Environmental Monitoring Market Size, Growth, Share & Trends Analysis

Environmental Monitoring Market by Product Type (Sensors, Indoor Monitors, Outdoor Monitors), Sampling Method (Continuous, Active, Passive, Intermittent), Component, Application, End User, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global environmental monitoring market, valued at US$15.33 billion in 2024, stood at US$16.10 billion in 2025 and is projected to advance at a resilient CAGR of 5.6% from 2025 to 2030, culminating in a forecasted valuation of US$21.14 billion by the end of the period. The expansion of the environmental monitoring sector is largely propelled by the imposition of stringent pollution monitoring regulations by governmental bodies, the ongoing decline in air quality characterized by escalating PM2.5 concentrations, and heightened public health concerns linked to increased pollution levels. Moreover, the surge in regulatory frameworks, coupled with advancements in sensor technology and a growing emphasis on environmental sustainability, is elevating the demand for precise and real-time monitoring solutions. This trend positions environmental analysis as a critical component of pollution management, resource optimization, and compliance with regulatory standards on a global scale.

KEY TAKEAWAYS

-

By RegionNorth America accounted for a share of 48.2% in the global market in 2024.

-

By ProductBy product, the outdoor monitors segment is expected to register the highest CAGR of 6.1% during the forecast period.

-

By ApplicationBy application, the air pollution segment is expected to record the fastest growth rate of 6.8% from 2025 to 2030.

-

By ComponentBy component, the particulate detection segment dominated the market with 46.6% in 2024.

-

By End UserBy end user, commercial service providers are expected to be the fastest-growing end users during the forecast period.

-

COMPETITIVE LANDSCAPE- KEY PLAYERS3M, Emerson Electric Co., and Thermo Fischer Scientific were identified as some of the star players in the environmental monitoring market (global), given their strong market share and product footprint. Companies in the environmental monitoring market are driven by rising demand for advanced instruments and by expanding pollution-detection infrastructure.

-

COMPETITIVE LANDSCAPE- STARTUPSEnvironmental Solutions & Innovations, Rtx Corporation, Raritan Inc, and Nesa SRL. have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The growth of the environmental monitoring market is primarily driven by stringent pollution-monitoring standards set by governments and worsening air quality due to rising PM2.5 levels. These factors have intensified health concerns associated with increasing pollution. Additionally, the demand for accurate, real-time monitoring solutions is driven by growing regulatory requirements, advancements in sensor technologies, and rising awareness of environmental sustainability. As a result, environmental analysis has become a vital component of pollution control, resource management, and global regulatory compliance.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The primary end users of environmental monitoring products include government agencies, industrial facilities, and commercial users. These users have a critical focus on detecting and analyzing pollutants. The shift toward IoT-enabled monitoring systems, advanced sensor technologies, and data analytics for environmental pollutants is creating major opportunities. Stringent environmental regulations, growing public awareness, and heightened concerns about climate change and industrial emissions are key factors influencing demand for environmental monitors. These developments are projected to drive demand for real-time environmental monitoring solutions, thereby fueling market growth. Demand for environmental monitoring products is expanding beyond regulatory compliance to include predictive analytics, real-time risk detection, and data-driven environmental planning across government bodies, enterprises, and end users from the healthcare, industrial, and residential segments. The convergence of advanced monitoring applications—covering air, water, soil, noise, and climate change—with digital enablers such as analytics and integrated reporting is reshaping the revenue mix and driving long-term market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption of sustainable measures across industries

-

Increasing health concerns due to rising pollution levels

Level

-

High cost of environmental monitoring products

-

Shortage of skilled professionals

Level

-

Increasing government funding to prevent and control environmental pollution

-

Growth opportunities in emerging markets

Level

-

Slow adoption of pollution control policies

-

Lack of protocol standardization across countries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of sustainable measures across industries

The world is currently experiencing a global climate crisis that is impossible to ignore. To avert the worst-case climate scenarios, countries worldwide have committed to reaching carbon net zero by 2050. Addressing sustainability across industries is a global priority, and the finance sector is no exception. As the world transitions to a clean energy future, sustainability is a primary ingredient and priority driving future economic growth. Adopting sustainable measures across industries to reduce carbon emissions can save the global economy an estimated USD 26 trillion by 2030.

