better environmental protection are driving companies to move towards using eco-friendly and low-emission refrigerants. The increase in consumer electronics grocery delivery services and the adoption of smart, connected refrigeration systems for real-time monitoring are also contributing to the fast market growth. All in all, North America is emerging as one of the most vibrant territories in the global commercial refrigeration market.

KEY TAKEAWAYS

-

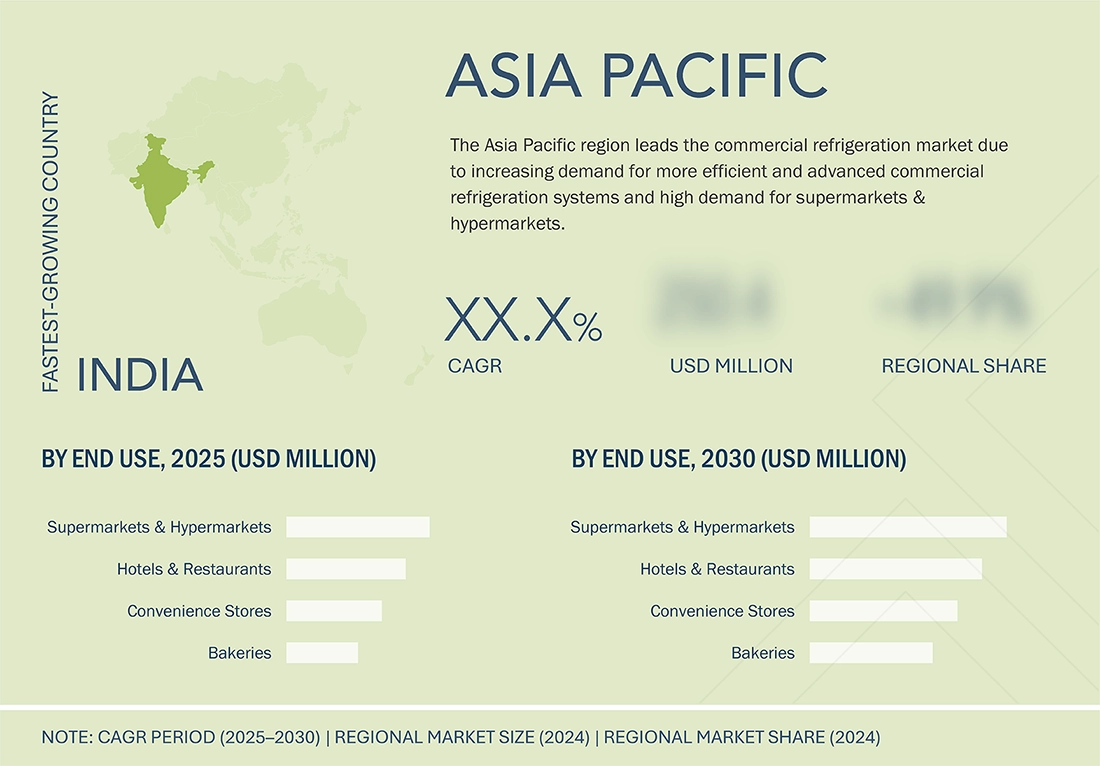

BY REGIONThe Asia Pacific region is expected to register the highest CAGR of 7.0% during forecast period.

-

BY PRODUCT TYPEBy product type, the transportation refrigeration segment is accounted for a 32.1% market share in 2024.

-

BY REFRIGERANT TYPEBy refrigerant type, hydrocarbons is expected to register the highest CAGR of 10.4% during forecast period.