Restraint: High cost of environmental monitoring products

Innovative solutions and cutting-edge technology are often more expensive. The cost of the product reflects the substantial research and development expenditures needed for advanced sensors, data collection techniques, and analysis tools. To ensure the accuracy and reliability of the data gathered, the products must also comply with strict regulatory requirements. Adherence to these standards often requires expensive certification, testing, and ongoing maintenance to maintain accreditation.

Opportunity: Increasing government funding to prevent and control environmental pollution

Increased government funding for the prevention and control of environmental pollution is creating significant growth opportunities in the environmental monitoring market. To ensure adherence to more stringent environmental regulations, governments worldwide are allocating larger budgets to enhance soil, water, and air quality monitoring systems. These projects are a part of larger sustainability and climate action programs that encourage the use of cutting-edge monitoring technologies, including data analytics platforms, IoT-based sensors, and remote sensing systems. Innovation in real-time pollution tracking and predictive environmental analysis is being accelerated by public-private partnerships and research grants.

Challenge: Slow adoption of pollution control policies

Healthcare and chemicals industries are vital components of a country’s economy. These industries account for more than half of total emissions of key air pollutants and greenhouse gases, as well as other critical environmental impacts, including releases of pollutants into water and soil, waste generation, and energy consumption. However, the slow adoption of the government-stated policies for pollution control poses a challenge. This can be attributed to uneven development of infrastructure and capacity gaps, and weak enforcement mechanisms.

ENVIRONMENTAL MONITORING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The use of Orion Water Quality Analyzers and Aerosol Monitoring Systems for analysis of air and water pollution | The analyzer ensures regulatory compliance and supports environmental risk assessments by providing extremely accurate, real-time detection of contaminants and particulates. |

|

Development of GC/MS and LC-MS-based systems for detecting trace-level of organic pollutants, pesticides, and heavy metals | It facilitates tracking the source of pollutants, enhancing environmental safety monitoring, and ultra-sensitive chemical identification. |

|

Use of Atomic Absorption Spectrometers and Clarus GC systems for soil and water contaminant analysis | The system improves data reliability in laboratories by enabling reliable, high-throughput detection of VOCs and heavy metals. |

|

DNeasy PowerWater and PowerSoil kits for microbial DNA extraction from environmental samples (water, soil, and air) | The kit facilitates easier microbial community analysis, thereby facilitating faster detection of pathogens and bioindicators in ecosystems. |

|

Deployment of continuous emission monitoring systems (CEMS) for compliance with industrial air quality norms | It provides automated, real-time monitoring and reporting of pollutant emissions, ensuring regulatory adherence and sustainability performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The environmental monitoring market ecosystem comprises manufacturers, regulatory authorities, raw material suppliers, and end users, each playing a critical role in market development. Manufacturers provide analytical instruments and monitoring systems, driven by innovation in accuracy, automation, and real-time data generation. Regulatory authorities establish environmental standards and compliance requirements, which directly influence adoption of monitoring solutions. Raw material suppliers support manufacturers with specialty chemicals, sensors, and components essential for product performance and reliability. End users, including utilities, industrial players, and regulated industries, adopt these solutions to ensure compliance, manage operational risks, and meet sustainability objectives. Regulatory stringency and digitalization remain the key forces shaping ecosystem dynamics.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Environmental Monitoring Market, By Product

Based on product, the environmental monitoring market is segmented into indoor monitors, outdoor monitors, sensors, wearables, and software. The outdoor monitors segment dominated the market in 2024 by product, driven by the growing adoption of advanced monitoring technologies, Internet of Things (IoT) integration, and wireless connectivity solutions. Environmental monitors are increasingly used to measure particulate matter (PM2.5, PM10), volatile organic compounds (VOCs), and greenhouse gases in real time.

Environmental Monitoring Market, By Component

Based on component, the environmental monitoring market is classified into particulate detection, chemical detection, biological detection, temperature sensing, moisture detection, and noise measurement. The particulate detection segment accounted for the largest share of the environmental monitoring market in 2024. This can be attributed to the rising levels of PM2.5 and PM10 in the air, increasing market demand for outdoor and indoor air quality monitors or PM monitors, and rapid rise in air pollution levels due to increasing industrialization and urbanization in emerging economies.

Environmental Monitoring Market, By Application

Based on application, the environmental monitoring market is segmented into air pollution monitoring, water pollution monitoring, soil pollution monitoring, and noise pollution monitoring. The water pollution monitoring segment is further categorized into surface & groundwater monitoring, as well as wastewater monitoring. The air pollution monitoring segment accounted for the largest share of the environmental monitoring market in 2024. This can be attributed to the rising level of air pollution across key markets (such as the US, Europe, China, India, and the Middle East), growing acceptance and demand for sensor-based air quality monitoring systems, increasing health concerns, and stringent air pollution control legislation by several governments.

Environmental Monitoring Market, By Sampling Method

Based on the sampling method, the market is segmented into continuous, active, passive, and intermittent monitoring. The selection of an environmental monitoring method depends on accessibility to the study area, pollution levels, the intended duration of monitoring, and the parameters being analyzed. In 2024, the continuous monitoring segment accounted for the largest share of the environmental monitoring market. This dominance is primarily attributed to the growing public emphasis on environmentally friendly industrial development, increased adoption of real-time sample monitoring, and rising levels of environmental pollution across major regions worldwide.

Environmental Monitoring Market, By End User

By end user, the environmental monitoring market is segmented into government agencies & smart city authorities, enterprises, commercial users, residential users, healthcare & pharmaceutical industries, industrial users, and other end users. The industrial users segment accounted for the largest share of the environmental monitoring market in 2024, owing to the growing number of power plants and refineries and urbanization in emerging economies. In addition, stringent regulations for industries along with workplace safety regulations drive high demand for environmental monitoring products.

REGION

North America to be largest region in the global environmental monitoring market during forecast period

North America, comprising the US and Canada, held the largest market share in the environmental monitoring market in 2024. This can be attributed to increased government funding for establishing environmental monitoring stations and to stringent regulations that support broader adoption of pollution-monitoring technologies. Additionally, technological advancements in environmental sensors and growing government initiatives to control pollution are further driving growth in the North American market.

ENVIRONMENTAL MONITORING MARKET: COMPANY EVALUATION MATRIX

Shimadzu (Star) is a leader in the environmental monitoring market, boasting the largest market share and a wide portfolio of advanced analytical instruments, as well as a global presence. 3M (Emerging Leader) is strengthening its position with innovative monitoring solutions and sustainable technologies that support regulatory compliance and safety. 3M’s focus on innovation and integrated environmental systems continues to boost its competitiveness. As industrialization and environmental regulations strengthen worldwide, 3M demonstrates significant potential to shift toward the emerging leaders’ quadrant by expanding its offerings and global reach in environmental monitoring solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Agilent Technologies (US)

- Thermo Fisher Scientific Inc. (US)

- Danaher (US)

- Shimadzu Corporation (Japan)

- Emerson Electric Co. (US)

- Honeywell International Inc. (US)

- PerkinElmer (US)

- 3M (US)

- bioMérieux S.A. (France)

- Merck KGaA (Germany)

- Siemens AG (Germany)

- Emerson Electric Co. (US)

- Forbes Marshall (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 15.33 Billion |

| Market Forecast in 2030 (Value) | USD 21.14 Billion |

| Growth Rate | CAGR of 5.6% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: ENVIRONMENTAL MONITORING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Environmental Monitoring System Manufacturer | Competitive benchmarking of air/water quality monitoring technologies | Evaluation of system accuracy, calibration techniques |

| Reagent & Consumable Supplier | Demand estimation for monitoring reagents and consumables across industries (air, water, soil) | Supplier profiling by application and usage |

| IoT Platform Developer | Market adoption benchmarking for IoT-based environmental monitoring systems | Cost-benefit analysis for automation integration |

| Environmental Consulting Firm | Evaluation of global regulatory standards for environmental monitoring | Vendor selection support for monitoring systems |

| Pharma/Biotech (Environmental Health Focus) | Mapping of air and water quality impact on health outcomes | Partnerships with research institutions focused on environmental health |

RECENT DEVELOPMENTS

- April 2025 : Thermo Fisher Scientific Inc. received FDA 510(k) clearance for its SeCore CDx HLA sequencing system for use as a companion diagnostic in patients expressing the A4 antigen.