-

BY DOOR TYPEBy door type, multi door type is expected to dominate the market

-

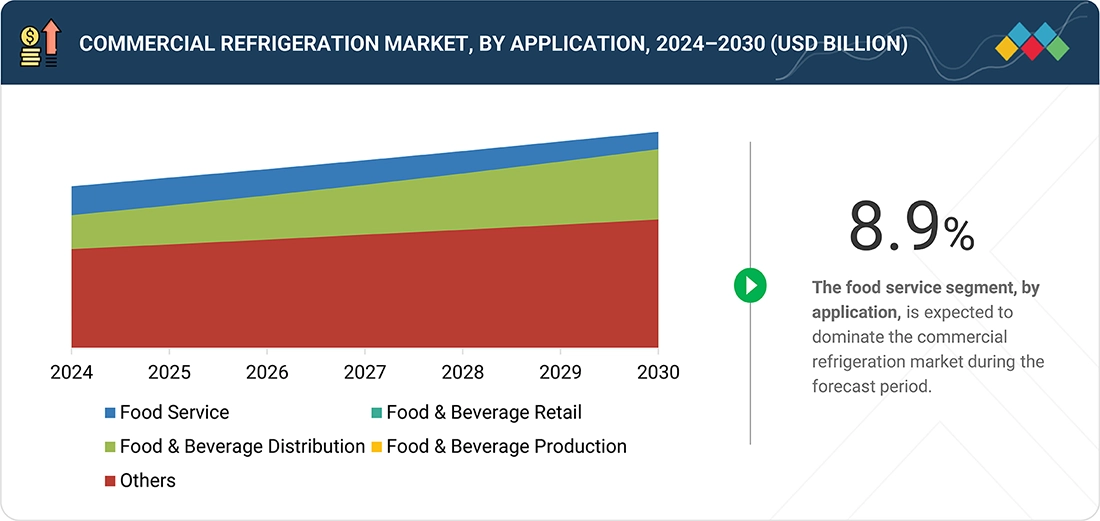

BY APPLICATIONBy application, food service is expected to dominate the market

-

BY END USEBy end use, supermarkets & hypermarkets is expected to dominate the market.

-

Competitive Landscape - Key PlayersHaier Inc., Daikin, and Johnson Controls were identified as some of the star players in the commercial refrigeration market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsSECOP GmbH, Elanpro, Norlake, Inc., and among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential emerging market leaders

The commercial refrigeration market has observed stable growth throughout the study period and is anticipated to continue with the same trend during the forecast period. Rapid urbanization and changing consumer lifestyles have increased the demand for convenience foods, fresh produce, and ready-to-eat meals. This, in turn, drives the need for efficient refrigeration solutions to store and transport these products which is expected to drive the growth of the market in the upcoming years.