- April 2025 : QIAGEN introduced the QIAcuity RCL Quant Kit and associated digital PCR assays to support quality control in cell and gene therapy, including applications in transplant medicine.

- August 2024 : QIAGEN introduced QIAseq xHYB Comprehensive Genomic Profiling (CGP) panels to enhance cancer genomic profiling. While primarily focused on oncology, these panels expand Qiagen's sequencing capabilities, which may indirectly benefit HLA typing applications.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

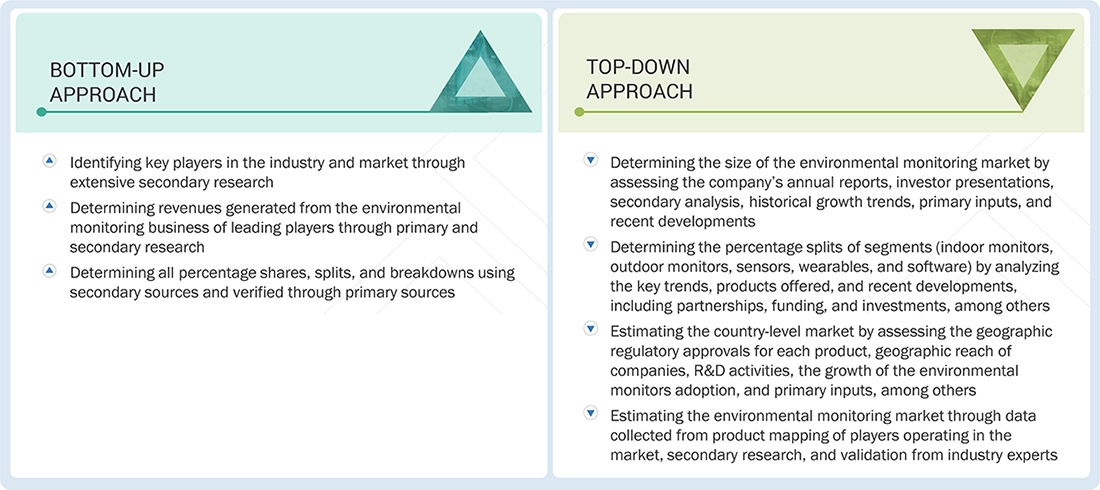

This research study extensively utilized secondary sources, directories, and databases to identify and gather valuable information for analyzing the global environmental monitoring market. Additionally, in-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives from leading market players, and industry consultants. These interviews helped obtain and validate critical qualitative and quantitative data while assessing growth prospects. The global market size was initially estimated through secondary research and refined and finalized through triangulation with insights from primary research.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and companies' SEC filings. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the environmental monitoring market. It was also used to obtain important information on key players, market classification & segmentation aligned with industry trends, and key developments from market and technology perspectives, down to the bottom-most level. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources on the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and other key executives from leading companies and organizations in the environmental monitoring market. The primary demand-side sources include OEMs, private and contract testing organizations, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on key industry trends & key market dynamics.

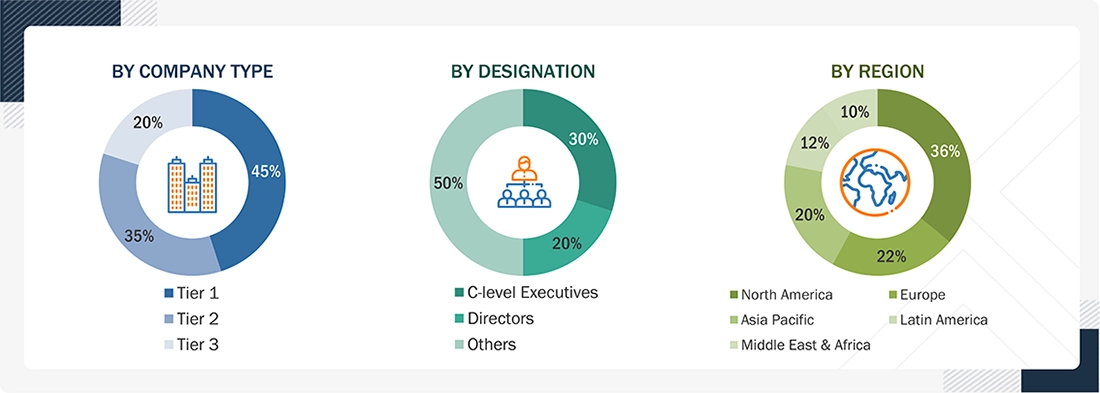

The following is a breakdown of the primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the environmental monitoring market. These methods were also widely used to estimate the sizes of various market subsegments. The research methodology used to estimate the market size includes the following:

- Generating a list of major global players operating in the environmental monitoring market

- Mapping annual revenues generated by major global players from the sales of environmental monitoring solutions (or nearest reported business unit/service category)

- Revenue mapping of key players to cover a major share of the global environmental monitoring market as of 2024

- Extrapolating the global value of the environmental monitoring industry

Environmental Monitoring Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the market size from the market-size estimation process described above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and obtain exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The environmental monitoring market comprises solutions designed to measure and analyze environmental conditions, track trends, and support evidence-based policy formulation and implementation. These systems also generate reliable data for reporting to national authorities, international organizations, and the public. Environmental monitoring serves a wide range of applications, including detecting changes in temperature, humidity, smoke, airflow, and water quality across industrial facilities, data centers, and remote locations. Monitoring equipment and software solutions enable accurate identification and analysis of environmental pollutants. These technologies are widely used for monitoring air, water, soil, and noise pollution. Overall, environmental monitoring plays a critical role in assessing pollution levels, protecting human health, ensuring product and operational safety, and supporting compliance with environmental regulations.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- Suppliers of raw materials and manufacturing equipment

- Environmental pollution detection traders, distributors, and suppliers

- Standards development officers

- Environmental Protection Agency (EPA) officials.

- Research and development (R&D) companies

- Laboratory directors

- Analytical chemists

- QA/QC managers

- Government agencies

- Regulatory agencies

- Solid waste management directors

Report Objectives

- To define, describe, and forecast the environmental monitoring market based on product, component, sampling method, application, end user, and region

- To provide detailed information on drivers, restraints, opportunities, challenges, and industry trends influencing the growth potential of the global environmental monitoring market

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global environmental monitoring market

- To analyze key growth opportunities in the global environmental monitoring market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market with respect to five major regions: North America (US and Canada), Europe (Germany, UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (GCC and Rest of Middle East & Africa)

- To profile the key players in the environmental monitoring market and comprehensively analyze their market shares and core competencies

- To analyze the competitive developments undertaken in the global environmental monitoring market, such as agreements, expansions, and acquisitions

Available customizations:

Based on the given market data, MarketsandMarkets offers customizations tailored to the company’s specific needs. The following customization options are available for this report

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top 3 companies

Regional Analysis

- A further breakdown of countries covered in the Rest of Asia Pacific environmental monitoring market

- A further breakdown of countries covered in the Rest of Europe environmental monitoring market

- A further breakdown of countries covered in the Rest of Latin American environmental monitoring market

Company Information

- Detailed analysis and profiling of additional market players (up to three)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Environmental Monitoring Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Environmental Monitoring Market

Max

Jun, 2022

Which strategies are being followed by the key players operating in the global Environmental Monitoring Market?.

Ethan

Jun, 2022

Which geography is expected to hold the largest share of the global Environmental Monitoring Market?.