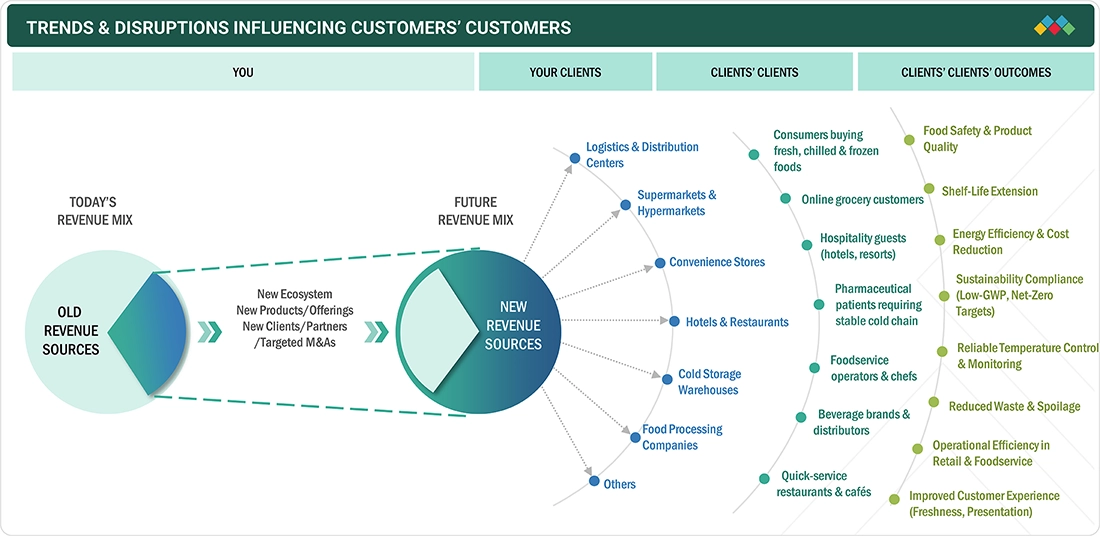

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from evolving customer trends or market disruptions. The growth of end-use industries, such as hotels & restaurants, supermarkets & hypermarkets, convenience stores, and bakeries, leads to the growing demand for commercial refrigeration market. These megatrends are expected to drive growth and increase the revenue of the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid expansion of cold chain infrastructure driven by e-commerce grocery and pharmaceutical sectors

-

Integration of IoT-enabled, energy-efficient, and smart control systems in commercial refrigeration

Level

-

Stringent regulations against the use of fluorocarbon refrigerants enforced by the United Nations Environment Programme (UNEP) under the Montreal Protocol and Kigali Amendment

Level

-

Rising demand for energy-efficient refrigeration systems utilizing natural refrigerants (CO2, ammonia, hydrocarbons)

-

High demand for frozen & processed food worldwide

Level

-

The Growing Skilled Labor Shortage in the Refrigeration Industry

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid expansion of cold chain infrastructure driven by e-commerce grocery and pharmaceutical sectors

The rapid development of cold chain infrastructure, propelled by the surge in e-commerce grocery delivery and the growing pharmaceutical distribution network, is significantly driving the commercial refrigeration market. The need for temperature-controlled storage and transportation to maintain product integrity, especially for perishable food and vaccines, has led to increased investments in advanced refrigeration systems, refrigerated warehouses, and last-mile cold logistics solutions. This trend is further strengthened by consumer demand for online grocery platforms and global vaccine distribution efforts, boosting the adoption of reliable and energy-efficient refrigeration technologies.

Restraint: Stringent regulations against the use of fluorocarbon refrigerants enforced by the United Nations Environment Programme (UNEP) under the Montreal Protocol and Kigali Amendment

Stringent regulations against fluorocarbon refrigerants have been implemented globally to address their harmful environmental effects, particularly their contribution to ozone depletion and climate change. These regulations aim to reduce the production, consumption, and emissions of hydrochlorofluorocarbons (HCFCs) and hydrofluorocarbons (HFCs), commonly used in refrigeration and air conditioning systems. Thus, regulations imposed on certain refrigerants are expected to hamper the growth of commercial refrigeration market.

Opportunity: Rising demand for energy-efficient refrigeration systems utilizing natural refrigerants (CO2, ammonia, hydrocarbons)

Ammonia/ Carbon Dioxide (NH3/CO2) cascade refrigeration systems have been used for several years. Various advantages of NH3/CO2 cascade refrigeration systems include low operating costs (as they use less energy per ton of refrigeration than other systems), low capital costs and compliance costs, optimal food quality, and increased throughput for food & beverage processing. These factors create opportunities in the commercial refrigeration market during forecast period.

Challenge: The Growing Skilled Labor Shortage in the Refrigeration Industry

The commercial refrigeration sector faces a mounting challenge due to the shortage of skilled technicians and engineers proficient in modern refrigeration technologies. As the industry transitions toward advanced systems using natural refrigerants and IoT-based controls, the demand for technically trained personnel has outpaced supply. This labour gap hampers installation efficiency, maintenance quality, and system optimization, particularly in emerging markets. Consequently, the shortage of skilled labour poses a significant challenge to scaling cold chain capacity and maintaining compliance with evolving environmental standards.

commercial-refrigeration-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Manufactures commercial refrigeration systems such as display cases, freezers, chillers, and cold storage units used in supermarkets, convenience stores, restaurants, and food service chains; Also offers IoT-integrated and energy-efficient cooling systems | Enhances energy efficiency and reduces operating costs, improves food preservation and temperature accuracy, and supports smart connectivity for real-time monitoring and predictive maintenance |

|

Provides advanced commercial refrigeration solutions, including CO2 systems, heat-pump-based cooling, and variable refrigerant systems for retail, cold chain, and hospitality environments | Ensures precise temperature control, reduces environmental impact with low-GWP refrigerants, and increases reliability and system lifespan through advanced compressor and control technologies |

|

Offers refrigeration systems, controls, and building automation solutions for retail food chains, distribution centers, and food processing facilities; Also integrates refrigeration into smart building management platforms | Improves operational efficiency through automated monitoring, ensures high food safety standards, reduces energy consumption, and enables seamless integration with building systems for centralized control |

|

Designs and manufactures commercial refrigeration equipment, including refrigerated cases, specialty merchandisers, transportation refrigeration systems, and CO2-based refrigeration architectures | Enhances product display and merchandising effectiveness, reduces total cost of ownership with energy-efficient systems, and improves sustainability through natural refrigerant solutions |

|

Provides evaporative condensers, fluid coolers, and heat-transfer equipment used in supermarket refrigeration, industrial cooling, cold storage, and large food distribution facilities | Delivers high efficiency in heat rejection, minimizes water and energy use, extends equipment lifespan, and improves system reliability for large-scale refrigeration operations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The commercial refrigeration ecosystem consists of raw material suppliers (e.g., Arkema, Honeywell), producers (e.g., Haier, Daikin, Johnson Control), distributors (e.g., Riverland Trading, Winsupply), and end users (e.g., Walmart, Dunkin, Mc Donald). Commercial Refrigerators is used in various end-uses, such as hotels & restaurants, supermarkets & hypermarkets, convenience stores, and bakeries, and others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Commercial Refrigeration Market, By Application

The food & beverage distribution segment is emerging as the fastest-growing application in the commercial refrigeration market as supply chains become more temperature-sensitive and globally connected. Rising demand for fresh, chilled, and frozen products powered by modern retail, food delivery platforms, and expanding cold storage networks has intensified the need for reliable and energy-efficient refrigeration systems across warehouses, distribution hubs, and transport fleets. Companies are investing in advanced chillers, CO2-based systems, and smart monitoring solutions to maintain product integrity from processing to retail shelves. This shift toward tighter cold chain control is driving sustained growth of the segment worldwide.

Commercial Refrigeration Market, By Product Type

The refrigerated display cases segment is witnessing the strongest growth in the commercial refrigeration market as retailers increasingly focus on product visibility, food safety, and energy-efficient merchandising. Supermarkets, convenience stores, and specialty food outlets are expanding their display formats to meet rising demand for fresh and ready-to-eat products, which has accelerated investments in modern display cases. New designs featuring LED lighting, low-GWP refrigerants, advanced insulation, and smart temperature controls are also driving market adoption. As retailers compete to improve the in-store shopping experience and reduce operating costs, refrigerated display cases continue to gain significant traction globally.

REGION

Asia Pacific to be fastest-growing region in global commercial refrigeration market during forecast period

The Asia Pacific region is leading the way in the growth of the commercial refrigeration market. This is attributed to the rapid growth of cold-chain logistics and the explosive growth of grocery shopping websites. As more and more people in China, India, Indonesia, Vietnam, and other fast-growing economies choose to have their fresh and frozen foods delivered online, investments are pouring into temperature-controlled warehouses, refrigerated last-mile delivery fleets, and urban micro-fulfillment centers.

commercial-refrigeration-market: COMPANY EVALUATION MATRIX

In the commercial refrigeration market matrix, Daikin (Star) leads with its integrated supply chain to maximize market reach and product diversification. Players under the Stars category primarily focus on new service & technology launches, as well as acquiring leading market positions through the provision of broad portfolios, catering to different requirements of customers. They are also focused on innovations and are geographically diversified. They also have broad industry coverage. Apart from that, they have strong operational and financial strength and endeavor to grow organically and inorganically in the market. Imbera (Emerging Leader) has a strong potential to build strategies to expand their business and stay on par with the star players. However, emerging leaders have not adopted effective growth strategies for their overall business.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Haier Inc. (China)

- Daikin (Japan)

- Johnson Controls (US)

- Dover Corporation (US)

- BALTIMORE AIRCOIL COMPANY (US)

- De Rigo Refrigeration (Italy)

- Fogel Group (Guatemala)

- SCM Frigo S.p.A (Italy)

- Kühlmobelwerk Limburg GmbH (Germany)

- MAYEKAWA MFG. CO., LTD. (Japan)

- Viessmann Kühlsysteme GmbH (Germany)

- Voltas (India)

- True Manufacturing Co., Inc. (US)

- Blue Star Limited (India)

- Imbera (Mexico)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 48.35 BN |

| Market Forecast in 2030 (Value) | USD 67.31 BN |

| CAGR (2025–2030) | 5.6% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered | By Product Type (Transportation Refrigeration, Refrigerator & Freezer Types, Refrigerated Display Case, Beverage Refrigeration, Ice Cream Merchandiser, and Refrigerated Vending Machine) |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

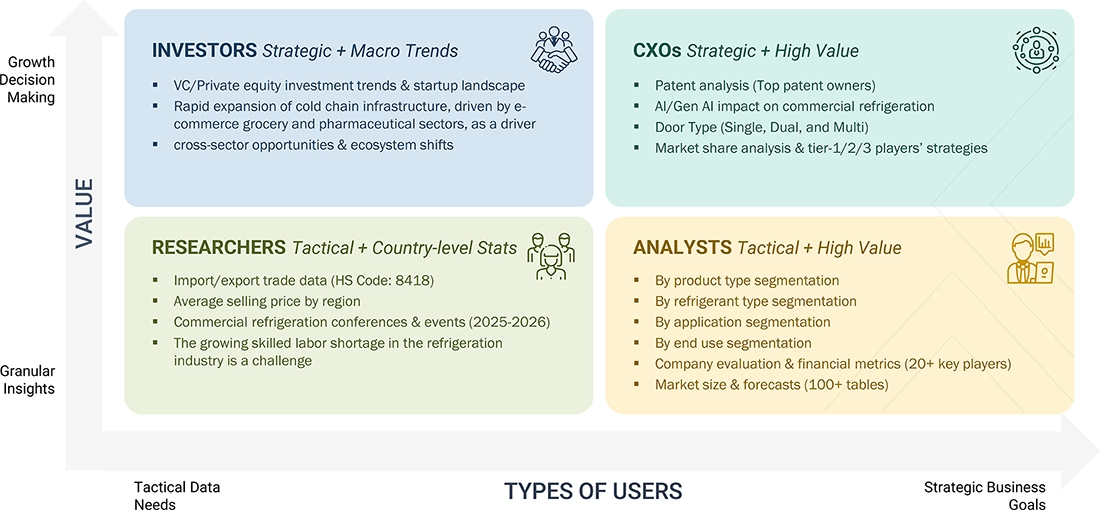

WHAT IS IN IT FOR YOU: commercial-refrigeration-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Food & Beverage Retail (Supermarkets, Hypermarkets, Convenience Stores) | Evaluate system performance in varying climates; regional regulatory mapping (EU F-Gas quotas, U.S. DOE standards); cost-benefit models for retrofits | Support clients with low-GWP transition roadmaps, optimize merchandising layouts for 15-25% energy savings, ensure FDA/EU food safety compliance |

| Food Service & Hospitality (Restaurants, QSRs, Hotels, Cloud Kitchens) | Study plug-in vs. remote architectures; predictive maintenance ROI via sensor data; comparison of A2L refrigerants for urban constraints | Enable clients to cut utility costs by 20-30%, reduce downtime through remote diagnostics, enhance HACCP compliance and sustainability branding |

| Transportation & Logistics (Reefer Trucks, Cold Storage Warehouses) | Evaluate multi-temp trailer efficiencies; regional demand forecasting (e-commerce boom); integration with telematics for real-time tracking | Help clients expand cold-chain capacity amid 8-10% annual growth, optimize fleet electrification, ensure ATP/FSMA compliance for perishable exports |

| Pharmaceutical & Healthcare (Hospitals, Labs, Vaccine Storage) | Analyze GMP-validated units; failure-mode simulations; regulatory alignment with FDA/EMA temperature excursion rules | Strengthen client cold-chain resilience (e.g., pandemic preparedness), support risk-based qualification, identify opportunities in biologics growth segment |

RECENT DEVELOPMENTS

- January 2025 : The company announced the launch of its new TrilliumSeries Dry Cooler, designed to meet the increasing demand for sustainable and water-efficient cooling solutions.

- June 2024 : Armacell acquired the engineering business of E&M Industries, a Western Australia-based specialist in thermal and acoustic insulation jacketing systems. Operating under Armacell Australia Engineering Pty Ltd., the acquisition strengthens Armacell's presence in the Asia Pacific insulation market and supports its strategic expansion into energy-efficient and industrial insulation solutions, including applications for data centers and energy infrastructure. The transaction enhances Armacell's capabilities in fabrication, energy-saving technologies, and solution-based insulation offerings.

- 45901 : De Rigo Refrigeration formed a strategic partnership with The Bond Group to serve as its official distributor in the UK, strengthening its presence in the UK commercial refrigeration market.

Table of Contents

Methodology

The research encompassed four primary actions in assessing the present market size of commercial refrigeration. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the commercial refrigeration value chain via primary research. The total market size is ascertained with both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the commercial refrigeration market begins with the collection of revenue data from prominent suppliers using secondary research. In the course of the secondary research, many secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The commercial refrigeration market comprises several stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of hotels & restaurants, supermarkets & hypermarkets, convenience stores, bakeries, and others. Advancements in technology characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the commercial refrigeration market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the commercial refrigeration market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Commercial Refrigeration Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Commercial refrigeration refers to the systems and equipment designed for commercial and industrial environments to store, chill, or freeze perishable goods under controlled temperature conditions. It plays a critical role in businesses such as supermarkets, grocery stores, convenience stores, restaurants, hospitals, and other industries. By maintaining precise temperature levels, commercial refrigeration inhibits the growth of bacteria, yeast, and mold, thereby extending shelf life, reducing product waste, and ensuring food safety and quality across retail and foodservice operations. These systems encompass a wide range of equipment, including display cases, walk-in coolers and freezers, reach-in refrigerators and freezers, refrigerated prep tables, beverage coolers, ice machines, and centralized refrigeration systems. Product categories in the market include transportation refrigeration, refrigerated display cases, beverage refrigeration, refrigerators and freezers, ice cream merchandisers, and refrigerated vending machines.

Key Stakeholders

- Commercial Refrigeration Manufacturers

- Commercial Refrigeration Suppliers

- Commercial Refrigeration Traders, Distributors, and Suppliers

- Investment Banks and Private Equity Firms

- Raw Material Suppliers

- Government and Research Organizations

- Consulting Companies/Consultants in the Chemicals and Materials Sectors

- Industry Associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global commercial refrigeration market in terms of value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global commercial refrigeration market

- To analyze and forecast the size of various segments (product type, refrigerant type, end-use, and application) of the commercial refrigeration market based on five major regions—North America, Asia Pacific, Europe, the Middle East & Africa, and South America, along with key countries in each of these regions

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the commercial refrigeration market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Commercial Refrigeration Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Commercial Refrigeration Market